Содержание

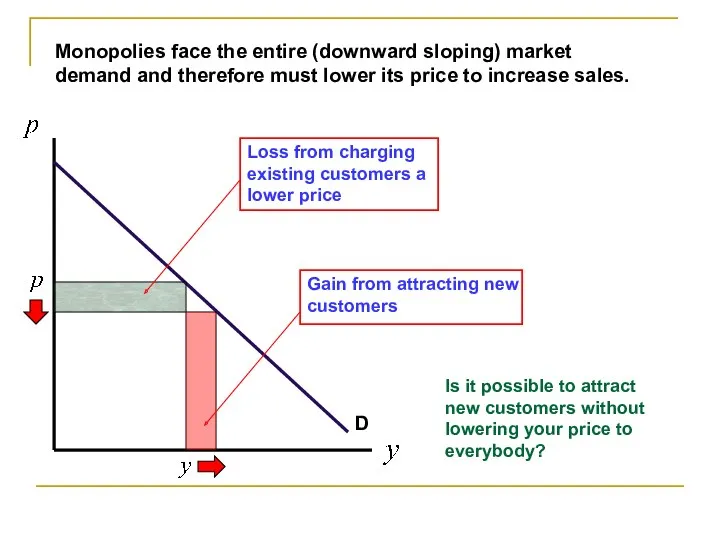

- 2. Monopolies face the entire (downward sloping) market demand and therefore must lower its price to increase

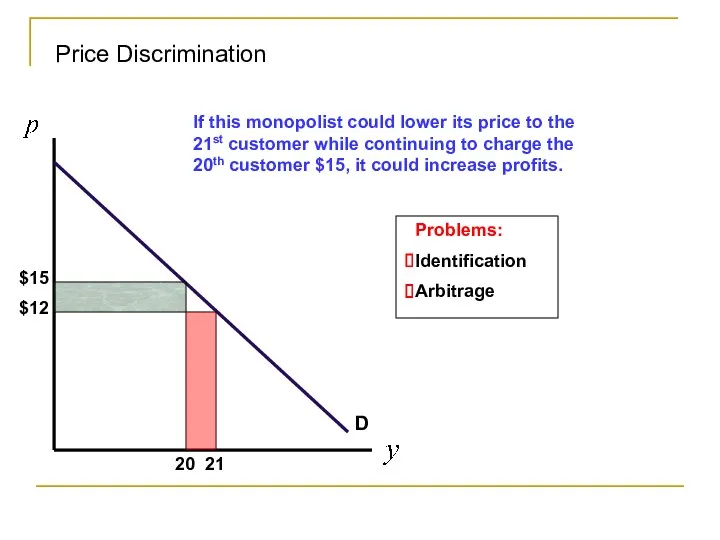

- 3. Price Discrimination D $15 $12 20 21 If this monopolist could lower its price to the

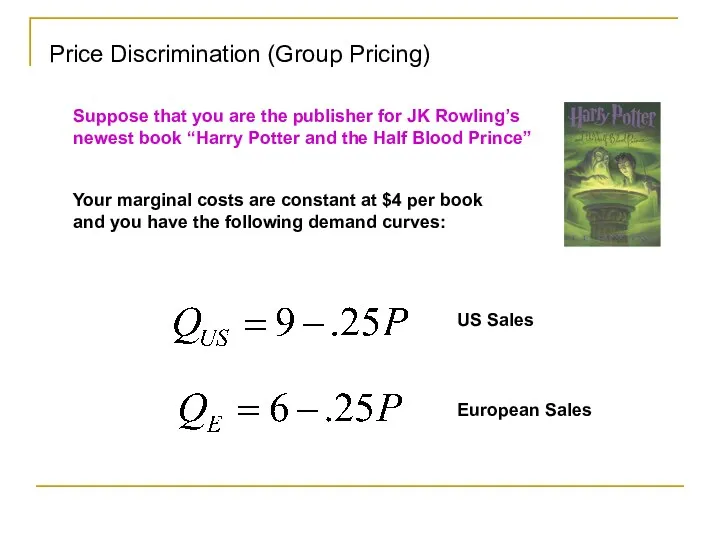

- 4. Price Discrimination (Group Pricing) Suppose that you are the publisher for JK Rowling’s newest book “Harry

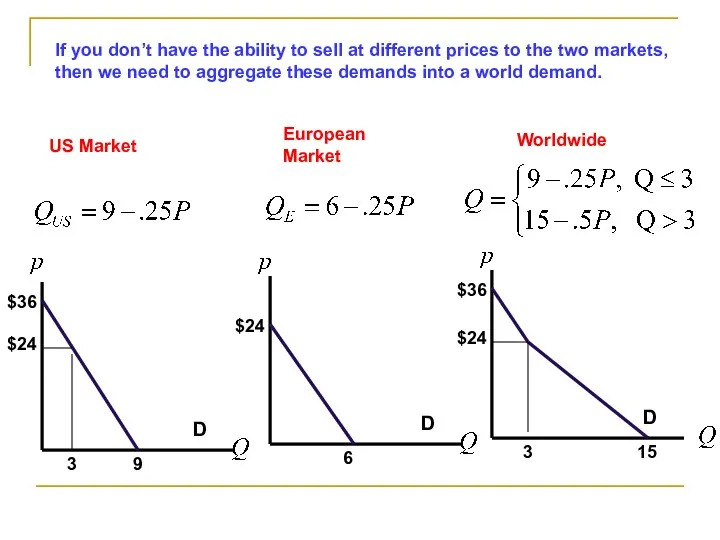

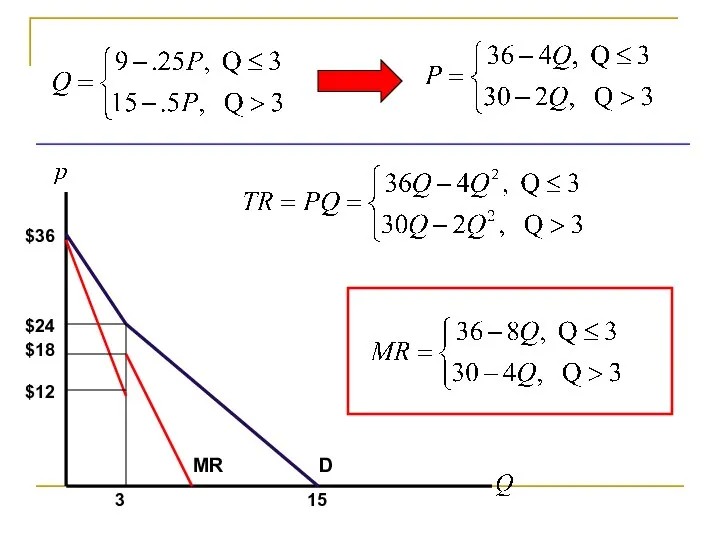

- 5. D $36 9 D $24 6 D $36 15 $24 3 European Market US Market Worldwide

- 6. $36 15 $24 3 $12 $18 D MR

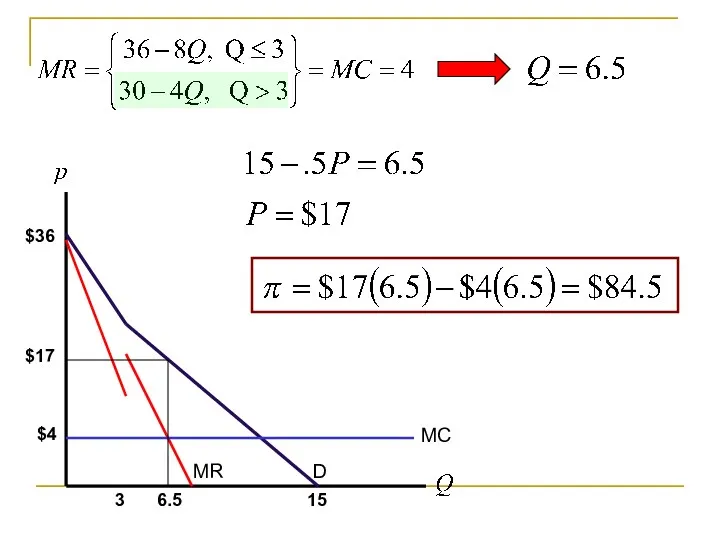

- 7. $36 15 3 D MR MC 6.5 $17 $4

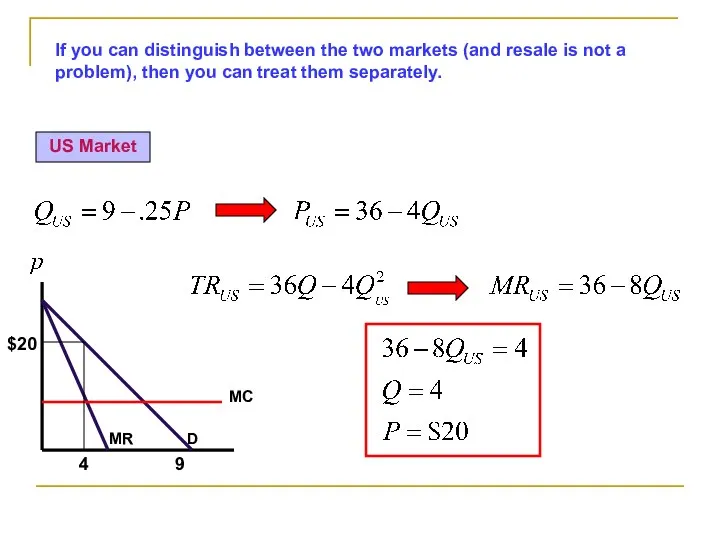

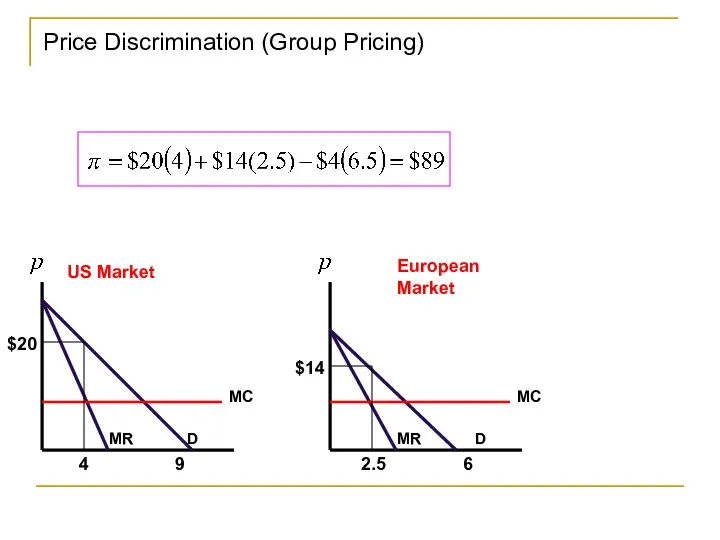

- 8. If you can distinguish between the two markets (and resale is not a problem), then you

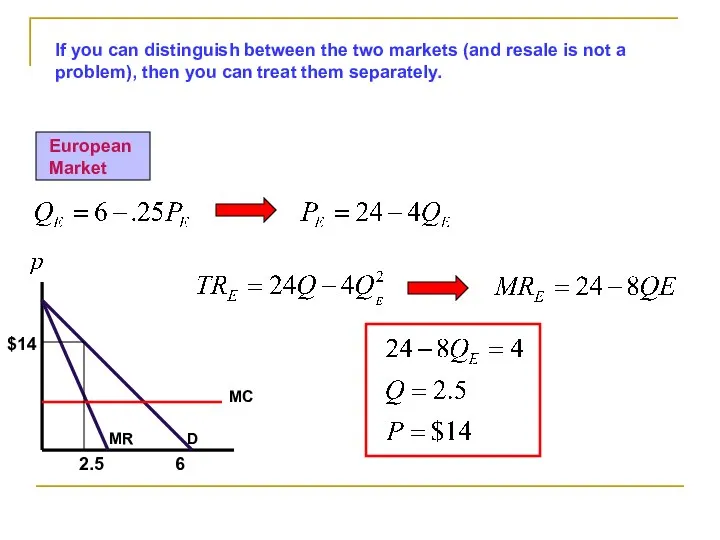

- 9. If you can distinguish between the two markets (and resale is not a problem), then you

- 10. D 9 MC MR 4 D 6 MC MR 2.5 $14 European Market US Market Price

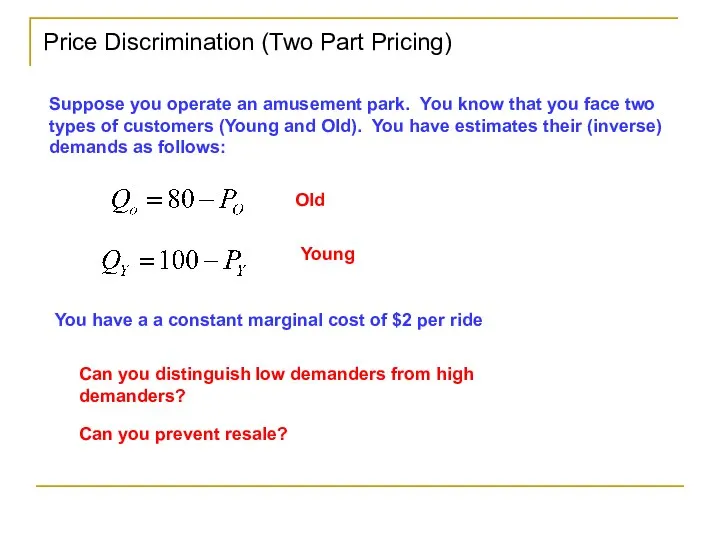

- 11. Price Discrimination (Two Part Pricing) Suppose you operate an amusement park. You know that you face

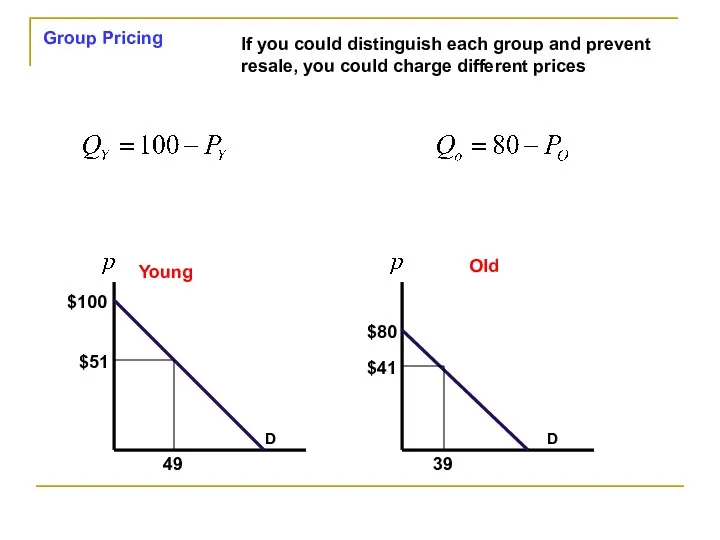

- 12. D 49 D 39 $41 Old Young Group Pricing $51 $100 $80 If you could distinguish

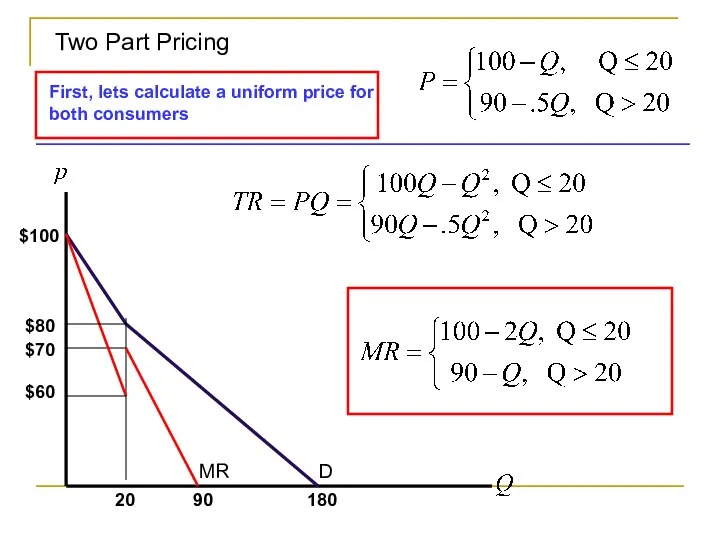

- 13. $100 180 $80 20 $60 $70 D MR First, lets calculate a uniform price for both

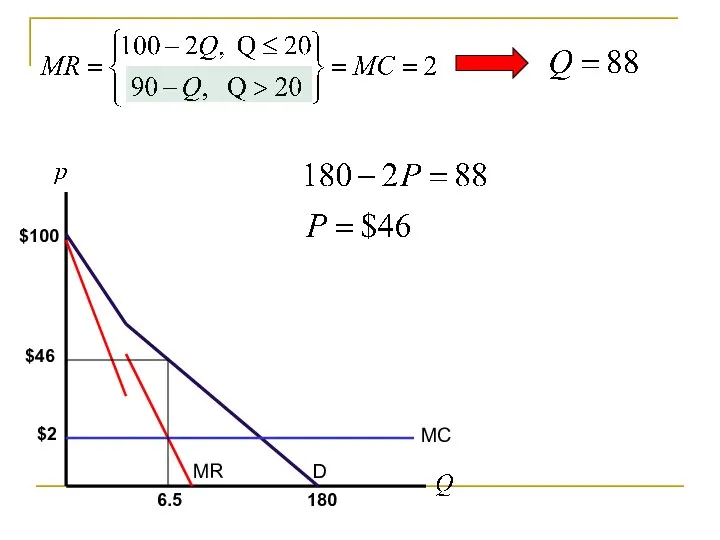

- 14. $100 180 D MR MC 6.5 $46 $2

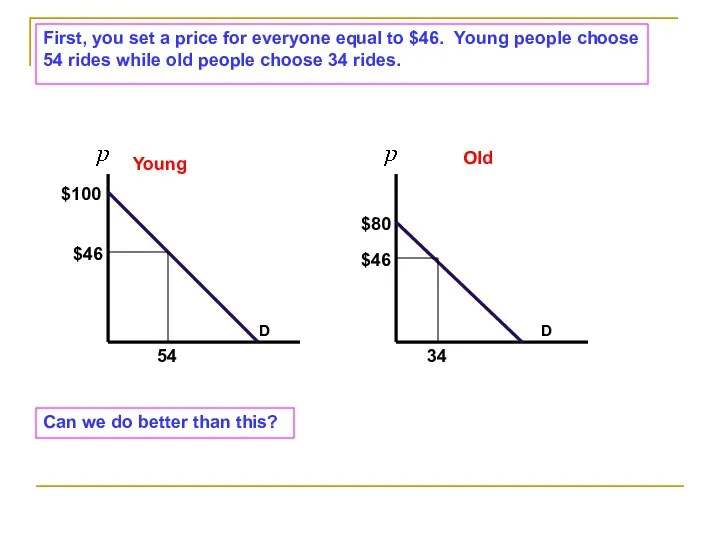

- 15. D 54 D 34 $46 Old Young First, you set a price for everyone equal to

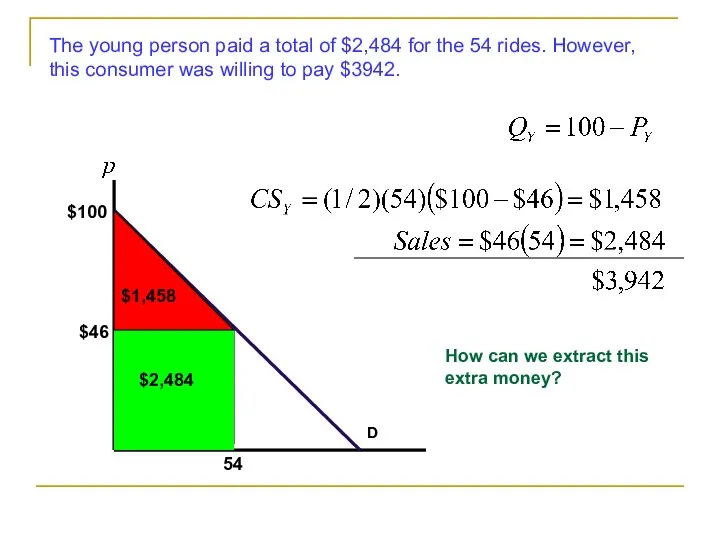

- 16. D 54 $46 $100 The young person paid a total of $2,484 for the 54 rides.

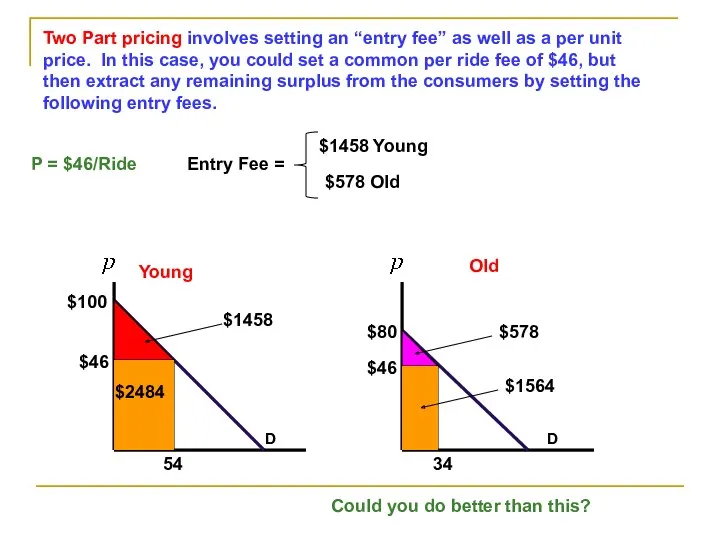

- 17. D 54 D 34 $46 Old Young Two Part pricing involves setting an “entry fee” as

- 18. D 98 D 78 $2 Old Young Suppose that you set the cost of the rides

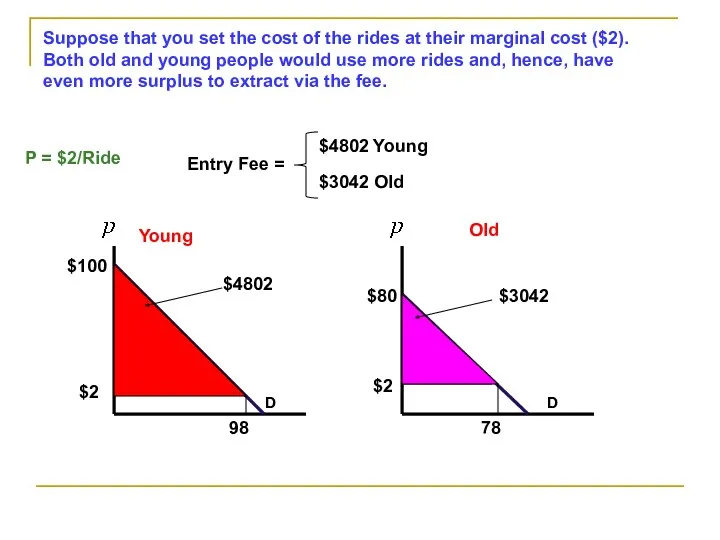

- 19. D 98 D 78 $2 Old Young $2 $100 $80 $4802 $3042 Block Pricing involves offering

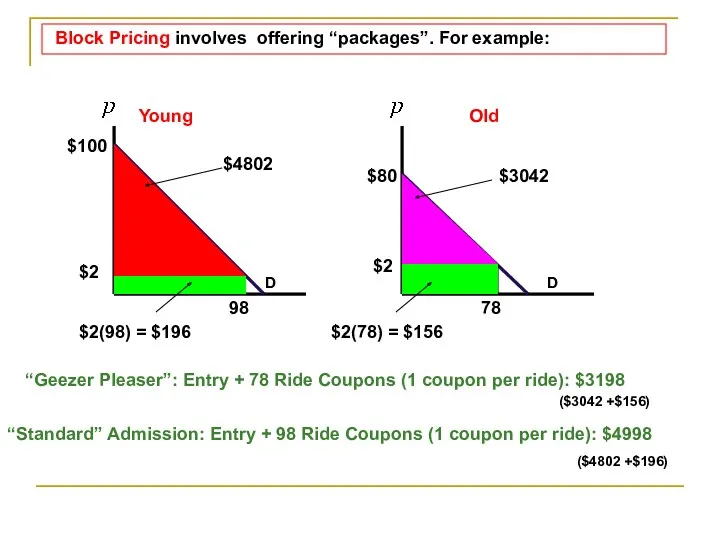

- 20. Suppose that you couldn’t distinguish High value customers from low value customers: Would this work? 1

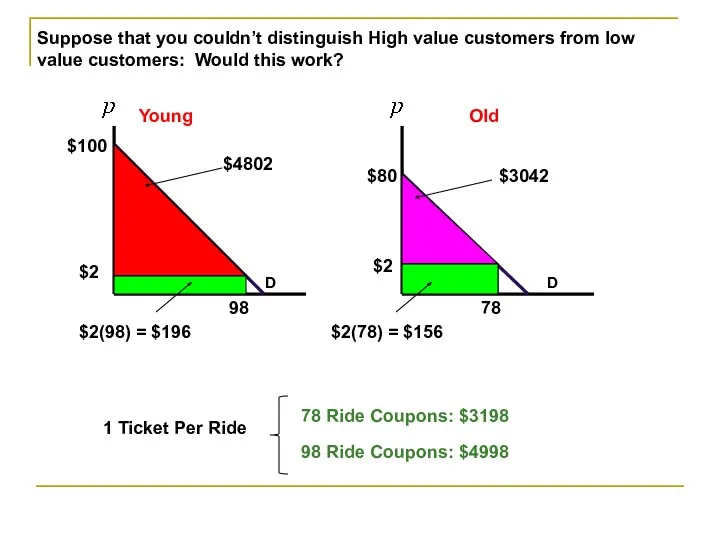

- 21. D 78 $22 $100 We know that is the high value consumer buys 98 ticket package,

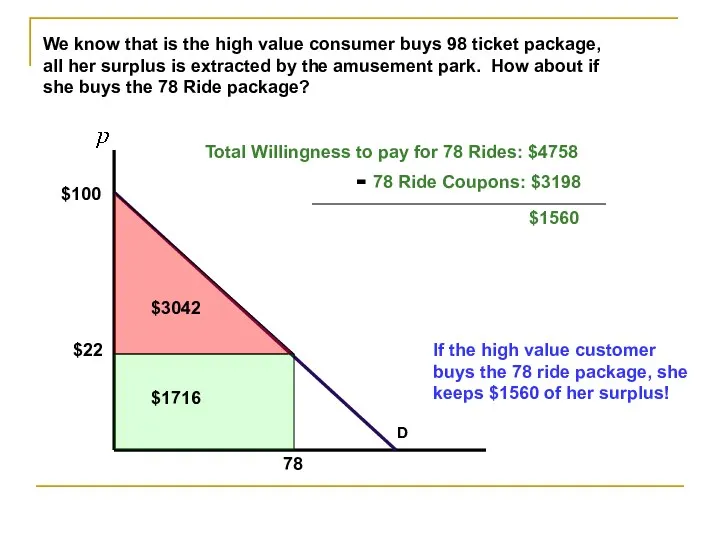

- 22. D 98 $2 $100 You need to set a price for the 98 ride package that

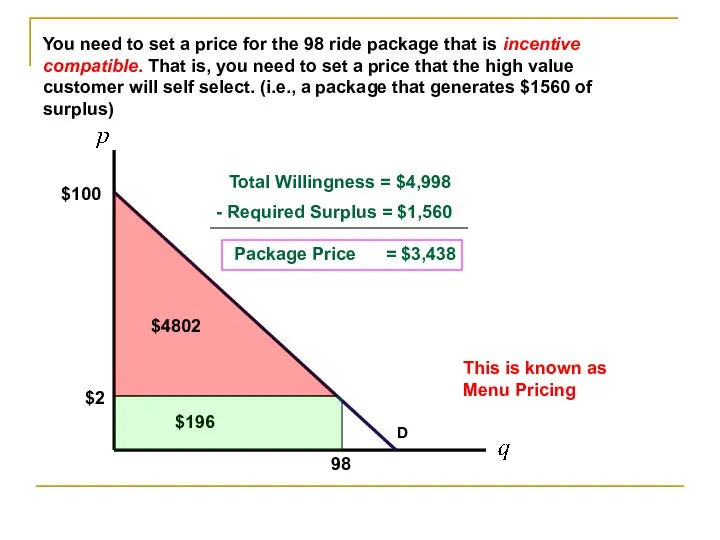

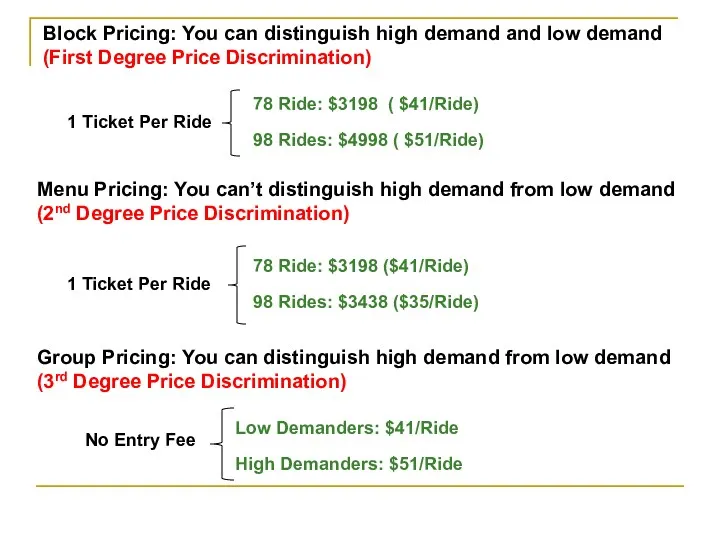

- 23. 1 Ticket Per Ride 78 Ride: $3198 ($41/Ride) 98 Rides: $3438 ($35/Ride) Menu Pricing: You can’t

- 24. Bundling Suppose that you are selling two products. Marginal costs for these products are $100 (Product

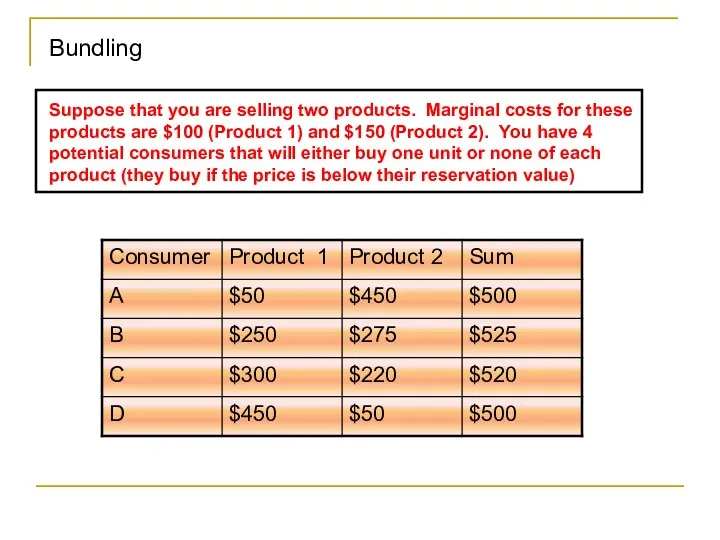

- 25. If you sold each of these products separately, you would choose prices as follows Product 1

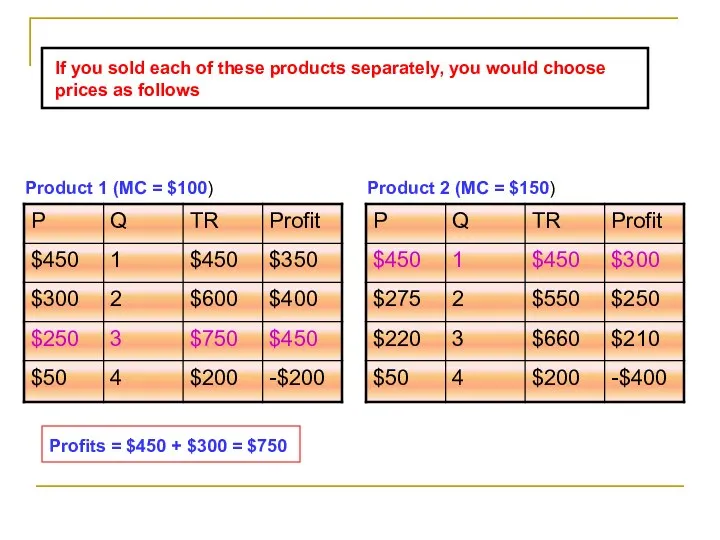

- 26. Pure Bundling does not allow the products to be sold separately Product 2 (MC = $150)

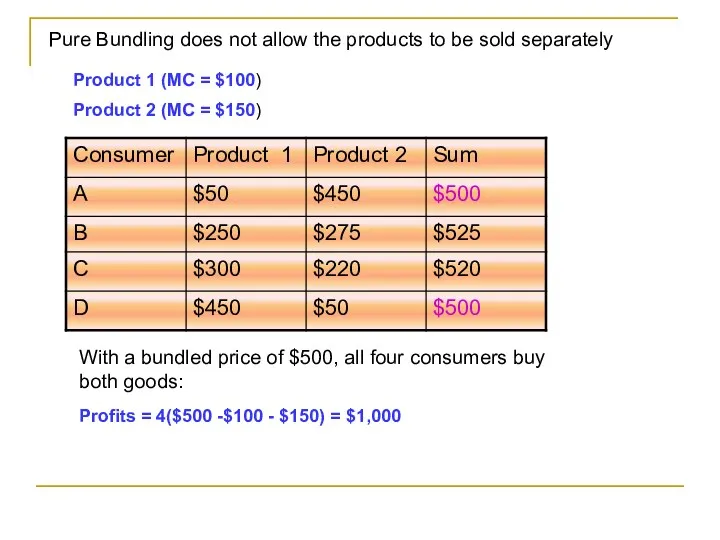

- 27. Mixed Bundling allows the products to be sold separately Product 1 (MC = $100) Product 2

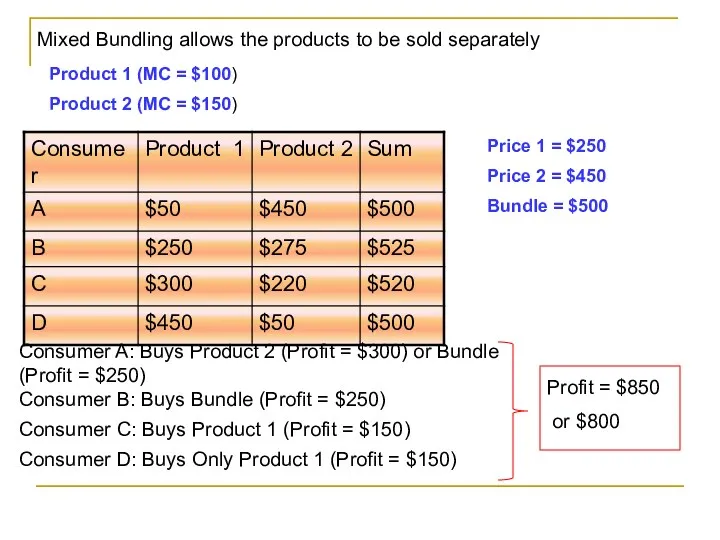

- 28. Mixed Bundling allows the products to be sold separately Product 1 (MC = $100) Product 2

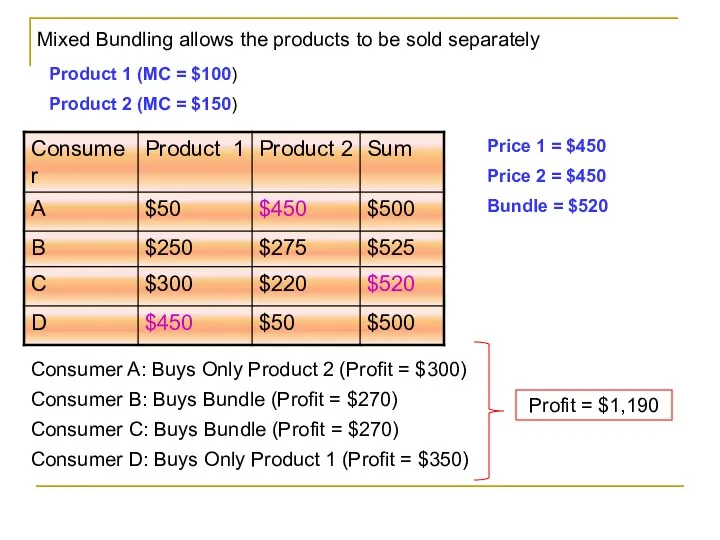

- 29. Product 1 (MC = $100) Product 2 (MC = $150) Bundling is only Useful When there

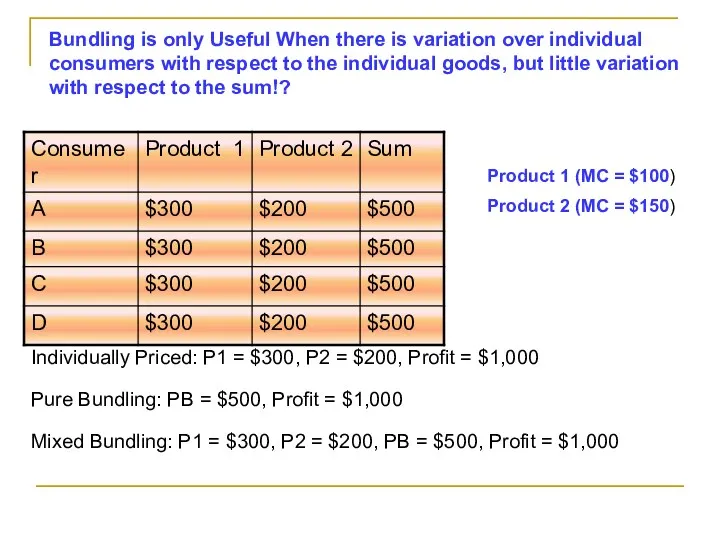

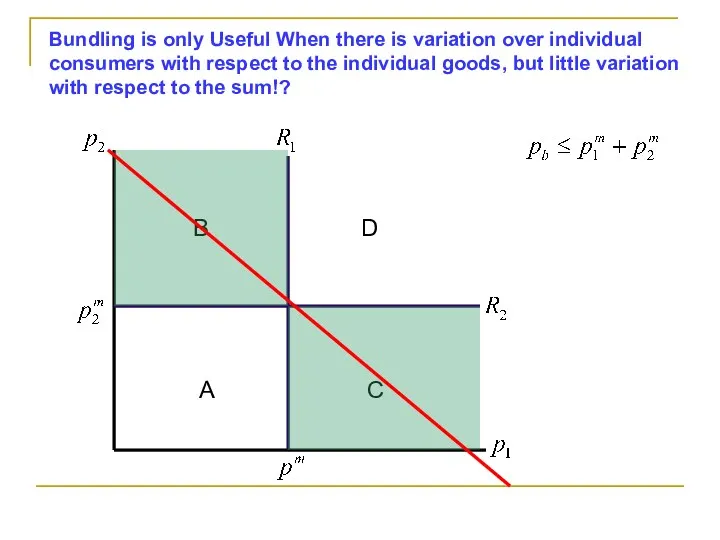

- 30. Bundling is only Useful When there is variation over individual consumers with respect to the individual

- 31. Tie-in Sales Suppose that you are the producer of laser printers. You face two types of

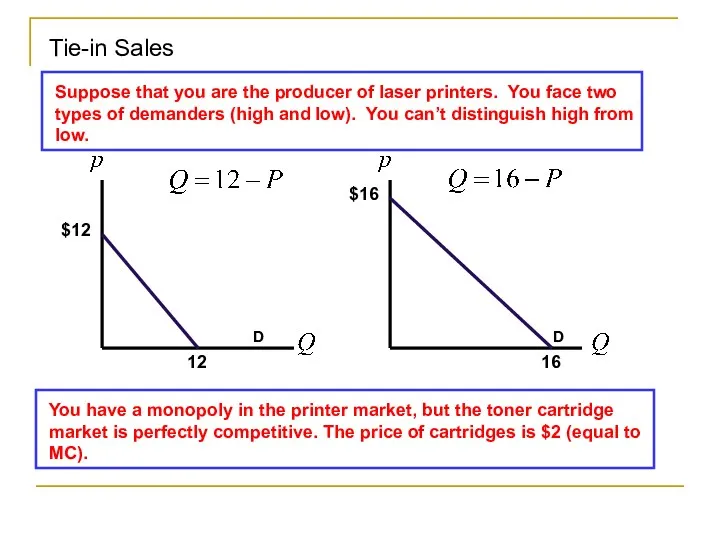

- 32. Tie-in Sales You have already built 1,000 printers (the production cost is sunk and can be

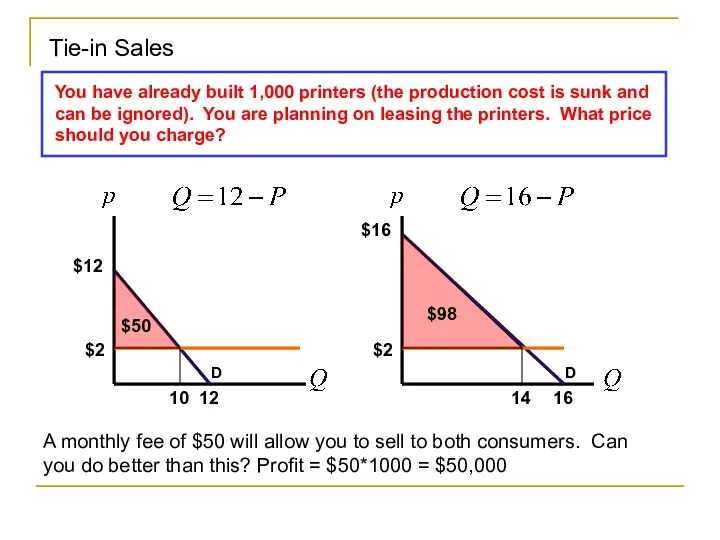

- 33. Tie-in Sales Suppose that you started producing toner cartridges and insisted that your lessees used your

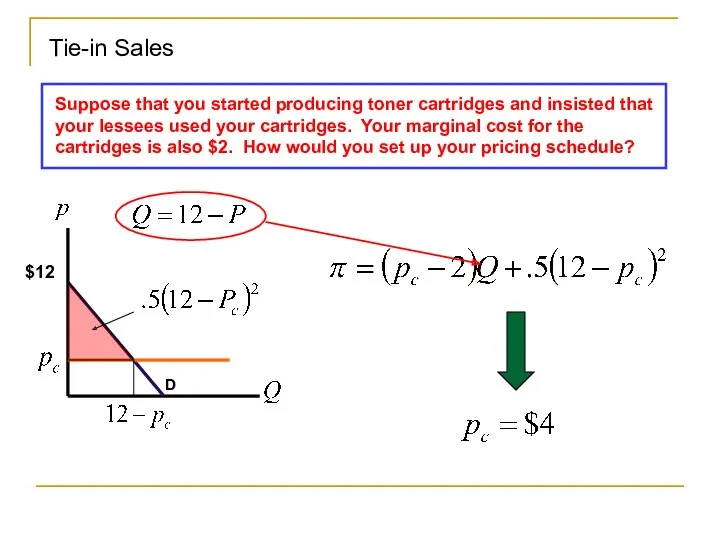

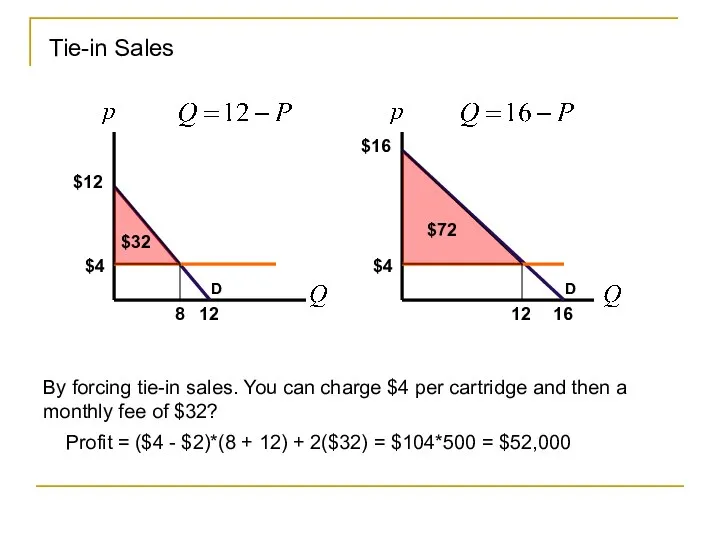

- 34. Tie-in Sales D 12 D 16 $12 $16 8 $4 $4 12 $32 $72 By forcing

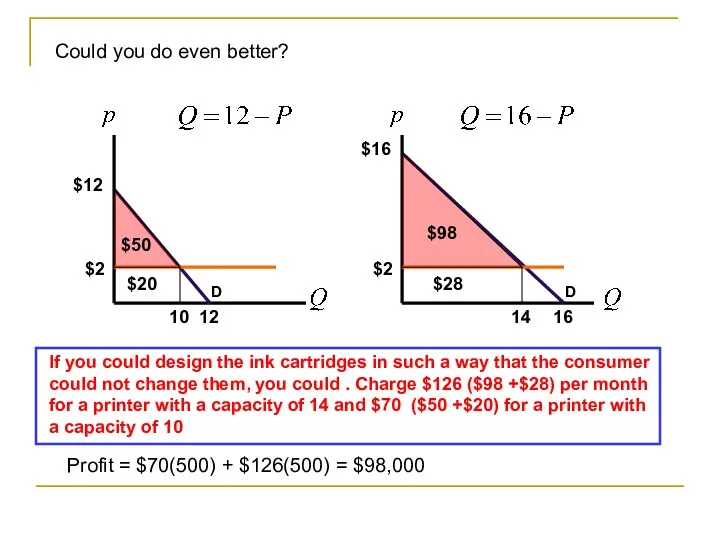

- 35. Could you do even better? If you could design the ink cartridges in such a way

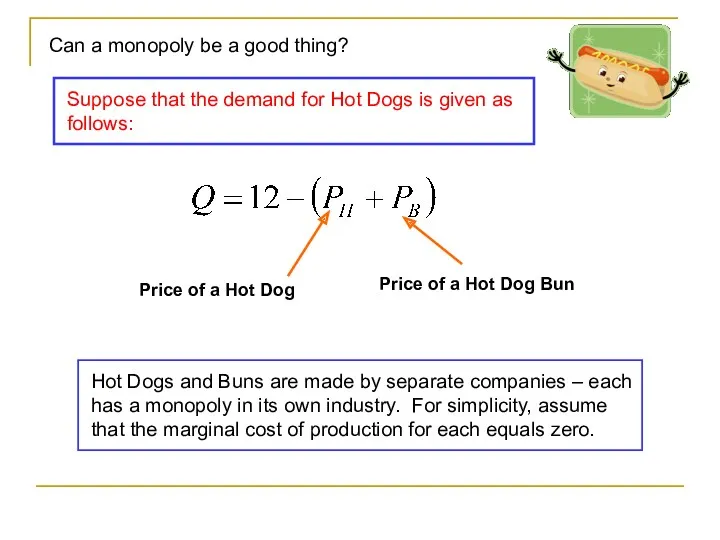

- 36. Can a monopoly be a good thing? Suppose that the demand for Hot Dogs is given

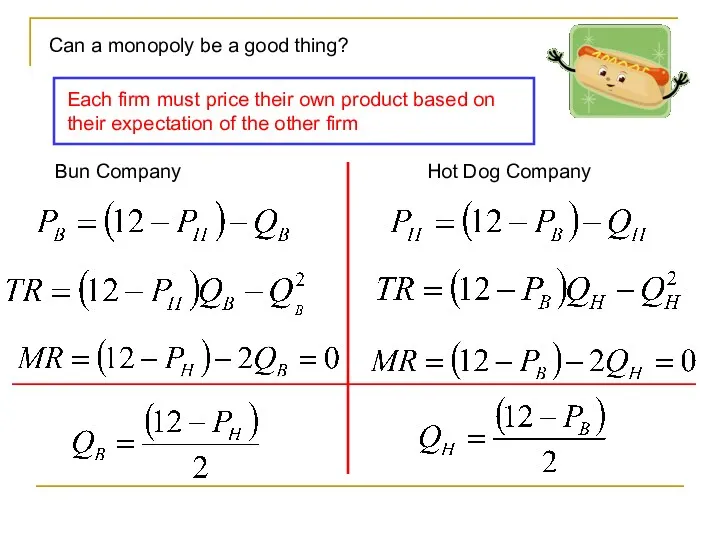

- 37. Can a monopoly be a good thing? Each firm must price their own product based on

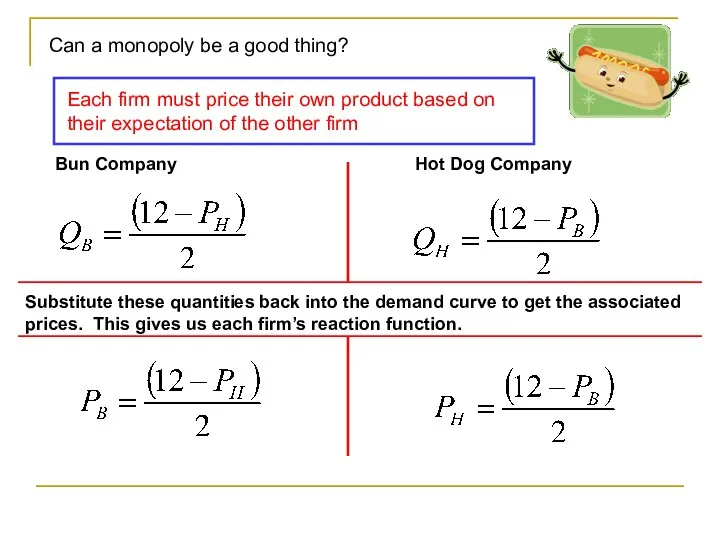

- 38. Can a monopoly be a good thing? Each firm must price their own product based on

- 39. Any equilibrium with the two firms must have each of them acting optimally in response to

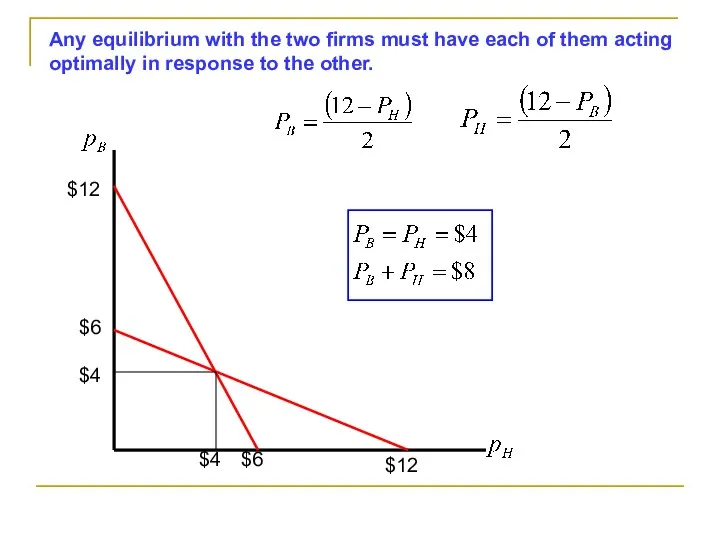

- 40. Can a monopoly be a good thing? Now, suppose that these companies merged into one monopoly

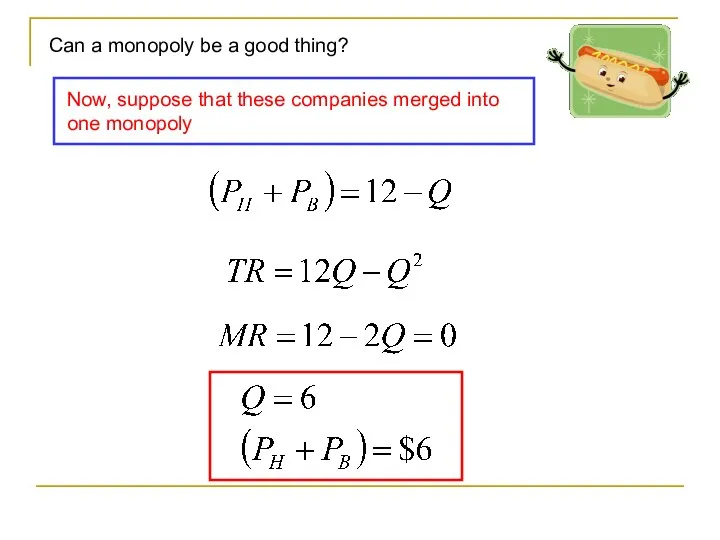

- 41. Case Study: Microsoft vs. Netscape The argument against Microsoft was using its monopoly power in the

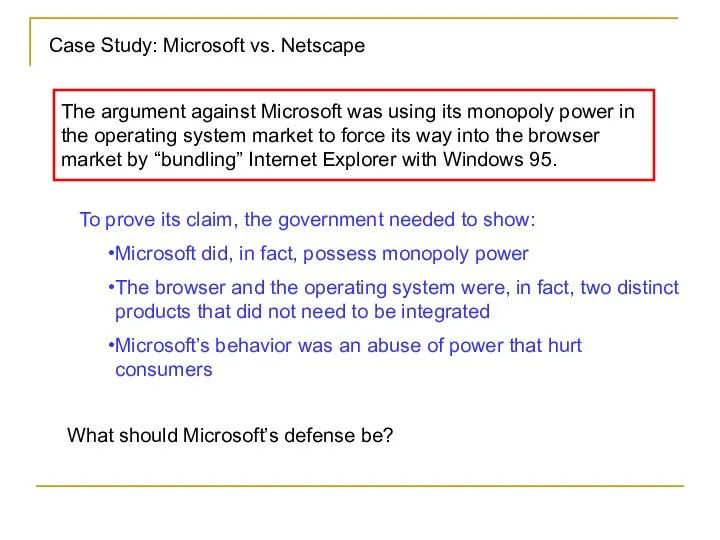

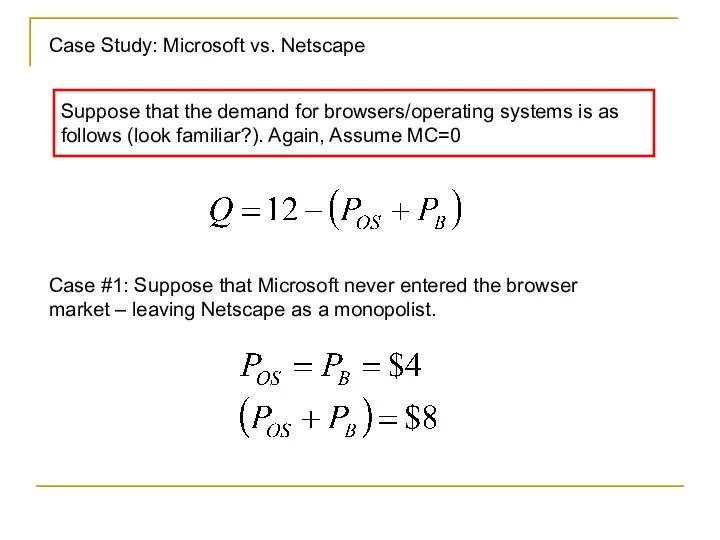

- 42. Case Study: Microsoft vs. Netscape Suppose that the demand for browsers/operating systems is as follows (look

- 43. Case Study: Microsoft vs. Netscape Case #2: Now, suppose that Microsoft competes in the Browser market

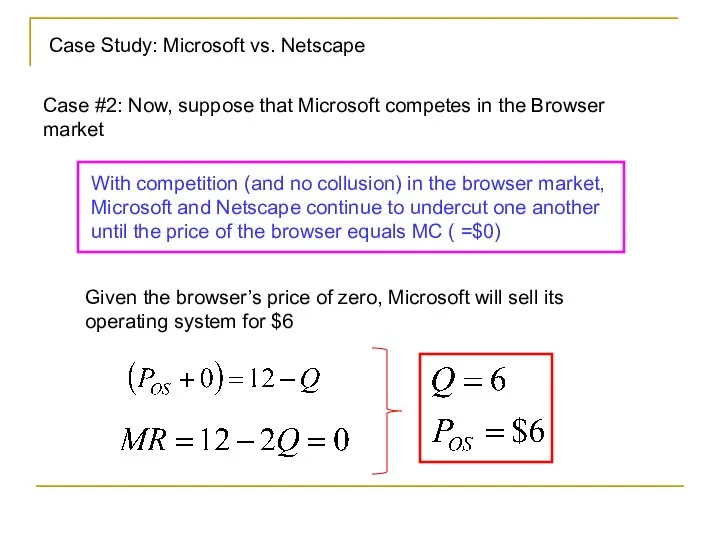

- 44. Spatial Competition – Location Preferences When you purchase a product, you pay more than just the

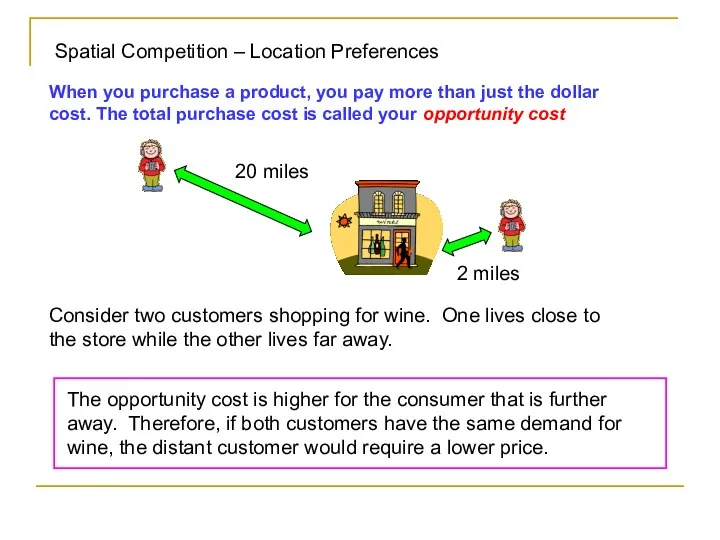

- 45. Spatial Competition – Location Preferences Starbucks currently has 5,200 locations in the US Gucci currently has

- 46. Consider a market with N identical consumers. Each has a demand given by We must include

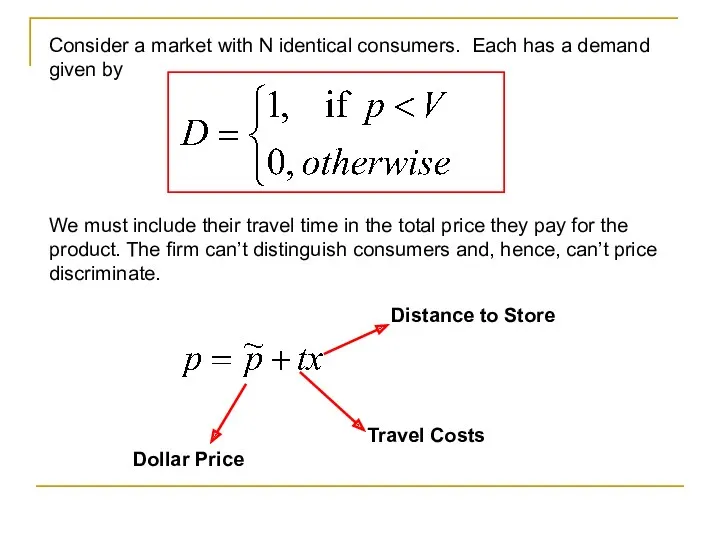

- 47. There is one street of length one. Suppose that you build one store in the middle.

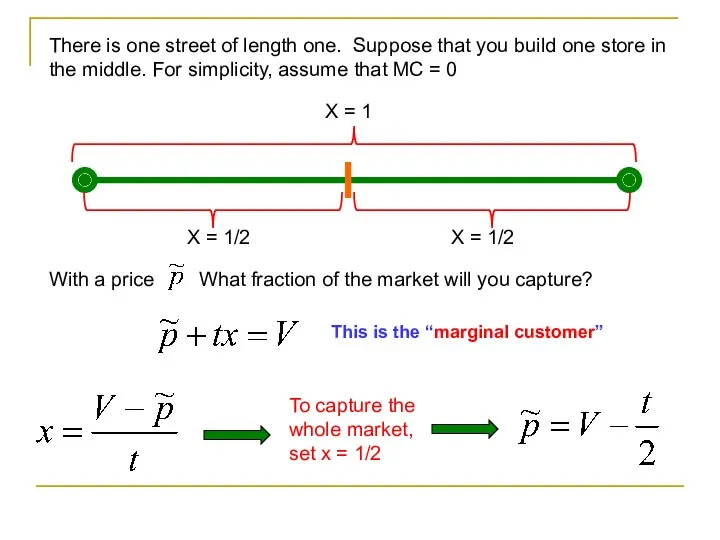

- 48. Now, suppose you build two stores… X = 1 X = 1/4 X = 1/4 With

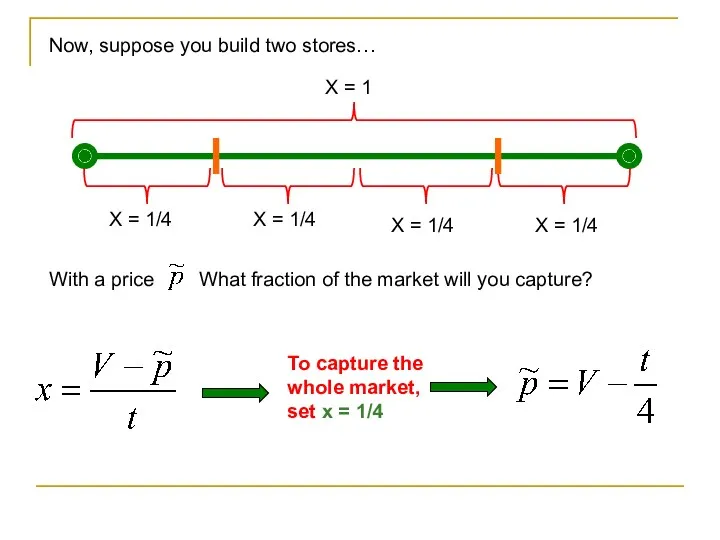

- 49. Now, suppose you build three stores… X = 1 X = 1/6 X = 1/6 With

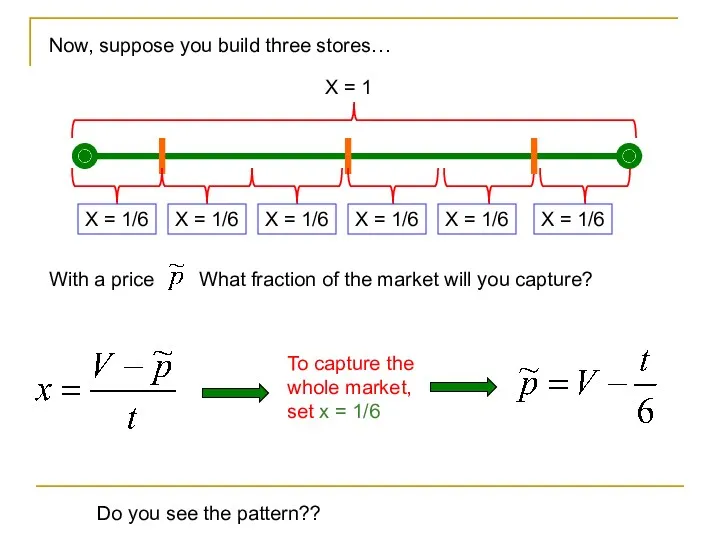

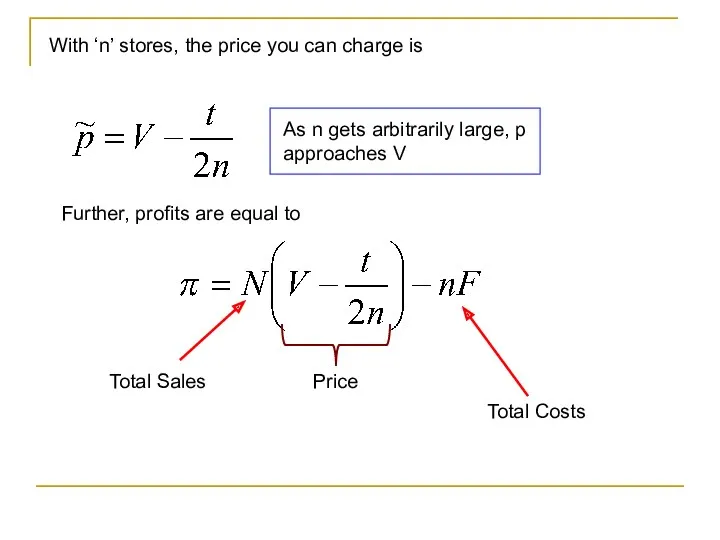

- 50. With ‘n’ stores, the price you can charge is As n gets arbitrarily large, p approaches

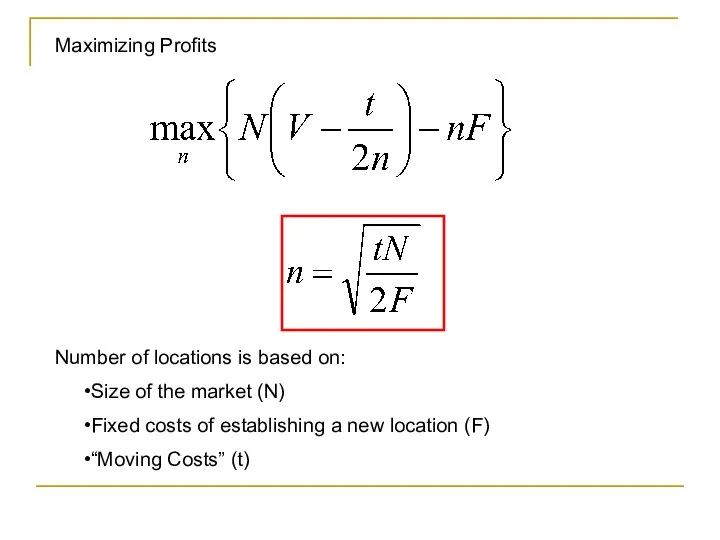

- 51. Maximizing Profits Number of locations is based on: Size of the market (N) Fixed costs of

- 53. Скачать презентацию

Famous People (Знаменитые люди)

Famous People (Знаменитые люди) Морфологические категории существительного. (Лекция 9)

Морфологические категории существительного. (Лекция 9) History of communications media. (Class 5)

History of communications media. (Class 5) г. have_got_has_got

г. have_got_has_got Having Fun!

Having Fun! Canada. Territory

Canada. Territory Повышение эффективности устной речи на уроках английского языка

Повышение эффективности устной речи на уроках английского языка Presentation about Lay’s brand

Presentation about Lay’s brand Spoken variety of language and its peculiarities. Written variety of language and its peculiarities

Spoken variety of language and its peculiarities. Written variety of language and its peculiarities The royal family

The royal family Игра пред / посленовогодняя по английскому языку для учащихся 3 класса Отгадай-ка

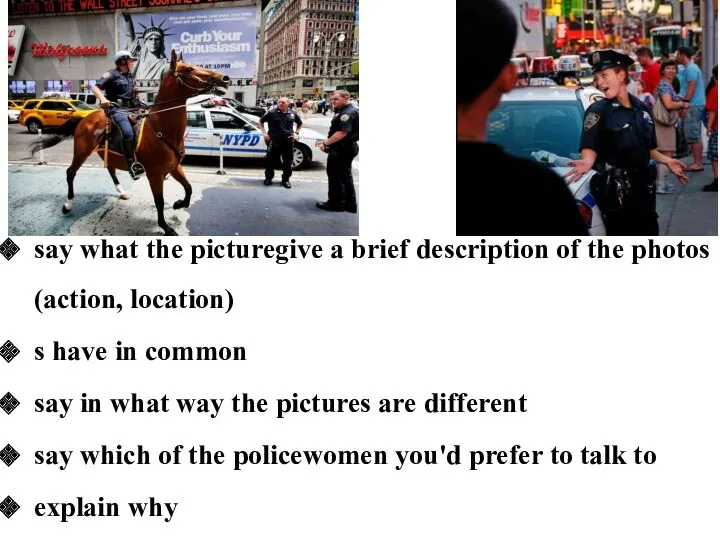

Игра пред / посленовогодняя по английскому языку для учащихся 3 класса Отгадай-ка Сравнение. Полицейские

Сравнение. Полицейские Speaking phrases

Speaking phrases Indefinite Verbal forms

Indefinite Verbal forms Computation linguistic

Computation linguistic To be going to

To be going to Ukraine

Ukraine Ecological problems of the Black Sea. Экологические проблемы Черного моря

Ecological problems of the Black Sea. Экологические проблемы Черного моря Давайте вспомним, что мы узнали в прошлом году. Повторение

Давайте вспомним, что мы узнали в прошлом году. Повторение Tutgood. English A1. 8-9 years old

Tutgood. English A1. 8-9 years old Learning styles. And how we can use them

Learning styles. And how we can use them Earth day

Earth day Знакомство с новой лексикой. Урок 40.2

Знакомство с новой лексикой. Урок 40.2 Metonymy

Metonymy What is she washing

What is she washing A an some

A an some Основы перевода. Уровни перевода и переводческие трансформации

Основы перевода. Уровни перевода и переводческие трансформации American Civil War

American Civil War