Содержание

- 2. The Purchasing Power of Money The price level P is measured in units of dollars per

- 3. Inflation The absolute price level at any given time is not as interesting as changes in

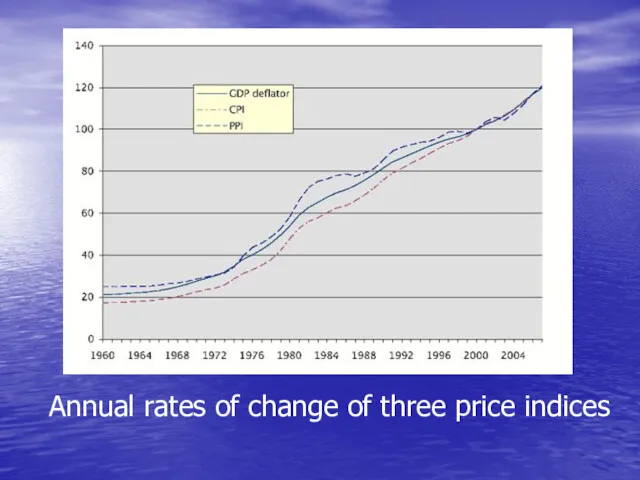

- 4. Indices of Inflation Consumer Price Index (CPI) “producer price index” (PPI) “GDP deflator” They generally correlate

- 5. Consumer Price Index - is a collection of goods and services developed to replicate the spending

- 6. Producer price index (PPI) purports to represent the costs faced by typical producers

- 7. “GDP deflator” attempts to measure the prices of all the goods and services produced in the

- 8. Annual rates of change of three price indices

- 9. The Law of Demand for Money The law of demand says that as the price of

- 10. Types of Demand for Money The desire to acquire money to be spent immediately (or in

- 11. Transactions Demand for Money First, people demand more money to hold as the supply of goods

- 12. Second influence is the cost of acquiring cash. If acquiring cash requires standing in line at

- 13. Third influence – the clearing system Concerning electronic money… Clearing system efficiencies reduce the demand to

- 14. The degree of vertical integration among business firms A forth and somewhat minor influence on the

- 15. Portfolio Demand for Money Money is the most liquid form of savings – you can spend

- 16. Opportunity cost of money The demand for a good or service depends in part on its

- 17. One more classification of reasons for money demand There are three fundamental reasons as to why

- 18. Demand for money is the amount of money that people desire to hold

- 19. Demand for money & income The amount of money demanded by people would change if their

- 20. A households' demand for money primarily depends on: the interest rate, their income, and wealth, other

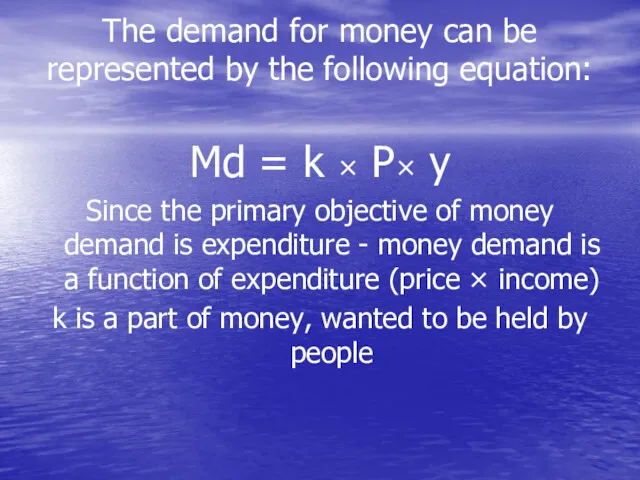

- 21. The demand for money can be represented by the following equation: Md = k × P×

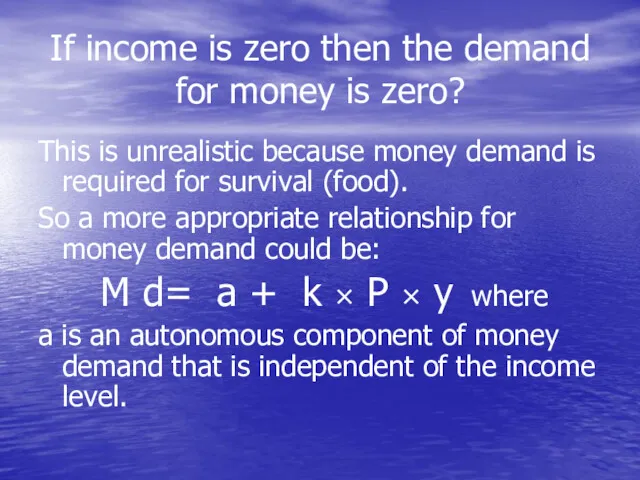

- 22. If income is zero then the demand for money is zero? This is unrealistic because money

- 23. The demand for any good or service is usually pictured in economics as a function of

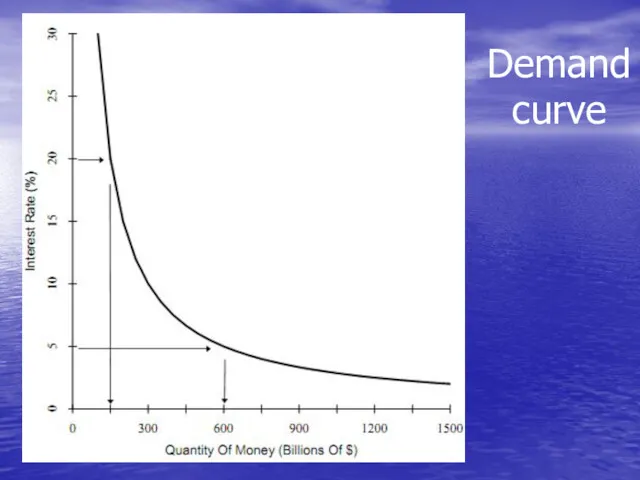

- 24. Demand curve

- 25. The quantity of money demanded is higher when the interest rate is lower. This inverse relationship

- 26. Shift of Demand Curve

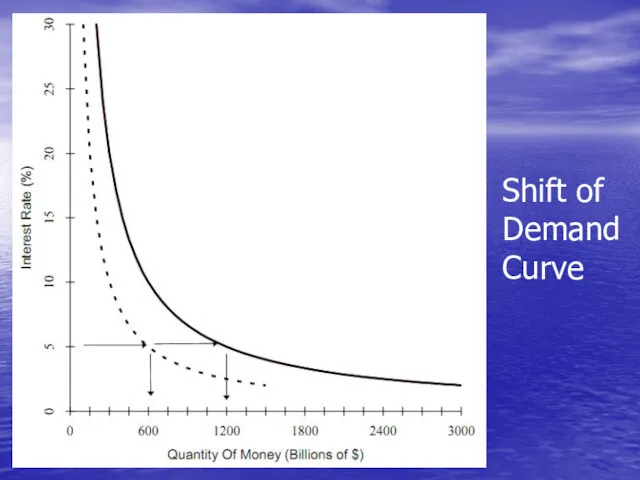

- 27. Rising wealth will contribute to higher demand for money holdings through the portfolio motive. Wealth would

- 28. Demand for Money & Velocity Since every dollar spent is someone’s dollar of income, an overall

- 29. Demand for Money & Real Output Another factor that influences the demand for money is real

- 30. Demand for Money & PPM Decline in the purchasing power of money (i.e., a rise in

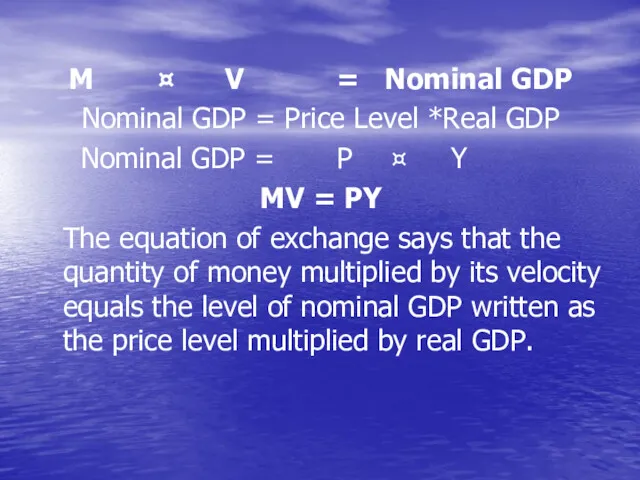

- 31. Equation of exchange MV=PY the number of dollars (M) the average number of transactions (V )

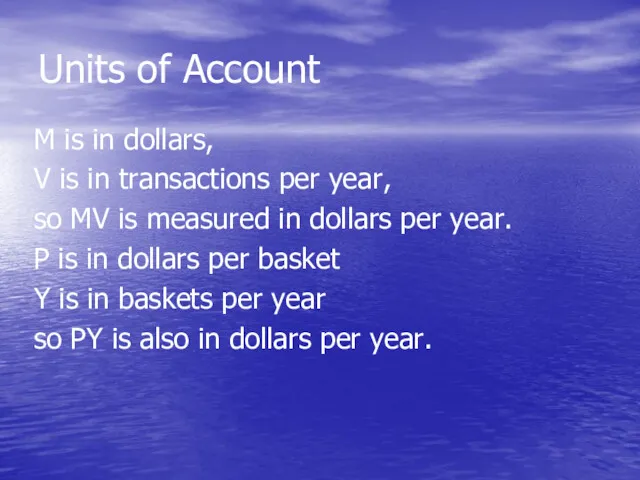

- 32. Units of Account M is in dollars, V is in transactions per year, so MV is

- 33. Let's put together a simple economy of four people where each person has the following: Person

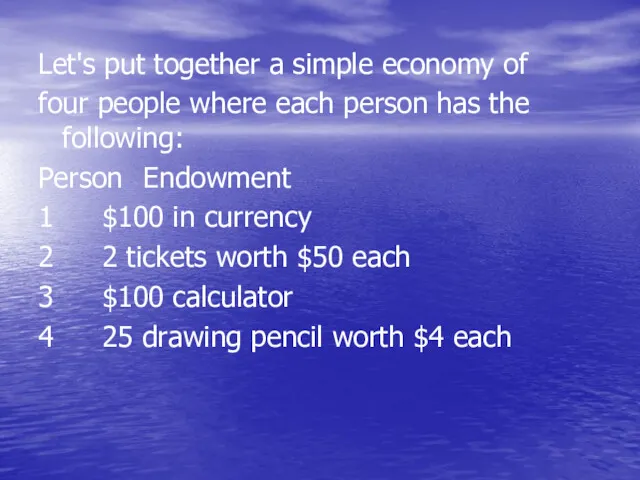

- 34. Suppose the following transactions take place: Person 1 wants a calculator, so she trades her $100

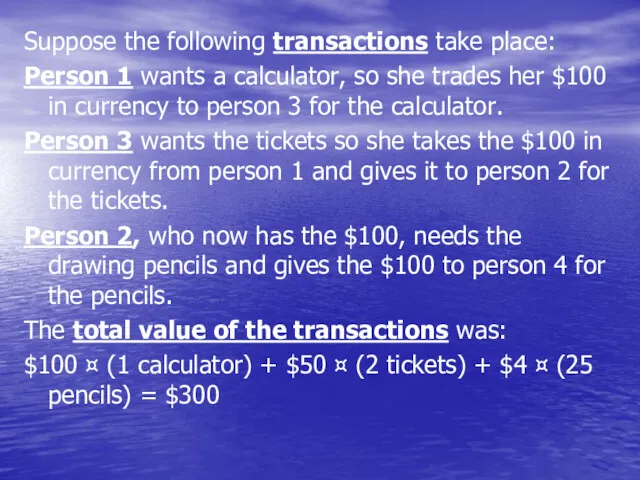

- 35. In this economy, the $100 in currency was used three times and generated $300 worth of

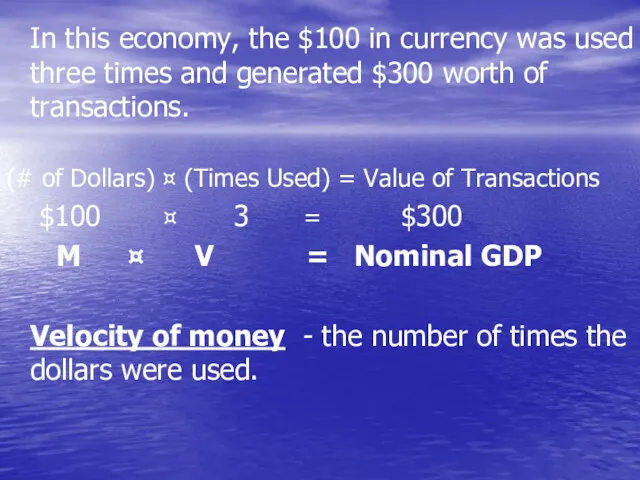

- 36. M ¤ V = Nominal GDP Nominal GDP = Price Level *Real GDP Nominal GDP =

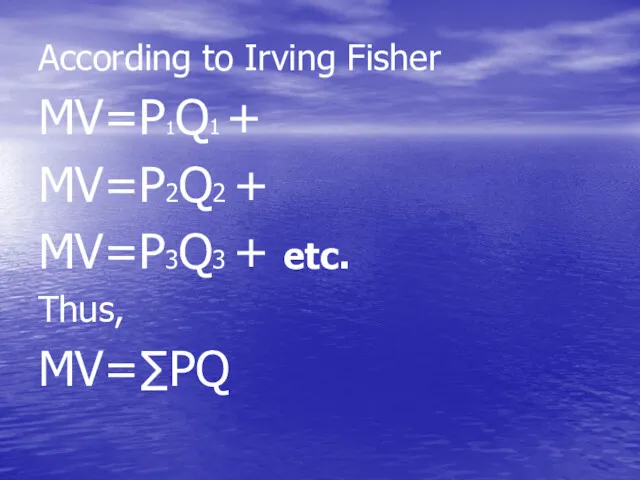

- 37. According to Irving Fisher MV=P1Q1 + MV=P2Q2 + MV=P3Q3 + etc. Thus, MV=∑PQ

- 38. The Quantity Theory of Money The quantity theory of money states that money growth translates directly

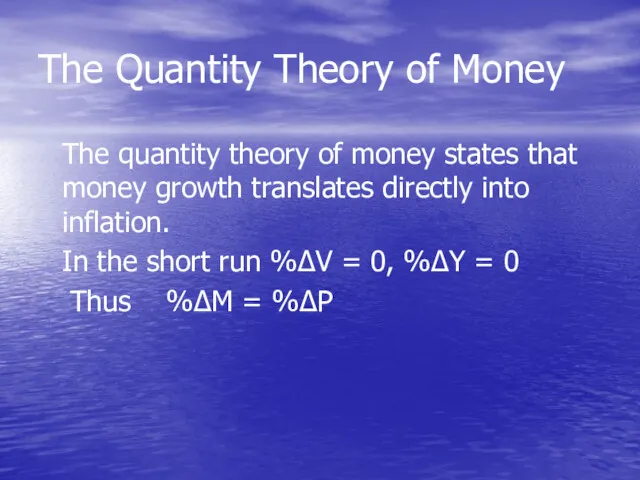

- 39. The equation explains why money growth exceed inflation in low-inflation economies The money growth can be

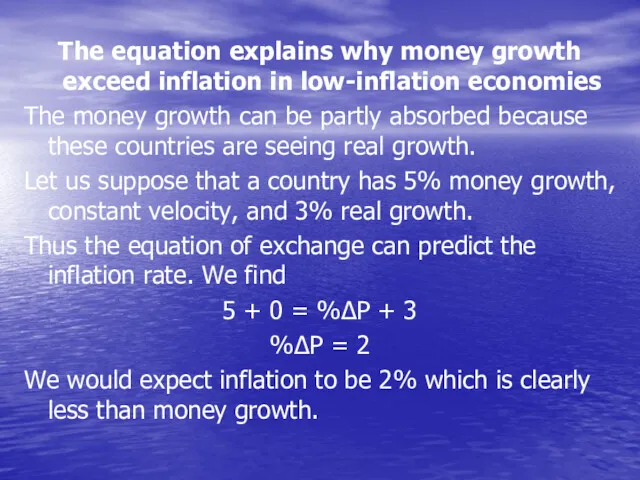

- 40. Individuals require money to complete transactions which means that: the number of dollars needed equals the

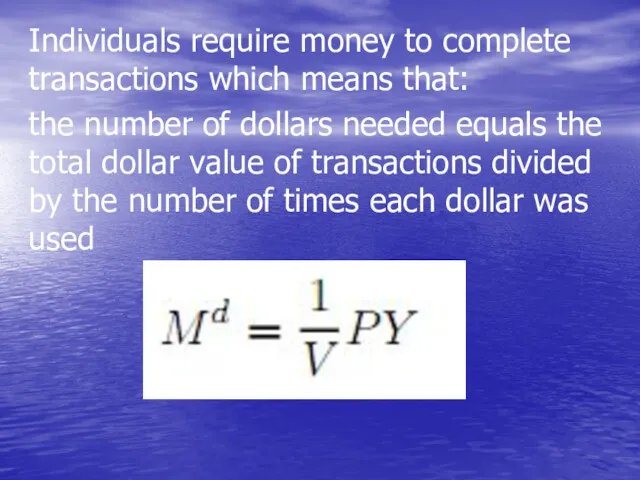

- 41. The Supply of Money is the quantity of money (currency and bank deposits) set by the

- 42. Supply of Money depends on: The reserve requirement Total amount of refinancing made by central bank

- 43. The reserve requirements (or cash reserve ratio) is a central bank regulation that sets the minimum

- 44. Characteristics of Supply Curve Since the supply of money does not vary with the rate of

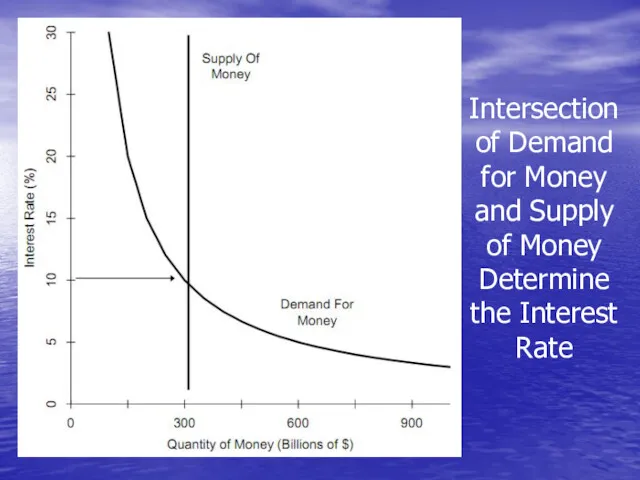

- 45. Intersection of Demand for Money and Supply of Money Determine the Interest Rate

- 46. Balance of supply & demand In Figure the supply of money is a vertical line at

- 47. If there is no balance of S&D… If the interest rate is 9% instead of 10%.

- 48. A Shift in the Supply of Money Imagine that the central bank boosts the money supply

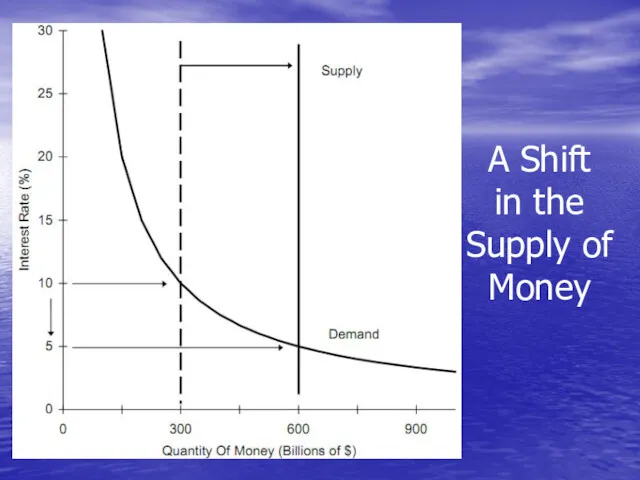

- 49. A Shift in the Supply of Money

- 50. Central Bank Increases Supply of Money When the central bank buys bonds in an open market

- 51. Central Bank Reduces Supply of Money When the central bank sells bonds it reduces the money

- 53. Скачать презентацию

Инновационные центры Индии

Инновационные центры Индии Экономический рост и развитие. Понятие ВВП

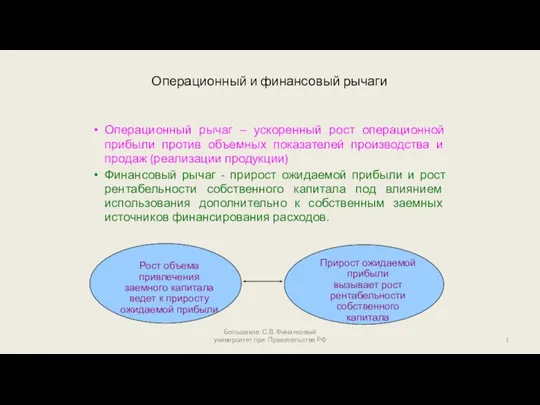

Экономический рост и развитие. Понятие ВВП Операционный и финансовый рычаги

Операционный и финансовый рычаги Перебудова та розпад Радянського Союзу

Перебудова та розпад Радянського Союзу Экономическая система общества

Экономическая система общества Индексный метод

Индексный метод Рыночная экономика

Рыночная экономика Социально-экономическое развитие Республики Крым и Севастополя на период до 2020 года

Социально-экономическое развитие Республики Крым и Севастополя на период до 2020 года Социология экономики и труда (тема №13 )

Социология экономики и труда (тема №13 ) Природные ресурсы. (Глава 8)

Природные ресурсы. (Глава 8) Особые экономические зоны как разновидность СЭЗ

Особые экономические зоны как разновидность СЭЗ Экономика, как наука. Возникновение и основные этапы развития экономической науки

Экономика, как наука. Возникновение и основные этапы развития экономической науки Политика привлечения прямых иностранных инвестиций

Политика привлечения прямых иностранных инвестиций Economic system

Economic system Антимонопольное регулирование и антимонопольная политика

Антимонопольное регулирование и антимонопольная политика Світова валютна система і міжнародні валютно-фінансові відносини. (Лекція 11)

Світова валютна система і міжнародні валютно-фінансові відносини. (Лекція 11) Химическая промышленность мира

Химическая промышленность мира Технико-экономическая характеристика транспортно-логистической цепи доставки стали

Технико-экономическая характеристика транспортно-логистической цепи доставки стали Управление конкурентноспособностью

Управление конкурентноспособностью Виды барьеров входа-выхода

Виды барьеров входа-выхода Кругооборот ресурсов, товаров и услуг, денег

Кругооборот ресурсов, товаров и услуг, денег Рынок труда. Самые востребованные профессии. Прогнозы специалистов

Рынок труда. Самые востребованные профессии. Прогнозы специалистов Национальная инновационная политика и инновационная среда

Национальная инновационная политика и инновационная среда Исследование перехода к хаосу в экономических системах

Исследование перехода к хаосу в экономических системах Экономическая оценка инвестиционных проектов

Экономическая оценка инвестиционных проектов Востребованность японского языка на трудовом рынке России

Востребованность японского языка на трудовом рынке России Қазақстанның саласындағы инвестициялық хал-ахуалдың проблемалары мен перспективаларыпроблемаларын талқылау

Қазақстанның саласындағы инвестициялық хал-ахуалдың проблемалары мен перспективаларыпроблемаларын талқылау Задачи антикризисных менеджеров

Задачи антикризисных менеджеров