Содержание

- 2. Topics in Macroeconomics WIUT Date: January 8, 2018 Presenter: Dr. Bilol Buzurukov MODULE

- 3. Module Leader Module leader: Bilol Buzurukov Email: bbuzurukov@wiut.uz Office hours: Thursday 09:00-11:00 Room number: ATB-216 Telephone

- 4. Module Delivery The module will be taught by a combination of lectures and tutorials. Lectures are

- 5. Module Content TW-1: Introduction to growth theory; TW-2: Solow Model of Economic Growth I; TW-3: Solow

- 6. Learning Outcomes Upon completion of the module, successful students will be able to: 1. Critically evaluate

- 7. Learning Platform University Intranet System Lecture and Seminar slides posted weekly; Support materials, such as articles,

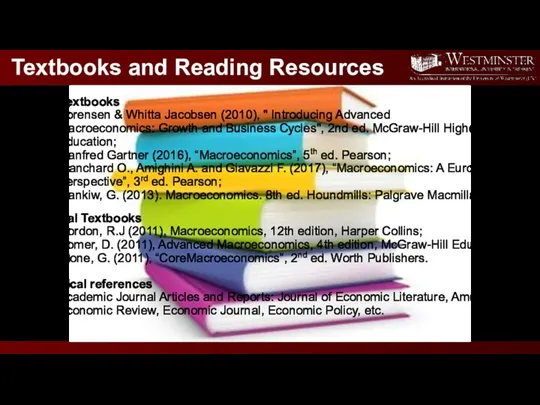

- 8. Textbooks and Reading Resources Core Textbooks Sorensen & Whitta Jacobsen (2010), " Introducing Advanced Macroeconomics: Growth

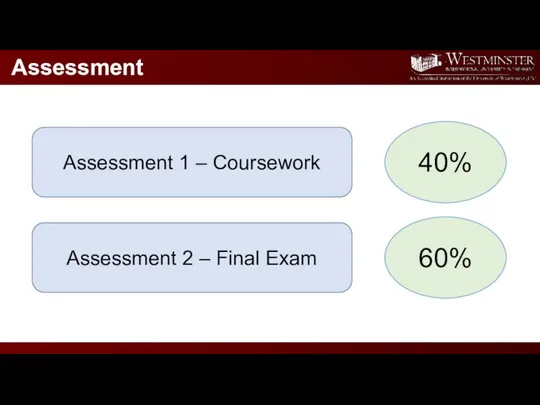

- 9. Assessment Assessment 1 – Coursework 40% Assessment 2 – Final Exam 60%

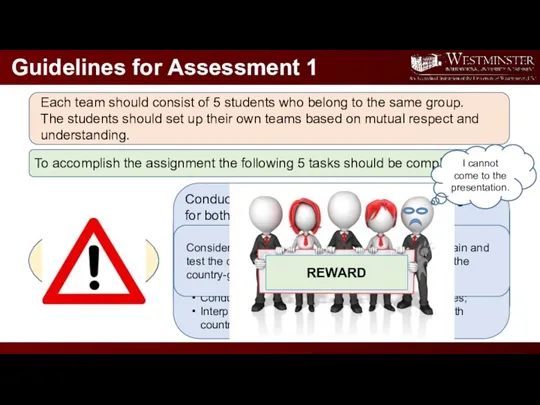

- 10. Guidelines for Assessment 1 Each team should consist of 5 students who belong to the same

- 11. LECTURE 1 Introduction to Growth Theory

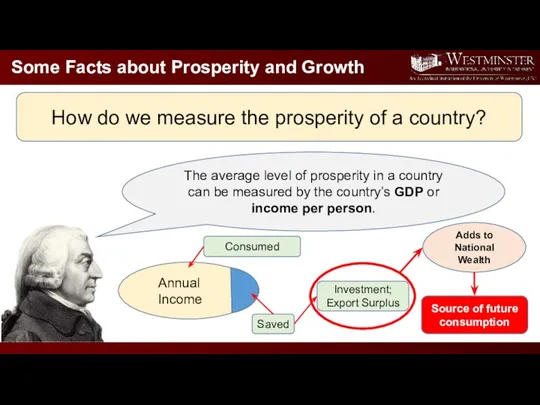

- 12. Some Facts about Prosperity and Growth The average level of prosperity in a country can be

- 13. Some Facts about Prosperity and Growth How do we measure the prosperity of a country? What

- 14. GDP per capita Why is GDP per capita a flawed measure of economic well-being? GDP counts

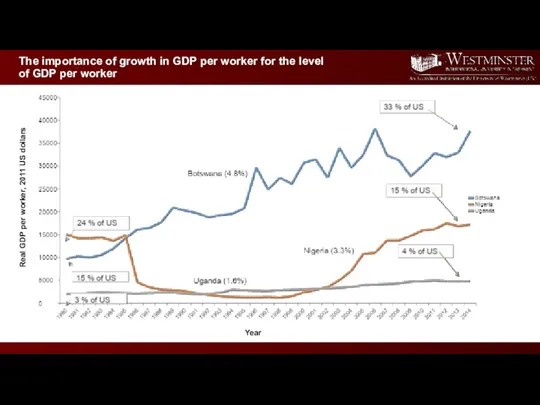

- 15. The importance of growth in GDP per worker for the level of GDP per worker Real

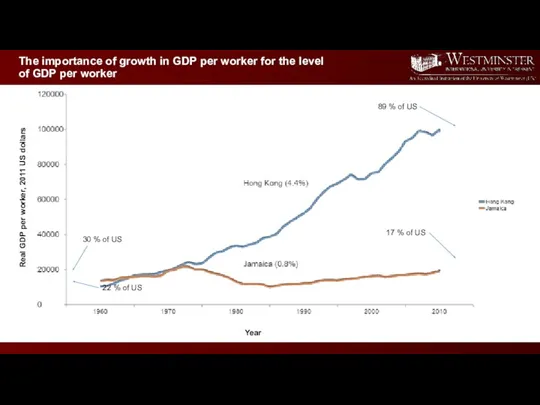

- 16. Real GDP per worker, 2011 US dollars Year The importance of growth in GDP per worker

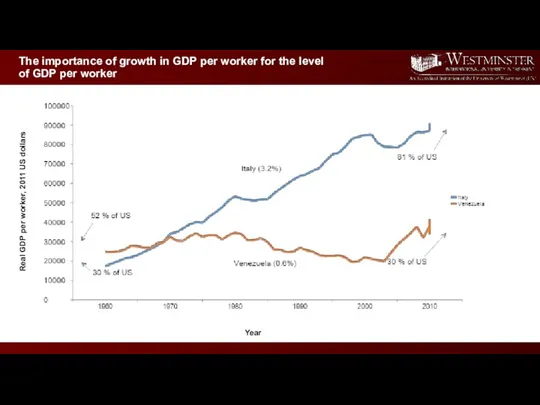

- 17. Real GDP per worker, 2011 US dollars Year The importance of growth in GDP per worker

- 18. Measuring the Wealth of a Nation How do we compare the income per person across countries?

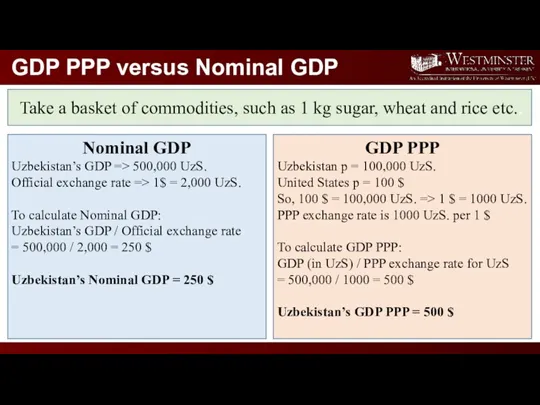

- 19. GDP PPP versus Nominal GDP Take a basket of commodities, such as 1 kg sugar, wheat

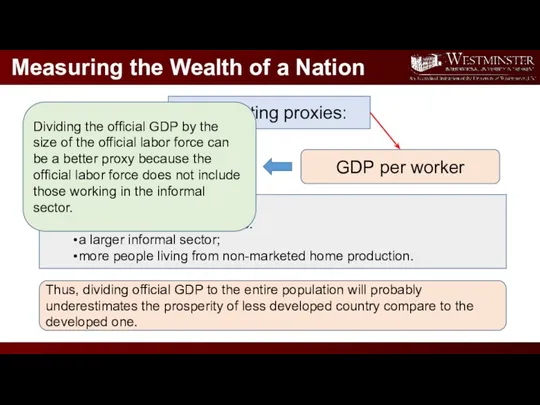

- 20. Measuring the Wealth of a Nation Competing proxies: GDP per capita GDP per worker Some issues

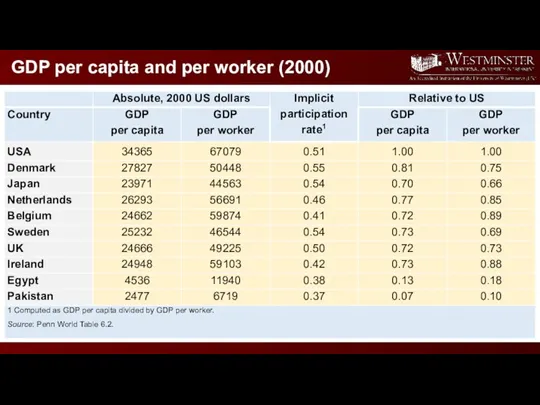

- 21. GDP per capita and per worker (2000)

- 22. The rich and the poor, the growing and the declining

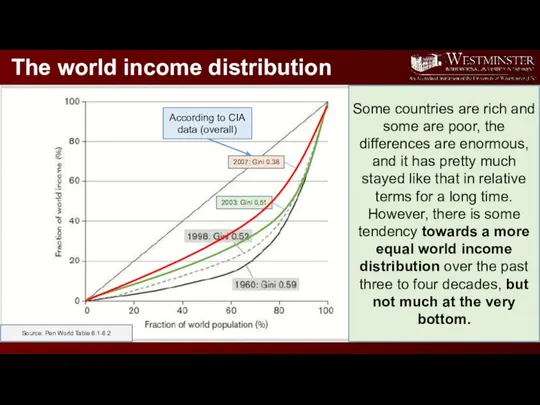

- 23. The world income distribution 2003: Gini 0.51 2007: Gini 0.38 According to CIA data (overall) Source:

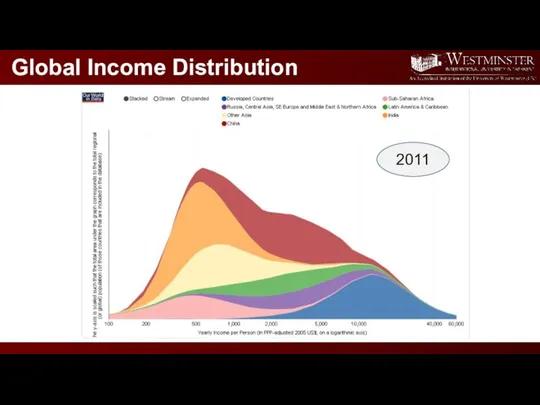

- 24. 1988 2011 Global Income Distribution

- 25. 15 poorest nations

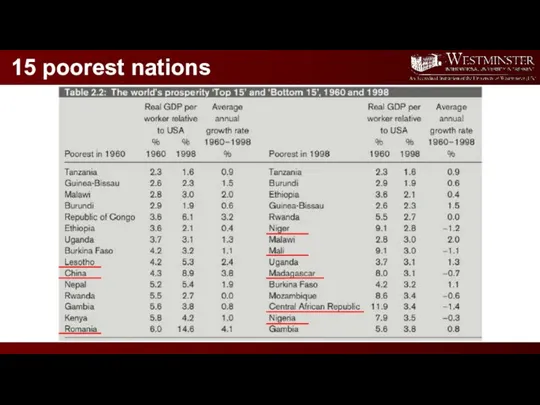

- 26. 15 richest nations

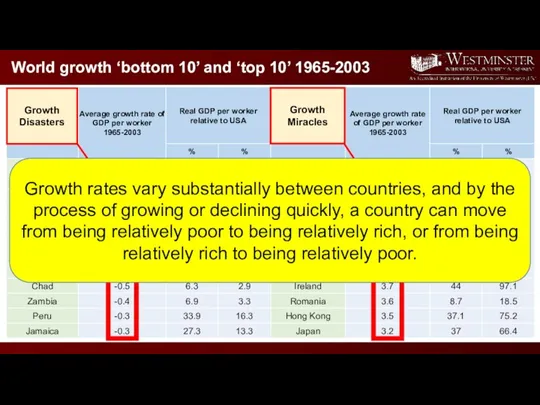

- 27. World growth ‘bottom 10’ and ‘top 10’ 1965-2003 Growth Disasters Growth Miracles Growth rates vary substantially

- 28. Quiz What do you think? What are the main reasons for some sub-Saharan and Middle East

- 29. CONVERGENCE Types of Convergence Absolute Convergence Conditional Convergence Club Convergence An interesting idea in economics would,

- 30. Absolute Convergence Hypothesis: In the long run GDP per worker (or per capita) converges to one

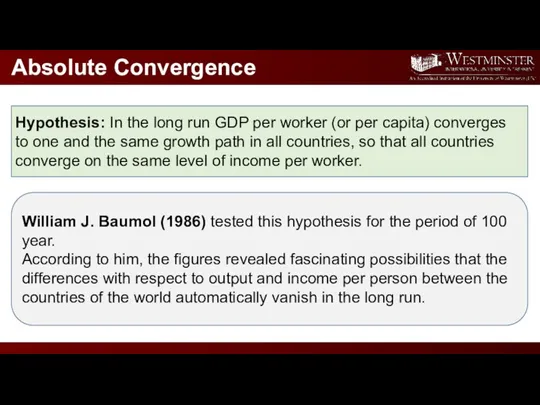

- 31. Convergence of GDP per worker Log of Real GDP per worker, 2011 US dollars Year Source:

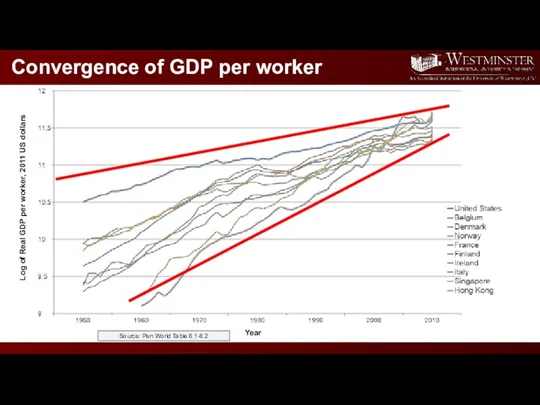

- 32. Foreign Aid As you witnessed from the graph, if the poverty disappears by itself, doesn’t it

- 33. In other words, average growth in GDP per worker from year 0 to year T. say,

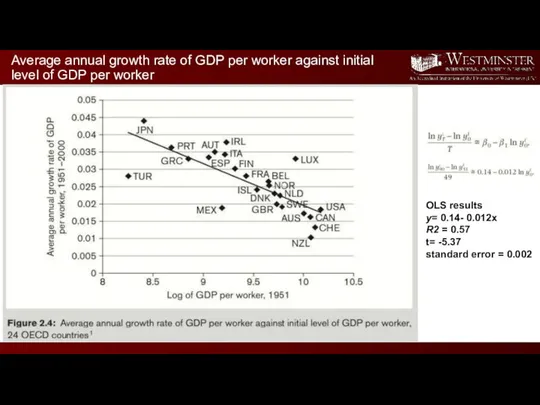

- 34. Average annual growth rate of GDP per worker against initial level of GDP per worker OLS

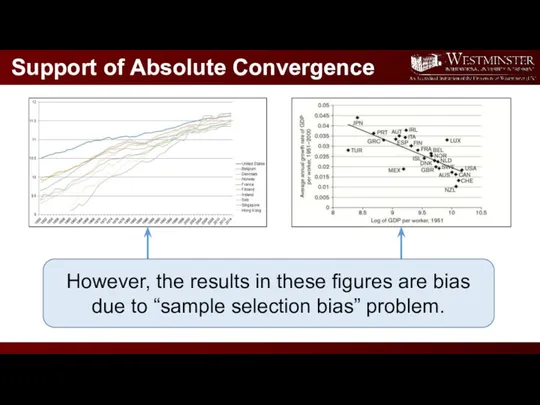

- 35. Support of Absolute Convergence However, the results in these figures are bias due to “sample selection

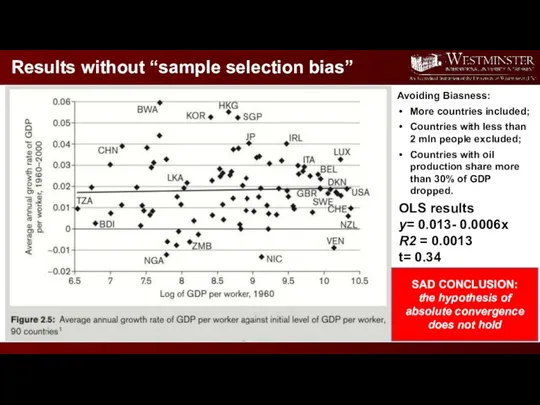

- 36. Results without “sample selection bias” OLS results y= 0.013- 0.0006x R2 = 0.0013 t= 0.34 Avoiding

- 37. Structural Characteristics of Countries Countries with higher rates of saving and investment have higher rates of

- 38. Conditional Convergence Hypothesis: A country's income per worker converges to a country-specific long-run growth path which

- 39. Modeling Conditional Convergence Where: z – a vector of variables capturing country-specific structural characteristics; Ϫ -is

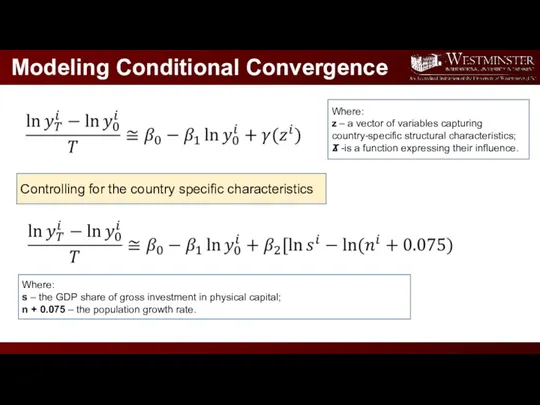

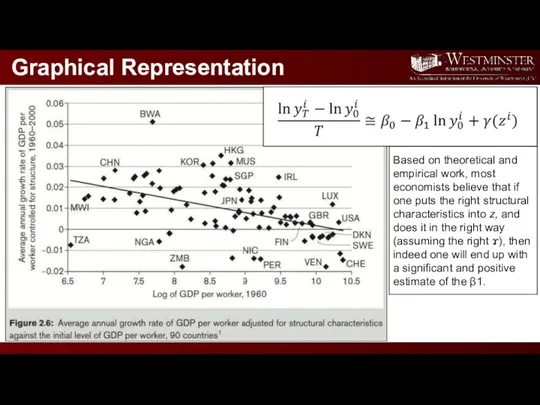

- 40. Graphical Representation Based on theoretical and empirical work, most economists believe that if one puts the

- 41. Foreign Aid What is the role of foreign aid in conditional convergence?

- 42. Club Convergence Hypothesis: A country's income per worker converges to a long-run growth path that depends

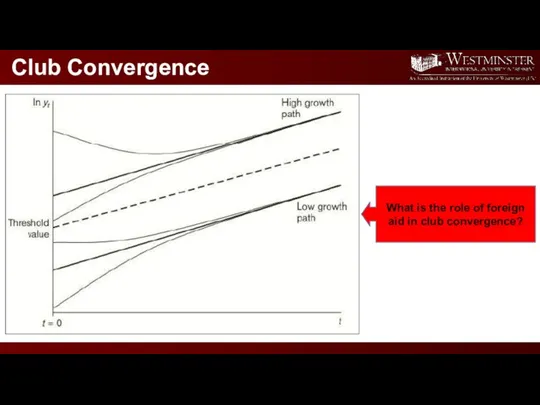

- 43. Club Convergence What is the role of foreign aid in club convergence?

- 44. Summary of Convergence Convergence: lf one controls appropriately for structural differences between the countries of the

- 45. Steady long-run growth Over periods of more than 130 years, probably up to 200 years, many

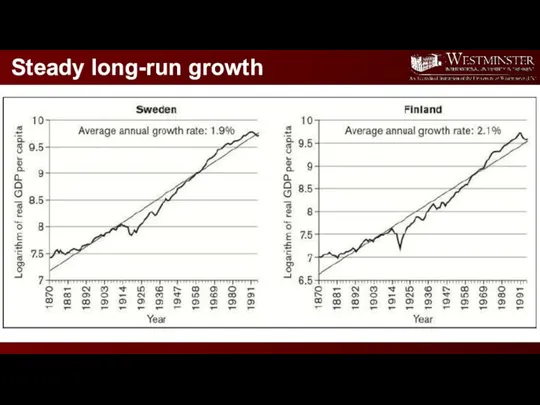

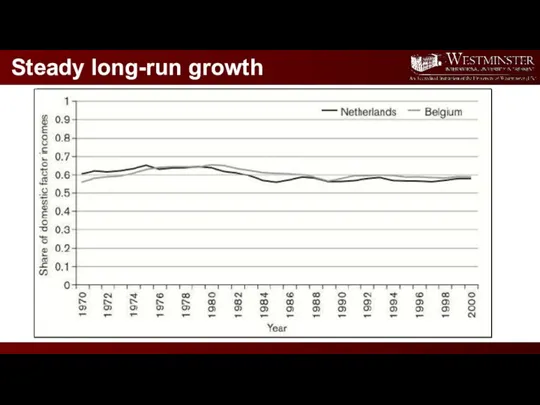

- 46. Steady long-run growth

- 47. Steady long-run growth

- 48. Balanced Growth The growth process follows a balanced growth path if GDP per worker, consumption per

- 49. Reference Sorensen & Whitta Jacobsen (2010), " Introducing Advanced Macroeconomics: Growth and Business Cycles", 2nd ed.

- 51. Скачать презентацию

Предприятие. Предпринимательство

Предприятие. Предпринимательство Аралас экономика және қазіргі қоғамдық өндіріс қызмет етуінің объективті нысаны

Аралас экономика және қазіргі қоғамдық өндіріс қызмет етуінің объективті нысаны Великое экономическое чудо Сингапура. Ли Куан Ю

Великое экономическое чудо Сингапура. Ли Куан Ю Экономика и ее роль в жизни общества

Экономика и ее роль в жизни общества Издержки производства и себестоимость продукции

Издержки производства и себестоимость продукции Центральный экономический район (ЦЭР)

Центральный экономический район (ЦЭР) Трудовые ресурсы и рынок труда

Трудовые ресурсы и рынок труда Азық-түлік мәселесінің себептері

Азық-түлік мәселесінің себептері Рыночные отношения в здравоохранении

Рыночные отношения в здравоохранении Анализ целевого рынка

Анализ целевого рынка ЕГЭ обществознание. Сборник типовых КИМов

ЕГЭ обществознание. Сборник типовых КИМов Роль Грузии в Новом шёлковом пути

Роль Грузии в Новом шёлковом пути Научные исследования, как объект финансирования

Научные исследования, как объект финансирования Теория потребительского выбора

Теория потребительского выбора Устойчивое развитие Тверской области

Устойчивое развитие Тверской области Рынок труда

Рынок труда Impact of 2013 banking crisis in Republic of Cyprus on national economy

Impact of 2013 banking crisis in Republic of Cyprus on national economy Экономика страхования и финансовые основы страховой деятельности. Инвестиционная деятельность страховых компаний

Экономика страхования и финансовые основы страховой деятельности. Инвестиционная деятельность страховых компаний Национальное хозяйство (экономика) России. 9 класс

Национальное хозяйство (экономика) России. 9 класс Занятость и безработица

Занятость и безработица Теория спроса и предложения. (Тема 1)

Теория спроса и предложения. (Тема 1) Производственная мощность

Производственная мощность Факторы удовлетворенности жизнью в пожилом возрасте и политика государства

Факторы удовлетворенности жизнью в пожилом возрасте и политика государства Экономическая доктрина марксизма

Экономическая доктрина марксизма Спрос и предложение. (8 класс)

Спрос и предложение. (8 класс) Мировая экономика

Мировая экономика Труд. Индустриальное общество

Труд. Индустриальное общество Муниципальное образование город Обнинск

Муниципальное образование город Обнинск