Содержание

- 2. CONTENT Purchase experience among jewelry customers TOUS brand metrics, perception, purchase experience TOUS advertising effectiveness Competitors:

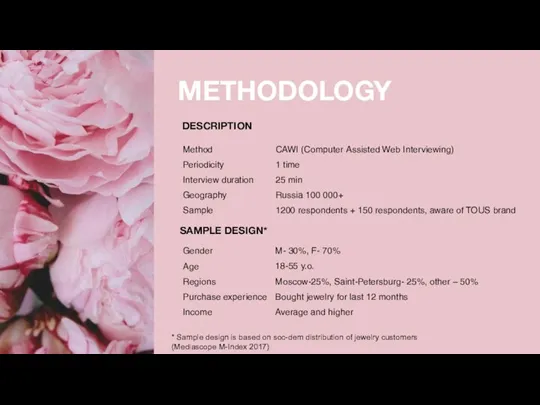

- 3. METHODOLOGY DESCRIPTION SAMPLE DESIGN* * Sample design is based on soc-dem distribution of jewelry customers (Mediascope

- 4. MAIN OBJECTIVES

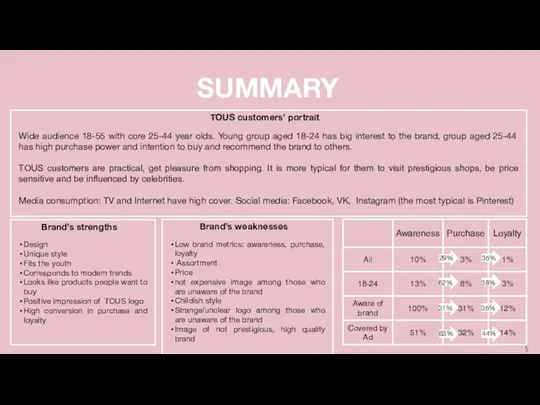

- 5. TOUS customers’ portrait Wide audience 18-55 with core 25-44 year olds. Young group aged 18-24 has

- 6. PURCHASE EXPERIENCE AMONG JEWELRY CUSTOMERS

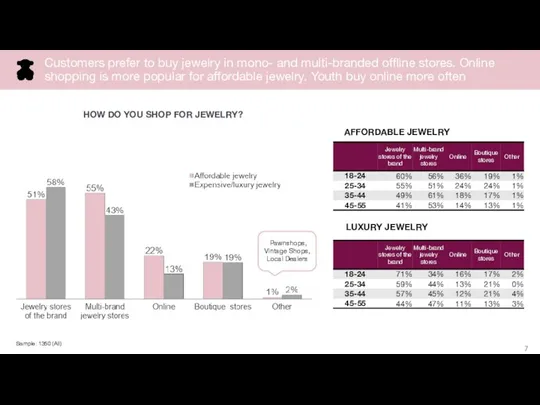

- 7. Pawnshops, Vintage Shops, Local Dealers Sample: 1350 (All) HOW DO YOU SHOP FOR JEWELRY? LUXURY JEWELRY

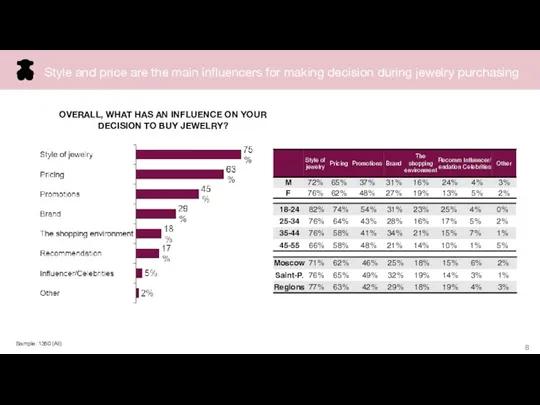

- 8. Sample: 1350 (All) OVERALL, WHAT HAS AN INFLUENCE ON YOUR DECISION TO BUY JEWELRY? Style and

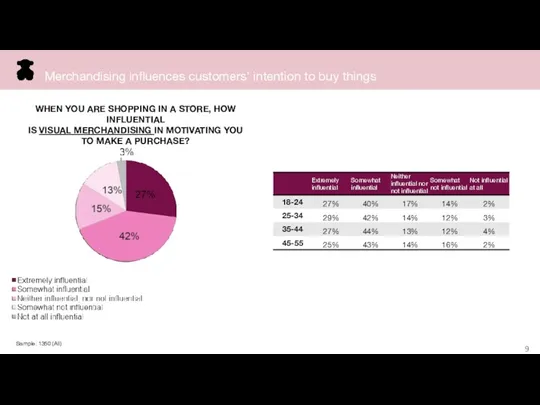

- 9. Sample: 1350 (All) WHEN YOU ARE SHOPPING IN A STORE, HOW INFLUENTIAL IS VISUAL MERCHANDISING IN

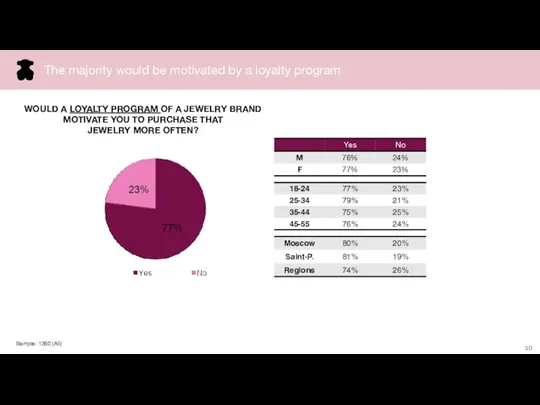

- 10. Sample: 1350 (All) WOULD A LOYALTY PROGRAM OF A JEWELRY BRAND MOTIVATE YOU TO PURCHASE THAT

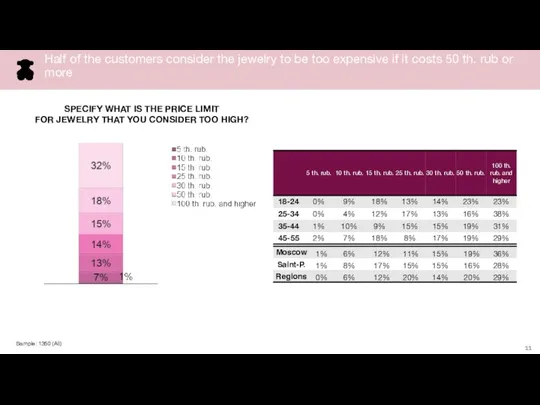

- 11. Sample: 1350 (All) SPECIFY WHAT IS THE PRICE LIMIT FOR JEWELRY THAT YOU CONSIDER TOO HIGH?

- 12. Sample: 1350 (All) WHAT JEWELRY/EXPENSIVE BIJOUTERIE HAVE YOU PURCHASED IN THE LAST 12 MONTHS? clasp to

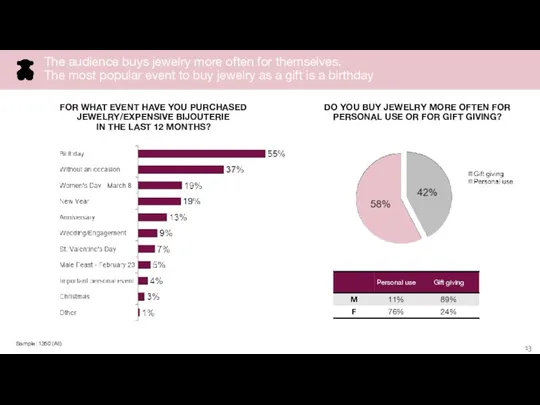

- 13. DO YOU BUY JEWELRY MORE OFTEN FOR PERSONAL USE OR FOR GIFT GIVING? FOR WHAT EVENT

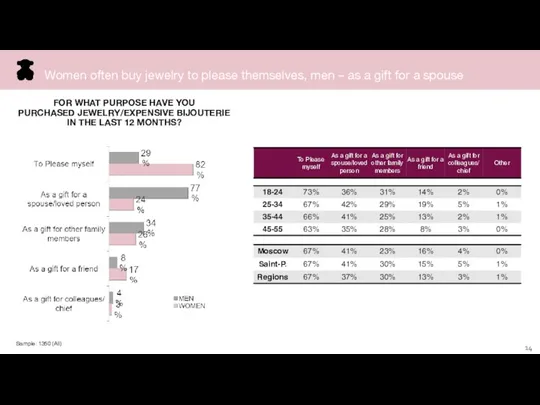

- 14. Sample: 1350 (All) FOR WHAT PURPOSE HAVE YOU PURCHASED JEWELRY/EXPENSIVE BIJOUTERIE IN THE LAST 12 MONTHS?

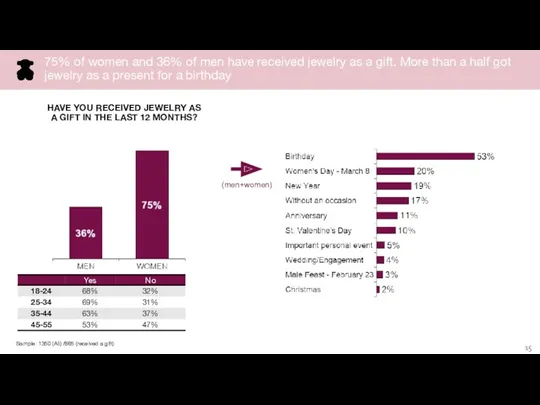

- 15. Sample: 1350 (All) /865 (received a gift) HAVE YOU RECEIVED JEWELRY AS A GIFT IN THE

- 16. . Customers buy jewelry more often for themselves. Women purchase jewelry to please themselves, men buy

- 17. TOUS BRAND METRICS, PERCEPTION AND PURCHASE EXPERIENCE

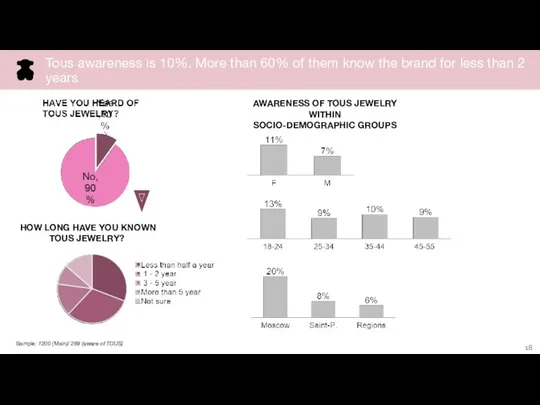

- 18. Tous awareness is 10%. More than 60% of them know the brand for less than 2

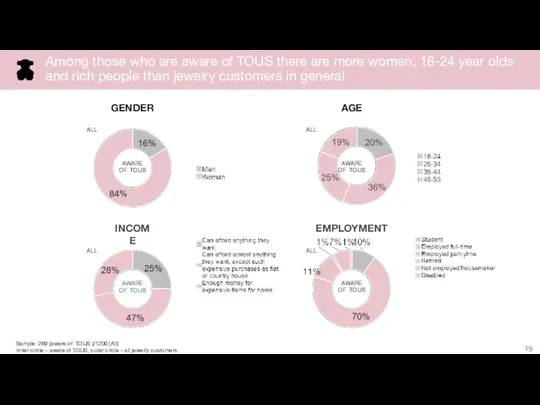

- 19. Sample: 269 (aware of TOUS )/1200 (All) Inner circle – aware of TOUS, outer circle –

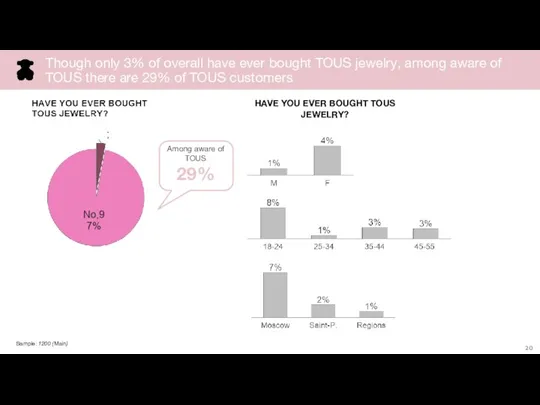

- 20. Sample: 1200 (Main) HAVE YOU EVER BOUGHT TOUS JEWELRY? Among aware of TOUS 29% Though only

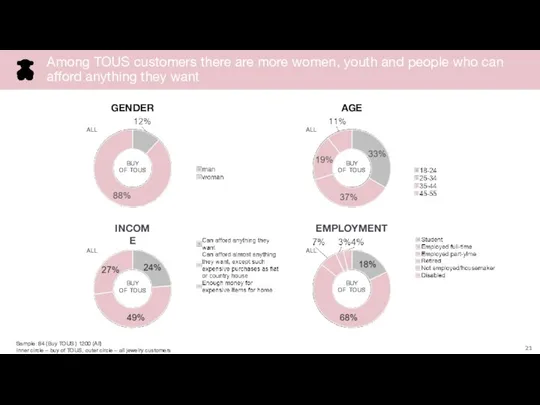

- 21. Among TOUS customers there are more women, youth and people who can afford anything they want

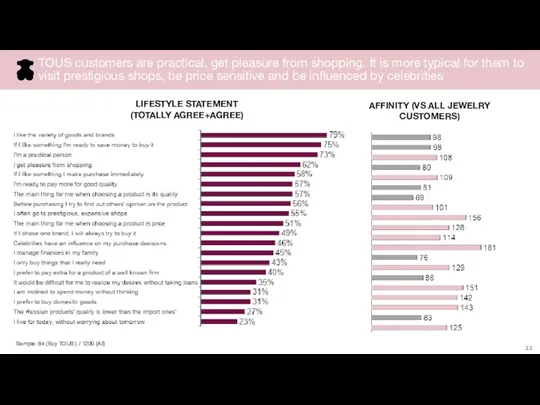

- 22. LIFESTYLE STATEMENT (TOTALLY AGREE+AGREE) AFFINITY (VS ALL JEWELRY CUSTOMERS) Sample: 84 (Buy TOUS ) / 1200

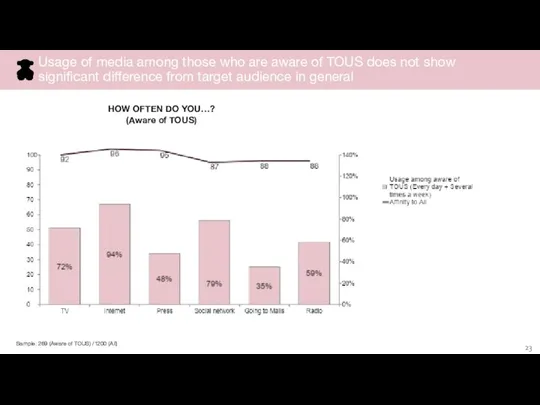

- 23. Sample: 269 (Aware of TOUS) /1200 (All) HOW OFTEN DO YOU…? (Aware of TOUS) Usage of

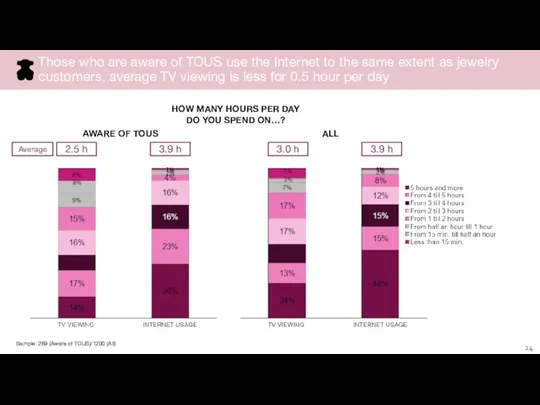

- 24. Sample: 269 (Aware of TOUS)/1200 (All) HOW MANY HOURS PER DAY DO YOU SPEND ON…? AWARE

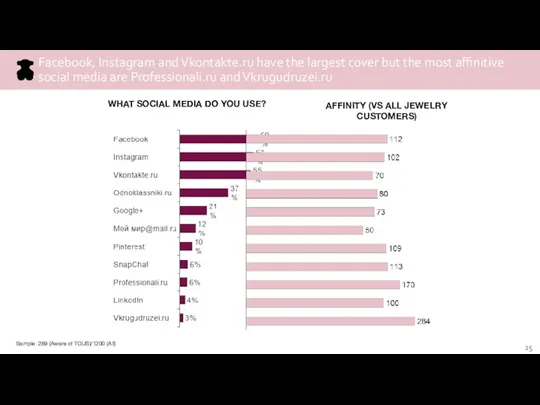

- 25. WHAT SOCIAL MEDIA DO YOU USE? AFFINITY (VS ALL JEWELRY CUSTOMERS) Sample: 269 (Aware of TOUS)/1200

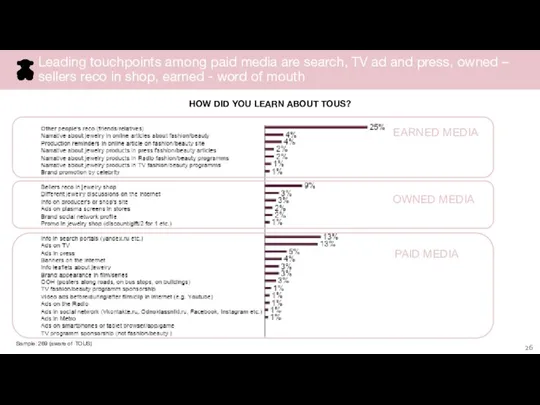

- 26. Sample: 269 (aware of TOUS) HOW DID YOU LEARN ABOUT TOUS? EARNED MEDIA OWNED MEDIA PAID

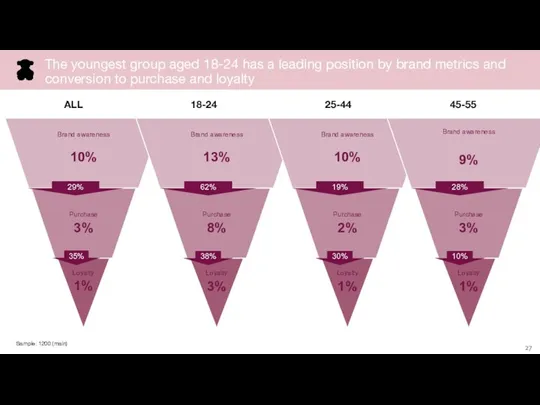

- 27. ALL 18-24 25-44 45-55 Sample: 1200 (main) The youngest group aged 18-24 has a leading position

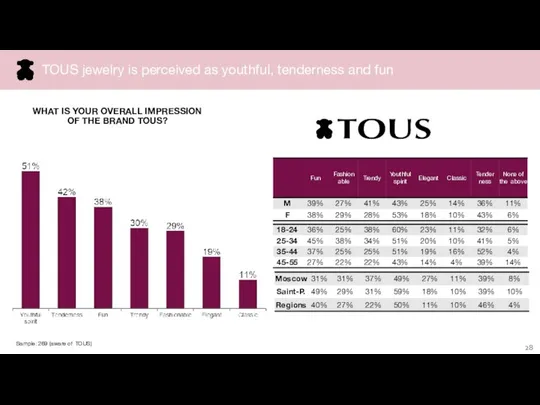

- 28. WHAT IS YOUR OVERALL IMPRESSION OF THE BRAND TOUS? Sample: 269 (aware of TOUS) TOUS jewelry

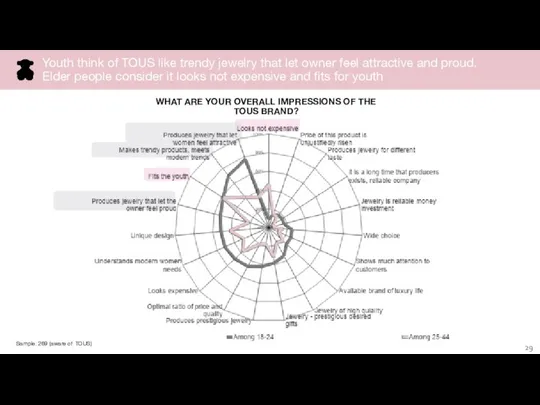

- 29. Sample: 269 (aware of TOUS) WHAT ARE YOUR OVERALL IMPRESSIONS OF THE TOUS BRAND? Youth think

- 30. Sample: 269 (aware of TOUS) EACH TOUS ITEM REFLECTS THE VALUES OF THE BRAND: TENDERNESS, FUN

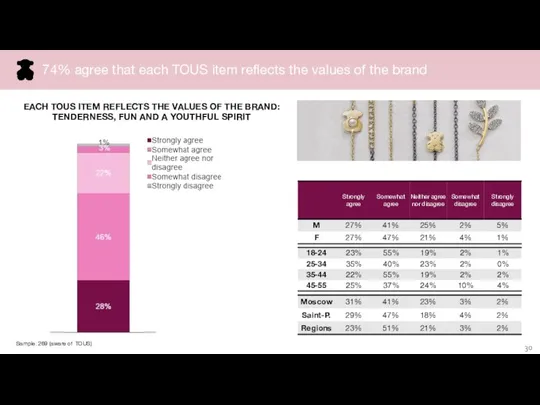

- 31. EVEN THOUGH YOU HAVE NOT HEARD OF TOUS, WHAT IS YOUR IMPRESSION OF THIS TYPE OF

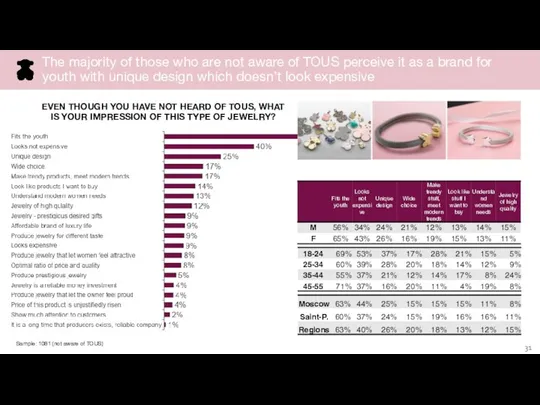

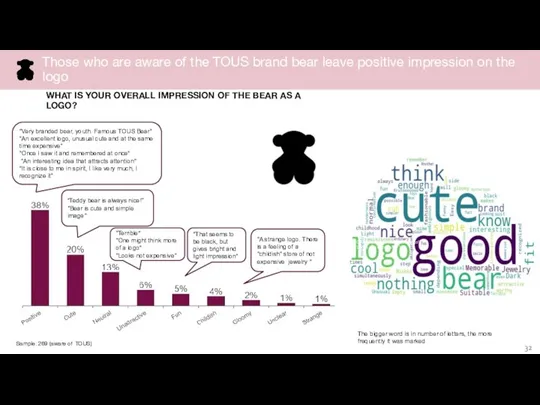

- 32. WHAT IS YOUR OVERALL IMPRESSION OF THE BEAR AS A LOGO? Sample: 269 (aware of TOUS)

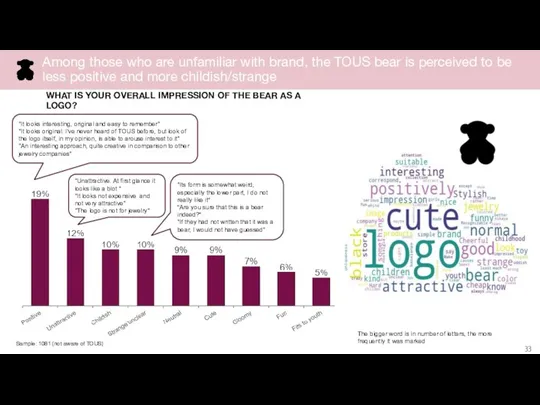

- 33. WHAT IS YOUR OVERALL IMPRESSION OF THE BEAR AS A LOGO? "Its form is somewhat weird,

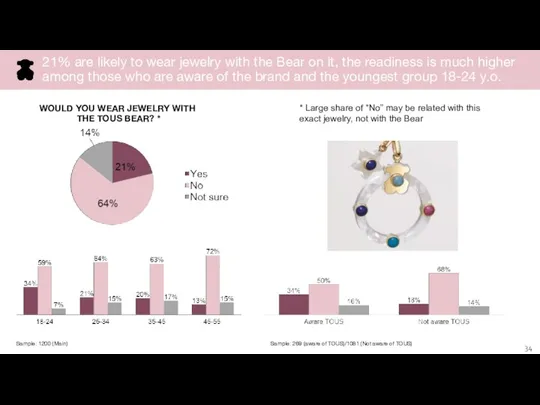

- 34. WOULD YOU WEAR JEWELRY WITH THE TOUS BEAR? * Sample: 1200 (Main) Sample: 269 (aware of

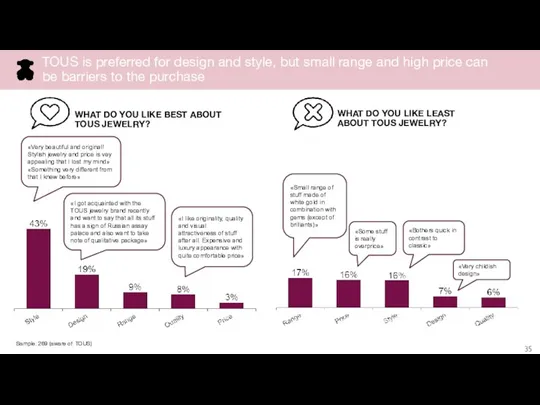

- 35. WHAT DO YOU LIKE BEST ABOUT TOUS JEWELRY? WHAT DO YOU LIKE LEAST ABOUT TOUS JEWELRY?

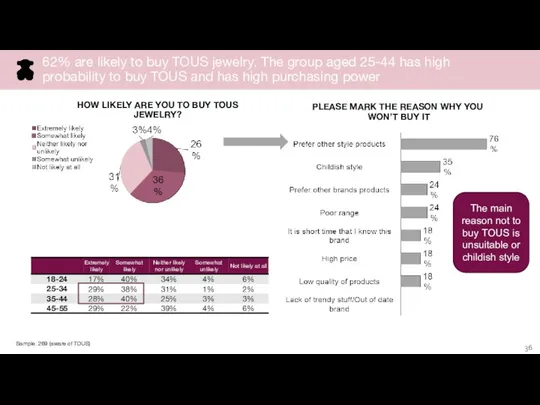

- 36. HOW LIKELY ARE YOU TO BUY TOUS JEWELRY? PLEASE MARK THE REASON WHY YOU WON’T BUY

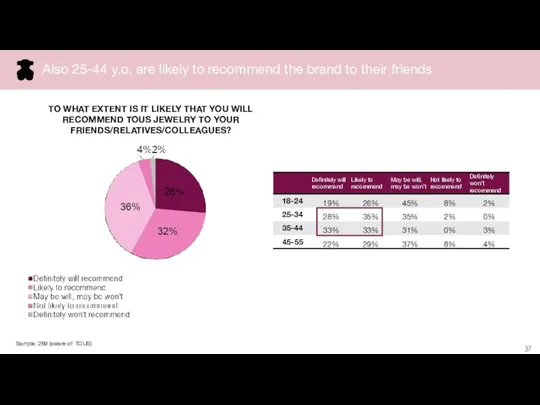

- 37. Sample: 269 (aware of TOUS) TO WHAT EXTENT IS IT LIKELY THAT YOU WILL RECOMMEND TOUS

- 38. TOUS ADVERTISING EFFECTIVENESS

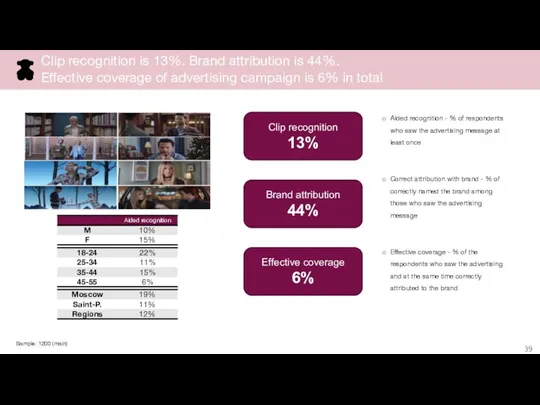

- 39. Aided recognition - % of respondents who saw the advertising message at least once Correct attribution

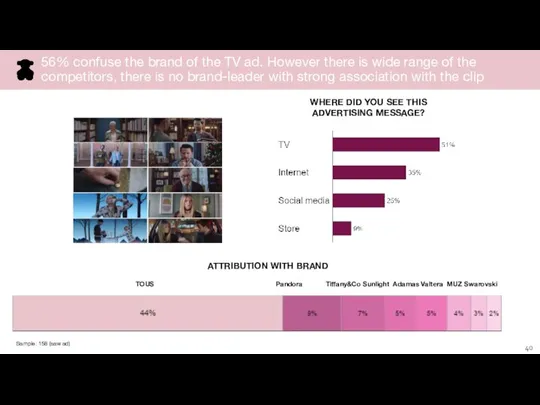

- 40. WHERE DID YOU SEE THIS ADVERTISING MESSAGE? ATTRIBUTION WITH BRAND Sample: 158 (saw ad) TOUS Pandora

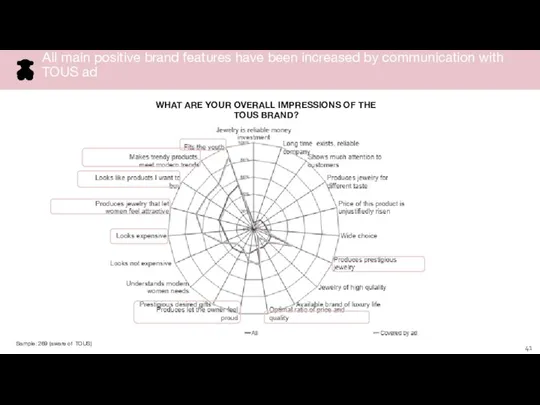

- 41. All main positive brand features have been increased by communication with TOUS ad Sample: 269 (aware

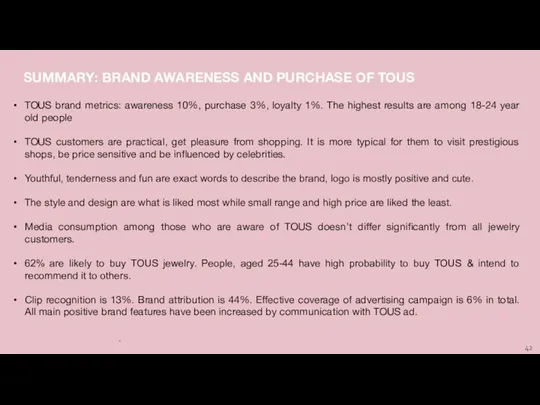

- 42. . TOUS brand metrics: awareness 10%, purchase 3%, loyalty 1%. The highest results are among 18-24

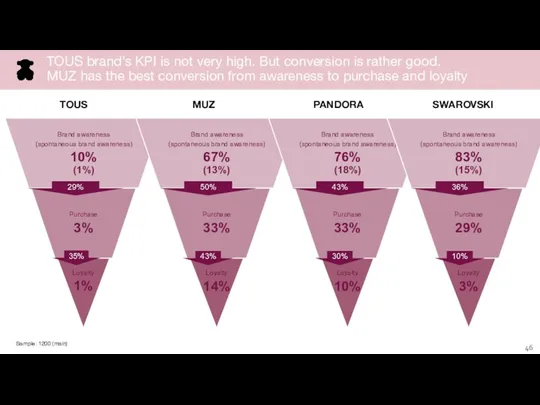

- 43. COMPETITORS: BRAND METRICS OVERVIEW

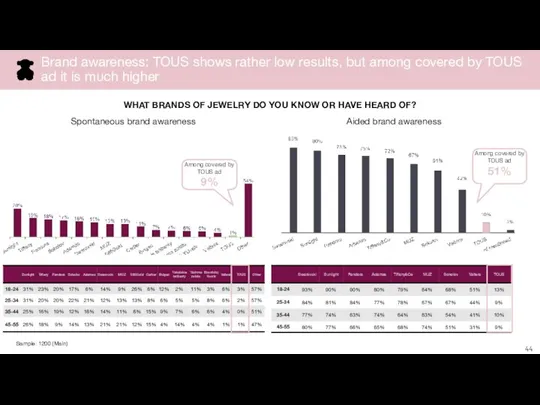

- 44. Among covered by TOUS ad 9% Sample: 1200 (Main) WHAT BRANDS OF JEWELRY DO YOU KNOW

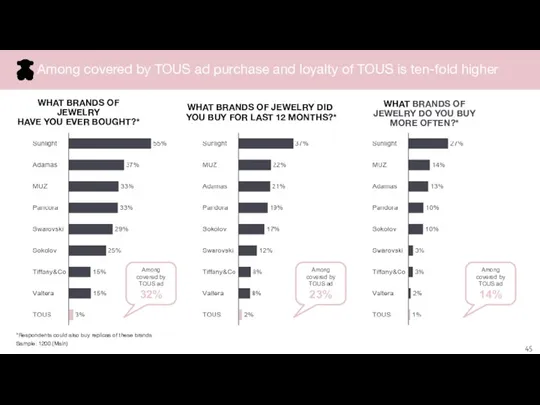

- 45. *Respondents could also buy replicas of these brands Sample: 1200 (Main) WHAT BRANDS OF JEWELRY HAVE

- 46. TOUS MUZ PANDORA SWAROVSKI Sample: 1200 (main) TOUS brand’s KPI is not very high. But conversion

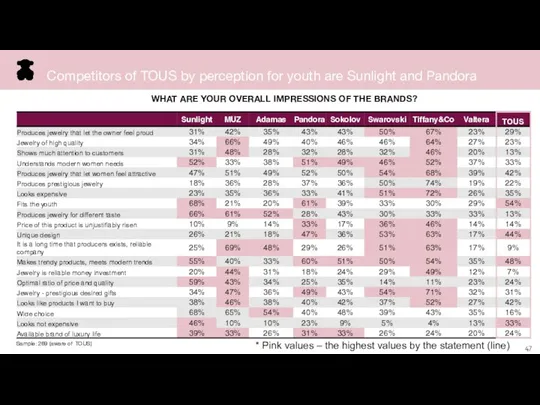

- 47. WHAT ARE YOUR OVERALL IMPRESSIONS OF THE BRANDS? Sample: 269 (aware of TOUS) Competitors of TOUS

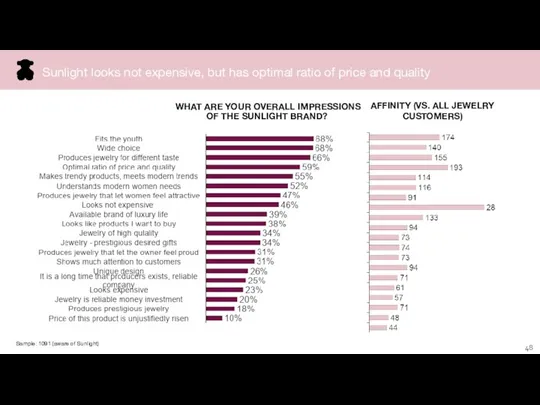

- 48. WHAT ARE YOUR OVERALL IMPRESSIONS OF THE SUNLIGHT BRAND? Sample: 1091 (aware of Sunlight) AFFINITY (VS.

- 49. WHAT ARE YOUR OVERALL IMPRESSIONS OF THE PANDORA BRAND? Sample: 1041 (aware of Pandora) AFFINITY (VS.

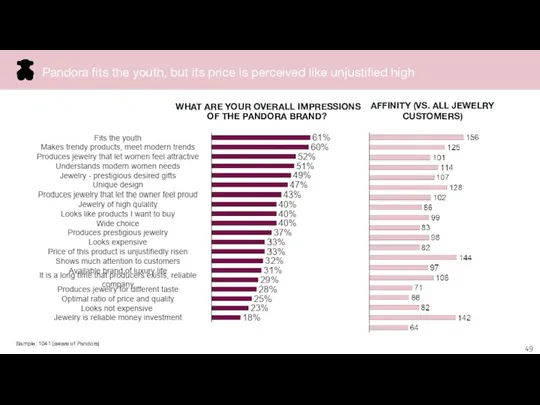

- 50. WHAT ARE YOUR OVERALL IMPRESSIONS OF THE SOKOLOV BRAND? Sample: 827 (aware of Sokolov) AFFINITY (VS.

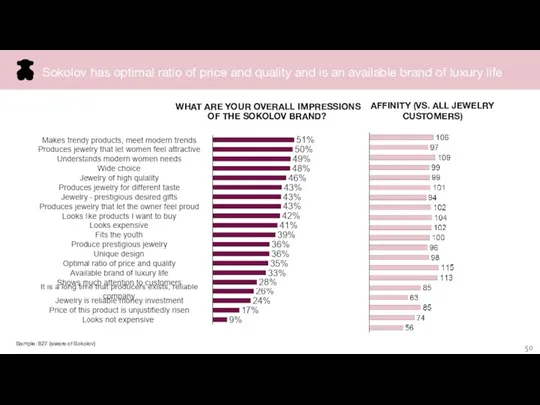

- 51. WHAT ARE YOUR OVERALL IMPRESSIONS OF THE MUZ BRAND? Sample: 909 (aware of Мoskovskiy yuvelirnyy zavod)

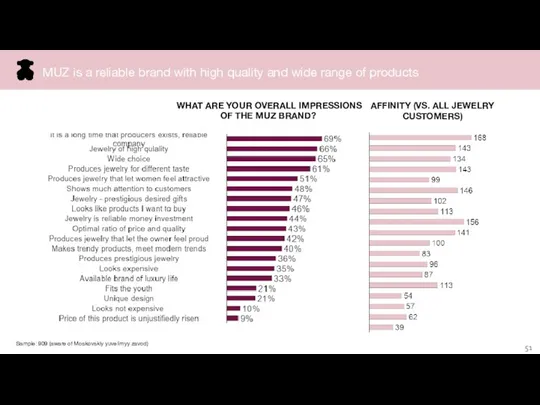

- 52. WHAT ARE YOUR OVERALL IMPRESSIONS OF THE SWAROVSKI BRAND? Sample: 1110 (aware of Swarovski) AFFINITY (VS.

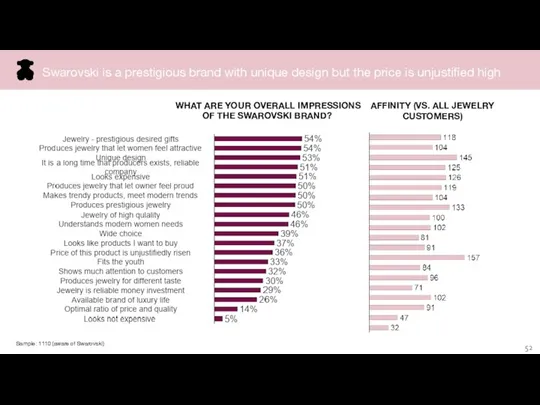

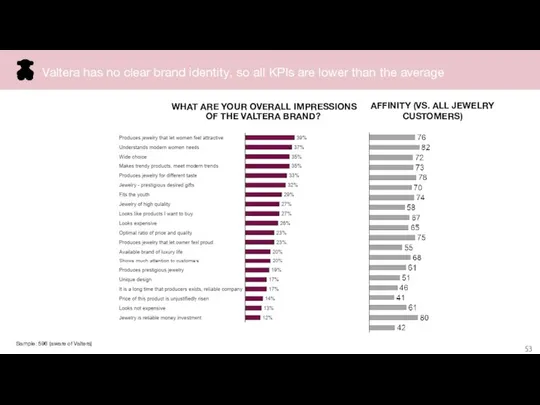

- 53. WHAT ARE YOUR OVERALL IMPRESSIONS OF THE VALTERA BRAND? Sample: 596 (aware of Valtera) AFFINITY (VS.

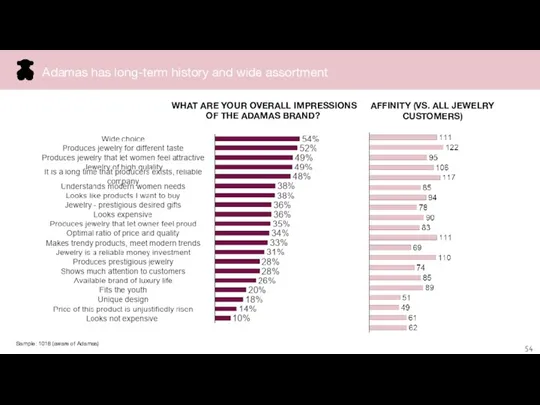

- 54. WHAT ARE YOUR OVERALL IMPRESSIONS OF THE ADAMAS BRAND? Sample: 1018 (aware of Adamas) AFFINITY (VS.

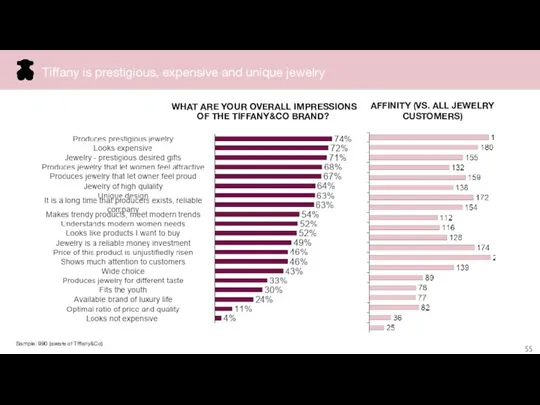

- 55. WHAT ARE YOUR OVERALL IMPRESSIONS OF THE TIFFANY&CO BRAND? Sample: 990 (aware of Tiffany&Co) AFFINITY (VS.

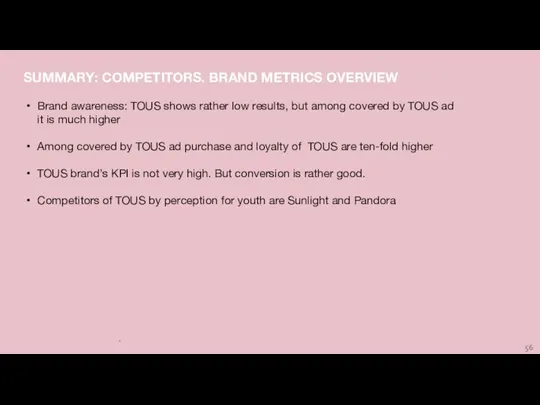

- 56. . Brand awareness: TOUS shows rather low results, but among covered by TOUS ad it is

- 57. Focus on two different audiences: W18-24 and W25-44 years old. Increase volume of market presence. Focus

- 58. The trend shows increase of media investments in the category of Jewelry There are 2 prevalent

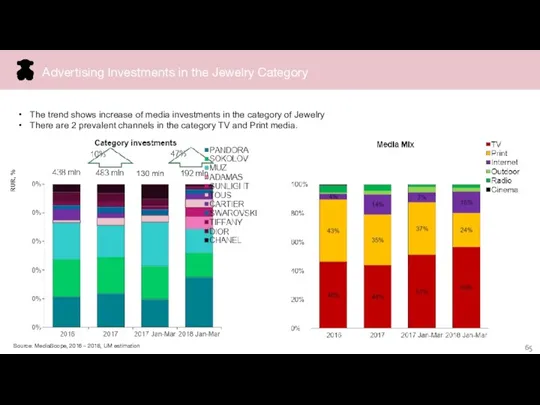

- 59. The trend shows an increase of media investments 2 prevalent channels remain to be TV and

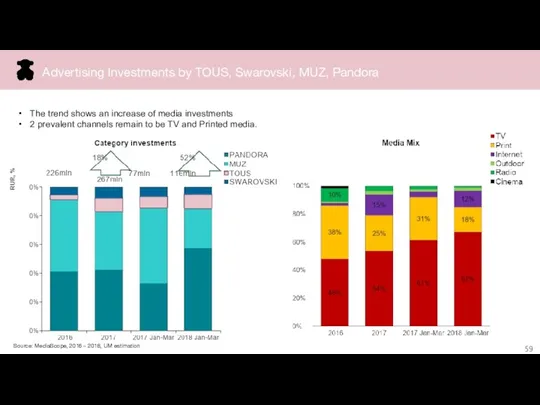

- 60. Seasonality shows clearly peaks in the gender holidays and New Year’s celebration Source: MediaScope, 2016 –

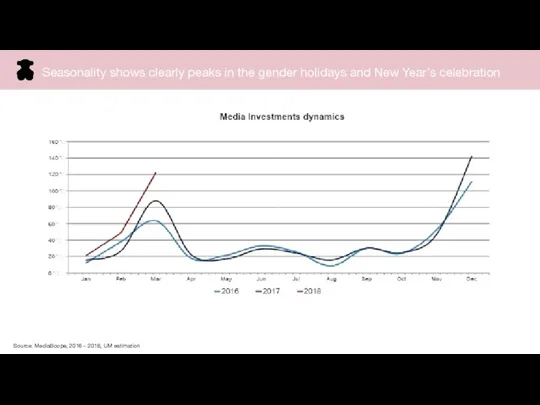

- 61. SOS vs SOV on Nat TV – Sokolov’s investments are the most efficient in terms of

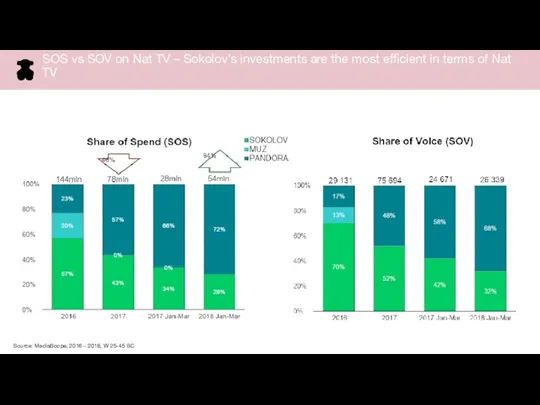

- 62. Regional TV – Sokolov and Moskow Jewelry Plant massively support their products in various cities Source:

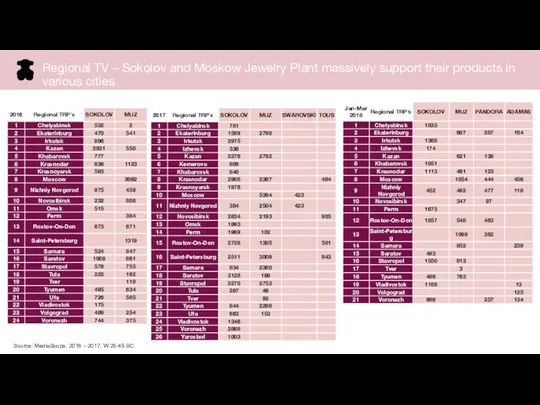

- 63. 2016 – 114mln 2017 – 123mln 2016 – 94mln 2017 – 113mln 2016 – 12mln 2017

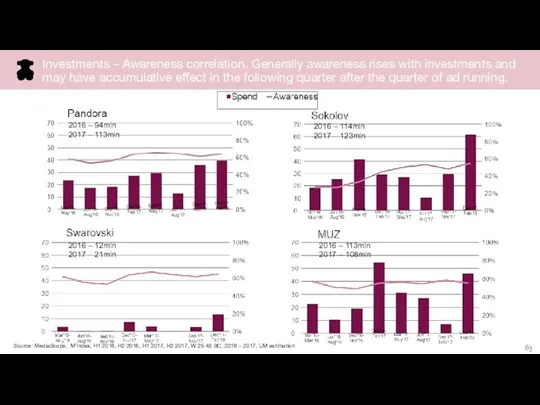

- 64. *By sales volume on jewelry market ** By the volume turnover of competitors: MUZ, Swarovski и

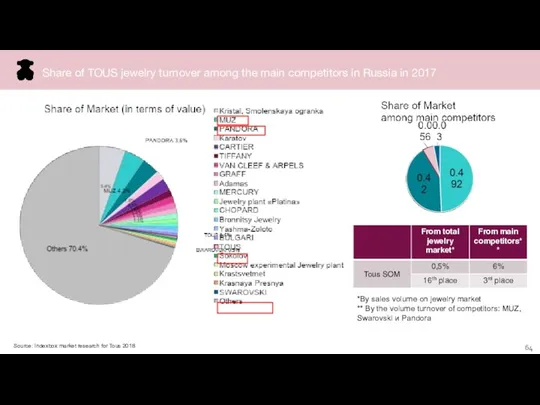

- 65. Relation between Market Share* and Spontaneous Brand Awareness in 2017 is not obvious in regard to

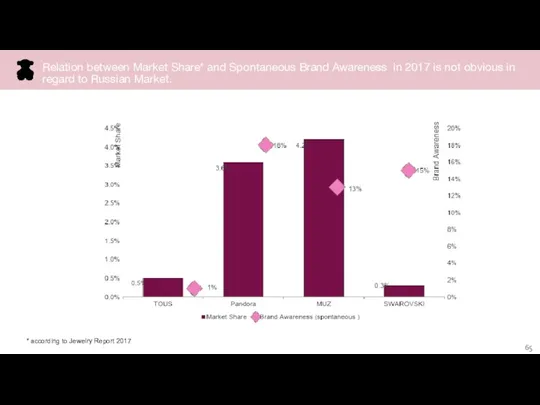

- 67. Скачать презентацию

Газированный напиток Шампусик торговой марки Добрый кашалот

Газированный напиток Шампусик торговой марки Добрый кашалот Территория доступной красоты

Территория доступной красоты Компания WOODBROK IMPEX LP

Компания WOODBROK IMPEX LP Основные понятия маркетинга

Основные понятия маркетинга Арт-фабрика. Доступное производство для креативного класса

Арт-фабрика. Доступное производство для креативного класса Закупочная логистика. (Тема 4)

Закупочная логистика. (Тема 4) Бренд Kapous Professional

Бренд Kapous Professional Обновление сети магазинов Мобил Хоум

Обновление сети магазинов Мобил Хоум Оптовые поставки детской обуви. ООО АНАЛИТИКА

Оптовые поставки детской обуви. ООО АНАЛИТИКА Линия средств PERFECT

Линия средств PERFECT Детский оздоровительный лагерь Маяк

Детский оздоровительный лагерь Маяк Инвестиционная стратегия предприятия

Инвестиционная стратегия предприятия Дәлелді медицина және маркетинг

Дәлелді медицина және маркетинг Монтаж витринного оформления SALE

Монтаж витринного оформления SALE Defender. Напыляемая шумоизоляция. Антикорозионные материалы. Гравийная защита

Defender. Напыляемая шумоизоляция. Антикорозионные материалы. Гравийная защита Путь самурая. Привлечение клиентов с интернета

Путь самурая. Привлечение клиентов с интернета Event-агентство Веселье

Event-агентство Веселье История бренда Swarovski

История бренда Swarovski Добровільне медичне страхування УНІКА. Корпоративна турбота

Добровільне медичне страхування УНІКА. Корпоративна турбота Эфирные масла dōTERRA

Эфирные масла dōTERRA Изучение спроса на товары для ремонта жилья

Изучение спроса на товары для ремонта жилья Каталог чая

Каталог чая Чек-лист: путь к идеальным бровям

Чек-лист: путь к идеальным бровям Складские услуги в Новой Москве

Складские услуги в Новой Москве Интернет-маркетолог с нуля. Анализ целевой аудитории и конкурентов. Привлечение пользователей

Интернет-маркетолог с нуля. Анализ целевой аудитории и конкурентов. Привлечение пользователей Брендинг территории

Брендинг территории Ambient реклама как средство локальных коммуникаций (на примере ПАО МТС)

Ambient реклама как средство локальных коммуникаций (на примере ПАО МТС) Группа строительных компаний ООО АЮВИ ГРУПП

Группа строительных компаний ООО АЮВИ ГРУПП