Содержание

- 2. Сокращения, используемые в презентации в рамках обзора рынка чая TBs/tbgs- teabags (чайные пакетики) LS – leaf

- 3. “B” brand: Value for money tea brand Created in 1998 especially for Russian and Ukrainian markets

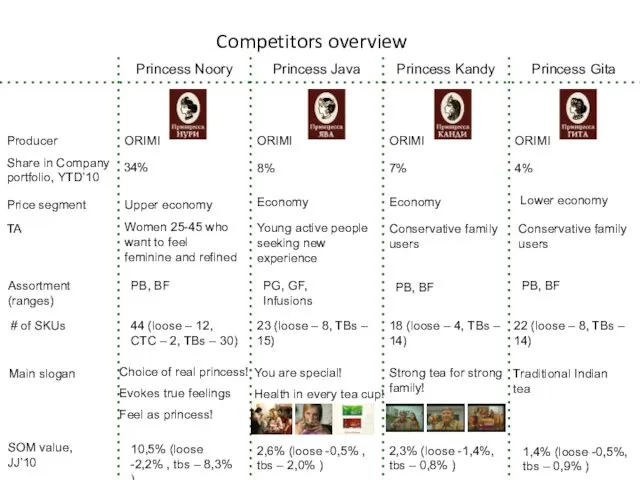

- 4. Competitors overview Princess Noory Princess Java Princess Kandy Princess Gita Producer ORIMI ORIMI ORIMI ORIMI Price

- 5. Competitors overview May tea Bodrost Golden Bowl Lisma Producer Price segment TA Assortment (ranges) Main slogan

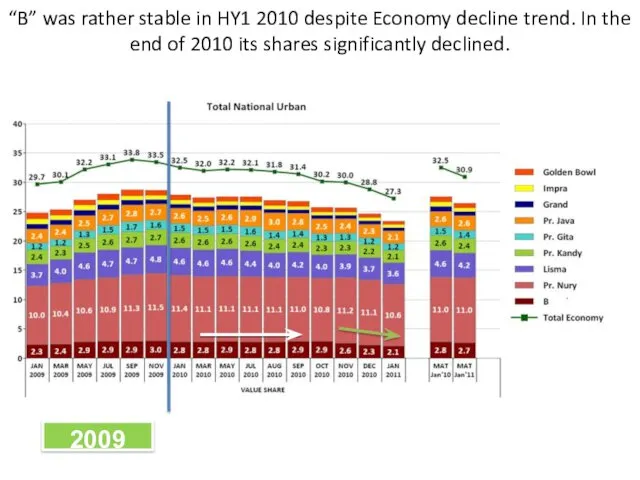

- 6. “B” was rather stable in HY1 2010 despite Economy decline trend. In the end of 2010

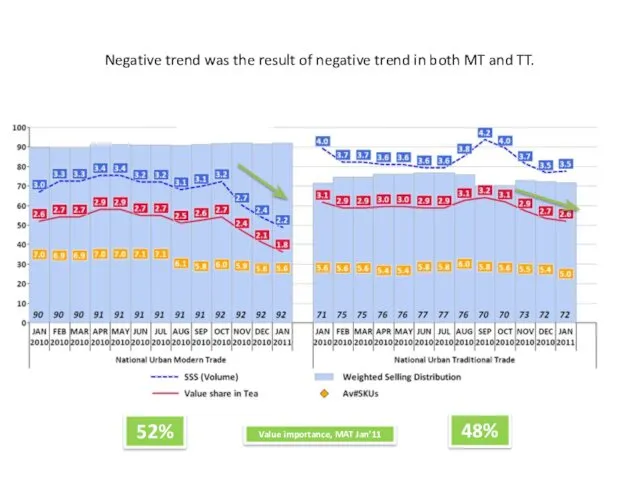

- 7. Negative trend was the result of negative trend in both MT and TT. 52% 48% Value

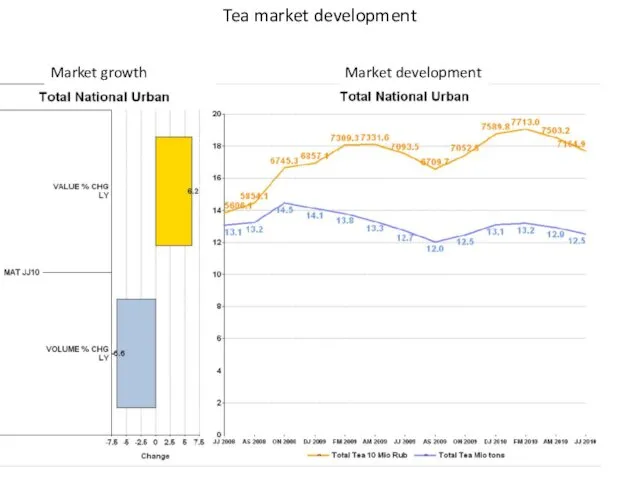

- 8. Tea market development Market growth Market development

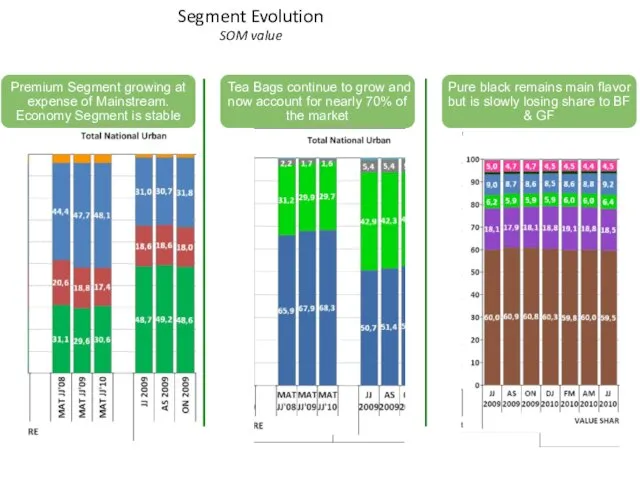

- 9. Segment Evolution SOM value

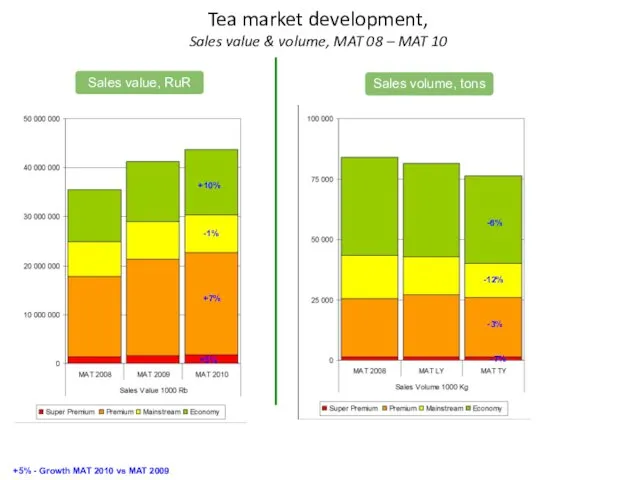

- 10. Tea market development, Sales value & volume, MAT 08 – MAT 10 +5% +5% - Growth

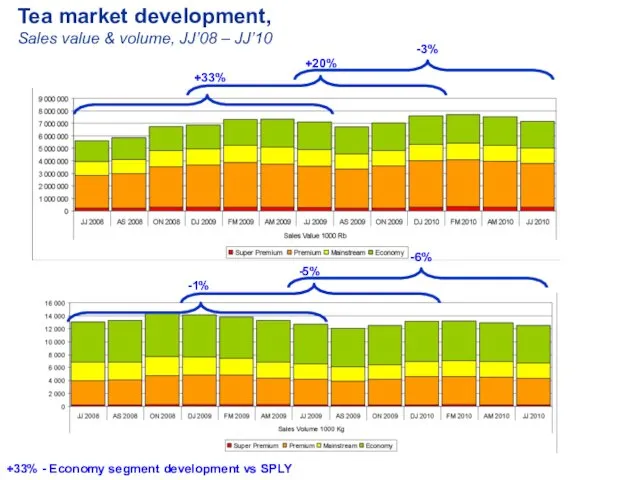

- 11. Tea market development, Sales value & volume, JJ’08 – JJ’10 +33% +20% -3% -1% -5% -6%

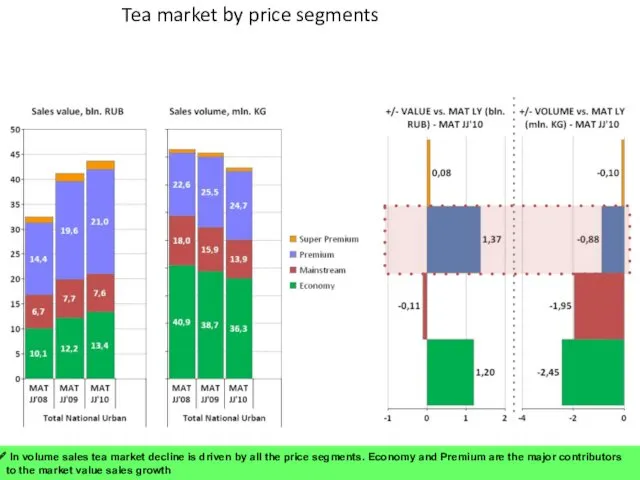

- 12. Tea market by price segments In volume sales tea market decline is driven by all the

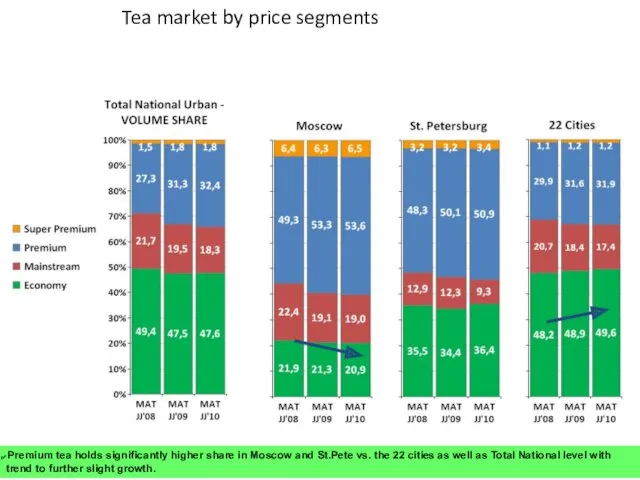

- 13. Page Tea market by price segments Premium tea holds significantly higher share in Moscow and St.Pete

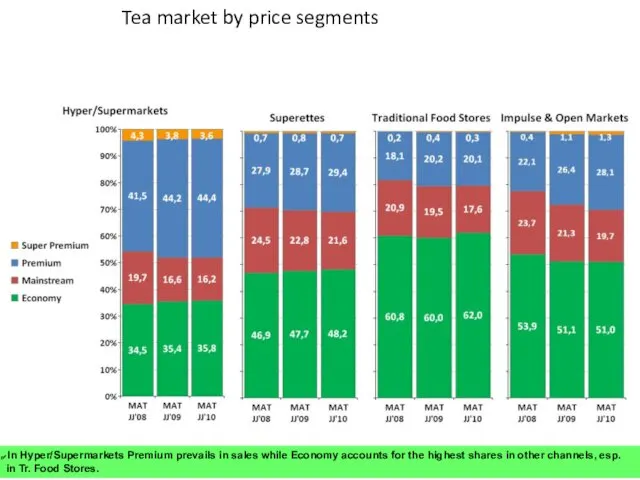

- 14. Page Tea market by price segments In Hyper/Supermarkets Premium prevails in sales while Economy accounts for

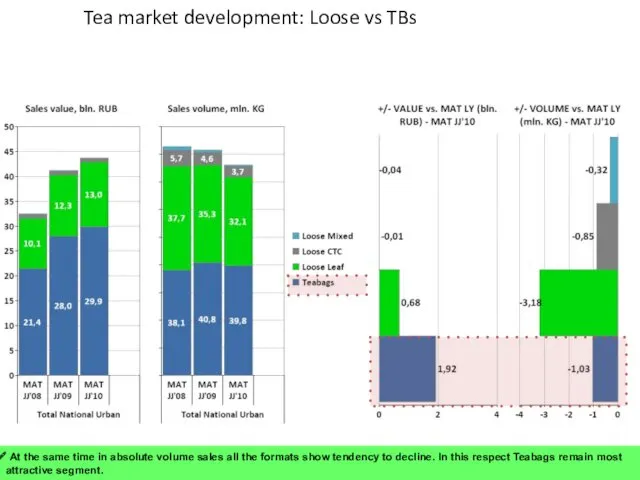

- 15. Page Tea market development: Loose vs TBs At the same time in absolute volume sales all

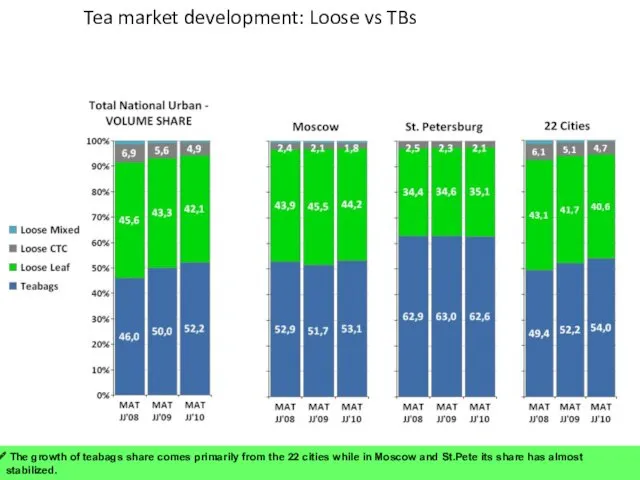

- 16. Page Tea market development: Loose vs TBs The growth of teabags share comes primarily from the

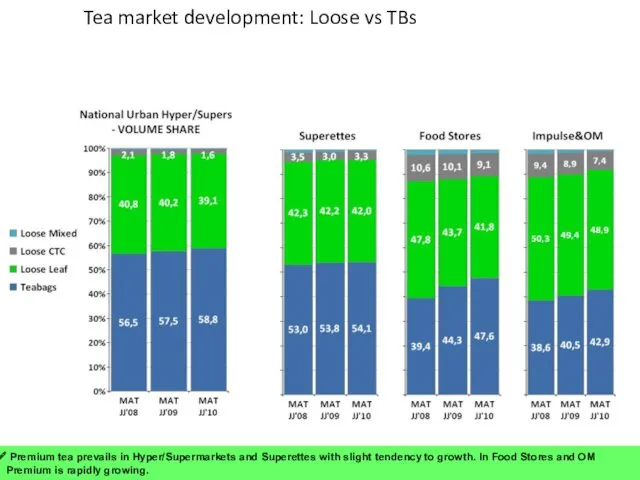

- 17. Page Tea market development: Loose vs TBs Premium tea prevails in Hyper/Supermarkets and Superettes with slight

- 18. PLACE

- 19. Market vs Economy players split Sales volume, Channels, MAT 08-10 -1% -5% -15% -8% -1% -

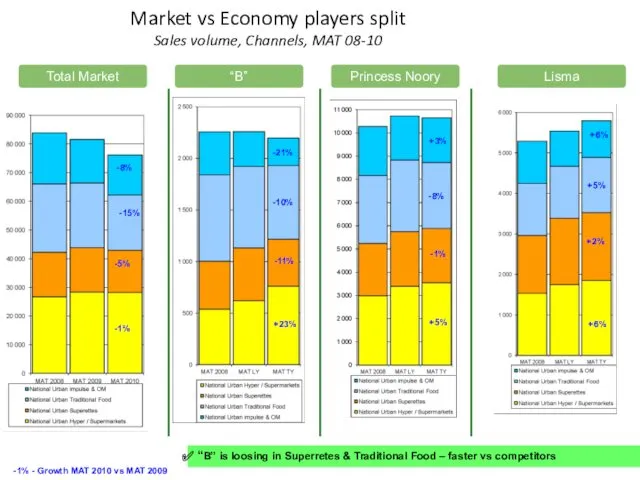

- 20. Tea market development : MT vs TT Traditional Trade importance is more or less stable, contributing

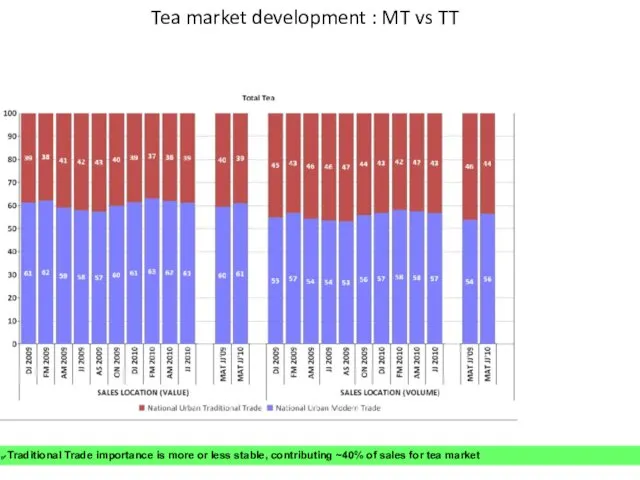

- 21. Tea market development : MT vs TT Traditional Trade is still significant for 24 cities and

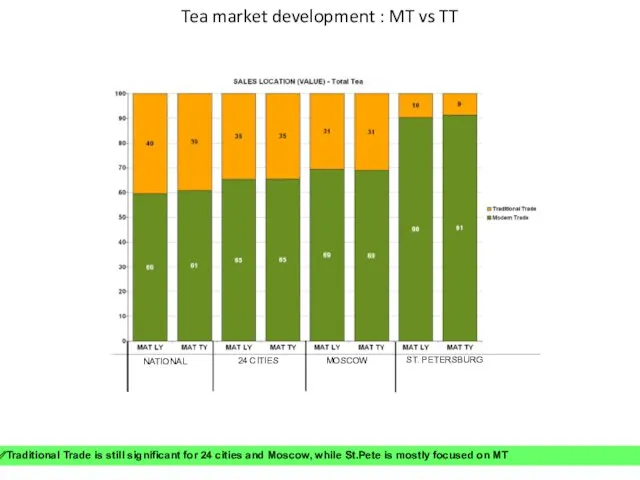

- 22. Market vs Economy players split Sales volume, Cities, MAT 08-10 +3% - Growth MAT 2010 vs

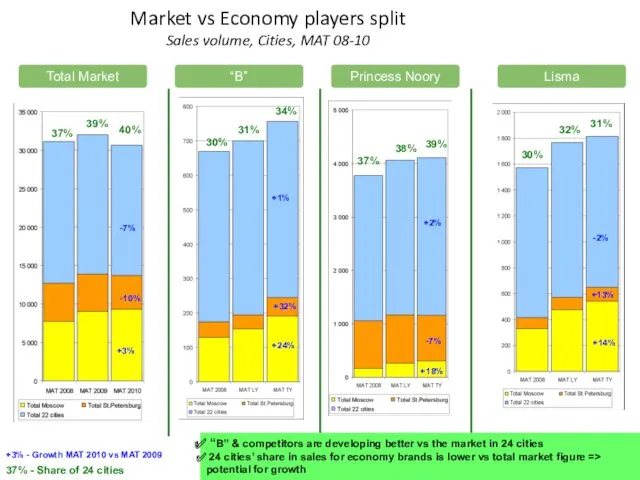

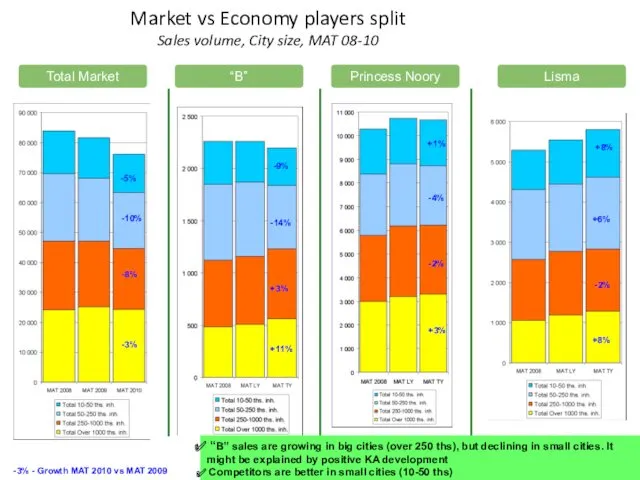

- 23. Market vs Economy players split Sales volume, City size, MAT 08-10 -3% - Growth MAT 2010

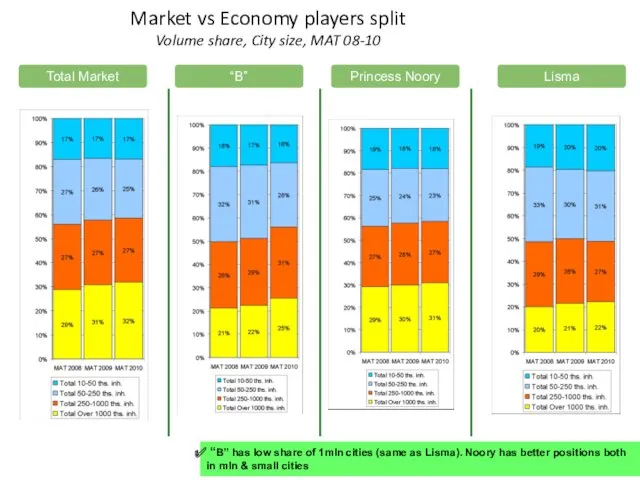

- 24. Market vs Economy players split Volume share, City size, MAT 08-10 “B” has low share of

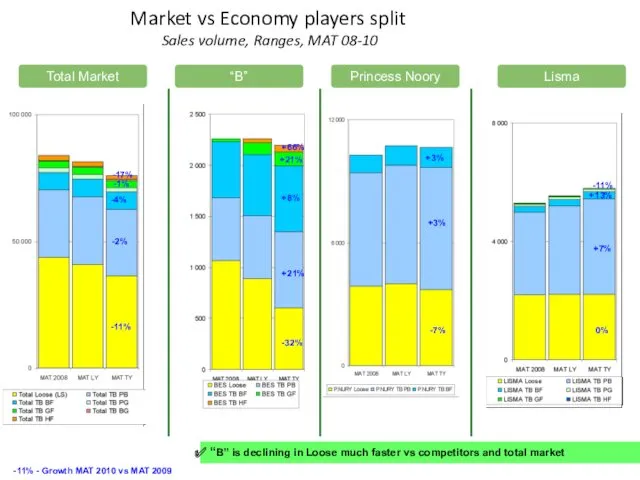

- 25. Market vs Economy players split Sales volume, Ranges, MAT 08-10 -11% - Growth MAT 2010 vs

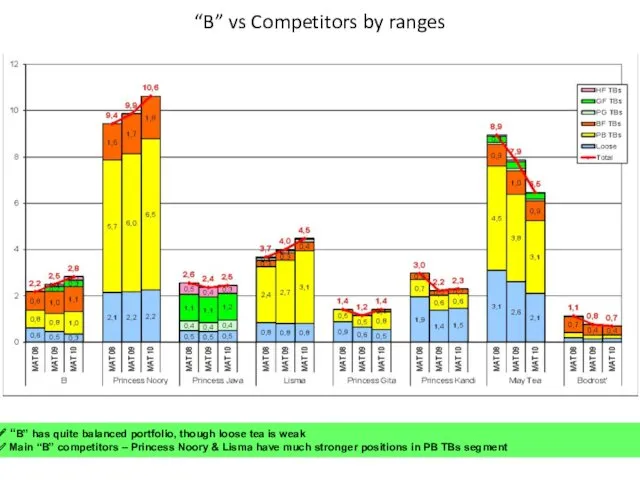

- 26. “B” vs Competitors by ranges “B” has quite balanced portfolio, though loose tea is weak Main

- 27. PRICE

- 28. Price comparison “B” vs competitors Pure Black 26 tbgs “B” is in line with strategic pricing

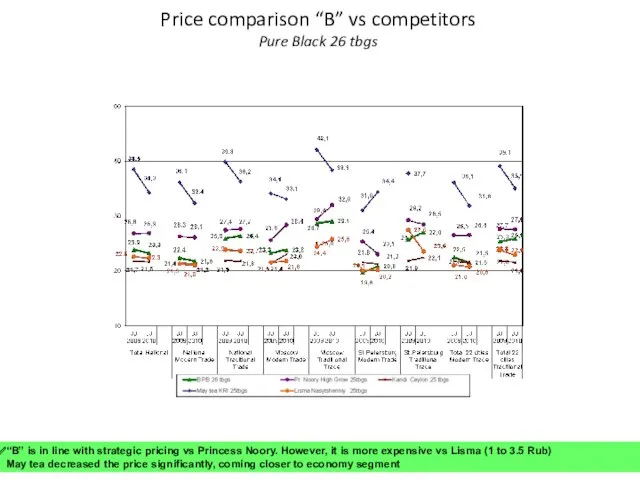

- 29. Price comparison “B” vs competitors Pure Black 50 tbgs, 100tbgs 50 TBs: “B” is OK both

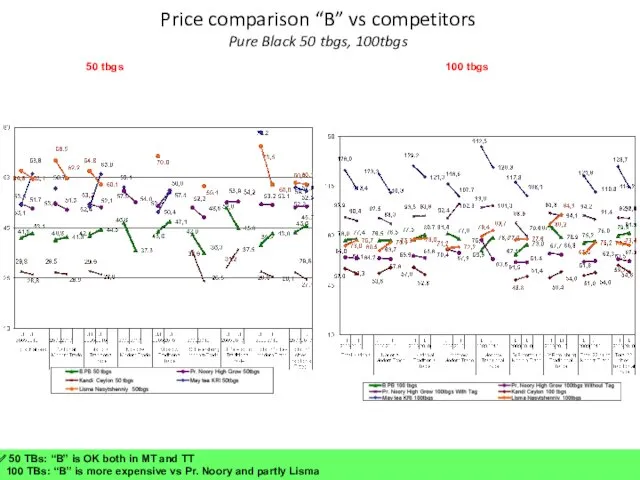

- 30. 100 tbgs development, SOM Value & price per pack “B” PB 100tbs has the highest SOM

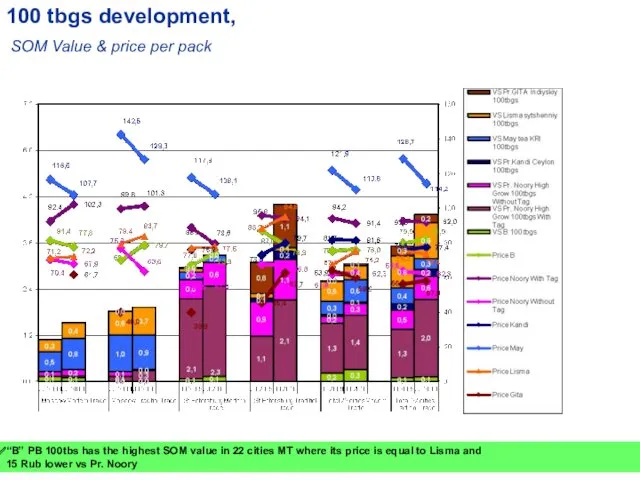

- 31. Price comparison “B” vs competitors Loose Pure Black 100 gr “B” Loose 100 gr has the

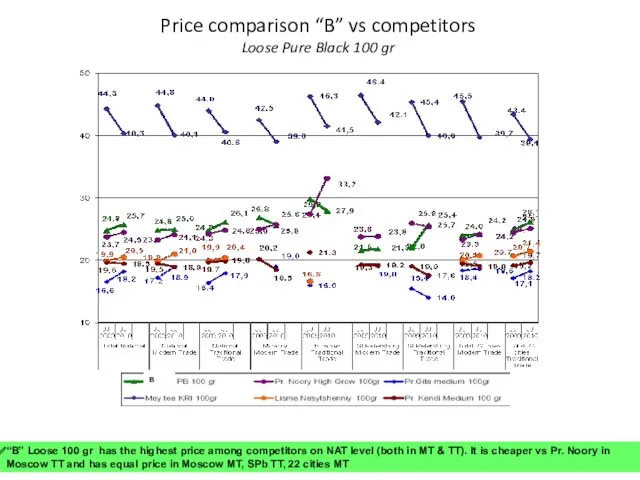

- 32. Price comparison “B” vs competitors BF, best distributed SKU “B” is in line with Strategic pricing

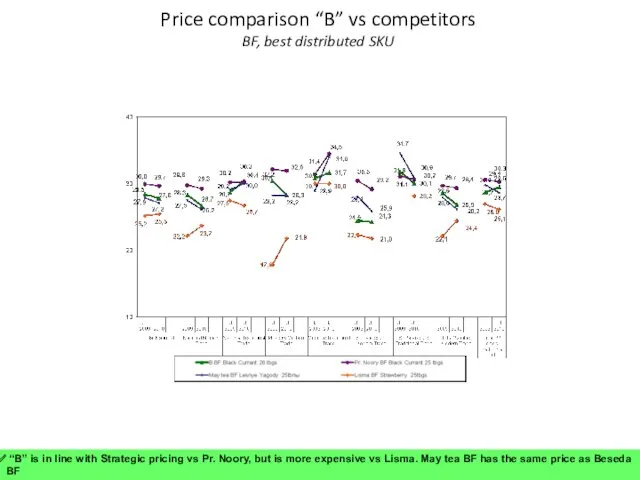

- 33. Price comparison “B” vs competitors GF 26 TBs, Infusions 20-25 TBs “B” GF is the most

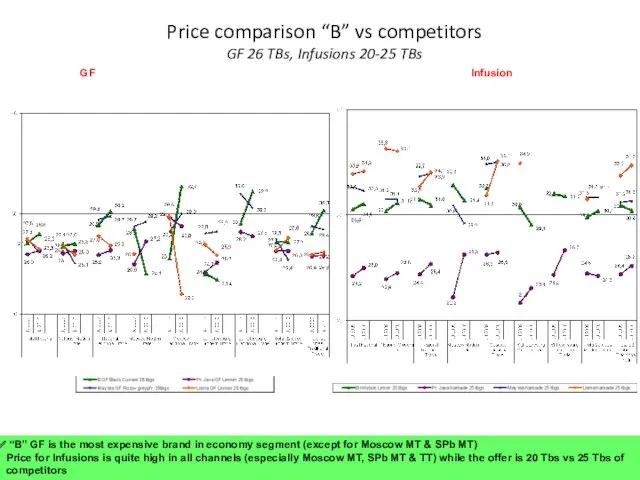

- 34. Price gap in TT vs MT, “B” has much higher price gap in TT vs MT

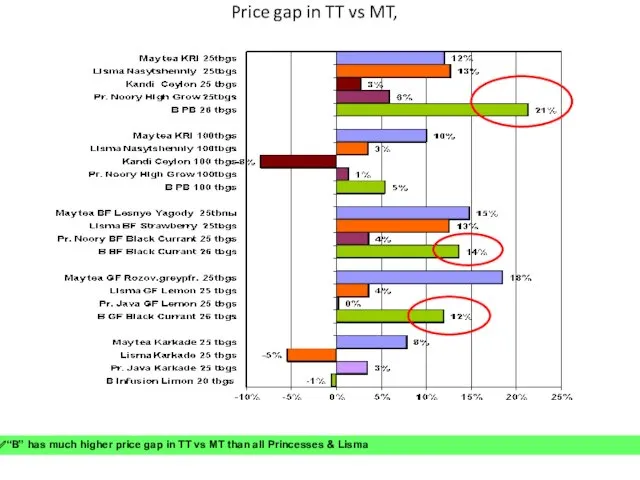

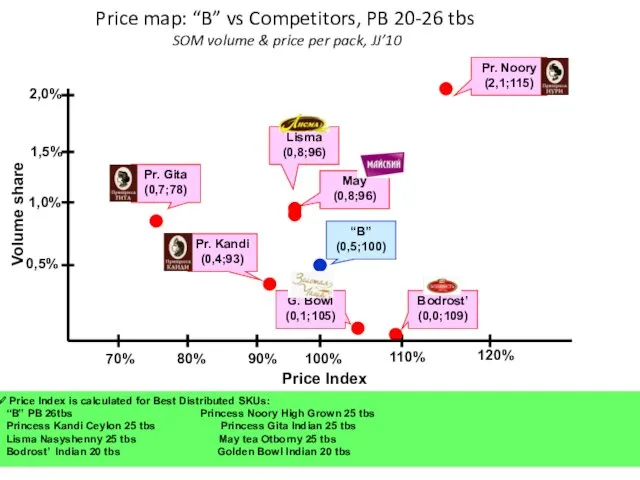

- 35. Price map: “B” vs Competitors, PB 20-26 tbs SOM volume & price per pack, JJ’10 “B”

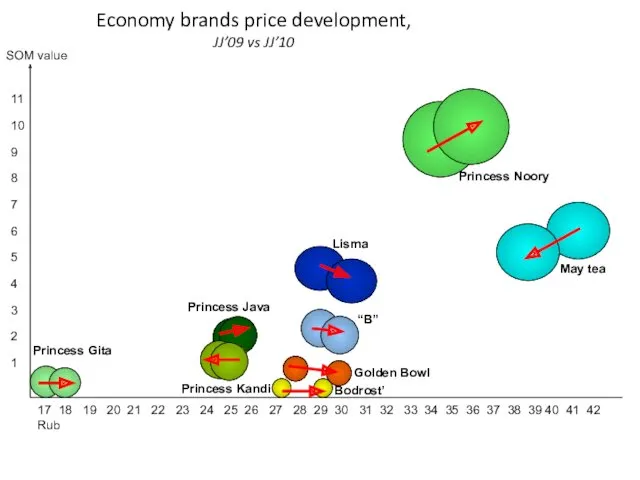

- 36. Economy brands price development, JJ’09 vs JJ’10 17 18 19 20 21 22 23 24 25

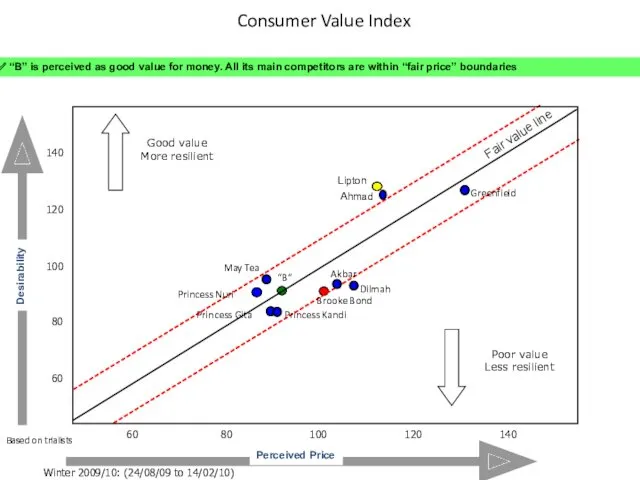

- 37. Consumer Value Index Winter 2009/10: (24/08/09 to 14/02/10) Fair value line Good value More resilient Poor

- 38. PROMOTION

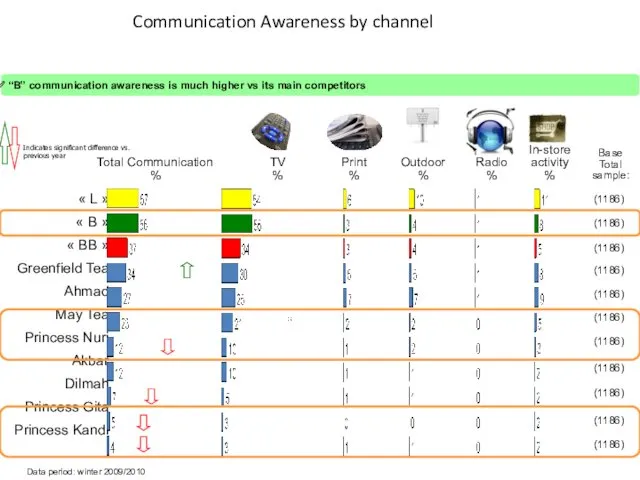

- 39. « L » « B » « BB » Greenfield Tea Ahmad May Tea Princess Nuri

- 40. “B” activities, 2008-2010 TV Launches Promo TV support for promo Fairy Tale 2 160 GRPs 7/04-27/04

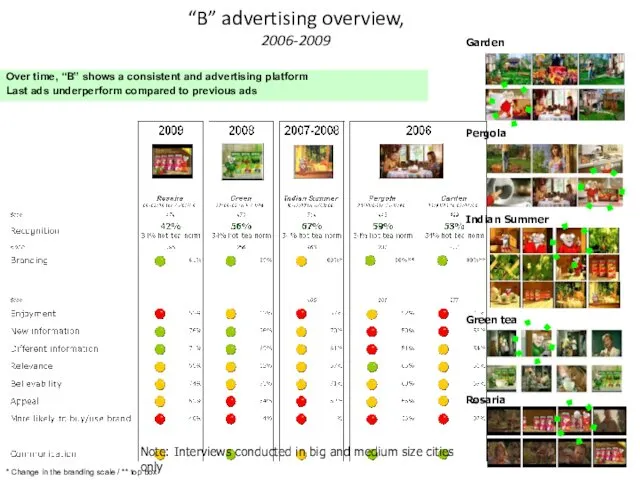

- 41. “B” advertising overview, 2006-2009 Over time, “B” shows a consistent and advertising platform Last ads underperform

- 42. Brand Communication Analysis 2009, 30 sec Tested from 14/09/09 to 15/11/09 Correct visibility for the new

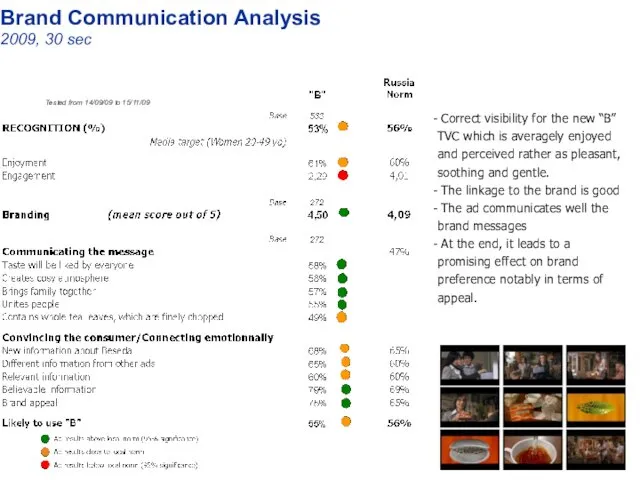

- 43. Mean score “B” 2.29 Among total sample Russian average 4.01 Brand Communication Analysis 2009, 30 sec

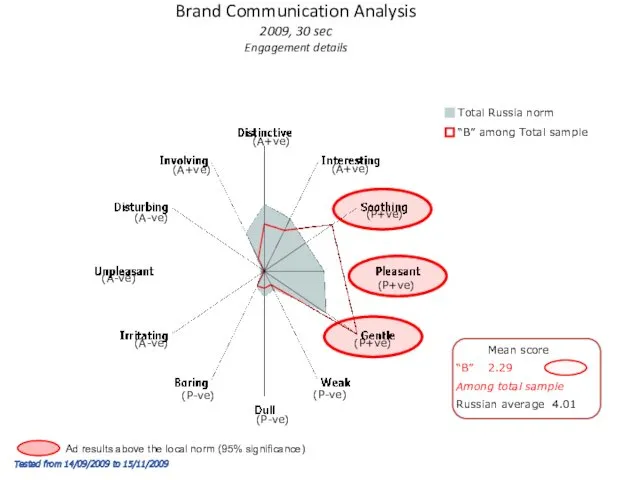

- 44. PostView TV – “B” ‘Teddy Bears’ Mar-Apr 2010, 15 sec Postview full diagnosis tested from 12/04/10

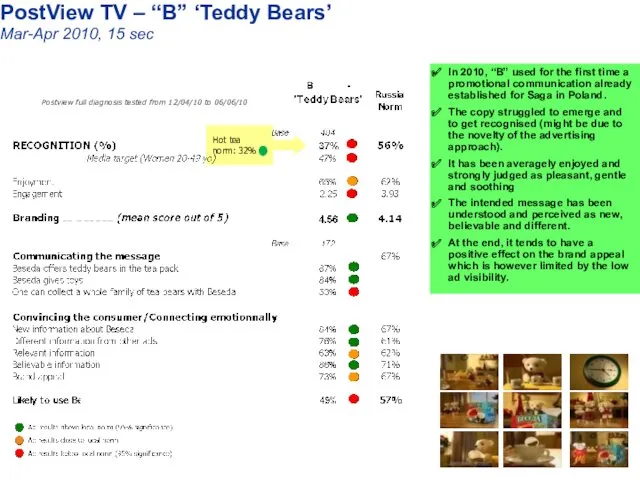

- 45. (P-ve) (A+ve) (A+ve) (P+ve) (P+ve) (P+ve) (P-ve) (P-ve) (A-ve) (A-ve) (A-ve) (A+ve) Total Russia norm Mean

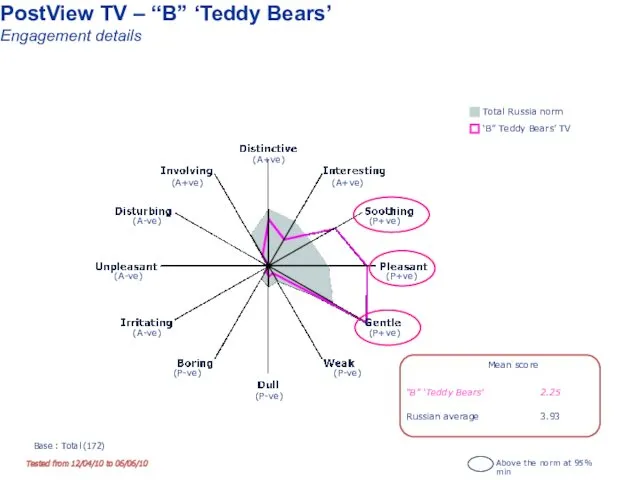

- 46. PostView TV – “B” ‘Velvet’ May 2010, 15 sec Tested from 07/06/10 to 18/07/10 Hot tea

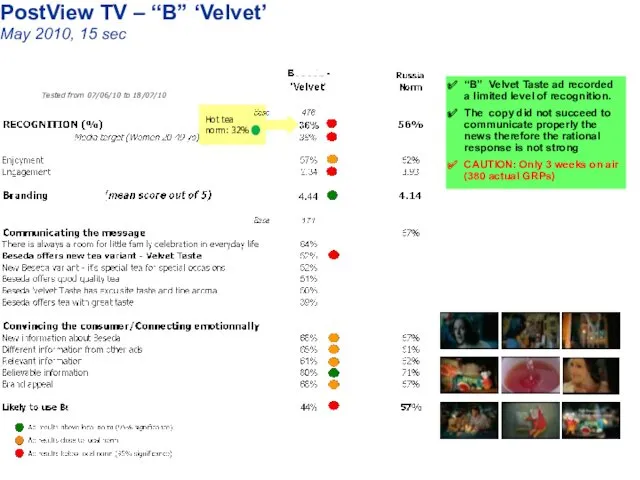

- 47. (P-ve) (A+ve) (A+ve) (P+ve) (P+ve) (P+ve) (P-ve) (P-ve) (A-ve) (A-ve) (A-ve) (A+ve) Total Russia norm Mean

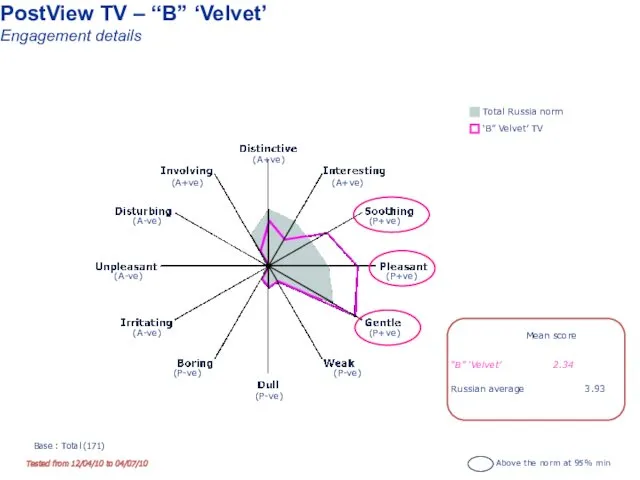

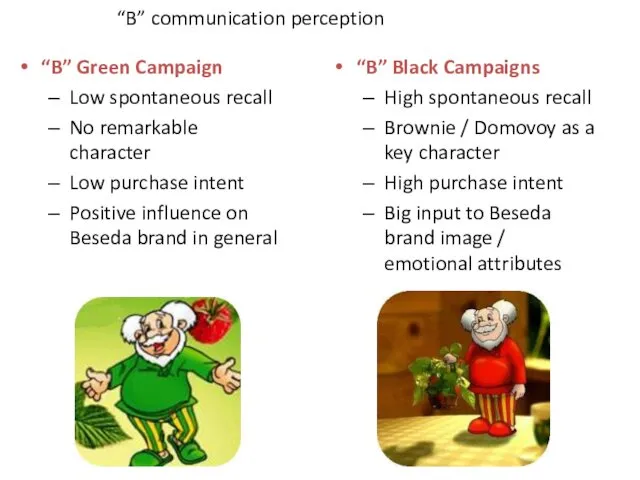

- 48. “B” communication perception “B” Green Campaign Low spontaneous recall No remarkable character Low purchase intent Positive

- 49. Princess Noory promo support 1998 2007 2003 2005 2006 2004 2009 2010 Repositioning after the crisis

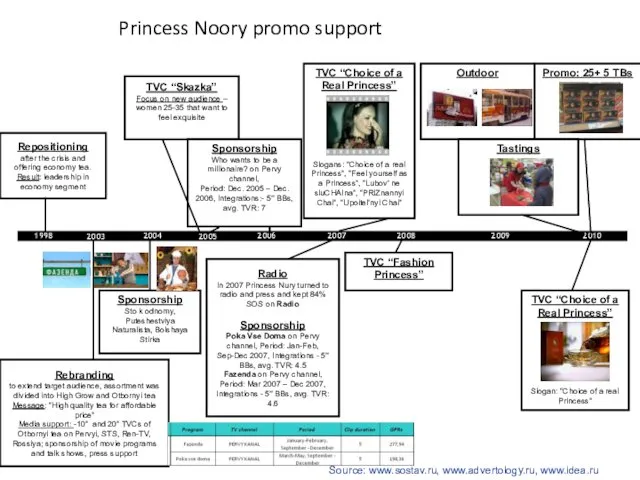

- 50. “B” sponsorship (Social Mission) Sponsor jingle 10 sec (“B” brand Video) Branded cups on the table

- 51. Competitors’ sponsorship

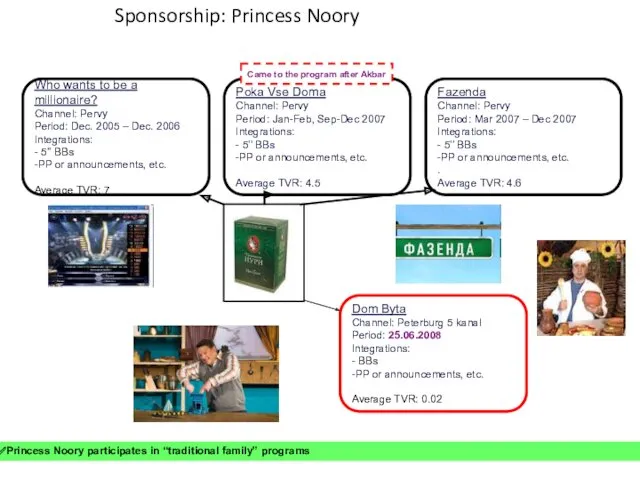

- 52. Sponsorship: Princess Noory Who wants to be a millionaire? Channel: Pervy Period: Dec. 2005 – Dec.

- 53. Green Rosaria New Indian Summer Fairy Tale Turn on TV Game « B » – Teddy

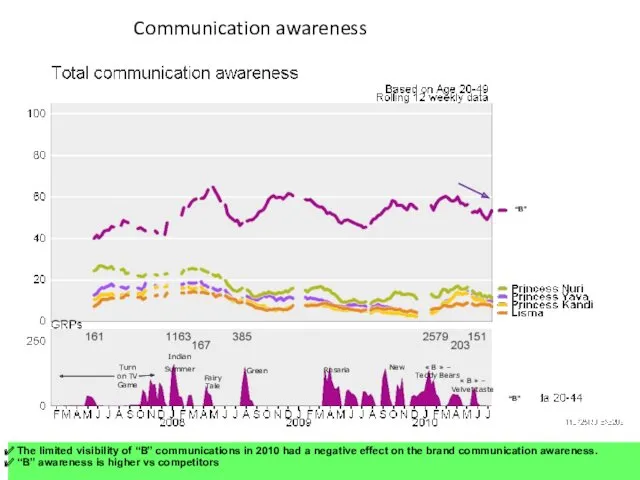

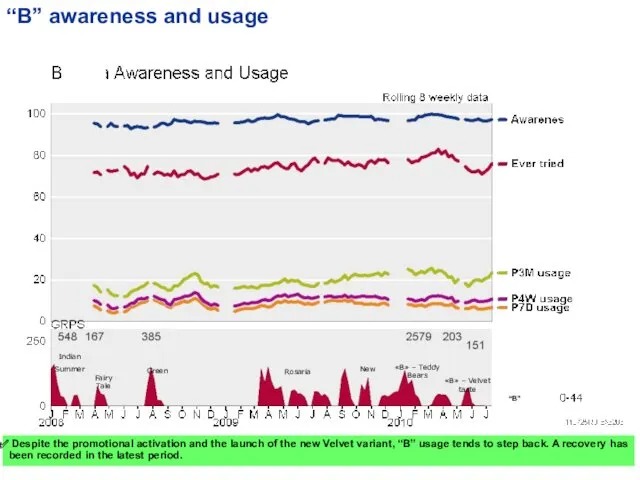

- 54. Green Indian Summer Fairy Tale Rosaria New «B» – Teddy Bears «B» – Velvet taste Despite

- 55. 49% 16% 11% Awareness Re-purchase intents Trial 31% 8% 4% “B” new product launch summary Indian

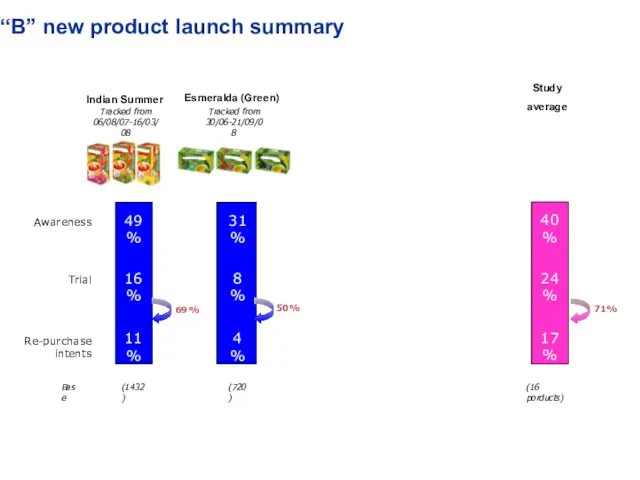

- 56. “B” Pure Black 100tbs promo effect SOM Value In MT promo brings good MS growth to

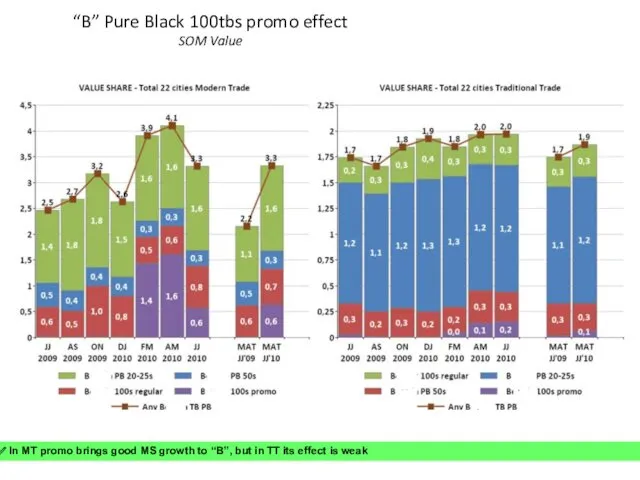

- 57. “B” 100tbs Bears promo “B” PB 100tbs promo has low WSD in several cities and almost

- 58. PRODUCT

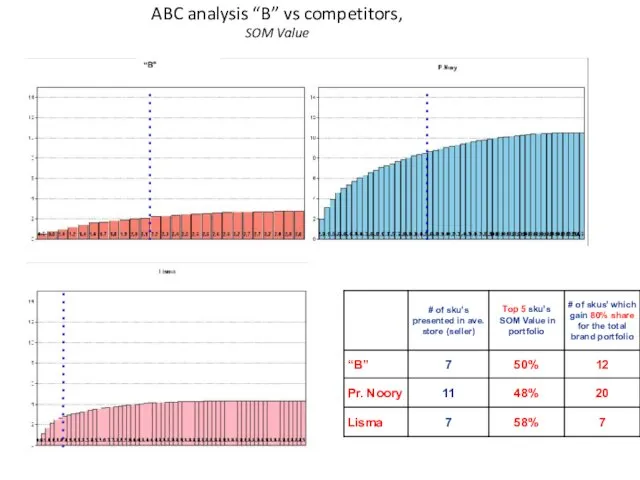

- 59. ABC analysis “B” vs competitors, SOM Value “B”

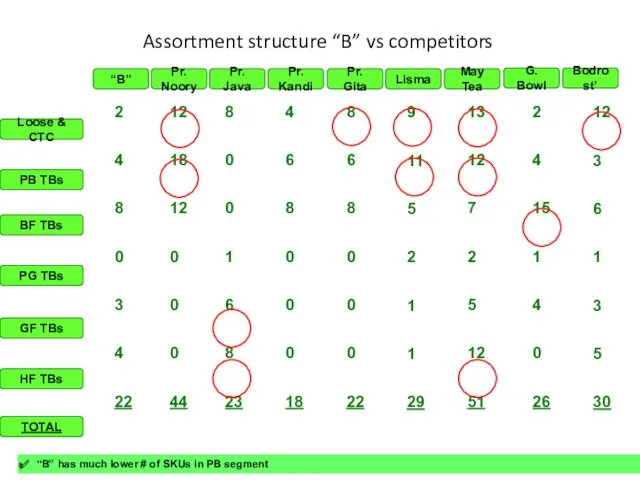

- 60. Assortment structure “B” vs competitors “B” Pr. Noory Pr. Java Pr. Kandi Pr. Gita Lisma May

- 61. “B” vs competitors PB Loose tea tasting results, Q3 2010 “B” Loose has quite good results

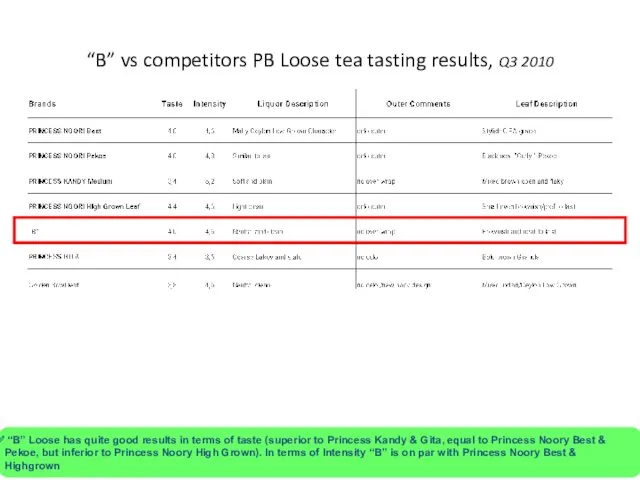

- 62. “B” vs competitors PB TBs tasting results, Q3 2010 “B” TBs is inferior to Princess Noory

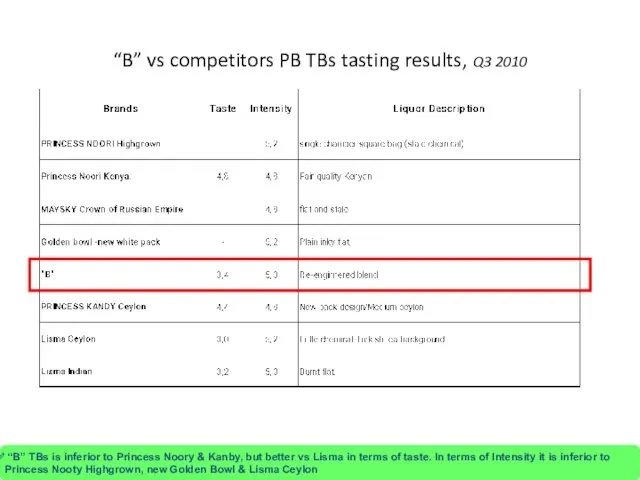

- 63. PROPOSITION

- 64. Tea category perception GENERAL CATEGORY BENEFITS Tonic/ exhilarant effect Well quenches one’s thirst Health benefits Unites

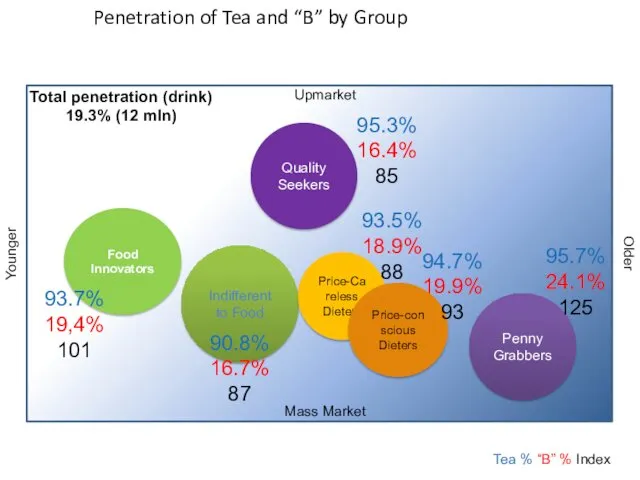

- 65. Penetration of Tea and “B” by Group Food Innovators Quality Seekers Penny Grabbers Indifferent to Food

- 66. “B” is interesting for… Dieters try to care about their body, need a small support in

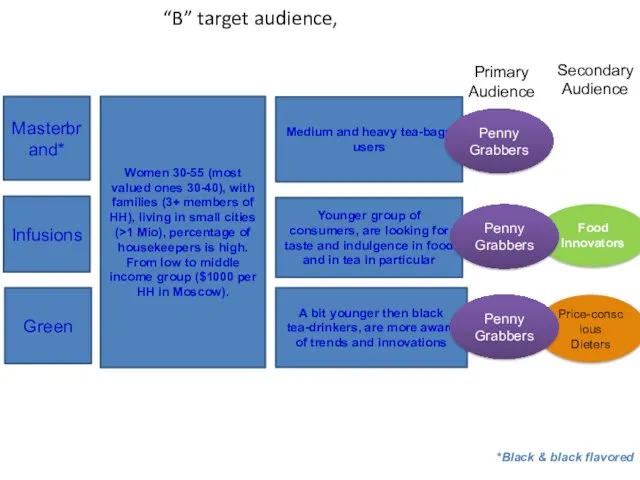

- 67. Food Innovators Price-conscious Dieters “B” target audience, Women 30-55 (most valued ones 30-40), with families (3+

- 68. “B” % Princess Noory % Princess Gita % Base: total sample (600) () - Figures from

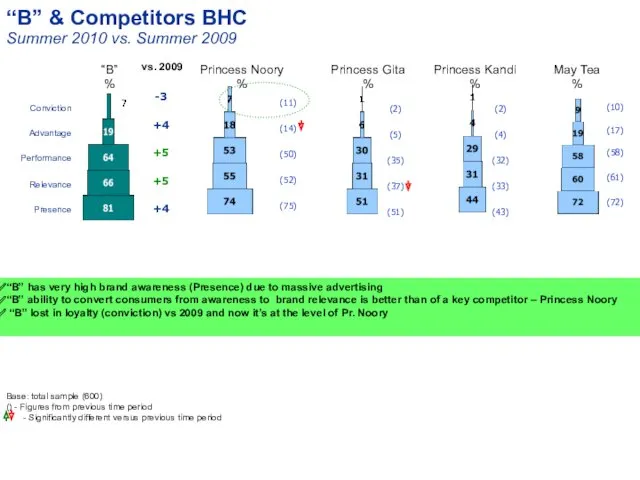

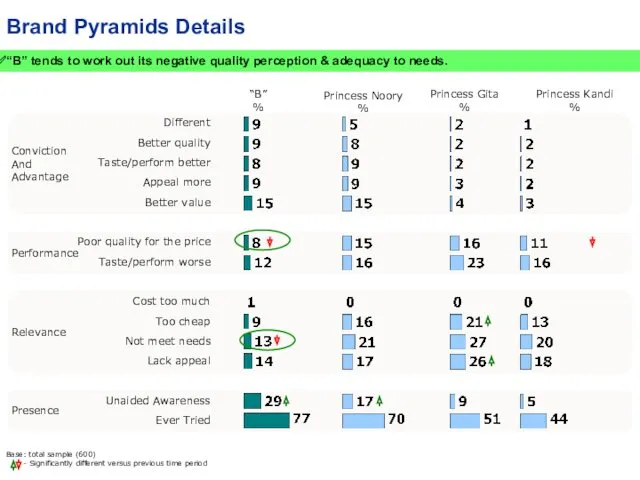

- 69. Better quality Taste/perform better Appeal more Different Better value Cost too much Too cheap Poor quality

- 70. Image positioning mapping “B” as a popular Russian tea brand, 2009 Note: “Typical Russian brand” has

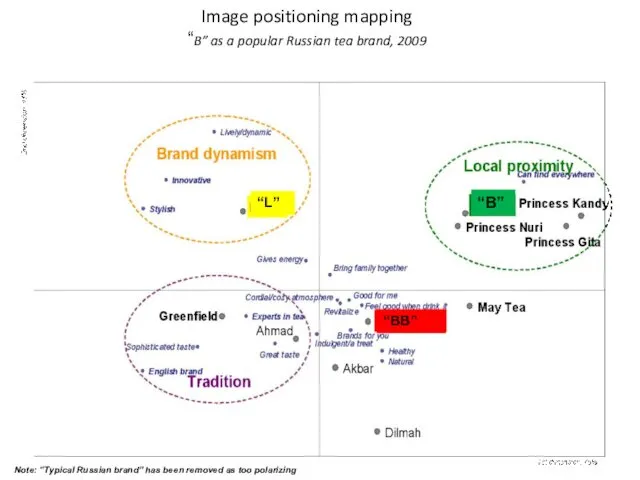

- 71. Category drivers of conviction Winter 07/08 Share of endorsement* Relevance through good taste Performance / Emotional

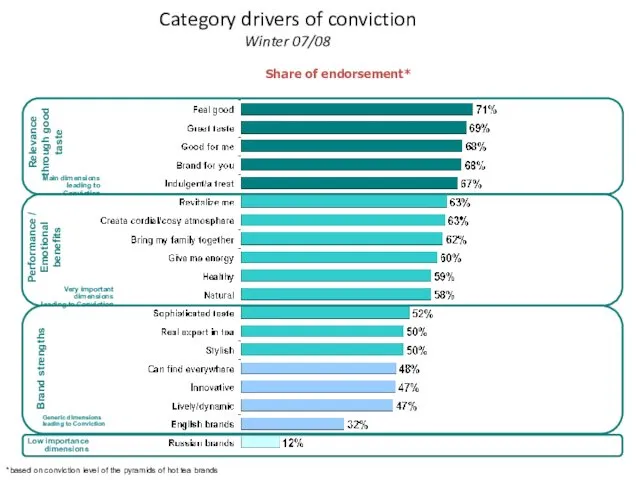

- 72. Base: Total sample (600) - Significantly different versus previous time period “B” Princess Noory Princess Gita

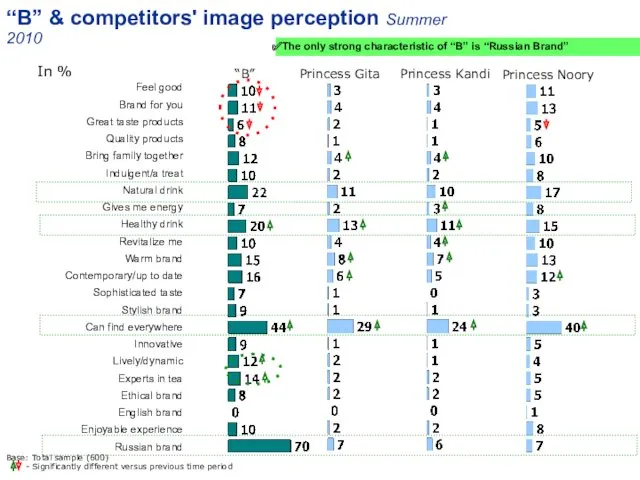

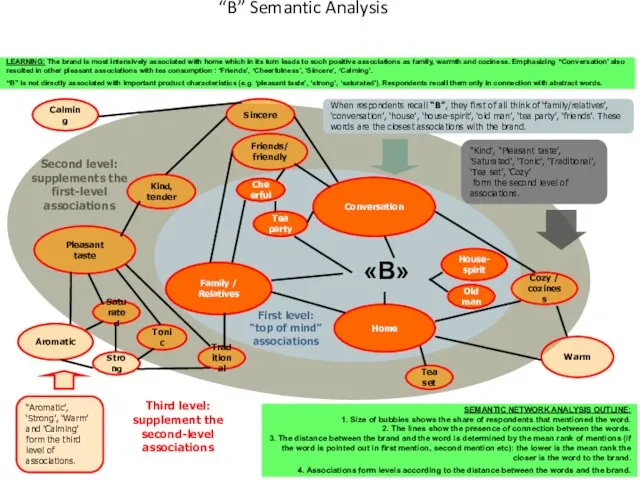

- 73. “B” Semantic Analysis Conversation Tea party Friends/ friendly Family / Relatives Old man House-spirit Home Sincere

- 74. “B” Brand Perception Ipsos, Sep 2009 Well-known brand with a history Strong and original advertising support

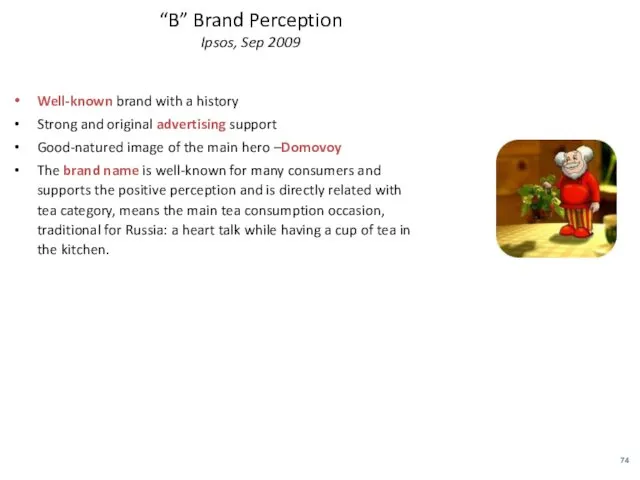

- 75. PACKAGE

- 76. Players in PB segment: package comparison “B” Princess Noori May Tea Lisma Princess Kandi Princess Gita

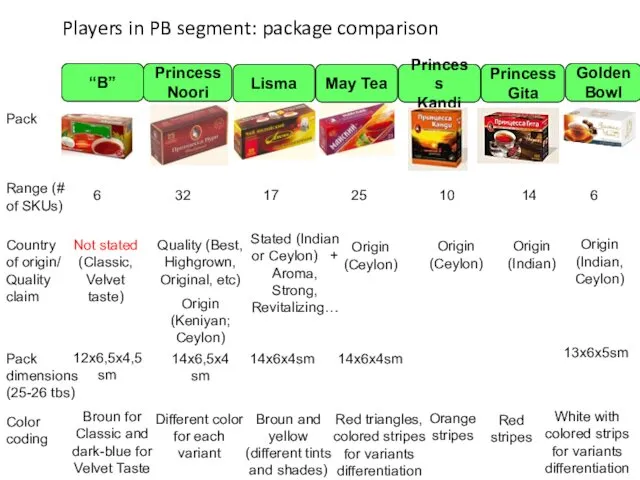

- 77. Players in BF segment: package comparison “B” Princess Noori May Tea Lisma Princess Kandi Princess Gita

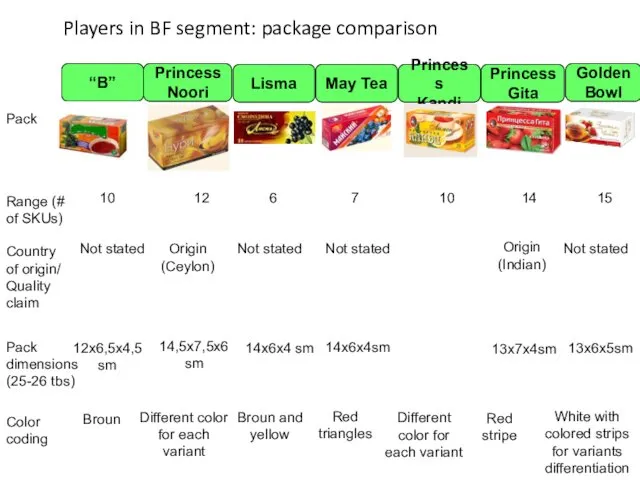

- 78. Players in GF segment: package comparison “B” Princess Java May Tea Lisma Golden Bowl Pack Range

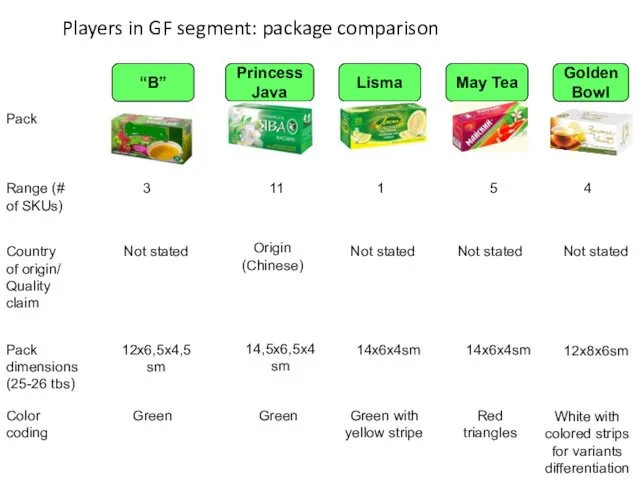

- 79. Players in HF segment: package comparison “B” Princess Java May Tea Lisma Golden Bowl Pack Range

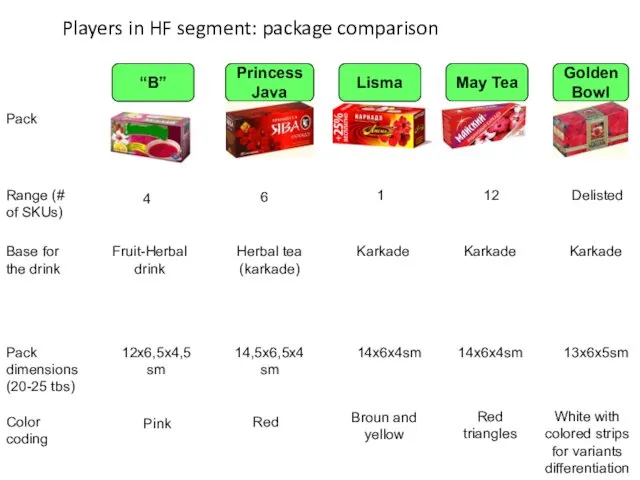

- 80. “B” packs are less noticeable on shelf in comparison with key competitors – Pr. Noory andLisma.

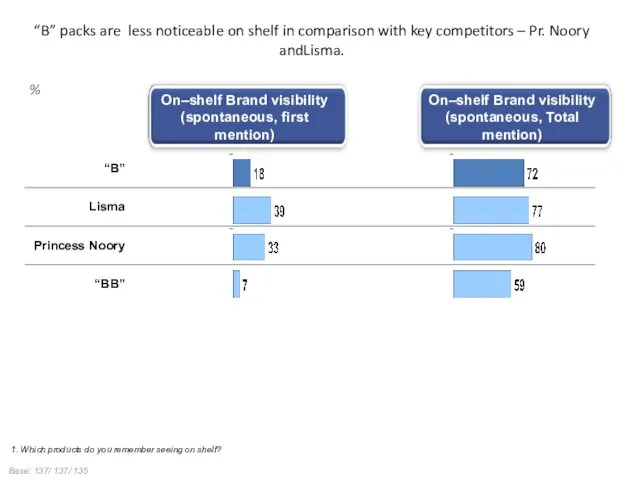

- 82. Скачать презентацию

Физико-химические свойства сырья, продукции, реагентов и материалов. (часть 1)

Физико-химические свойства сырья, продукции, реагентов и материалов. (часть 1) Познавательно-исследовательский проект Чудо огород

Познавательно-исследовательский проект Чудо огород Нацистская Германия

Нацистская Германия Инновационные полигоны газоперерабатывающей отрасли НГХК (Нефтегазохимический комплекс)1. Лекция 4

Инновационные полигоны газоперерабатывающей отрасли НГХК (Нефтегазохимический комплекс)1. Лекция 4 Клеточный цикл

Клеточный цикл Движение воздушных масс.Атмосферные фронты.Циклоны и антициклоны 8 класс

Движение воздушных масс.Атмосферные фронты.Циклоны и антициклоны 8 класс Пассивные помехи, ложные цели и ловушки. Тема 8

Пассивные помехи, ложные цели и ловушки. Тема 8 Старостат. Лекция для старост 1 курса Санкт-Петербургского политехнического университета имени Петра Великого

Старостат. Лекция для старост 1 курса Санкт-Петербургского политехнического университета имени Петра Великого Значение бутербродов

Значение бутербродов Глобальные проблемы

Глобальные проблемы Опрессовка

Опрессовка Динамика движения

Динамика движения Балалар және ересектердегі угри ауруы

Балалар және ересектердегі угри ауруы Юрий Алексеевич Гагарин

Юрий Алексеевич Гагарин Процессы физико-химической обработки

Процессы физико-химической обработки Катастрофа Ту-134 в Куйбышеве 20 октября 1986 года

Катастрофа Ту-134 в Куйбышеве 20 октября 1986 года методическая разработка по профилактике дисграфии у дошкольников

методическая разработка по профилактике дисграфии у дошкольников Строение иммунной системы

Строение иммунной системы Теорема Пифагора. Шаржи

Теорема Пифагора. Шаржи Деловая игра для педагогов Гиперактивный ребенок в детском саду

Деловая игра для педагогов Гиперактивный ребенок в детском саду Мультимедийные технологии

Мультимедийные технологии Презентация В гостях у сказки

Презентация В гостях у сказки Слагаемые успеха в бизнесе

Слагаемые успеха в бизнесе Водоснабжение завода по переработке керамических изделий

Водоснабжение завода по переработке керамических изделий Выступление МАОУ24 14.02.22 Гришаткина С.А

Выступление МАОУ24 14.02.22 Гришаткина С.А Символика Приморского края, Надеждинского района и п. Раздольное

Символика Приморского края, Надеждинского района и п. Раздольное Химия в сельском хозяйстве. 9 кл.

Химия в сельском хозяйстве. 9 кл. Психика және сана

Психика және сана