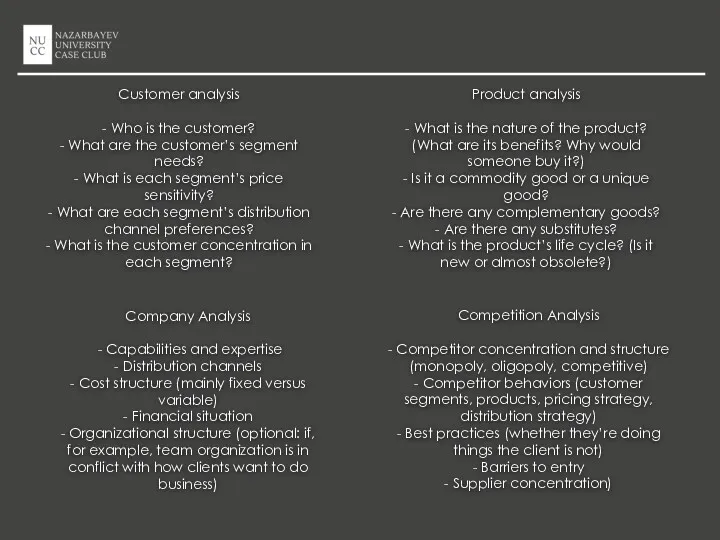

Competition Analysis

- Competitor concentration and structure (monopoly, oligopoly, competitive)

-

Competitor behaviors (customer segments, products, pricing strategy, distribution strategy)

- Best practices (whether they’re doing things the client is not)

- Barriers to entry

- Supplier concentration)

Customer analysis

- Who is the customer?

- What are the customer’s segment needs?

- What is each segment’s price sensitivity?

- What are each segment’s distribution channel preferences?

- What is the customer concentration in each segment?

Company Analysis

- Capabilities and expertise

- Distribution channels

- Cost structure (mainly fixed versus variable)

- Financial situation

- Organizational structure (optional: if, for example, team organization is in conflict with how clients want to do business)

Product analysis

- What is the nature of the product? (What are its benefits? Why would someone buy it?)

- Is it a commodity good or a unique good?

- Are there any complementary goods?

- Are there any substitutes?

- What is the product’s life cycle? (Is it new or almost obsolete?)

Уголовно-процессуальное право. Уголовно-процессуальное законодательство

Уголовно-процессуальное право. Уголовно-процессуальное законодательство Назначение и выплата страхового обеспечения

Назначение и выплата страхового обеспечения Законность и правопорядок

Законность и правопорядок Банковское право

Банковское право Адамның негізгі құқықтары мен міндеттері

Адамның негізгі құқықтары мен міндеттері Громадянське суспільство. Невід'ємні права кожного громадянина

Громадянське суспільство. Невід'ємні права кожного громадянина Учение Г. Кельзена о чистой теории права

Учение Г. Кельзена о чистой теории права Государственный контракт, муниципальный контракт

Государственный контракт, муниципальный контракт Гражданские правоотношения. Понятие гражданского правоотношения и его особенности

Гражданские правоотношения. Понятие гражданского правоотношения и его особенности Еңбекті қорғауды

Еңбекті қорғауды Оперативно-розыскная деятельность

Оперативно-розыскная деятельность Проблемы исполнения алиментных обязательств родителями в отношении несовершеннолетних детей в Российской Федерации

Проблемы исполнения алиментных обязательств родителями в отношении несовершеннолетних детей в Российской Федерации Ассоциация юристов России

Ассоциация юристов России Правительство РФ. Порядок формирования, компетенция, акты. Сложение полномочий и отставка Правительства

Правительство РФ. Порядок формирования, компетенция, акты. Сложение полномочий и отставка Правительства Семья и школа: детство без жестокости и насилия

Семья и школа: детство без жестокости и насилия ЕИТКС МВД России. Интегрированный банк данных ИБД-Регион

ЕИТКС МВД России. Интегрированный банк данных ИБД-Регион Административное принуждение и его виды. Административная ответственность. (Тема 10)

Административное принуждение и его виды. Административная ответственность. (Тема 10) Ответственность в международном праве

Ответственность в международном праве Право європейського союзу

Право європейського союзу Рабочее время и время отдыха

Рабочее время и время отдыха Понятие преступления и состав. Лекция 2

Понятие преступления и состав. Лекция 2 Семья прецедентного права (1)

Семья прецедентного права (1) Общее собрание собственников многоквартирного дома № 12 по ул. Доронино

Общее собрание собственников многоквартирного дома № 12 по ул. Доронино Основы гражданского права

Основы гражданского права Права человека и гражданина

Права человека и гражданина Организация управления в области градостроительства

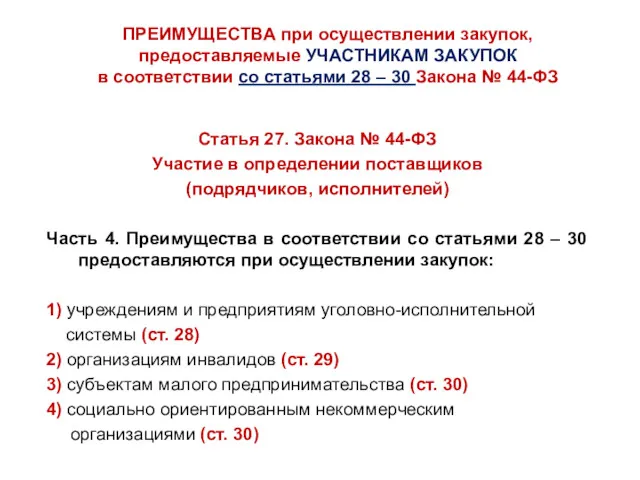

Организация управления в области градостроительства Статья 27 Закона № 44-ФЗ. Участие в определении поставщиков (подрядчиков, исполнителей)

Статья 27 Закона № 44-ФЗ. Участие в определении поставщиков (подрядчиков, исполнителей) Очная ставка

Очная ставка