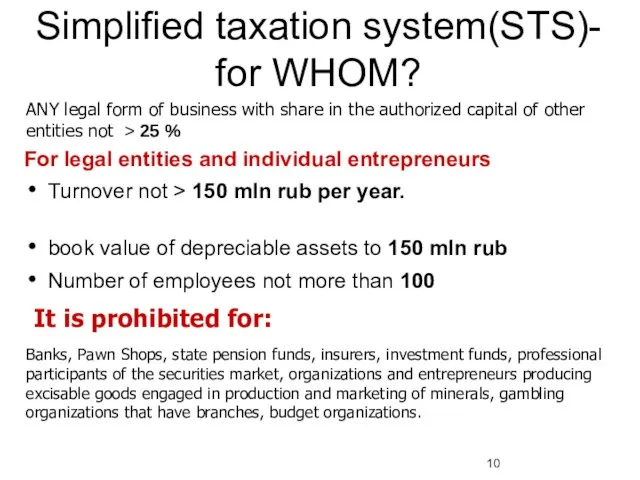

For legal entities and individual entrepreneurs

Turnover not > 150 mln rub

per year.

book value of depreciable assets to 150 mln rub

Number of employees not more than 100

ANY legal form of business with share in the authorized capital of other entities not > 25 %

It is prohibited for:

Banks, Pawn Shops, state pension funds, insurers, investment funds, professional participants of the securities market, organizations and entrepreneurs producing excisable goods engaged in production and marketing of minerals, gambling organizations that have branches, budget organizations.

Simplified taxation system(STS)- for WHOM?

What are you going to do next weekend

What are you going to do next weekend Пасха в России and Easter in England

Пасха в России and Easter in England Past Simple Questions

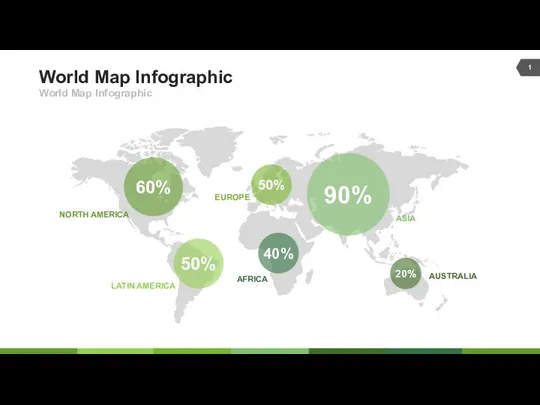

Past Simple Questions World Map Infographic

World Map Infographic My family

My family Memory Game 08 (Body parts)

Memory Game 08 (Body parts) French national dishes. Croissant

French national dishes. Croissant Merry Christmas

Merry Christmas Presentation on the topic of personal player

Presentation on the topic of personal player Articles

Articles Articles

Articles Thanksgiving day. День благодарения

Thanksgiving day. День благодарения Some music

Some music The present continuous tense (настоящее продолженное время)

The present continuous tense (настоящее продолженное время) Pulmonary tuberculosis. The Passive Voice. Present and Past Nenses the Pfssive Voice

Pulmonary tuberculosis. The Passive Voice. Present and Past Nenses the Pfssive Voice The monuments of The First World War

The monuments of The First World War Farm Animals Hidden Picture Game

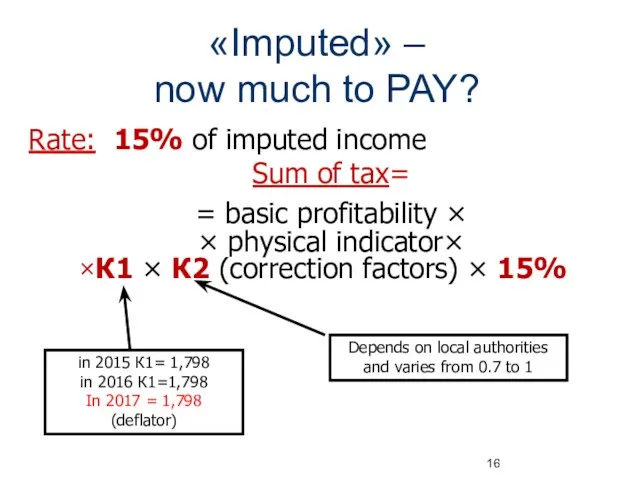

Farm Animals Hidden Picture Game Financial information

Financial information Time. What time is it

Time. What time is it Burger. Pizza

Burger. Pizza Have to, has to

Have to, has to Степени сравнения

Степени сравнения Happu Halloween

Happu Halloween Действия в будущем

Действия в будущем Choose the right modal verb

Choose the right modal verb Paralympic games. One World-One Dream

Paralympic games. One World-One Dream CAMPAIGN. English for the Military

CAMPAIGN. English for the Military Merry Christmas

Merry Christmas