Содержание

- 2. Learning outcomes Income statement Why businesses need to keep accounting records such as income statements Why

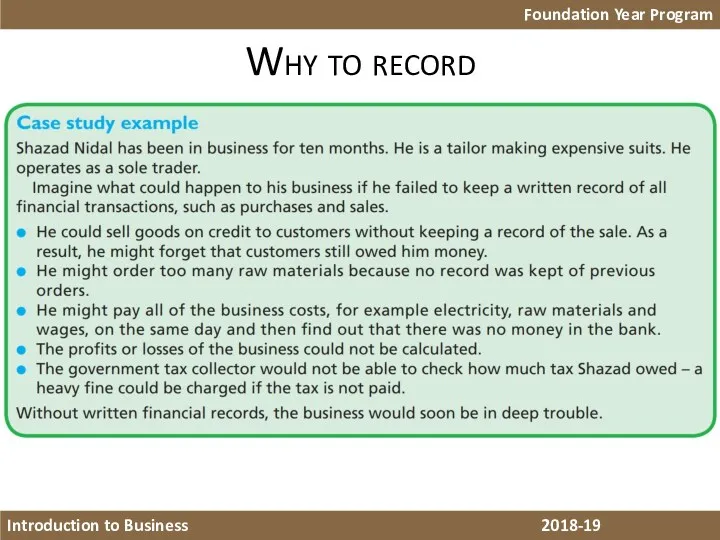

- 3. Why to record Foundation Year Program Introduction to Business 2018-19

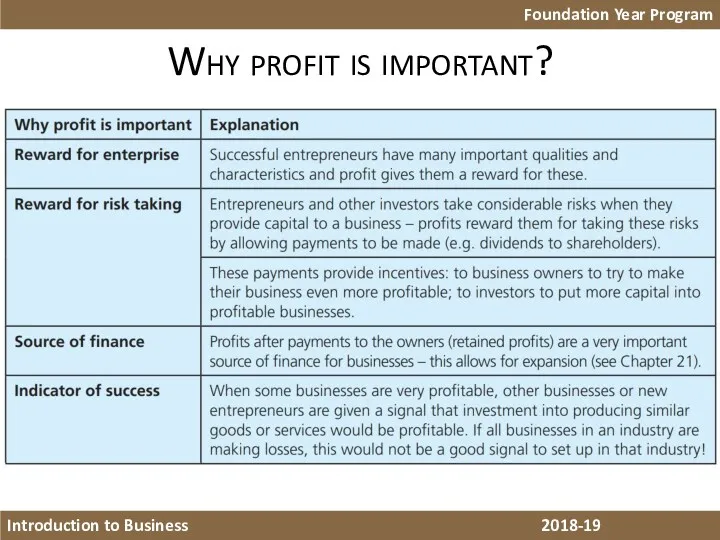

- 4. Why profit is important? Foundation Year Program Introduction to Business 2018-19

- 5. Income statement Foundation Year Program Introduction to Business 2018-19 Is it higher or lower than last

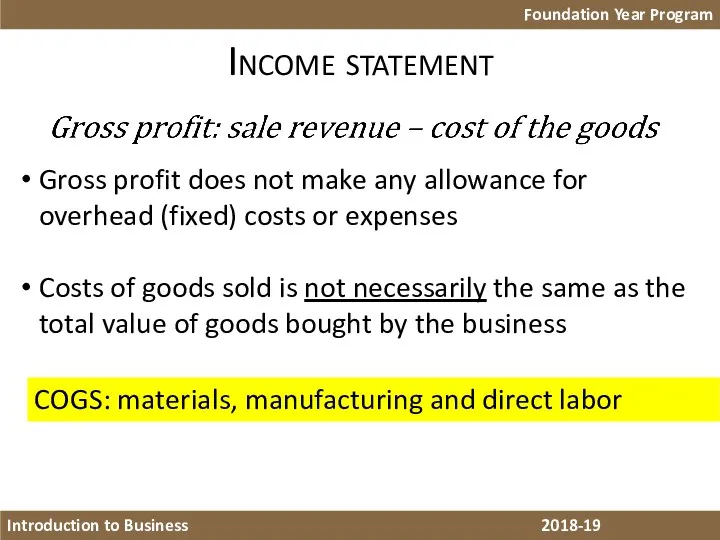

- 6. Income statement Foundation Year Program Introduction to Business 2018-19 Gross profit does not make any allowance

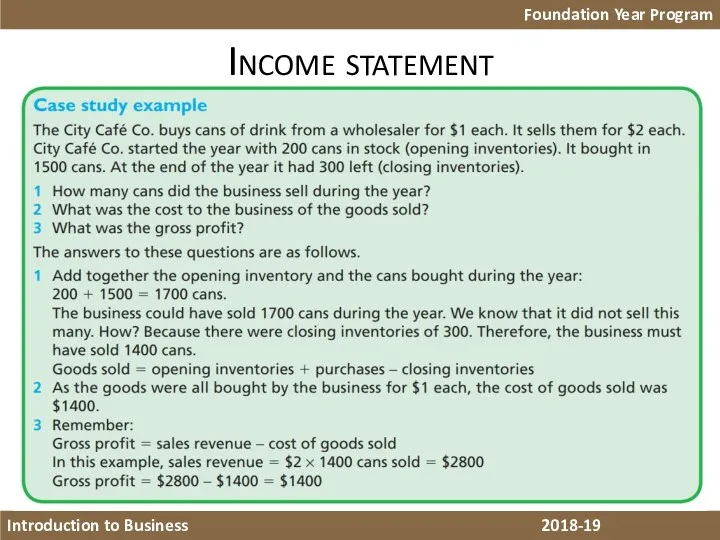

- 7. Income statement Foundation Year Program Introduction to Business 2018-19

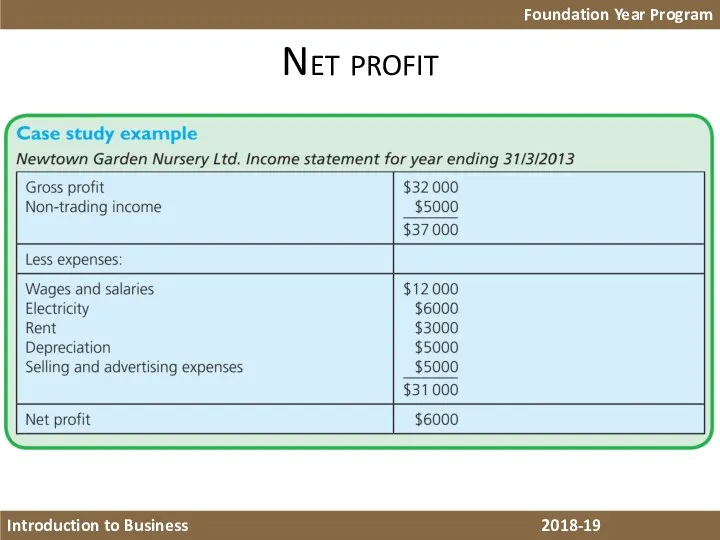

- 8. Foundation Year Program Introduction to Business 2018-19 Net profit

- 9. Foundation Year Program Introduction to Business 2018-19 COGS: materials, manufacturing and direct labor

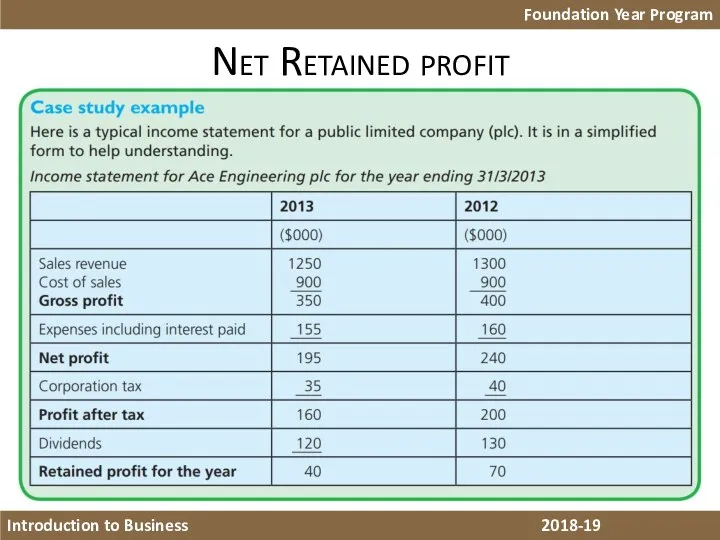

- 10. Net Retained profit Foundation Year Program Introduction to Business 2018-19

- 11. Income statement Foundation Year Program Introduction to Business 2018-19

- 12. Learning outcomes – Balance Sheet The main elements of a balance sheet The main classification of

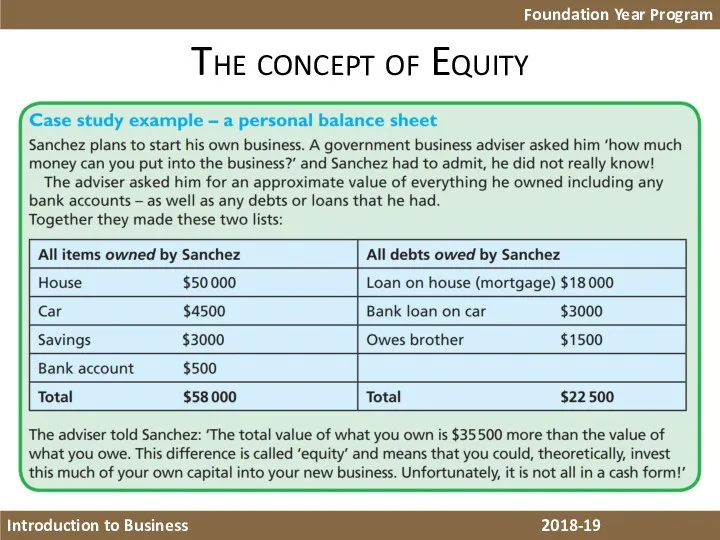

- 13. The concept of Equity Foundation Year Program Introduction to Business 2018-19

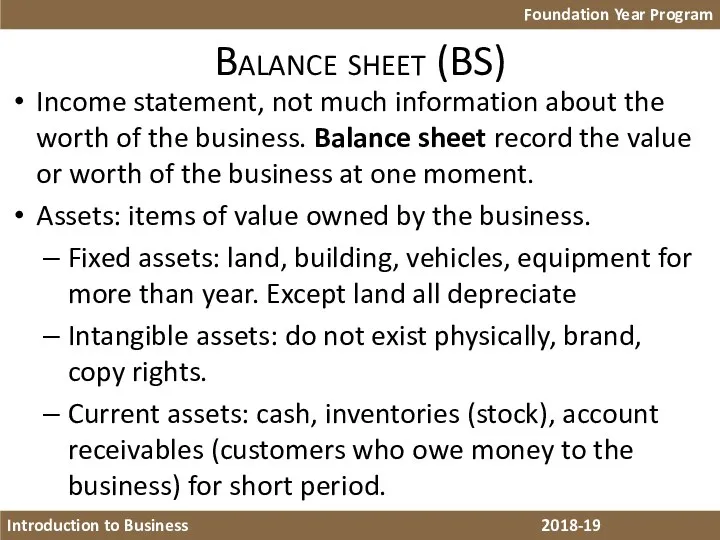

- 14. Balance sheet (BS) Income statement, not much information about the worth of the business. Balance sheet

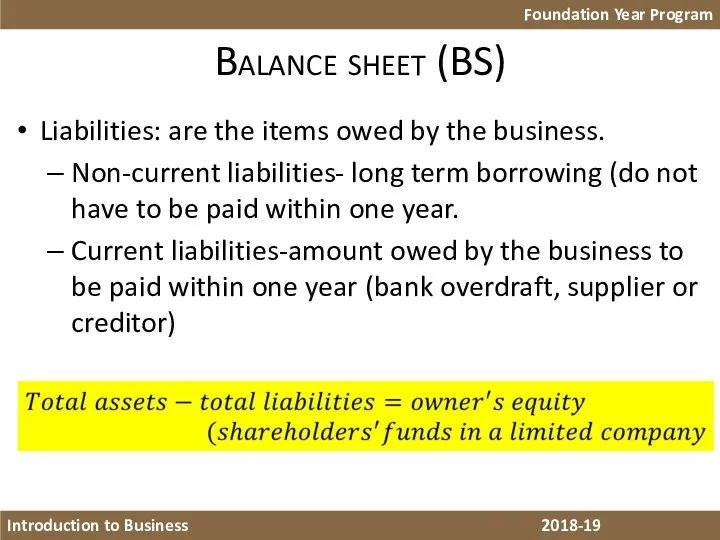

- 15. Balance sheet (BS) Liabilities: are the items owed by the business. Non-current liabilities- long term borrowing

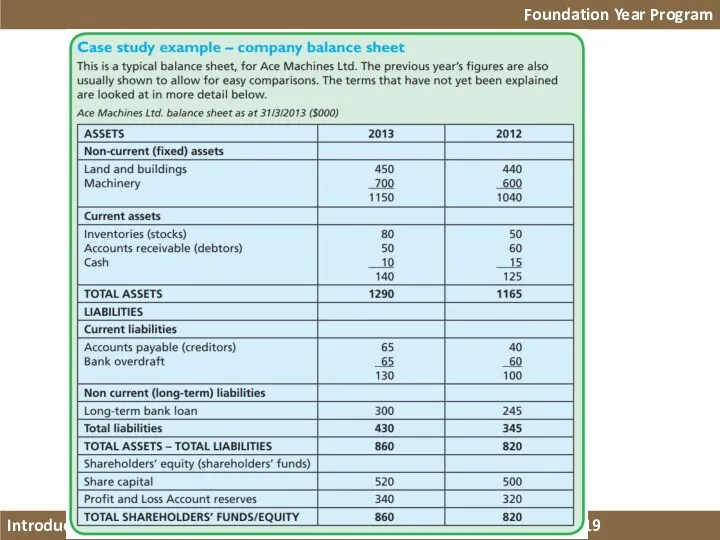

- 16. Foundation Year Program Introduction to Business 2018-19

- 17. Analysis of account Learning outcome Interpreting financial statement Profitability rations Concept of liquidity Use ratios to

- 18. Analysis of account Observe the data to know the performance and financial strength of the business

- 19. Analysis of account Foundation Year Program Introduction to Business 2018-19

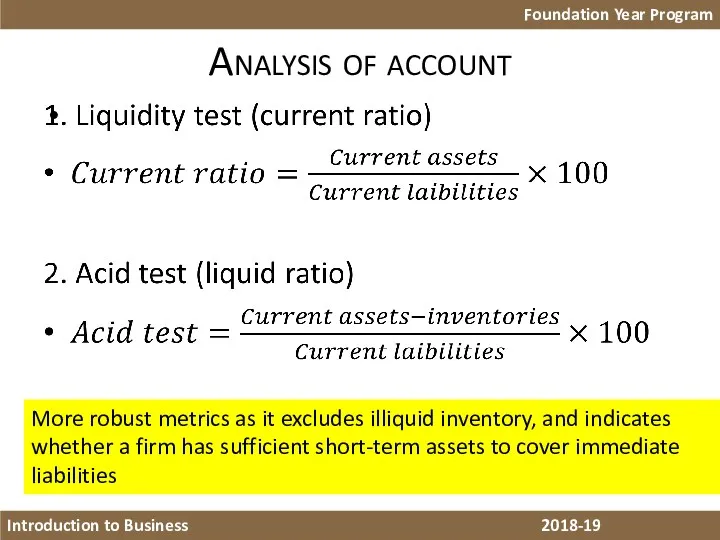

- 20. Analysis of account Foundation Year Program Introduction to Business 2018-19 More robust metrics as it excludes

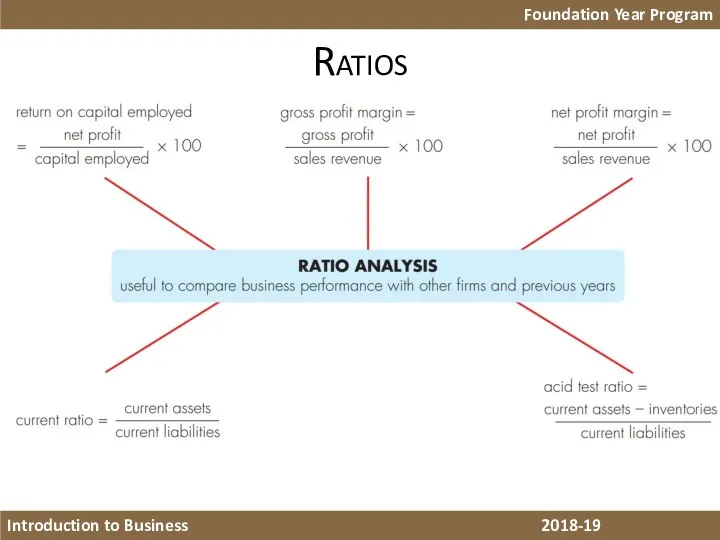

- 21. Ratios Foundation Year Program Introduction to Business 2018-19

- 23. Скачать презентацию

My student life

My student life The present simple Tense

The present simple Tense Лекция 5. Передача имен собственных. Реалии. Лексические и лексико-грамматические трансформации

Лекция 5. Передача имен собственных. Реалии. Лексические и лексико-грамматические трансформации Artificial intelligence

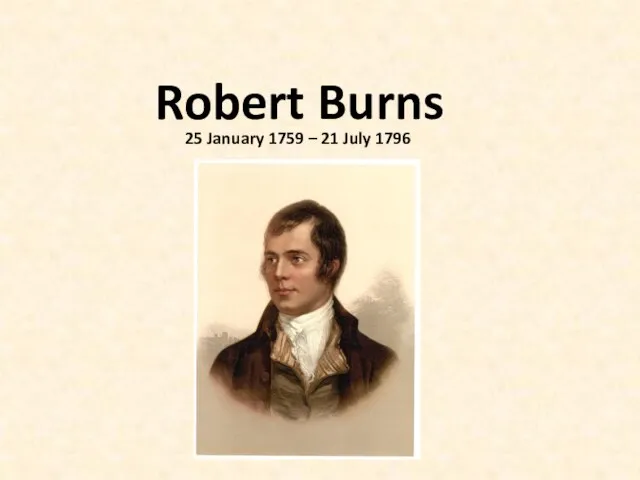

Artificial intelligence Robert Burns. 25 January 1759 – 21 July 1796

Robert Burns. 25 January 1759 – 21 July 1796 Countries and continents - 2

Countries and continents - 2 Successful company quietly brilliant

Successful company quietly brilliant English and American writers

English and American writers My own game. Categories

My own game. Categories 10 вариантов. Тренажер по подготовке к ОГЭ по английскому языку. Устная часть. (Задания 1-3)

10 вариантов. Тренажер по подготовке к ОГЭ по английскому языку. Устная часть. (Задания 1-3) Writing letters

Writing letters Притяжательная форма существительных

Притяжательная форма существительных Countries & Nationalities

Countries & Nationalities The halloween films

The halloween films Англоязычная публикация международного уровня: структура, содержание, стиль. (Часть 2)

Англоязычная публикация международного уровня: структура, содержание, стиль. (Часть 2) American Families

American Families УМК Forward. Английский язык 6 класс

УМК Forward. Английский язык 6 класс The royal family

The royal family Сослагательное наклонение. Subjunctive Mood

Сослагательное наклонение. Subjunctive Mood When’s your birthday?

When’s your birthday? Lexicology 2019

Lexicology 2019 Welcome to Englishland

Welcome to Englishland Let’s repeat relative clauses

Let’s repeat relative clauses The world around me

The world around me Happy English

Happy English My Personality

My Personality Critical thinking project

Critical thinking project Big or small

Big or small