Содержание

- 2. After successful broadcasts Among CIFS students

- 3. Comes of one the most Expected lecture of season

- 4. Business Organization: Forms of Business Ownership Lecture 4

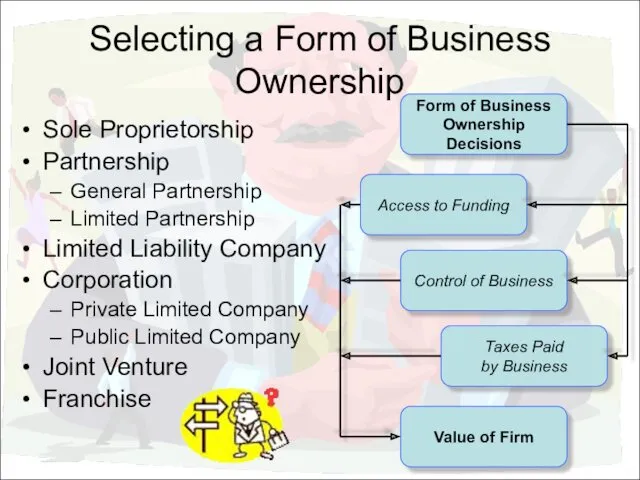

- 6. Selecting a Form of Business Ownership Sole Proprietorship Partnership General Partnership Limited Partnership Limited Liability Company

- 7. Concepts of Business Ownership Unlimited Liability – no limit on the debts for which the owner

- 8. Concepts of Business Ownership Continuity – death of an owner does not stop the business from

- 9. Sole Proprietorship Owned by a single owner The owner – sole proprietor, sole trader Full control

- 10. Sole Proprietorship Advantages vs. Disadvantages “+” Easy to set up Complete control Owner keeps all profit

- 11. Partnership General Partnership Co-owned by two or more people Extra skills / specialization areas Partners have

- 12. Partnership Limited Partnership Limited partner(s) + at least one general partner Limited partner Liability is limited

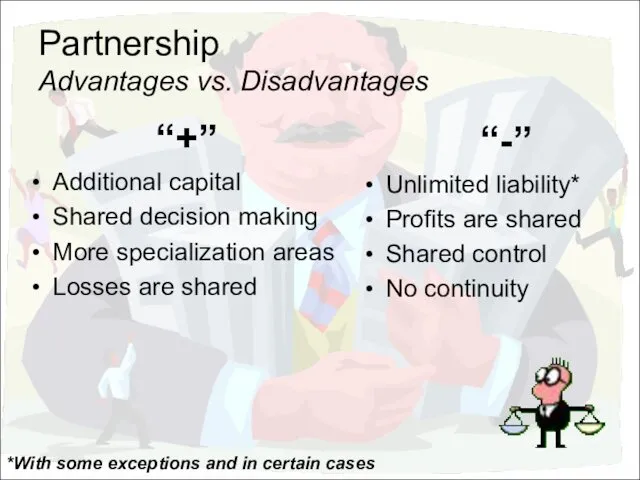

- 13. Partnership Advantages vs. Disadvantages “+” Additional capital Shared decision making More specialization areas Losses are shared

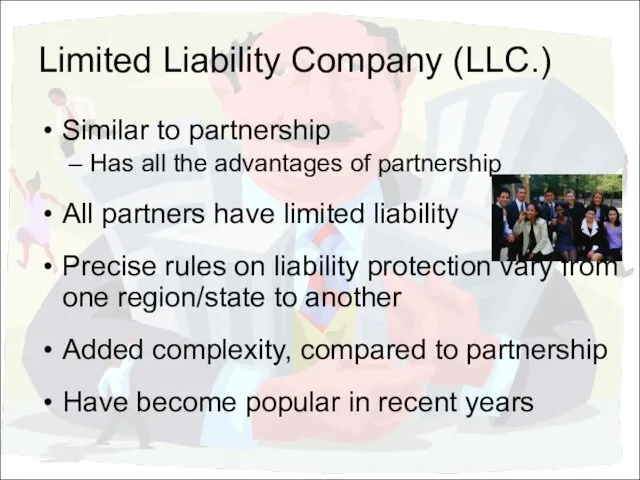

- 14. Limited Liability Company (LLC.) Similar to partnership Has all the advantages of partnership All partners have

- 15. LLC “UNITEL” works under Beeline TM

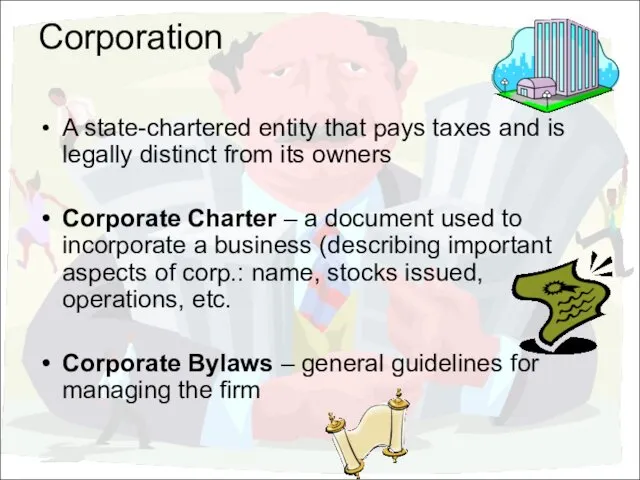

- 16. Corporation A state-chartered entity that pays taxes and is legally distinct from its owners Corporate Charter

- 17. Corporation Limited liability for owners Separate legal identity This leads to double taxation (how?) Shareholders elect

- 18. Corporation Privately Held vs. Publicly Held Privately Held Corporation (Ltd., Pte.) – restricted to a small

- 19. Corporation Advantages vs. Disadvantages “+” Limited liability Access to funds Easy to transfer ownership (sell shares)

- 21. Joint Venture Two businesses working together on one project Producing in one country and selling in

- 24. Franchise An arrangement whereby a business owner allows others to use its trademark, trade name, or

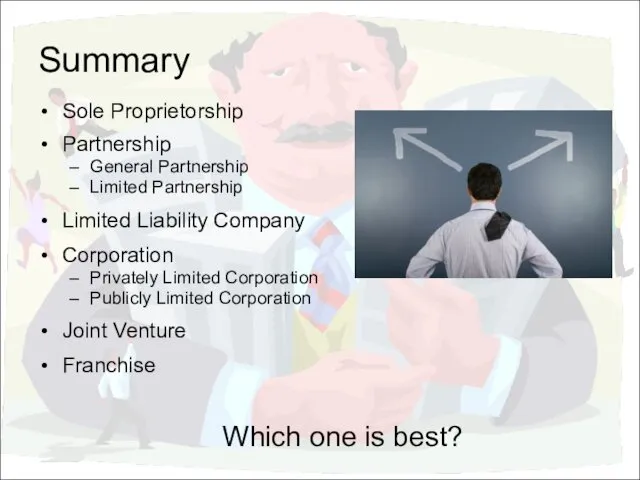

- 26. Summary Sole Proprietorship Partnership General Partnership Limited Partnership Limited Liability Company Corporation Privately Limited Corporation Publicly

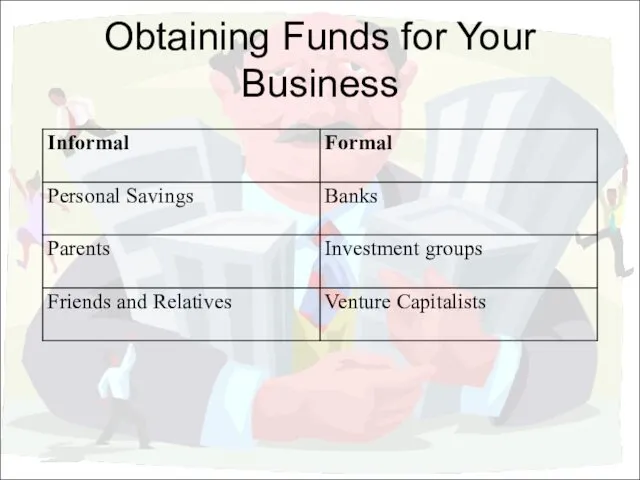

- 27. Obtaining Funds for Your Business

- 29. Скачать презентацию

Франчайзинг. Инструменты контроля качества. Аутсорсинг (вопросы и ответы)

Франчайзинг. Инструменты контроля качества. Аутсорсинг (вопросы и ответы) Малое и среднее предпринимательство и поддержка индивидуальной предпринимательской инициативы

Малое и среднее предпринимательство и поддержка индивидуальной предпринимательской инициативы Бизнес-идея

Бизнес-идея Бизнес перезагрузка

Бизнес перезагрузка Портрет компании

Портрет компании Парикмахерская Apaches

Парикмахерская Apaches Космик – лидер на рынке активного отдыха в России

Космик – лидер на рынке активного отдыха в России Мастерская чистоты

Мастерская чистоты Создание и деятельность сельскохозяйственных кооперативов

Создание и деятельность сельскохозяйственных кооперативов Журнал Format

Журнал Format Клининговая компания “Агентство чистоты”

Клининговая компания “Агентство чистоты” Виды и формы бизнеса. Урок 18

Виды и формы бизнеса. Урок 18 Конкурентоспособность бизнеса и институты, ее обеспечивающие

Конкурентоспособность бизнеса и институты, ее обеспечивающие Бизнес-план Организация производства одежды из экоматериалов

Бизнес-план Организация производства одежды из экоматериалов Описание продукции, характер бизнеса

Описание продукции, характер бизнеса Виды бизнеса: особенности, система и формы государственной поддержки

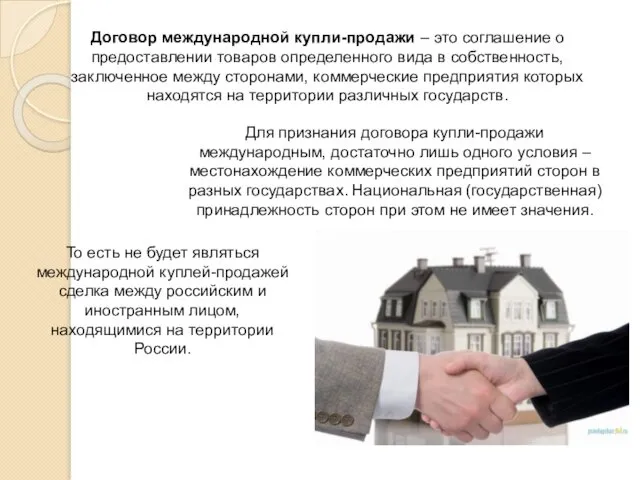

Виды бизнеса: особенности, система и формы государственной поддержки Договор международной купли-продажи

Договор международной купли-продажи Гостиничные цепи и консорциумы. Лекция 5

Гостиничные цепи и консорциумы. Лекция 5 Бізнес-план зі створення хостел-містечка зі старих автобусів

Бізнес-план зі створення хостел-містечка зі старих автобусів Coffe bar. Бизнес кофе на вынос

Coffe bar. Бизнес кофе на вынос Сеть аптек Ригла. Собственные торговые марки

Сеть аптек Ригла. Собственные торговые марки Развитие конного туризма в Акмолинской области

Развитие конного туризма в Акмолинской области Слагаемые успеха в бизнесе

Слагаемые успеха в бизнесе Бизнес-план малого предприятия Мини-пекарня <<Счастье есть>>

Бизнес-план малого предприятия Мини-пекарня <<Счастье есть>> Стартап пен жұмыс істеп тұрған бизнесті ажыратуды үйрену

Стартап пен жұмыс істеп тұрған бизнесті ажыратуды үйрену Как открыть свой бизнес с нуля. Если вам 20 или чуточку больше

Как открыть свой бизнес с нуля. Если вам 20 или чуточку больше Бизнес-проект Транспортная компания

Бизнес-проект Транспортная компания Франчайзинг в международной торговле

Франчайзинг в международной торговле