Слайд 2

Introduction

A business is always owned by someone. This can just be

one person, or thousands. So a business can have a number of different types of ownership depending on the aims and objectives of the owners.

Most businesses aim to make profit for their owners. Profits may not be the major objective, but in order to survive a business will need make a profit in the long term.

Some organisations however will be ‘not-for-profit’, such as charities or government-run corporations.

Слайд 3

Key Learning Points

What are the different types of business organisation?

What are

the advantages and disadvantages of each type?

What are the implications of the choice of business organisation on key issues such as:

Ability to raise finance

Control of the business

Business aims and objectives

Слайд 4

Main types of business organisation

Sole trader

Partnership

Private Limited Company (“Ltd”)

Public Limited Company

(“plc”)

Слайд 5

Sole Trader

A sole trader is a business owned by one person

The

owner makes all the decisions about how the business is run

The owner keeps all the profit, but also suffers all the losses of the business

Слайд 6

Examples of sole traders

Small shops

Small hairdressers

Accountants

Can you think of any others?

Слайд 7

Advantages of a Sole Trader

Cheap and easy to set up

Keep

all the profits

Make all the decisions

Personal contact with customers

Слайд 8

Disadvantages of a

Sole Trader

Unlimited liability (this means that the owner

is responsible for all of the debts of the business)

Lack of capital can prevent expansion

Suffer all losses yourself

Business ends when the owner dies

Слайд 9

Partnership

Business where there are two or more owners of the enterprise

Most

partnerships have between two and twenty members though there are examples like the major accountancy firms where there are hundreds of partners

Слайд 10

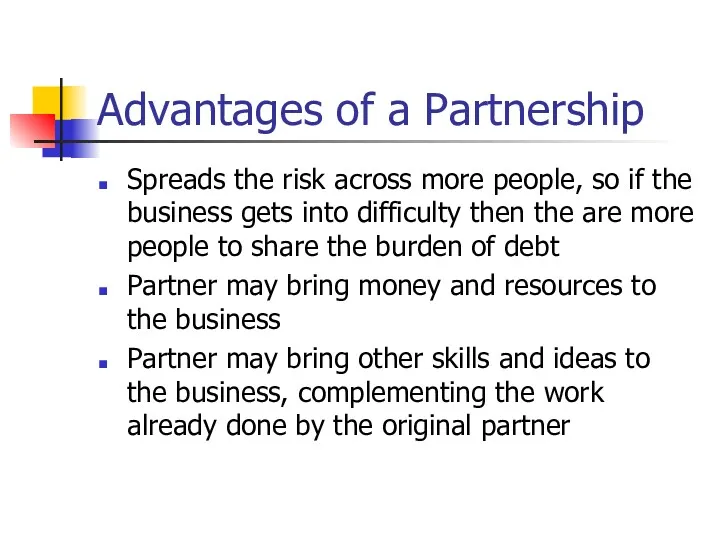

Advantages of a Partnership

Spreads the risk across more people, so if

the business gets into difficulty then the are more people to share the burden of debt

Partner may bring money and resources to the business

Partner may bring other skills and ideas to the business, complementing the work already done by the original partner

Слайд 11

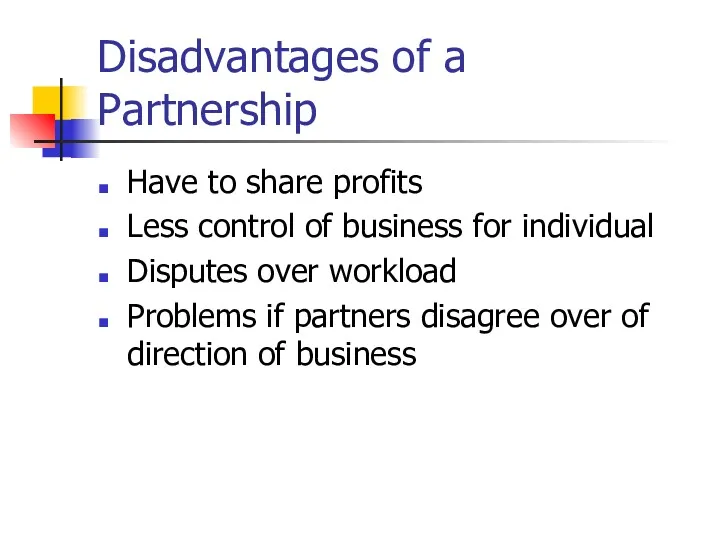

Disadvantages of a Partnership

Have to share profits

Less control of business for

individual

Disputes over workload

Problems if partners disagree over of direction of business

Слайд 12

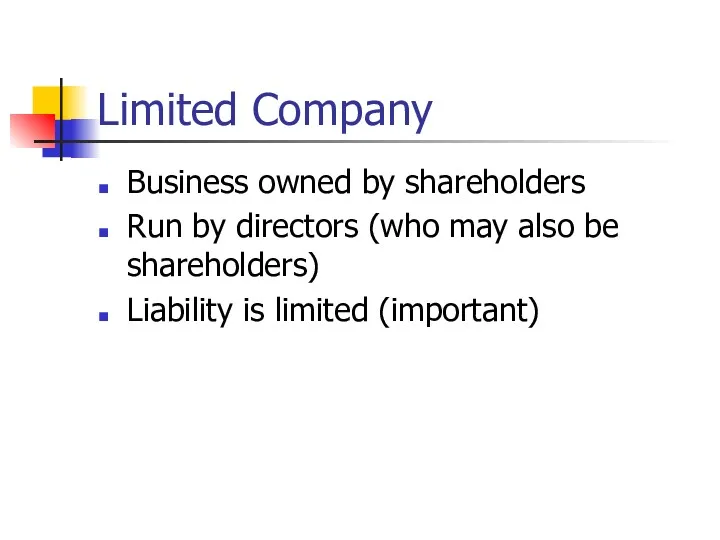

Limited Company

Business owned by shareholders

Run by directors (who may also be

shareholders)

Liability is limited (important)

Слайд 13

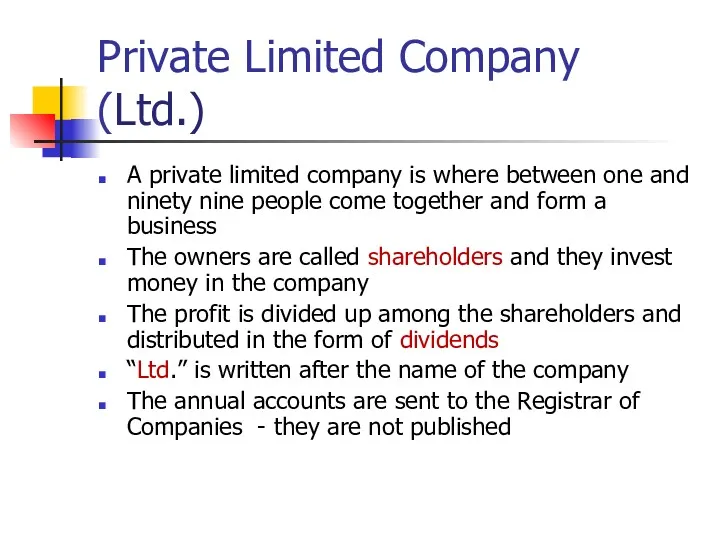

Private Limited Company (Ltd.)

A private limited company is where between one

and ninety nine people come together and form a business

The owners are called shareholders and they invest money in the company

The profit is divided up among the shareholders and distributed in the form of dividends

“Ltd.” is written after the name of the company

The annual accounts are sent to the Registrar of Companies - they are not published

Слайд 14

Advantages of a Private Limited Company

Shareholders have limited liability: If the

business fails you can only lose the money that you invested in the company. Your own personal wealth cannot be touched.

Easier to raise finance

Business continues to exist even when an owner dies

Слайд 15

Disadvantages of a Private Limited Company

Costly to set up

A lot

of legal requirements when forming a company

Shares cannot be transferred to the general public

Слайд 16

Public Limited Company (Plc)

Business owned by shareholders

Run by directors (who may

also be shareholders)

Liability is limited

Слайд 17

Advantages of a Public Limited Company

The ability to raise larger capital

Widening

the shareholder base and spreading risk

More growth and expansion opportunities

Shares are more easily transferable

Going public can enhance the options for the founders to exit the business at some point in the future, if they wish to do so

Здоровый бычок

Здоровый бычок Бизнес-проект по открытию семейного кафе “Хатхор”

Бизнес-проект по открытию семейного кафе “Хатхор” Как в 2 раза увеличить продажи Вконтакте используя авторассылку?

Как в 2 раза увеличить продажи Вконтакте используя авторассылку? Сообщение о бизнес проекте Undertale

Сообщение о бизнес проекте Undertale Поддержка социальных предпринимателей

Поддержка социальных предпринимателей Бизнес-план. Турагенство Эльс-Транс

Бизнес-план. Турагенство Эльс-Транс Бизнес-план. Комплексное решение по шумоизоляции помещений

Бизнес-план. Комплексное решение по шумоизоляции помещений Бизнес-идея и бизнес-план. Поиск и оценка бизнес-идеи

Бизнес-идея и бизнес-план. Поиск и оценка бизнес-идеи Бизнес проект Магазин одежды, 10 кл

Бизнес проект Магазин одежды, 10 кл “GV PARTNERS” - гарантія успіху вашого бізнесу

“GV PARTNERS” - гарантія успіху вашого бізнесу Мы знаем толк в блинах. Бизнес-проект

Мы знаем толк в блинах. Бизнес-проект Компания WinTRADE

Компания WinTRADE Бизнес-план. Создание спортивно - развлекательного центра

Бизнес-план. Создание спортивно - развлекательного центра Организация IT-компании

Организация IT-компании Предпринимательство и его формы

Предпринимательство и его формы Бизнес модель. Построение бизнес-модели

Бизнес модель. Построение бизнес-модели Бизнес модель Канвас

Бизнес модель Канвас Структура и содержание разделов бизнес-плана. Экономика организации

Структура и содержание разделов бизнес-плана. Экономика организации Обеспечение доступа субъектов МСП к закупкам крупнейших заказчиков

Обеспечение доступа субъектов МСП к закупкам крупнейших заказчиков Проект по созданию крытого парка аттракционов

Проект по созданию крытого парка аттракционов Профессия XXI века – eventменеджер

Профессия XXI века – eventменеджер Бизнес-план Продажа канцтоваров в школе

Бизнес-план Продажа канцтоваров в школе The Creative Enterprise Programme. Impact Hub Odessa

The Creative Enterprise Programme. Impact Hub Odessa Бизнес-план. Ферма Индолина

Бизнес-план. Ферма Индолина Бизнес-план кафе

Бизнес-план кафе Домашняя пекарня

Домашняя пекарня Антикоррупционное поведение компаний

Антикоррупционное поведение компаний Постановка проблемы. Социальное предпринимательство

Постановка проблемы. Социальное предпринимательство