Содержание

- 2. Comparing Merchandising Activities with Manufacturing Activities Merchandising Company Purchase inventory in ready-to-sell condition. Manufacturing Company Manufacture

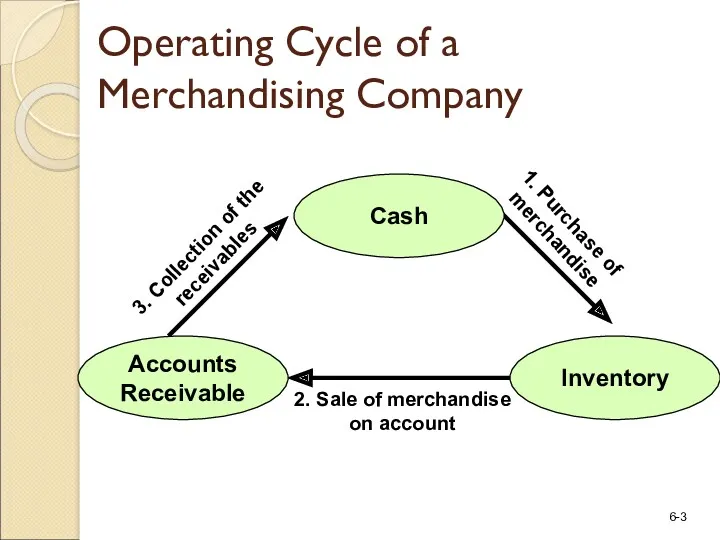

- 3. Operating Cycle of a Merchandising Company 1. Purchase of merchandise 3. Collection of the receivables 2.

- 4. Retailers and Wholesalers Retailers sell merchandise directly to the public. Wholesalers buy merchandise from several different

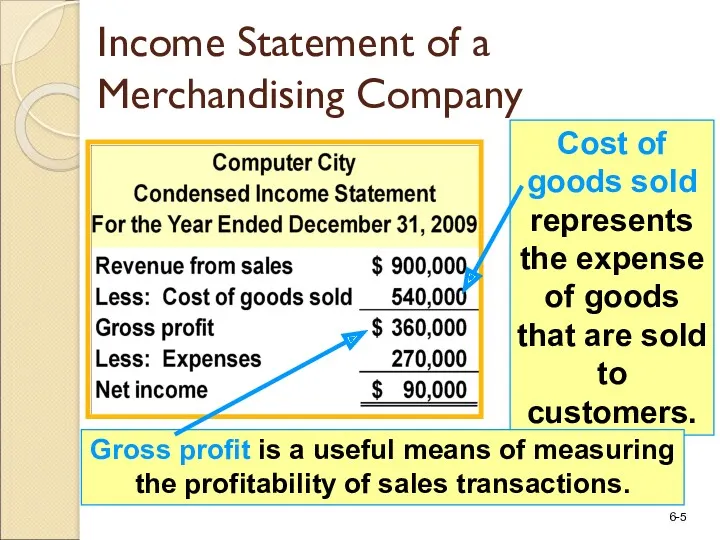

- 5. Income Statement of a Merchandising Company

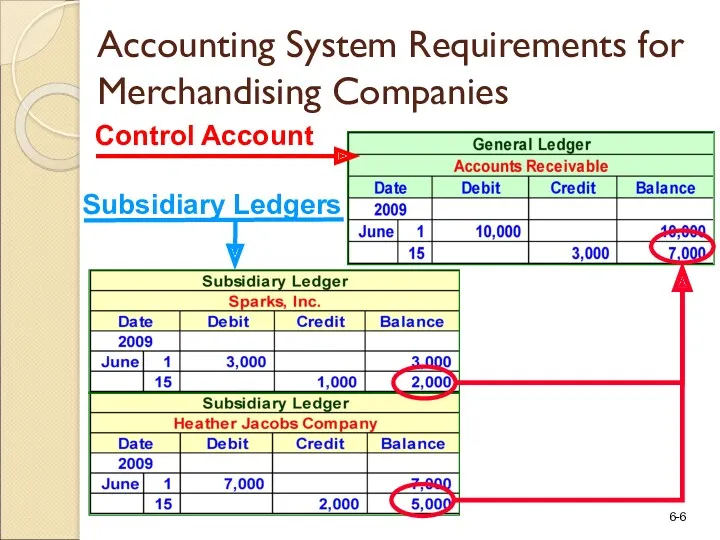

- 6. Accounting System Requirements for Merchandising Companies Control Account

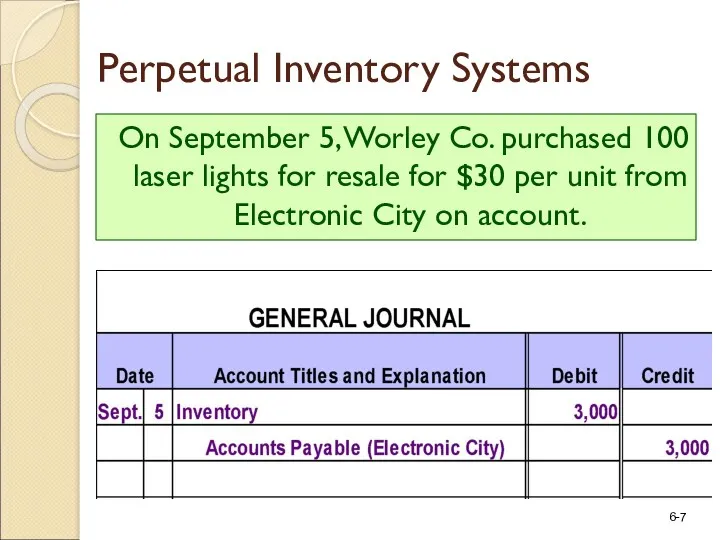

- 7. On September 5, Worley Co. purchased 100 laser lights for resale for $30 per unit from

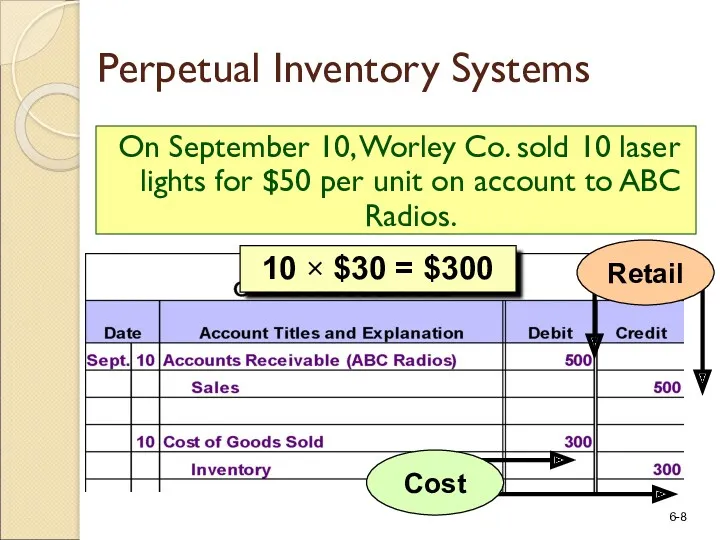

- 8. On September 10, Worley Co. sold 10 laser lights for $50 per unit on account to

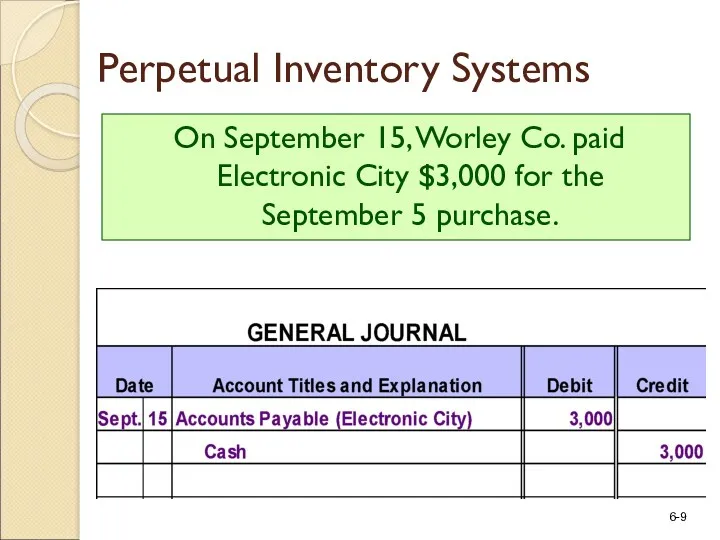

- 9. On September 15, Worley Co. paid Electronic City $3,000 for the September 5 purchase. Perpetual Inventory

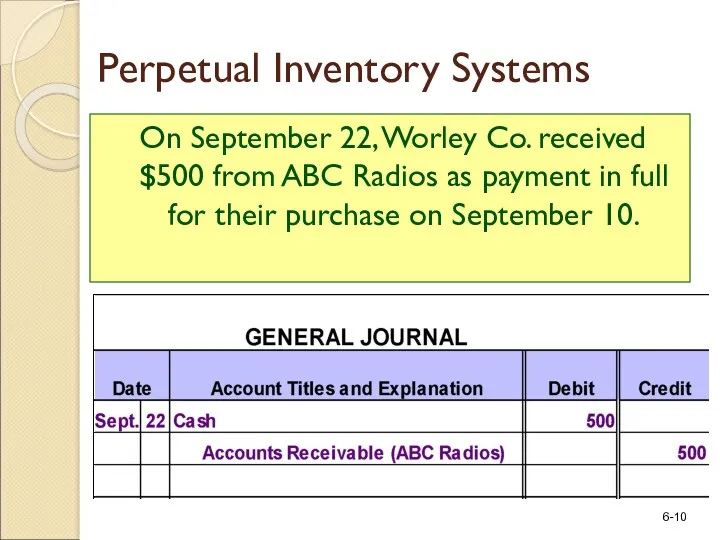

- 10. On September 22, Worley Co. received $500 from ABC Radios as payment in full for their

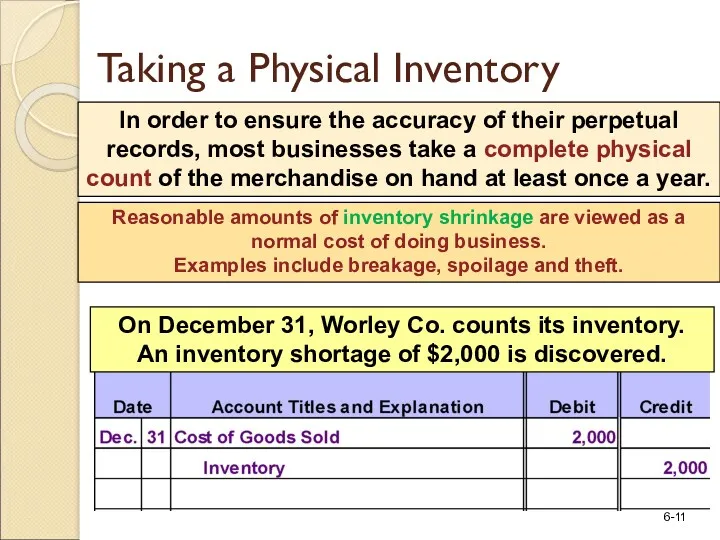

- 11. In order to ensure the accuracy of their perpetual records, most businesses take a complete physical

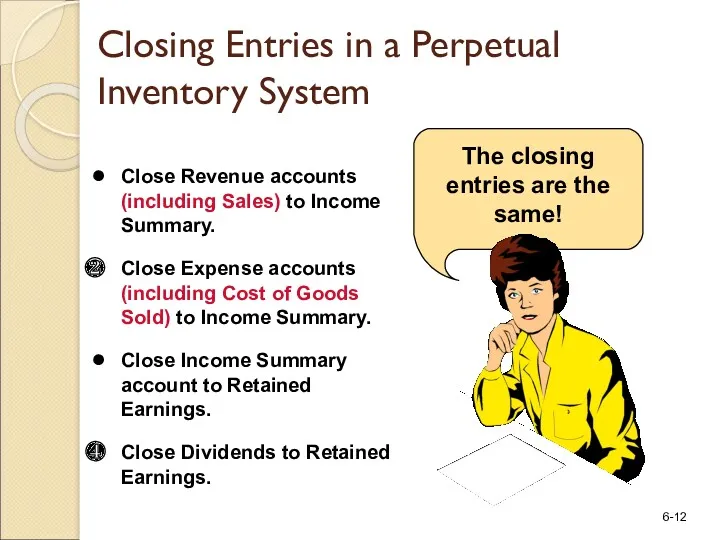

- 12. Closing Entries in a Perpetual Inventory System Close Revenue accounts (including Sales) to Income Summary. Close

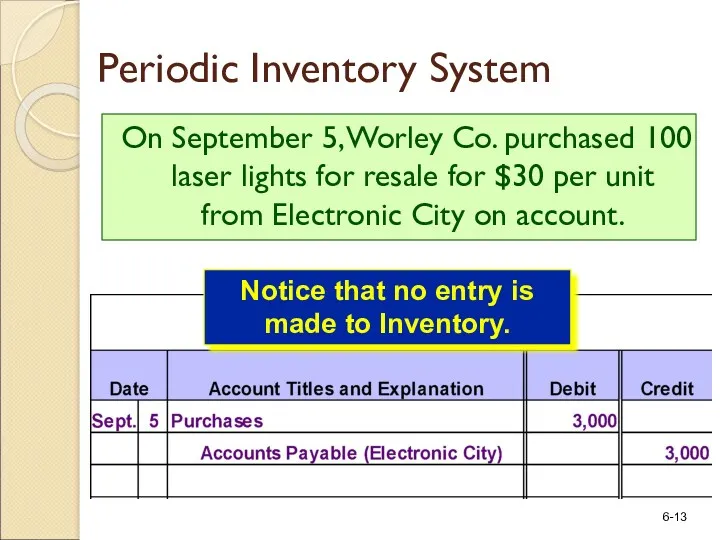

- 13. On September 5, Worley Co. purchased 100 laser lights for resale for $30 per unit from

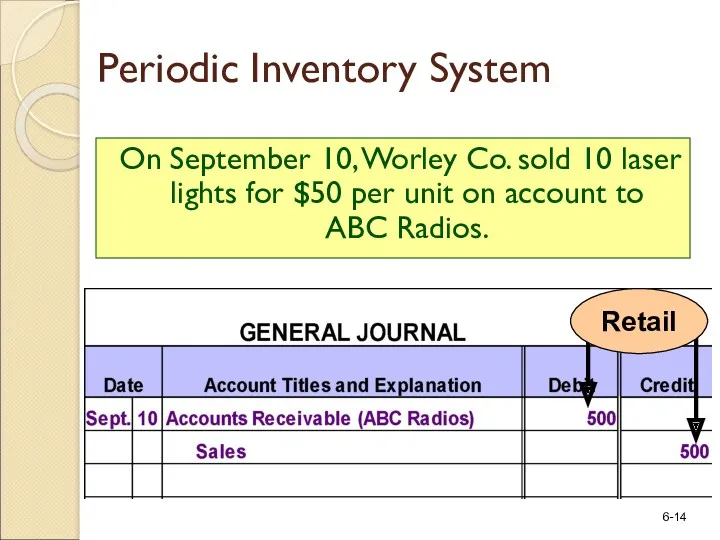

- 14. On September 10, Worley Co. sold 10 laser lights for $50 per unit on account to

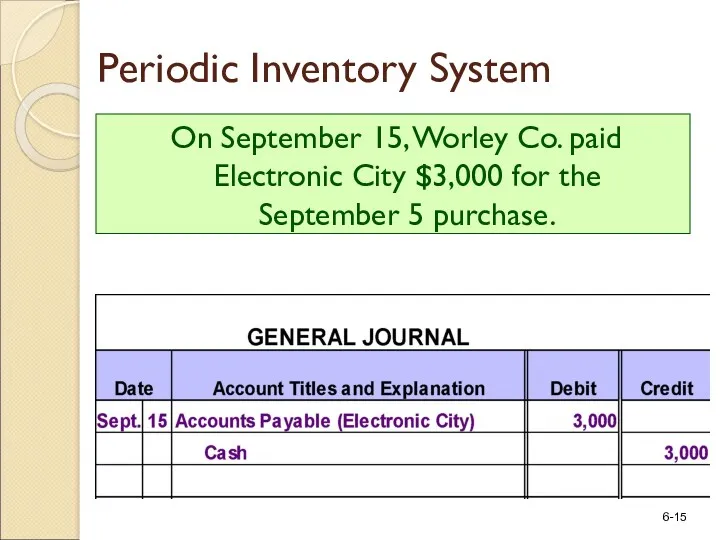

- 15. On September 15, Worley Co. paid Electronic City $3,000 for the September 5 purchase. Periodic Inventory

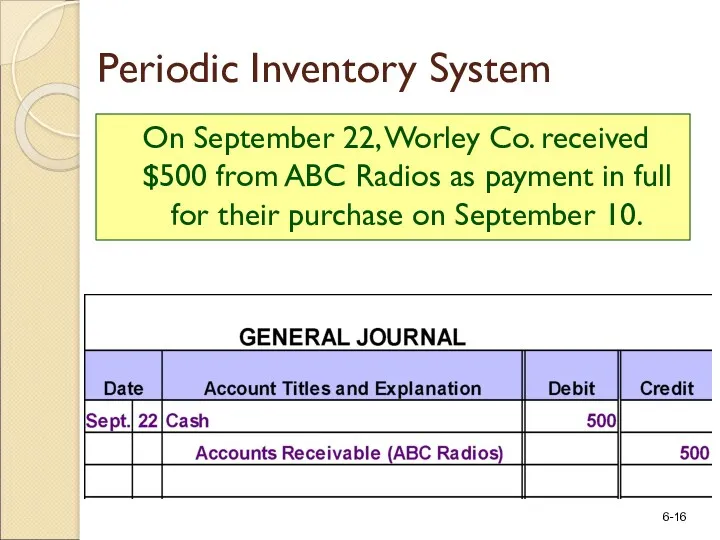

- 16. On September 22, Worley Co. received $500 from ABC Radios as payment in full for their

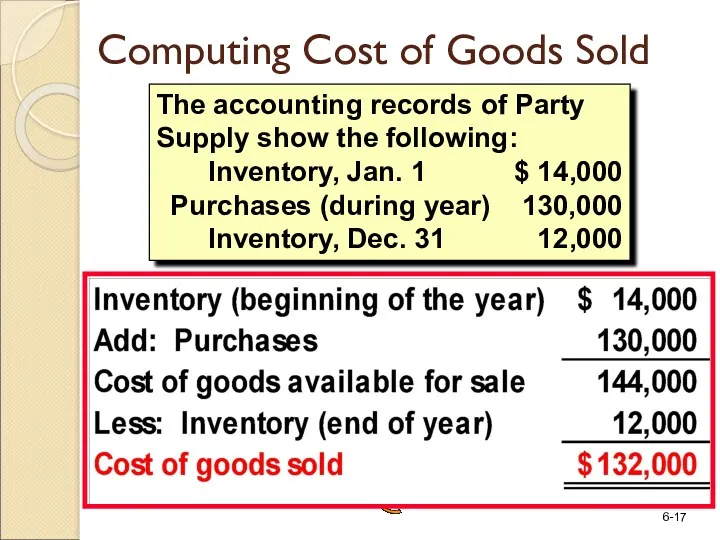

- 17. Computing Cost of Goods Sold The accounting records of Party Supply show the following: Inventory, Jan.

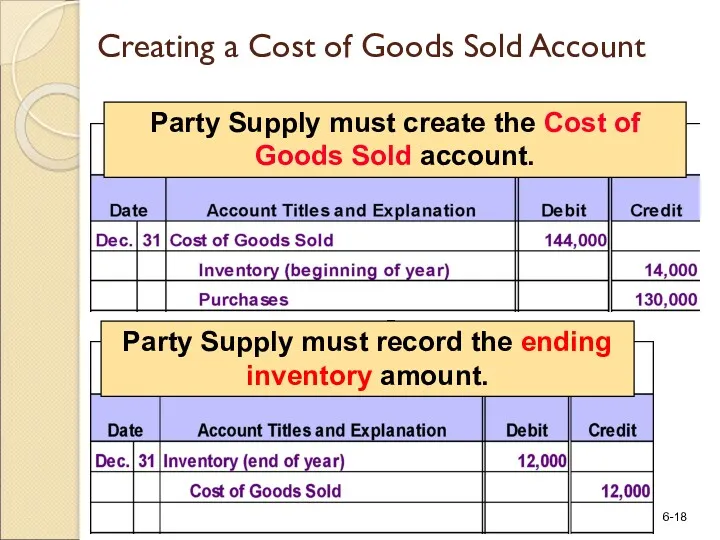

- 18. Creating a Cost of Goods Sold Account Party Supply must create the Cost of Goods Sold

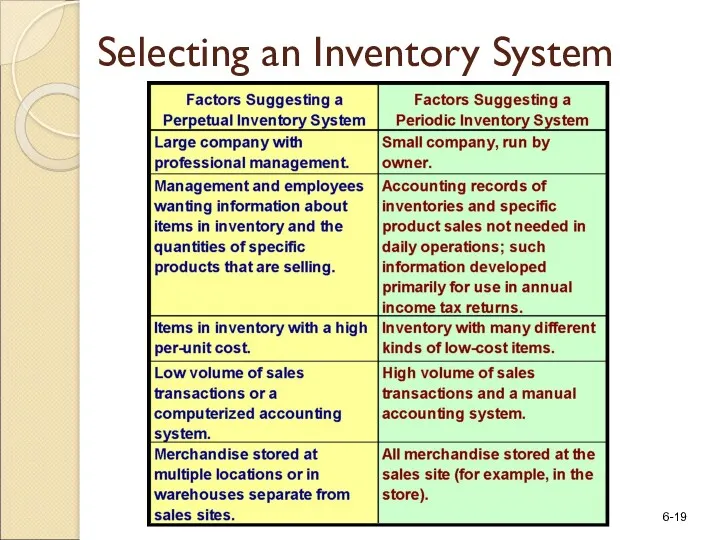

- 19. Selecting an Inventory System

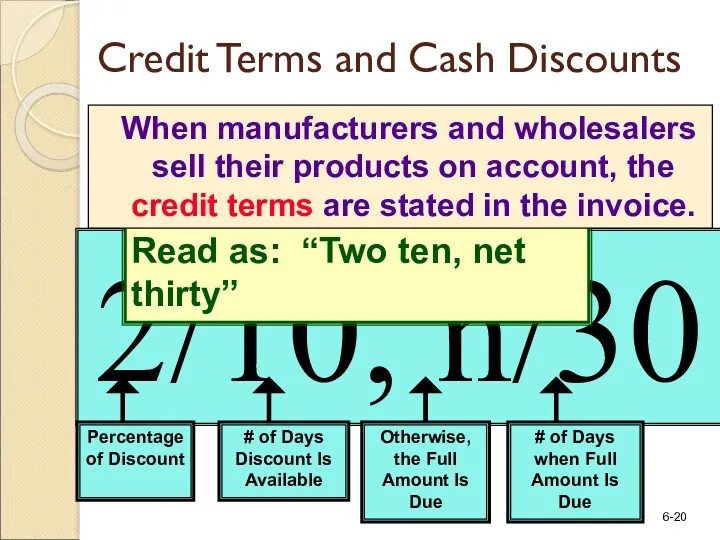

- 20. Credit Terms and Cash Discounts 2/10, n/30 When manufacturers and wholesalers sell their products on account,

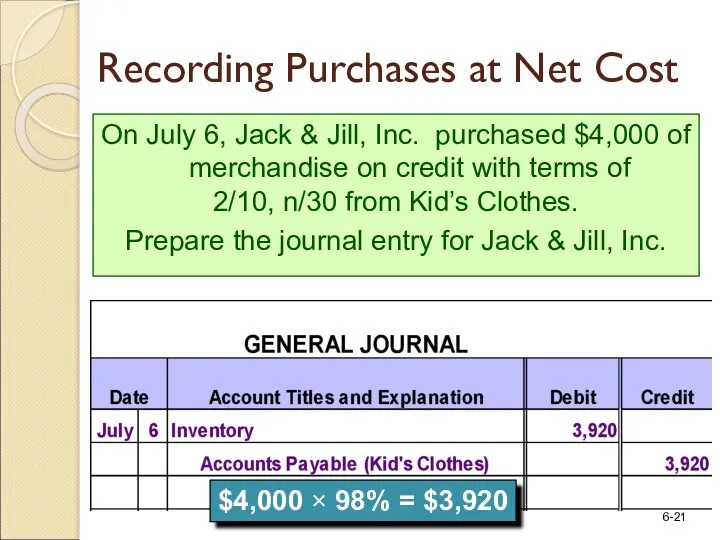

- 21. Recording Purchases at Net Cost $4,000 × 98% = $3,920 On July 6, Jack & Jill,

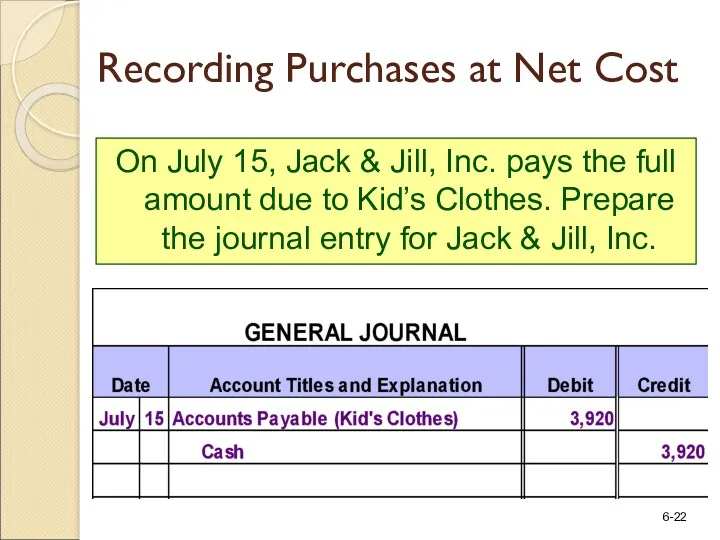

- 22. On July 15, Jack & Jill, Inc. pays the full amount due to Kid’s Clothes. Prepare

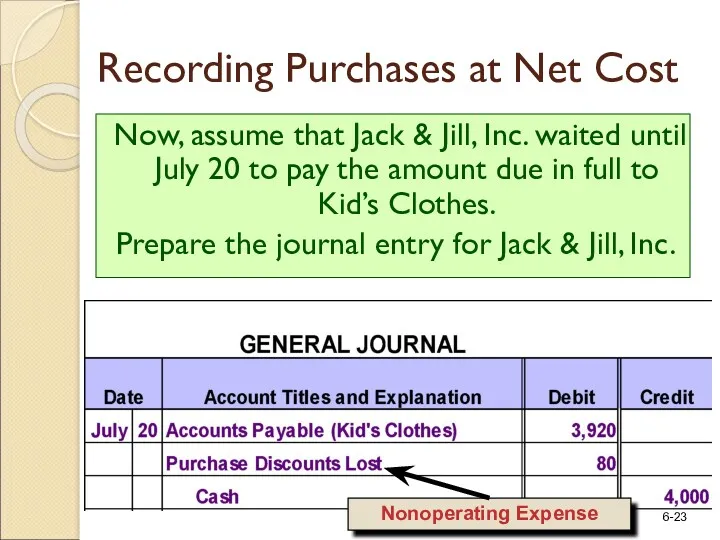

- 23. Now, assume that Jack & Jill, Inc. waited until July 20 to pay the amount due

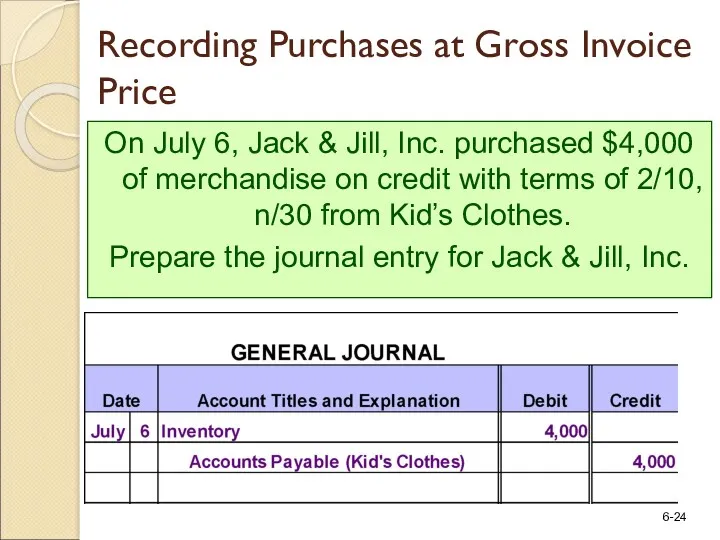

- 24. Recording Purchases at Gross Invoice Price On July 6, Jack & Jill, Inc. purchased $4,000 of

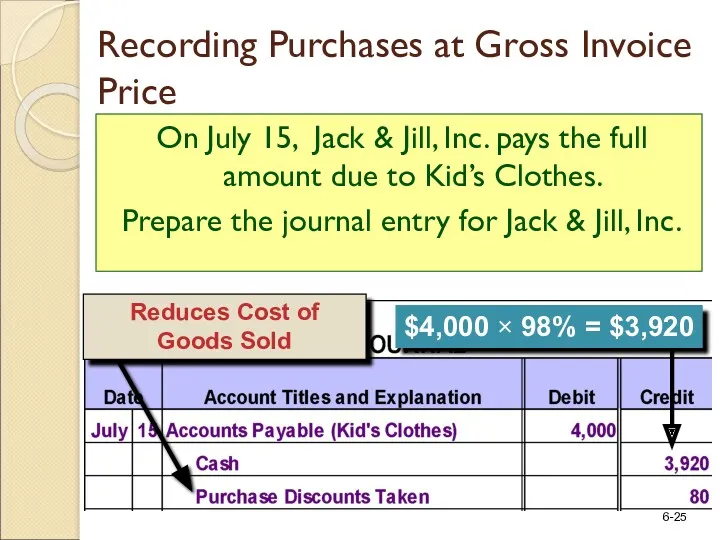

- 25. On July 15, Jack & Jill, Inc. pays the full amount due to Kid’s Clothes. Prepare

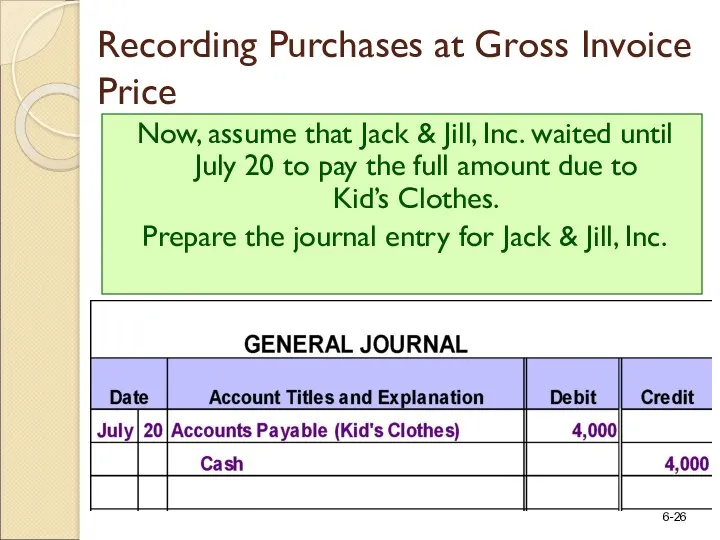

- 26. Now, assume that Jack & Jill, Inc. waited until July 20 to pay the full amount

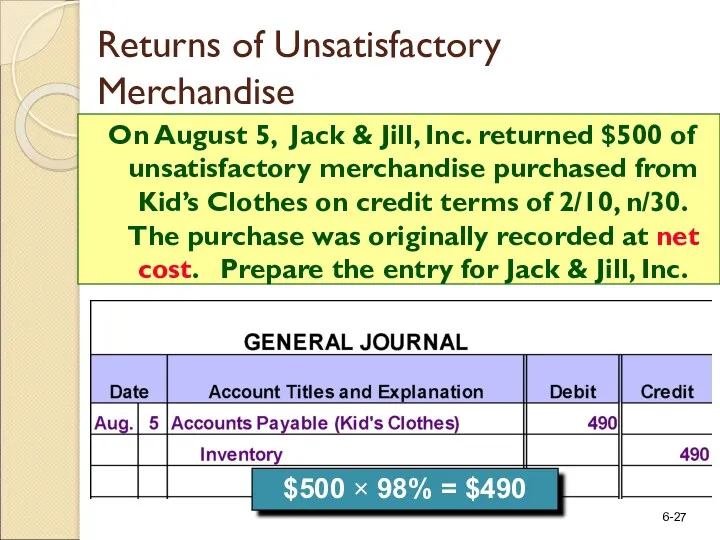

- 27. $500 × 98% = $490 On August 5, Jack & Jill, Inc. returned $500 of unsatisfactory

- 28. Transportation costs related to the acquisition of assets are part of the cost of the asset

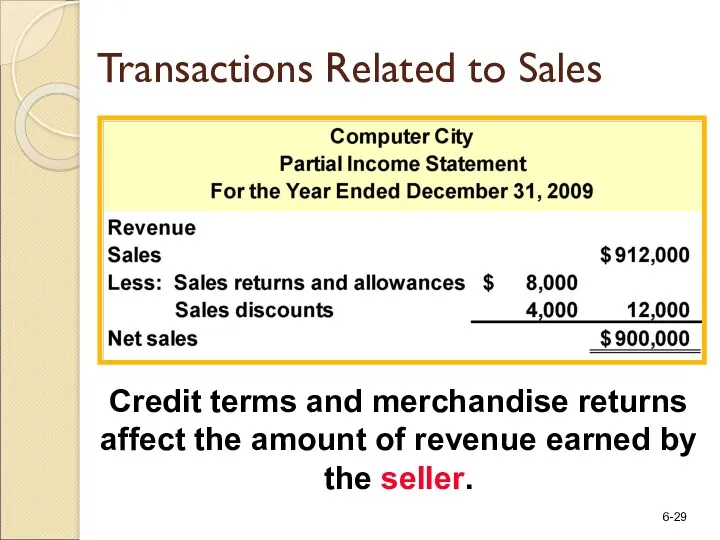

- 29. Credit terms and merchandise returns affect the amount of revenue earned by the seller. Transactions Related

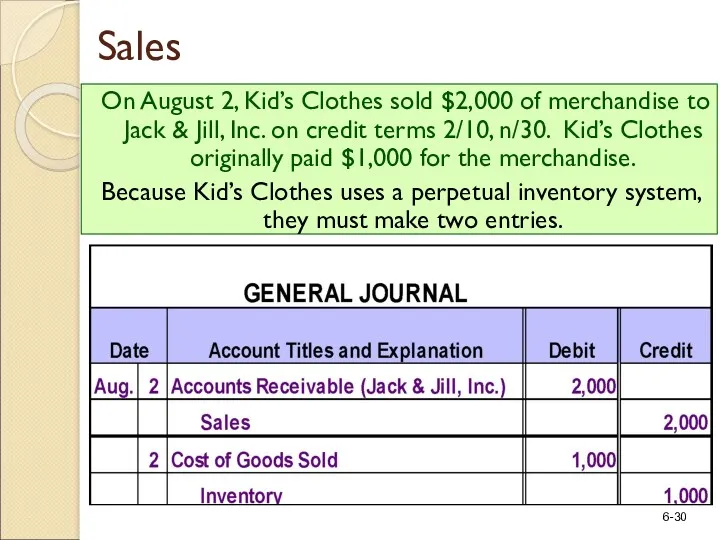

- 30. On August 2, Kid’s Clothes sold $2,000 of merchandise to Jack & Jill, Inc. on credit

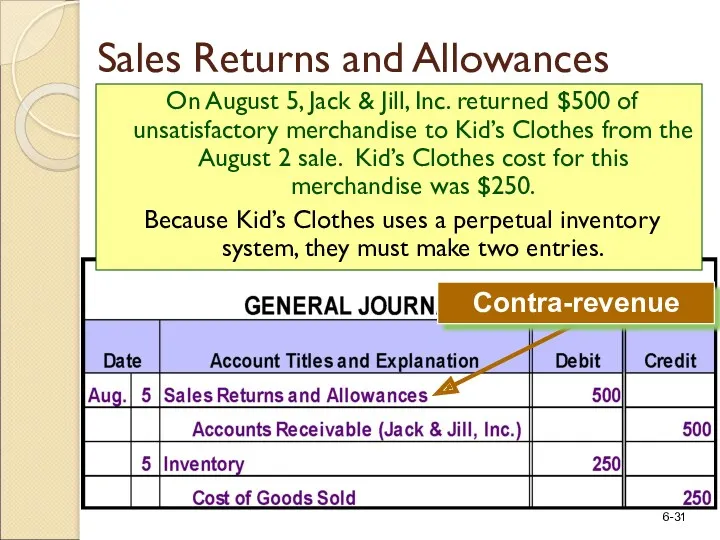

- 31. Contra-revenue On August 5, Jack & Jill, Inc. returned $500 of unsatisfactory merchandise to Kid’s Clothes

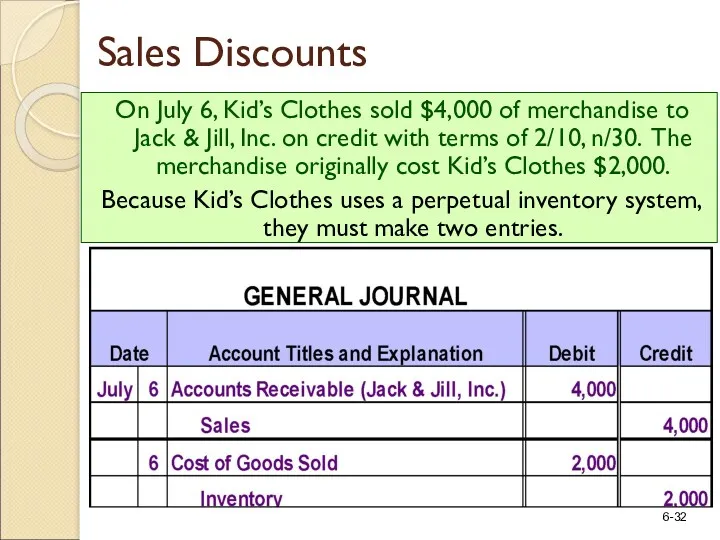

- 32. On July 6, Kid’s Clothes sold $4,000 of merchandise to Jack & Jill, Inc. on credit

- 33. On July 15, Kid’s Clothes receives the full amount due from Jack & Jill, Inc. from

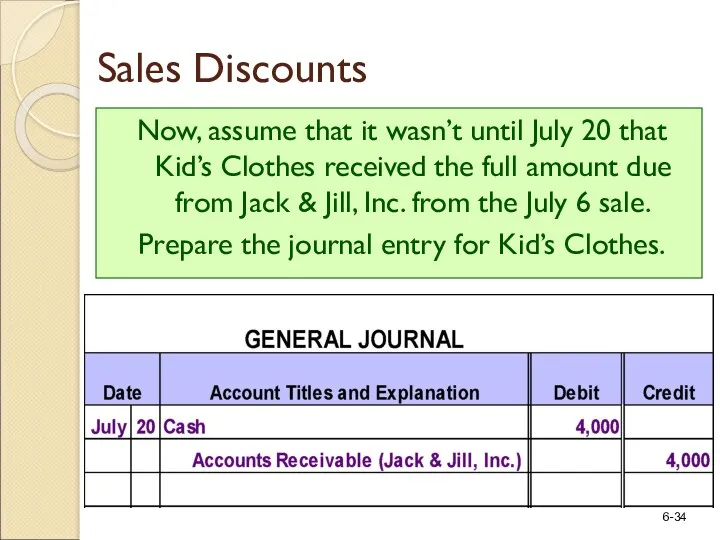

- 34. Now, assume that it wasn’t until July 20 that Kid’s Clothes received the full amount due

- 35. Delivery costs incurred by sellers are debited to Delivery Expense, an operating expense. Delivery Expenses

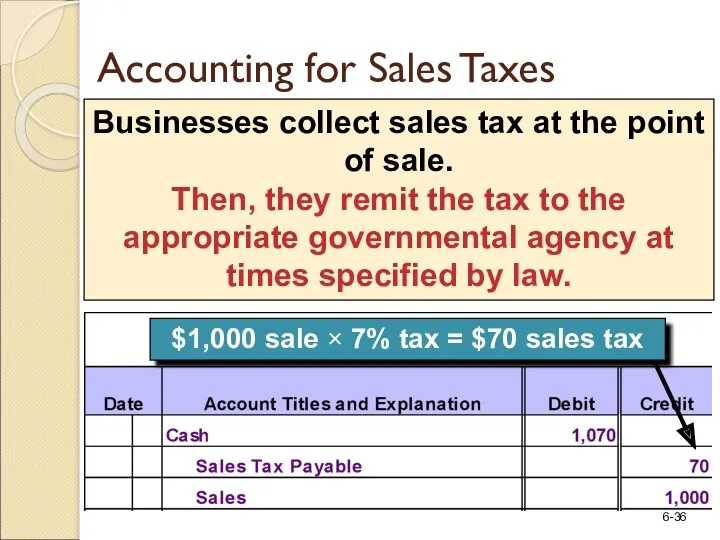

- 36. Businesses collect sales tax at the point of sale. Then, they remit the tax to the

- 37. Modifying an Accounting System Most businesses use special journals rather than a general journal to record

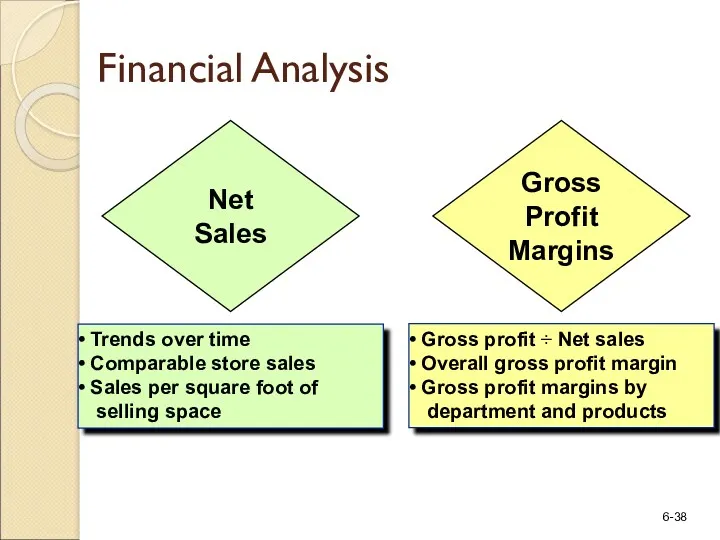

- 38. Financial Analysis Net Sales Gross Profit Margins Trends over time Comparable store sales Sales per square

- 39. Ethics, Fraud, and Corporate Governance Sales discounts and allowances are contra-revenue accounts. Sales discounts and allowances

- 41. Скачать презентацию

Франчайзинг. Инструменты контроля качества. Аутсорсинг (вопросы и ответы)

Франчайзинг. Инструменты контроля качества. Аутсорсинг (вопросы и ответы) Малое и среднее предпринимательство и поддержка индивидуальной предпринимательской инициативы

Малое и среднее предпринимательство и поддержка индивидуальной предпринимательской инициативы Бизнес-идея

Бизнес-идея Бизнес перезагрузка

Бизнес перезагрузка Портрет компании

Портрет компании Парикмахерская Apaches

Парикмахерская Apaches Космик – лидер на рынке активного отдыха в России

Космик – лидер на рынке активного отдыха в России Мастерская чистоты

Мастерская чистоты Создание и деятельность сельскохозяйственных кооперативов

Создание и деятельность сельскохозяйственных кооперативов Журнал Format

Журнал Format Клининговая компания “Агентство чистоты”

Клининговая компания “Агентство чистоты” Виды и формы бизнеса. Урок 18

Виды и формы бизнеса. Урок 18 Конкурентоспособность бизнеса и институты, ее обеспечивающие

Конкурентоспособность бизнеса и институты, ее обеспечивающие Бизнес-план Организация производства одежды из экоматериалов

Бизнес-план Организация производства одежды из экоматериалов Описание продукции, характер бизнеса

Описание продукции, характер бизнеса Виды бизнеса: особенности, система и формы государственной поддержки

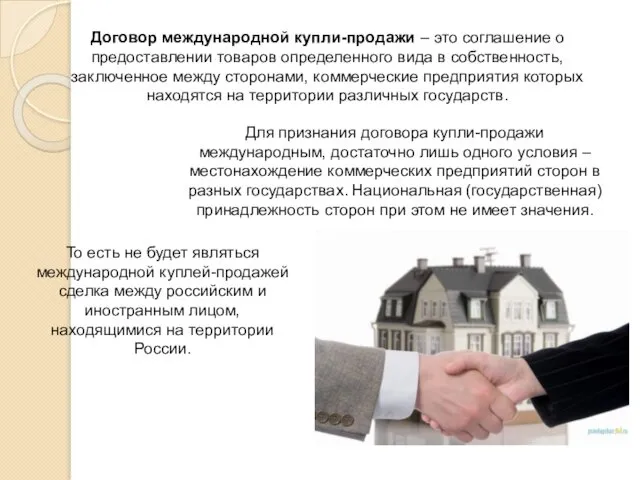

Виды бизнеса: особенности, система и формы государственной поддержки Договор международной купли-продажи

Договор международной купли-продажи Гостиничные цепи и консорциумы. Лекция 5

Гостиничные цепи и консорциумы. Лекция 5 Бізнес-план зі створення хостел-містечка зі старих автобусів

Бізнес-план зі створення хостел-містечка зі старих автобусів Coffe bar. Бизнес кофе на вынос

Coffe bar. Бизнес кофе на вынос Сеть аптек Ригла. Собственные торговые марки

Сеть аптек Ригла. Собственные торговые марки Развитие конного туризма в Акмолинской области

Развитие конного туризма в Акмолинской области Слагаемые успеха в бизнесе

Слагаемые успеха в бизнесе Бизнес-план малого предприятия Мини-пекарня <<Счастье есть>>

Бизнес-план малого предприятия Мини-пекарня <<Счастье есть>> Стартап пен жұмыс істеп тұрған бизнесті ажыратуды үйрену

Стартап пен жұмыс істеп тұрған бизнесті ажыратуды үйрену Как открыть свой бизнес с нуля. Если вам 20 или чуточку больше

Как открыть свой бизнес с нуля. Если вам 20 или чуточку больше Бизнес-проект Транспортная компания

Бизнес-проект Транспортная компания Франчайзинг в международной торговле

Франчайзинг в международной торговле