Слайд 8

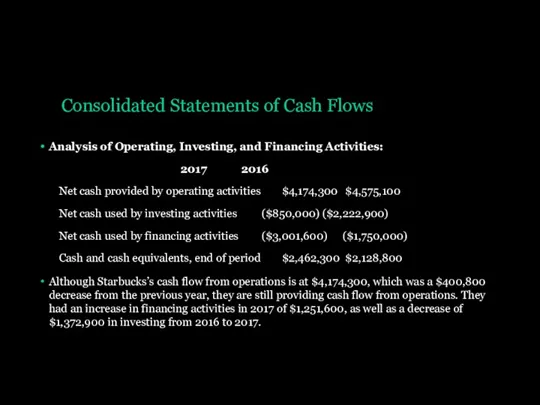

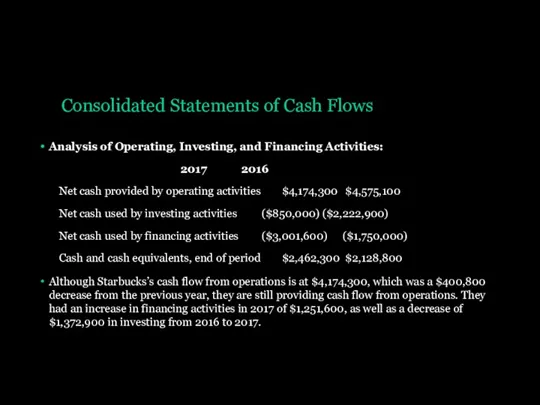

Consolidated Statements of Cash Flows

Analysis of Operating, Investing, and Financing Activities:

2017 2016

Net

cash provided by operating activities $4,174,300 $4,575,100

Net cash used by investing activities ($850,000) ($2,222,900)

Net cash used by financing activities ($3,001,600) ($1,750,000)

Cash and cash equivalents, end of period $2,462,300 $2,128,800

Although Starbucks’s cash flow from operations is at $4,174,300, which was a $400,800 decrease from the previous year, they are still providing cash flow from operations. They had an increase in financing activities in 2017 of $1,251,600, as well as a decrease of $1,372,900 in investing from 2016 to 2017.

Резюме бизнес-идеи

Резюме бизнес-идеи Понятие и источники предпринимательского права. (Тема 1)

Понятие и источники предпринимательского права. (Тема 1) Образовательный проект Лови волну

Образовательный проект Лови волну Виды и формы бизнеса

Виды и формы бизнеса Бизнес-план. Спортивно-развлекательный отдых

Бизнес-план. Спортивно-развлекательный отдых Анализ международной деятельности компании Apple

Анализ международной деятельности компании Apple Проект. Строительство установки вдувания пылеугольного топлива в доменные печи

Проект. Строительство установки вдувания пылеугольного топлива в доменные печи Салон красоты City Style

Салон красоты City Style Кәсіпкерлік қызмет субъектілерінің жауапкершілігі. (Тақырып 9)

Кәсіпкерлік қызмет субъектілерінің жауапкершілігі. (Тақырып 9) Продвижение туристических услуг

Продвижение туристических услуг Предпринимательская деятельность в туризме

Предпринимательская деятельность в туризме Мастер-класс. Как найти первых клиентов

Мастер-класс. Как найти первых клиентов Роль транспортного обслуживания в индустрии. Лекция 2

Роль транспортного обслуживания в индустрии. Лекция 2 Мобильная кофейня

Мобильная кофейня Компания Giggle. Проект START UP

Компания Giggle. Проект START UP LLC RUBIN-15

LLC RUBIN-15 Создание и развитие индустриальных парков

Создание и развитие индустриальных парков Бизнес-планирование

Бизнес-планирование

Гастрономический тур в Хорватию

Гастрономический тур в Хорватию Бизнес-проект Этнотуризм выходного дня на базе национальной общины Самутнели Белоярского района

Бизнес-проект Этнотуризм выходного дня на базе национальной общины Самутнели Белоярского района Кафе Сладкая фантазия

Кафе Сладкая фантазия Структура бизнес-плана

Структура бизнес-плана Бизнес – идея

Бизнес – идея Создание образа продуктивной модели бизнеса

Создание образа продуктивной модели бизнеса Бизнес в партнерстве

Бизнес в партнерстве Бизнес-идея

Бизнес-идея ESG strategy for А101

ESG strategy for А101