Содержание

- 2. Module logistics See the module outline for details. Some highlights: Textbooks: Lipczynski, Wilson and Goddard Church

- 3. Module structure Structure ? Conduct ? Performance Market definition Concentration measures Concentration determinants Testing SCP, NEIO

- 4. IO is the application of microeconomic theory to the analysis of firms, markets and industries In

- 5. IO increases our understanding of problems faced by firms: Externally, how firms compete in the marketplace

- 6. For policy makers: Competition policy aims to prevent firms from abusing market power. [Sherman Act 1890,

- 7. 2010: The EU commission accuses Google of promoting its shopping service in internet search at the

- 8. Google could face a 3bn euros fine. Related to that case, IO provides answers to the

- 9. Typology of market structures

- 10. Dynamic theory where markets are changing due to the activities of entrepreneurial and profit-seeking innovators. “Creative

- 11. Creative destruction: The music industry 1850 1900 1950 2000 Wind-up gramophone Barrel organ Pianola Hi-Fi stereo

- 12. The Chicago School The Chicago School (1970-80s): Also argues against government intervention Large firms are large

- 13. Concentrates on empirical analysis rather than on theoretical analysis. Bain (1956): There is a causal relationship

- 14. Structure ? Conduct ? Performance The SCP paradigm The number and size distribution of firms Entry

- 15. According to SCP, relationships between structural variables and market performance hold across industries. The line of

- 16. SCP & European banking: Structure 1980s: European banking was fragmented. Banks did not operate in other

- 17. SCP & European banking: Structure 1990-2009: decline in the number of banks

- 18. SCP & European banking: Structure 1990-2009: increased level of seller concentration

- 19. SCP & European banking: Conduct Following the deregulation, many banks have consolidated (M&A), e.g. Unicredito (Italy)

- 20. SCP & European banking: Performance 1990-2006: increased profitability despite the lowering of entry barriers. How to

- 21. Structure ? Conduct ? Performance Conduct to structure? R&D, advertising, differentiation Performance to structure? Growth and

- 22. Structure ? Conduct ? Performance Public policies that aim to prevent the abuse of market power

- 23. Profits in America and the practical relevance of IO Source: ‘Too much of a good thing’.

- 24. Profits in America

- 25. Profits in America - Historical developments In the 1990s American firms faced a wave of competition

- 26. Profits in America

- 27. Profits in America

- 28. Profits in America About 25% of America’s abnormal profits are spread across a wide range of

- 29. Production and costs

- 30. Production and costs

- 31. Short run production

- 32. Short run costs

- 33. Long run costs In the long-run, firms can change their usage of all the inputs, including

- 34. Long run costs

- 35. Application to oil pipelines Costs associated with construction and operation: Planning and design Acquisition of clearing

- 36. Application to oil pipelines Electricity costs vary with throughput, but the number of personnel does not.

- 37. Economies of scale Economies of scale impact the LRAC Minimum efficient scale = output level beyond

- 38. Economies of scale

- 39. Empirical studies of economies of scale Some firms have U-shaped LRAC However, manufacturing firms often have

- 40. Empirical studies of economies of scale Survivorship studies: If a particular plant size is efficient, eventually

- 41. Economies of scope Economies of scope are the cost savings that arise when a firm produces

- 42. Economies of scope Example 3: Umbrella advertising Advertising one Samsung product will lead to more demand

- 43. Demand elasticity

- 44. Demand elasticity

- 45. Demand elasticity

- 46. Demand elasticity

- 47. Cross-price elasticity of demand CES>0. Goods 1 and 2 are substitute. As the price of Good

- 49. Скачать презентацию

Глобальная экономика. Тема 9. Прогнозные сценарии глобального развития

Глобальная экономика. Тема 9. Прогнозные сценарии глобального развития Тенденции и факторы развития социальной сферы

Тенденции и факторы развития социальной сферы Механизмы стимулирования развития арктической зоны с использованием государственно-частного партнерства

Механизмы стимулирования развития арктической зоны с использованием государственно-частного партнерства Рыночная экономика и ее модели. Тема 4

Рыночная экономика и ее модели. Тема 4 Жоспарлау қызметінің құрлымы

Жоспарлау қызметінің құрлымы Экономика. Факторы производства

Экономика. Факторы производства Тема 10. Экономическая роль государства

Тема 10. Экономическая роль государства Способы факторного анализа на основе принципа элиминирования. (Тема 3)

Способы факторного анализа на основе принципа элиминирования. (Тема 3) Рынок ресурсов (на примере рынка труда)

Рынок ресурсов (на примере рынка труда) Занятие по Экономическому практикуму

Занятие по Экономическому практикуму Основные фонды

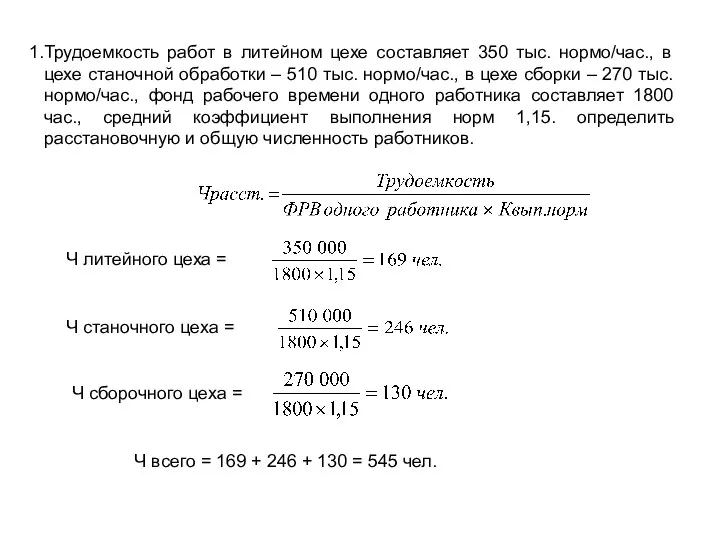

Основные фонды Задачи по УП - экзамен

Задачи по УП - экзамен Совершенствование кадрового обеспечения АПК Костромской области

Совершенствование кадрового обеспечения АПК Костромской области Международная миграция рабочей силы

Международная миграция рабочей силы Постсоветское пространство. Укрепление влияния России и его кризис

Постсоветское пространство. Укрепление влияния России и его кризис Особенности коммерческой деятельности при участии на выставках, ярмарках, аукционах, товарных биржах

Особенности коммерческой деятельности при участии на выставках, ярмарках, аукционах, товарных биржах Безработица. Ее причины и последствия

Безработица. Ее причины и последствия Экономические системы

Экономические системы Международная сегментация и стратегии проникновения на зарубежные рынки

Международная сегментация и стратегии проникновения на зарубежные рынки Типы экономических систем

Типы экономических систем История развития пищевой промышленности России

История развития пищевой промышленности России Переход хозяйственных систем на инновационный тип развития

Переход хозяйственных систем на инновационный тип развития Государственное регулирование и саморегулирование рынка медицинских товаров и услуг

Государственное регулирование и саморегулирование рынка медицинских товаров и услуг Экономические основы деятельности фирмы

Экономические основы деятельности фирмы Доходы. Сбережения

Доходы. Сбережения Мировая экономика: основные черты и тенденции развития мировой экономики и мирового хозяйства

Мировая экономика: основные черты и тенденции развития мировой экономики и мирового хозяйства Экономика Курской области и доходы областного бюджета

Экономика Курской области и доходы областного бюджета Розрахунково - графічна робота Регіональна економіка

Розрахунково - графічна робота Регіональна економіка