Содержание

- 2. COURSE REVISION The following topics highlight the prime learning points for the course They are not

- 3. QUESTION 1: COMPULSORY You must do Question 1 For the remaining questions you choose 3 out

- 4. TOPIC 1: ECONOMIC RISK ANALYSIS FOR EMERGING ECONOMIES

- 5. ECONOMIC RISK ANALYSIS (ERA) IMF uses quantitative analysis for evaluating economies Economic risk is present in

- 6. FINDING THE DATA Most of the data is available from the World Bank The data is

- 7. ERA EXAM QUESTION PART I: QUANTITATIVE DATA “Examine the data set provided on (Country X), considered

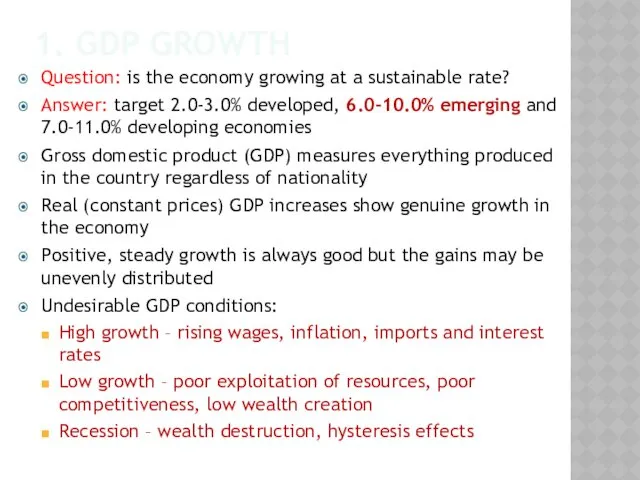

- 8. 1. GDP GROWTH Question: is the economy growing at a sustainable rate? Answer: target 2.0-3.0% developed,

- 9. GDP GROWTH TARGETS Need to find a balance between a booming economy and recession An overheating

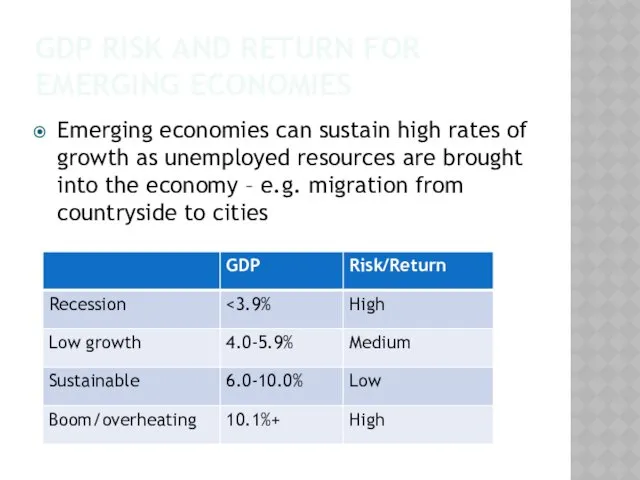

- 10. GDP RISK AND RETURN FOR EMERGING ECONOMIES Emerging economies can sustain high rates of growth as

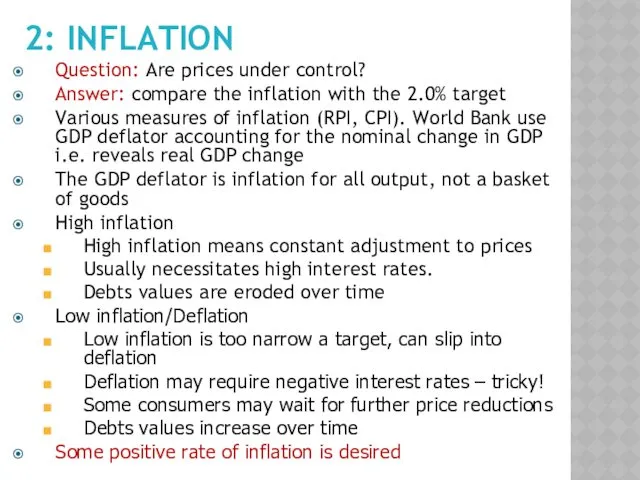

- 11. 2: INFLATION Question: Are prices under control? Answer: compare the inflation with the 2.0% target Various

- 12. INFLATION AND RISK/RETURN Most central banks are targeting 2.0% CPI inflation Some central banks will accept

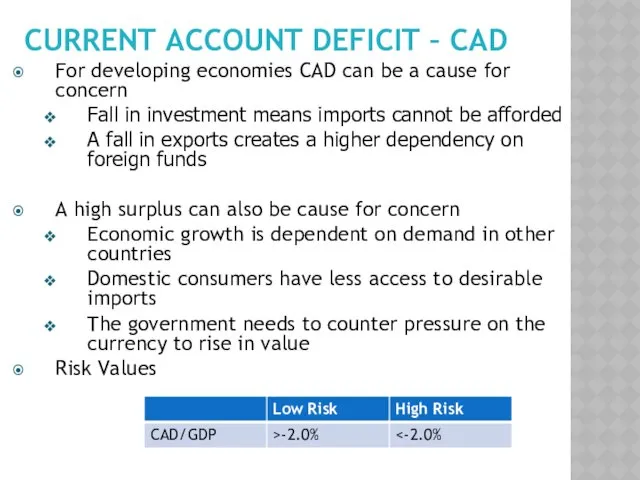

- 13. 3: CURRENT ACCOUNT DEFICIT – CAD Question: how great is the short-term trade burden? Answer: compare

- 14. CURRENT ACCOUNT DEFICIT – CAD For developing economies CAD can be a cause for concern Fall

- 15. CRITICISM OF THE IMF QUANTITATIVE APPROACH Many feel that the IMF style of analysis does more

- 16. FOCUS POINTS Memorise the targets – could be represented as graphs? Be sure to match the

- 17. ERA EXAM QUESTION PART II: FDI INVESTMENT DECISION The second half of Exam Question 1 concerns

- 18. FACTORS INFLUENCING FDI The economic factors that are appropriate to the FDI decision depend upon the

- 19. GREENWICH MNEMONIC - GLIFTS GLIFTS is only there to help you remember – it should not

- 20. USING GLIFTS G – GDP per capita growth rate (the trend). May indicate a growing productivity,

- 21. OTHER INTERESTING DATA… An entrepreneur will browse data looking for items of interest This is when

- 22. SOURCES World Bank IMF (for CAD/GDP) – latest World Economic Outlook report Australia CAD/GDP – Mr

- 23. FOCUS POINTS Prepare a range of case study companies in advance and think about what they

- 24. QUESTIONS 2-6: UNCOMPULSORY 5 questions, you choose 3 of them Each requires a mini-essay answer: Start

- 25. TOPIC 2: RISK & UNCERTAINTY

- 26. RISK VS UNCERTAINTY Knight (1921)/ Chicago Risk : When probabilities can be identified, eg. playing poker,

- 27. TYPES OF UNCERTAINTY Level 1 : past predictive, trend analysis Predicting the demand for pizzas during

- 28. UNCERTAINTY TYPES COMPARED… Pizza demand Technology possibilities Product plan Election

- 29. RISK AND PLANNING Hope of success >>>> Assured Failure Assured Success No Risk No Risk 100/0

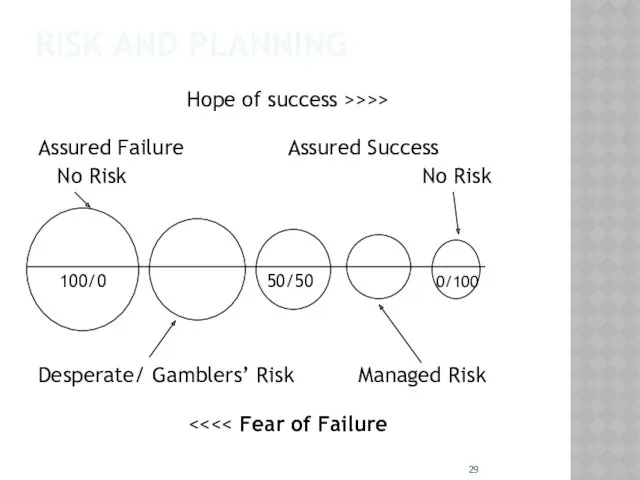

- 30. THE RISK/UNCERTAINTY CALCULUS Scale of potential harm War vs local fire Likelihood of occurrence Earthquake vs

- 31. RISK, UNCERTAINTY AND REWARD Risk is the strategist’s best friend The degree of risk is compensated

- 32. RISK ANALYSIS STEPS Step I : Sorting Environmental Data Performance : GDP, Inflation, BoP etc Strategy:

- 33. FOCUS POINTS You should be aware that risk is a normal part of the business environment

- 34. TOPIC 3: INTERNATIONAL TRADE

- 35. MERCANTALISM Principal: wealth based on holdings of gold The Concept: Trade is a zero sum game:

- 36. ADAM SMITH AND ABSOLUTE ADVANTAGE Principle: Adam Smith – both nations can gain from trade The

- 37. COMPARATIVE ADVANTAGE Principle: Ricardo (1817) – even a country with all absolute advantages is comparatively better

- 38. MERCANTILISM AND DEVELOPING ECONOMIES Mercantilism allows a country to build up industry based on export sales

- 39. FOCUS POINTS Familiarise yourself with the temptations of mercantilism and how countries think they can gain

- 40. TOPIC 4: FIVE FORCES MODEL

- 41. PORTER’S PERSPECTIVE Asserted that industry attractiveness is not a function of specific technology or product attributes

- 42. THE 5 FORCES MODEL All forces work together to shape the competitive landscape of the industry

- 43. THE BARGAINING POWER OF BUYERS The extent to which the buyer can influence the prices Can

- 44. POWER OF SUPPLIERS The extent to which the suppliers can influence the cost of production in

- 45. THREAT OF NEW ENTRANTS The threat from the market getting flooded with new players Can happen

- 46. THREAT OF SUBSTITUTES The ability to use another product for similar use Can happen when… Different

- 47. EXTENT OF INTER-FIRM COMPETITION An increase in the number of firms will increase competitive rivalry… will

- 48. FACTORS NOT FORCES The competitive forces impact on profitability – some items are factors but do

- 49. ANDREW GROVE: SIX FORCES MODEL Model adds role of complementors to the Five Forces model Complementors

- 50. FOCUS POINTS Consider case studies that don’t just illustrate how the model works but reveal additional

- 51. TOPIC 5: INTERNATIONAL MARKETING

- 52. KOTLER: THE 4 PS Product Value of the product to the consumer Adaptations New product development

- 53. 1. PRODUCT – DELIVERING VALUE Legal requirement Safety – pharmaceuticals Environment – cars Non-tariff barriers Cultural

- 54. NEW PRODUCT DEVELOPMENT (NPD) Rate of NPD greater in countries where It is an R&D intensive

- 55. 2: PRICE – INTERNATIONAL ISSUES Government controls Minimum and maximum prices Prohibition against dumping Taxation Market

- 56. PRICING RISK Inflation A “paper profit” may be pumped up by inflation on inventory Tax is

- 57. 3: PROMOTION Push strategy Emphasizes personal selling within the distribution chain Requires intense use of a

- 58. 4: PLACE Different distribution systems due to Country-specific differences Consumer spending habits Retail concentration Choosing the

- 59. 3 MORE PS Service industries have intangible aspects that need marketing Kotler felt 4 was enough

- 60. FOCUS POINTS You need to do more than illustrate how the 4Ps work, you need to

- 61. TOPIC 6: STRATEGIC ALLIANCES

- 62. STRATEGIC ALLIANCES TYPES Joint Venture - JV Partners create a separate firm The joint venture shares

- 63. 1: JOINT VENTURE Definition The term “joint venture” tends to describe the purpose of the alliance

- 64. 2: EQUITY STRATEGIC ALLIANCE Definition Partner firms take different sized shares Often used for a new

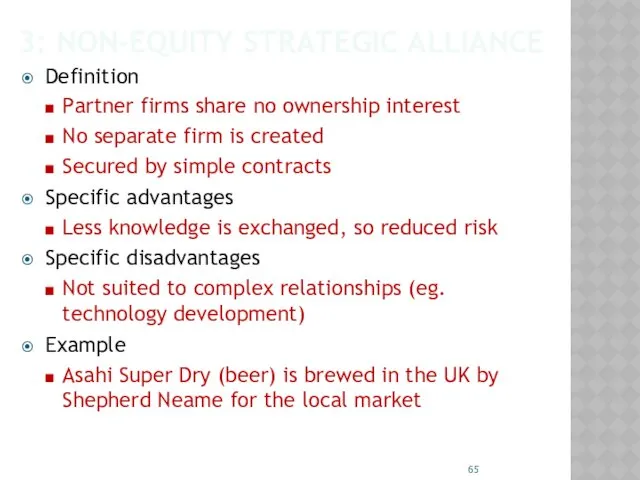

- 65. 3: NON-EQUITY STRATEGIC ALLIANCE Definition Partner firms share no ownership interest No separate firm is created

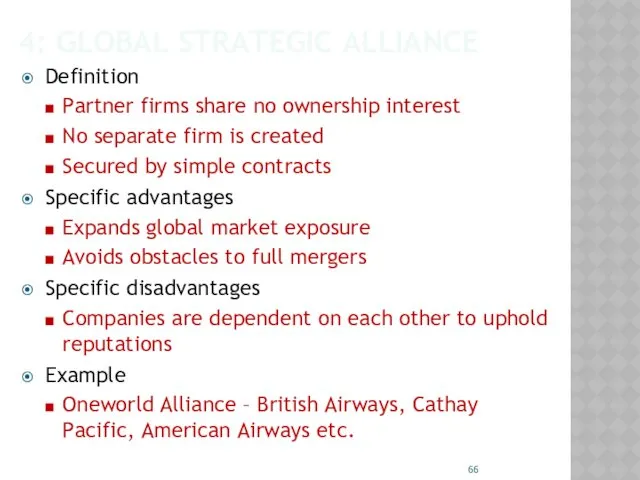

- 66. 4: GLOBAL STRATEGIC ALLIANCE Definition Partner firms share no ownership interest No separate firm is created

- 68. Скачать презентацию

Производственная программа и производственные мощности предприятия. Тема 9

Производственная программа и производственные мощности предприятия. Тема 9 Отчет о работе администрации Двуреченского сельского поселения за 2018 год и план работы на 2019 год

Отчет о работе администрации Двуреченского сельского поселения за 2018 год и план работы на 2019 год Карл Маркс. Экономическая теория - марксизм

Карл Маркс. Экономическая теория - марксизм О государственной поддержке малых форм хозяйствования агропромышленного комплекса Хабаровского края

О государственной поддержке малых форм хозяйствования агропромышленного комплекса Хабаровского края Территориальное планирование сельского поселения Утевка муниципального района Нефтегорский Самарской области

Территориальное планирование сельского поселения Утевка муниципального района Нефтегорский Самарской области Характеристика рыночного хозяйства Франции

Характеристика рыночного хозяйства Франции Эконометрика

Эконометрика Сущность теории предельной полезности. Закон убывающей предельной полезности

Сущность теории предельной полезности. Закон убывающей предельной полезности Рынок и рыночный механизм. Спрос и предложение

Рынок и рыночный механизм. Спрос и предложение Государственное регулирование кризисных ситуаций в экономике

Государственное регулирование кризисных ситуаций в экономике Теория фирмы. Теория поведения производителя

Теория фирмы. Теория поведения производителя Возможности территории опережающего социально-экономического развития (ТОСЭР) Благовещенск

Возможности территории опережающего социально-экономического развития (ТОСЭР) Благовещенск Технико-экономическое обоснование энергосберегающих мероприятий для электрических сетей 10-110 кВ

Технико-экономическое обоснование энергосберегающих мероприятий для электрических сетей 10-110 кВ Оңтүстік өңірдегі мал шаруашылығынан түскен өнімдер республика нарығында қаншалықты маңызды

Оңтүстік өңірдегі мал шаруашылығынан түскен өнімдер республика нарығында қаншалықты маңызды Статистика цен

Статистика цен Разработка водного тура

Разработка водного тура Мастер-класс от SATTAROVFAMILY. Обществознание. Разбор второй части варианта ЕГЭ

Мастер-класс от SATTAROVFAMILY. Обществознание. Разбор второй части варианта ЕГЭ How tax cuts stimulate the economy

How tax cuts stimulate the economy Лекция № 5. Вмешательство государства и общественное благосостояние

Лекция № 5. Вмешательство государства и общественное благосостояние Повышение эффективности предпринимательской деятельности малого предприятия на примере ООО Росстандарт

Повышение эффективности предпринимательской деятельности малого предприятия на примере ООО Росстандарт Планирование труда

Планирование труда Формирование и распределение доходов в рыночной экономике

Формирование и распределение доходов в рыночной экономике Порядок организации экспортного контроля

Порядок организации экспортного контроля Глобальні проблеми людства

Глобальні проблеми людства Кредитно-банковская система Объединенных Арабских Эмиратов (ОАЭ)

Кредитно-банковская система Объединенных Арабских Эмиратов (ОАЭ) Мировая экономика и международные экономические отношения

Мировая экономика и международные экономические отношения Устойчивое развитие Тверской области

Устойчивое развитие Тверской области Теории эластичности спроса и предложения

Теории эластичности спроса и предложения