Содержание

- 2. Meaning of Investments Commitment of money that is expected to generate additional money Current commitment of

- 3. Why do individuals invest? To achieve a higher level of consumption in the future by forgoing

- 4. Why Study Investments? The Personal Aspects To earn better returns in relation to the risk we

- 5. Underlying investment decisions: the tradeoff between expected return and risk Expected return is not usually the

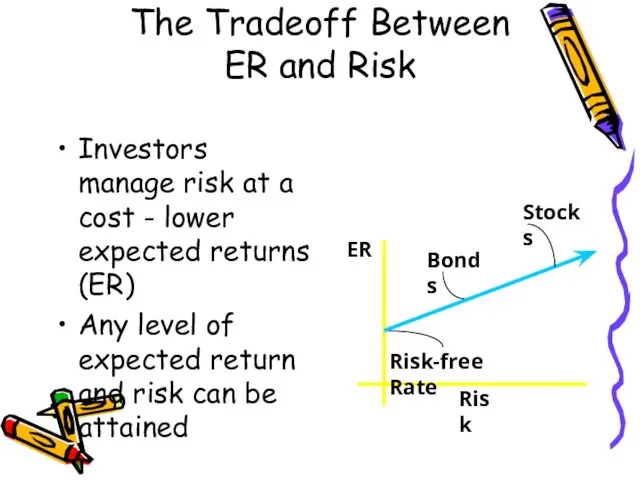

- 6. Investors manage risk at a cost - lower expected returns (ER) Any level of expected return

- 7. Two-step process: Security analysis and valuation Necessary to understand security characteristics Portfolio management Selected securities viewed

- 8. Uncertainty in ex post returns dominates decision process Future unknown and must be estimated Foreign financial

- 10. Скачать презентацию

Статистический анализ показателей национального богатства РФ

Статистический анализ показателей национального богатства РФ Особливості ринку праці

Особливості ринку праці Развитие малого и среднего предпринимательства в Тульской области

Развитие малого и среднего предпринимательства в Тульской области Отчет Главы муниципального образования городское поселение Щёлкино Ленинского района Республики Крым

Отчет Главы муниципального образования городское поселение Щёлкино Ленинского района Республики Крым Конкурентная политика предприятия на национальном и международном рынках

Конкурентная политика предприятия на национальном и международном рынках Потребности, блага и услуги, ресурсы. Ограниченность ресурсов. Экономические и неэкономические блага. Альтернативная стоимость

Потребности, блага и услуги, ресурсы. Ограниченность ресурсов. Экономические и неэкономические блага. Альтернативная стоимость Теория издержек производства

Теория издержек производства Теория и анализ отраслевых рынков. Характеристика основных рыночных структур

Теория и анализ отраслевых рынков. Характеристика основных рыночных структур Собственность. Конкуренция. Экономическая свобода

Собственность. Конкуренция. Экономическая свобода Энергосервис и энергосервисные договоры (на примере работы с энергетическими предприятиями)

Энергосервис и энергосервисные договоры (на примере работы с энергетическими предприятиями) Понятие, сущность логистики внешнеэкономической деятельности. Тема 1

Понятие, сущность логистики внешнеэкономической деятельности. Тема 1 Муниципальное образование, как субъект экономической деятельности РФ. (Тема 10)

Муниципальное образование, как субъект экономической деятельности РФ. (Тема 10) Теория производства

Теория производства Японская политика инновационной деятельности

Японская политика инновационной деятельности Цели и методы государственного регулирования экономики

Цели и методы государственного регулирования экономики Функционально-стоимостной анализ

Функционально-стоимостной анализ Общественный сектор

Общественный сектор Меркантилизм как первая теоретическая школа

Меркантилизм как первая теоретическая школа Формирование объемов деятельности предприятия

Формирование объемов деятельности предприятия Prospective Areas of Collaboration

Prospective Areas of Collaboration Экономическая теория. Деньги как инструмент обмена. Лекция № 15

Экономическая теория. Деньги как инструмент обмена. Лекция № 15 Виды потерь в бережливом производстве

Виды потерь в бережливом производстве Глобализация и глобальные проблемы современности

Глобализация и глобальные проблемы современности Сущность и задачи (экономическогО) районирования России

Сущность и задачи (экономическогО) районирования России Устойчивое развитие Тверской области

Устойчивое развитие Тверской области Главная цель экономического развития региона Ленинградской области

Главная цель экономического развития региона Ленинградской области Фонд Сколково. Инновации в ТЭК и предложение по сотрудничеству со странами БРИКС

Фонд Сколково. Инновации в ТЭК и предложение по сотрудничеству со странами БРИКС Основные понятия и классификации СНС

Основные понятия и классификации СНС