Содержание

- 2. In this Lecture: Consumer’s consumption/savings decision – responses of consumer to changes in income and interest

- 3. Intertemporal decisions They involve a trade off across periods of time: between current and future consumption,

- 4. Our model Two period model: today and tomorrow For simplicity: income is exogenous (no work/leisure decision).

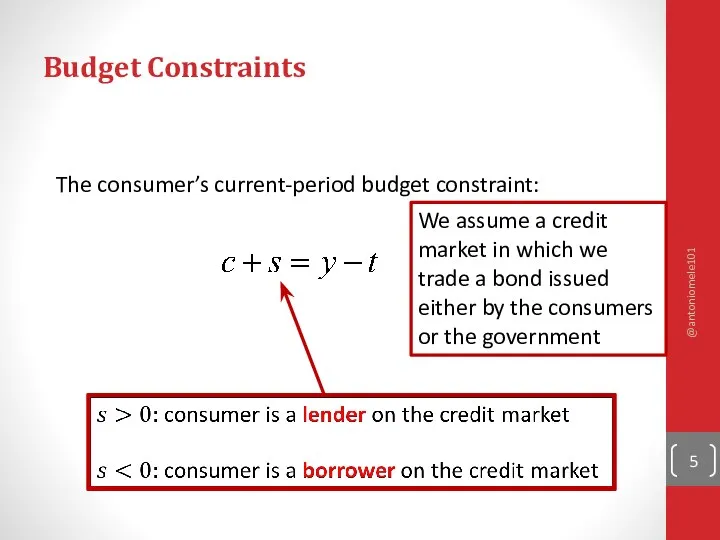

- 5. Budget Constraints The consumer’s current-period budget constraint: We assume a credit market in which we trade

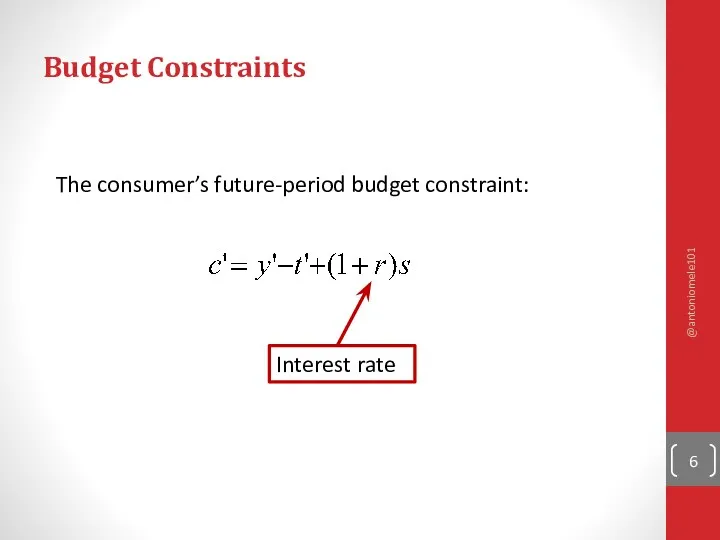

- 6. Budget Constraints The consumer’s future-period budget constraint: Interest rate @antoniomele101

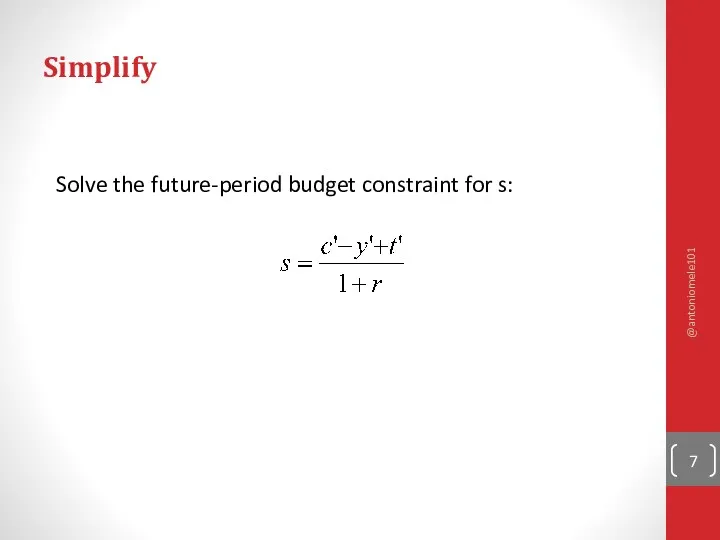

- 7. Simplify Solve the future-period budget constraint for s: @antoniomele101

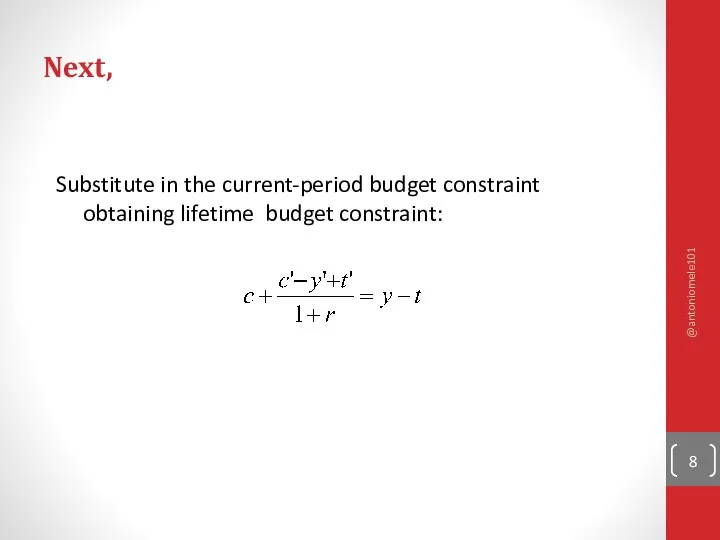

- 8. Next, Substitute in the current-period budget constraint obtaining lifetime budget constraint: @antoniomele101

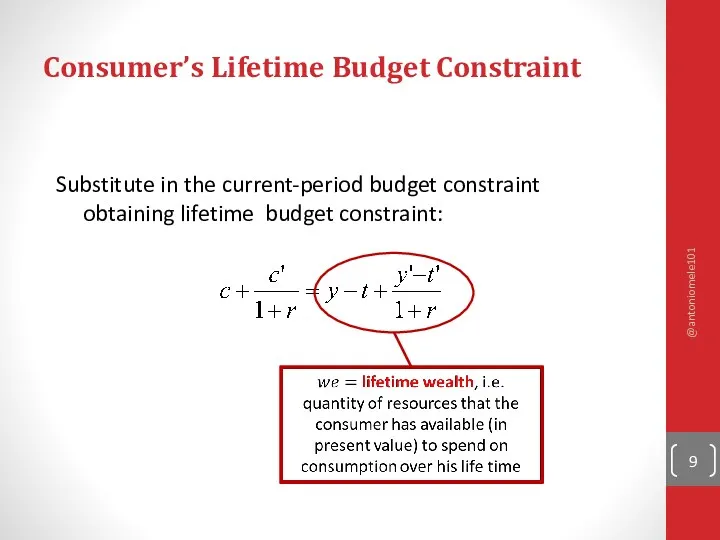

- 9. Consumer’s Lifetime Budget Constraint Substitute in the current-period budget constraint obtaining lifetime budget constraint: @antoniomele101

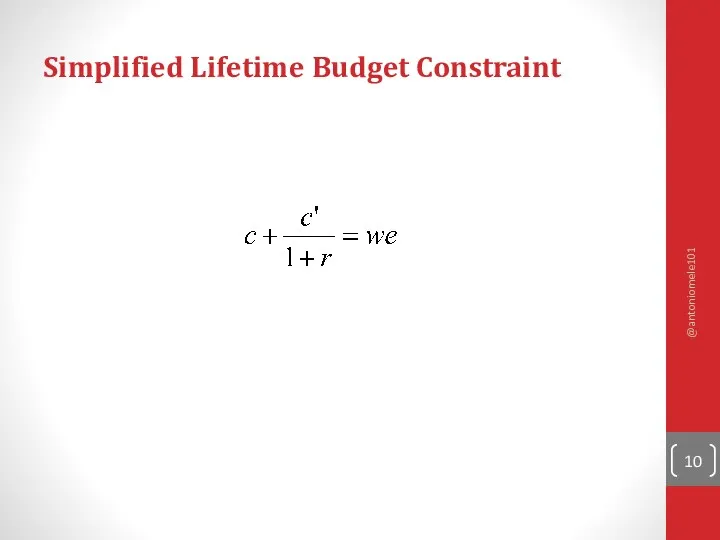

- 10. Simplified Lifetime Budget Constraint @antoniomele101

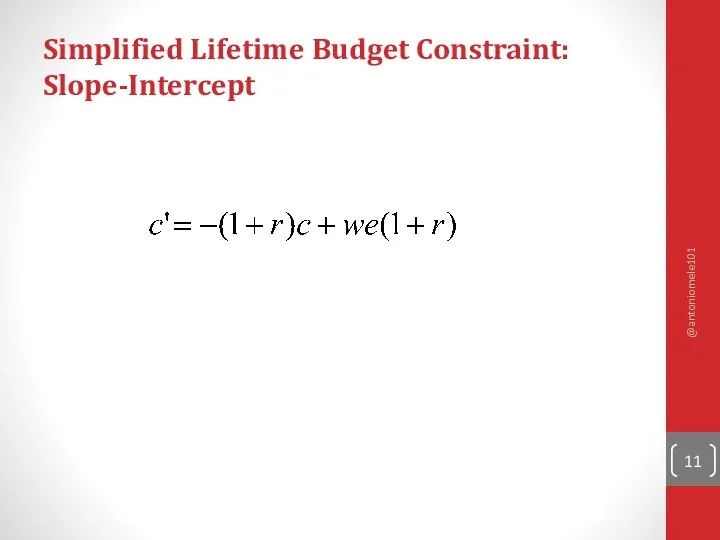

- 11. Simplified Lifetime Budget Constraint: Slope-Intercept @antoniomele101

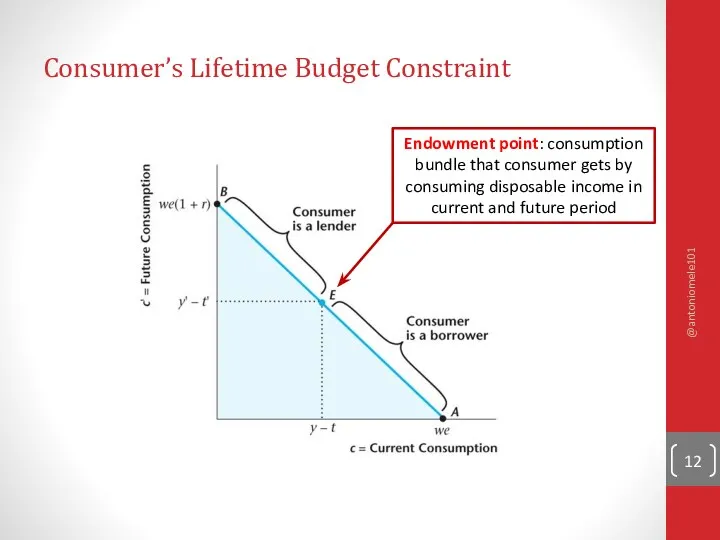

- 12. Consumer’s Lifetime Budget Constraint Endowment point: consumption bundle that consumer gets by consuming disposable income in

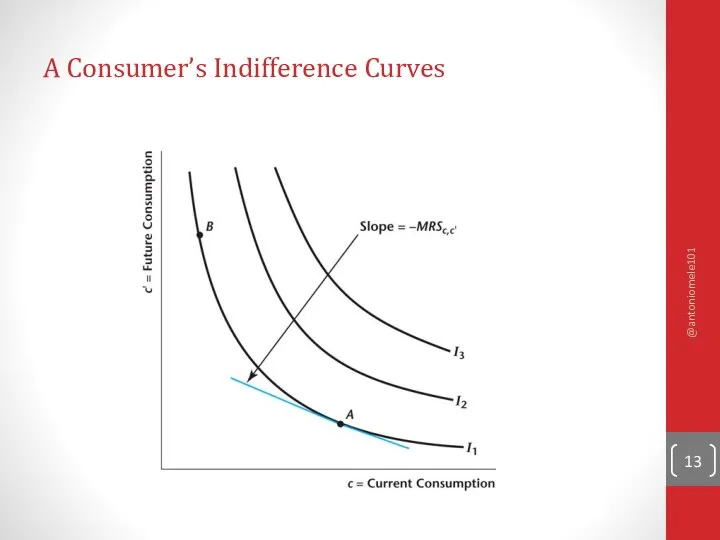

- 13. A Consumer’s Indifference Curves @antoniomele101

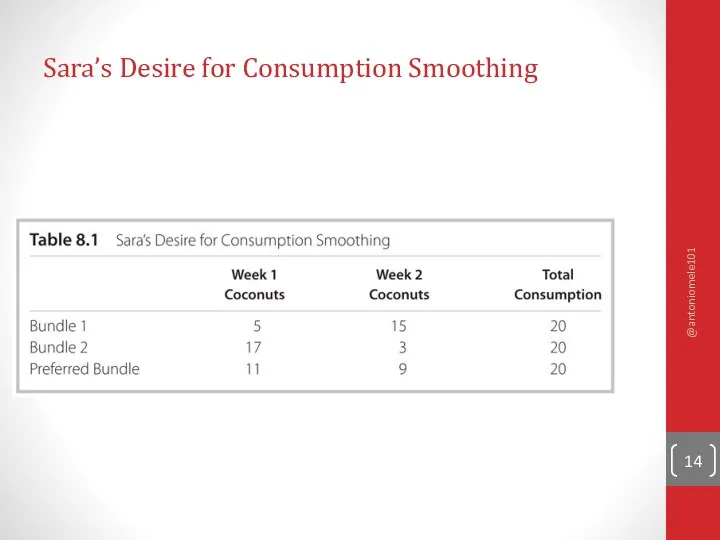

- 14. Sara’s Desire for Consumption Smoothing @antoniomele101

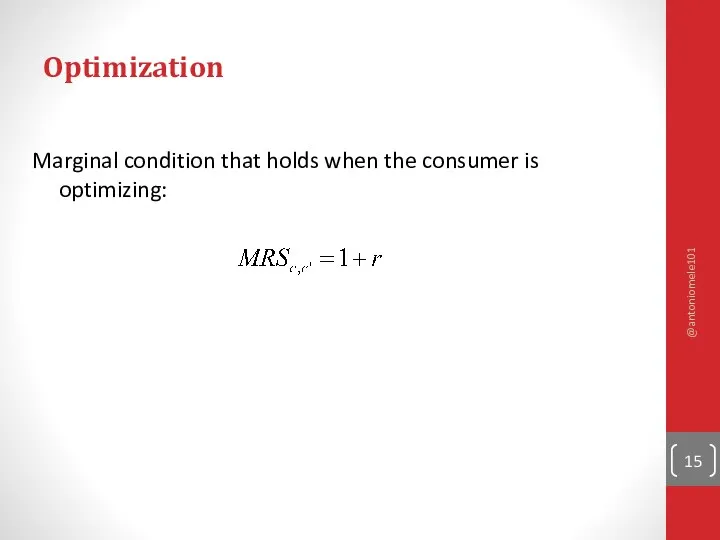

- 15. Optimization Marginal condition that holds when the consumer is optimizing: @antoniomele101

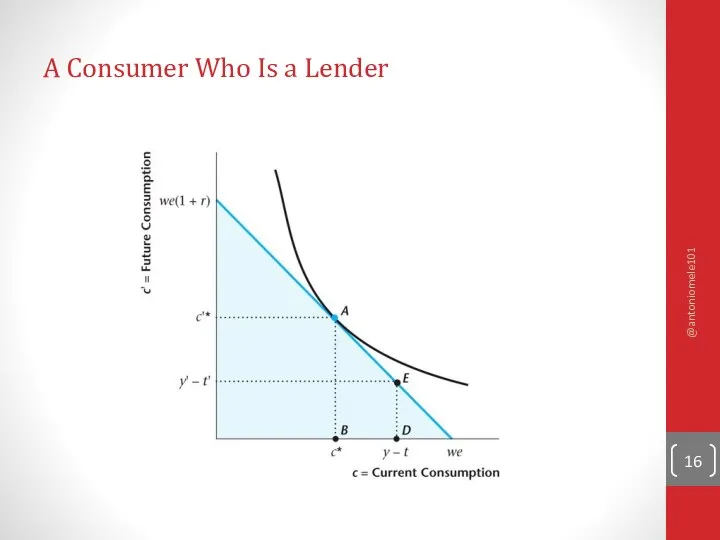

- 16. A Consumer Who Is a Lender @antoniomele101

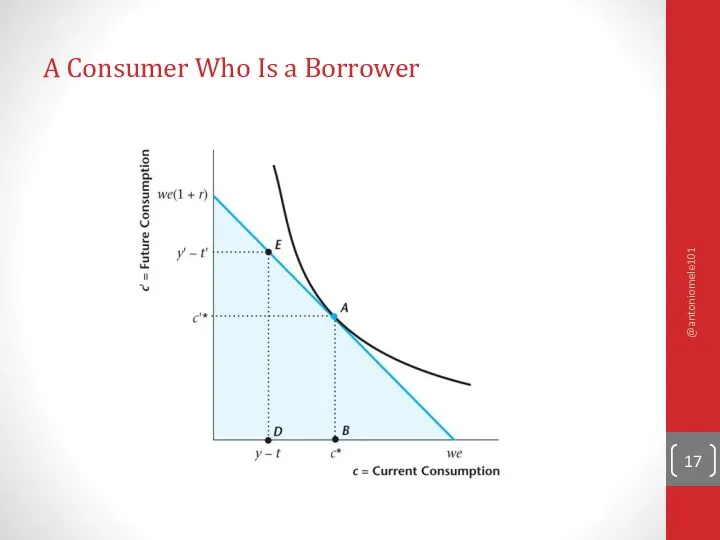

- 17. A Consumer Who Is a Borrower @antoniomele101

- 18. An Increase in Current Income for the Consumer Current and future consumption increase. Saving increases. The

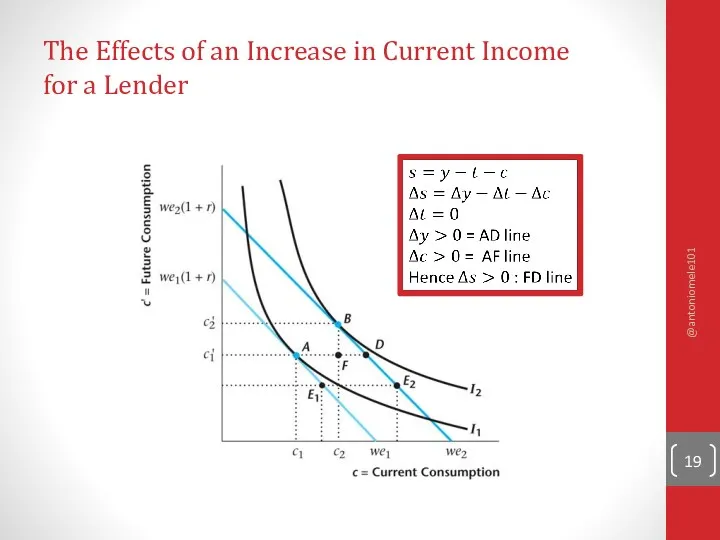

- 19. The Effects of an Increase in Current Income for a Lender @antoniomele101

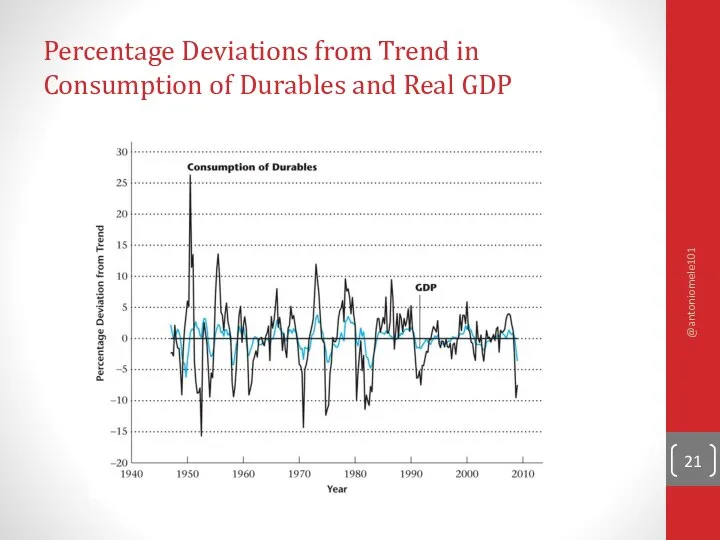

- 20. Observed Consumption-Smoothing Behavior If all consumers try to smooth consumption overtime, we should observe that aggregate

- 21. Percentage Deviations from Trend in Consumption of Durables and Real GDP @antoniomele101

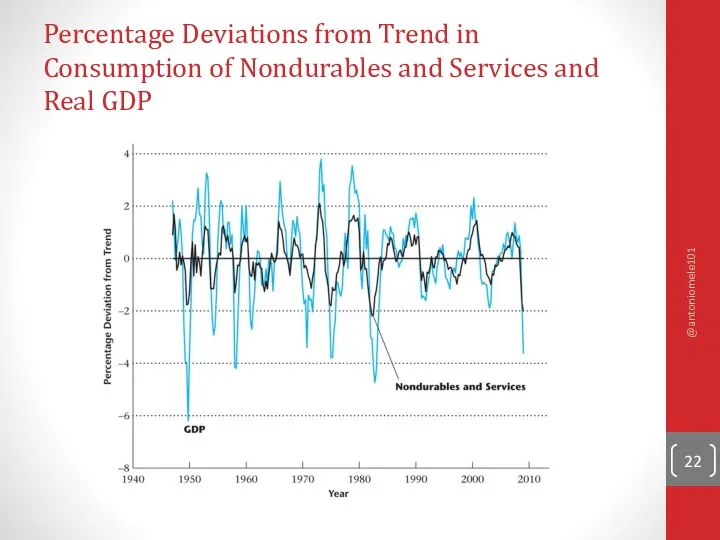

- 22. Percentage Deviations from Trend in Consumption of Nondurables and Services and Real GDP @antoniomele101

- 23. An Increase in Future Income for the Consumer Current and future consumption increase. Saving decreases. The

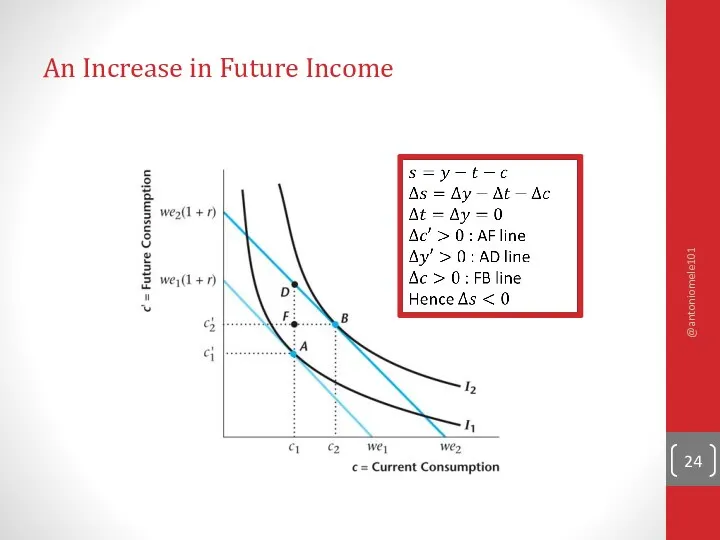

- 24. An Increase in Future Income @antoniomele101

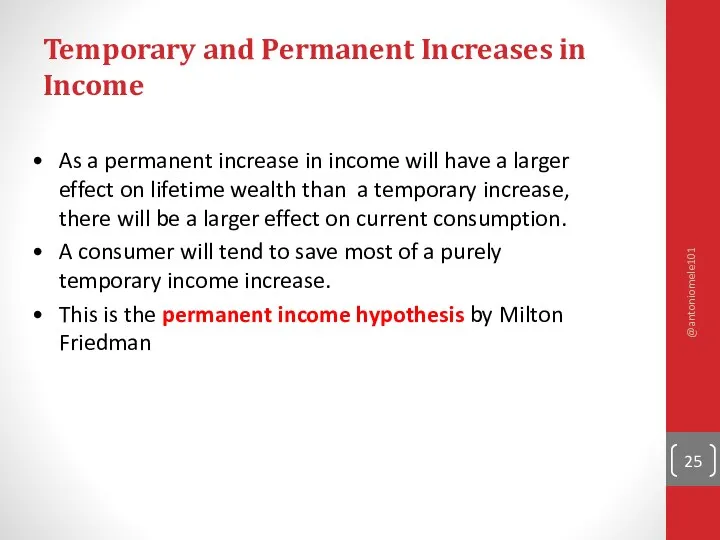

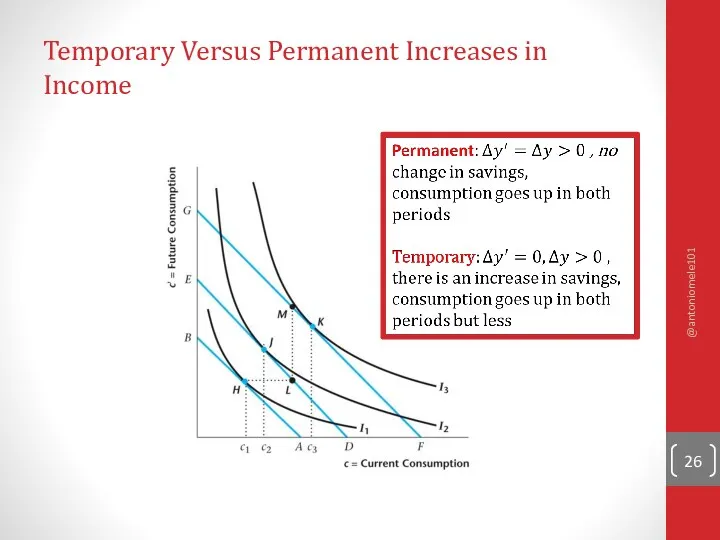

- 25. Temporary and Permanent Increases in Income As a permanent increase in income will have a larger

- 26. Temporary Versus Permanent Increases in Income @antoniomele101

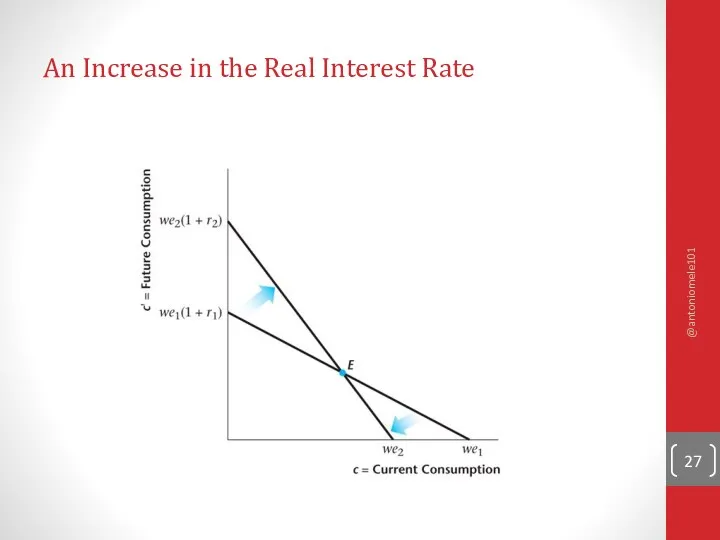

- 27. An Increase in the Real Interest Rate @antoniomele101

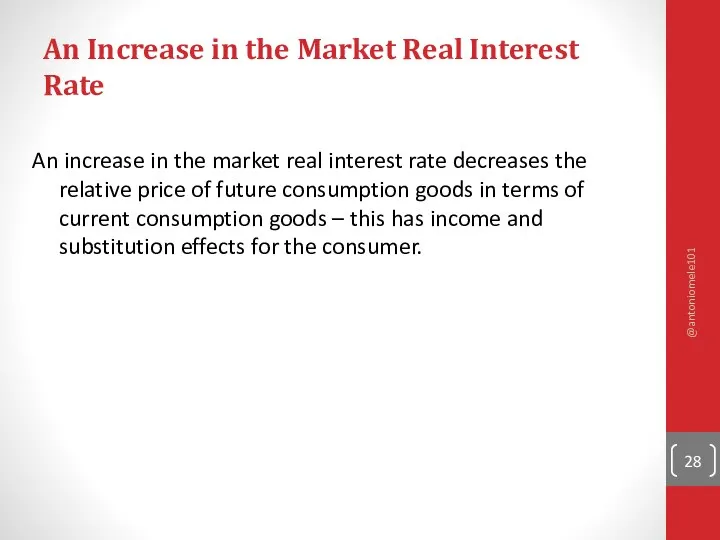

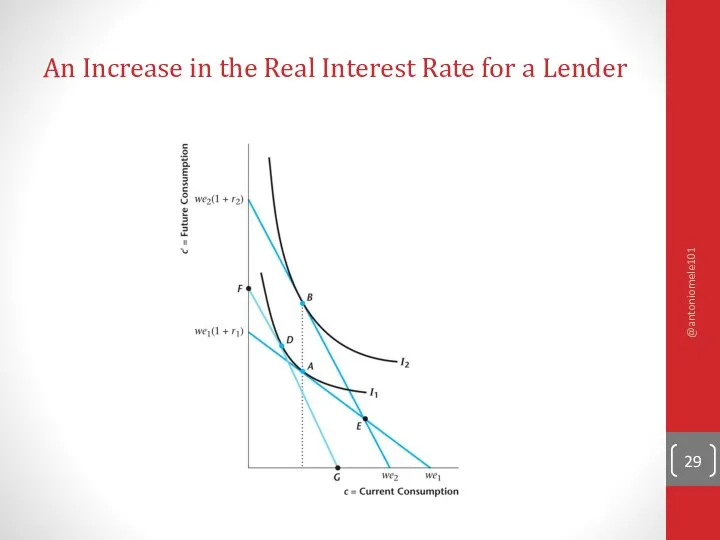

- 28. An Increase in the Market Real Interest Rate An increase in the market real interest rate

- 29. An Increase in the Real Interest Rate for a Lender @antoniomele101

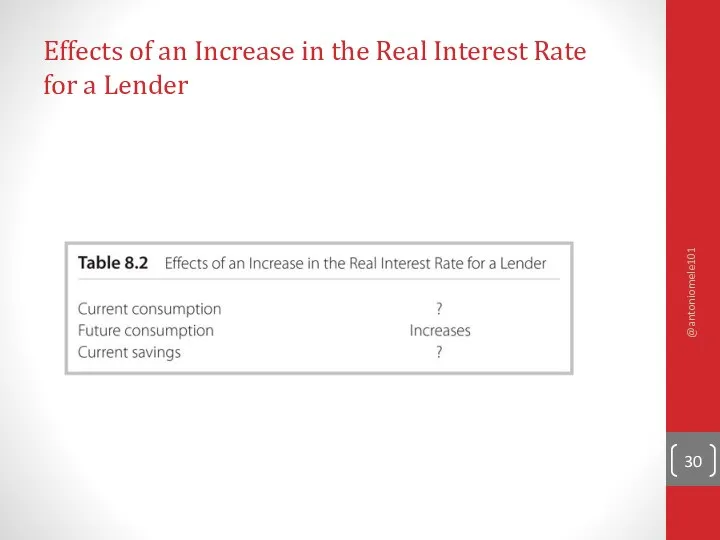

- 30. Effects of an Increase in the Real Interest Rate for a Lender @antoniomele101

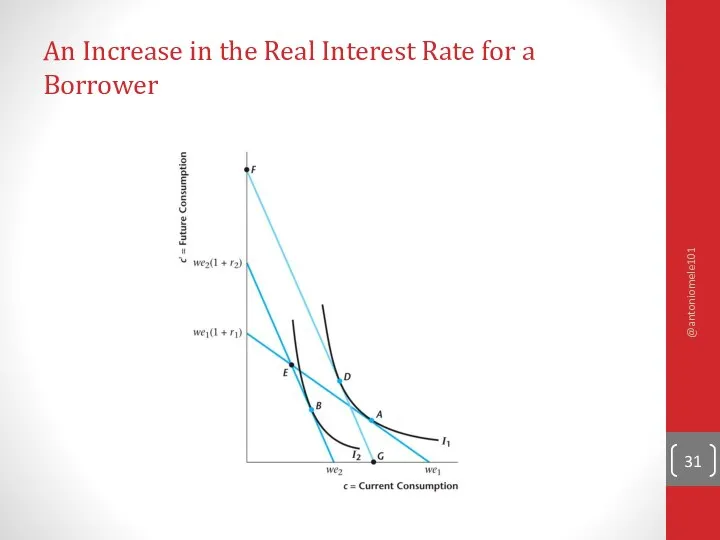

- 31. An Increase in the Real Interest Rate for a Borrower @antoniomele101

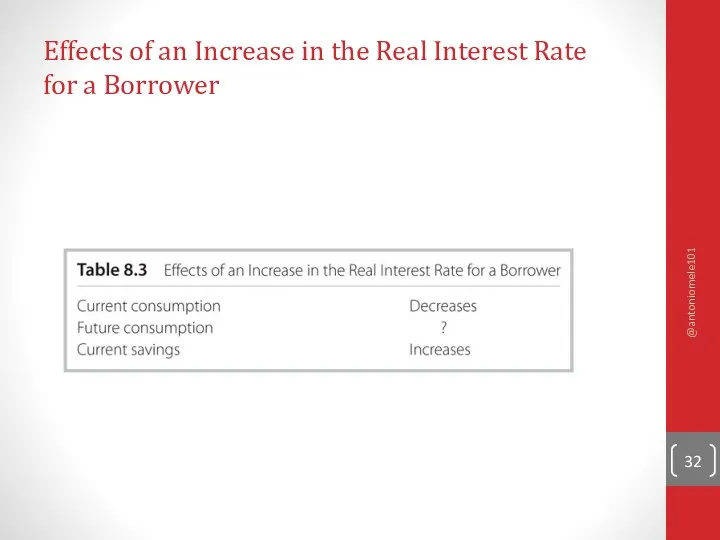

- 32. Effects of an Increase in the Real Interest Rate for a Borrower @antoniomele101

- 33. Introducing the government Government buys G, financed either with taxes or debt. T=Nt, T’=Nt’ Private and

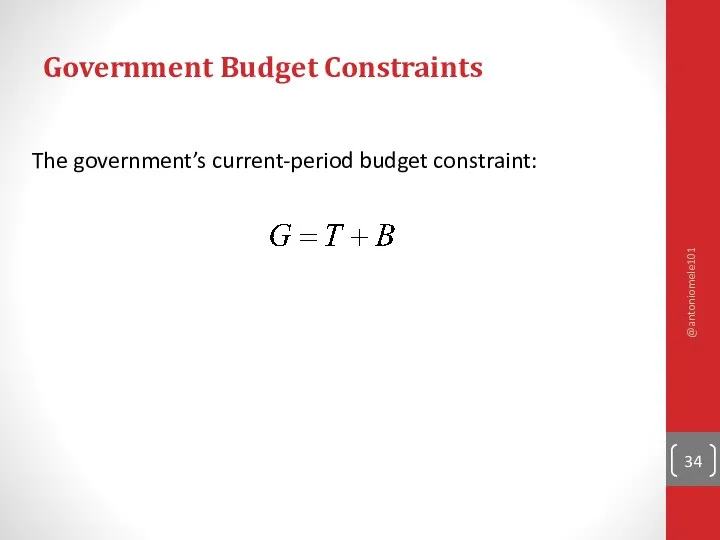

- 34. Government Budget Constraints The government’s current-period budget constraint: @antoniomele101

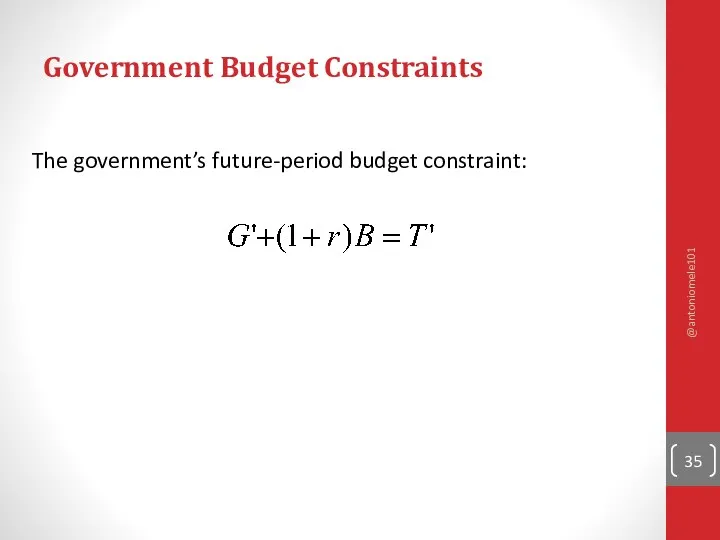

- 35. Government Budget Constraints The government’s future-period budget constraint: @antoniomele101

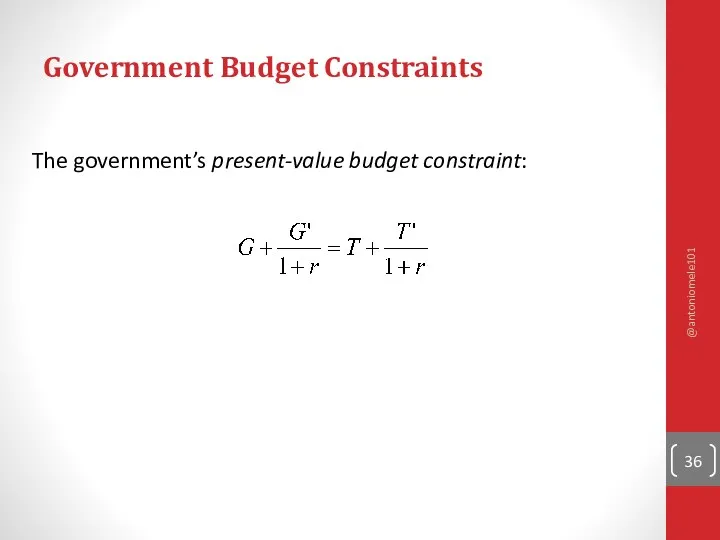

- 36. Government Budget Constraints The government’s present-value budget constraint: @antoniomele101

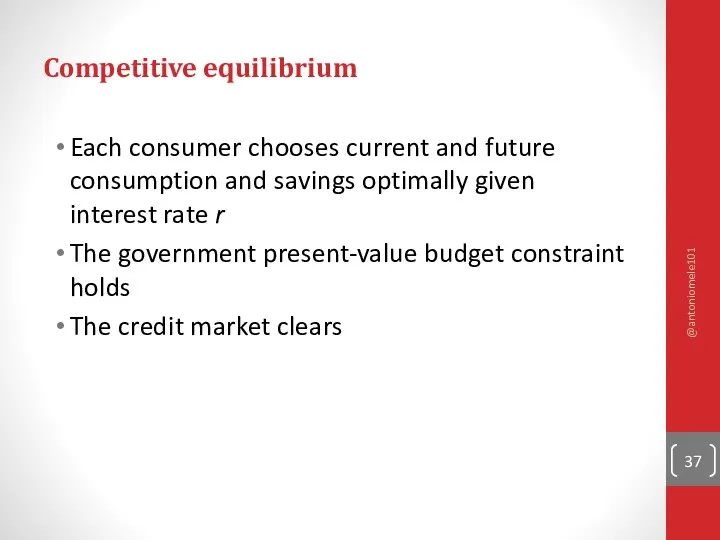

- 37. Competitive equilibrium Each consumer chooses current and future consumption and savings optimally given interest rate r

- 38. Credit Market Equilibrium Condition Total private savings is equal to the quantity of government bonds issued

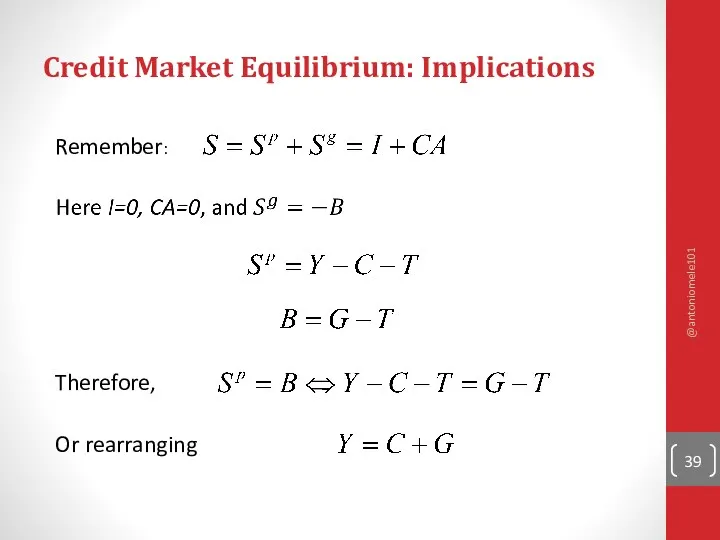

- 39. Credit Market Equilibrium: Implications Remember: Therefore, Or rearranging @antoniomele101

- 40. Income-Expenditure Identity Credit market equilibrium implies that the income-expenditure identity holds. @antoniomele101

- 41. Ricardian Equivalence The Ricardian Equivalence Theorem states that , under some conditions, a change in the

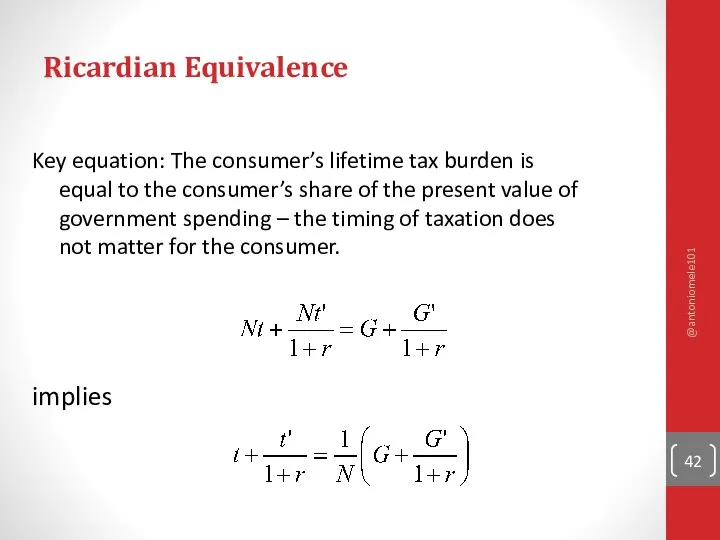

- 42. Ricardian Equivalence Key equation: The consumer’s lifetime tax burden is equal to the consumer’s share of

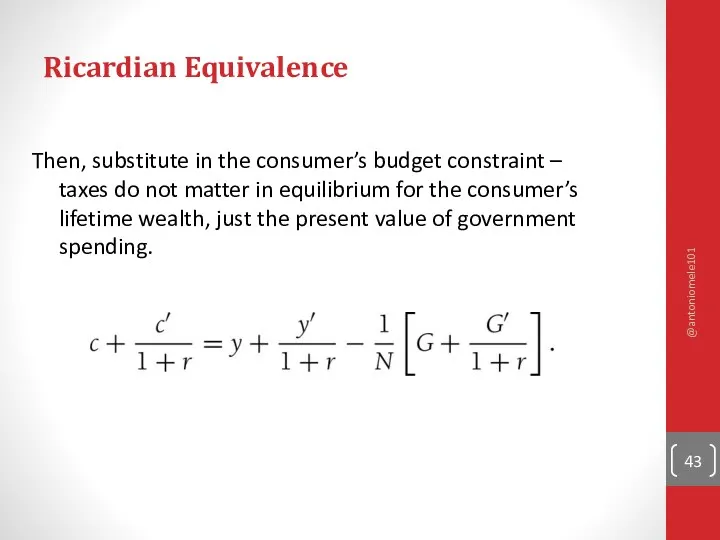

- 43. Ricardian Equivalence Then, substitute in the consumer’s budget constraint – taxes do not matter in equilibrium

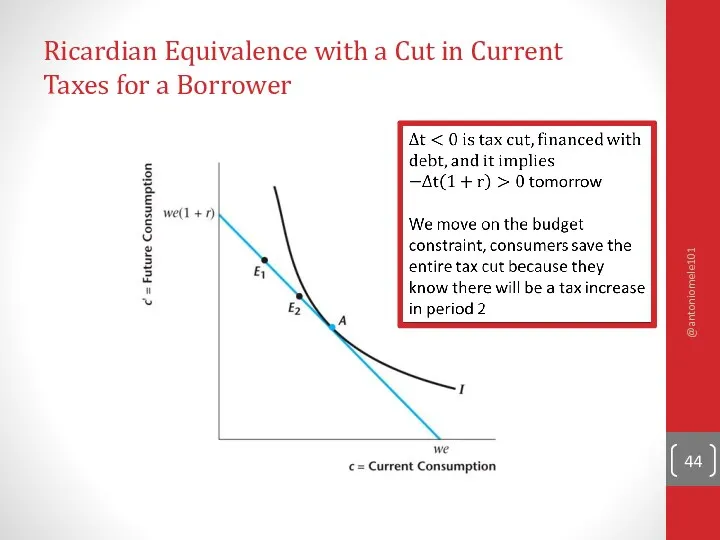

- 44. Ricardian Equivalence with a Cut in Current Taxes for a Borrower @antoniomele101

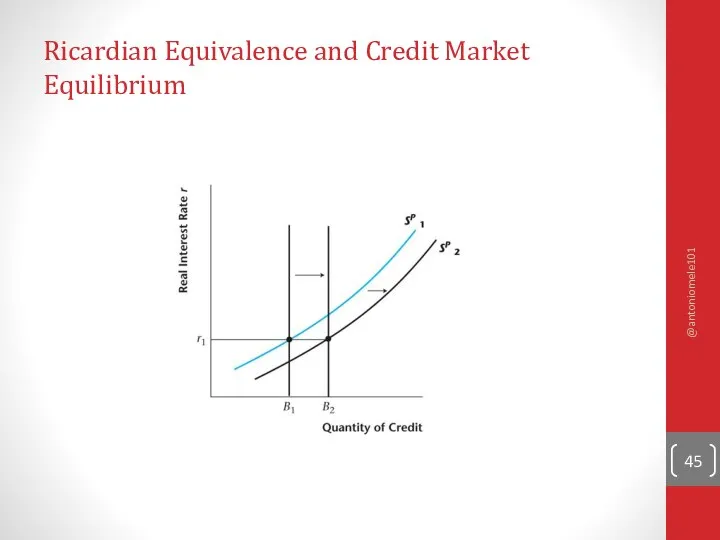

- 45. Ricardian Equivalence and Credit Market Equilibrium @antoniomele101

- 46. Discussion of the assumptions Ricardian equivalence theorems says government debt represents our future liabilities as a

- 48. Скачать презентацию

Studiu Individual la disciplina ,,Economia Turismului”

Studiu Individual la disciplina ,,Economia Turismului” Перспективные направления развития Самарской области

Перспективные направления развития Самарской области Прикладная экономика

Прикладная экономика Природные и трудовые ресурсы Азербайджана и их использование

Природные и трудовые ресурсы Азербайджана и их использование Роль государства в экономике

Роль государства в экономике Предмет и метод экономической науки

Предмет и метод экономической науки Международная торговля

Международная торговля Муниципальное образование Город Липецк

Муниципальное образование Город Липецк Милтон Фридман

Милтон Фридман Производство. Потребление

Производство. Потребление Україна за роки незалежності

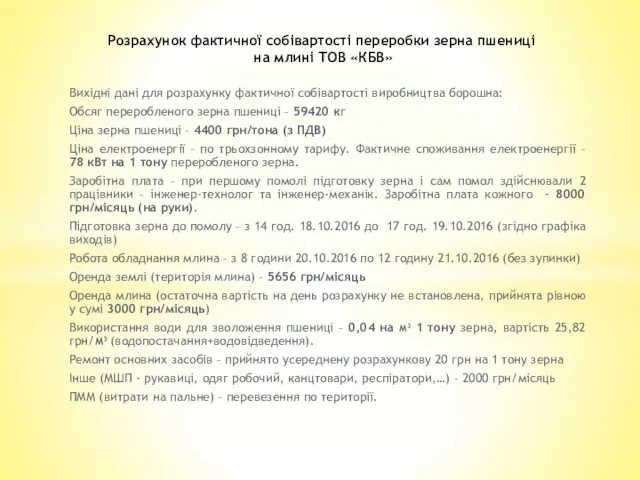

Україна за роки незалежності Розрахунок фактичної собівартості переробки зерна пшениці на млині ТОВ КБВ

Розрахунок фактичної собівартості переробки зерна пшениці на млині ТОВ КБВ ГД-экономика

ГД-экономика Экономические аспекты проекта. Лекция 02

Экономические аспекты проекта. Лекция 02 Фирмы в экономике

Фирмы в экономике Введение в экономику. Рынок. Рыночный механизм

Введение в экономику. Рынок. Рыночный механизм Система оценки качества продукции в производстве

Система оценки качества продукции в производстве Эволюция развития русской экономической мысли с самого начала до революции

Эволюция развития русской экономической мысли с самого начала до революции Энергия, энергетические ресурсы, энергосбережение при транспортировке энергетических ресурсов. Лекция 1

Энергия, энергетические ресурсы, энергосбережение при транспортировке энергетических ресурсов. Лекция 1 Опыт прогнозирования в зарубежных странах

Опыт прогнозирования в зарубежных странах Анализ территориальной репрезентативности ООПТ в административно-экономических районах СФО и ДВФО

Анализ территориальной репрезентативности ООПТ в административно-экономических районах СФО и ДВФО Паспорт территории Медведевского сельского поселения Джанкойского района Республики Крым

Паспорт территории Медведевского сельского поселения Джанкойского района Республики Крым Введение в микроэкономику

Введение в микроэкономику Экономическая и социальная политика государства

Экономическая и социальная политика государства Спрос и закон спроса

Спрос и закон спроса Теория потребительского поведения в рыночной экономики

Теория потребительского поведения в рыночной экономики Гипотеза финансовой хрупкости и нестабильность современного капитализма

Гипотеза финансовой хрупкости и нестабильность современного капитализма Предпринимательская деятельность

Предпринимательская деятельность