Содержание

- 2. IN THIS CHAPTER, YOU WILL LEARN: . . . the meaning and measurement of the most

- 3. Gross Domestic Product: Expenditure and Income Two definitions: Total expenditure on domestically produced final goods and

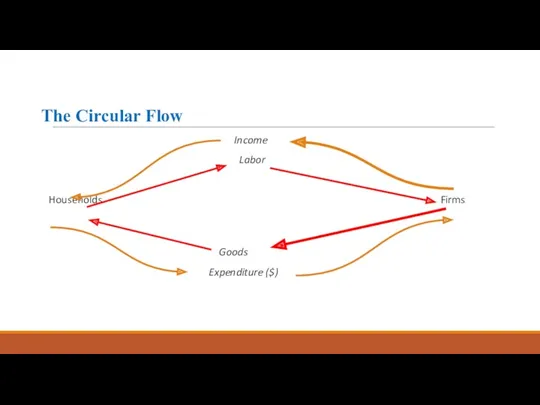

- 4. The Circular Flow Income Labor Households Firms Goods Expenditure ($)

- 5. Value added Value added: The value of output minus the value of the intermediate goods used

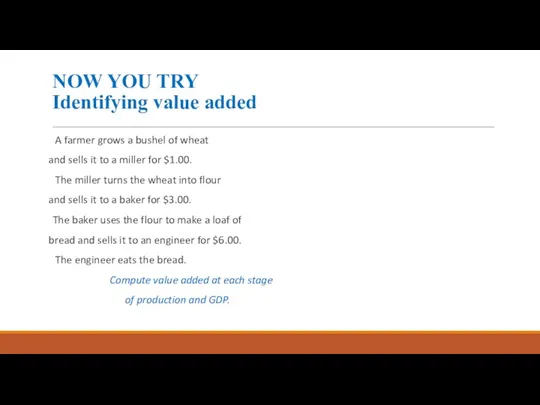

- 6. NOW YOU TRY Identifying value added A farmer grows a bushel of wheat and sells it

- 7. Final goods, value added, and GDP GDP = value of final goods produced = sum of

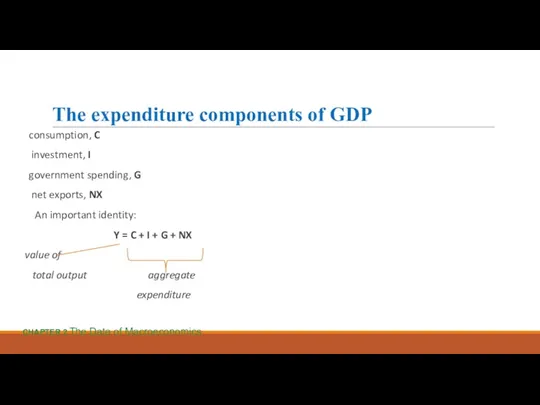

- 8. The expenditure components of GDP consumption, C investment, I government spending, G net exports, NX An

- 9. Consumption (C) Definition: The value of all goods and services bought by households. Includes: Durable goods

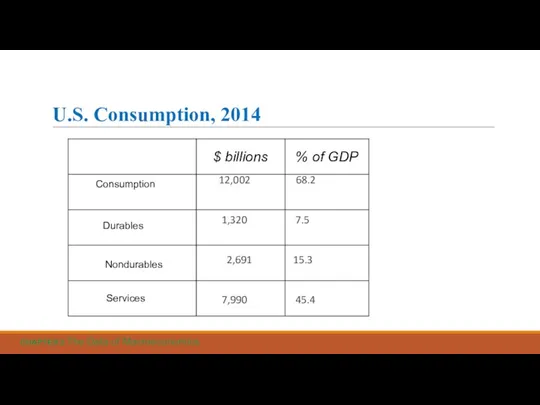

- 10. U.S. Consumption, 2014 12,002 68.2 1,320 7.5 2,691 15.3 7,990 45.4 Consumption Durables Nondurables Services CHAPTER

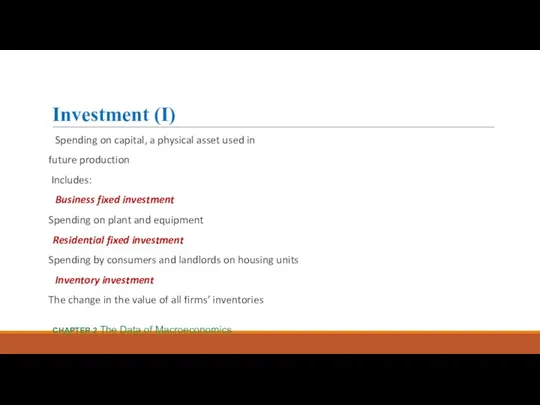

- 11. Investment (I) Spending on capital, a physical asset used in future production Includes: Business fixed investment

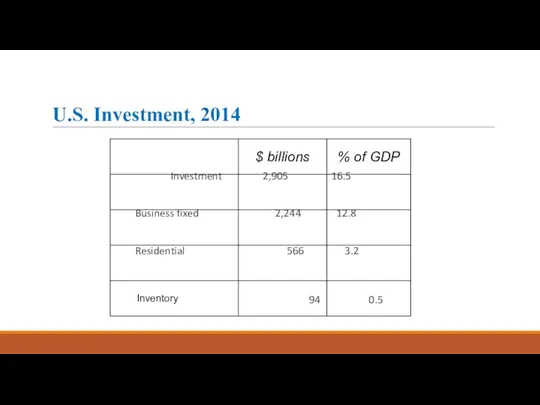

- 12. U.S. Investment, 2014 Investment 2,905 16.5 Business fixed 2,244 12.8 Residential 566 3.2 94 0.5 Inventory

- 13. Investment vs. capital Note: Investment is spending on new capital. Example (assumes no depreciation): 1/1/2016: Economy

- 14. Stocks vs. Flows A stock is a quantity measured at a point in time. E.g., “The

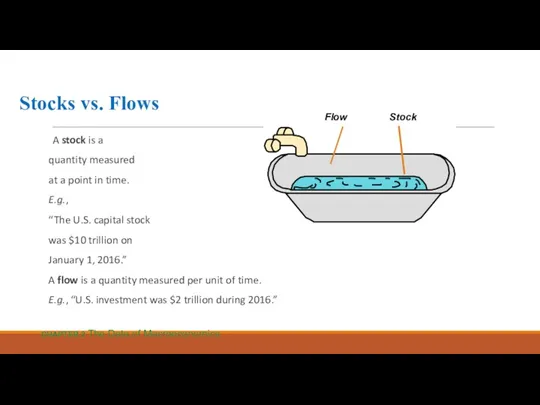

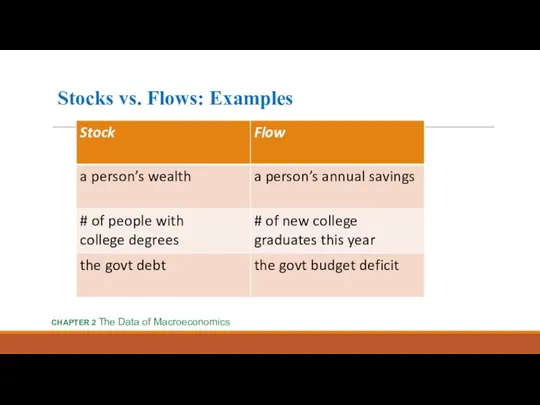

- 15. Stocks vs. Flows: Examples CHAPTER 2 The Data of Macroeconomics

- 16. NOW YOU TRY Stock or Flow? The balance on your credit card statement How much time

- 17. Government spending (G) G includes all government spending on goods and services. G excludes transfer payments

- 18. U.S. Government Spending, 2014 CHAPTER 2 The Data of Macroeconomics

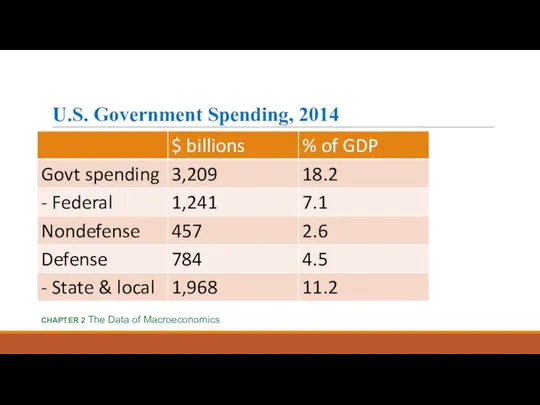

- 19. Net exports (NX) NX = exports – imports Exports: the value of goods and services sold

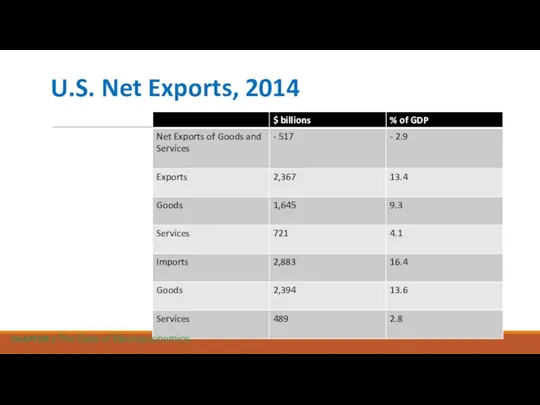

- 20. U.S. Net Exports, 2014 CHAPTER 2 The Data of Macroeconomics

- 21. Y = C + I + G + NX value of total output aggregate expenditure CHAPTER

- 22. NOW YOU TRY An expenditure-output puzzle? Suppose a firm: produces $10 million worth of final goods

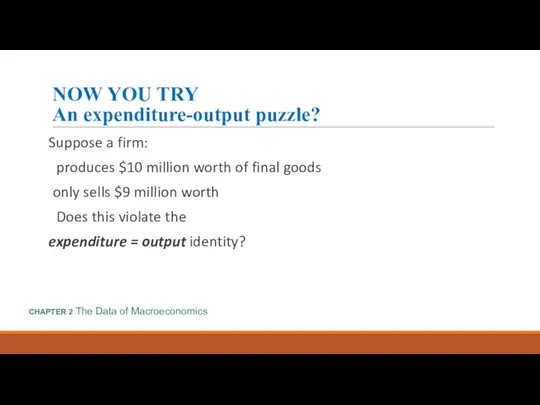

- 23. Why output = expenditure Unsold output goes into inventory, and is counted as “inventory investment” .

- 24. GDP: An important and versatile concept We have now seen that GDP measures: total income total

- 25. GNP vs. GDP Gross national product (GNP): Total income earned by the nation’s factors of production,

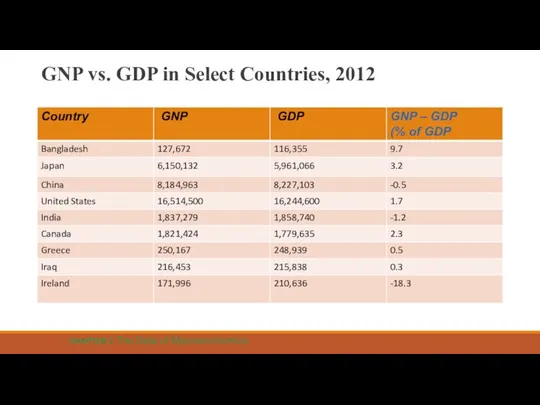

- 26. GNP vs. GDP Gross national product (GNP): Total income earned by the nation’s factors of production,

- 27. NOW YOU TRY Discussion Question In your country, which would you want to be bigger, GDP

- 28. GNP vs. GDP in Select Countries, 2012 CHAPTER 2 The Data of Macroeconomics

- 29. Other Measures of Income Net National Product = GNP – Depreciation National Income = NNP –

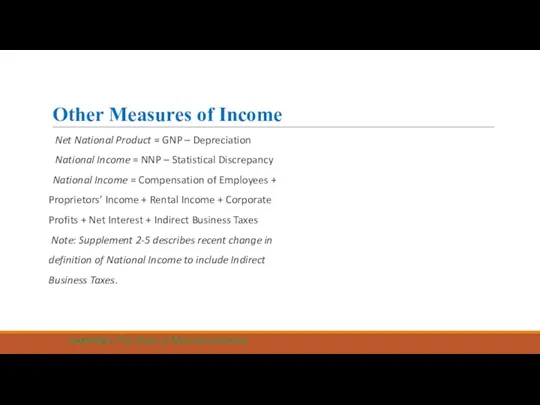

- 30. Components of National Income, 2014 CHAPTER 2 The Data of Macroeconomics Indirect Business Taxes and Other

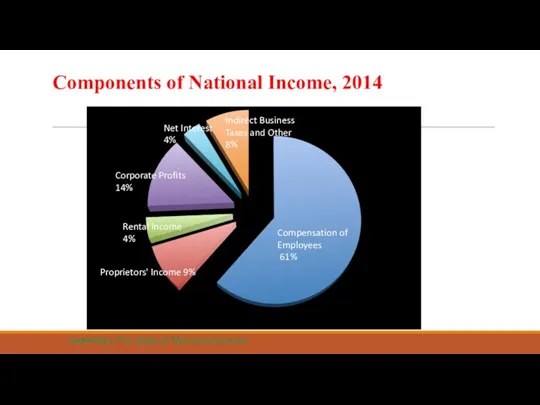

- 31. Other Measures of Income Personal Income = National Income - Indirect Business Taxes - Corporate Profits

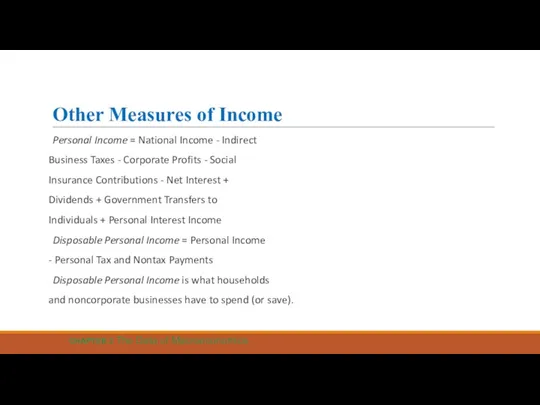

- 32. Real vs. nominal GDP GDP is the value of all final goods and services produced. Nominal

- 33. Solve the problem ???? Compute nominal GDP in each year. Compute real GDP in each year

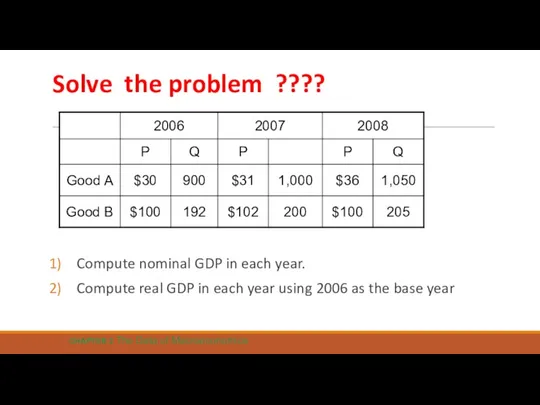

- 34. Solution Nominal GDP is Ps × Qs the same year 2006: $46,200 = $30 × 900

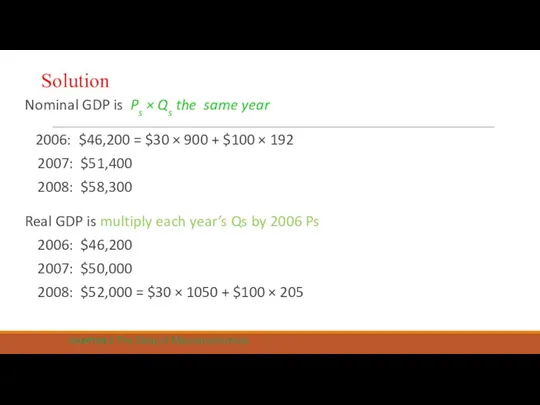

- 35. Real GDP controls for inflation Changes in nominal GDP can be due to: changes in prices

- 36. U.S. Nominal and Real GDP, 1950-2006 CHAPTER 2 The Data of Macroeconomics Real GDP( in price

- 37. GDP deflator CHAPTER 2 The Data of Macroeconomics

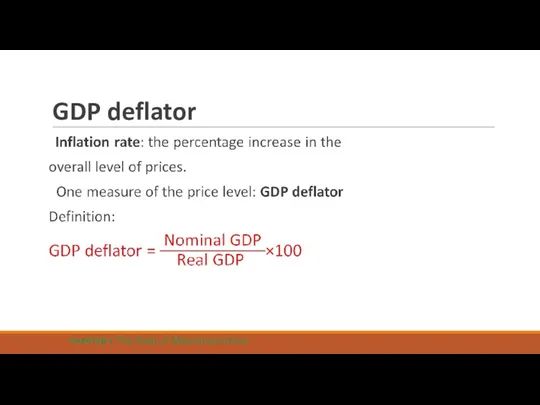

- 38. Practice problem, part 2 Use your previous answers to compute the GDP deflator in each year.

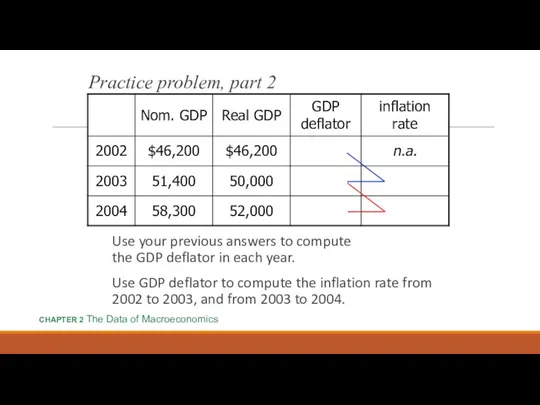

- 39. Answers to practice problem, part 2 CHAPTER 2 The Data of Macroeconomics

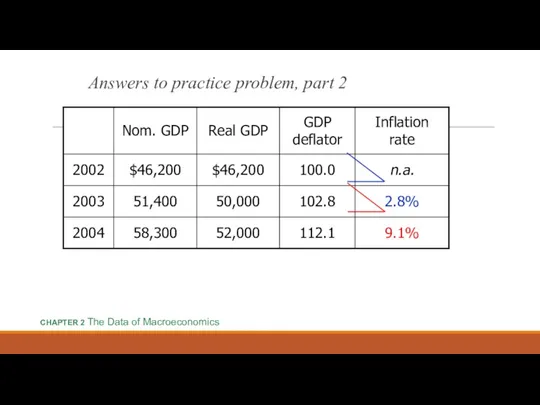

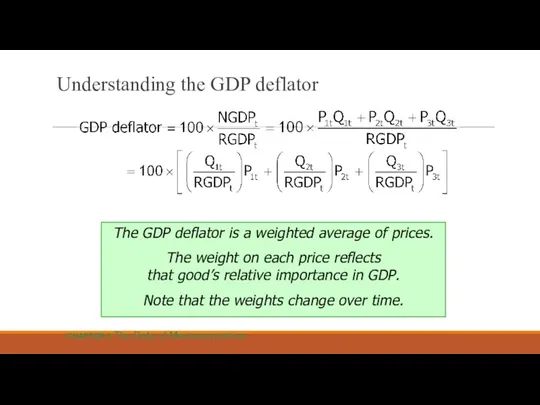

- 40. Understanding the GDP deflator Example with 3 goods For good i = 1, 2, 3 Pit

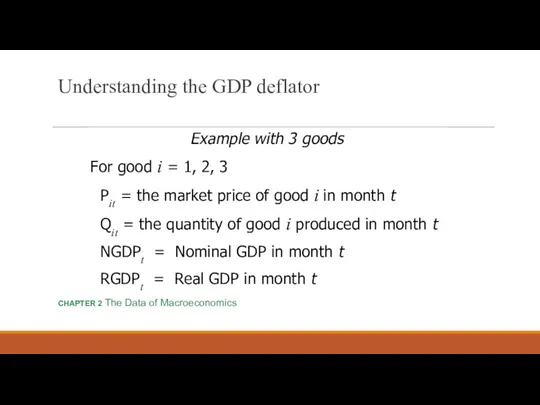

- 41. Understanding the GDP deflator The GDP deflator is a weighted average of prices. The weight on

- 42. Working with percentage changes EX: If your hourly wage rises 5% and you work 7% more

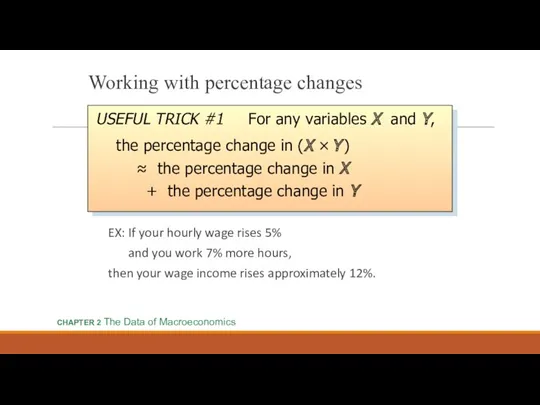

- 43. Working with percentage changes EX: GDP deflator = 100 × NGDP/RGDP. If NGDP rises 9% and

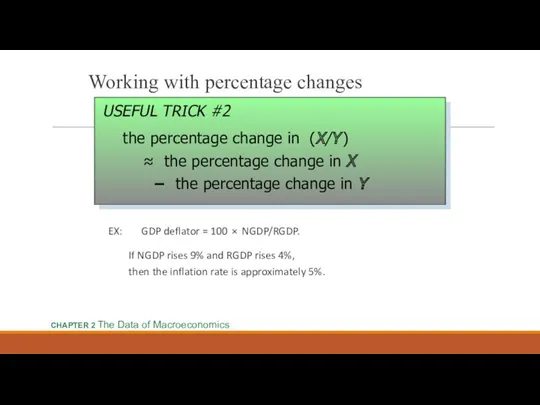

- 44. Chain-weighted Real GDP Over time, relative prices change, so the base year should be updated periodically.

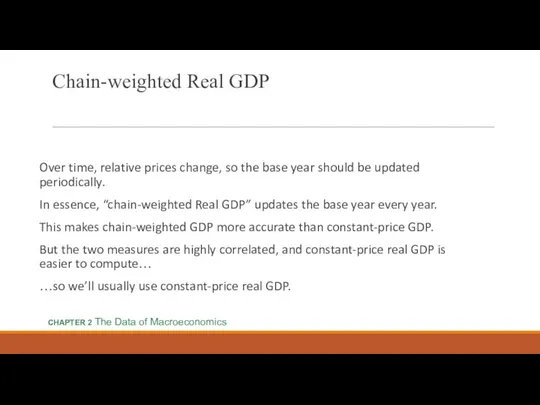

- 45. Consumer Price Index (CPI) A measure of the overall level of prices Published by the Bureau

- 46. How the BLS constructs the CPI Surveys consumers to determine composition of the typical consumer’s “basket”

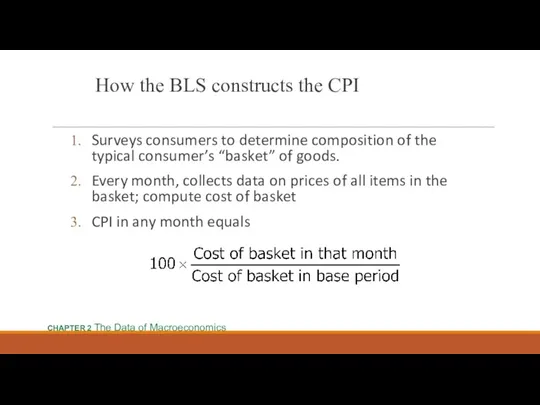

- 47. Exercise: Compute the CPI The basket contains 20 pizzas and 10 compact discs. prices: pizza CDs

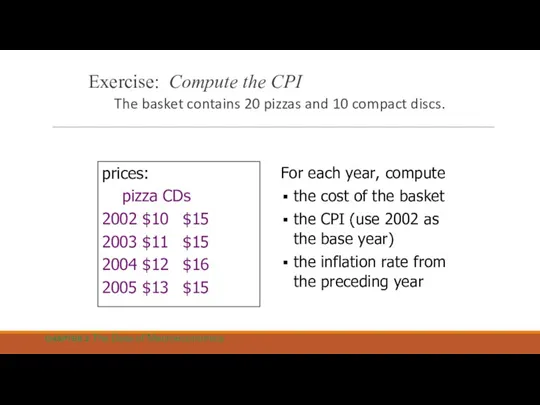

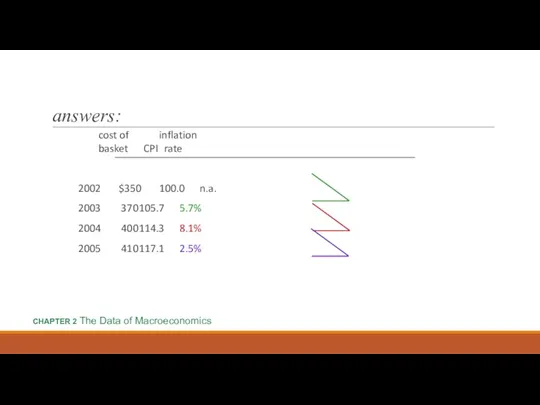

- 48. answers: cost of inflation basket CPI rate 2002 $350 100.0 n.a. 2003 370 105.7 5.7% 2004

- 49. The composition of the CPI’s “basket” CHAPTER 2 The Data of Macroeconomics

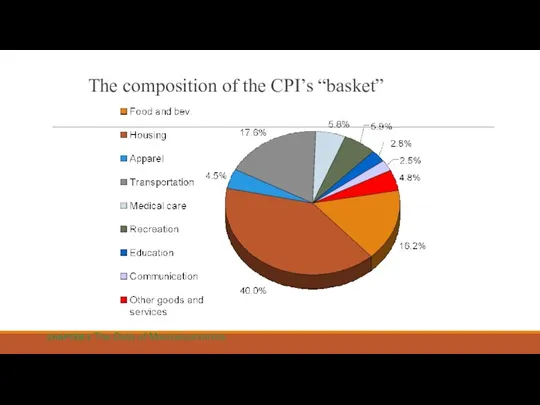

- 50. Understanding the CPI Example with 3 goods For good i = 1, 2, 3 Ci =

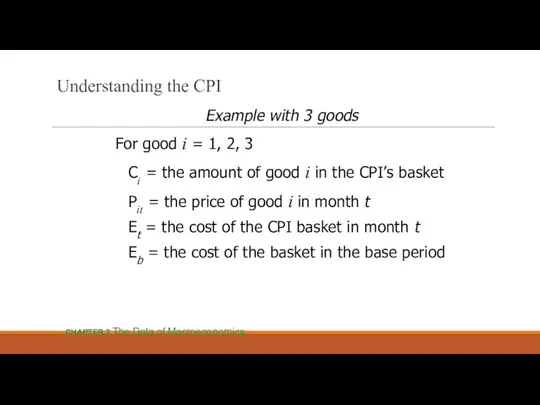

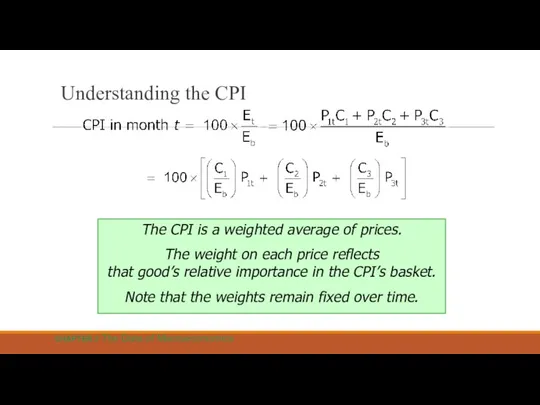

- 51. Understanding the CPI The CPI is a weighted average of prices. The weight on each price

- 52. Reasons why the CPI may overstate inflation Substitution bias: The CPI uses fixed weights, so it

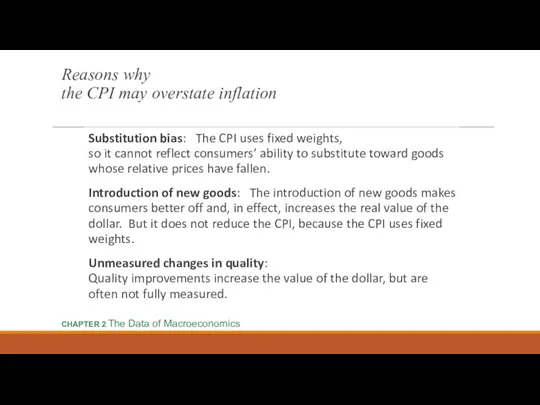

- 53. The CPI’s bias The Boskin Panel’s “best estimate”: The CPI overstates the true increase in the

- 54. Discussion topic: If your grandmother receives Social Security, how is she affected by the CPI’s bias?

- 55. CPI vs. GDP deflator prices of capital goods included in GDP deflator (if produced domestically) excluded

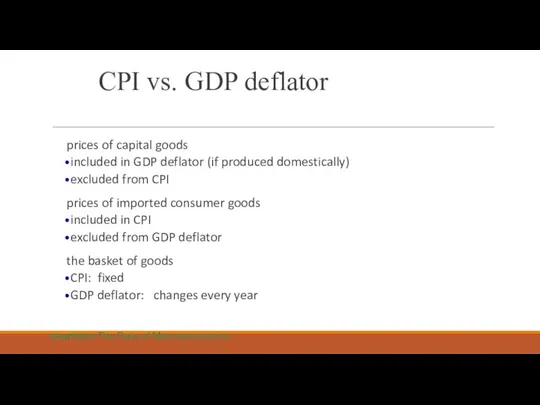

- 56. Two measures of inflation 16 14 12 10 8 6 4 2 0 - 2 Percentage

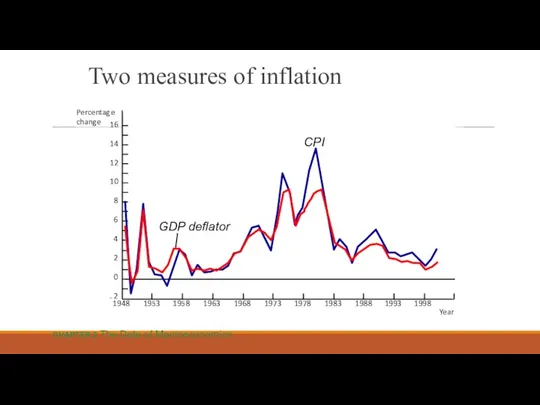

- 57. Categories of the population employed working at a paid job unemployed not employed but looking for

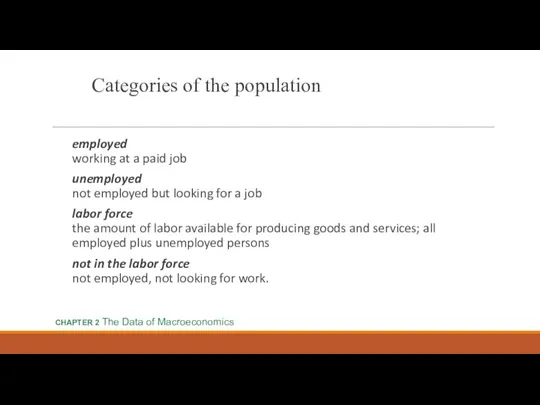

- 58. Two important labor force concepts unemployment rate percentage of the labor force that is unemployed labor

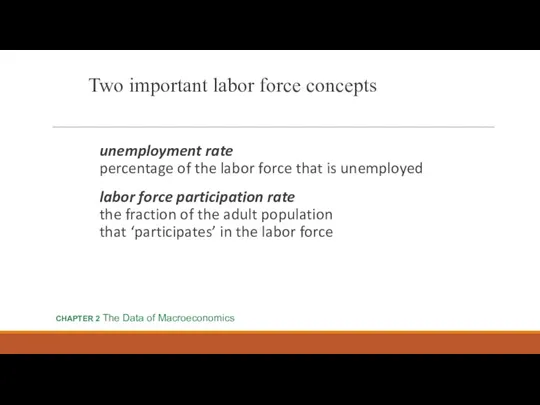

- 59. Exercise: Compute labor force statistics U.S. adult population by group, May 2003 Number employed = 137.5

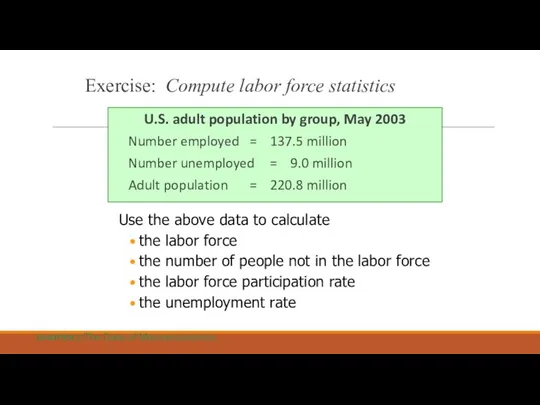

- 60. Answers: data: E = 137.5, U = 9.0, POP = 220.8 labor force L = E

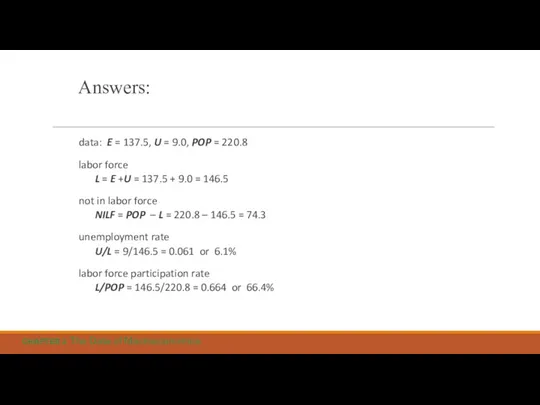

- 61. Exercise: Compute percentage changes in labor force statistics Suppose the population increases by 1% the labor

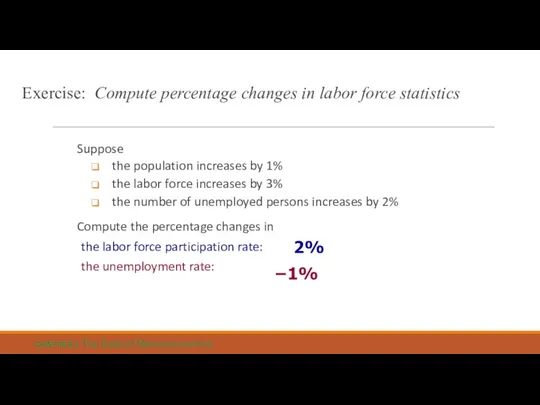

- 62. Employed workers help produce GDP, while unemployed workers do not. So one would expect a negative

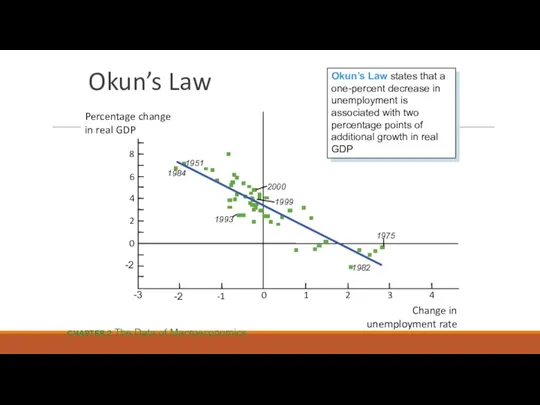

- 63. Okun’s Law 1951 1984 1999 2000 1993 1982 1975 Change in unemployment rate 10 Percentage change

- 64. Chapter Summary Gross Domestic Product (GDP) measures both total income and total expenditure on the economy’s

- 66. Скачать презентацию

Международная миграция рабочей силы

Международная миграция рабочей силы Введение в социально-экономическую статистику (СЭС)

Введение в социально-экономическую статистику (СЭС) Великие географические открытия. Часть 1

Великие географические открытия. Часть 1 Концепции построения ЛС при управлении запасами

Концепции построения ЛС при управлении запасами Современные особенности международной торговли товарами

Современные особенности международной торговли товарами Государственная промышленная и научнотехническая политика, как инструменты регулирования экономики

Государственная промышленная и научнотехническая политика, как инструменты регулирования экономики Типы рыночных структур

Типы рыночных структур Поведение потребителя

Поведение потребителя Эндогенные теории экономического роста

Эндогенные теории экономического роста Потребности и ресурсы. Проблема выбора в экономике

Потребности и ресурсы. Проблема выбора в экономике Экономические и математически методы экономического анализа

Экономические и математически методы экономического анализа Современное рыночное хозяйство

Современное рыночное хозяйство Сетевые технологии планирования и управления в условиях неопределённости

Сетевые технологии планирования и управления в условиях неопределённости Принятие решений как особый вид человеческой деятельности

Принятие решений как особый вид человеческой деятельности Исламдық қаржы орталықтары

Исламдық қаржы орталықтары Статистика национального богатства. Валовой внутренний продукт

Статистика национального богатства. Валовой внутренний продукт Личные финансы: сущность и особенности. (Лекция 3)

Личные финансы: сущность и особенности. (Лекция 3) Мировая экономика и международные экономические отношения

Мировая экономика и международные экономические отношения Основы поведения субъектов рыночной экономики.Общая и предельная полезность. Закон убывающей предельной полезности. Кривые безразличия

Основы поведения субъектов рыночной экономики.Общая и предельная полезность. Закон убывающей предельной полезности. Кривые безразличия Методика и техника изучения затрат рабочего времени. Хронометраж, фотографии рабочего времени

Методика и техника изучения затрат рабочего времени. Хронометраж, фотографии рабочего времени Стратегическое планирование в Республике Казахстан

Стратегическое планирование в Республике Казахстан Фармакоэкономический анализ и его методы

Фармакоэкономический анализ и его методы Характеристика рыночного хозяйства Франции

Характеристика рыночного хозяйства Франции Цели устойчивого развития

Цели устойчивого развития Система государственного прогнозирования в РФ

Система государственного прогнозирования в РФ Итоговое собрание АСП Атополе Мото Кудрово. Итоги января 2023

Итоговое собрание АСП Атополе Мото Кудрово. Итоги января 2023 Моделі соціального інвестування розвинутих країн світу

Моделі соціального інвестування розвинутих країн світу ИСО-ның ұйымдастырушылық құрылымы

ИСО-ның ұйымдастырушылық құрылымы