Содержание

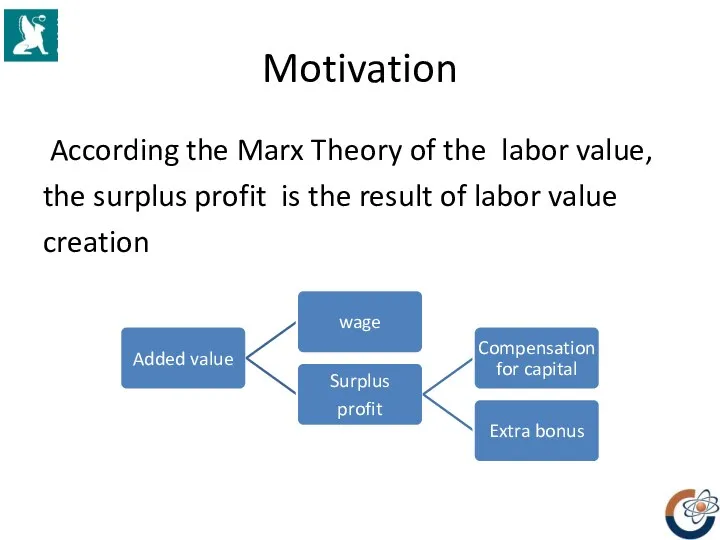

- 2. Motivation According the Marx Theory of the labor value, the surplus profit is the result of

- 3. Motivation The intellectual capital of an enterprise is a very complicated and dynamic system consisting of

- 4. Research Methodology Our research is based on the methods of observation, data collection, analysis and synthesis,

- 5. Dispute of two Cambridge on the capital nature Piero Sraffa, Joan Robinson, Luigi Pasinetti, Pierandzhelo Garenyany

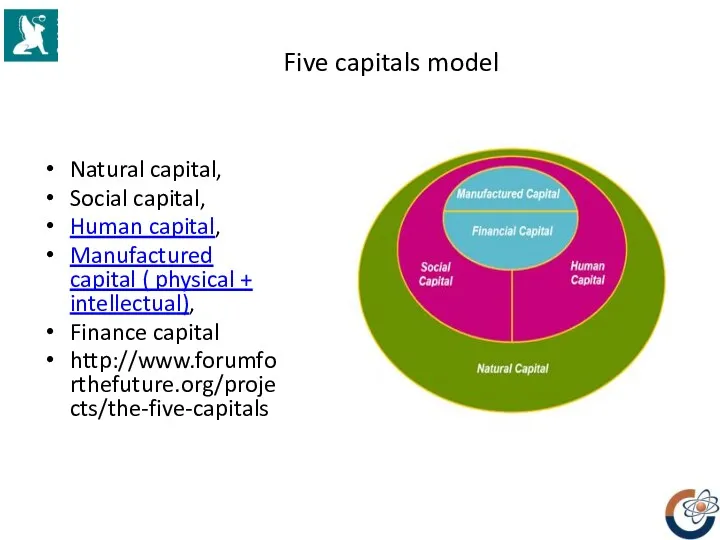

- 6. Five capitals model Natural capital, Social capital, Human capital, Manufactured capital ( physical + intellectual), Finance

- 7. Surplus profit method (capitalization of goodwill) is separately identified among them as a method which the

- 8. To reveal the relationship between intellectual capital investments and companies’ financial performance, we carried out a

- 9. Regression analysis Also we considered whether an intellectual capital management system or, at least, its elements

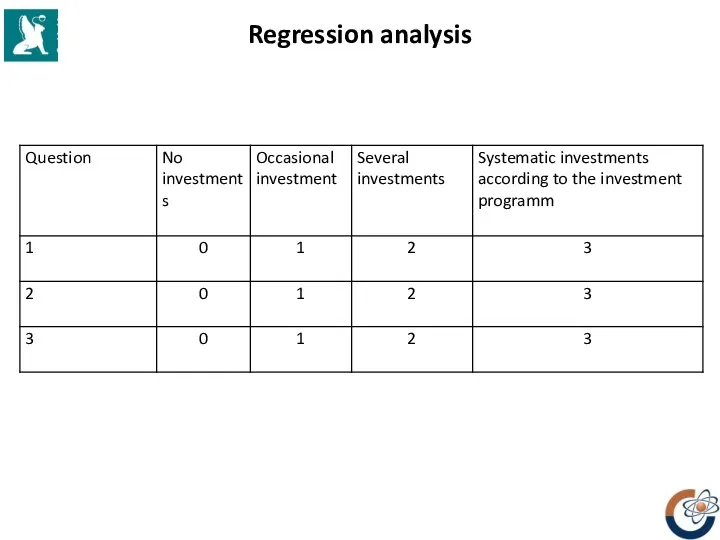

- 10. Regression analysis Respondents were asked to state how they would estimate the investments in the following

- 11. Regression analysis

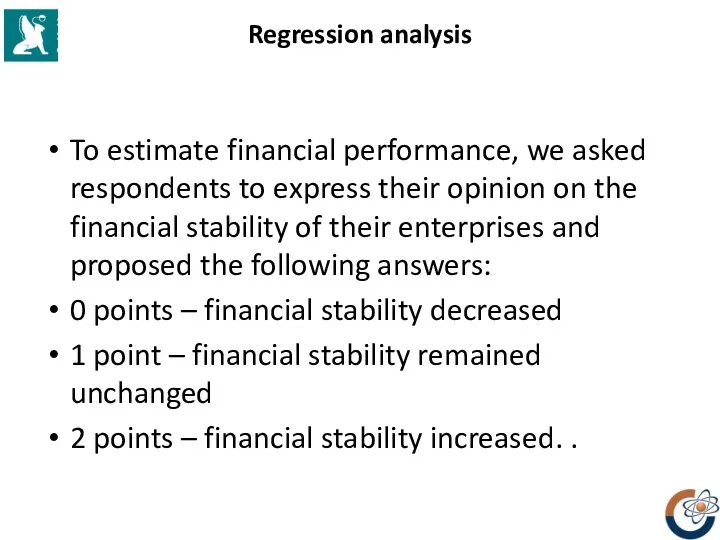

- 12. Regression analysis To estimate financial performance, we asked respondents to express their opinion on the financial

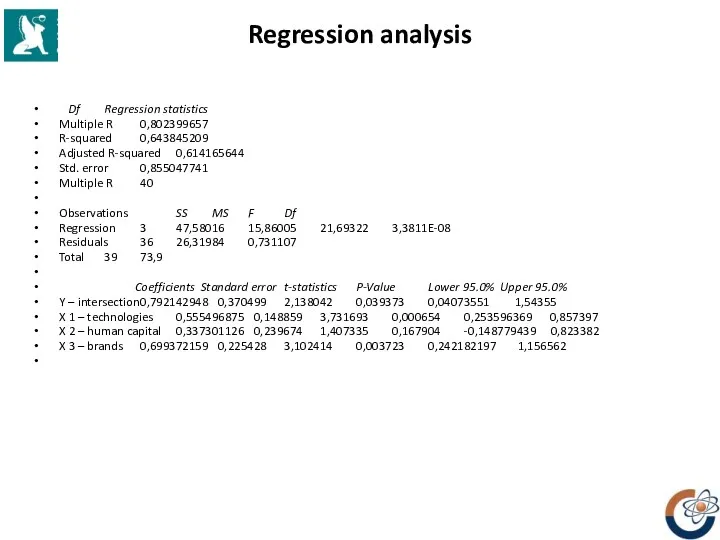

- 13. Regression analysis Df Regression statistics Multiple R 0,802399657 R-squared 0,643845209 Adjusted R-squared 0,614165644 Std. error 0,855047741

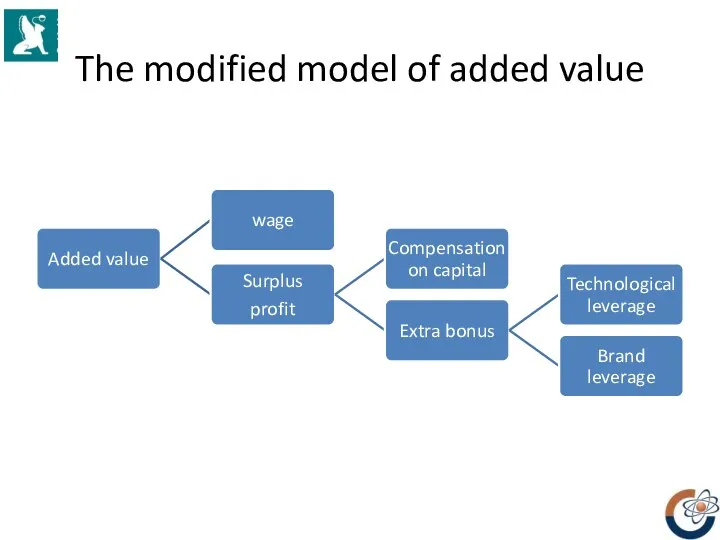

- 14. The modified model of added value

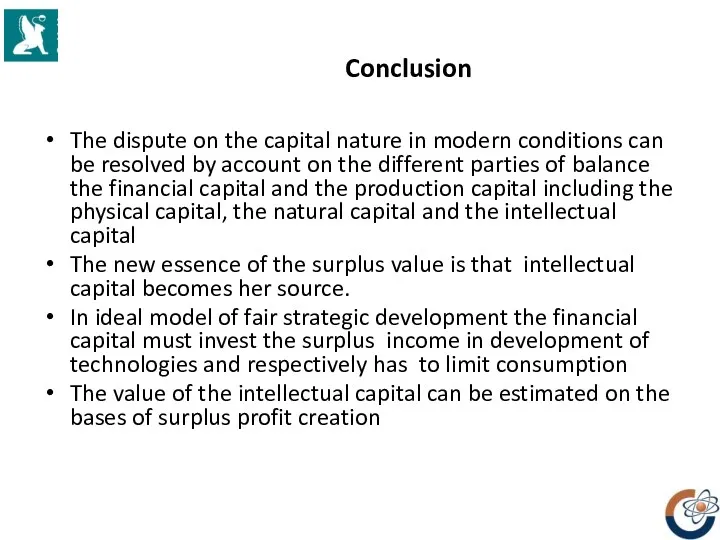

- 15. Conclusion The dispute on the capital nature in modern conditions can be resolved by account on

- 17. Скачать презентацию

Эндогенные теории экономического роста

Эндогенные теории экономического роста Анализ использования трудовых ресурсов предприятия

Анализ использования трудовых ресурсов предприятия Основы устойчивости функционирования объектов экономики и территорий в чрезвычайных условиях

Основы устойчивости функционирования объектов экономики и территорий в чрезвычайных условиях Ресурсы предприятия

Ресурсы предприятия Нобелевские премии по экономике

Нобелевские премии по экономике Теория игр и стратегическое поведение

Теория игр и стратегическое поведение Решение экономических задач

Решение экономических задач Система отношений собственности в современной экономике. Тема 8

Система отношений собственности в современной экономике. Тема 8 Анализ варианта 403, формат ЕГЭ. Обществознание

Анализ варианта 403, формат ЕГЭ. Обществознание Введение в экономическую теорию

Введение в экономическую теорию Основные проблемы России

Основные проблемы России Правовые аспекты современного производства

Правовые аспекты современного производства Економічна і соціальна рада ООН (ЕКОСОР)

Економічна і соціальна рада ООН (ЕКОСОР) Безработица: причины и последствия

Безработица: причины и последствия Кейнсианство – Экономическая теория Дж. М. Кейнса

Кейнсианство – Экономическая теория Дж. М. Кейнса О социально-экономическом развитии Беломорского муниципального района по итогам 2021 года и задачах на 2022 год

О социально-экономическом развитии Беломорского муниципального района по итогам 2021 года и задачах на 2022 год Учет электроэнергии. Требования к пунктам установки средств учета электроэнергии, расчетным счетчикам

Учет электроэнергии. Требования к пунктам установки средств учета электроэнергии, расчетным счетчикам ВКР: Анализ факторов и резервов производительности труда на предприятии

ВКР: Анализ факторов и резервов производительности труда на предприятии Russia as a donor and its aid to other countries

Russia as a donor and its aid to other countries Платежный баланс

Платежный баланс Прикладная информатика в экономике

Прикладная информатика в экономике Экономические санкции против России: причины, основные направления, последствия

Экономические санкции против России: причины, основные направления, последствия История европейской интеграции

История европейской интеграции Европейский Союз. Крупнейшие политические интеграционные объединения

Европейский Союз. Крупнейшие политические интеграционные объединения Хозяйство Австралии

Хозяйство Австралии Неравенство в России

Неравенство в России Инфляционные процессы и стабилизация цен

Инфляционные процессы и стабилизация цен Презентация к уроку по тема Фирмы. Капитал. Прибыль (9 класс)

Презентация к уроку по тема Фирмы. Капитал. Прибыль (9 класс)