Содержание

- 2. Outline Government and Public projects Public Goods/Consumer and Producer Surplus The concept of Benefit/Cost (B/C) ratio

- 3. Government and Public Projects Public projects are those funded, owned and operated by a government Governmental

- 4. Public Goods A public good is a good that is both non-excludable and non-rival in that

- 5. Public Goods Many public goods may at times be subject to excessive use resulting in negative

- 6. Welfare Aim of the Government The chief aim of the government is: National defense General welfare

- 7. Public Activities Not all public activities have to have direct impact on ALL the citizens of

- 8. Public Activities Moreover, some public activities might have a negative effect on a part of the

- 9. Public Activities Public projects are usually much more complicated than private projects in many respects That

- 10. Public vs Private Projects There are number of special factors that are not ordinarily found in

- 11. Main differences between public and private projects Purpose: Private projects are more profit oriented, while public

- 12. Main differences between public and private projects Project Life: Private projects are usually much shorter (5

- 13. Main differences between public and private projects Beneficiaries of the project: Normally the private investor himself

- 14. How to judge on public projects? Governments do not usually deal with Profit, therefore we deal

- 15. How to judge on public projects? Benefit/cost ratios are frequently used for government decisions Costs accrue

- 16. Judging proposed investments For now, we will avoid some of these problems In particular, we will

- 17. The Benefit/Cost Method The Benefit/Cost Method involves the calculation of a ratio of benefits to costs

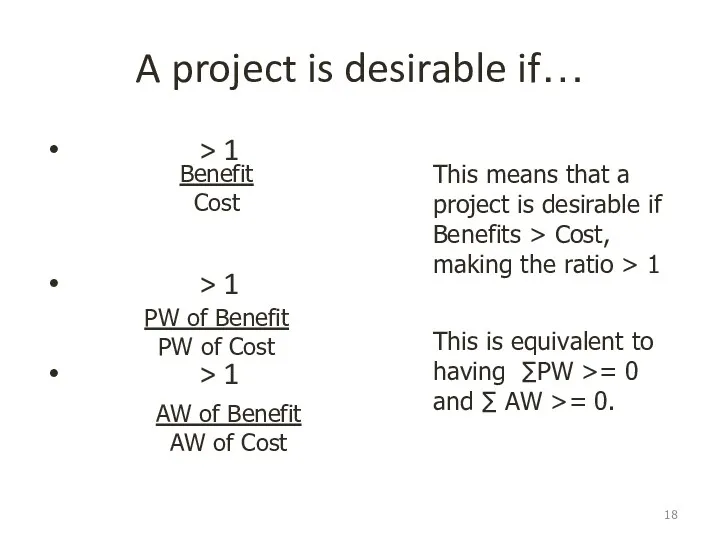

- 18. A project is desirable if… > 1 > 1 > 1 Benefit Cost PW of Benefit

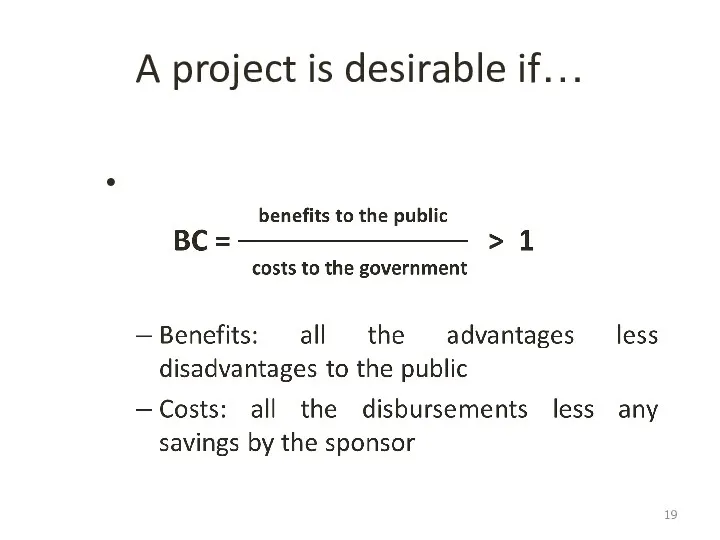

- 19. A project is desirable if…

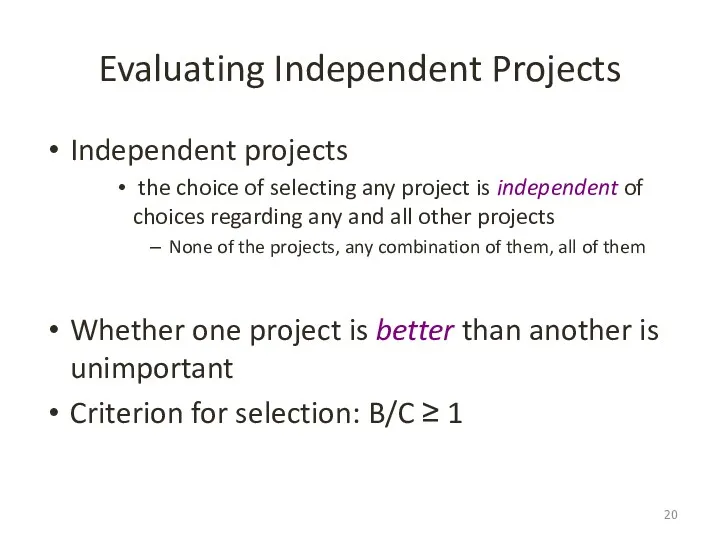

- 20. Evaluating Independent Projects Independent projects the choice of selecting any project is independent of choices regarding

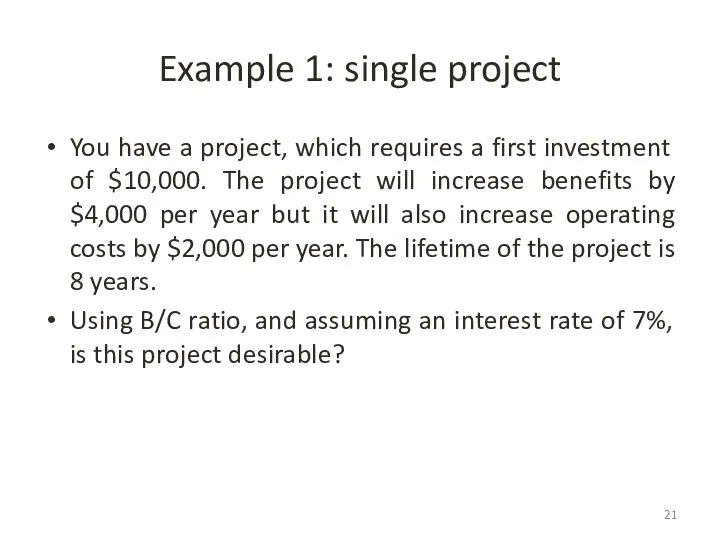

- 21. Example 1: single project You have a project, which requires a first investment of $10,000. The

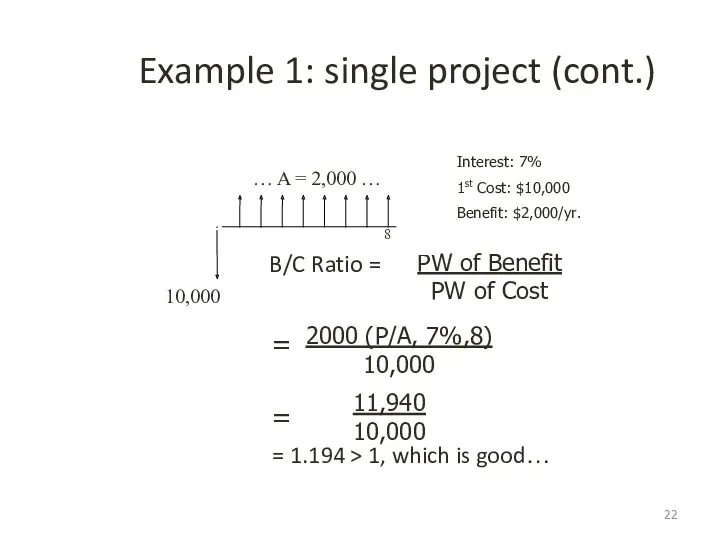

- 22. Example 1: single project (cont.) B/C Ratio = = 1.194 > 1, which is good… PW

- 23. Example 2: single project You are considering to install or not a new machine. The first

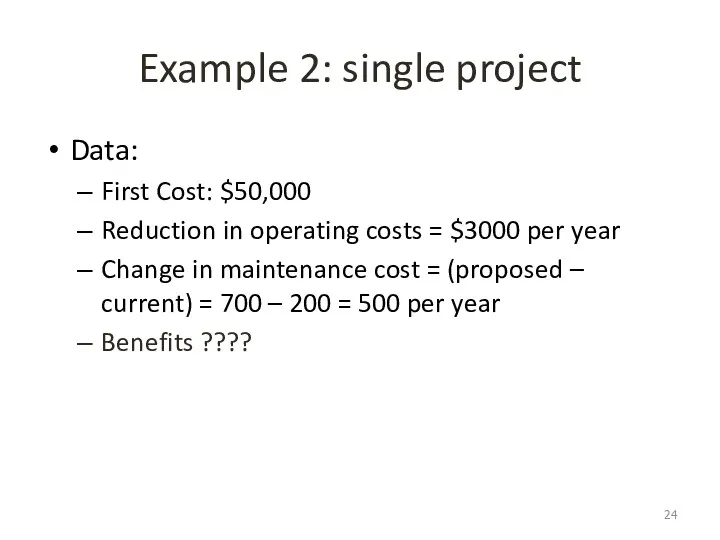

- 24. Example 2: single project Data: First Cost: $50,000 Reduction in operating costs = $3000 per year

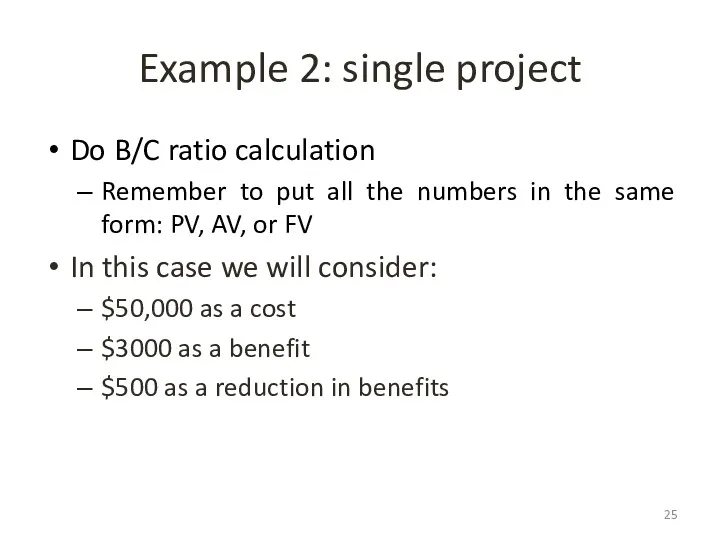

- 25. Example 2: single project Do B/C ratio calculation Remember to put all the numbers in the

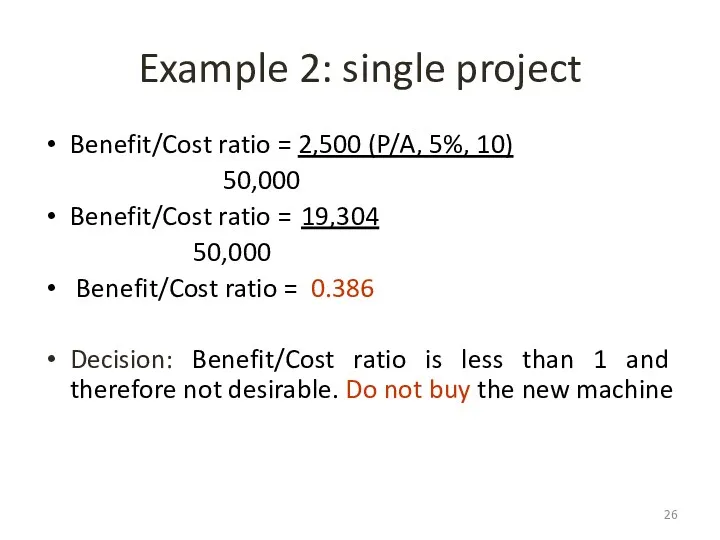

- 26. Example 2: single project Benefit/Cost ratio = 2,500 (P/A, 5%, 10) 50,000 Benefit/Cost ratio = 19,304

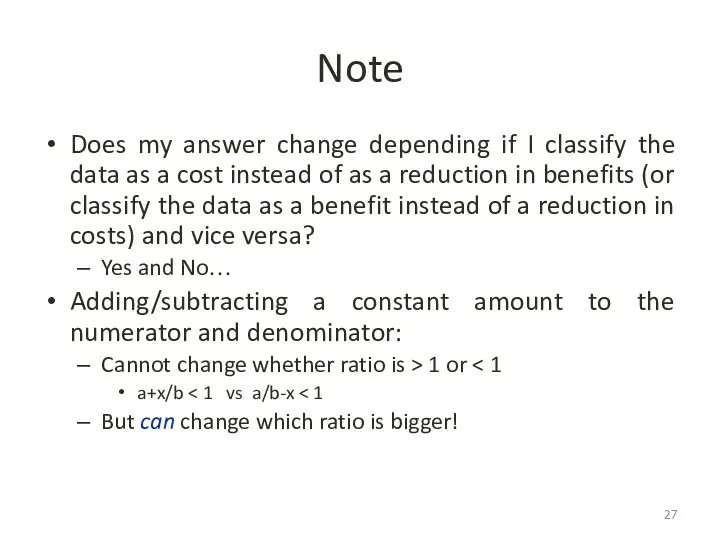

- 27. Note Does my answer change depending if I classify the data as a cost instead of

- 28. In other words… Adding/subtracting a constant amount to the numerator and denominator will change your answer,

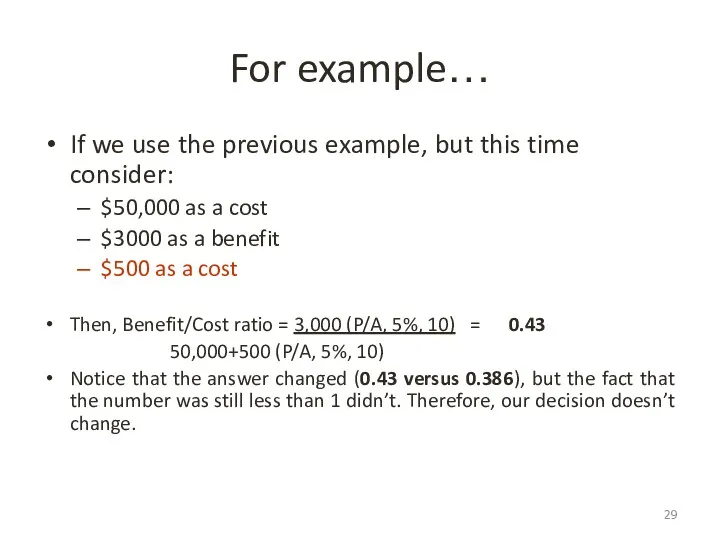

- 29. For example… If we use the previous example, but this time consider: $50,000 as a cost

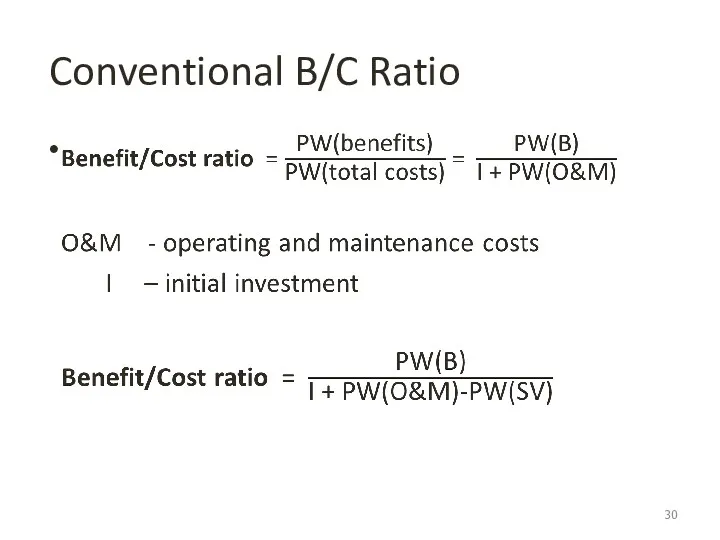

- 30. Conventional B/C Ratio

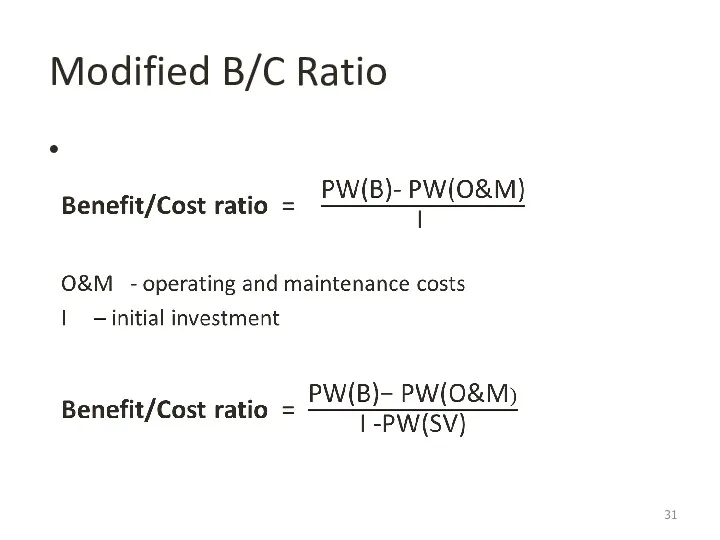

- 31. Modified B/C Ratio

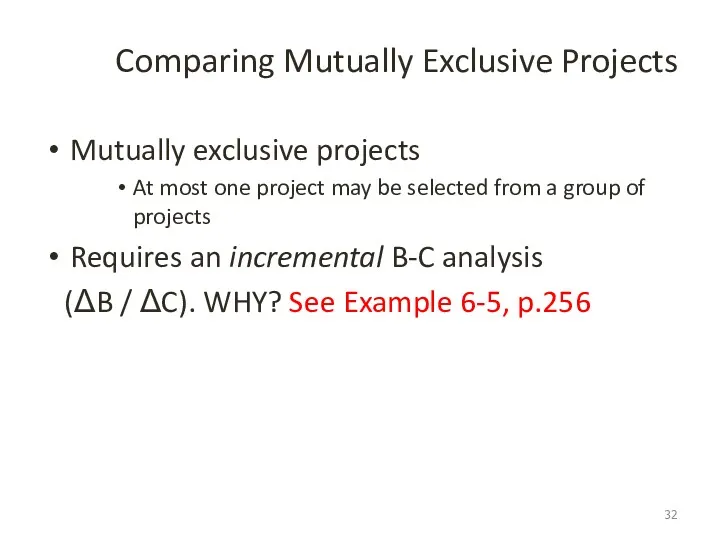

- 32. Comparing Mutually Exclusive Projects Mutually exclusive projects At most one project may be selected from a

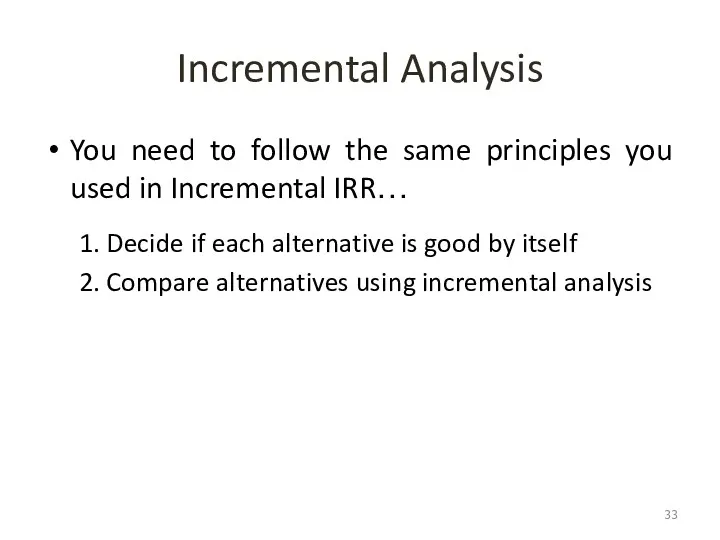

- 33. Incremental Analysis You need to follow the same principles you used in Incremental IRR… 1. Decide

- 34. Incremental Analysis Rank the alternatives in order of increasing total equivalent worth of costs The “do

- 35. Example: multiple projects You are deciding between three alternatives and you need to pick the best

- 36. Alternative A First cost = $45,000 Tax benefits = $7,000 per year Salvage value of $30,000

- 37. Alternative B First cost = $25,000 Tax benefits = $3,000 per year Salvage value = $15,000

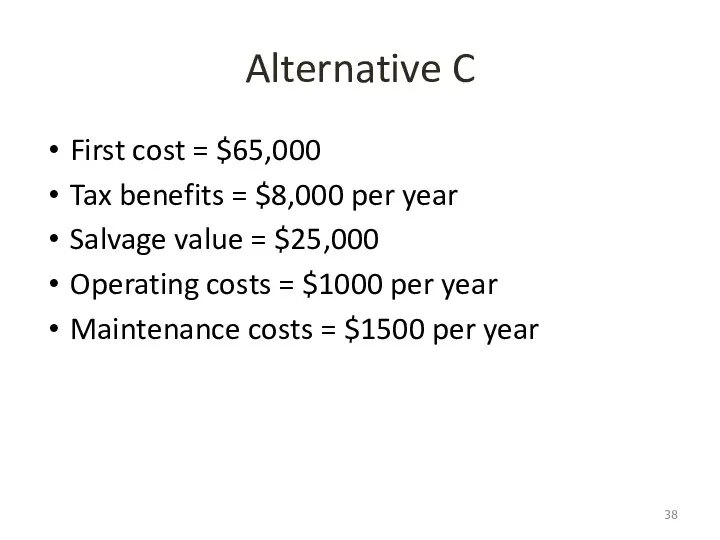

- 38. Alternative C First cost = $65,000 Tax benefits = $8,000 per year Salvage value = $25,000

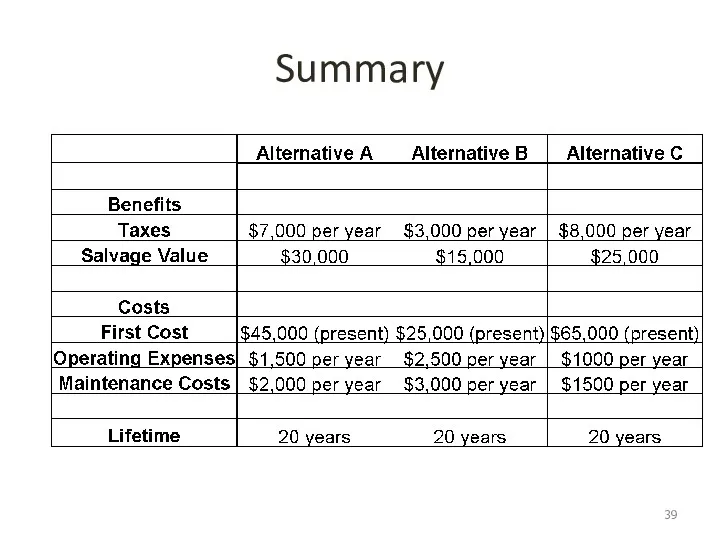

- 39. Summary

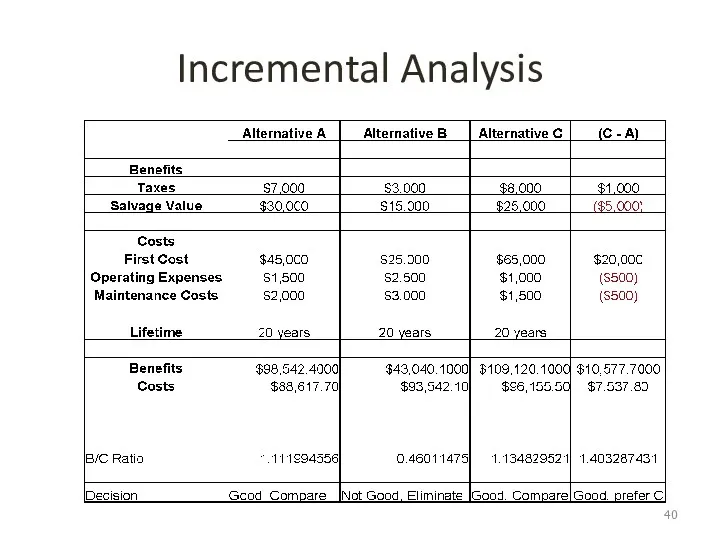

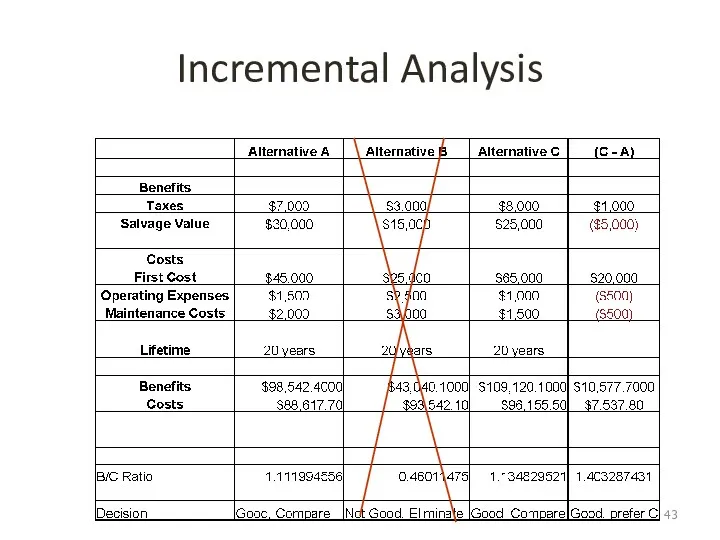

- 40. Incremental Analysis

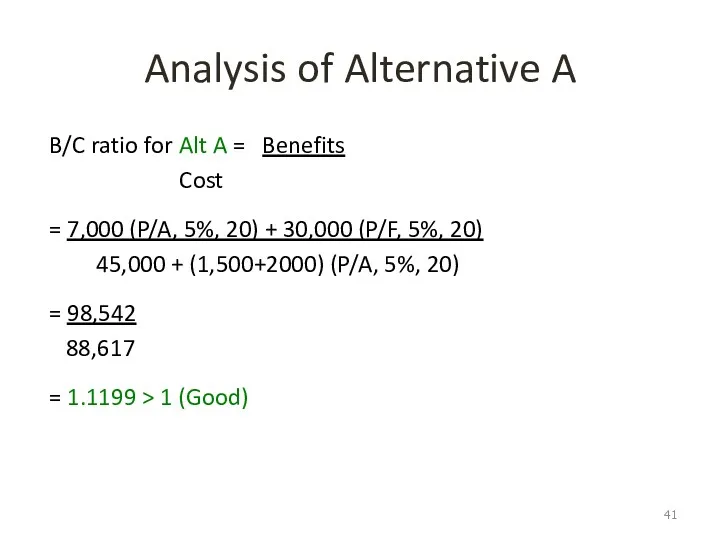

- 41. Analysis of Alternative A B/C ratio for Alt A = Benefits Cost = 7,000 (P/A, 5%,

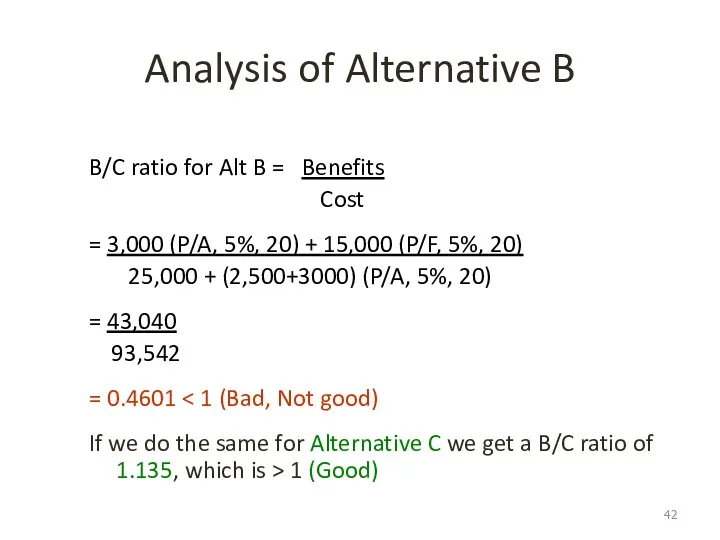

- 42. Analysis of Alternative B B/C ratio for Alt B = Benefits Cost = 3,000 (P/A, 5%,

- 43. Incremental Analysis

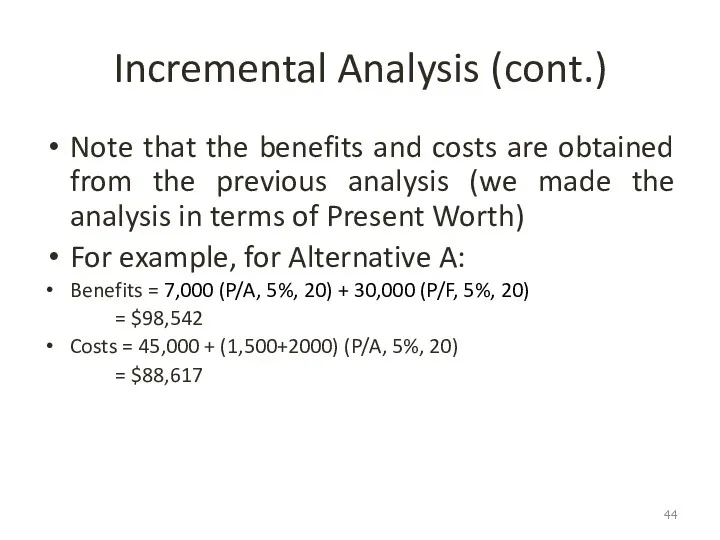

- 44. Incremental Analysis (cont.) Note that the benefits and costs are obtained from the previous analysis (we

- 45. Incremental Analysis (cont.) Compute Incremental B/C for C-A In this case, since Incremental B/C of (C-A)

- 47. Скачать презентацию

Макроэкономикалық тепе-теңдік

Макроэкономикалық тепе-теңдік Научные исследования, как объект финансирования

Научные исследования, как объект финансирования LM Равновесие в модели IS/LM

LM Равновесие в модели IS/LM Мировая экономика: основные черты и тенденции развития мировой экономики и мирового хозяйства

Мировая экономика: основные черты и тенденции развития мировой экономики и мирового хозяйства Человеческий капитал

Человеческий капитал Рынки факторов производства

Рынки факторов производства Диагностика конкурентной среды. Модели конкуренции

Диагностика конкурентной среды. Модели конкуренции Основные производственные фонды предприятия. Экономическая сущность, состав и структура, оценка и учет основных фондов

Основные производственные фонды предприятия. Экономическая сущность, состав и структура, оценка и учет основных фондов Теоретические основы прогнозирования и планирования. Этапы прогнозирования

Теоретические основы прогнозирования и планирования. Этапы прогнозирования Методическая разработка урока Учет кредитов и займов. Практическая деятельность студентов.

Методическая разработка урока Учет кредитов и займов. Практическая деятельность студентов. Презентация Проблема ограниченности экономических ресурсов и ее последствия

Презентация Проблема ограниченности экономических ресурсов и ее последствия О социально-экономическом развитии Костомукшского городского округа по итогам 2021 года и задачах на 2022 год

О социально-экономическом развитии Костомукшского городского округа по итогам 2021 года и задачах на 2022 год Факторы трудовой миграции

Факторы трудовой миграции Модель IS-LM и совокупный спрос

Модель IS-LM и совокупный спрос Теория экономического цикла (взгляд австрийской школы)

Теория экономического цикла (взгляд австрийской школы) Стратегия развития предпринимательства на территории Кировского муниципального района до 2019 года

Стратегия развития предпринимательства на территории Кировского муниципального района до 2019 года Глобалізація. Види глобалізації

Глобалізація. Види глобалізації Кривые безразличия. Бюджетные линии

Кривые безразличия. Бюджетные линии Современное Мировое хозяйство и международное географическое разделение труда. Лекция № 8

Современное Мировое хозяйство и международное географическое разделение труда. Лекция № 8 Тема 7. Рынок труда. Заработная плата

Тема 7. Рынок труда. Заработная плата Property relations and their role in the economy. The main form of economy

Property relations and their role in the economy. The main form of economy Особливості ринку праці

Особливості ринку праці Организация складского хозяйства по обеспечению хранения плодоовощной продукции на примере ООО ФРУТЕКС

Организация складского хозяйства по обеспечению хранения плодоовощной продукции на примере ООО ФРУТЕКС Тұрақты дамудың негізгі принциптері

Тұрақты дамудың негізгі принциптері Особенности контроля за сделками и инвестициями субъекта ЕМ (естественная монополия)

Особенности контроля за сделками и инвестициями субъекта ЕМ (естественная монополия) Өтпелі экономиканың мәні мен заңдылықтары

Өтпелі экономиканың мәні мен заңдылықтары Альтернативные модели поведения фирмы

Альтернативные модели поведения фирмы Макроэкономическая нестабильность: циклы и кризисы. Безработица. Инфляция

Макроэкономическая нестабильность: циклы и кризисы. Безработица. Инфляция