Strengthening Profitability Through Stability and Transparency. Japanese Quality LNG Investment at The Heart of Indonesia презентация

Содержание

- 2. Table of Content Indonesia LNG Market Outlook 2018………..................................... Overview of - Shinoken Group....................................................... Investment Product Plan.................................................................

- 3. Section 1 : Indonesian LNG Market Outlook

- 4. Market and Economic Outlook 2018 Key Investment Points US Government Policies influence on market return with

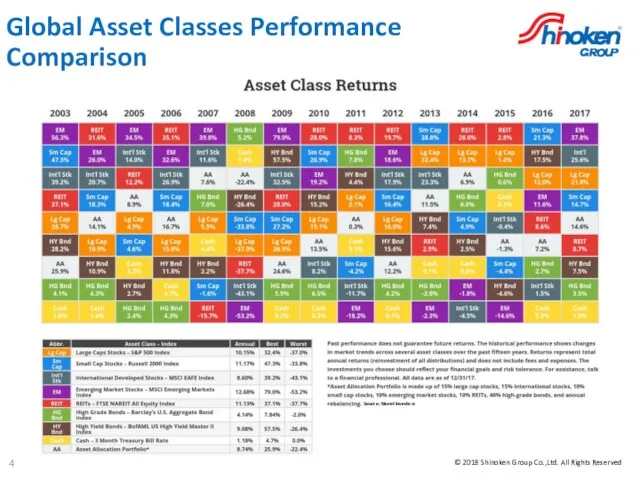

- 5. Global Asset Classes Performance Comparison Source: Novel Investors

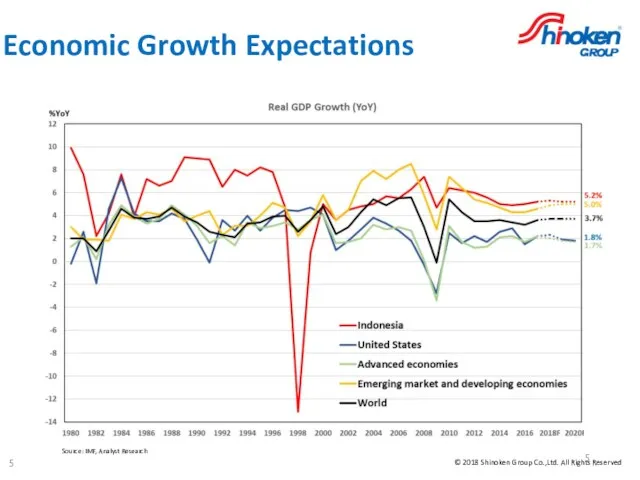

- 6. Economic Growth Expectations Source: IMF, Analyst Research

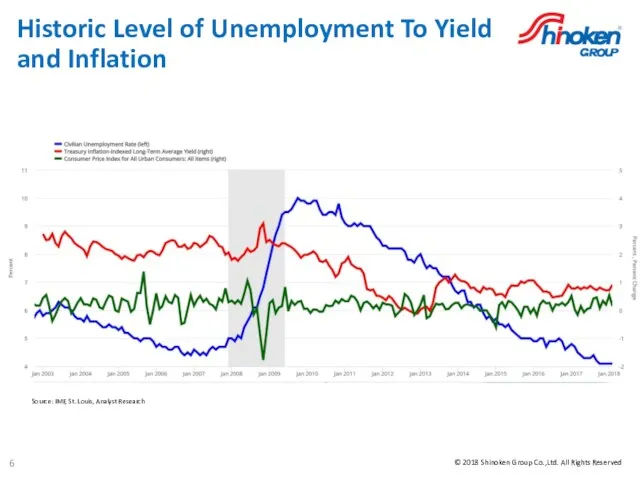

- 7. Historic Level of Unemployment To Yield and Inflation Source: IMF, St. Louis, Analyst Research

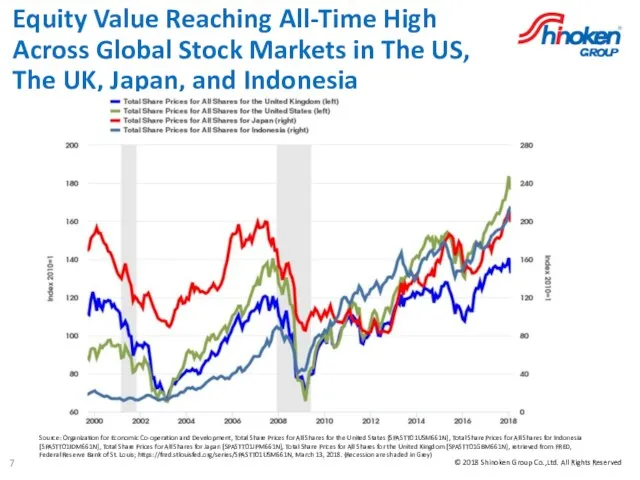

- 8. Equity Value Reaching All-Time High Across Global Stock Markets in The US, The UK, Japan, and

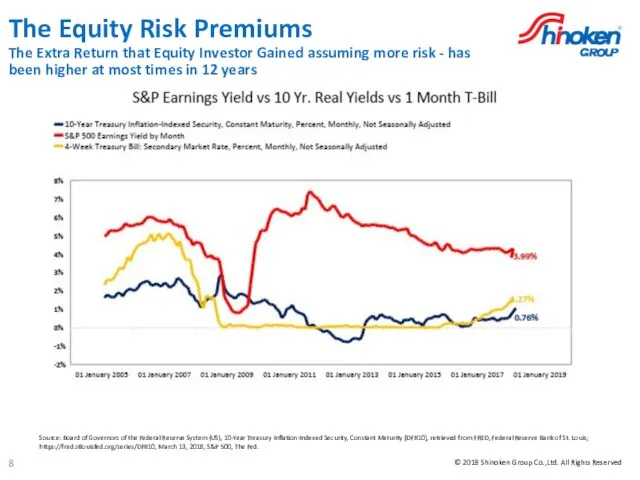

- 9. The Equity Risk Premiums The Extra Return that Equity Investor Gained assuming more risk - has

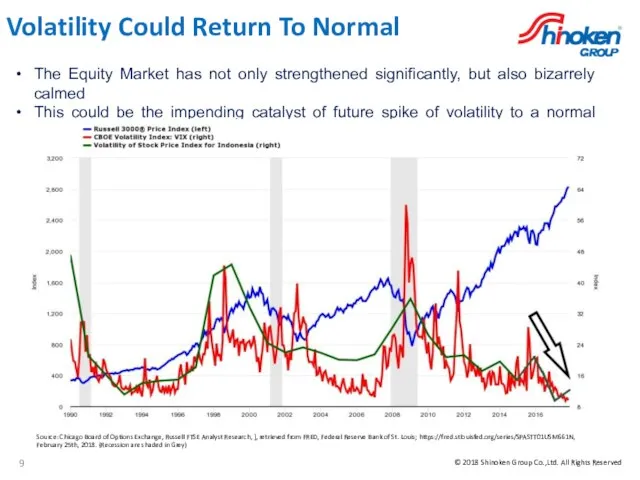

- 10. Volatility Could Return To Normal Source: Chicago Board of Options Exchange, Russell FTSE Analyst Research, ],

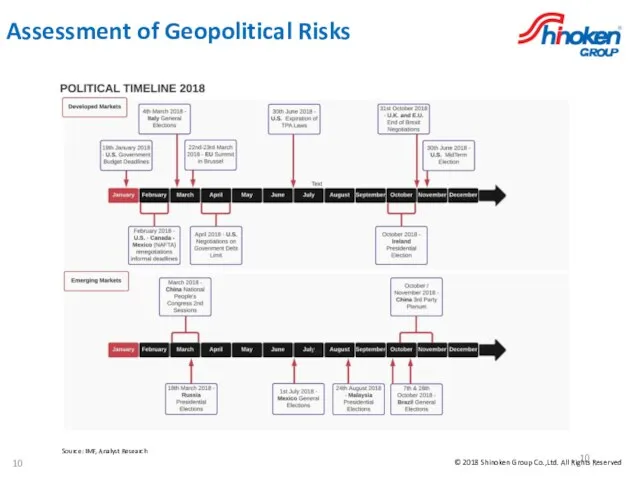

- 11. Assessment of Geopolitical Risks Source: IMF, Analyst Research

- 12. Key Market Outlook : Indonesian Economic Research

- 13. Indonesian Macroeconomic Reviews and Outlook Indonesian Government Attempts to Reduce Budget Deficit Could Potentially Backfired into

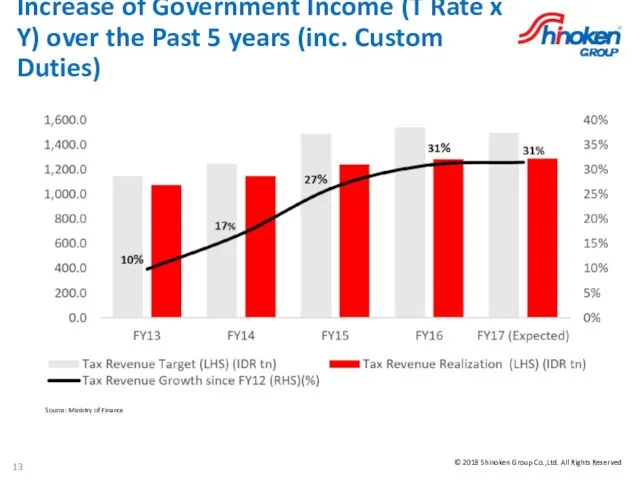

- 14. Increase of Government Income (T Rate x Y) over the Past 5 years (inc. Custom Duties)

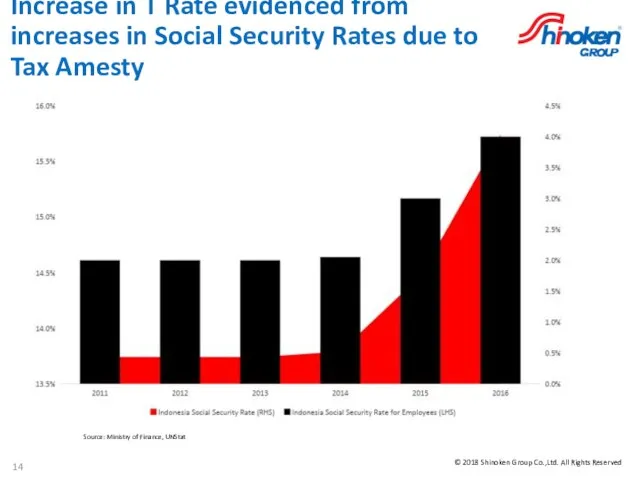

- 15. Increase in T Rate evidenced from increases in Social Security Rates due to Tax Amesty Source:

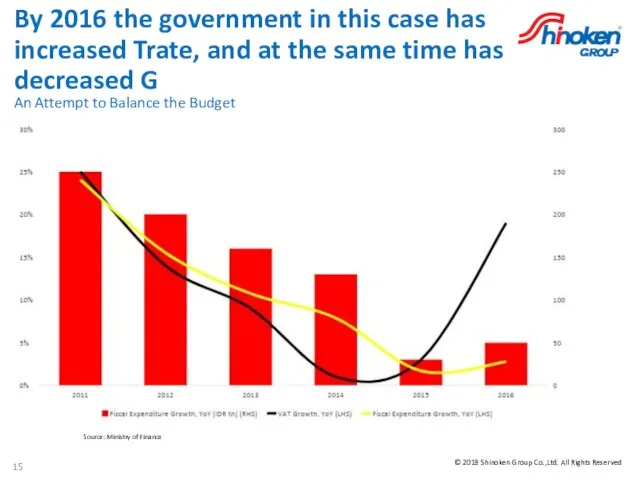

- 16. By 2016 the government in this case has increased Trate, and at the same time has

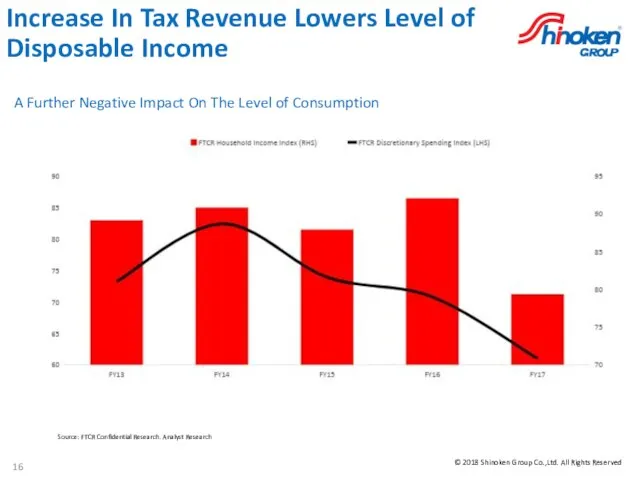

- 17. Increase In Tax Revenue Lowers Level of Disposable Income Source: FTCR Confidential Research. Analyst Research A

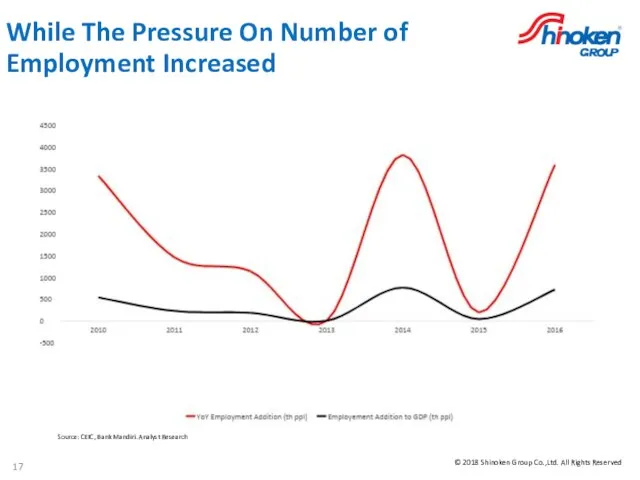

- 18. While The Pressure On Number of Employment Increased Source: CEIC, Bank Mandiri. Analyst Research

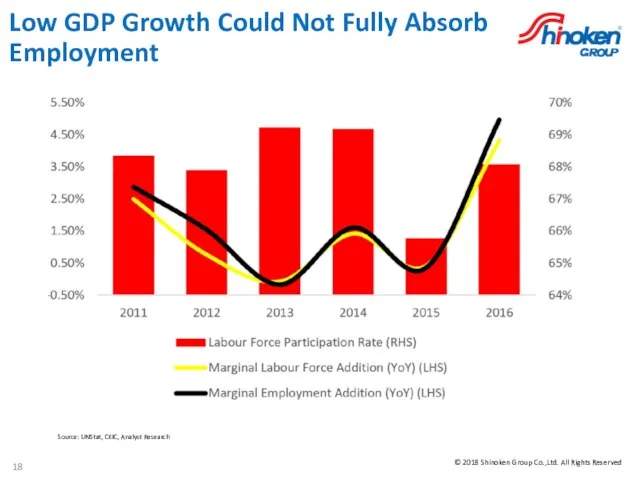

- 19. Low GDP Growth Could Not Fully Absorb Employment Source: UNStat, CEIC, Analyst Research

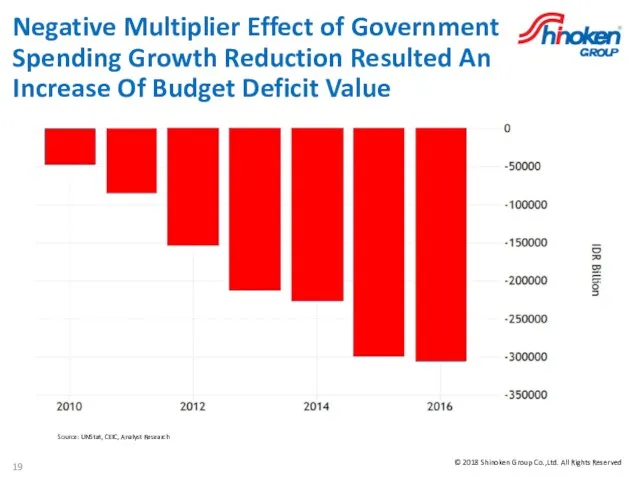

- 20. Negative Multiplier Effect of Government Spending Growth Reduction Resulted An Increase Of Budget Deficit Value Source:

- 21. Indonesian Fiscal Rebalancing All in all, over the last 2 years since FY14, the tax rate,

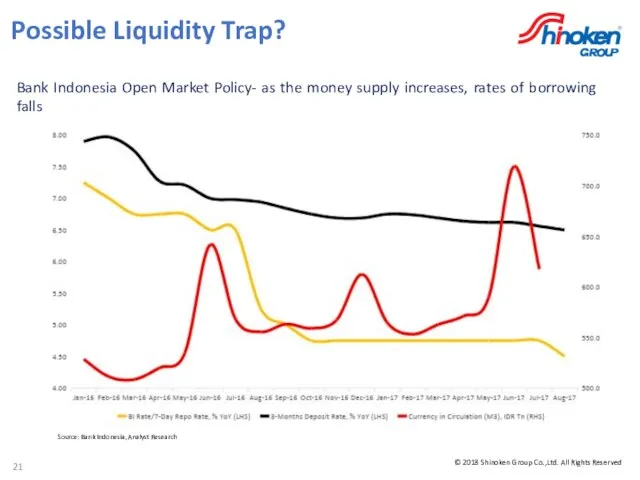

- 22. Possible Liquidity Trap? Source: Bank Indonesia, Analyst Research Bank Indonesia Open Market Policy- as the money

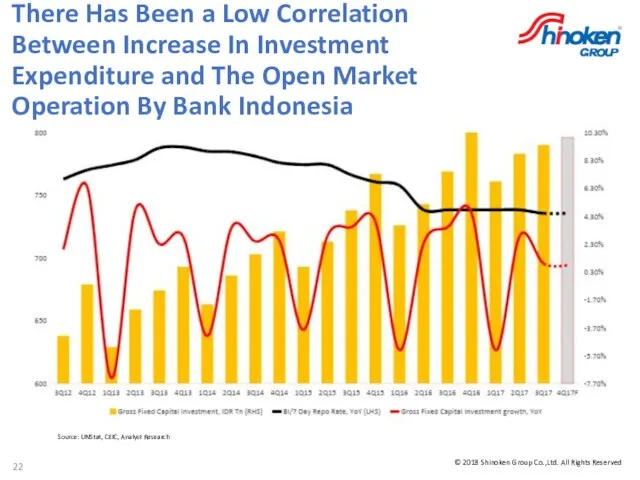

- 23. There Has Been a Low Correlation Between Increase In Investment Expenditure and The Open Market Operation

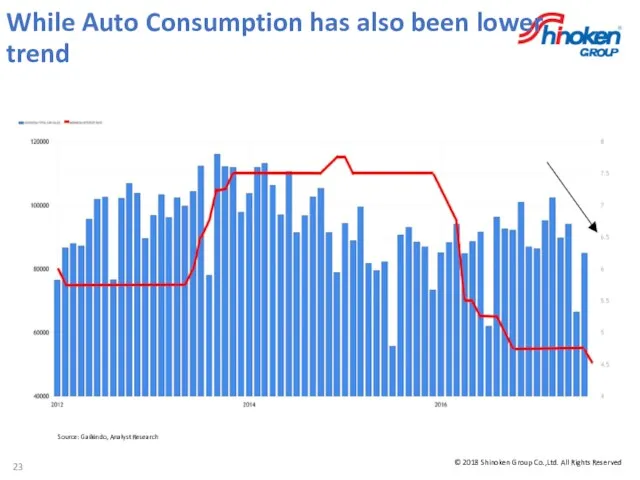

- 24. While Auto Consumption has also been lower trend Source: Gaikindo, Analyst Research

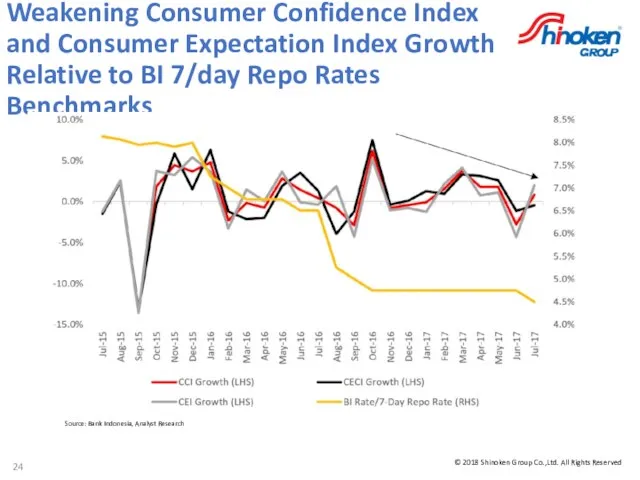

- 25. Weakening Consumer Confidence Index and Consumer Expectation Index Growth Relative to BI 7/day Repo Rates Benchmarks

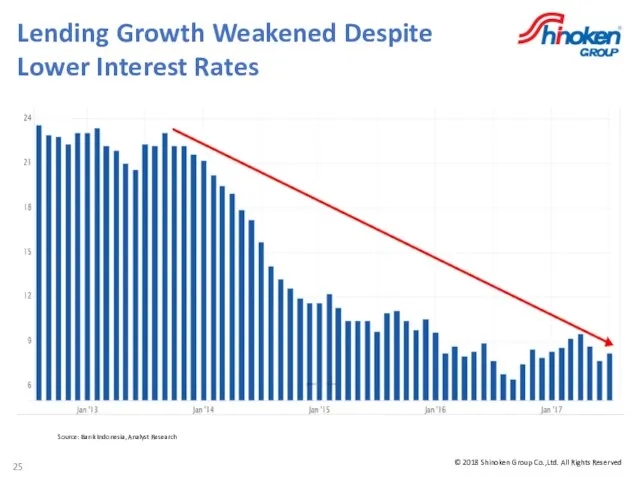

- 26. Source: Bank Indonesia, Analyst Research Lending Growth Weakened Despite Lower Interest Rates

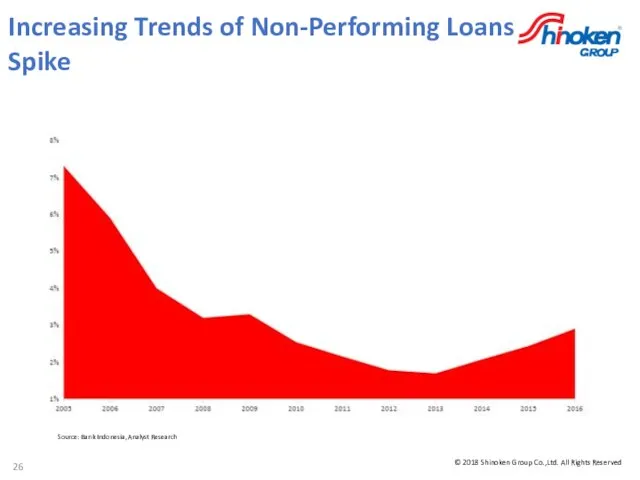

- 27. Source: Bank Indonesia, Analyst Research Increasing Trends of Non-Performing Loans Spike

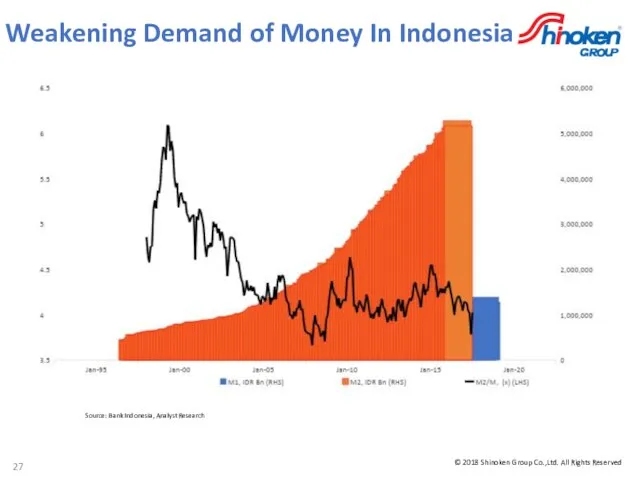

- 28. Source: Bank Indonesia, Analyst Research Weakening Demand of Money In Indonesia

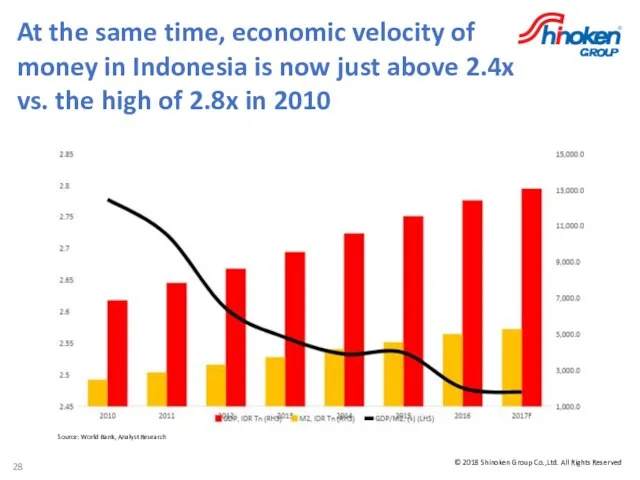

- 29. Source: World Bank, Analyst Research At the same time, economic velocity of money in Indonesia is

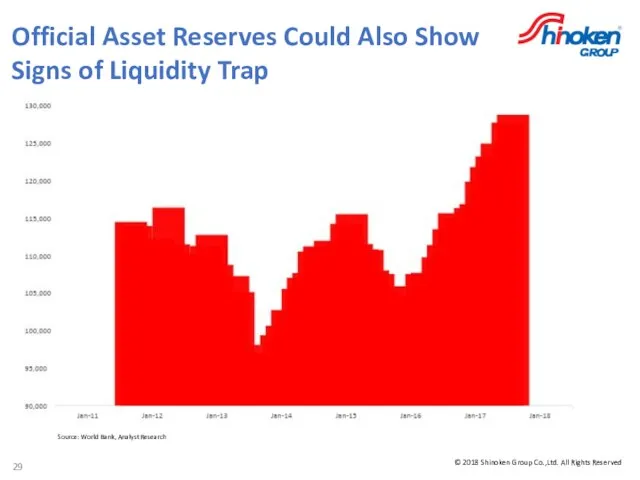

- 30. Source: World Bank, Analyst Research Official Asset Reserves Could Also Show Signs of Liquidity Trap

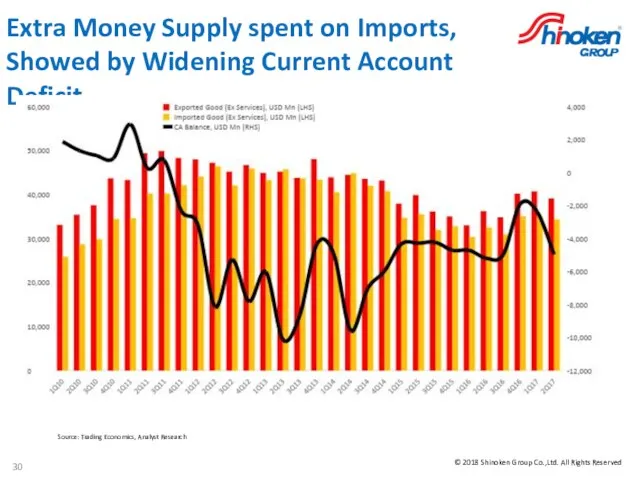

- 31. Source: Trading Economics, Analyst Research Extra Money Supply spent on Imports, Showed by Widening Current Account

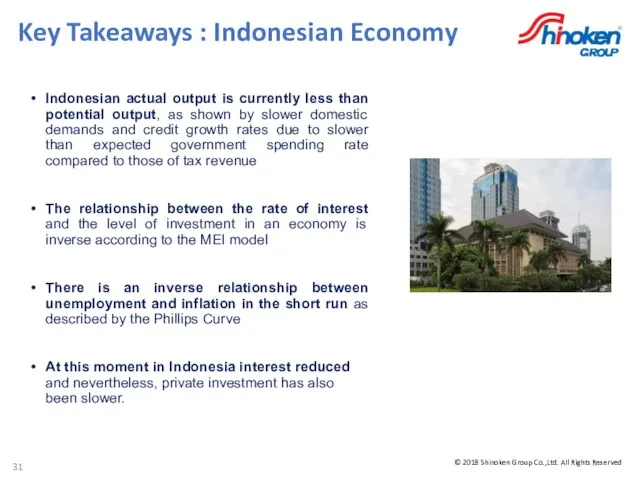

- 32. Key Takeaways : Indonesian Economy Indonesian actual output is currently less than potential output, as shown

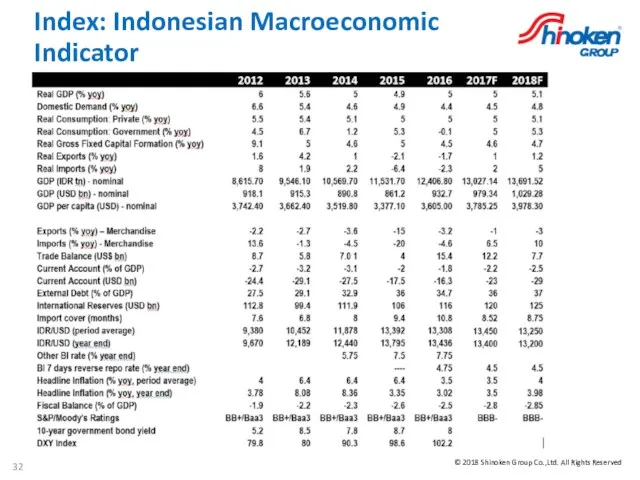

- 33. Index: Indonesian Macroeconomic Indicator

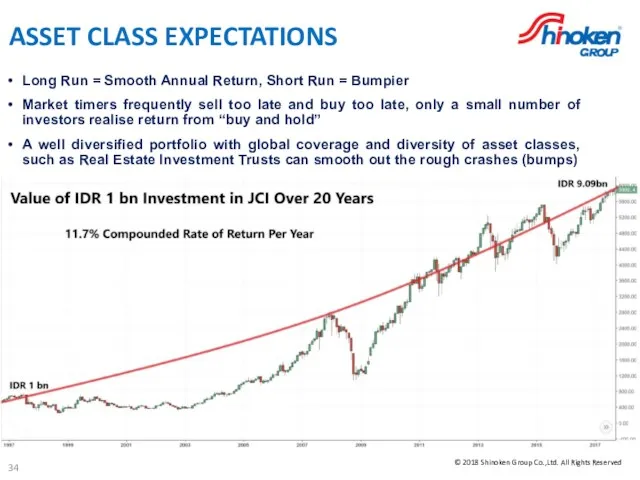

- 34. What does this mean for Investors? Lower expectations of a strong global stock market performance, including

- 35. ASSET CLASS EXPECTATIONS Long Run = Smooth Annual Return, Short Run = Bumpier Market timers frequently

- 36. Раздел 2 : Обзор Shinoken Group

- 37. Надежный партнер- Shinoken Group Shinoken Group ((TYO: 8909) is a Japanese professional services and investment management

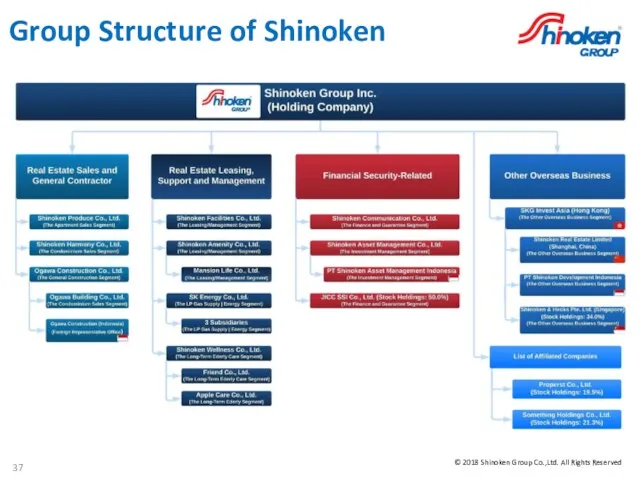

- 38. Group Structure of Shinoken

- 39. Основная деятельность Shinoken в Японии Comment: I took this from Shinoken FY17 Result English Presentation. I

- 40. Основная деятельность Shinoken в Японии Comment: I also took this from Shinoken FY17 Result English Presentation.

- 41. Опыт в организации строительства и продаже кондоминиум апартаментов высокого класса Comment: I also took this from

- 42. Бизнес по обслуживанию и сдаче в аренду апартаментов Shinoken в Японии Comment: For our REITs Products,

- 43. Присутствие Shinoken Group в Азии Comment: I have an idea to add this slide as a

- 44. Деятельность Shinoken в Индонезии осуществляется с 2005 года

- 45. Деятельность Shinoken в Индонезии Компания Shinoken начала осуществление своей деятельности в Индонезии через строительное подразделение, сформировав

- 46. Управление активами Shinoken Shinoken Group has newly established Real Estate Fund Business, Shinoken Asset Management Co.,

- 47. Управление активами Shinoken в Индонезии PT Shinoken Asset Management Indonesia (SAMI) is a subsidiary of Shinoken

- 48. Раздел 3: Инвестиционный план

- 49. Продукты наших инвестиций PT Shinoken Asset Management Indonesia (SAMI) is a “Boutique Investment Management Firm” that

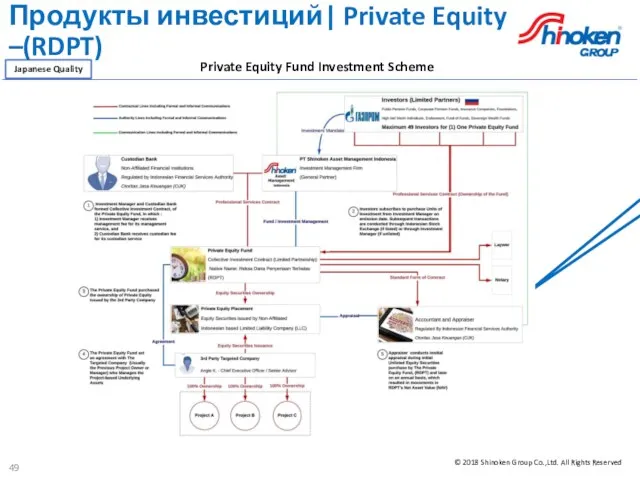

- 50. Продукты инвестиций| Private Equity –(RDPT) Private Equity Fund Investment Scheme Comment: If I may share, the

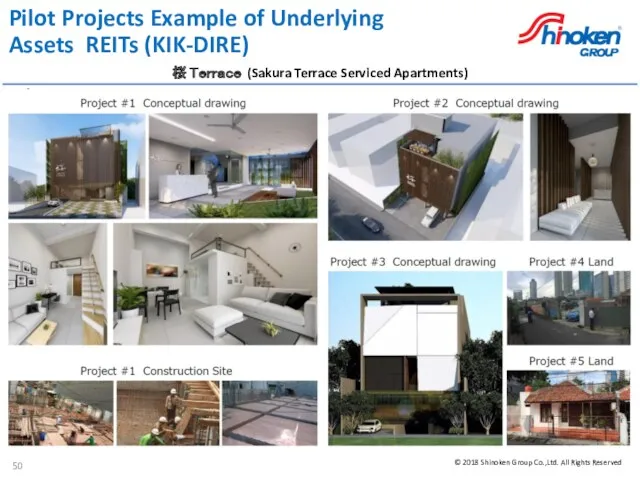

- 51. Pilot Projects Example of Underlying Assets REITs (KIK-DIRE) 桜 Terrace (Sakura Terrace Serviced Apartments)

- 52. Why REITs: Investment Rationale Behind Real Estate Investment Trusts (REITs)

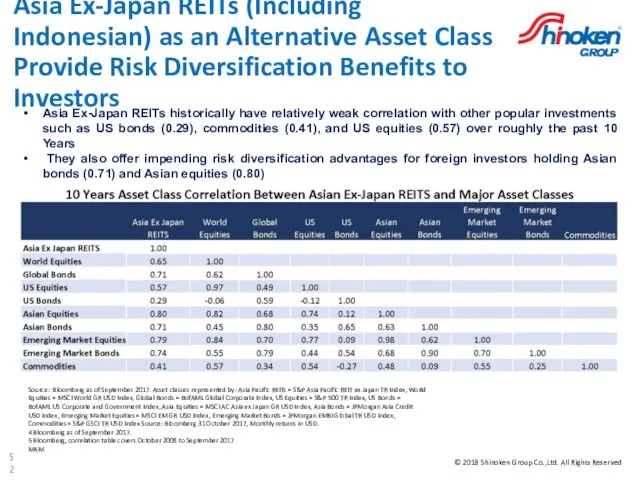

- 53. Asia Ex-Japan REITs (Including Indonesian) as an Alternative Asset Class Provide Risk Diversification Benefits to Investors

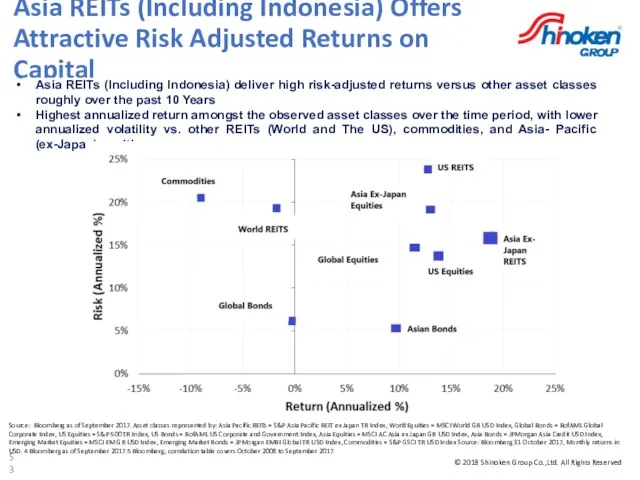

- 54. Asia REITs (Including Indonesia) Offers Attractive Risk Adjusted Returns on Capital Source: Bloomberg as of September

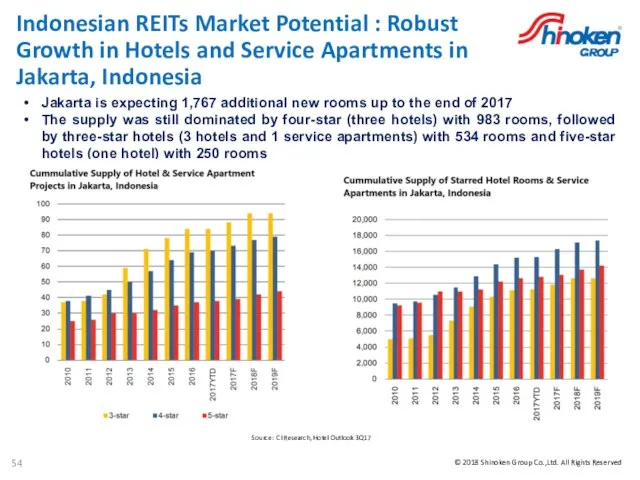

- 55. Indonesian REITs Market Potential : Robust Growth in Hotels and Service Apartments in Jakarta, Indonesia Source:

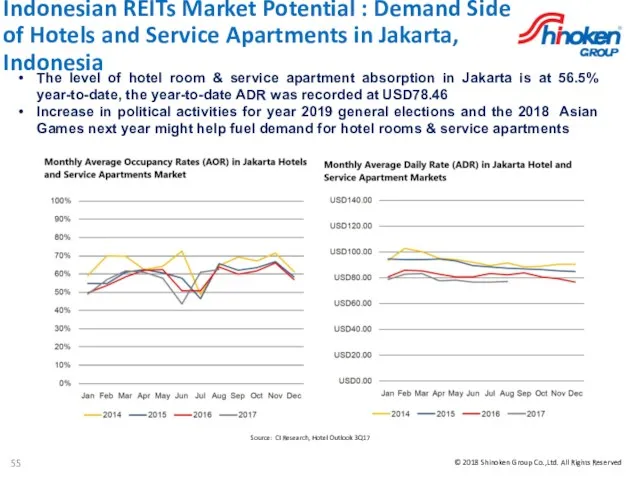

- 56. Indonesian REITs Market Potential : Demand Side of Hotels and Service Apartments in Jakarta, Indonesia Source:

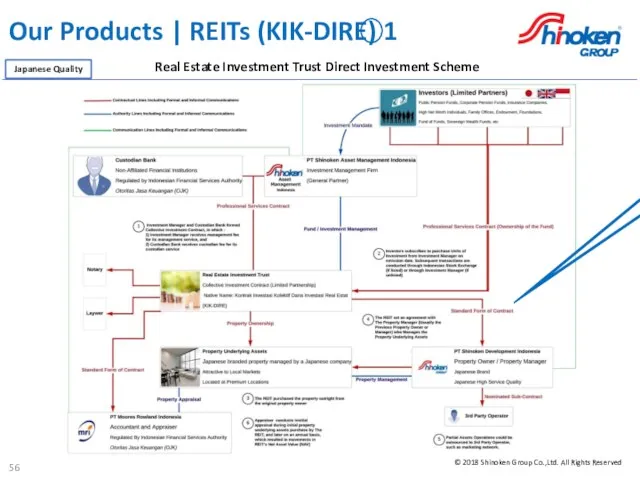

- 57. Our Products | REITs (KIK-DIRE) 1 Real Estate Investment Trust Direct Investment Scheme Comment: If I

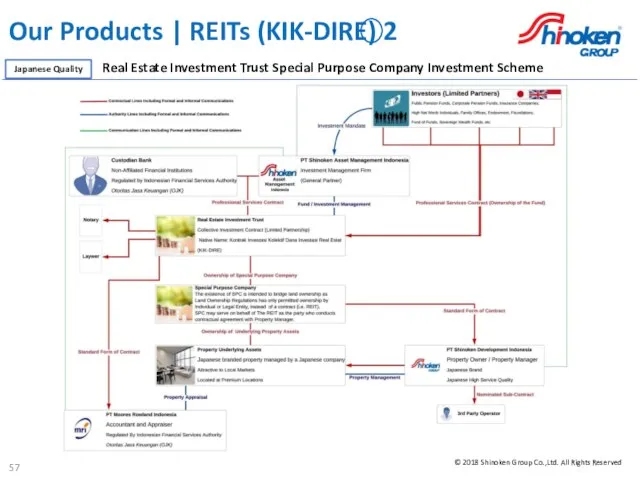

- 58. Our Products | REITs (KIK-DIRE) 2 Real Estate Investment Trust Special Purpose Company Investment Scheme Japanese

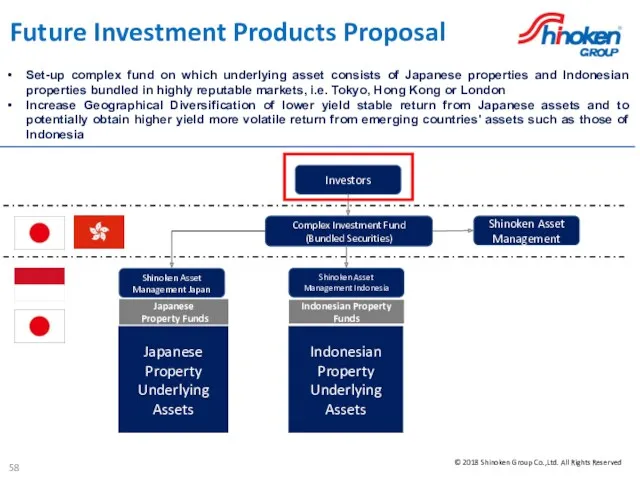

- 59. Future Investment Products Proposal Set-up complex fund on which underlying asset consists of Japanese properties and

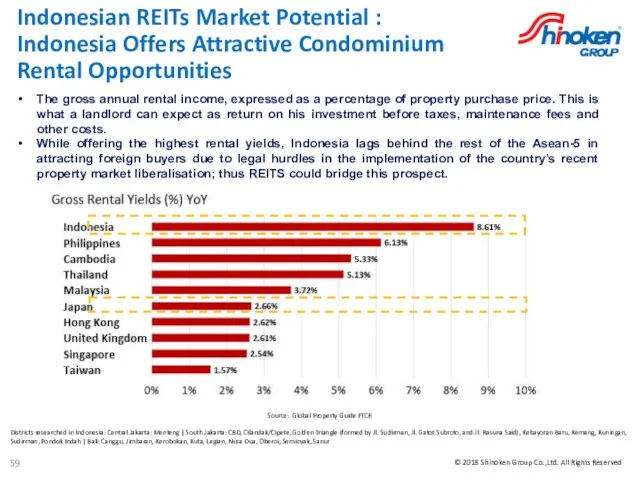

- 60. Indonesian REITs Market Potential : Indonesia Offers Attractive Condominium Rental Opportunities Source: Global Property Guide FTCR

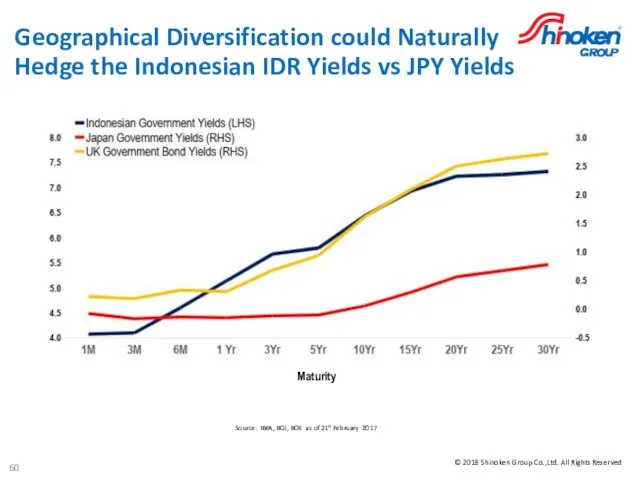

- 61. Geographical Diversification could Naturally Hedge the Indonesian IDR Yields vs JPY Yields Source: IBPA, BOJ, BOE

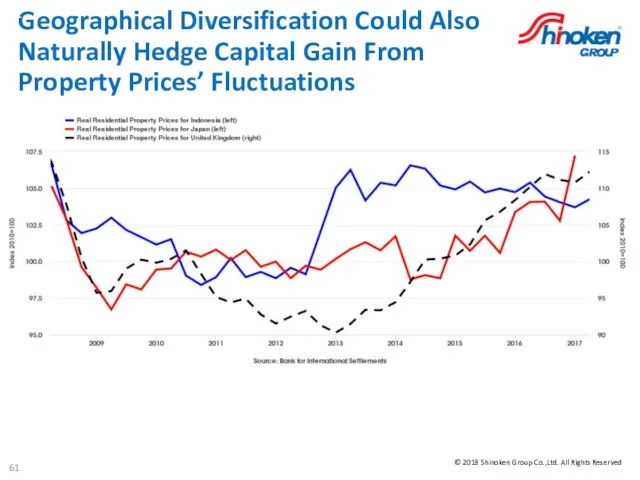

- 62. Geographical Diversification Could Also Naturally Hedge Capital Gain From Property Prices’ Fluctuations

- 63. Competitive Advantages of our Funds High Reputation in Japan The most valuable asset Shinoken has is

- 64. Competitive Advantages of our Private Equity Fund Japanese Quality Investments Shinoken Private Equity (RDPT) would have

- 65. Section 4: Distribution Details

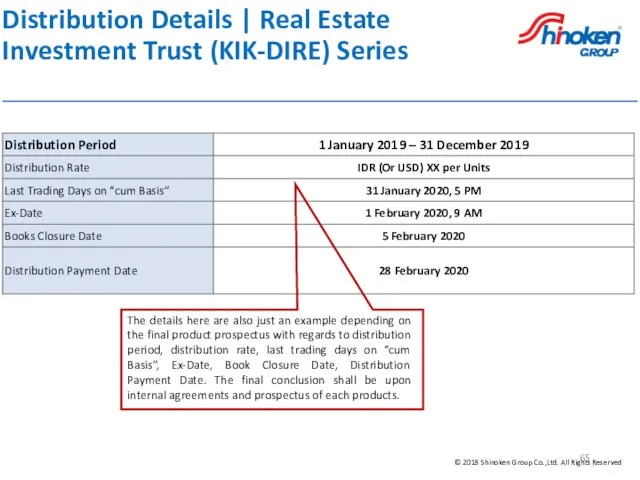

- 66. Distribution Details | Real Estate Investment Trust (KIK-DIRE) Series The details here are also just an

- 67. Section 5: Capital and Risk Management

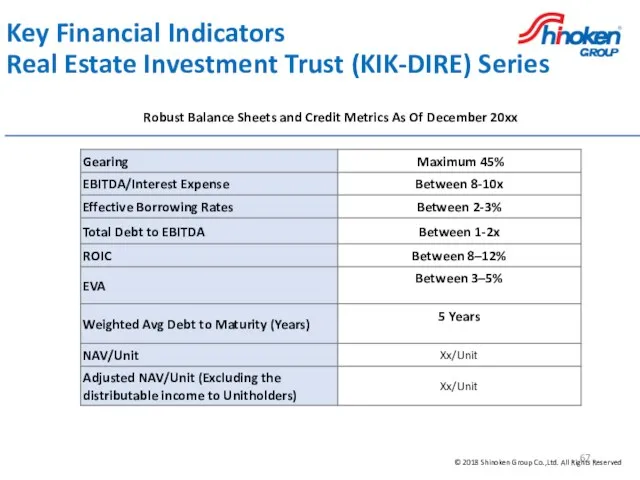

- 68. Key Financial Indicators Real Estate Investment Trust (KIK-DIRE) Series Robust Balance Sheets and Credit Metrics As

- 69. Section 6 : Appendix

- 70. Financial Services Authority (OJK) Regulations Related To REITs in Indonesia POJK 19 / POJK. 04/2016: Investment

- 71. What are REITs and What made them so popular? Bridge Property Ownership with small retail investor

- 72. The 11th Package Tax Incentives to replace MOF Reg. 200 and The Capital Gain Tax, which

- 73. The advantages of a strong REITs Market in Indonesia Unlock potential funding for the property sector,

- 74. Замечание Ценность подразделений Shinoken Residence Investment Funds и вытекающий из этого доход может как расти, так

- 76. Скачать презентацию

Виды торговли

Виды торговли Қазақстан Республикасының көтерме фирма шығындары

Қазақстан Республикасының көтерме фирма шығындары Рынки факторов производства. Лекция 5

Рынки факторов производства. Лекция 5 Особенности системы стратегического планирования в Японии

Особенности системы стратегического планирования в Японии Торгово-технологический процесс в торговле

Торгово-технологический процесс в торговле Проблема развития моногородов

Проблема развития моногородов Оборотный капитал

Оборотный капитал Фискальная политика

Фискальная политика Ақша. Шығу тарихы

Ақша. Шығу тарихы How tax cuts stimulate the economy

How tax cuts stimulate the economy Конкурентоспособность предприятия на примере филиала ОАО “Беллифт” “Беллифтмонтаж”

Конкурентоспособность предприятия на примере филиала ОАО “Беллифт” “Беллифтмонтаж” Деньги и их функции

Деньги и их функции Визуализация процесса тактического управления таможенными органами

Визуализация процесса тактического управления таможенными органами Теоретические основы регионального управления и территориального планирования

Теоретические основы регионального управления и территориального планирования Трудовые ресурсы, производительность труда

Трудовые ресурсы, производительность труда Өндірістін тиімділігін жене табыстылыгын аныктайтын шығындар

Өндірістін тиімділігін жене табыстылыгын аныктайтын шығындар Кейнсианство. Джон Мейнард Кейнс

Кейнсианство. Джон Мейнард Кейнс Қазақстанның сыртқы экономикалық саясатының мәселелері

Қазақстанның сыртқы экономикалық саясатының мәселелері Ukraina. Reforma emerytalna

Ukraina. Reforma emerytalna Внешний мир. Расходы. Отток капитала. Приток капитала

Внешний мир. Расходы. Отток капитала. Приток капитала Международная миграция рабочей силы

Международная миграция рабочей силы Процесс принятия потребителями решения о покупке

Процесс принятия потребителями решения о покупке Инфракрасный обогрев в помещении

Инфракрасный обогрев в помещении Презентация по теме Зачем нужна биржа

Презентация по теме Зачем нужна биржа Закон убывающей предельной полезности

Закон убывающей предельной полезности Сутність РФП, функції та роль в економіці. Суб’єкти та інструменти РФП, їх класифікація та характеристика. Теми 1-2

Сутність РФП, функції та роль в економіці. Суб’єкти та інструменти РФП, їх класифікація та характеристика. Теми 1-2 Структура экономики в рамках концепции устойчивого развития

Структура экономики в рамках концепции устойчивого развития Рынок. Причины возникновения рынка

Рынок. Причины возникновения рынка