Содержание

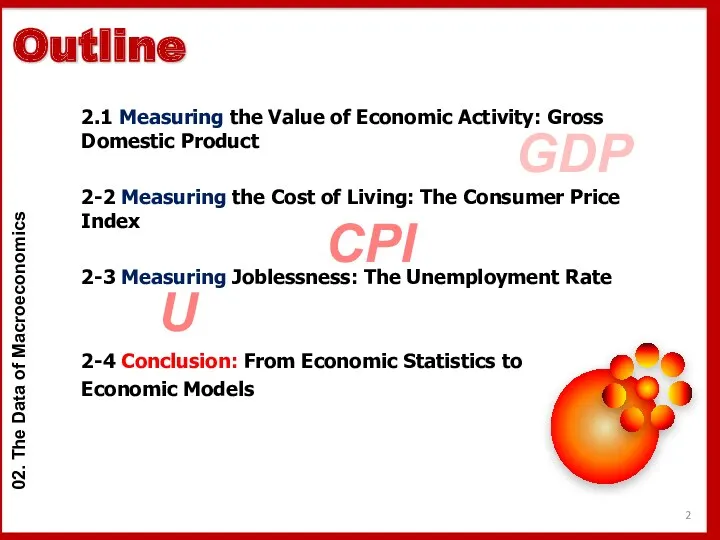

- 2. 2.1 Measuring the Value of Economic Activity: Gross Domestic Product 2-2 Measuring the Cost of Living:

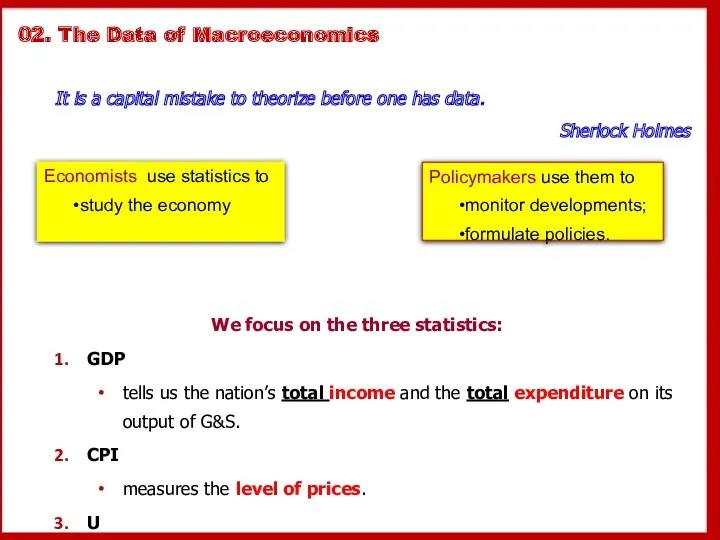

- 3. 02. The Data of Macroeconomics It is a capital mistake to theorize before one has data.

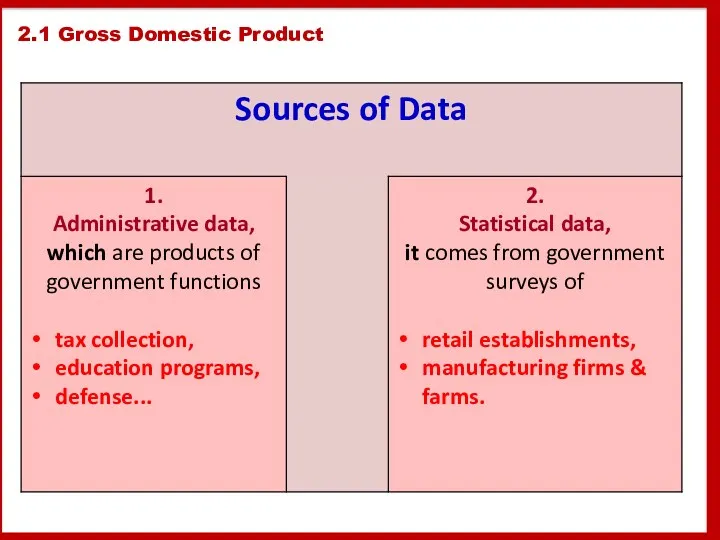

- 4. 2.1 Gross Domestic Product

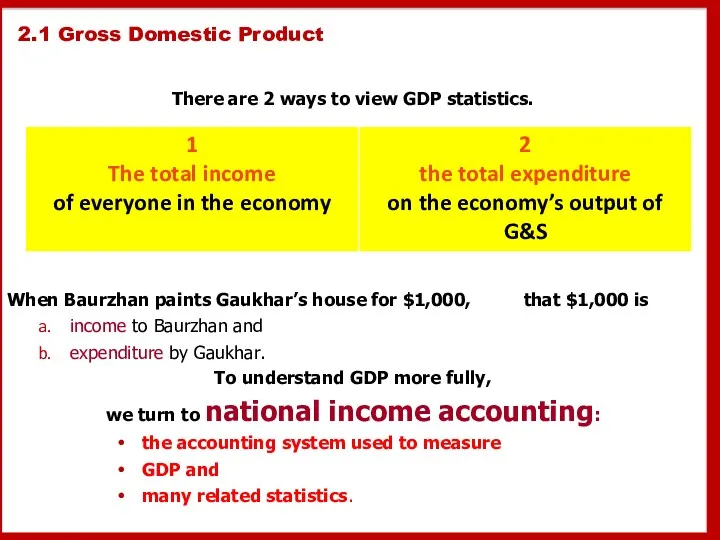

- 5. 2.1 Gross Domestic Product There are 2 ways to view GDP statistics. Income must equal expenditure.

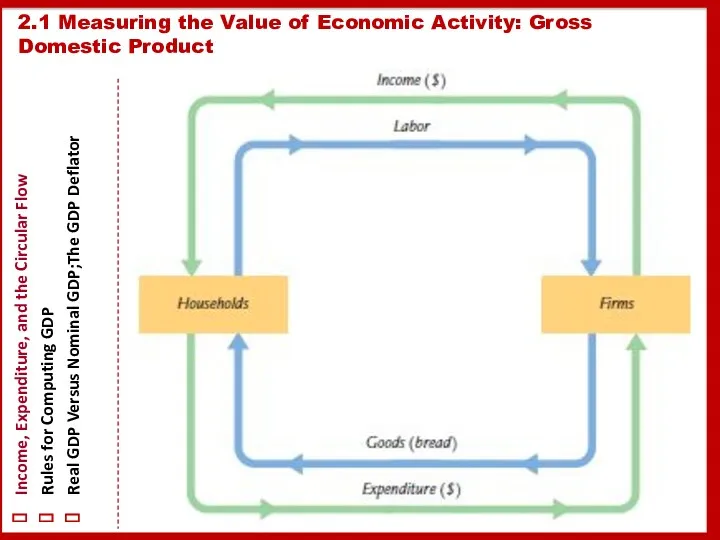

- 6. 2.1 Measuring the Value of Economic Activity: Gross Domestic Product Income, Expenditure, and the Circular Flow

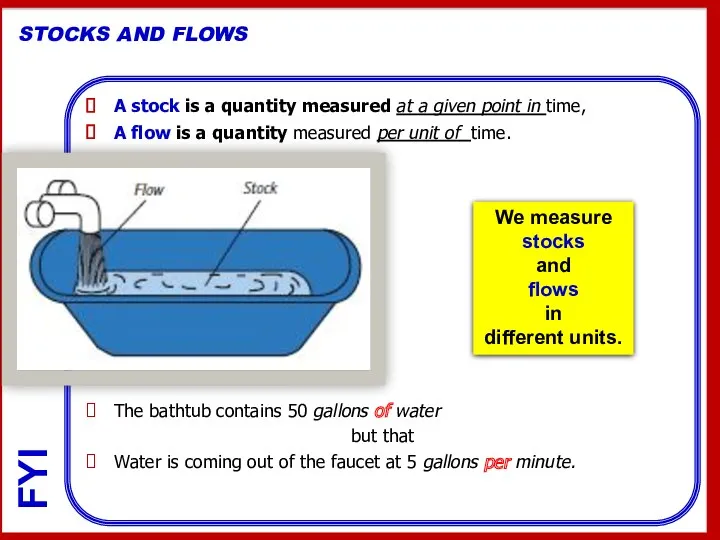

- 7. A stock is a quantity measured at a given point in time, A flow is a

- 8. A person’s wealth is a stock; his income and expenditure are flows. The number of unemployed

- 9. A person’s wealth is a stock; his income and expenditure are flows. The number of unemployed

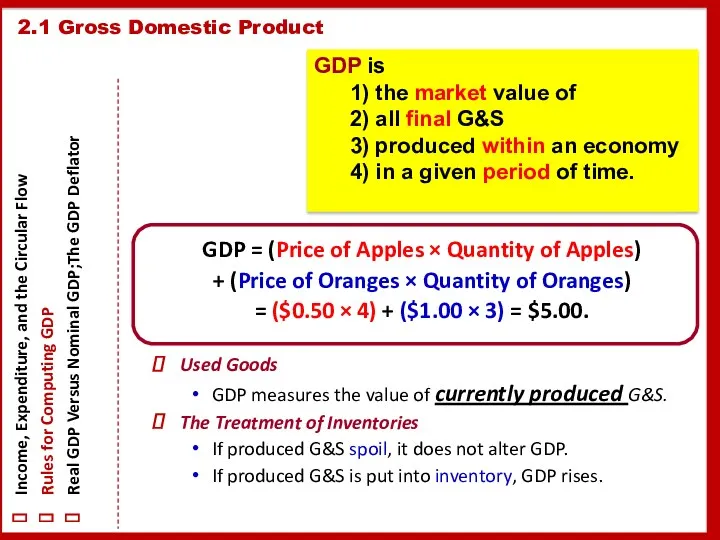

- 10. GDP = (Price of Apples × Quantity of Apples) + (Price of Oranges × Quantity of

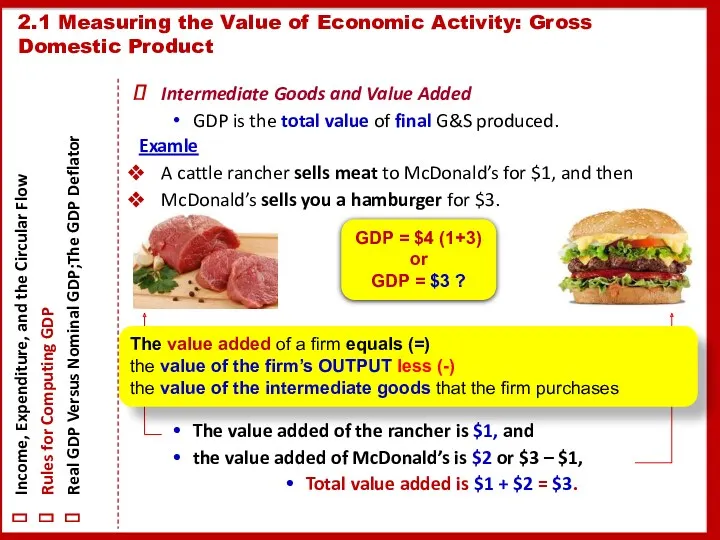

- 11. Intermediate Goods and Value Added GDP is the total value of final G&S produced. Examle A

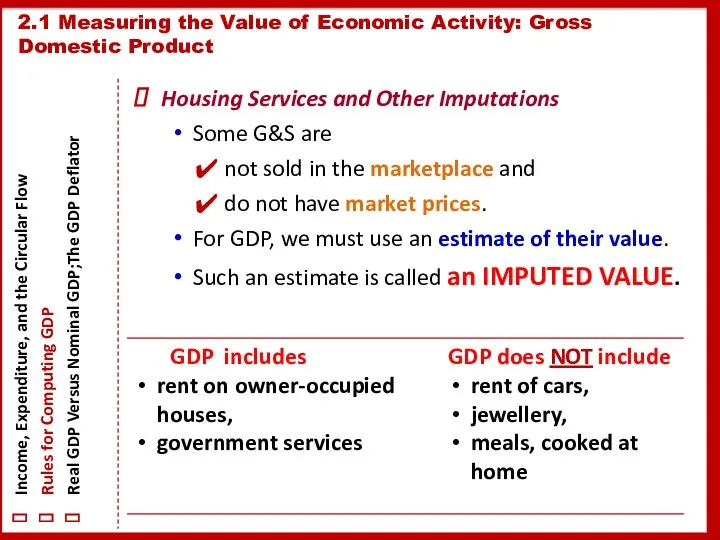

- 12. Housing Services and Other Imputations Some G&S are not sold in the marketplace and do not

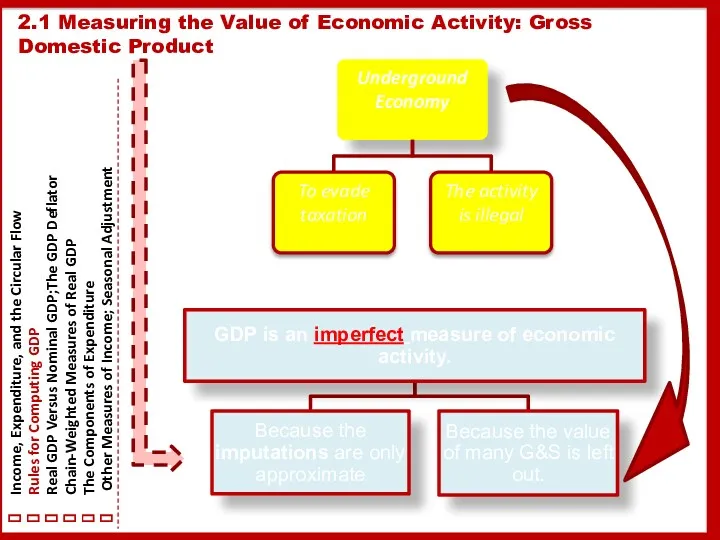

- 13. 2.1 Measuring the Value of Economic Activity: Gross Domestic Product Income, Expenditure, and the Circular Flow

- 14. The imperfections are most PROBLEMATIC when comparing standards of living across countries. The imperfections remains fairly

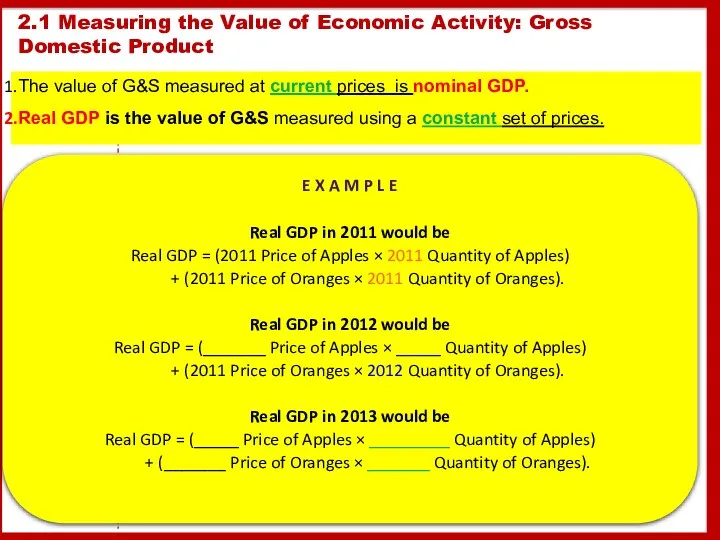

- 15. E X A M P L E Real GDP in 2011 would be Real GDP =

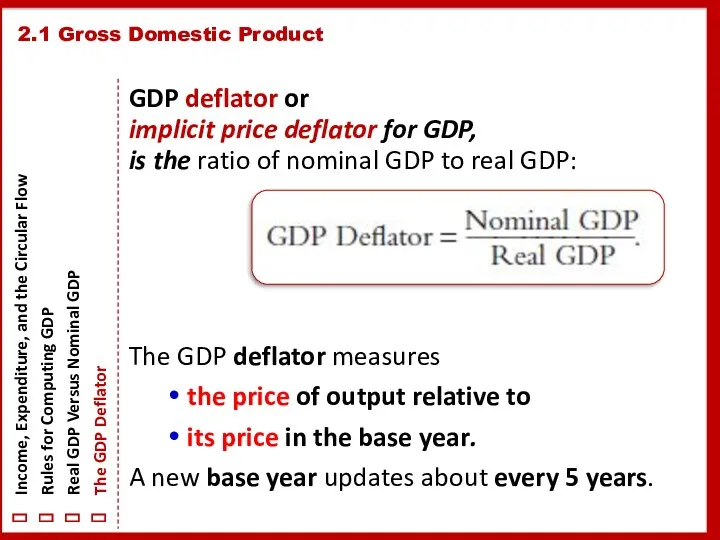

- 16. GDP deflator or implicit price deflator for GDP, is the ratio of nominal GDP to real

- 17. Chain-weighted measures of real GDP, 1995 The base year changes continuously over time. This CWM of

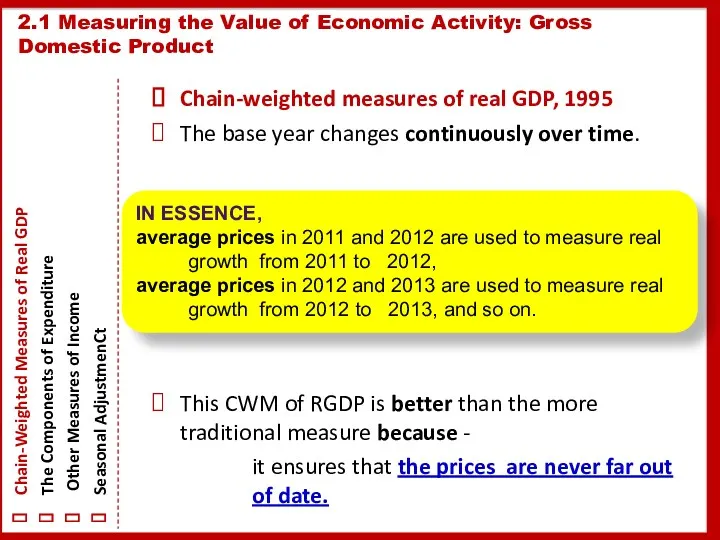

- 18. TWO ARITHMETIC TRICKS FOR WORKING WITH PERCENTAGE CHANGES growth in Y+ growth in P = 8%

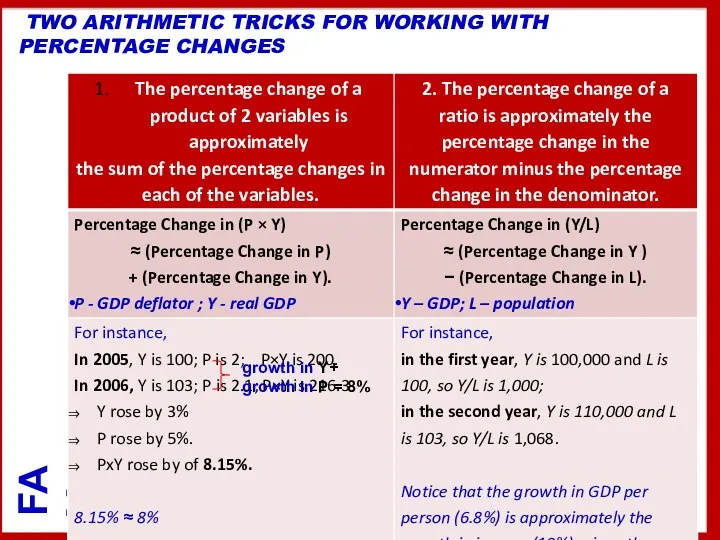

- 19. The national income accounts divide GDP into four broad categories of spending: 2.1 Gross Domestic Product

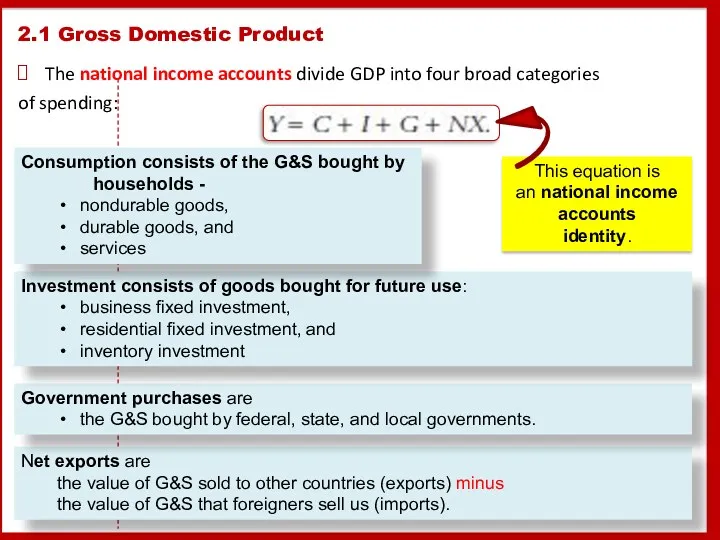

- 20. WHAT IS INVESTMENT?

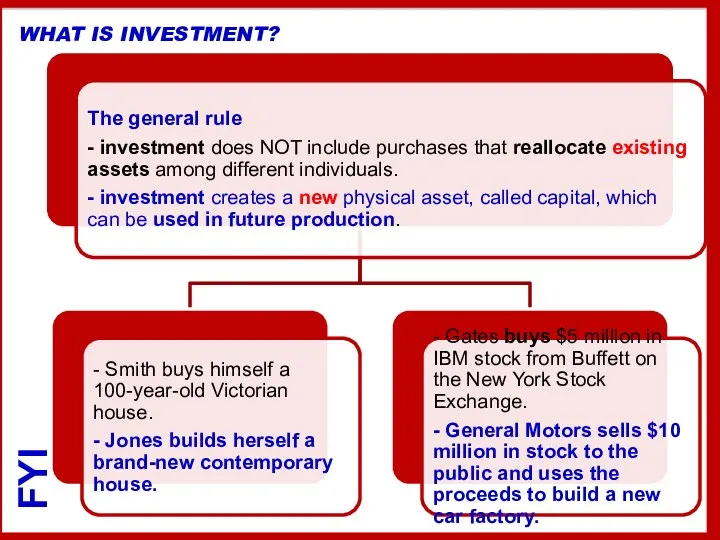

- 21. GDP AND ITS COMPONENTS

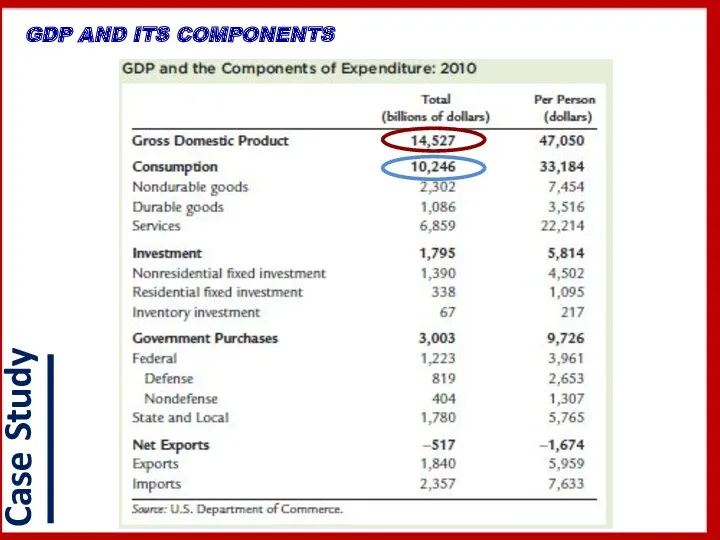

- 22. GNP Gross national product = GDP + Factor Payments from Abroad – Factor Payments to Abroad.

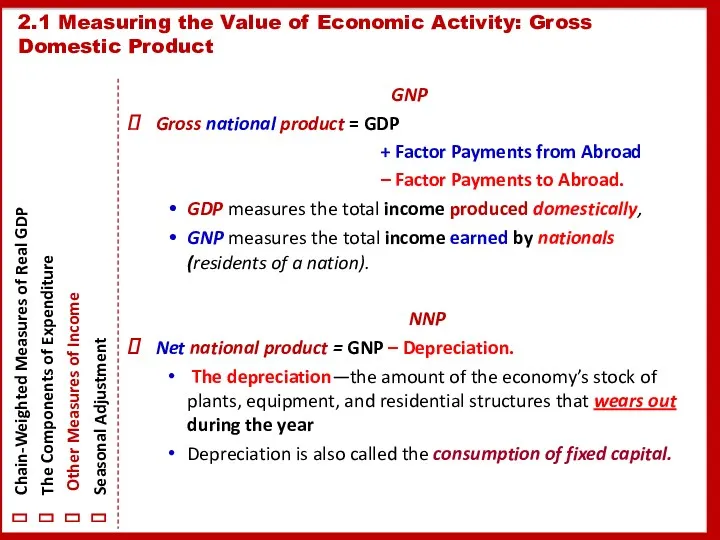

- 23. NI national income ≈NNP They two differ by a small correction called the statistical discrepancy, which

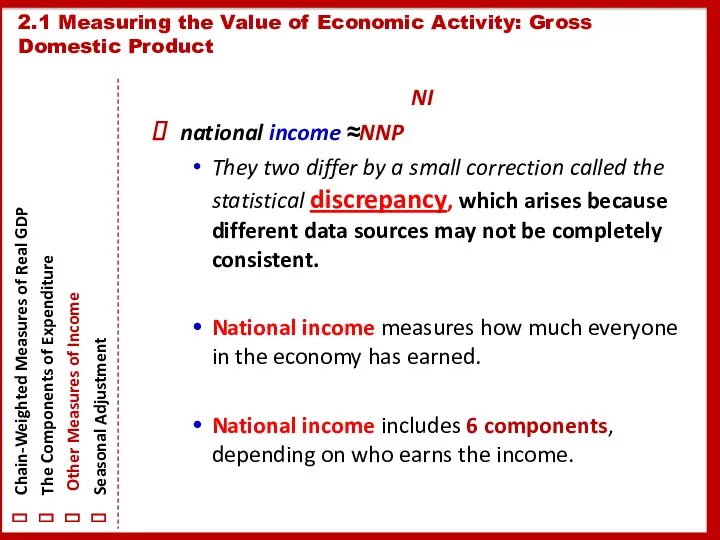

- 24. I - Workers 1 Compensation of employees (63%). II -Firms 2 Corporate profits (14%). The income

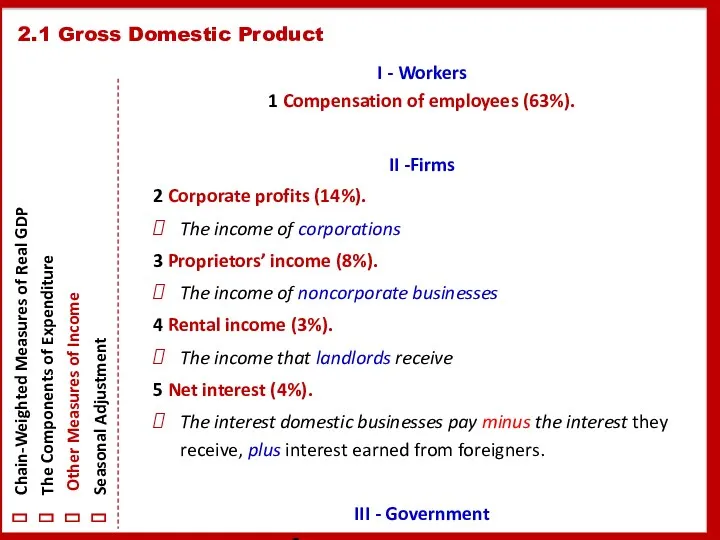

- 25. Personal Income = National Income − Indirect Business Taxes − Corporate Profits + Dividends − Social

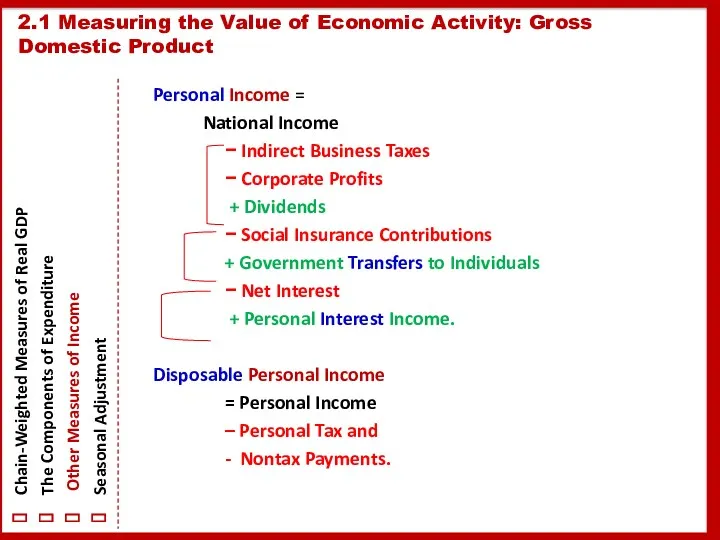

- 26. Most of the economic statistics reported in the newspaper are seasonally adjusted. This means that the

- 27. The increase in the overall level of prices, called inflation. The most commonly used measure of

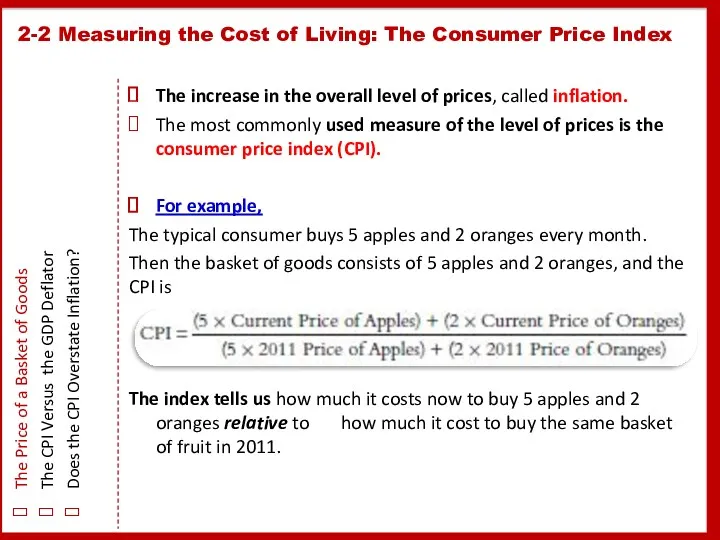

- 28. The PRODUCER price index, a typical basket of goods bought by firms. price indexes for SPECIFIC

- 29. GDP deflator measures the prices of All G&S produced includes only those goods produced domestically assigns

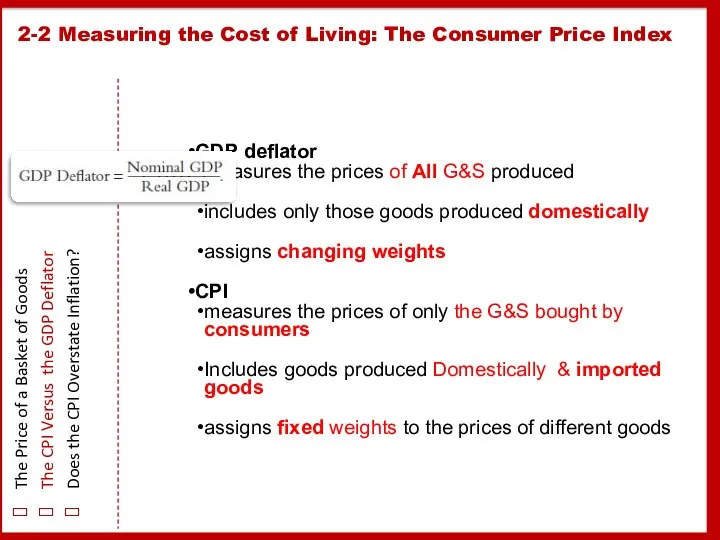

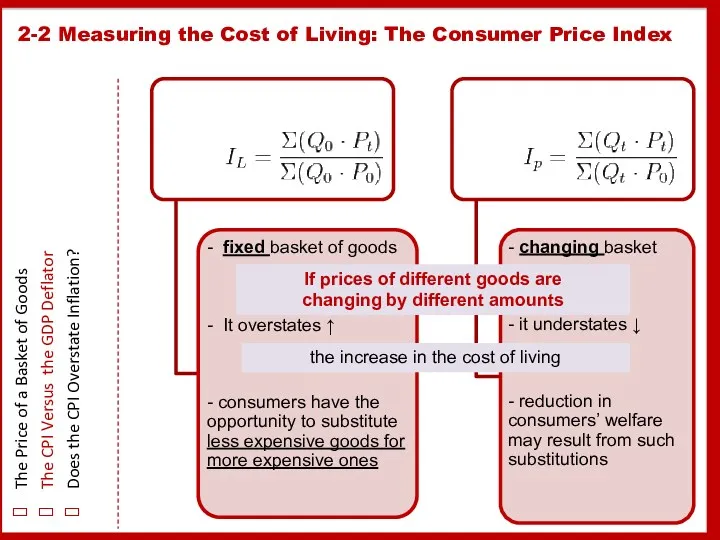

- 30. The GDP Deflator and the CPI This figure shows the % change in the GDP deflator

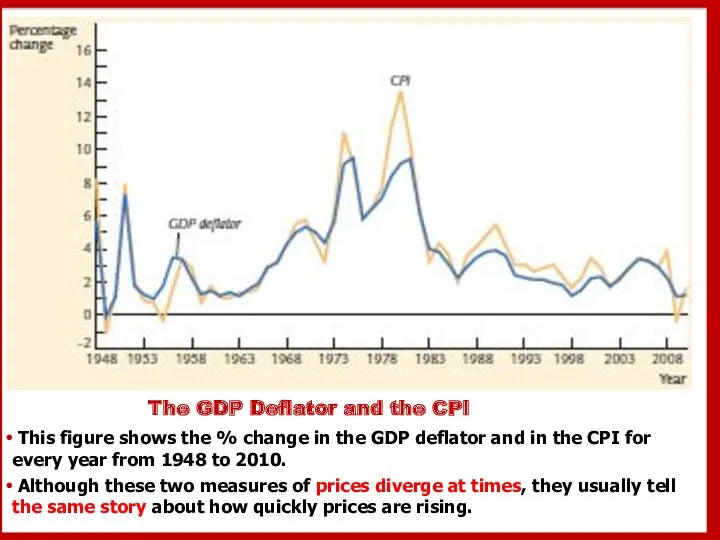

- 31. 2-2 Measuring the Cost of Living: The Consumer Price Index The Price of a Basket of

- 32. Why the CPI Overstate Inflation? One problem is the substitution bias we have already discussed. A

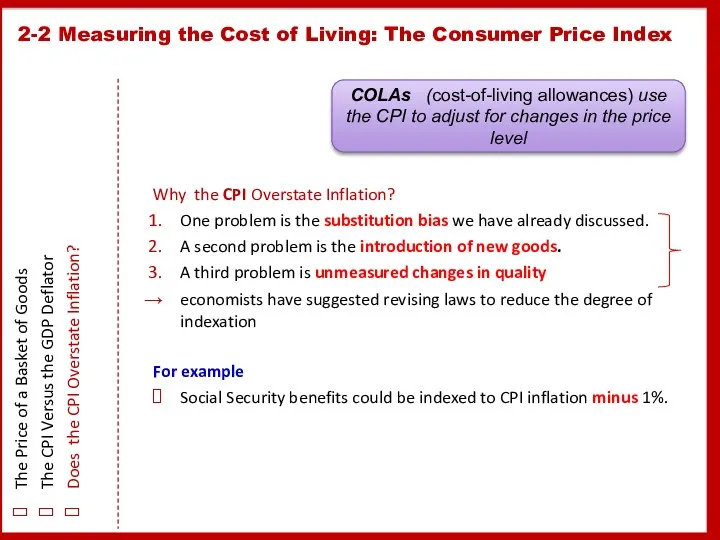

- 33. Cavallo and Rigobon collect data on the prices charged by ONLINE retailers. From their offices in

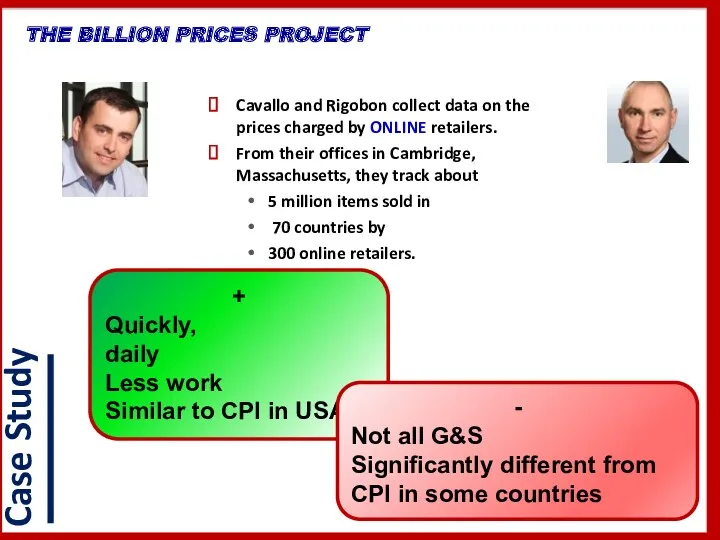

- 34. The unemployment rate is the statistic that measures the % of those people wanting to work

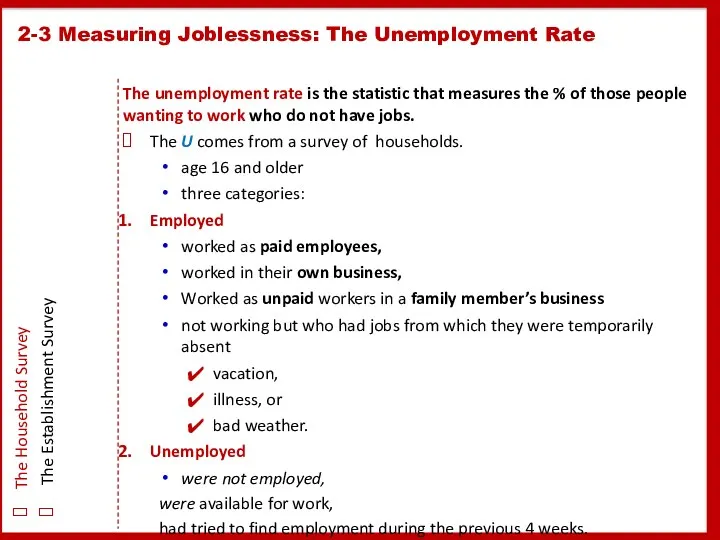

- 35. Who wants a job but has given up looking—a discouraged worker— is counted as not being

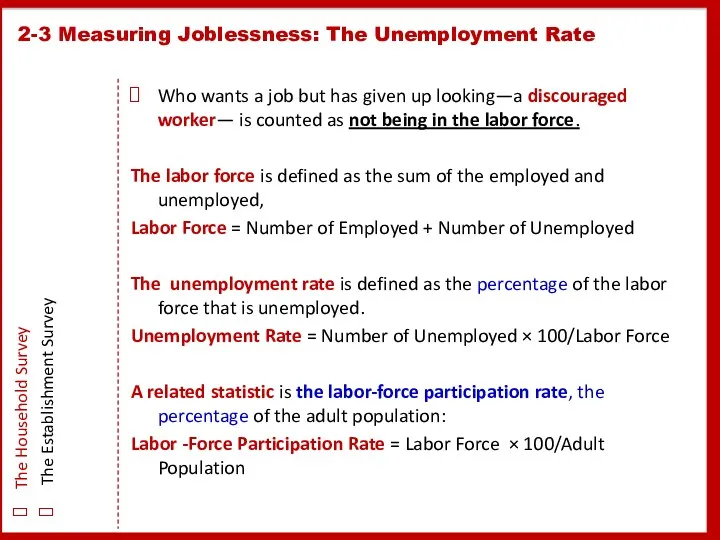

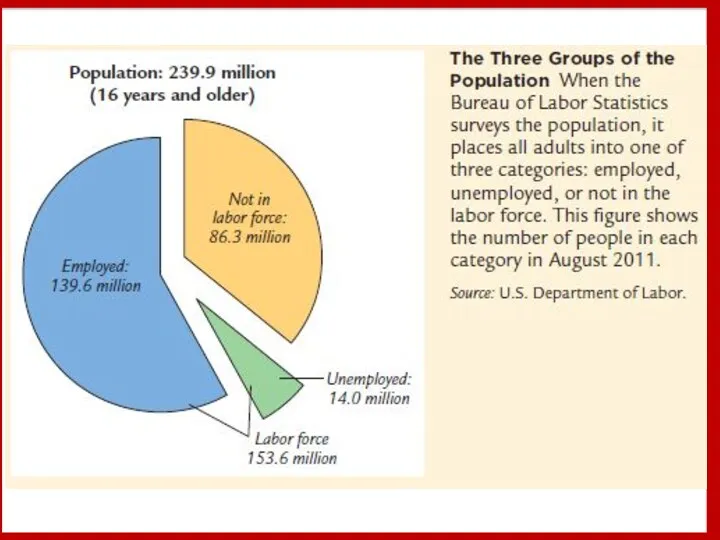

- 37. TRENDS IN LABOR-FORCE PARTICIPATION Labor-Force Participation. Over the past several decades, the labor-force participation rate for

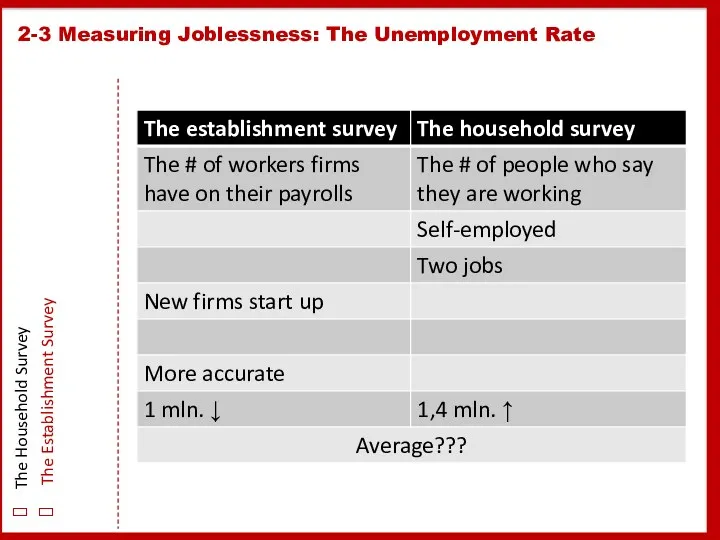

- 38. 2-3 Measuring Joblessness: The Unemployment Rate The Household Survey The Establishment Survey

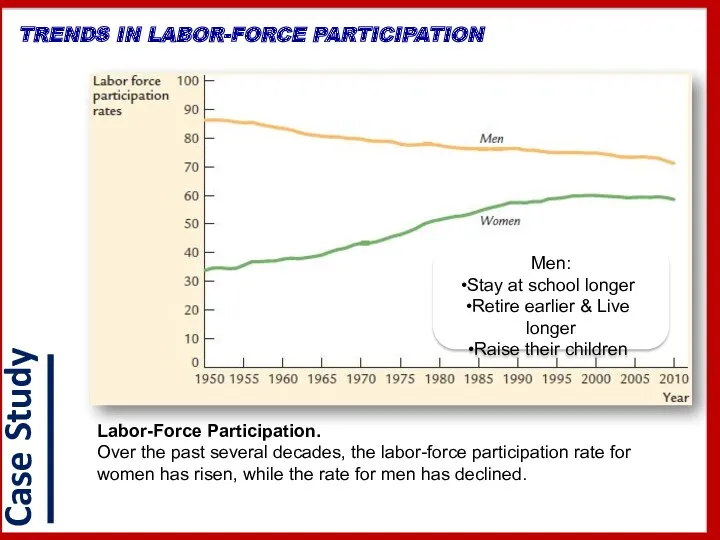

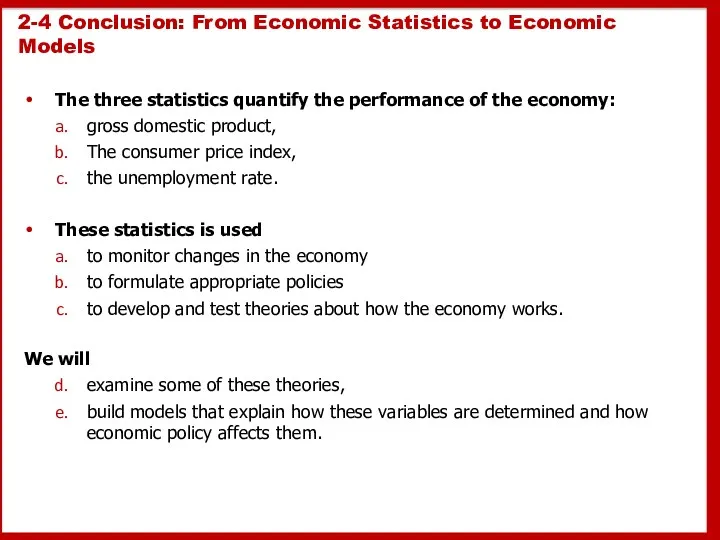

- 39. 2-4 Conclusion: From Economic Statistics to Economic Models The three statistics quantify the performance of the

- 41. Скачать презентацию

Моделирование прогнозных сценариев регионального развития

Моделирование прогнозных сценариев регионального развития Халықаралық экономикалық қатынастар

Халықаралық экономикалық қатынастар Курганская область

Курганская область The business analysis, planning and monitoring. (Сhapter 2)

The business analysis, planning and monitoring. (Сhapter 2) Диагностика конкурентоспособности страны и конкурентной среды в отрасли

Диагностика конкурентоспособности страны и конкурентной среды в отрасли Международная миграция рабочей силы

Международная миграция рабочей силы Політична економія як фундаментальна суспільна наука

Політична економія як фундаментальна суспільна наука Концепция развития международного грузопассажирского аэропорта федерального значения Ярославль (Туношна)

Концепция развития международного грузопассажирского аэропорта федерального значения Ярославль (Туношна) Финансовые модели и оценка бизнеса

Финансовые модели и оценка бизнеса Рынок труда. Обществознание 11 класс

Рынок труда. Обществознание 11 класс Рыночная конкуренция. (Тема 6)

Рыночная конкуренция. (Тема 6) Цифровая экономика в металлургической промышленности: реальность и перспективы

Цифровая экономика в металлургической промышленности: реальность и перспективы Американдық қанағаттану индексі

Американдық қанағаттану индексі Понятие, сущность логистики внешнеэкономической деятельности. Тема 1

Понятие, сущность логистики внешнеэкономической деятельности. Тема 1 Європейський Союз. Хронологія творення. (Лекція 2)

Європейський Союз. Хронологія творення. (Лекція 2) Облік малоцінних та швидкозношувальніх предметів в сучасних умовах

Облік малоцінних та швидкозношувальніх предметів в сучасних умовах Спрос, предложение и рыночное равновесие

Спрос, предложение и рыночное равновесие Цифровая экономика, понятие, перспективы, тенденции развития в РФ

Цифровая экономика, понятие, перспективы, тенденции развития в РФ Kościół Katolicki wobec integracji Polski z UE

Kościół Katolicki wobec integracji Polski z UE Теория отраслевых рынков

Теория отраслевых рынков Влияние кризиса 2014-2015 на экономику РФ

Влияние кризиса 2014-2015 на экономику РФ Ринок праці. Лекція 8

Ринок праці. Лекція 8 Денежно-кредитная политика

Денежно-кредитная политика Impact of 2013 banking crisis in Republic of Cyprus on national economy

Impact of 2013 banking crisis in Republic of Cyprus on national economy Альтернативные источники энергии

Альтернативные источники энергии Анализ факторов, влияющих на стоимость геодезических работ

Анализ факторов, влияющих на стоимость геодезических работ Развитие экологического туризма в Республике Казахстан

Развитие экологического туризма в Республике Казахстан Розрахунок економічної ефективності автоматизації процесу екстракції у виробництві олії

Розрахунок економічної ефективності автоматизації процесу екстракції у виробництві олії