Содержание

- 2. Recent Developments: Attribution of profits to Permanent Establishments Revision of Chapters I-III of the Transfer Pricing

- 3. 1. ATTRIBUTION OF PROFITS TO PERMANENT ESTABLISHMENTS www.oecd.org/ctp/tp/pe

- 4. In July 2008, the OECD Council approved the final Report on the Attribution of Profits to

- 5. 2. PROPOSED REVISION OF CHAPTERS I-III OF THE TRANSFER PRICING GUIDELINES www.oecd.org/ctp/tp/cpm

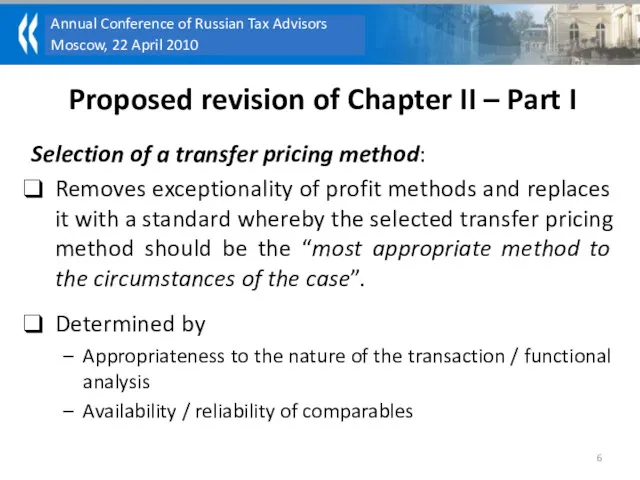

- 6. Proposed revision of Chapter II – Part I Selection of a transfer pricing method: Removes exceptionality

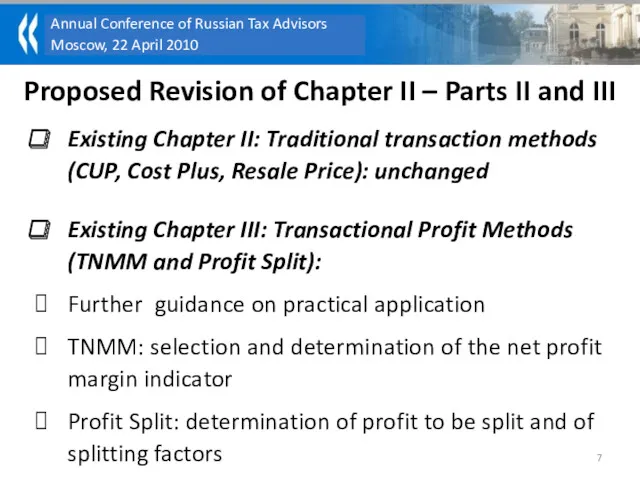

- 7. Proposed Revision of Chapter II – Parts II and III Existing Chapter II: Traditional transaction methods

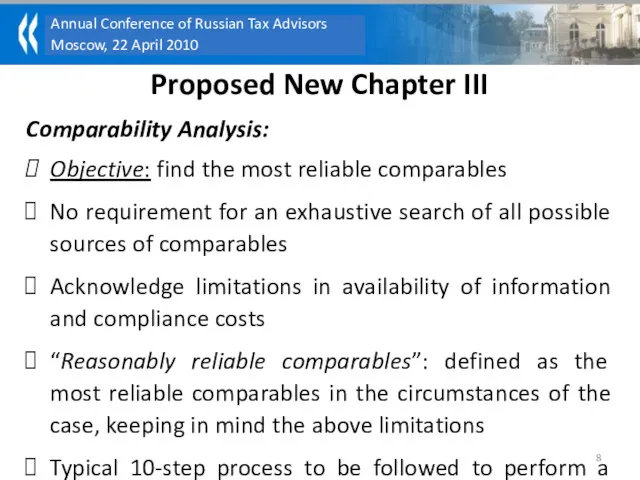

- 8. Proposed New Chapter III Comparability Analysis: Objective: find the most reliable comparables No requirement for an

- 9. Non-domestic comparables should not be automatically rejected Foreign comparables

- 10. Use of secret comparables discouraged Exception: in Mutual Agreement Procedures do eliminate double taxation Secret comparables

- 11. Arm’s length range and statistical tools In some cases it will be possible to arrive at

- 12. Arm’s length range and statistical tools If comparability defects remain that cannot be identified and/or quantified,

- 13. Loss-making comparables Not systematically rejected Case-by-case (risk profile in particular) Independent enterprise would not continue loss-making

- 14. 3 New Annexes Practical illustration of issues in relation to the application of transactional profit methods

- 15. 3. TRANSFER PRICING ASPECTS OF BUSINESS RESTRUCTURINGS www.oecd.org/ctp/tp/br

- 16. Relevance of the issue: Tax base erosion concern for certain countries Uncoordinated reactions by governments, for

- 17. Definition of business restructurings: “Cross-border redeployment (transfer) by a multinational enterprise of functions, assets and/or risks

- 18. OECD Discussion Draft consists of 4 Issues Notes: Special Consideration for Risks Arm’s Length Compensation for

- 19. The consultation process 37 detailed contributions received from the public (see ww.oecd.org/ctp/tp/br) Consultation with commentators held

- 20. Some good progress ! More consensus than non-consensus Starting point is not abusive cases Multinational Enterprises

- 21. Some good progress ! Profit potential not an asset: decrease of Profit Potential not a taxable

- 22. Way forward Business comments identified areas for further work (while generally recognising that OECD draft was

- 23. Way forward WP6 meetings of March 2010 and June 2010. Objective to finalise 2nd half of

- 24. 4. NEXT TOPIC FOR CONSIDERATION (2011-2012): INTANGIBLES?

- 25. Transfer Pricing Apects of Intangibles Current guidance: Chapters VI and VIII of the TP Guidelines Emerging

- 27. Скачать презентацию

Основы организации труда на предприятии

Основы организации труда на предприятии Національна економіка України

Національна економіка України Influence of tourism industry on the economy of UK

Influence of tourism industry on the economy of UK Республика Таджикистан Бедность и окружающая среда

Республика Таджикистан Бедность и окружающая среда Отраслевая и территориальная структура мирового хозяйства

Отраслевая и территориальная структура мирового хозяйства Droga Polski do Unii Europejskiej

Droga Polski do Unii Europejskiej Инфляция и ее социальные последствия. Тема 6.4

Инфляция и ее социальные последствия. Тема 6.4 Бизнес-модели основных секторов инновационной экономики

Бизнес-модели основных секторов инновационной экономики Ассортиментная политика, как элемент конкурентной стратегии организации общественного питания и направления ее совершенствования

Ассортиментная политика, как элемент конкурентной стратегии организации общественного питания и направления ее совершенствования Экономический кризис

Экономический кризис Краснодарский край. Социально-экономический аспект

Краснодарский край. Социально-экономический аспект Экономический цикл и экономический рост

Экономический цикл и экономический рост Планирование и прогнозирование динамики финансовой сферы экономики

Планирование и прогнозирование динамики финансовой сферы экономики Становление и сущность мирового хозяйства. (Лекция 1)

Становление и сущность мирового хозяйства. (Лекция 1) GDP measurement and national accounts

GDP measurement and national accounts Условия совершенной конкуренции

Условия совершенной конкуренции Международная торговля результатами интеллектуальной деятельности

Международная торговля результатами интеллектуальной деятельности Macroeconomic control of innovation activity, change of leader, vector of change

Macroeconomic control of innovation activity, change of leader, vector of change Семейная экономика

Семейная экономика Моделирование равновесия фирмы при различных типах рыночных структур. Чистая монополия

Моделирование равновесия фирмы при различных типах рыночных структур. Чистая монополия Экономическая и социальная политика государства

Экономическая и социальная политика государства Вопросы по экономике

Вопросы по экономике Опис Компанії 浙江金蛋科技有限公司

Опис Компанії 浙江金蛋科技有限公司 Всероссийская научно-практическая конференция студентов и молодых ученых Актуальные проблемы экономической теории

Всероссийская научно-практическая конференция студентов и молодых ученых Актуальные проблемы экономической теории Қазақстандағы кедейшіліктің негізгі ерекшеліктері, себептері және мүмкін бола алатын сардаптары

Қазақстандағы кедейшіліктің негізгі ерекшеліктері, себептері және мүмкін бола алатын сардаптары Фискальная политика

Фискальная политика Производство, как материальная основа экономики

Производство, как материальная основа экономики ЕГЭ по Обществознанию.Экономика

ЕГЭ по Обществознанию.Экономика