Содержание

- 2. Let’s review our voyage to date: We have analyzed: Measuring economic activity Aggregate production functions and

- 3. What picture do you have in mind when you think of business cycles? “Note that the

- 4. Understanding business cycles Major elements of cycles short-period (1-3 yr) erratic fluctuations in output pro-cyclical movements

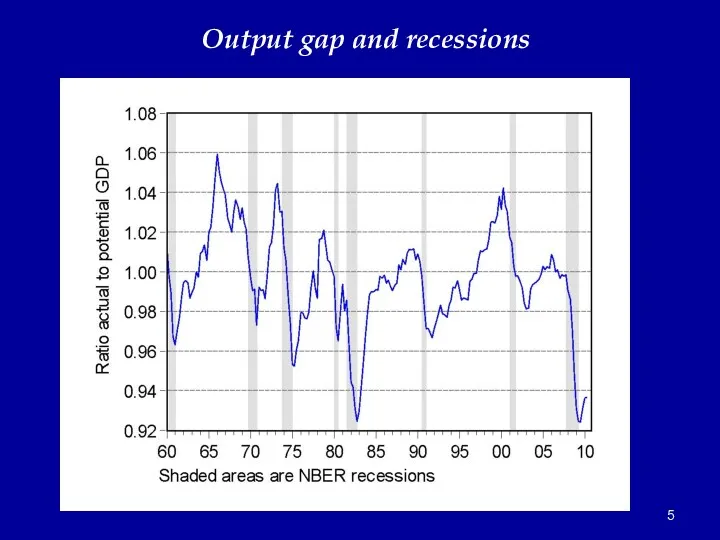

- 5. Output gap and recessions

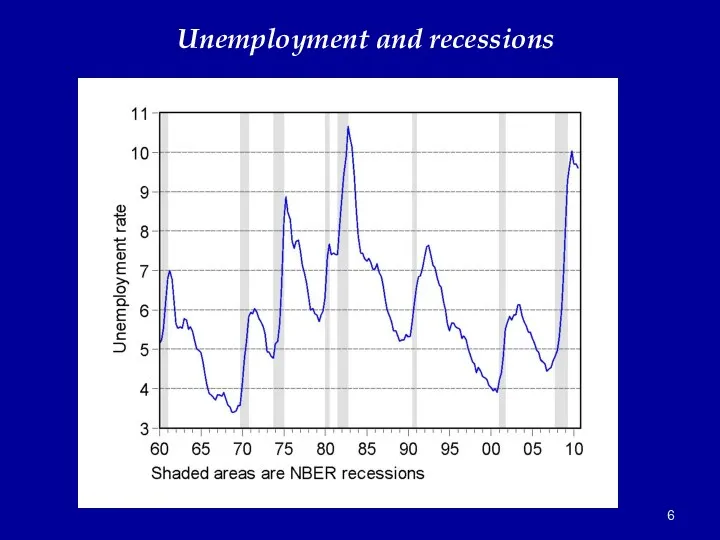

- 6. Unemployment and recessions

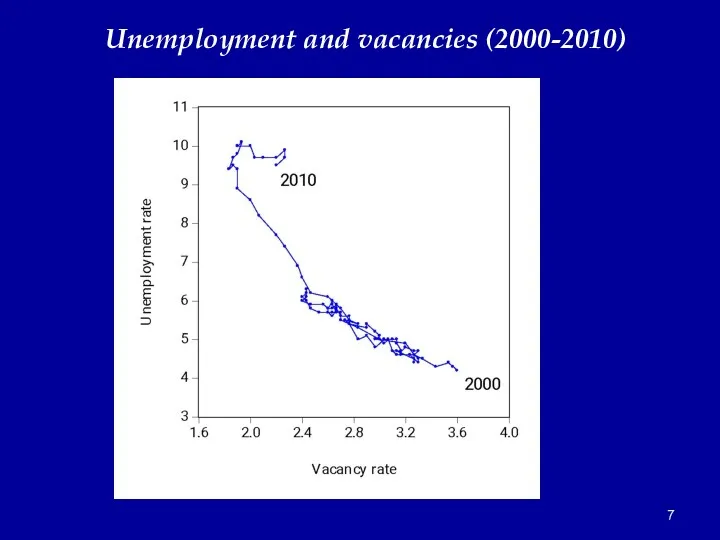

- 7. Unemployment and vacancies (2000-2010)

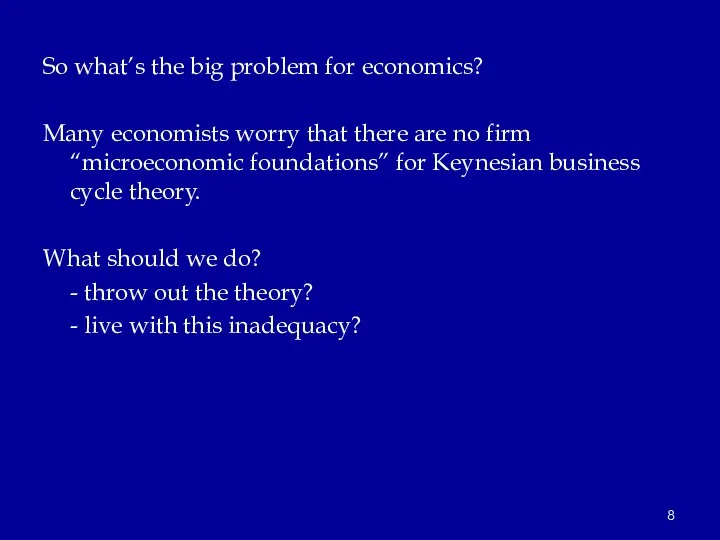

- 8. So what’s the big problem for economics? Many economists worry that there are no firm “microeconomic

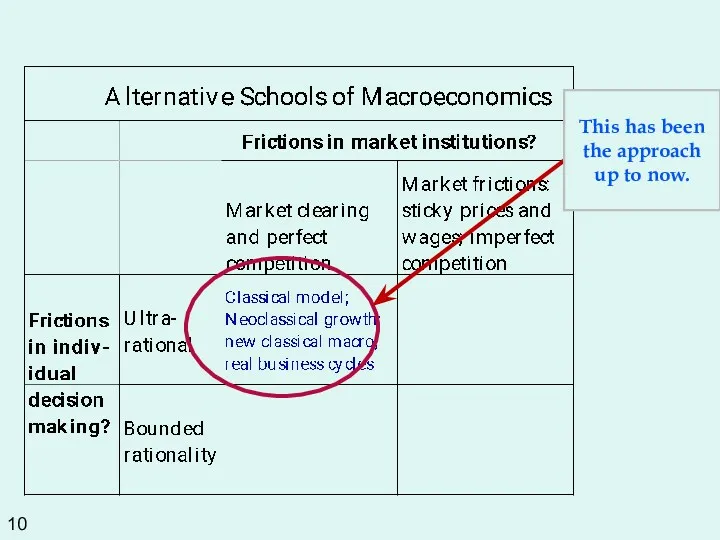

- 10. This has been the approach up to now.

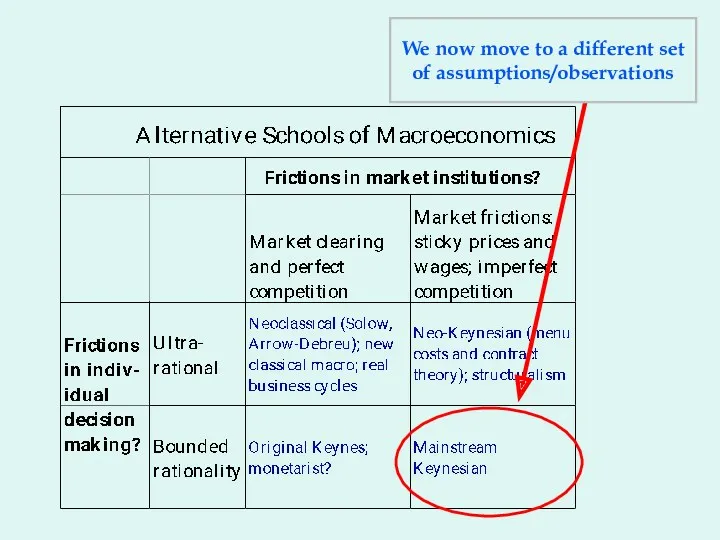

- 11. We now move to a different set of assumptions/observations

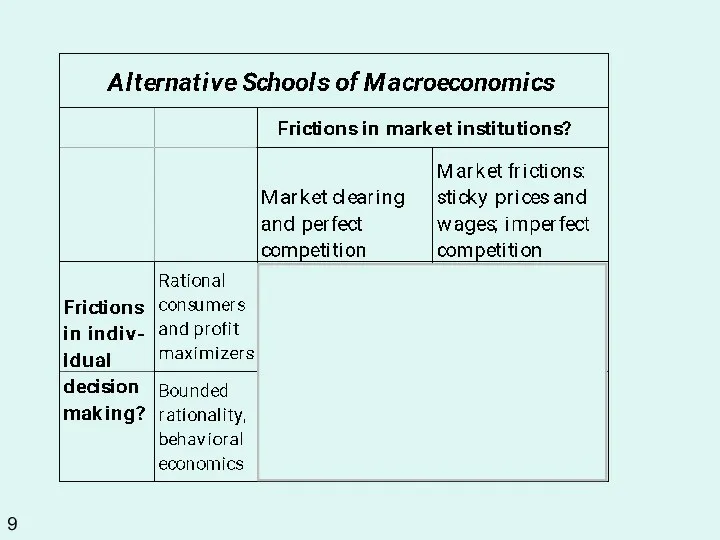

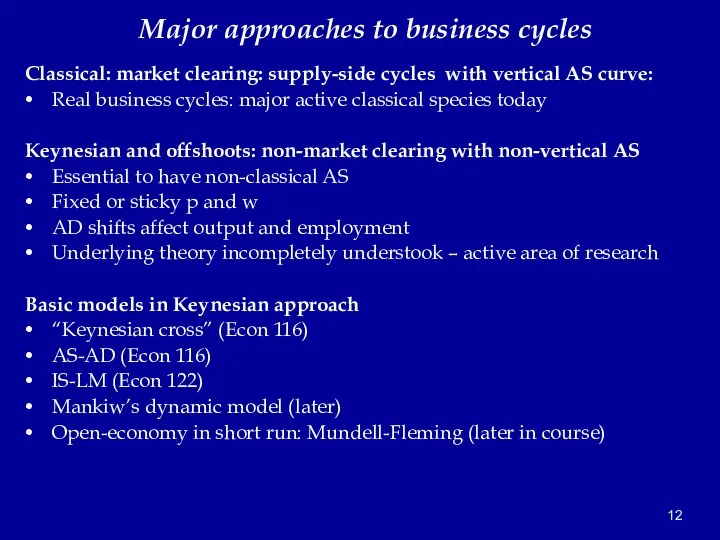

- 12. Major approaches to business cycles Classical: market clearing: supply-side cycles with vertical AS curve: Real business

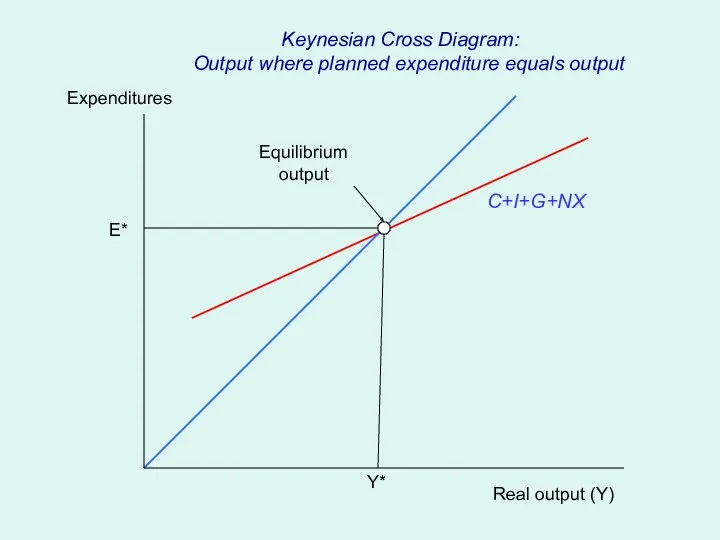

- 13. Real output (Y) Expenditures C+I+G+NX Y* E* Equilibrium output Keynesian Cross Diagram: Output where planned expenditure

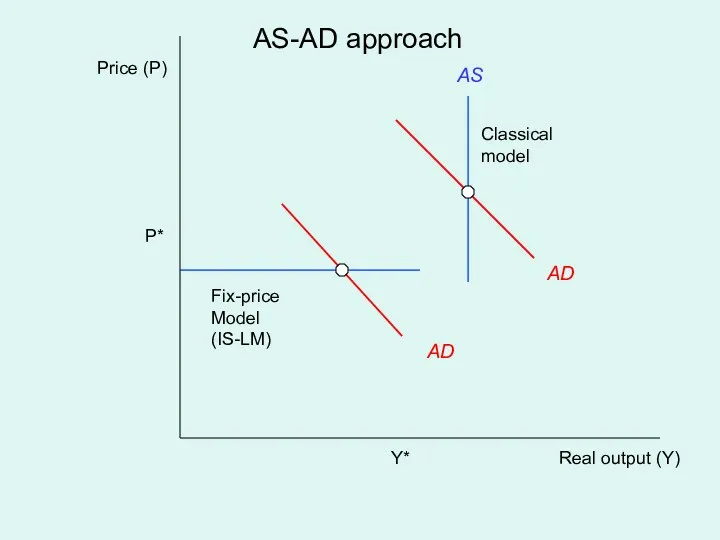

- 14. Real output (Y) Price (P) AD AS Y* P* Classical model Fix-price Model (IS-LM) AS-AD approach

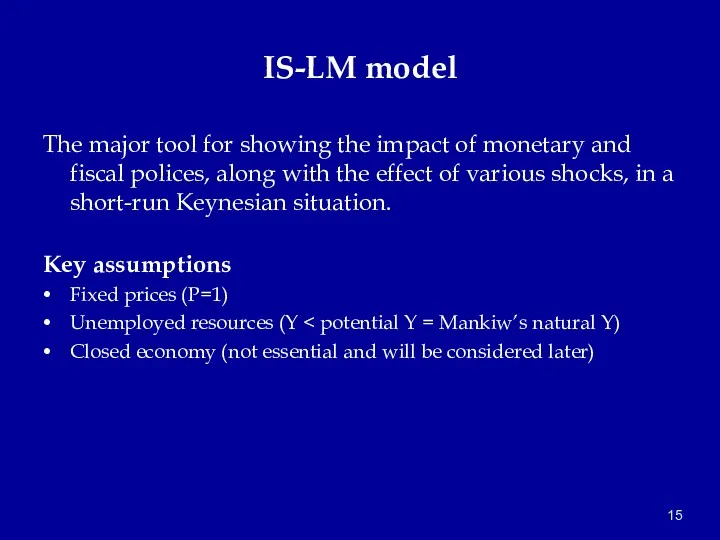

- 15. IS-LM model The major tool for showing the impact of monetary and fiscal polices, along with

- 16. The Founder of Macroeconomics Gwendolen Darwin Raverat

- 17. Keynes on Why macroeconomics is difficult or Why the models are so confusing! Professor Planck, of

- 19. Where are we? We are now attempting to understand the basic features of business cycles. Aggregate

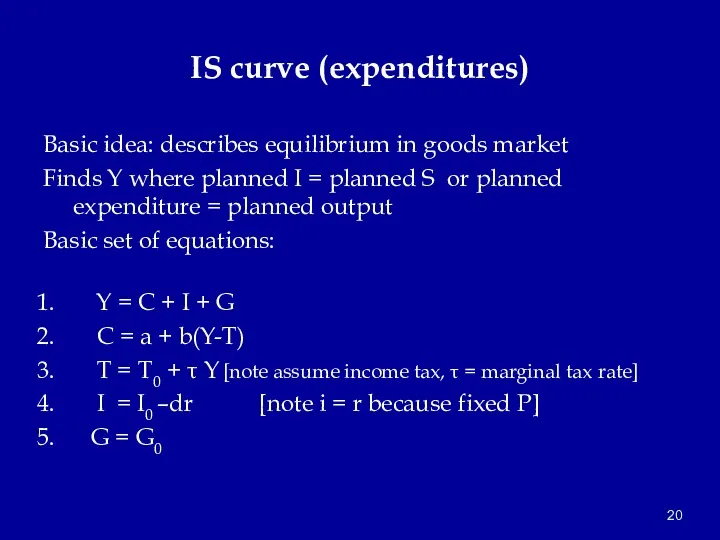

- 20. IS curve (expenditures) Basic idea: describes equilibrium in goods market Finds Y where planned I =

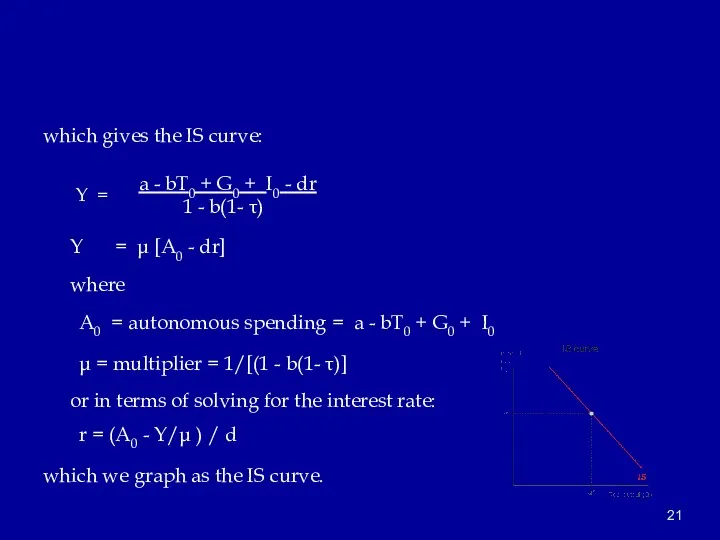

- 21. which gives the IS curve: Y = a - bT0 + G0 + I0 - dr

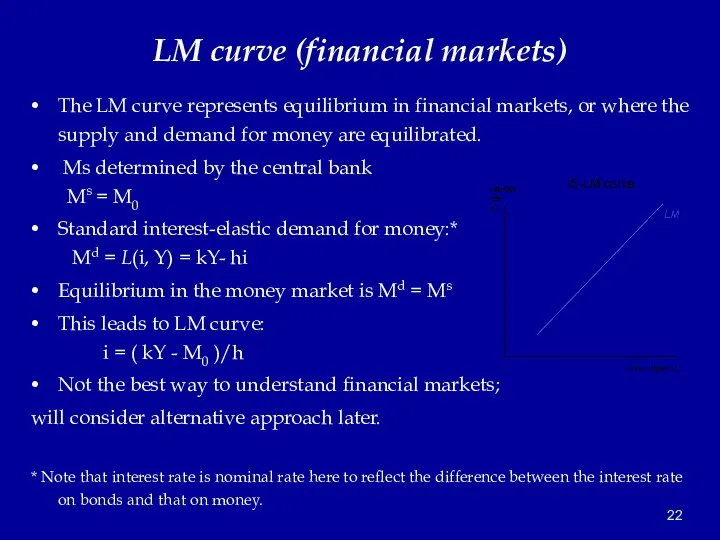

- 22. LM curve (financial markets) The LM curve represents equilibrium in financial markets, or where the supply

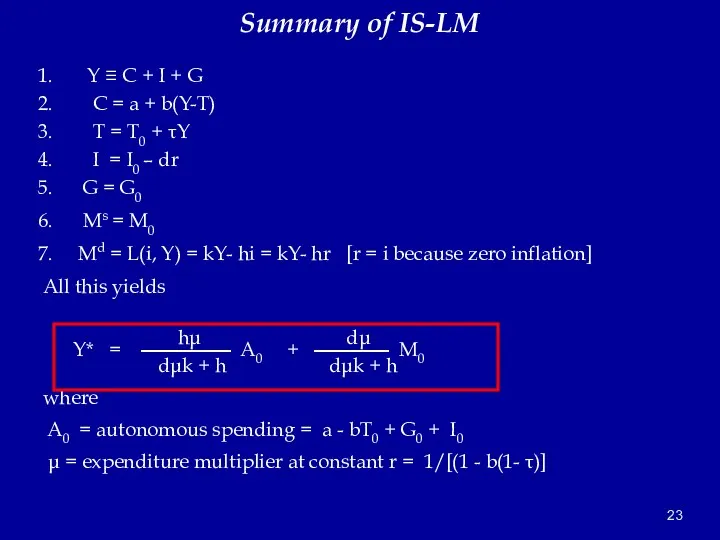

- 23. Summary of IS-LM Y ≡ C + I + G C = a + b(Y-T) T

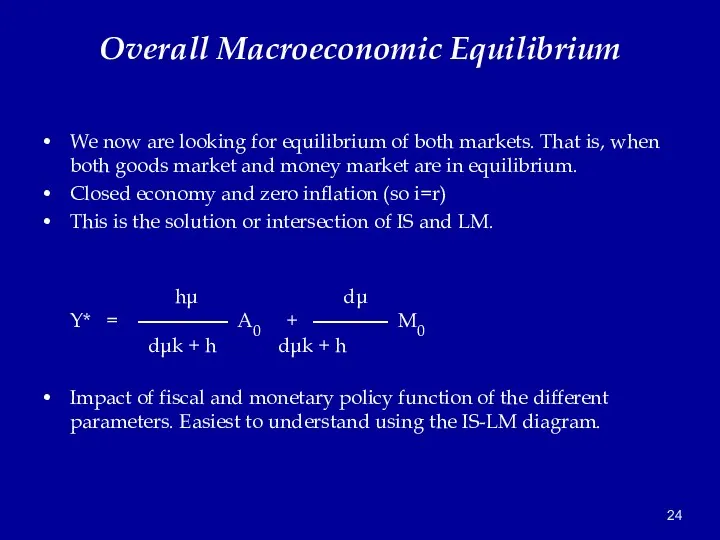

- 24. Overall Macroeconomic Equilibrium We now are looking for equilibrium of both markets. That is, when both

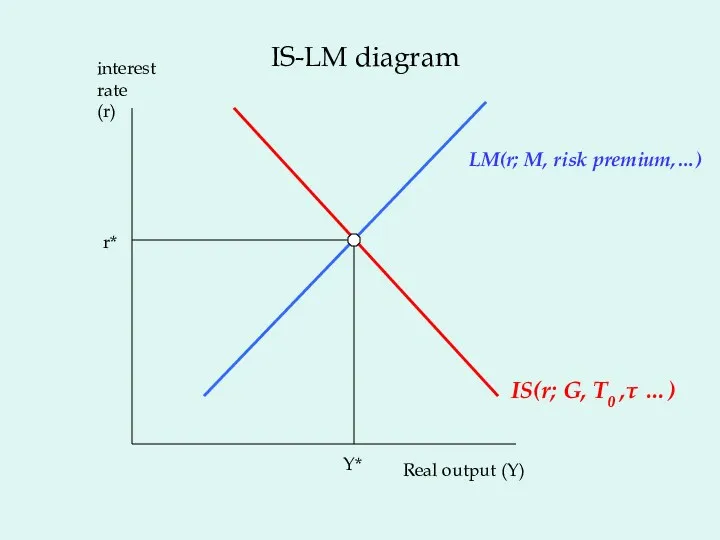

- 25. Real output (Y) interest rate (r) IS(r; G, T0 ,τ …) LM(r; M, risk premium,…) Y*

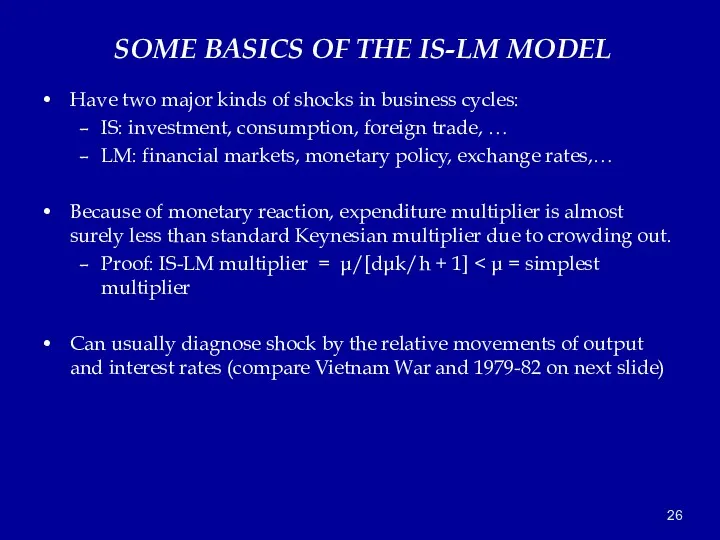

- 26. SOME BASICS OF THE IS-LM MODEL Have two major kinds of shocks in business cycles: IS:

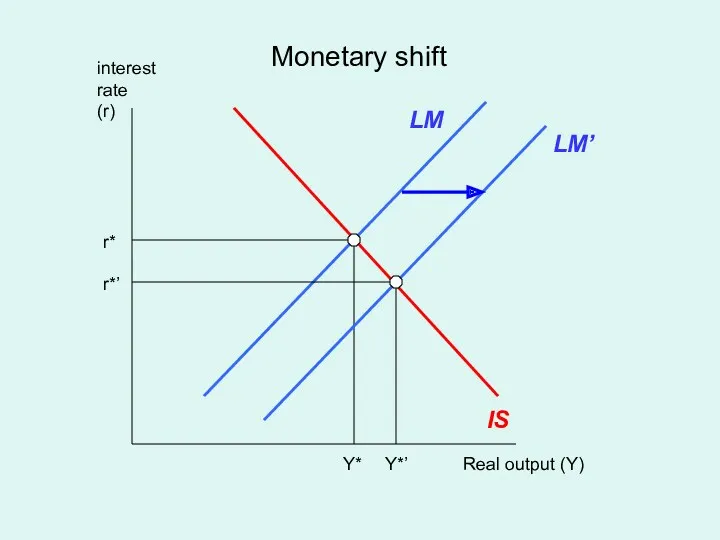

- 27. Now several interesting cases Case 1. A change in monetary policy Note: by a monetary policy,

- 28. Real output (Y) interest rate (r) IS LM Y* r* Monetary shift LM’ Y*’ r*’

- 29. More on financial issues… Case 1A. A monetary crisis that increases risk premiums - This important

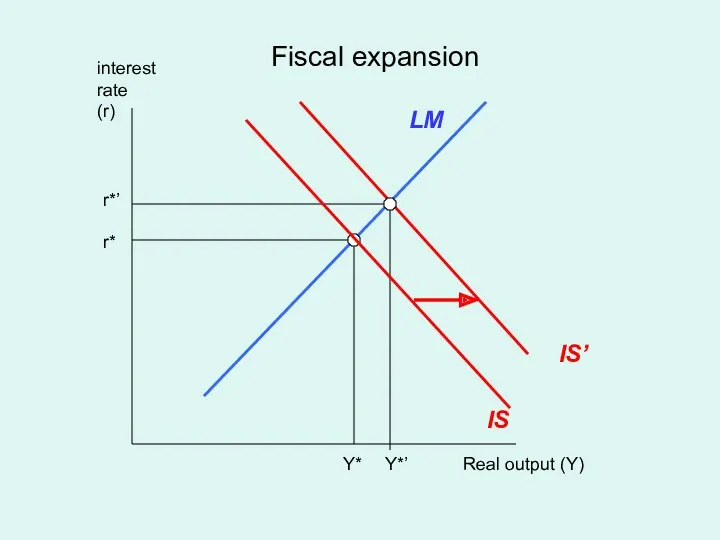

- 30. Case 2. What are the effects of fiscal policy? A fiscal policy shift is change in

- 31. Real output (Y) interest rate (r) IS LM Y* r* Fiscal expansion Y*’ r*’ IS’

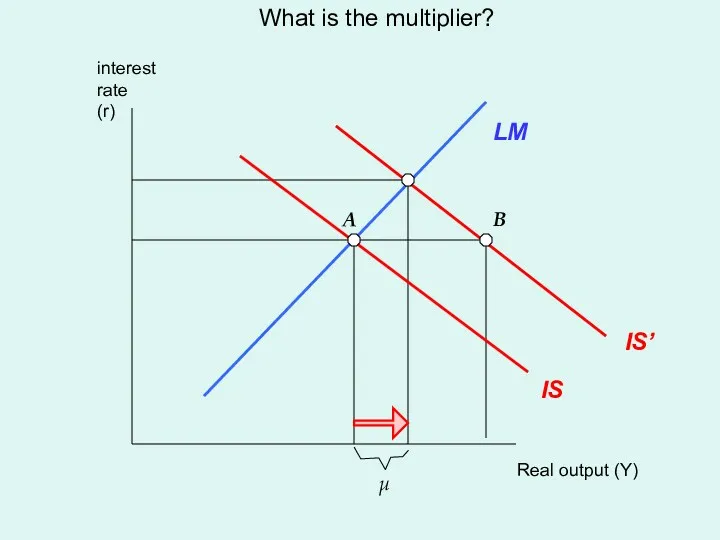

- 32. Real output (Y) interest rate (r) IS LM What is the multiplier? IS’ μ A B

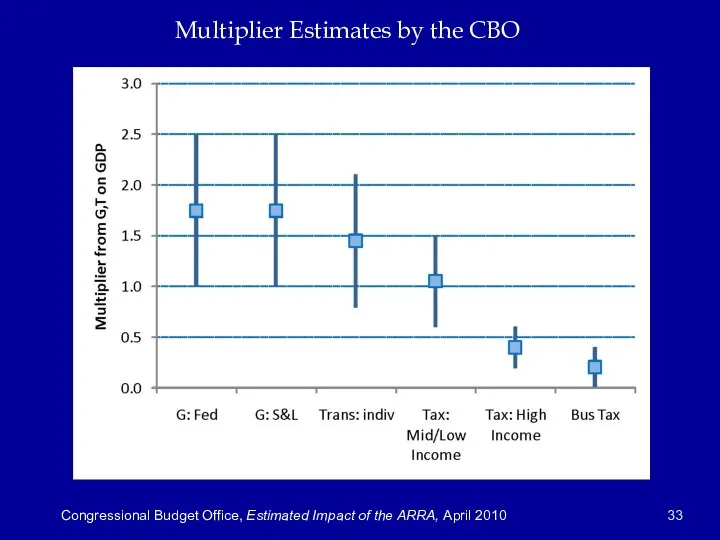

- 33. Multiplier Estimates by the CBO Congressional Budget Office, Estimated Impact of the ARRA, April 2010

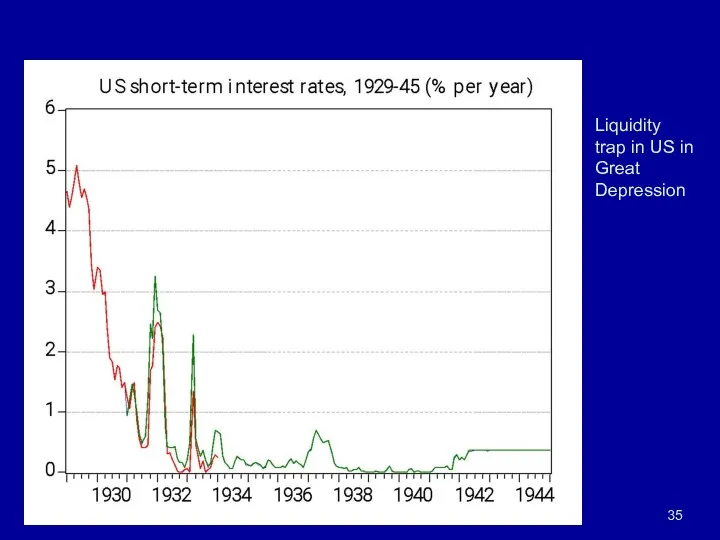

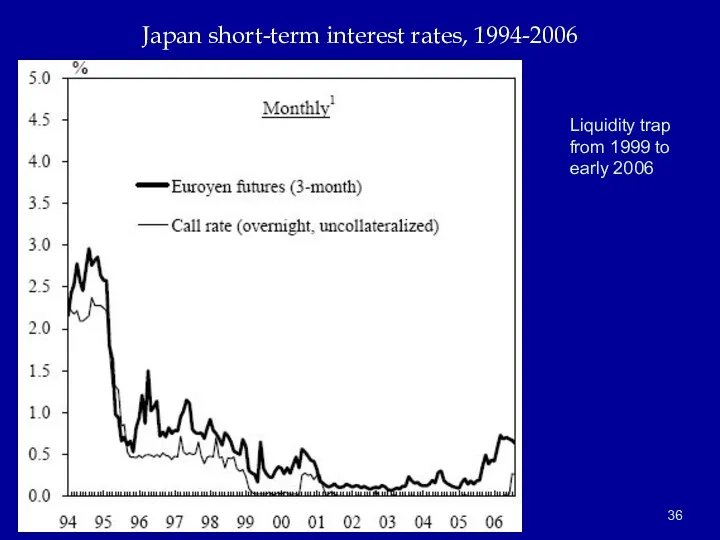

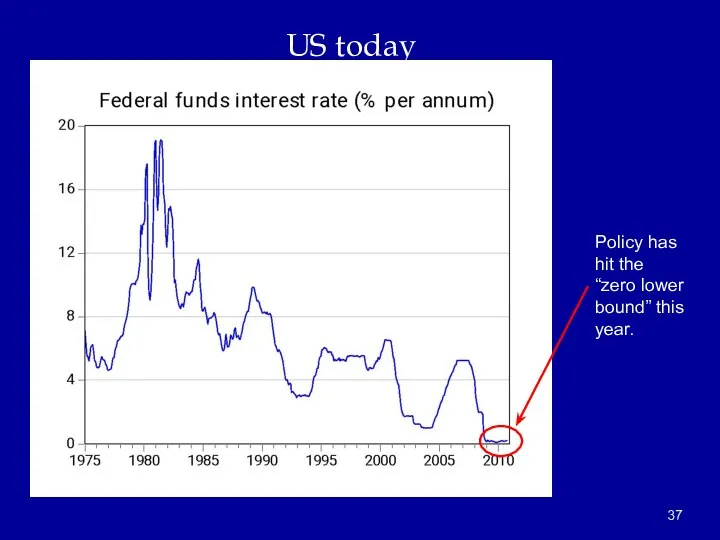

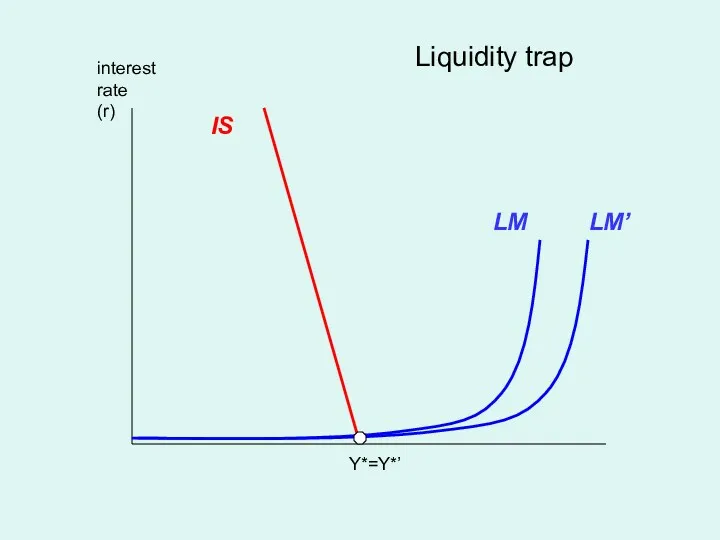

- 34. Case 2b. The liquidity trap. Today, this is taken to be where nominal interest rate is

- 35. Liquidity trap in US in Great Depression

- 36. Japan short-term interest rates, 1994-2006 Liquidity trap from 1999 to early 2006

- 37. US today Policy has hit the “zero lower bound” this year.

- 38. interest rate (r) IS Y*=Y*’ Liquidity trap LM LM’

- 39. Heavy hitters in the Obama administration Regulation: Cass Sunstein Departed budget: Peter Orszag Economics czar Larry

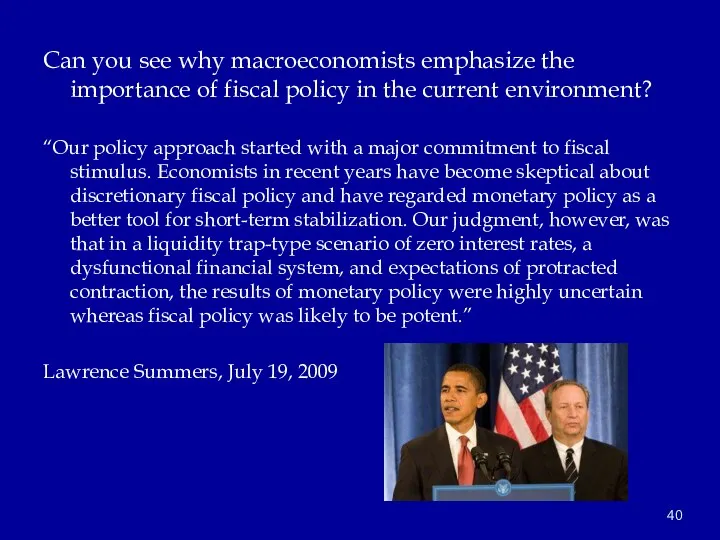

- 40. Can you see why macroeconomists emphasize the importance of fiscal policy in the current environment? “Our

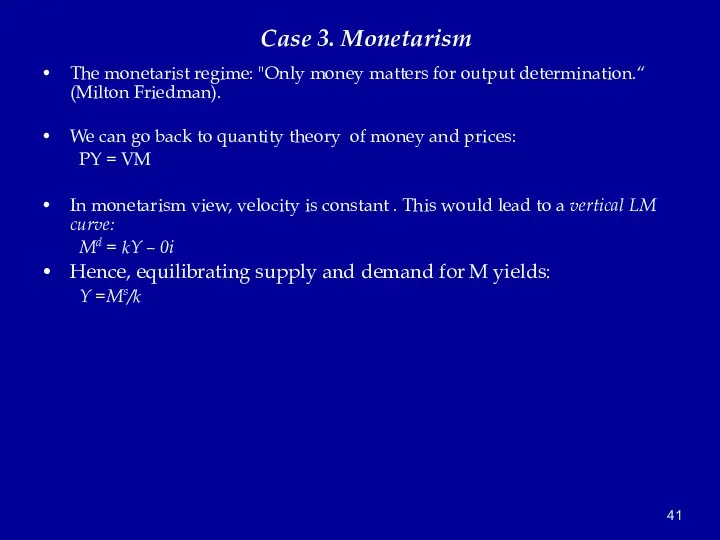

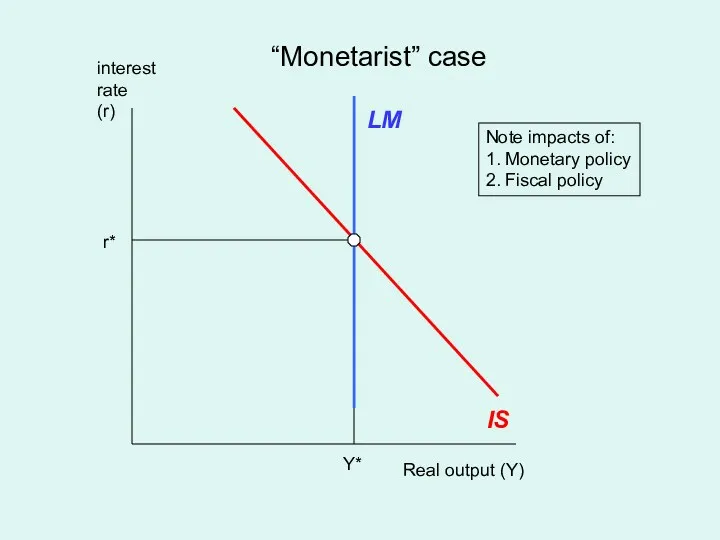

- 41. The monetarist regime: "Only money matters for output determination.“ (Milton Friedman). We can go back to

- 42. Real output (Y) interest rate (r) IS LM Y* r* “Monetarist” case Note impacts of: 1.

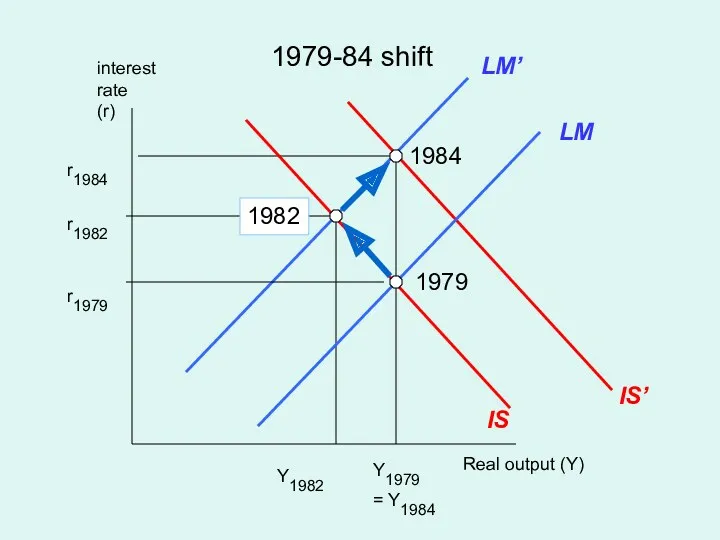

- 43. Important historical cases Case 4. Changing the fiscal-monetary mix to stimulate or depress investment A depressing

- 44. Real output (Y) interest rate (r) IS LM 1979-84 shift LM’ r1979 Y1979 Y1982 = Y1984

- 45. Important historical cases Pro-growth policies The opposite would be to tighten fiscal policies and loosen monetary

- 47. Скачать презентацию

Промышленность РСО Алании. Лабораторная работа №4

Промышленность РСО Алании. Лабораторная работа №4 Анализ социально-экономических показателей тверской области

Анализ социально-экономических показателей тверской области Своя игра. Обществознание

Своя игра. Обществознание Основы внутрифирменного планирования

Основы внутрифирменного планирования Организационное проектирование

Организационное проектирование World Tourism Market. Introduction to the market and international tourism

World Tourism Market. Introduction to the market and international tourism Теория потребительского поведения

Теория потребительского поведения Ефективність виробництва

Ефективність виробництва Обеспечение экономической состоятельности организации

Обеспечение экономической состоятельности организации Сегмент упаковки в экономике замкнутого цикла

Сегмент упаковки в экономике замкнутого цикла Қазақстан тәуелсіздігі , ел басы , 2030 стратегиясы

Қазақстан тәуелсіздігі , ел басы , 2030 стратегиясы Cистема основных счетов СНС

Cистема основных счетов СНС Вектор развития внешнеэкономической деятельности России в условиях экономических санкций

Вектор развития внешнеэкономической деятельности России в условиях экономических санкций Человек в экономике

Человек в экономике Многообразие рынков

Многообразие рынков Рынок

Рынок The Economist: The Work of Calculation

The Economist: The Work of Calculation Внешнеторговые взаимоотношения Российской Федерации и Европейского союза. Таможенный аспект

Внешнеторговые взаимоотношения Российской Федерации и Европейского союза. Таможенный аспект Проблема терроризма в России. Бесланская трагедия

Проблема терроризма в России. Бесланская трагедия Конкурентоспособность предприятий сферы услуг в условиях глобализации экономики

Конкурентоспособность предприятий сферы услуг в условиях глобализации экономики Экономика. Семейный бюджет

Экономика. Семейный бюджет Историческая школа Германии. Институционализм. Условия появления институционализма. (Занятие 8)

Историческая школа Германии. Институционализм. Условия появления институционализма. (Занятие 8) Безработица и инфляция как проявления экономической нестабильности

Безработица и инфляция как проявления экономической нестабильности Налоги

Налоги Экономика. Учебники из ЭБС

Экономика. Учебники из ЭБС Модели потребления, сбережения, инвестиций

Модели потребления, сбережения, инвестиций Научно-техническая революция и мировое хозяйство. Лекция 4

Научно-техническая революция и мировое хозяйство. Лекция 4 Собственность и ее место в экономической системе. Модели экономических систем. Рыночная экономика

Собственность и ее место в экономической системе. Модели экономических систем. Рыночная экономика