Содержание

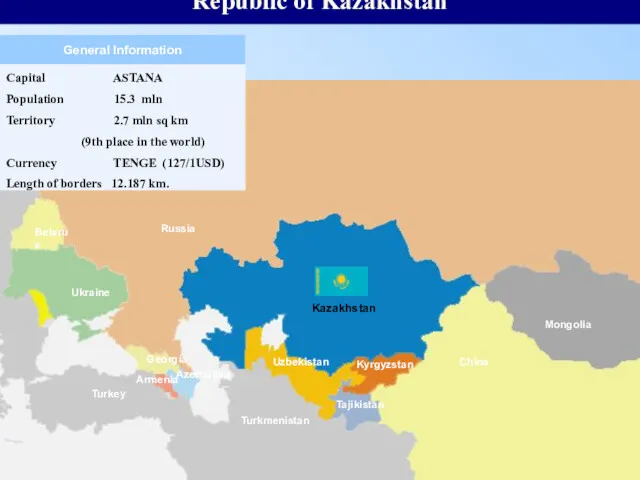

- 2. Kazakhstan China General Information Russia Mongolia Kyrgyzstan Tajikistan Azerbaijan Georgia Ukraine Belarus Turkey Turkmenistan Uzbekistan Armenia

- 3. Major achievement of the Republic of Kazakhstan for the last 15 years An effective democratic society.

- 4. The major country’s reforms Constitutional law "On Independent Statehood of the Republic of Kazakhstan" A privatization

- 5. State social policy 1. A social protection of mother and child: The children’s allowance increase; An

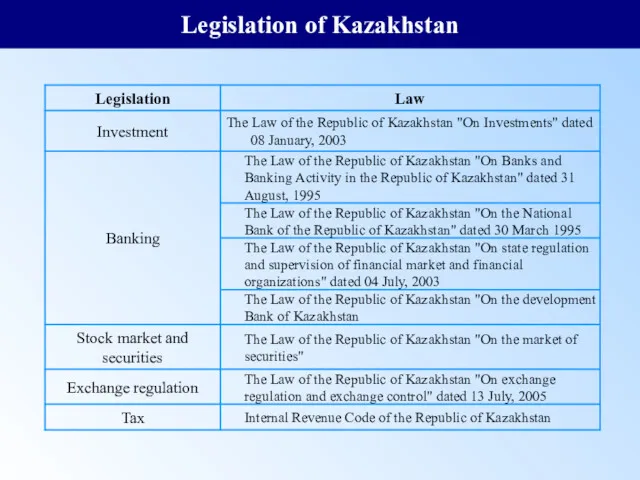

- 6. Legislation of Kazakhstan

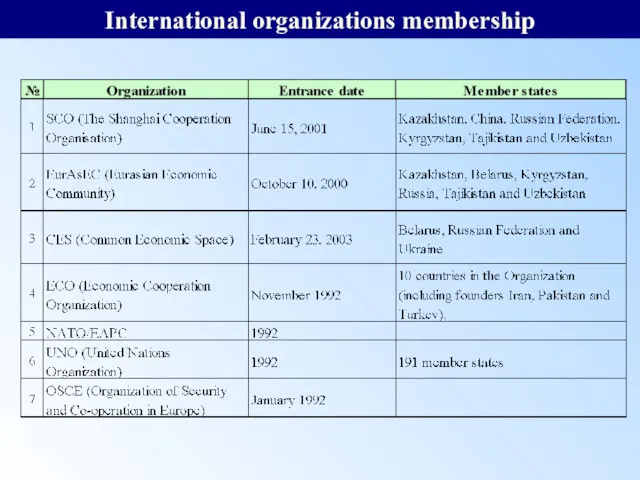

- 7. International organizations membership

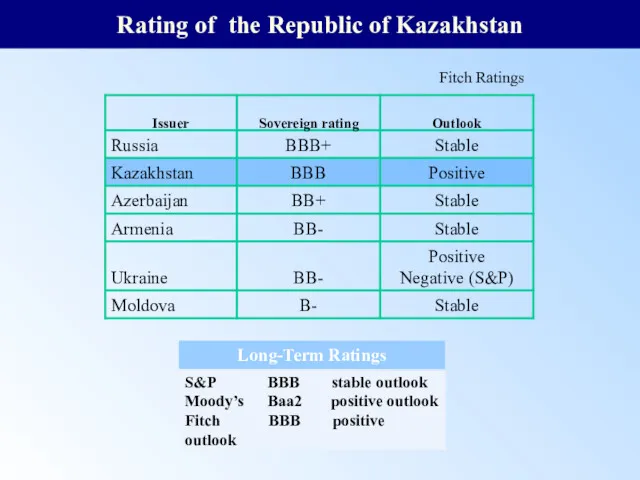

- 8. Rating of the Republic of Kazakhstan Fitch Ratings S&P BBB stable outlook Moody’s Baa2 positive outlook

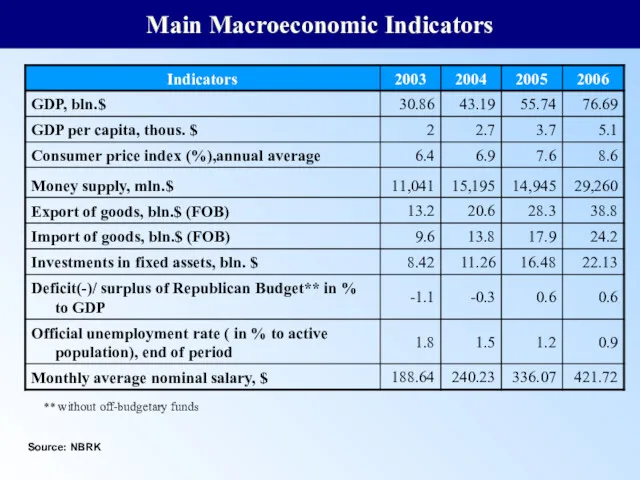

- 9. Main Macroeconomic Indicators ** without off-budgetary funds Source: NBRK

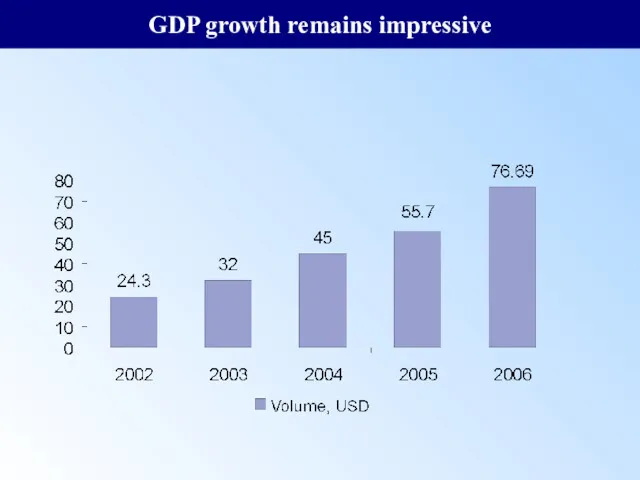

- 10. GDP growth remains impressive

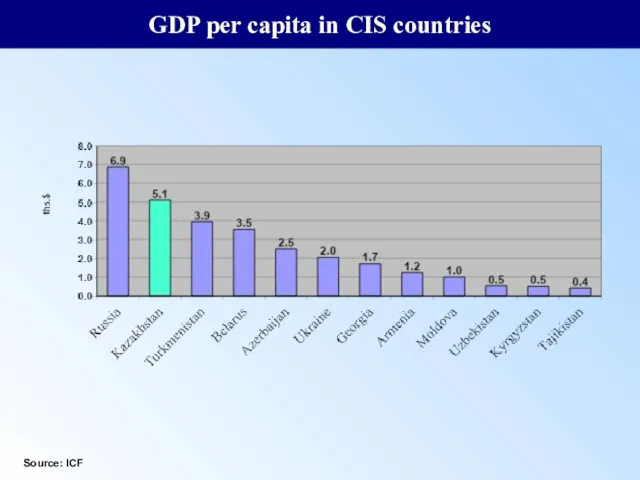

- 11. GDP per capita in CIS countries Source: ICF

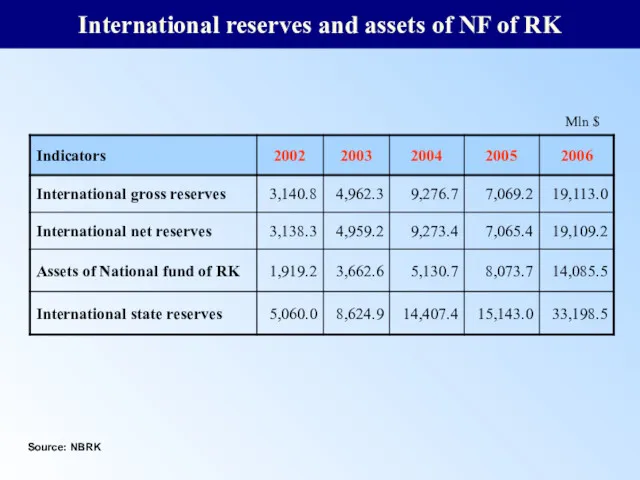

- 12. International reserves and assets of NF of RK Mln $ Source: NBRK

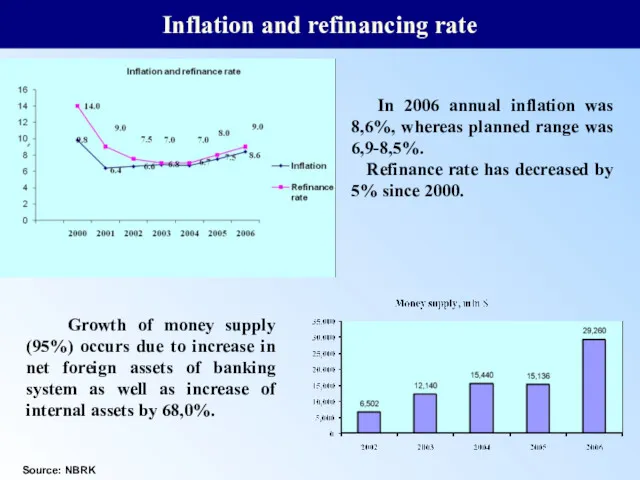

- 13. Inflation and refinancing rate Source: NBRK In 2006 annual inflation was 8,6%, whereas planned range was

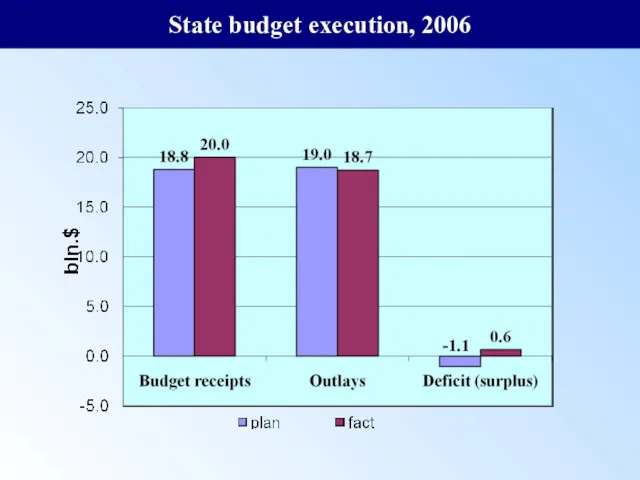

- 14. State budget execution, 2006

- 15. Prerequisites for arrangement of favorable investment climate. In October 2000 European Union granted status of the

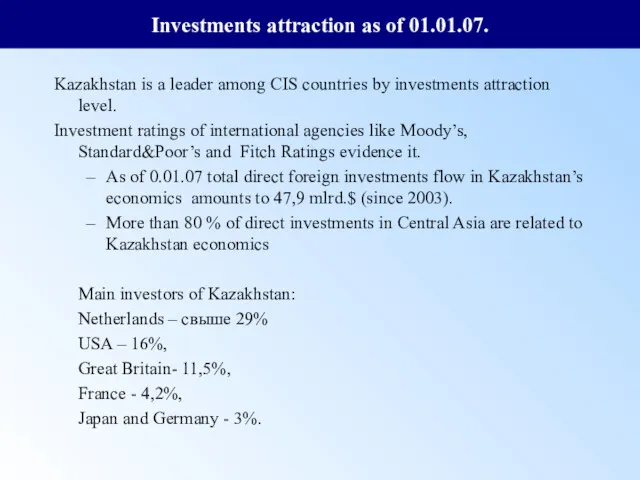

- 16. Kazakhstan is a leader among CIS countries by investments attraction level. Investment ratings of international agencies

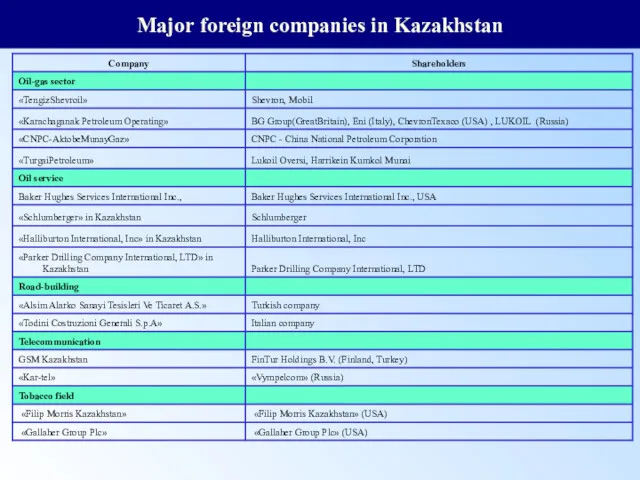

- 17. Major foreign companies in Kazakhstan

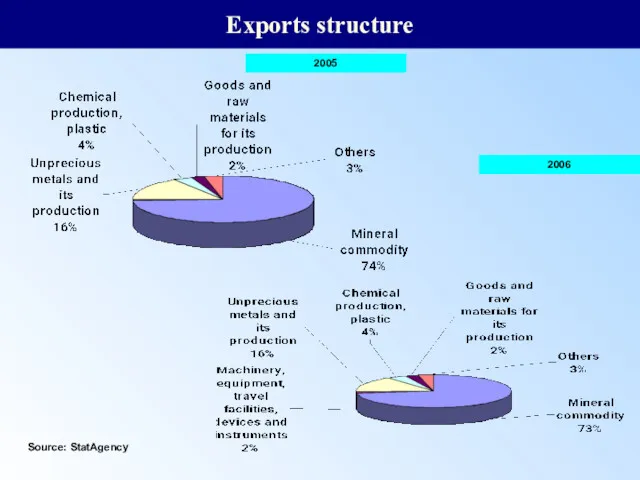

- 18. Exports structure Source: StatAgency 2005 2006

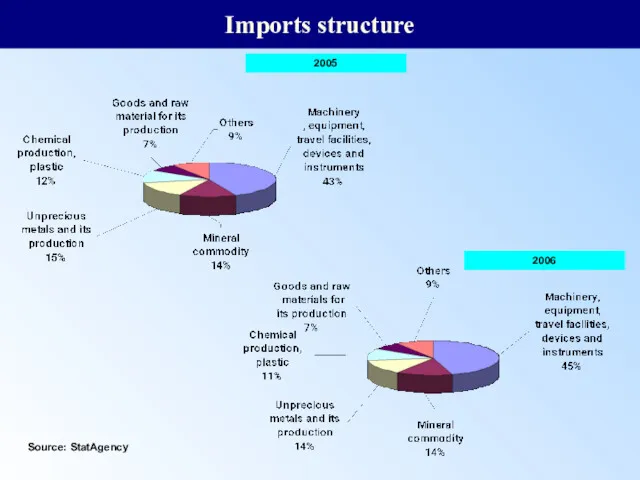

- 19. Imports structure Source: StatAgency 2005 2006

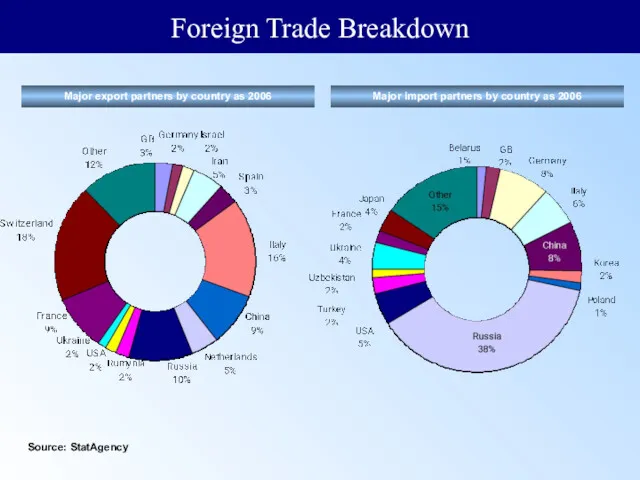

- 20. Major export partners by country as 2006 Major import partners by country as 2006 Source: StatAgency

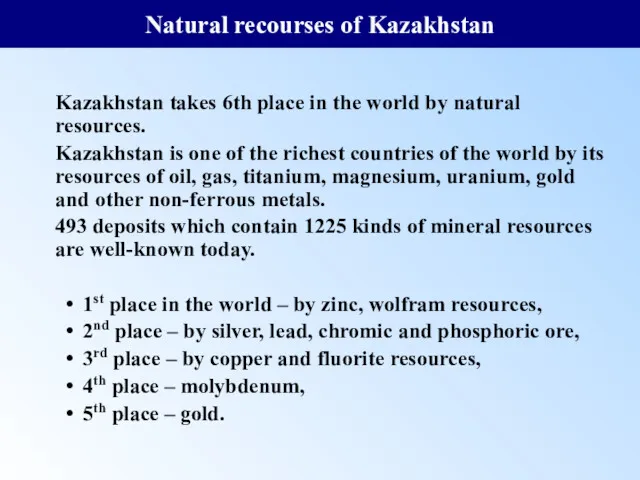

- 21. Kazakhstan takes 6th place in the world by natural resources. Kazakhstan is one of the richest

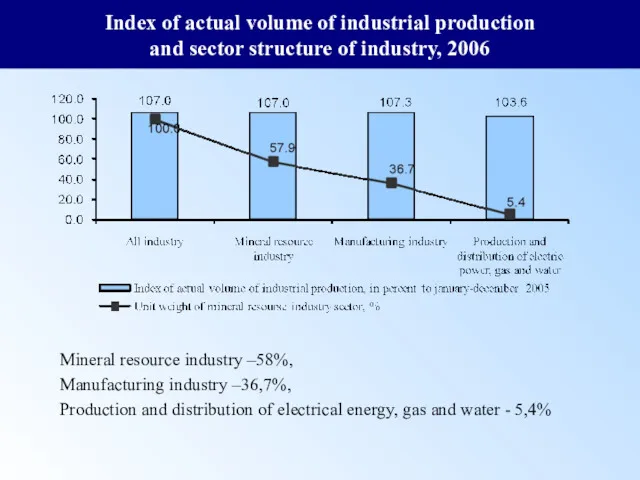

- 22. Index of actual volume of industrial production and sector structure of industry, 2006 Mineral resource industry

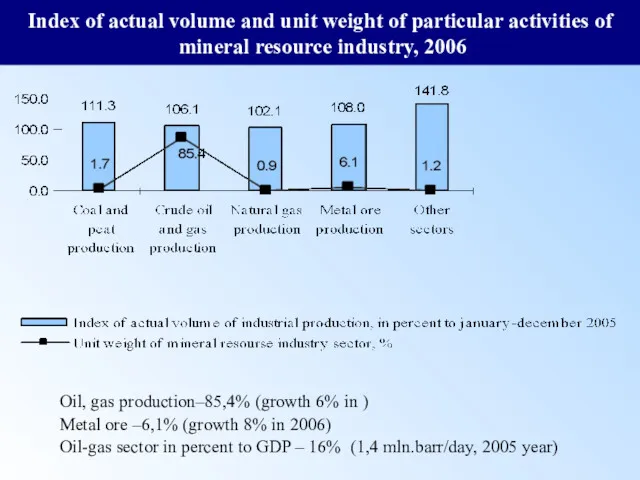

- 23. Index of actual volume and unit weight of particular activities of mineral resource industry, 2006 Oil,

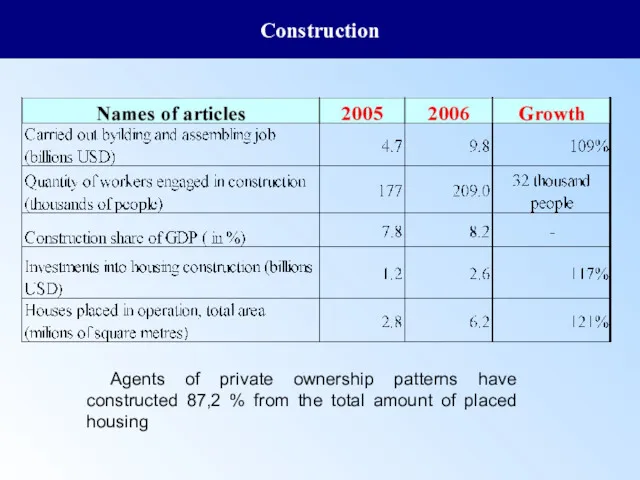

- 24. Construction Agents of private ownership patterns have constructed 87,2 % from the total amount of placed

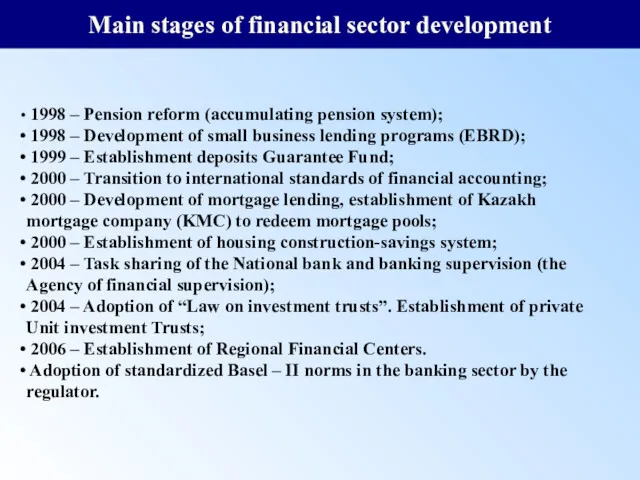

- 25. Main stages of financial sector development 1998 – Pension reform (accumulating pension system); 1998 – Development

- 26. Pension reform First stage — 1998—2001 years. Beginning of pension reform. State reserves regulatory functions and

- 27. The European Bank for Reconstruction and Development in Kazakhstan 1998 - EBRD was financing small and

- 28. Kazakhstan Deposit Insurance Fund To increase the general public’s confidence in the domestic financial system and

- 29. Mortgage lending development 2001 – First mortgage credit in Kazakhstan was issued. This credit was issued

- 30. Housing Construction-Saving System Housing construction savings system targets citizens, who have a stable income, but do

- 31. Establishment of Financial Supervision Agency Agency of the Republic of Kazakhstan on Regulation and Monitoring over

- 32. Regional Financial Center in Almaty Regional Financial Center in Almaty is a special legal regime regulating

- 33. Part of financial sector in economics 47,2 57,5 78,9 97,2 0 20 40 60 80 100

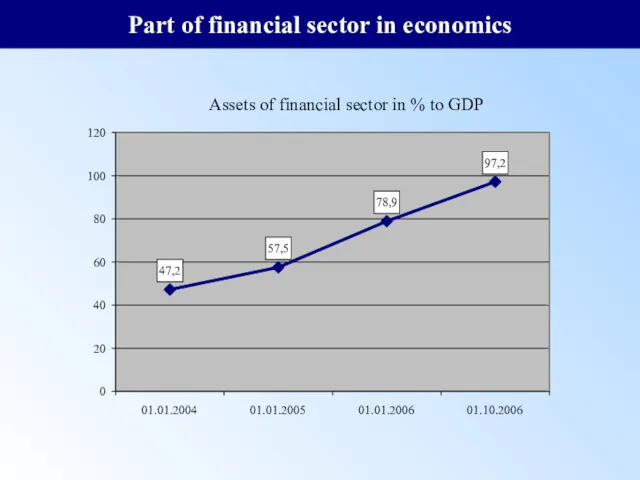

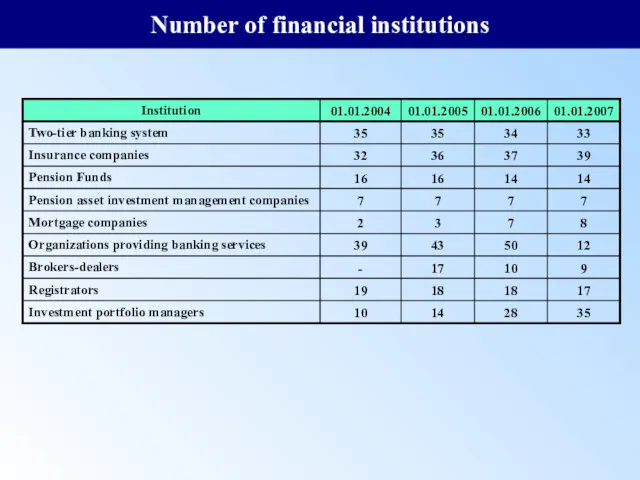

- 34. Number of financial institutions

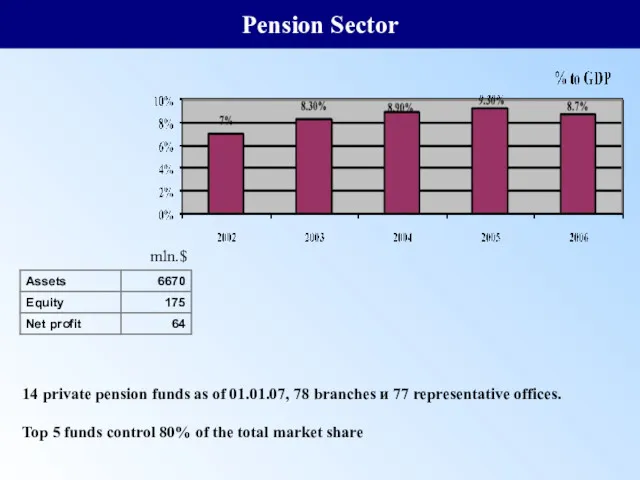

- 35. Pension Sector 14 private pension funds as of 01.01.07, 78 branches и 77 representative offices. Top

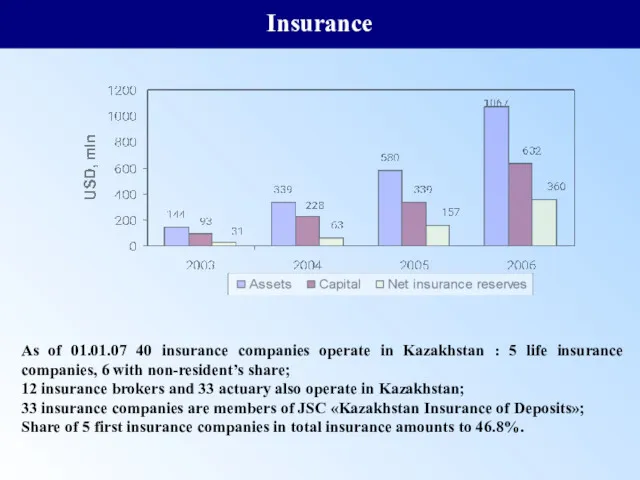

- 36. Insurance As of 01.01.07 40 insurance companies operate in Kazakhstan : 5 life insurance companies, 6

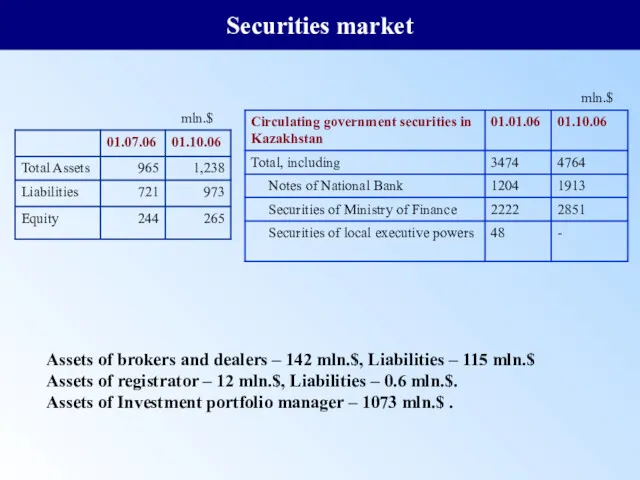

- 37. Securities market Assets of brokers and dealers – 142 mln.$, Liabilities – 115 mln.$ Assets of

- 38. Kazakhstan development plans till 2015 Kazakhstan plans to join 50 most development countries till 2015: 1.

- 39. Priorities of Kazakhstan financial sector development till 2011 Assurance of Kazakhstan’s regional economic leadership and becoming

- 41. Скачать презентацию

Атмосферные осадки

Атмосферные осадки Почвы – верхний плодородный слой земной коры

Почвы – верхний плодородный слой земной коры Страна восходящего солнца

Страна восходящего солнца Компас. Строение компаса

Компас. Строение компаса Горы

Горы Вода в мировом океане(7 класс)

Вода в мировом океане(7 класс) Мадагаскар. Основная характеристика

Мадагаскар. Основная характеристика Гавайские острова

Гавайские острова я гражданин

я гражданин Северный полюс, Арктика, Антарктида и их жители

Северный полюс, Арктика, Антарктида и их жители Объединенные Арабские Эмираты

Объединенные Арабские Эмираты Анализ и обобщение данных о водном балансе речных бассейнов

Анализ и обобщение данных о водном балансе речных бассейнов Республика Таджикистан

Республика Таджикистан Солнечная радиация. 8 класс

Солнечная радиация. 8 класс Закономерности распределения тепла и влаги по территории России

Закономерности распределения тепла и влаги по территории России Страны Западной Центральной Африки. Нигерия

Страны Западной Центральной Африки. Нигерия Особенности и перспективы развития туризма в Санкт-Петербурге

Особенности и перспективы развития туризма в Санкт-Петербурге Остров Врангеля (заповедник)

Остров Врангеля (заповедник) Изотопная геохимия. Общие вопросы (изотопы, радиоактивный распад)

Изотопная геохимия. Общие вопросы (изотопы, радиоактивный распад) Города Сибири. Красноярск и Томск

Города Сибири. Красноярск и Томск Зона вологих вічнозелених екваторіальних лісів

Зона вологих вічнозелених екваторіальних лісів Восточная Сибирь

Восточная Сибирь НТР и мировое хозяйство. 10 класс

НТР и мировое хозяйство. 10 класс The East of England

The East of England Бразилия

Бразилия Геоинформационные системы (ГИС)

Геоинформационные системы (ГИС) Норвегия

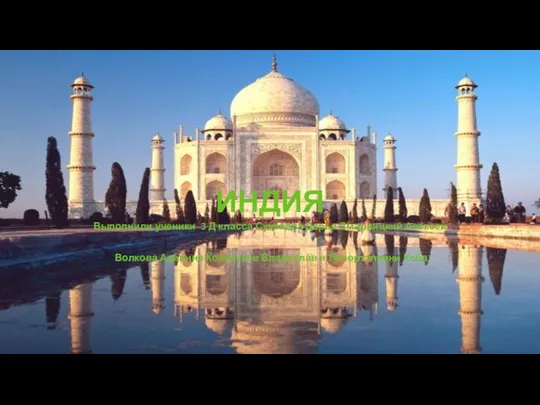

Норвегия Индия. Достопримечательности Индии

Индия. Достопримечательности Индии