Содержание

- 2. Summary “Avangard LLC” is a new company who have recently agreed with Gazpromneft to build and

- 3. summary To develop and operate the new facility it is planned for Avangard to conclude a

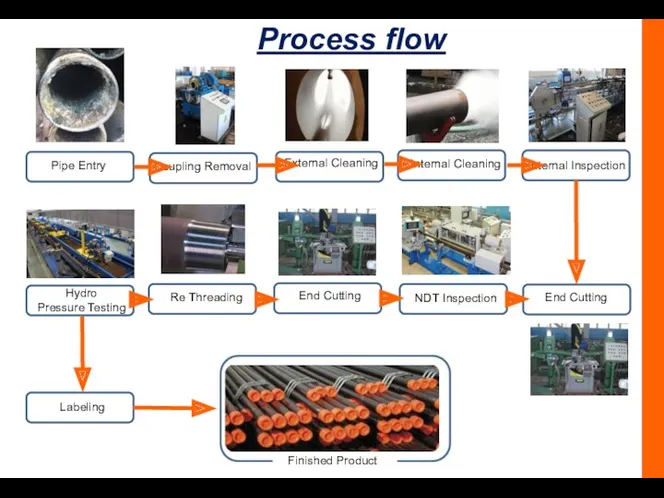

- 4. Process flow Pipe Entry Coupling Removal External Cleaning Internal Cleaning Internal Inspection End Cutting NDT Inspection

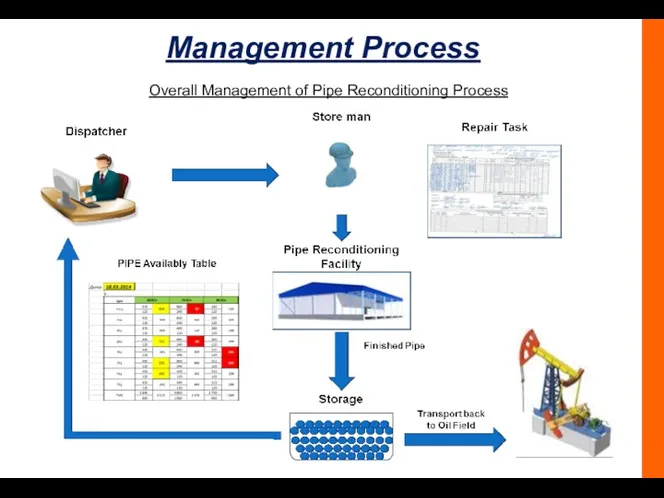

- 5. Management Process Overall Management of Pipe Reconditioning Process

- 6. Management of Inventory Pipe inventory is maintained using unique state-of-the-art "1C" Software

- 7. The Reconditioning Process Pipe will be collected from the field sites and transported to the rehab

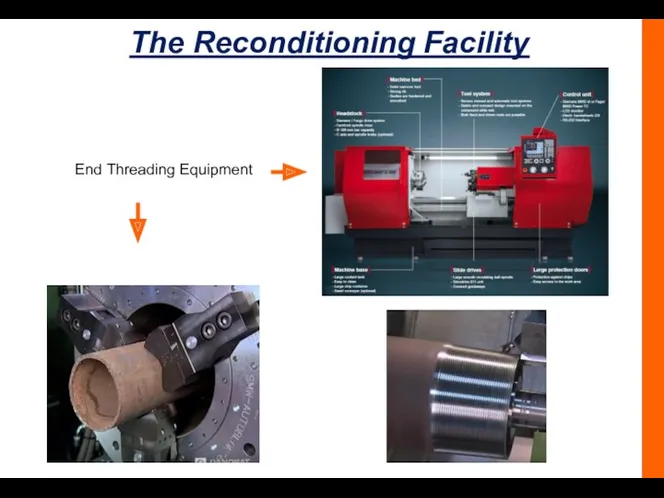

- 8. Pipes will be rethreaded at both ends (if required), where this operation will take place at

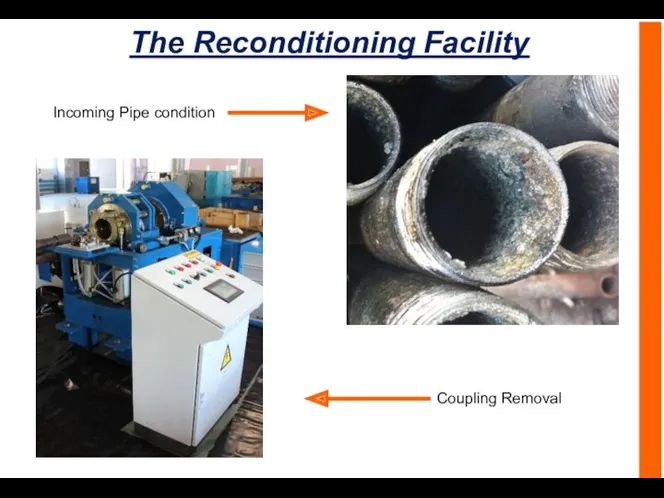

- 9. The Reconditioning Facility Incoming Pipe condition Coupling Removal

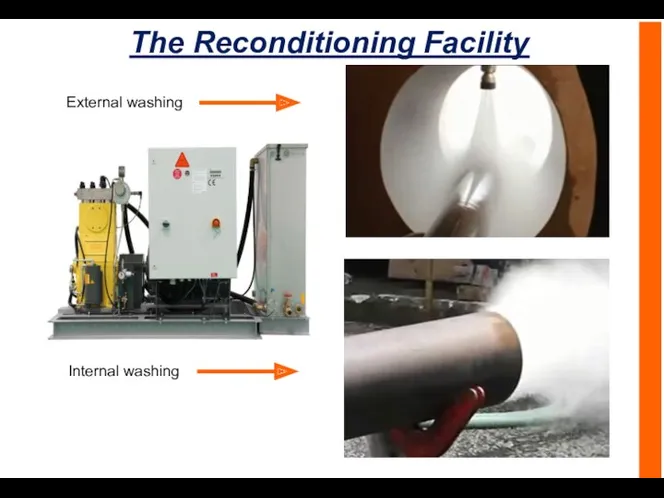

- 10. The Reconditioning Facility External washing Internal washing

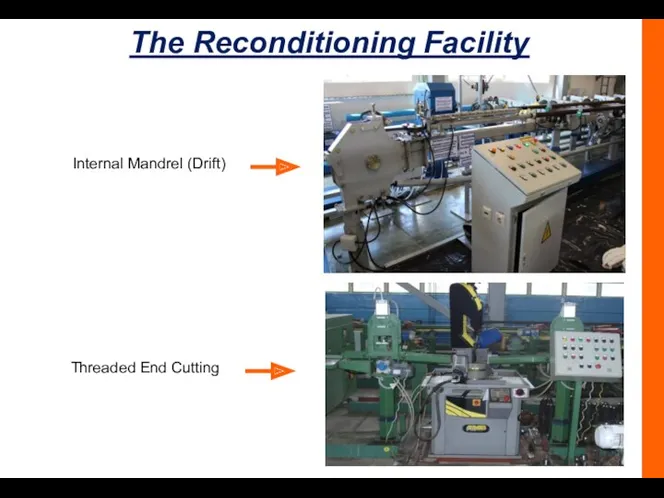

- 11. The Reconditioning Facility Internal Mandrel (Drift) Threaded End Cutting

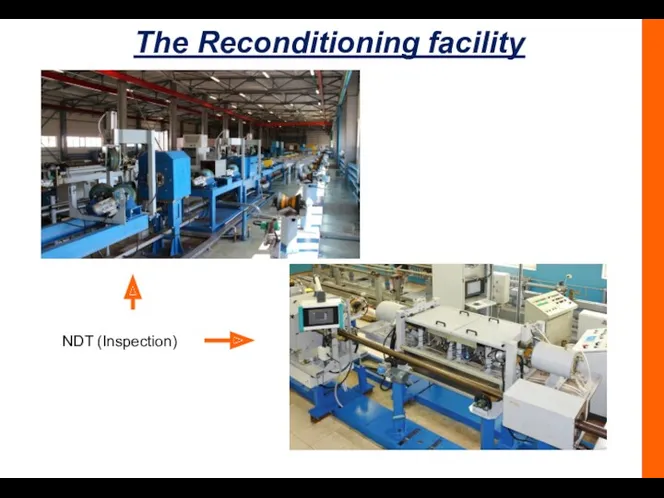

- 12. The Reconditioning facility NDT (Inspection)

- 13. The Reconditioning facility Coupling End Cutting (if required) End Threading Area

- 14. The Reconditioning Facility End Threading Equipment

- 15. The Reconditioning facility Hydrostatic Testing

- 16. The Reconditioning facility Pipe Labeling Finished Pipes Finished Pipes Ready to Dispatch

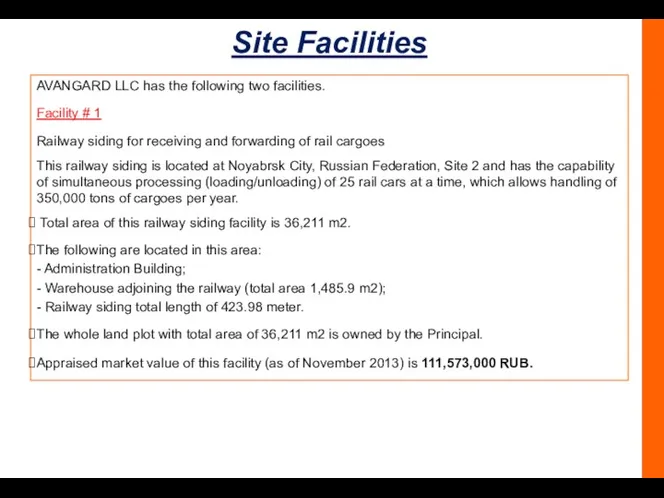

- 17. Site Facilities AVANGARD LLC has the following two facilities. Facility # 1 Railway siding for receiving

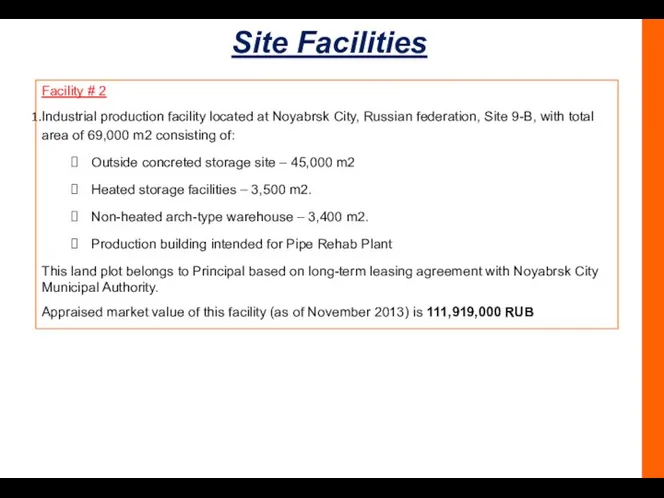

- 18. Site Facilities Facility # 2 Industrial production facility located at Noyabrsk City, Russian federation, Site 9-В,

- 19. Facility location Industrial production facility located at Noyabrsk City, Russian federation, Site 9-В, with total area

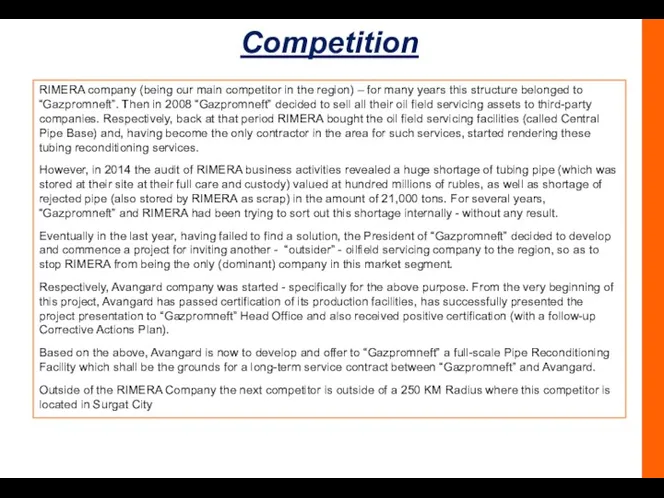

- 20. Competition RIMERA company (being our main competitor in the region) – for many years this structure

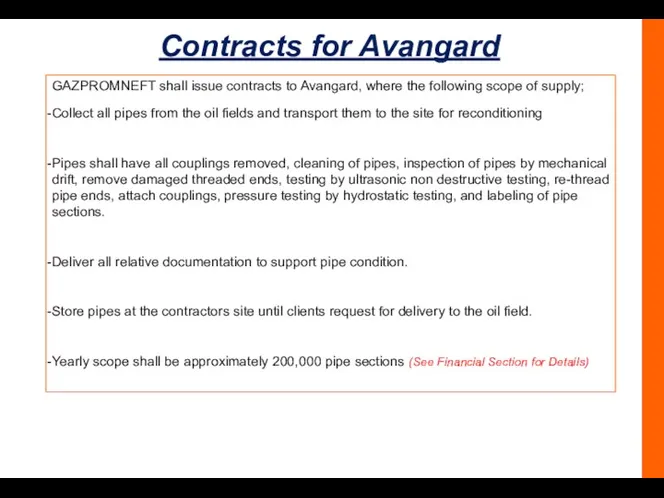

- 21. Contracts for Avangard GAZPROMNEFT shall issue contracts to Avangard, where the following scope of supply; Collect

- 22. Summary of Financing Needs Infrastructure Investment - Ru 444,800,000 - Euro €7,174,194 (@62:10 Startup Funding -

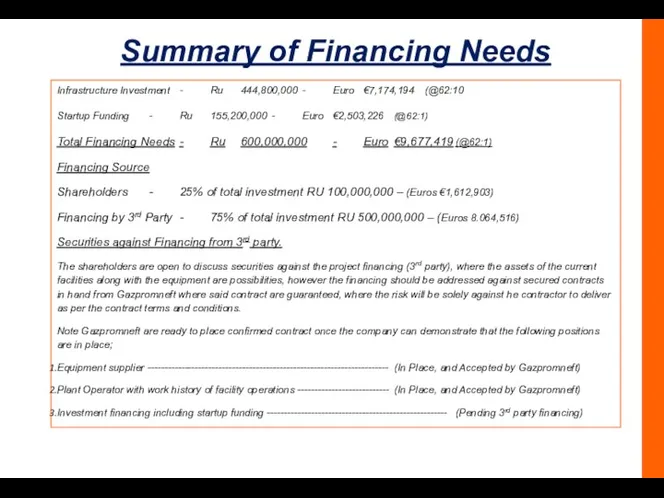

- 23. Investment Cost

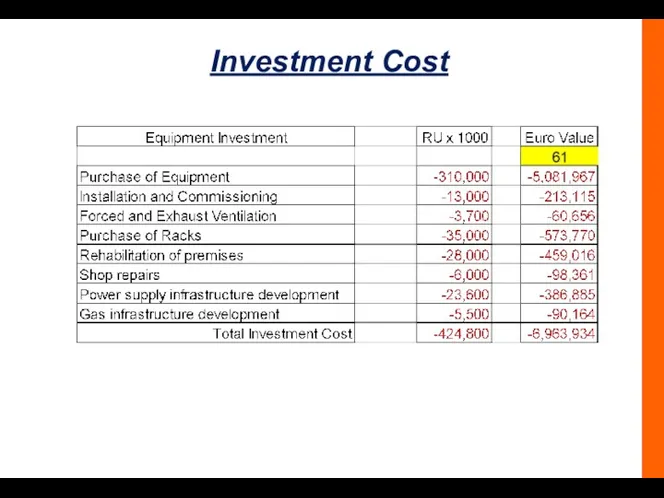

- 24. Yearly cash flow projections (Before Dividend Payments)

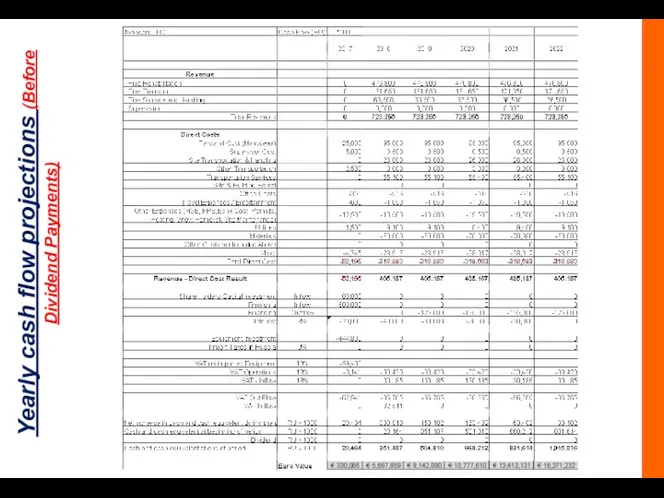

- 25. Projected P&L Sheet

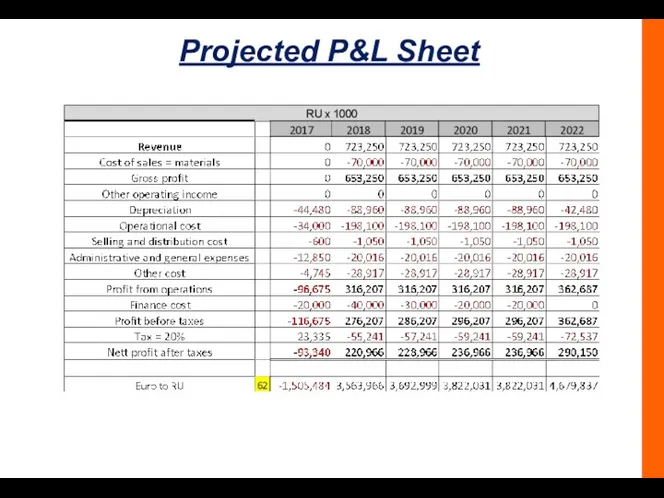

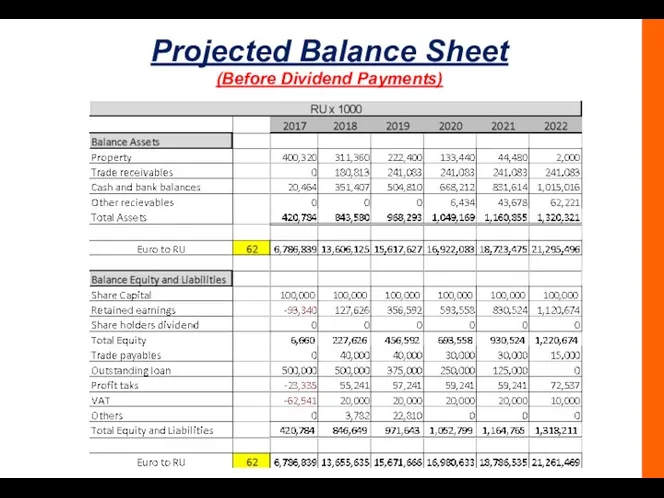

- 26. Projected Balance Sheet (Before Dividend Payments)

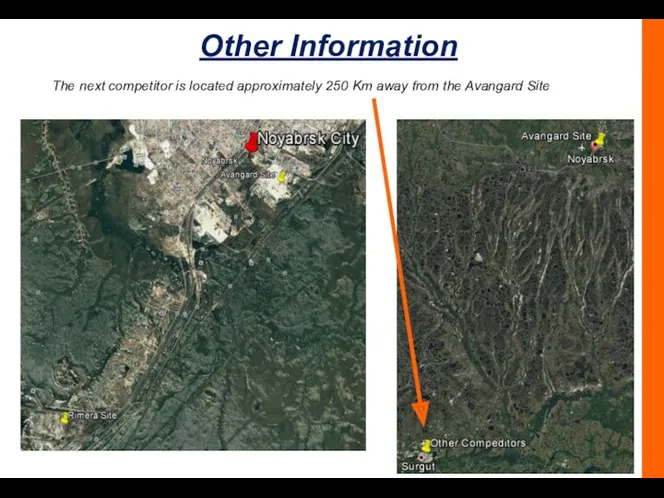

- 27. Other Information The next competitor is located approximately 250 Km away from the Avangard Site

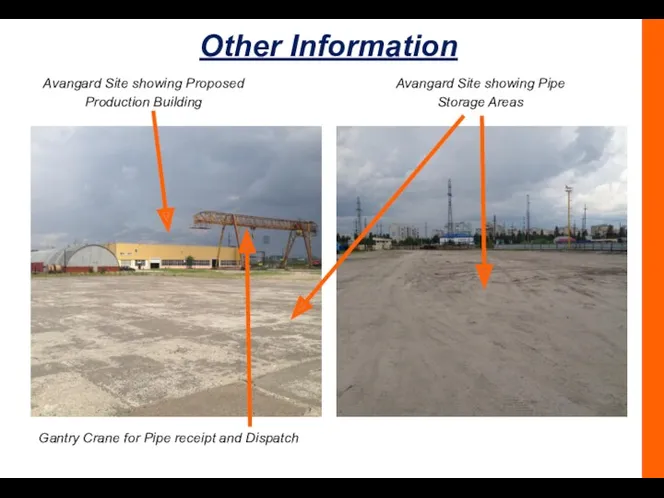

- 28. Other Information Avangard Site showing Proposed Production Building Avangard Site showing Pipe Storage Areas Gantry Crane

- 29. Other Facilities by Principal The Principal shareholder of Avangard has other operations within his portfolio as

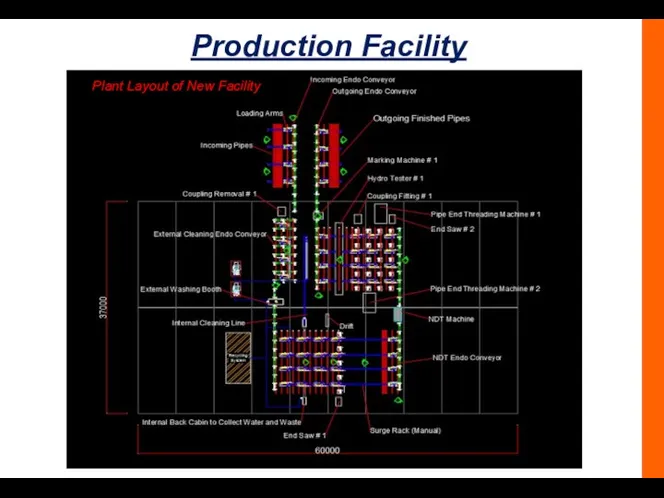

- 30. Production Facility Plant Layout of New Facility

- 31. Closing The enclosed is an overview of the plan to develop a complete reconditioning facility to

- 33. Скачать презентацию

Рекрутирование через интернет-магазин Oriflame

Рекрутирование через интернет-магазин Oriflame Добро пожаловать в Билайн

Добро пожаловать в Билайн Audi AG - немецкая автомобилестроительная компания в составе концерна Volkswagen Group

Audi AG - немецкая автомобилестроительная компания в составе концерна Volkswagen Group Инновационный проект

Инновационный проект Алгоритм работы с покупателем

Алгоритм работы с покупателем Чек-лист: путь к идеальным бровям

Чек-лист: путь к идеальным бровям Project: Global Social Media Plan November Topic:Hill-Start Assist Subline: Highlight the Hill-Start Assist feature using nature

Project: Global Social Media Plan November Topic:Hill-Start Assist Subline: Highlight the Hill-Start Assist feature using nature Драгоценные монеты Сбербанка

Драгоценные монеты Сбербанка Каталог продукции ТМ AleVi

Каталог продукции ТМ AleVi Виды маркетинга в зависимости от спроса

Виды маркетинга в зависимости от спроса Маркетинговая среда

Маркетинговая среда Основное оборудование

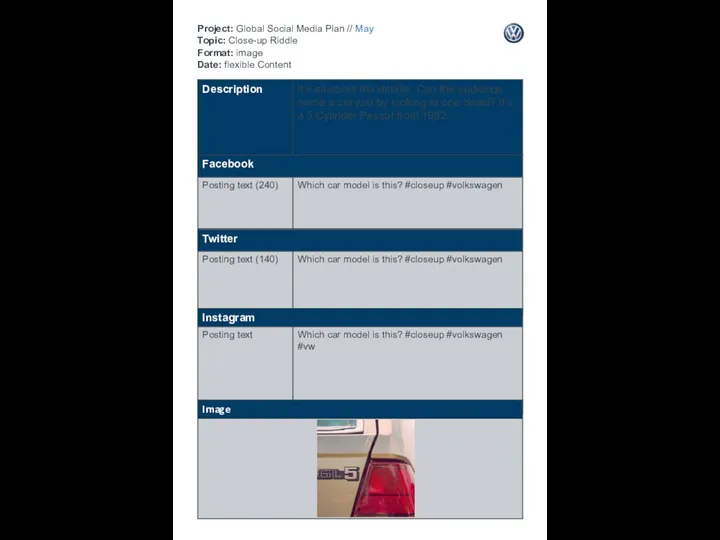

Основное оборудование Project: Global Social Media Plan // May Topic: Close-up Riddle Format: image Date: flexible Content

Project: Global Social Media Plan // May Topic: Close-up Riddle Format: image Date: flexible Content Журнал Холодно

Журнал Холодно Фирма по продаже сотовых телефонов Micro

Фирма по продаже сотовых телефонов Micro Nash果汁红葡萄-苹果. Grape-apple red

Nash果汁红葡萄-苹果. Grape-apple red Обзор ключевых инструментов рекламы и маркетинга в разных соцсетях

Обзор ключевых инструментов рекламы и маркетинга в разных соцсетях Конкурентные преимущества фирм в глобальных масштабах

Конкурентные преимущества фирм в глобальных масштабах Маркетинг как концепция рыночного управления

Маркетинг как концепция рыночного управления БиоКОД Алоэ

БиоКОД Алоэ Телеконтакт! Работа для современного человека

Телеконтакт! Работа для современного человека Клиентоориентированность. Имидж библиотеки

Клиентоориентированность. Имидж библиотеки Продукты Zinzino. Предложения для клиента

Продукты Zinzino. Предложения для клиента What is Co-Branding

What is Co-Branding История рекламы

История рекламы ЗАО Металлист

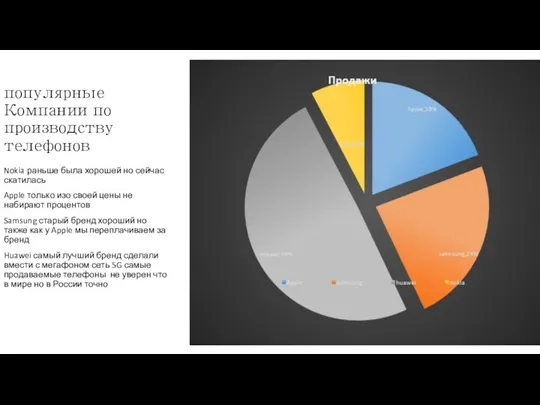

ЗАО Металлист популярные Компании по производству телефонов

популярные Компании по производству телефонов Project: Global Social Media Plan // June Topic: Passat B6 Format: video Date: Flexible Content

Project: Global Social Media Plan // June Topic: Passat B6 Format: video Date: Flexible Content