Содержание

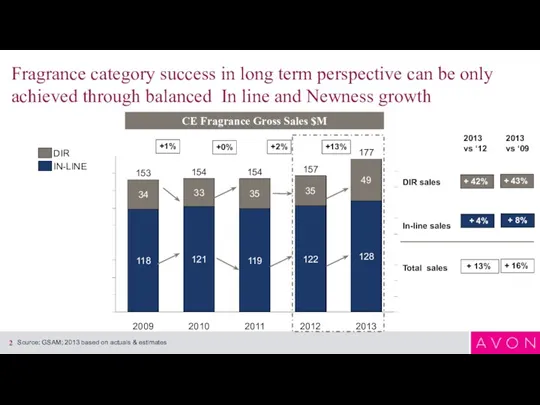

- 2. Fragrance category success in long term perspective can be only achieved through balanced In line and

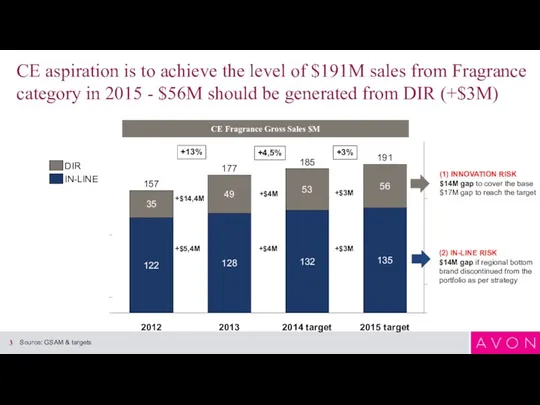

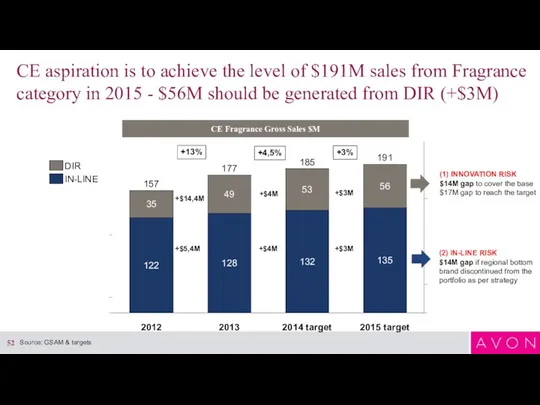

- 3. CE aspiration is to achieve the level of $191M sales from Fragrance category in 2015 -

- 4. In 2015 we need to continue the strategy from 2014 and find new sources of energising

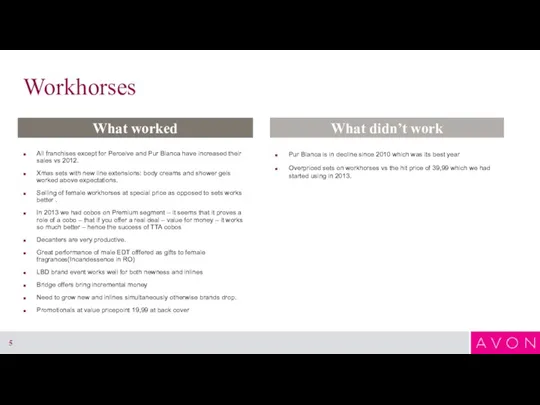

- 5. Workhorses All franchises except for Perceive and Pur Blanca have increased their sales vs 2012. Xmas

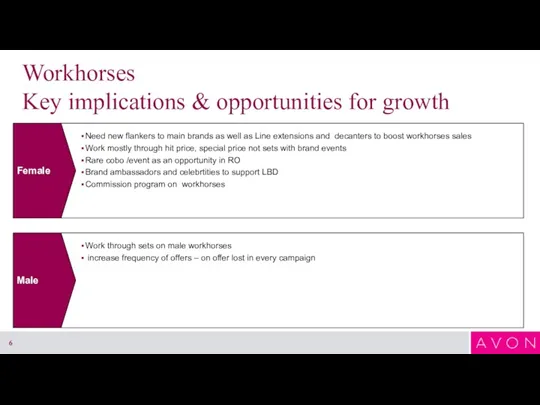

- 6. Workhorses Key implications & opportunities for growth Male Work through sets on male workhorses increase frequency

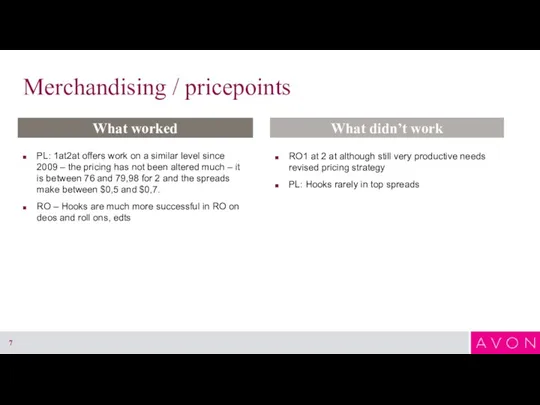

- 7. Merchandising / pricepoints PL: 1at2at offers work on a similar level since 2009 – the pricing

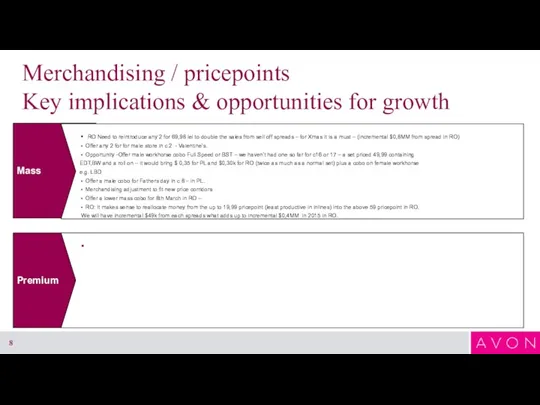

- 8. Merchandising / pricepoints Key implications & opportunities for growth Premium Mass RO Need to reintroduce any

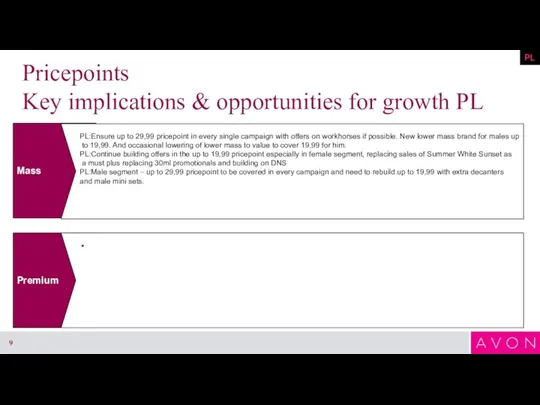

- 9. Pricepoints Key implications & opportunities for growth PL Premium Mass PL:Ensure up to 29,99 pricepoint in

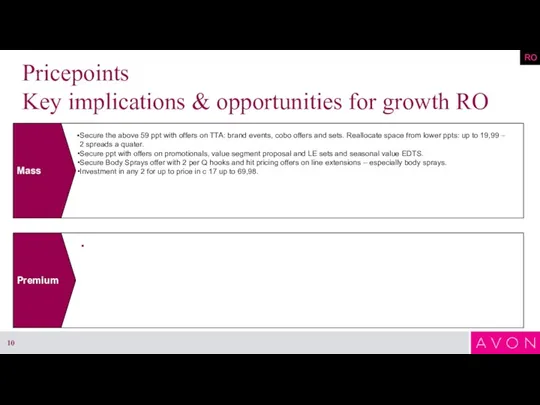

- 10. Pricepoints Key implications & opportunities for growth RO Premium Mass Secure the above 59 ppt with

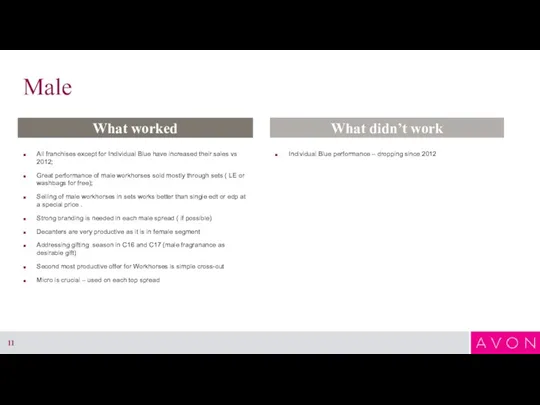

- 11. Male What worked What didn’t work All franchises except for Individual Blue have increased their sales

- 12. Male Key implications & opportunities for growth Premium Mass Strengthen Individual Blue using fragrance best practise

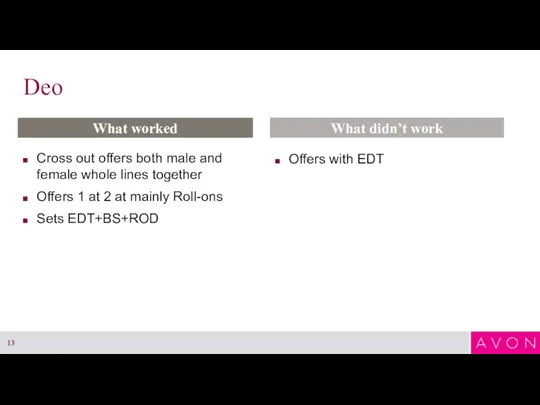

- 13. Deo Cross out offers both male and female whole lines together Offers 1 at 2 at

- 14. Deo Key implications & opportunities for growth Male More 1at 2at offers for body sprays or

- 15. Occassions What worked What didn’t work

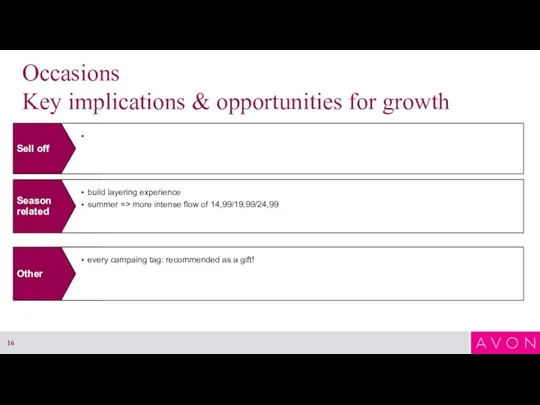

- 16. Occasions Key implications & opportunities for growth Season related build layering experience summer => more intense

- 17. Avon Category penetration among Avon Shoppers 21% 35% 59% 85% 59% We can also see huge

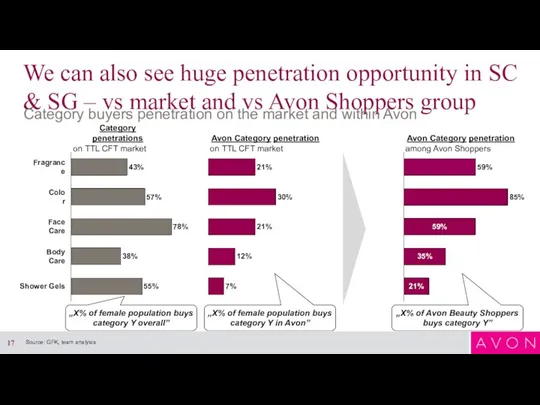

- 18. Some age segments reach its penetration limits e.g. In Fragrance (25-44); in Care, issue is valid

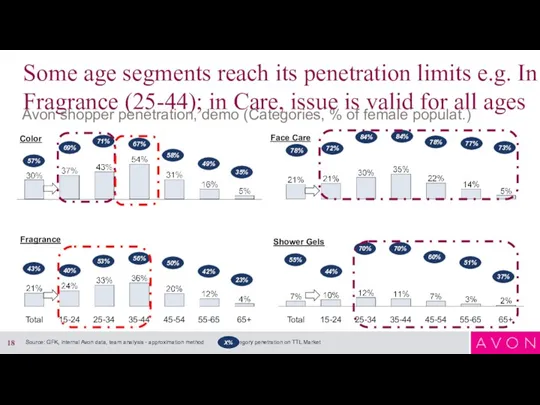

- 19. For categories, Frag/Color need to seek new source of growth, while ‘Care’ needs to recruit Shoppers

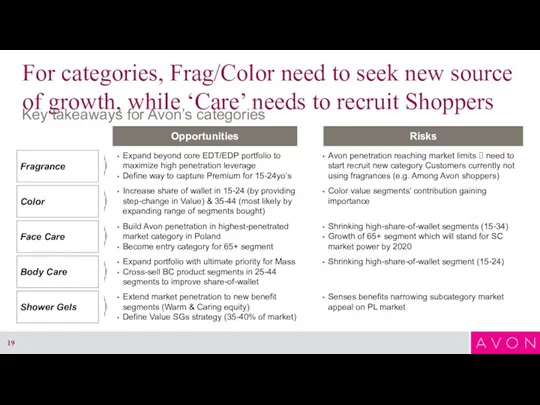

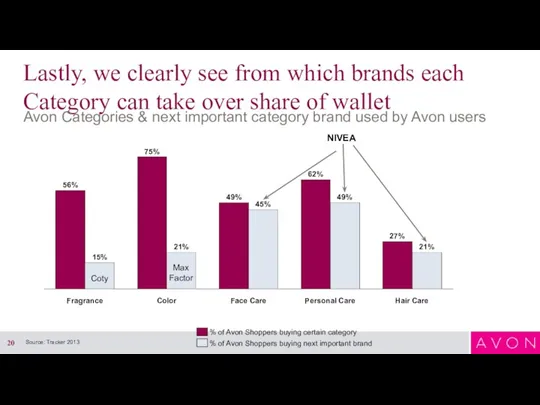

- 20. Lastly, we clearly see from which brands each Category can take over share of wallet Avon

- 21. KEY SUCCESS FACTORS IN-LINE - WINNING MIX

- 22. KEY SUCCESS FACTORS IN-LINE - WINNING MIX

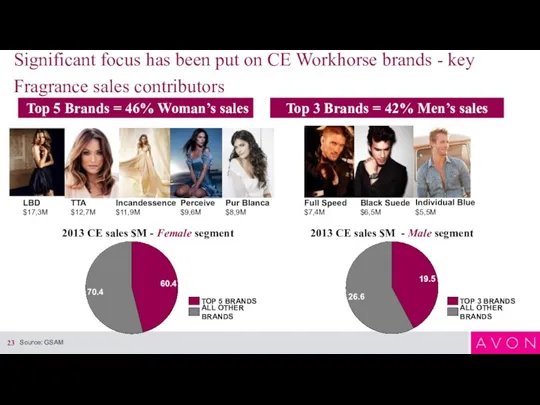

- 23. Top 5 Brands = 46% Woman’s sales Top 3 Brands = 42% Men’s sales Significant focus

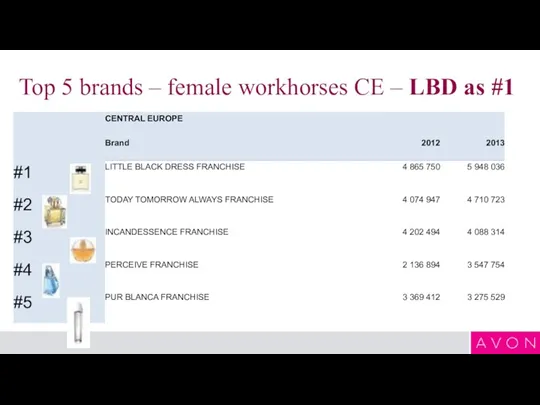

- 24. Top 5 brands – female workhorses CE – LBD as #1

- 25. Top 5 brands – female workhorses PL – LBD as #1

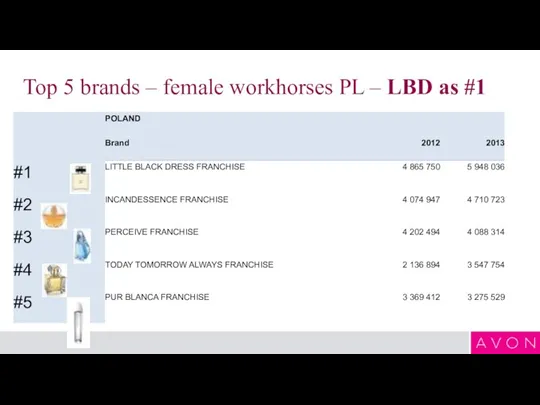

- 26. Top 5 brands – female workhorses RO – TTA as #1

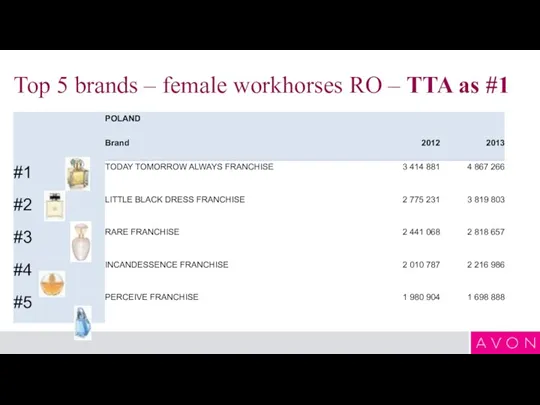

- 27. 2012 and 2013 results clearly indicate that Workhorses growth cannot be achieved without increase in Innovation

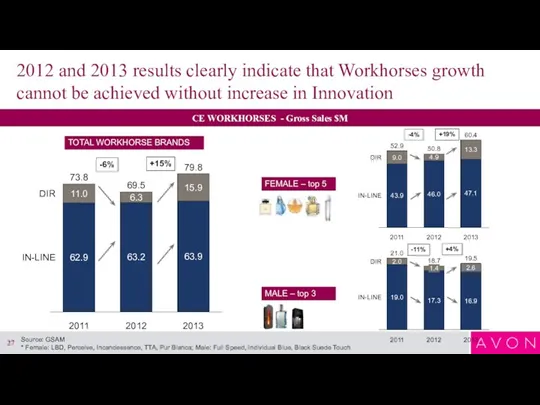

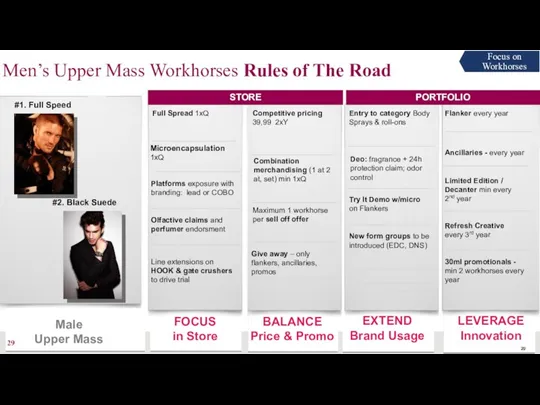

- 28. FOCUS in Store Microencapsulation 1xQ LEVERAGE Innovation Combination merchandising (1 at 2 at, set) min 1xQ

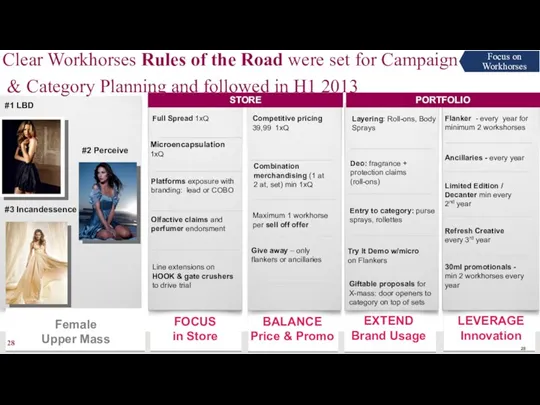

- 29. FOCUS in Store Microencapsulation 1xQ LEVERAGE Innovation Combination merchandising (1 at 2 at, set) min 1xQ

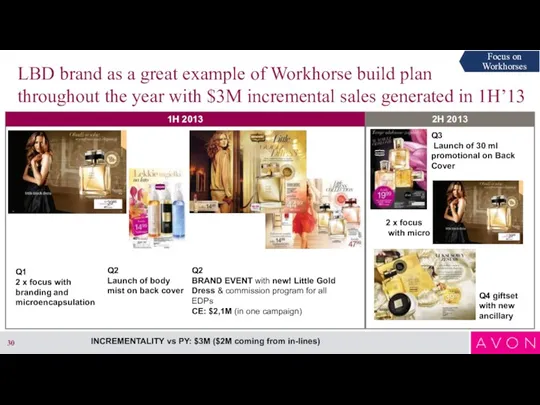

- 30. LBD brand as a great example of Workhorse build plan throughout the year with $3M incremental

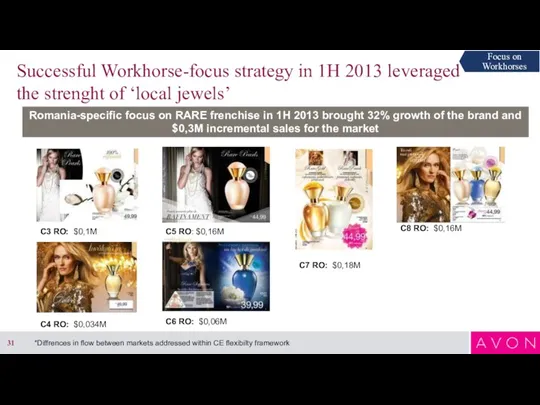

- 31. Successful Workhorse-focus strategy in 1H 2013 leveraged the strenght of ‘local jewels’ *Diffrences in flow between

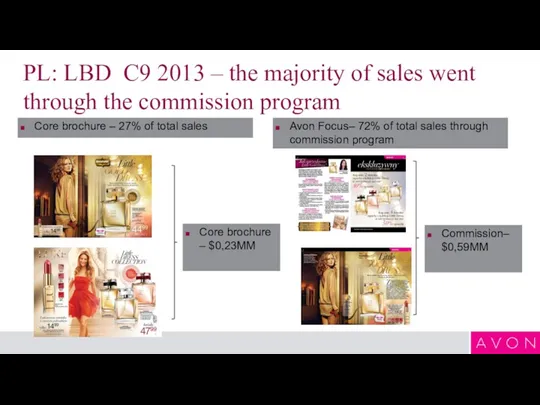

- 32. PL: LBD C9 2013 – the majority of sales went through the commission program Core brochure

- 33. RO: LBD C9 2013 – the majority of sales went through core brochure Core brochure –

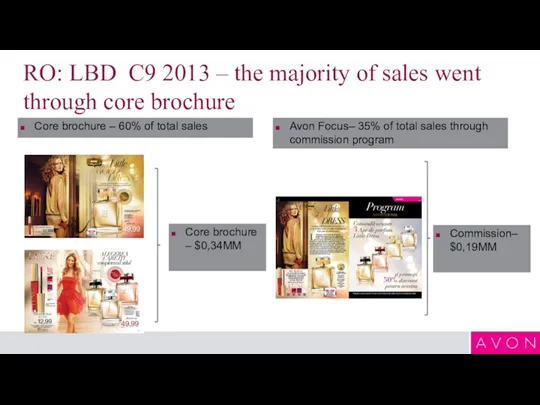

- 34. KEY SUCCESS FACTORS IN-LINE - WINNING MIX

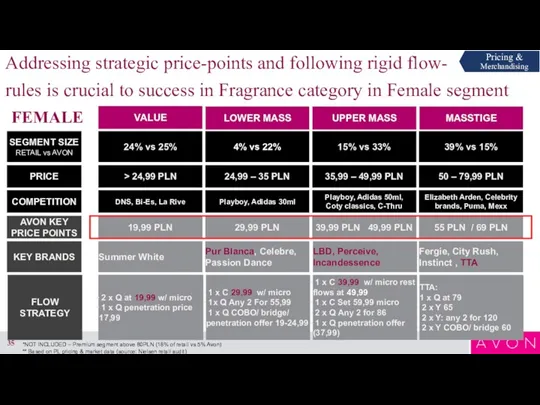

- 35. LOWER MASS AVON KEY PRICE POINTS VALUE 19,99 PLN UPPER MASS MASSTIGE 29,99 PLN 39,99 PLN

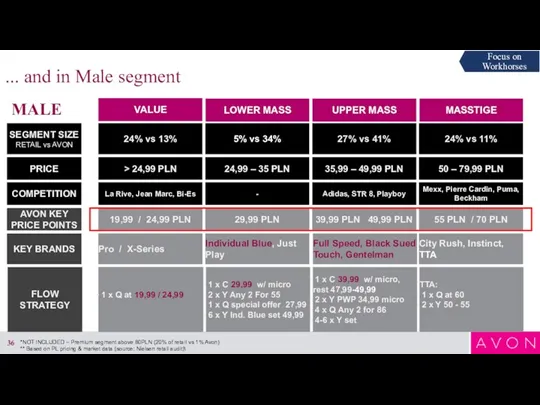

- 36. LOWER MASS AVON KEY PRICE POINTS VALUE 19,99 / 24,99 PLN UPPER MASS MASSTIGE 29,99 PLN

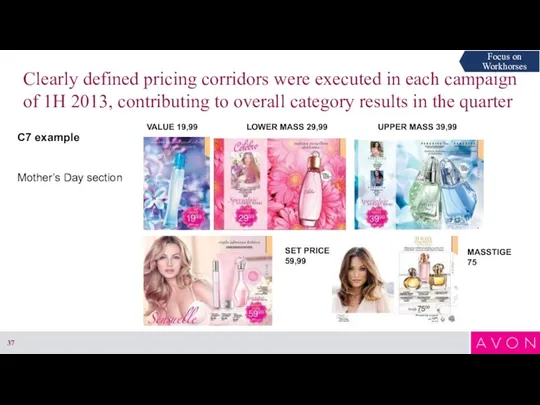

- 37. Clearly defined pricing corridors were executed in each campaign of 1H 2013, contributing to overall category

- 38. KEY SUCCESS FACTORS IN-LINE - WINNING MIX

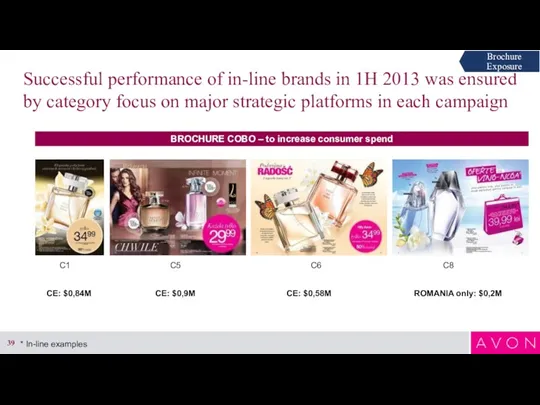

- 39. Successful performance of in-line brands in 1H 2013 was ensured by category focus on major strategic

- 40. Fragrance EDT’s were promoted in bridge offers in order to boost activity in consequitive campaigns C7

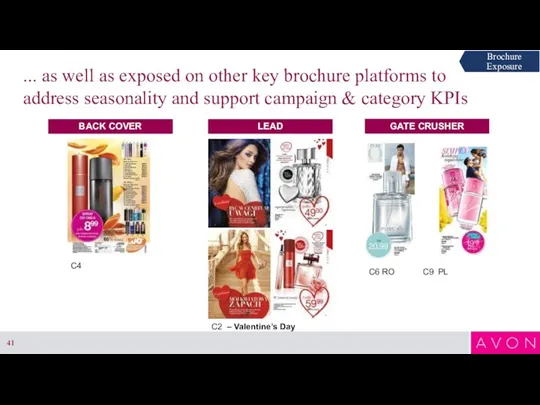

- 41. ... as well as exposed on other key brochure platforms to address seasonality and support campaign

- 42. KEY SUCCESS FACTORS IN-LINE - WINNING MIX

- 43. Fragrance store success lays in balanced merchandising (1) C4 C6 C9 PL: $0,4M RO:$0,1M PL: $0,25M

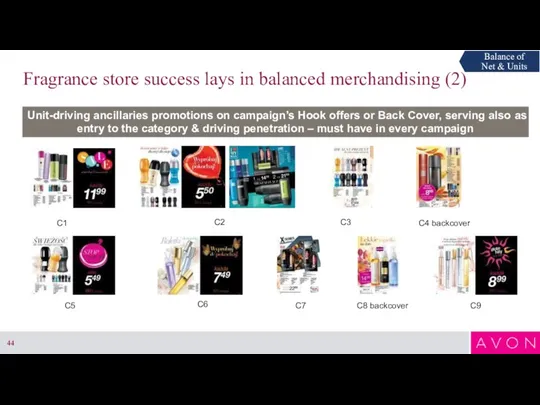

- 44. C1 C2 C4 backcover C3 C5 C6 C7 C8 backcover C9 Unit-driving ancillaries promotions on campaign’s

- 45. Set with EDT + purse spray + body spray C6 Set with + EDT body wash

- 46. KEY SUCCESS FACTORS IN-LINE - WINNING MIX

- 47. Focus on branding and consumer insight related communication, combined with sesonally relevant creative execution & story

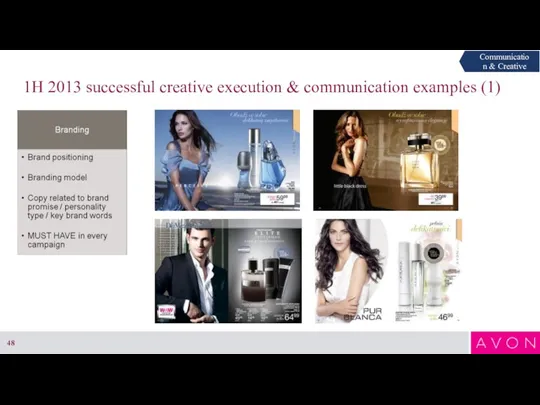

- 48. 1H 2013 successful creative execution & communication examples (1)

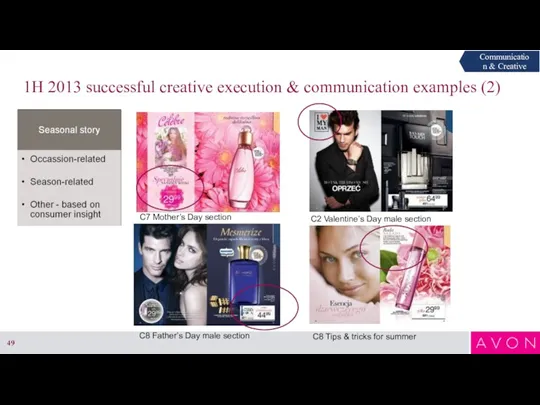

- 49. 1H 2013 successful creative execution & communication examples (2) C7 Mother’s Day section C2 Valentine’s Day

- 50. 1H 2013 successful creative execution & communication examples (3) Olfactive pyramid explanation Perfumer quote to support

- 51. 2015 Situation assesment

- 52. CE aspiration is to achieve the level of $191M sales from Fragrance category in 2015 -

- 53. Appendix 2015 Innovation pipeline

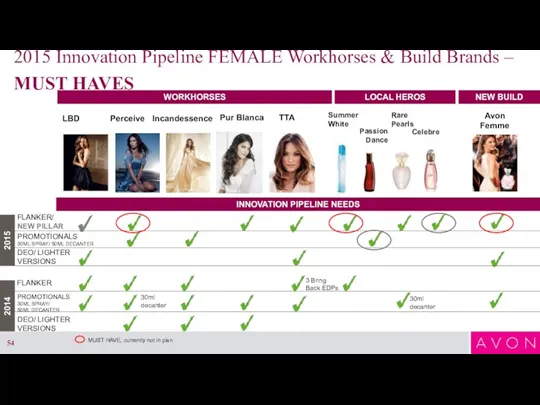

- 54. WORKHORSES INNOVATION PIPELINE NEEDS FLANKER/ NEW PILLAR DEO/ LIGHTER VERSIONS LOCAL HEROS 2015 Innovation Pipeline FEMALE

- 56. Скачать презентацию

Ростовые куклы

Ростовые куклы Разработка рекламы земельного объекта: характеристика объекта рекламы, определение факторов цены,

Разработка рекламы земельного объекта: характеристика объекта рекламы, определение факторов цены, Добро пожаловать в клуб inCruises

Добро пожаловать в клуб inCruises В бизнесе всё решают связью

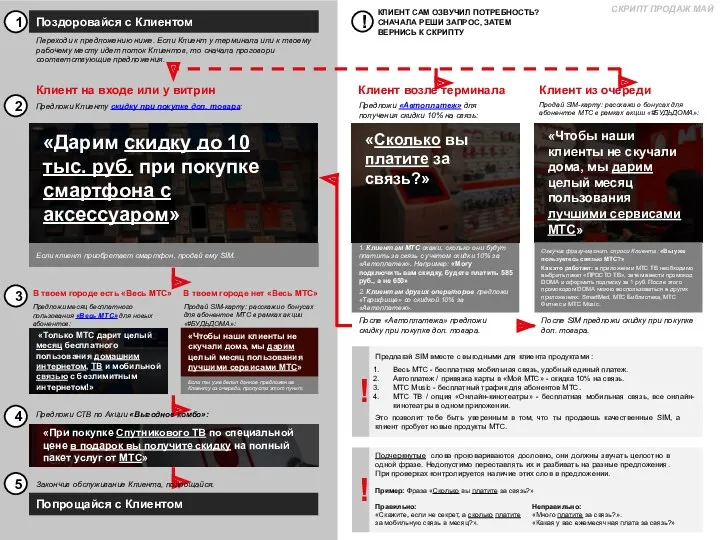

В бизнесе всё решают связью С нами работать выгодно и удобно! Профессиональный ведущий Алексей Кутаков

С нами работать выгодно и удобно! Профессиональный ведущий Алексей Кутаков Мерчандайзинг в розничном магазине Вrandshop и его влияние на эффективность продаж

Мерчандайзинг в розничном магазине Вrandshop и его влияние на эффективность продаж ООО Альфа Транзит

ООО Альфа Транзит Орифлэйм. Каталог №14

Орифлэйм. Каталог №14 Як заробляти в страхуванні

Як заробляти в страхуванні Бизнес-проекты: менеджмент и маркетинг. Проект 2 Компания и ее потребитель

Бизнес-проекты: менеджмент и маркетинг. Проект 2 Компания и ее потребитель Гольфстрим. Охранные системы

Гольфстрим. Охранные системы Бренд Dove

Бренд Dove Тарифы и услуги МТС

Тарифы и услуги МТС Гедонист(1)

Гедонист(1) Фьоникс фарма – Ексклузивен представител за България на Contour® Plus на Bayer

Фьоникс фарма – Ексклузивен представител за България на Contour® Plus на Bayer Санитарно-гигиеническое оборудование и расходные материалы. Бренд Cleaneq

Санитарно-гигиеническое оборудование и расходные материалы. Бренд Cleaneq Архитектурные элементы интерьера квартиры

Архитектурные элементы интерьера квартиры Разработка товарного предложения и управление товаром

Разработка товарного предложения и управление товаром Новинка от ВЭЛНЭС протеиновый комплекс

Новинка от ВЭЛНЭС протеиновый комплекс Протеиновый коктейль из сыворотки. Компания TopLife

Протеиновый коктейль из сыворотки. Компания TopLife Проект по разработке фирменного стиля для онлайн-магазина детских товаров

Проект по разработке фирменного стиля для онлайн-магазина детских товаров Управление маркетингом: бюджет маркетинга, организация службы маркетинга

Управление маркетингом: бюджет маркетинга, организация службы маркетинга Гофротара по оптимальным ценам

Гофротара по оптимальным ценам Каталог TUT.BY

Каталог TUT.BY Технология создания анимационных программ. Основные этапы

Технология создания анимационных программ. Основные этапы Витрины. Магазины Флоенция, Милан 9-13 января

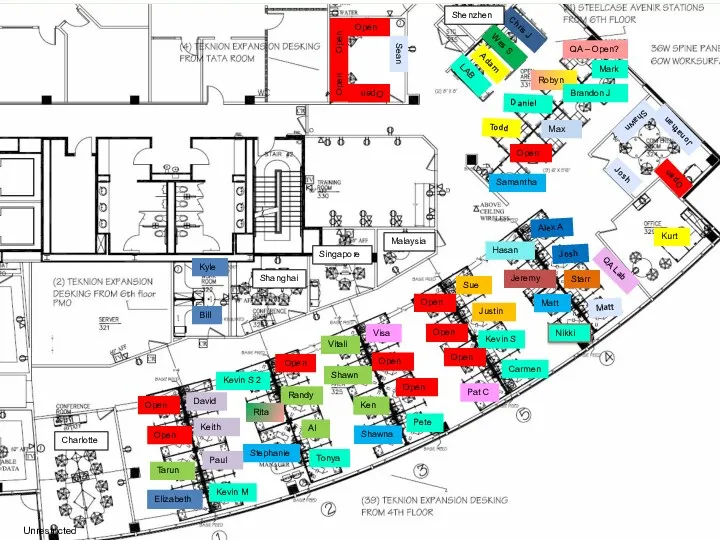

Витрины. Магазины Флоенция, Милан 9-13 января CLT Seating. QA – Open?

CLT Seating. QA – Open? Picard – Histor

Picard – Histor