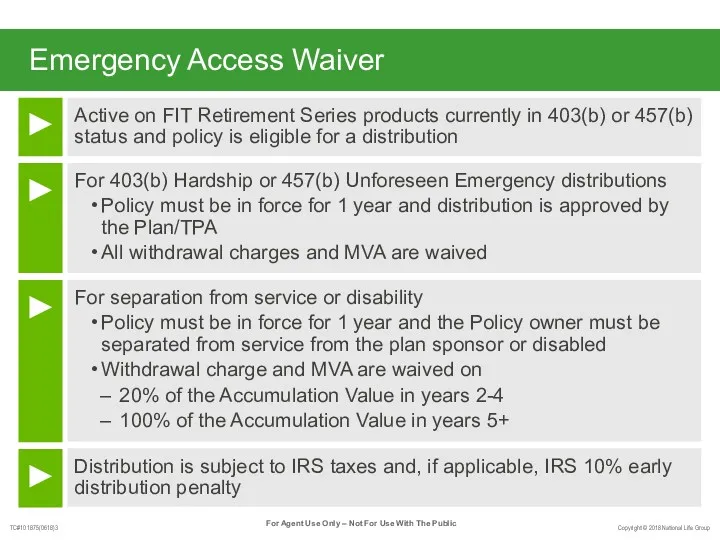

Emergency Access Waiver

Active on FIT Retirement Series products currently in 403(b)

or 457(b) status and policy is eligible for a distribution

For 403(b) Hardship or 457(b) Unforeseen Emergency distributions

Policy must be in force for 1 year and distribution is approved by the Plan/TPA

All withdrawal charges and MVA are waived

For separation from service or disability

Policy must be in force for 1 year and the Policy owner must be separated from service from the plan sponsor or disabled

Withdrawal charge and MVA are waived on

20% of the Accumulation Value in years 2-4

100% of the Accumulation Value in years 5+

Distribution is subject to IRS taxes and, if applicable, IRS 10% early distribution penalty

►

►

►

►

Стратегии продвижения товара

Стратегии продвижения товара Электронная коммерция

Электронная коммерция Разработка проекта по продвижению музыкальной группы LaScala

Разработка проекта по продвижению музыкальной группы LaScala Повышение продаж на сайте в несколько кликов

Повышение продаж на сайте в несколько кликов Сеть современных универсальных книжных магазинов Читай-город

Сеть современных универсальных книжных магазинов Читай-город Несколько рецептов для меню аргонавта

Несколько рецептов для меню аргонавта Marketing for Hospitality and Tourism. The Role of Marketing in Strategic Planning. Chapter 3

Marketing for Hospitality and Tourism. The Role of Marketing in Strategic Planning. Chapter 3 Курс тренинг с экономическим эффектом

Курс тренинг с экономическим эффектом Product concepts

Product concepts Каталитическое системы - отопления помещений - очистки воздуха. ООО ЭкоКат

Каталитическое системы - отопления помещений - очистки воздуха. ООО ЭкоКат Характеристики маркетингу. Маркетингові дослідження

Характеристики маркетингу. Маркетингові дослідження Наше новое имя. Бизнес-студия

Наше новое имя. Бизнес-студия Microsoft PowerPoint

Microsoft PowerPoint Semiconductor Chips that Support AI

Semiconductor Chips that Support AI Kaspersky internet security 2017

Kaspersky internet security 2017 Торговый кластер под размещение объектов торговли (48 магазинов)

Торговый кластер под размещение объектов торговли (48 магазинов) Компания Faberon

Компания Faberon Lnternational marketing. Social and cultural environment. (Chapter 4)

Lnternational marketing. Social and cultural environment. (Chapter 4) TCP Optimization

TCP Optimization Не экономьте на бизнесе. Экономьте на связи

Не экономьте на бизнесе. Экономьте на связи Результаты работы по проекту ЕРКЦ в 2015 году и планы на 2016 год

Результаты работы по проекту ЕРКЦ в 2015 году и планы на 2016 год Маркетинг и продажи

Маркетинг и продажи Cost & Sell. CRM sample

Cost & Sell. CRM sample Brief Mika Barni

Brief Mika Barni Как увеличить прибыль своего бизнеса

Как увеличить прибыль своего бизнеса Икона рекламного бизнеса XX века. Coca-Cola

Икона рекламного бизнеса XX века. Coca-Cola Латеральный маркетинг

Латеральный маркетинг The 10 Golden Rules of Customer Service

The 10 Golden Rules of Customer Service