Содержание

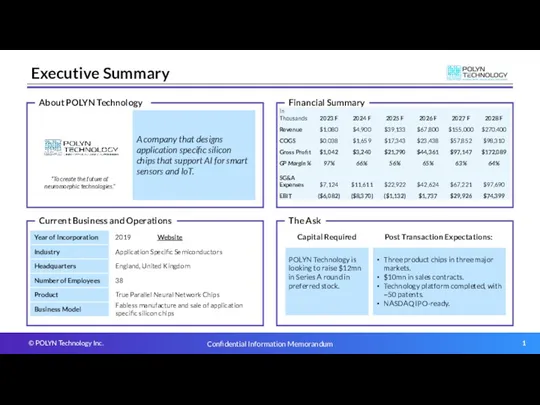

- 2. Executive Summary About POLYN Technology Current Business and Operations The Ask Financial Summary A company that

- 3. Commercial Overview

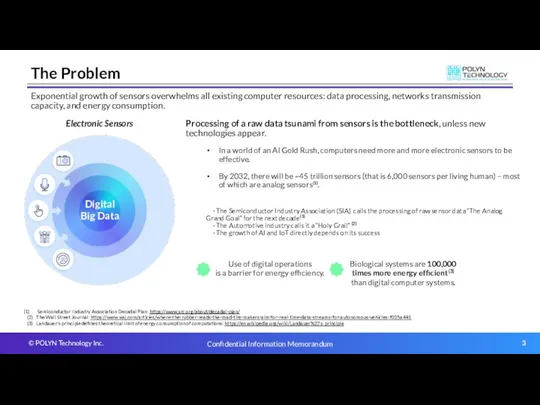

- 4. The Problem Exponential growth of sensors overwhelms all existing computer resources: data processing, networks transmission capacity,

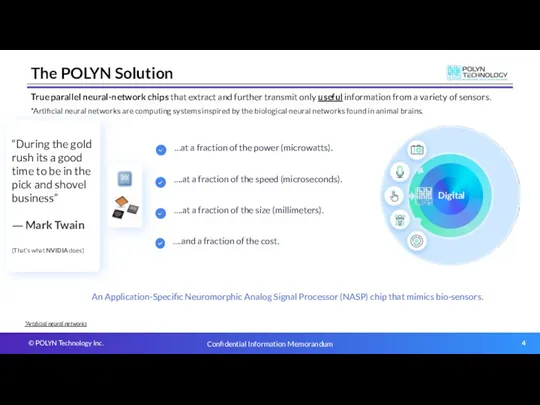

- 5. The POLYN Solution True parallel neural-network chips that extract and further transmit only useful information from

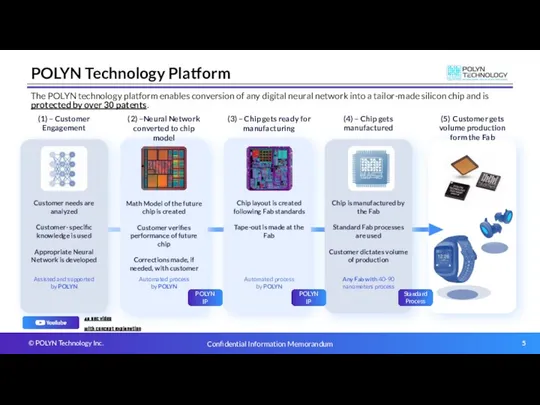

- 6. POLYN Technology Platform The POLYN technology platform enables conversion of any digital neural network into a

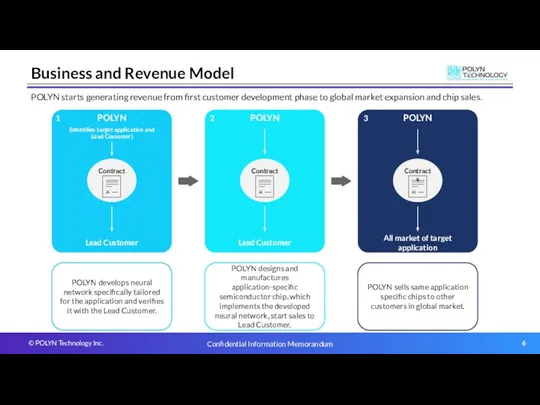

- 7. Business and Revenue Model POLYN starts generating revenue from first customer development phase to global market

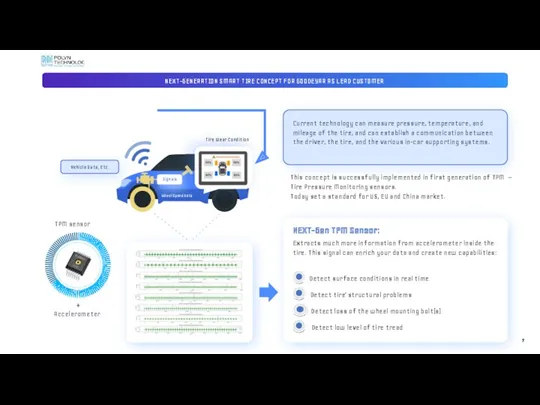

- 8. 7 NEXT-GENERATION SMART TIRE CONCEPT FOR GOODEYAR AS LEAD CUSTOMER Current technology can measure pressure, temperature,

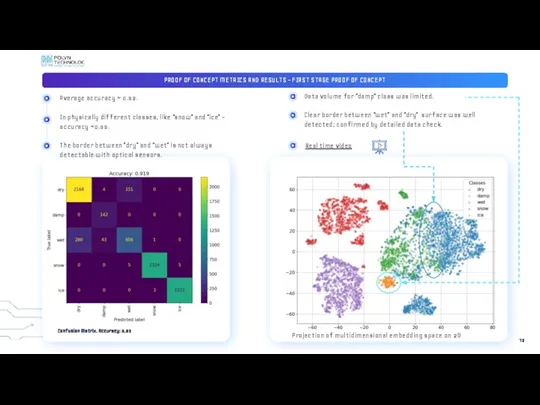

- 9. PROOF OF CONCEPT METRICS AND RESULTS - FIRST STAGE PROOF OF CONCEPT ` Confusion Matrix. Accuracy:

- 10. VIDEO

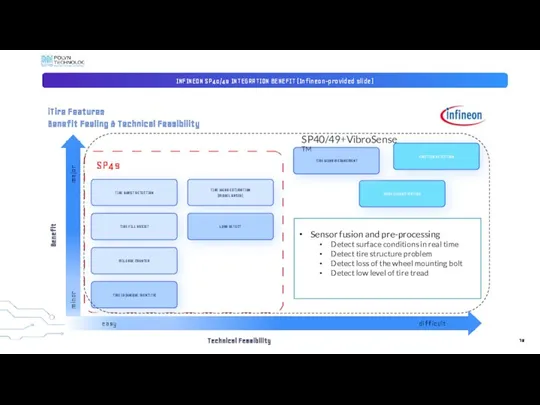

- 11. INFINEON SP40/49 INTEGRATION BENEFIT (Infineon-provided slide) ROAD CLASSIFICATION FRICTION DETECTION TIRE WEAR MESUREMENT Benefit Technical Feasibility

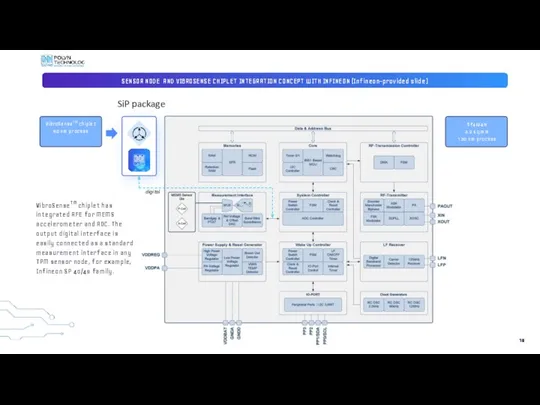

- 12. SOLUTION: NEUROMORPHIC ANALOG SIGNAL PROCESSING FOR SENSOR RAW DATA SENSOR NODE AND VIBROSENSE CHIPLET INTEGRATION CONCEPT

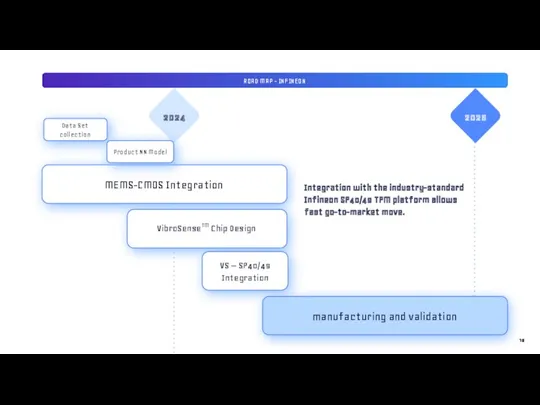

- 13. SOLUTION: NEUROMORPHIC ANALOG SIGNAL PROCESSING FOR SENSOR RAW DATA ROAD MAP - INFINEON 2024 Data Set

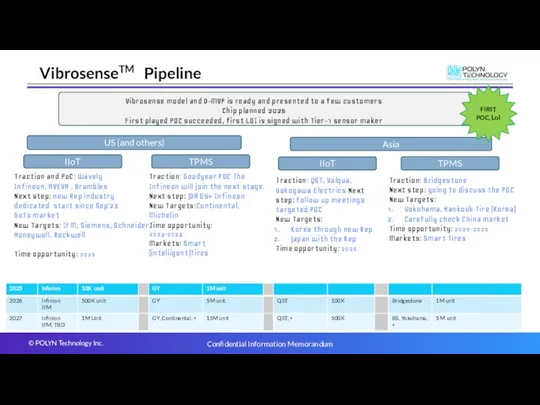

- 14. US (and others) IIoT TPMS Asia IIoT TPMS Vibrosense model and D-MVP is ready and presented

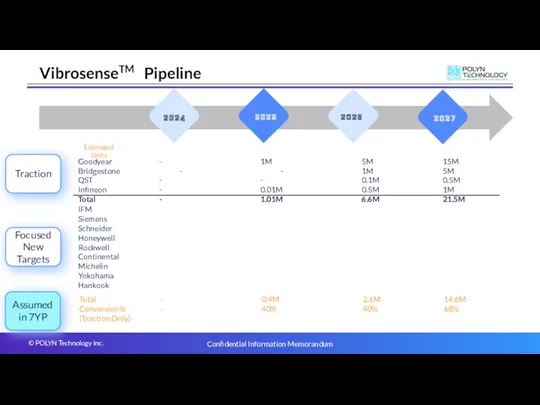

- 15. VibrosenseTM Pipeline Traction Focused New Targets 2024 2025 2026 2027 Goodyear - 1M 5M 15M Bridgestone

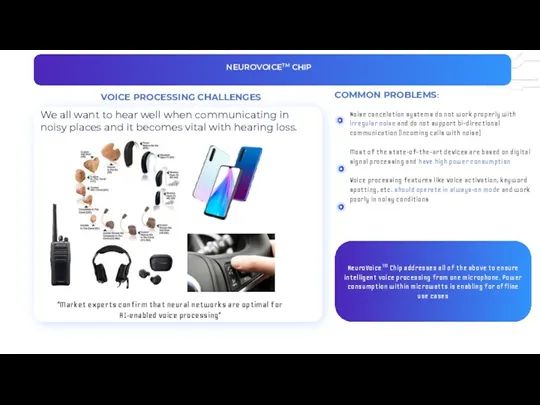

- 16. ` NeuroVoiceTM Chip addresses all of the above to ensure intelligent voice processing from one microphone.

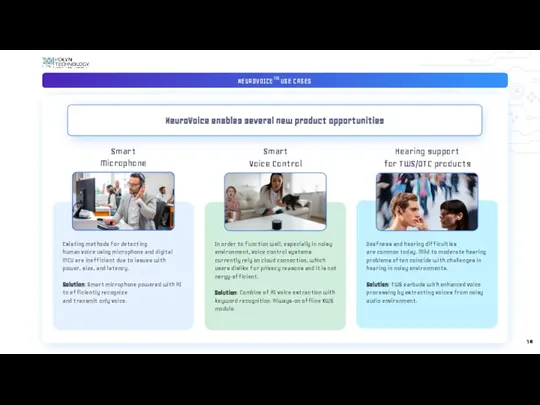

- 17. NEUROVOICETM USE CASES ` ` NeuroVoice enables several new product opportunities Smart Microphone Smart Voice Control

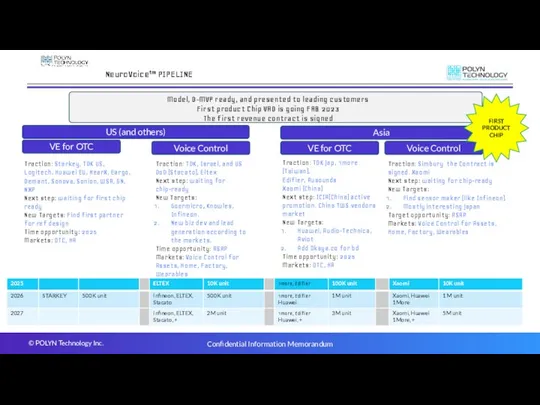

- 18. US (and others) VE for OTC Voice Control Asia VE for OTC Voice Control Model, D-MVP

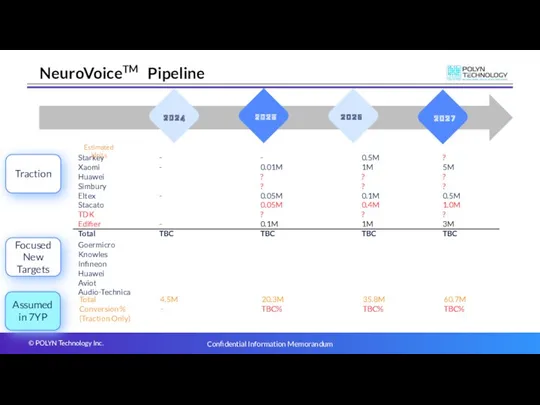

- 19. NeuroVoiceTM Pipeline Traction Focused New Targets 2024 2025 2026 2027 Starkey - - 0.5M ? Xaomi

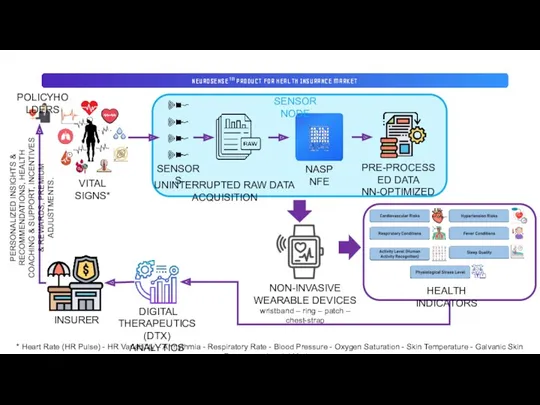

- 20. NEUROSENSETM PRODUCT FOR HEALTH INSURANCE MARKET * Heart Rate (HR Pulse) - HR Variability – Arrhythmia

- 21. HEALTH INSURANCE MARKET – INSURERS ALREADY TRYING WEARABLE DEVICES - EXAMPLES GoTo market strategy: Integration of

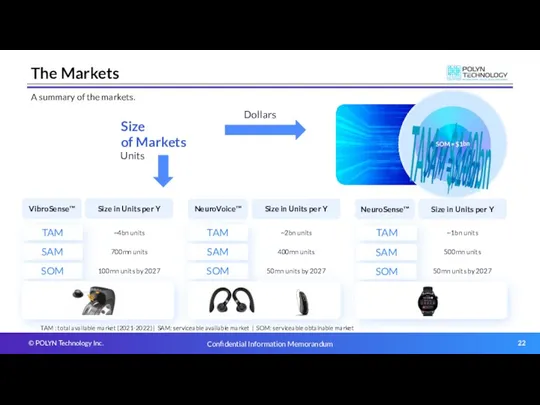

- 22. Immediate Multi-Billion Unit Markets The POLYN Technology platform delivers enabling solutions for various applications. Always-ON monitoring

- 23. The Markets A summary of the markets. TAM : total available market (2021-2022) | SAM: serviceable

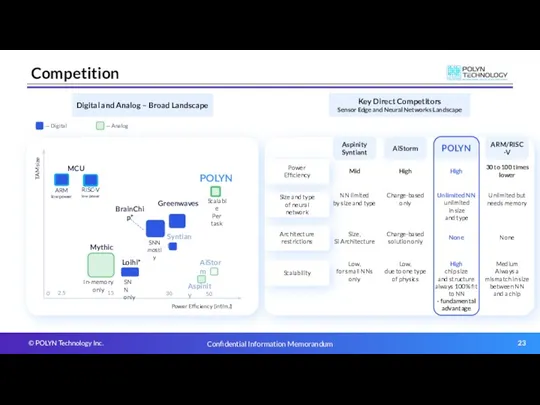

- 24. Competition Power Efficiency (inf/mJ) TAM size — Analog — Digital Power Efficiency Architecture restrictions Size and

- 25. Roadmap 2023 2024 2025 2026 2027 PRODUCTS NEUROSENSE 1.0 VIBROSENSE 1.0 VIBROSENSE 2.0 GROWTH NEUROSENSE 2.0

- 26. Leadership Team A team of professionals experienced in implementing and commercializing new technologies.

- 27. Financial Overview

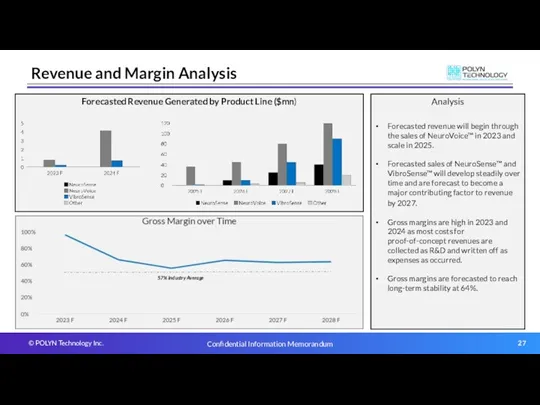

- 28. Forecasted Revenue Generated by Product Line ($mn) Revenue and Margin Analysis Analysis Forecasted revenue will begin

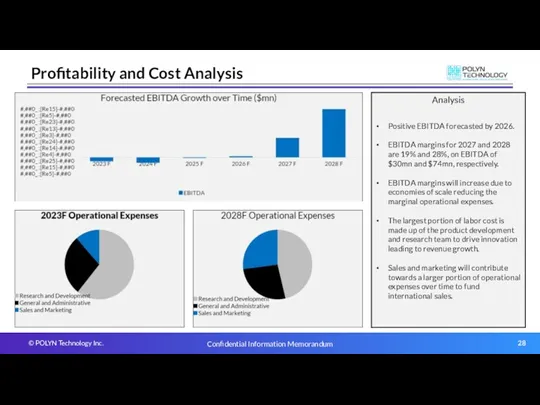

- 29. Profitability and Cost Analysis Analysis Positive EBITDA forecasted by 2026. EBITDA margins for 2027 and 2028

- 31. Скачать презентацию

YCLIENTS. Онлайн-запись в компанию

YCLIENTS. Онлайн-запись в компанию Секреты успешного резюме

Секреты успешного резюме Прайс-лист Рыболовные товары

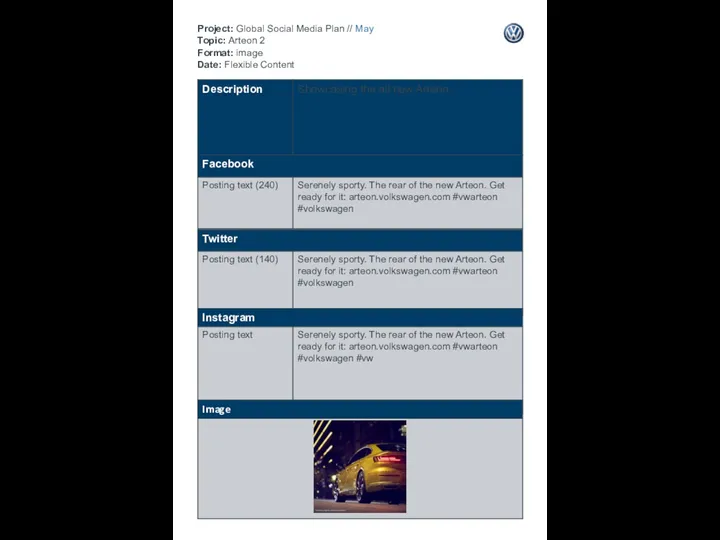

Прайс-лист Рыболовные товары Project: Global Social Media Plan // May Topic: Arteon 2 Format: image Date: Flexible Content

Project: Global Social Media Plan // May Topic: Arteon 2 Format: image Date: Flexible Content Инновации и инновационная деятельность, как объект управления. (Тема 3, вопросы 4-10)

Инновации и инновационная деятельность, как объект управления. (Тема 3, вопросы 4-10) Значение цинка в питании. БАД компании NSP, содержащие цинк

Значение цинка в питании. БАД компании NSP, содержащие цинк Презентація нових безпровідних навушників “Air Beats”

Презентація нових безпровідних навушників “Air Beats” Проект создания туристической фирмы

Проект создания туристической фирмы Минский завод виноградных вин

Минский завод виноградных вин ARPU. Инструменты оптимизации

ARPU. Инструменты оптимизации Отчет о прохождении учебной практики по профессиональному модулю. Организация и управление торгово-сбытовой деятельностью

Отчет о прохождении учебной практики по профессиональному модулю. Организация и управление торгово-сбытовой деятельностью Сетевая акция Литературный фантик

Сетевая акция Литературный фантик Рынок труда. Маркетинг персонала. Имидж и бренд работодателя

Рынок труда. Маркетинг персонала. Имидж и бренд работодателя Геймификация (игрофикация)

Геймификация (игрофикация) Копирайтинг. Способы заинтересовать читателя

Копирайтинг. Способы заинтересовать читателя Wavin ekoplastik

Wavin ekoplastik Продукты по уходу за кожей. Диадемин

Продукты по уходу за кожей. Диадемин Услуга Бесплатный вызов 8-800

Услуга Бесплатный вызов 8-800 Stibo. Professional Services. Web content v4CW

Stibo. Professional Services. Web content v4CW Конкуренция на рынке медицинских товаров и услуг

Конкуренция на рынке медицинских товаров и услуг Алгоритм - продажа на вебинарах

Алгоритм - продажа на вебинарах Разработка проекта по продвижению музыкальной группы LaScala

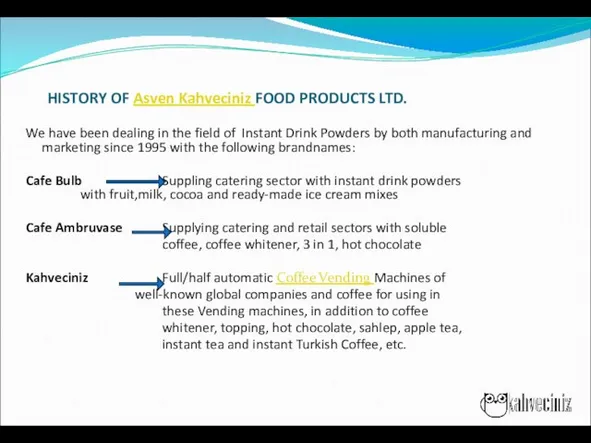

Разработка проекта по продвижению музыкальной группы LaScala History of Asven Kahveciniz Food products LTD

History of Asven Kahveciniz Food products LTD Продукты на сдачу. Страховая компания Вусо

Продукты на сдачу. Страховая компания Вусо Маркетинговый план интернет-канала TWT

Маркетинговый план интернет-канала TWT Подробнее о продуктах для и после бритья

Подробнее о продуктах для и после бритья Веб-приложение для управления офисом и создания бронирований офисных рабочих мест

Веб-приложение для управления офисом и создания бронирований офисных рабочих мест Rena Rosh. Продукт корпорации

Rena Rosh. Продукт корпорации