Содержание

- 2. Chapter Outline 8.1 Decision Trees 8.4 Options

- 3. Stewart Pharmaceuticals The Stewart Pharmaceuticals Corporation is considering investing in developing a drug that cures the

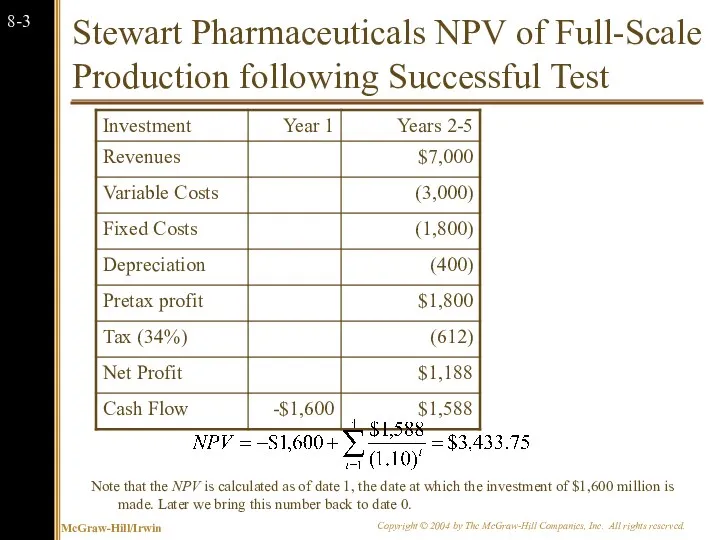

- 4. Stewart Pharmaceuticals NPV of Full-Scale Production following Successful Test Note that the NPV is calculated as

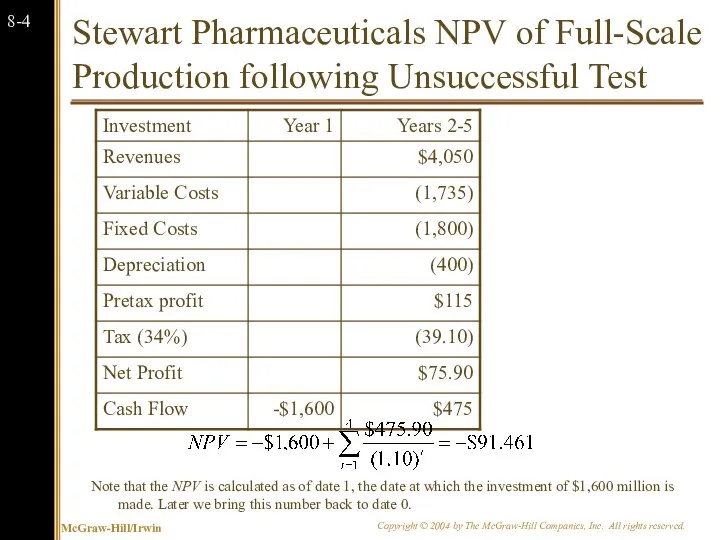

- 5. Stewart Pharmaceuticals NPV of Full-Scale Production following Unsuccessful Test Note that the NPV is calculated as

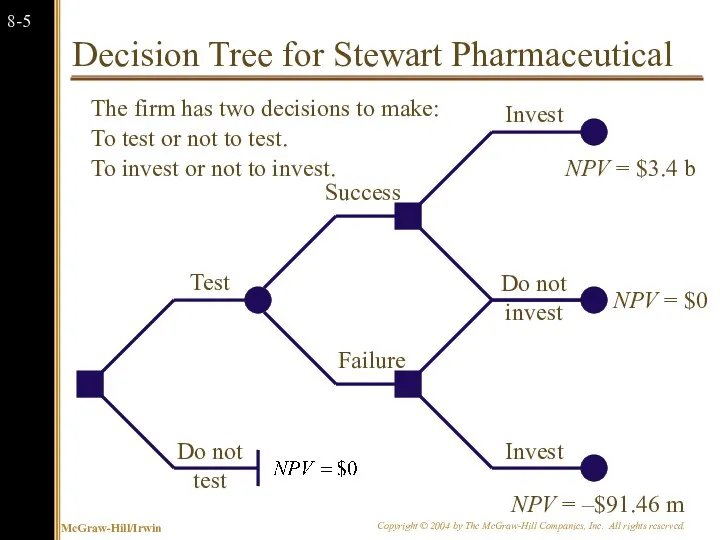

- 6. Decision Tree for Stewart Pharmaceutical Do not test Test Failure Success Do not invest Invest The

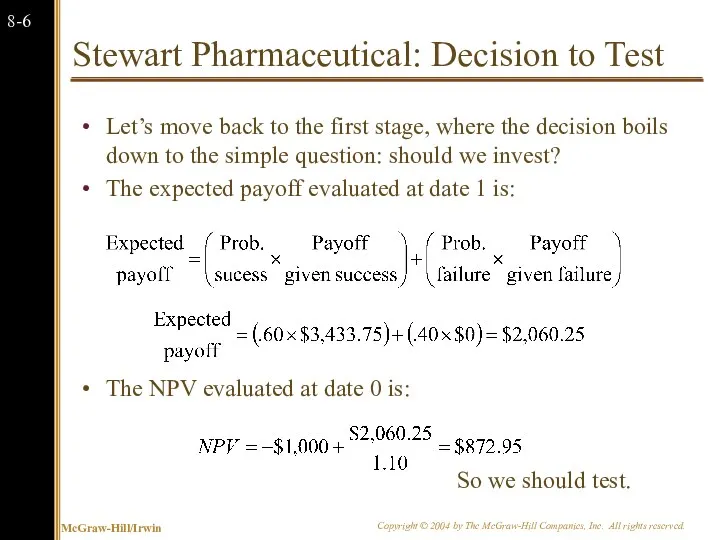

- 7. Stewart Pharmaceutical: Decision to Test Let’s move back to the first stage, where the decision boils

- 8. 8.4 Options One of the fundamental insights of modern finance theory is that options have value.

- 9. Options The Option to Expand Has value if demand turns out to be higher than expected.

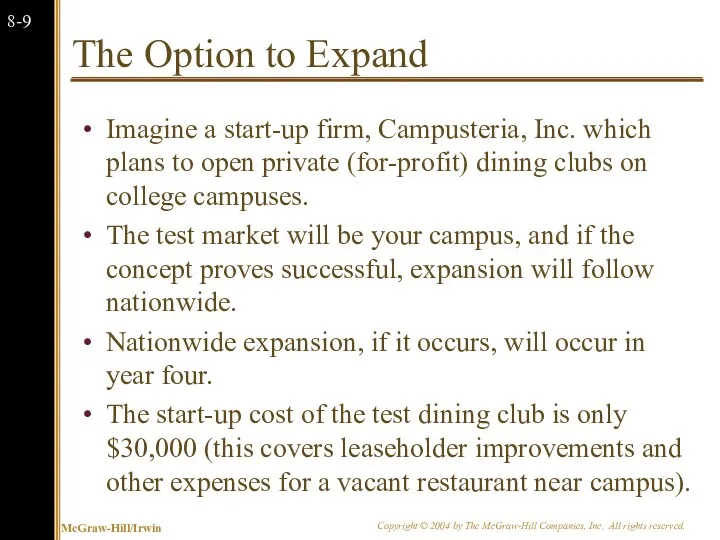

- 10. The Option to Expand Imagine a start-up firm, Campusteria, Inc. which plans to open private (for-profit)

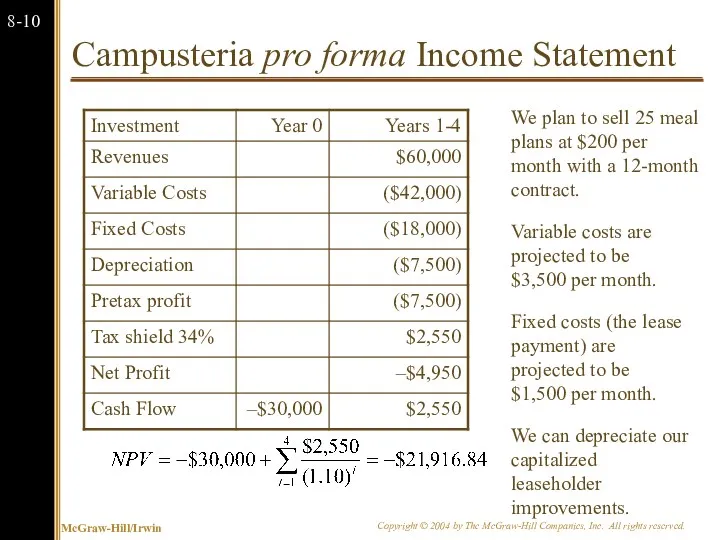

- 11. Campusteria pro forma Income Statement We plan to sell 25 meal plans at $200 per month

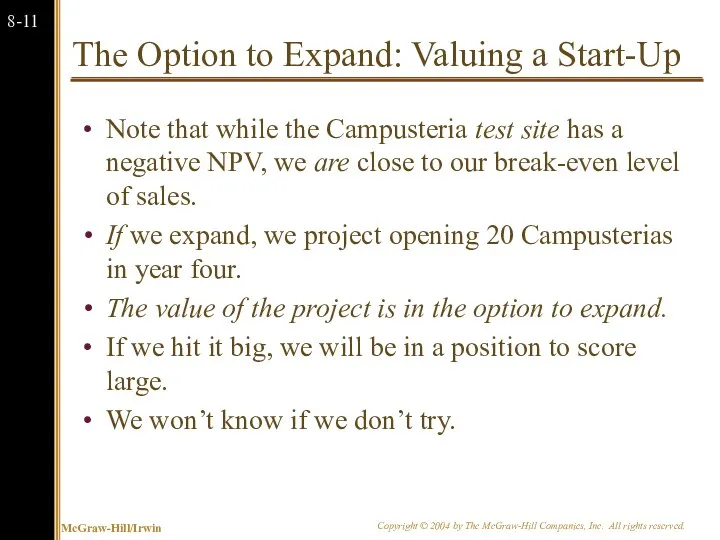

- 12. The Option to Expand: Valuing a Start-Up Note that while the Campusteria test site has a

- 13. Discounted Cash Flows and Options We can calculate the market value of a project as the

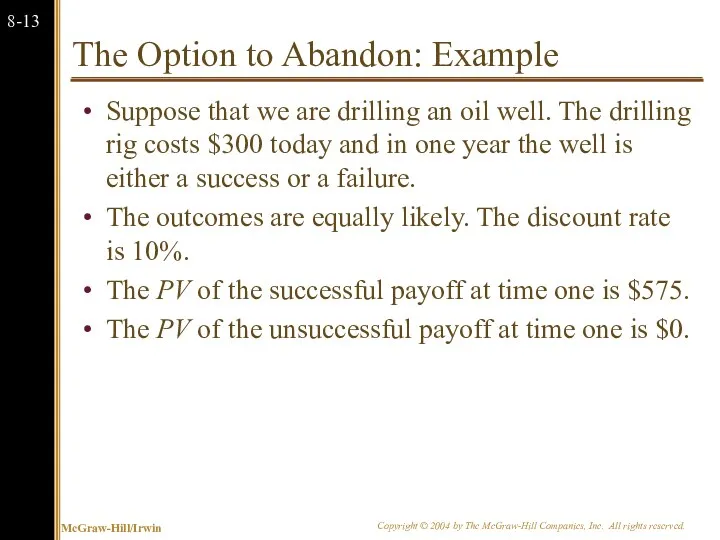

- 14. The Option to Abandon: Example Suppose that we are drilling an oil well. The drilling rig

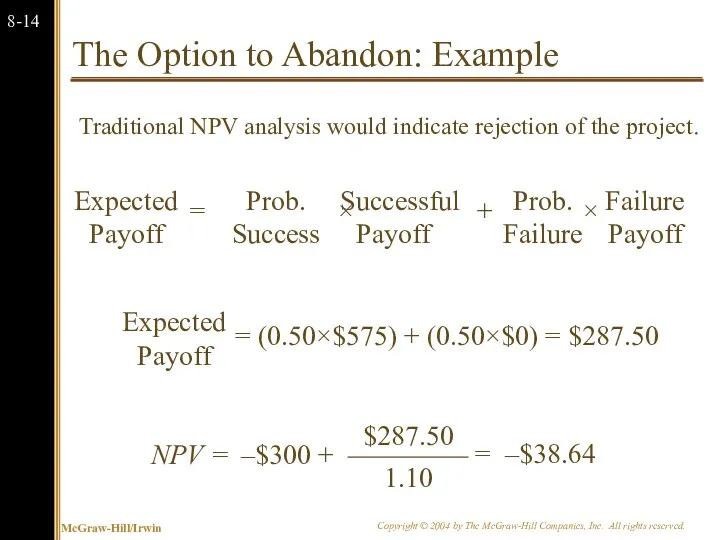

- 15. The Option to Abandon: Example Traditional NPV analysis would indicate rejection of the project.

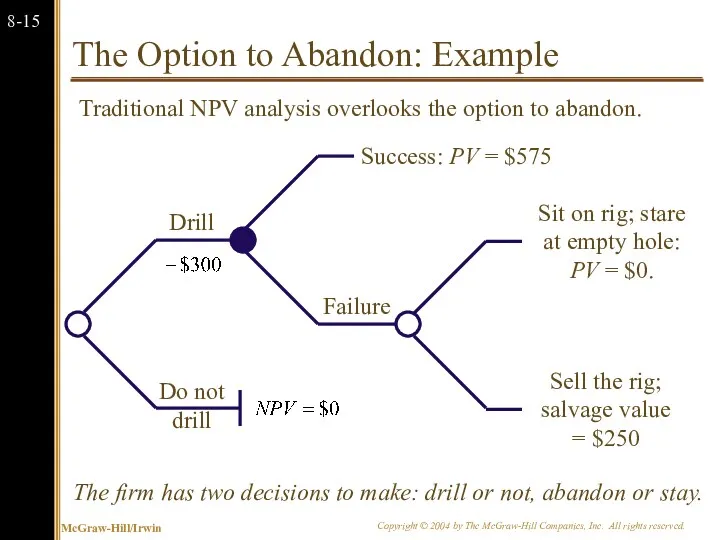

- 16. The Option to Abandon: Example The firm has two decisions to make: drill or not, abandon

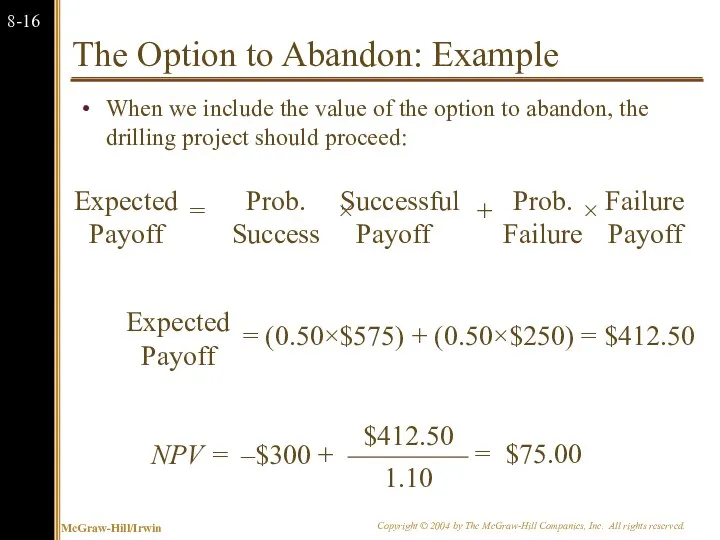

- 17. The Option to Abandon: Example When we include the value of the option to abandon, the

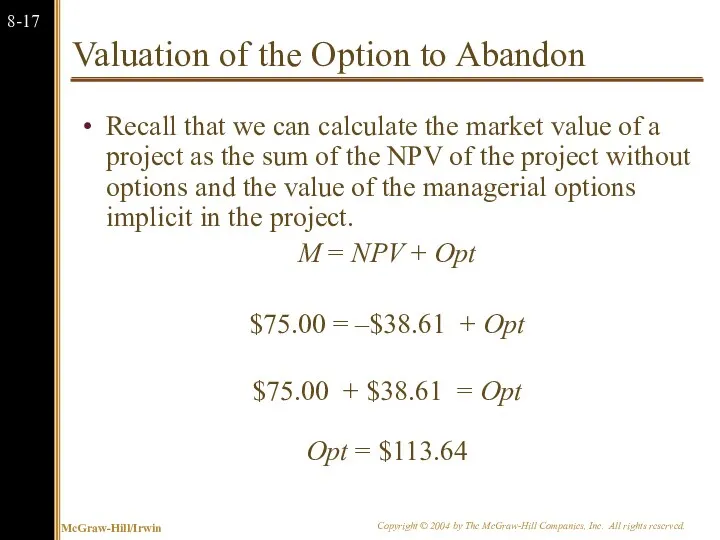

- 18. Valuation of the Option to Abandon Recall that we can calculate the market value of a

- 20. Скачать презентацию

Комплексная характеристика предприятия Gloria Jeans

Комплексная характеристика предприятия Gloria Jeans Сбербанк России

Сбербанк России Тарифные планы Билайн

Тарифные планы Билайн Polotno. Простой подход к созданию совершенных свадеб

Polotno. Простой подход к созданию совершенных свадеб Товародвижение и сбыт в маркетинге

Товародвижение и сбыт в маркетинге Продвижение в социальных сетях. Приложение Instagram

Продвижение в социальных сетях. Приложение Instagram P3 Business Analysis

P3 Business Analysis Компания Faberon

Компания Faberon Ошибки при подборе запросов для сайта

Ошибки при подборе запросов для сайта Агентство DDB

Агентство DDB Поставка. Актуальные вопросы заключения, исполнения и расторжения

Поставка. Актуальные вопросы заключения, исполнения и расторжения Использование Интернета в маркетинге

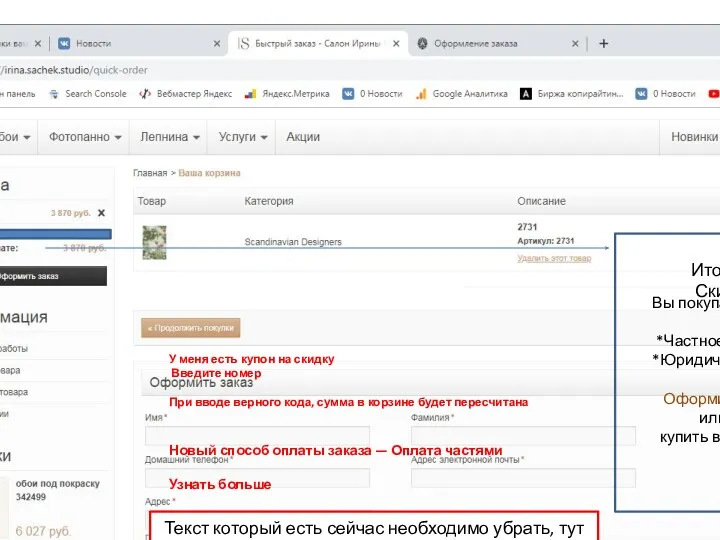

Использование Интернета в маркетинге Правила оформления продажи товара

Правила оформления продажи товара Продажи для менеджера

Продажи для менеджера Передова мережа станцій оренди павербанків

Передова мережа станцій оренди павербанків Производитель кофе Agazzi

Производитель кофе Agazzi USDA Agricultural Marketing Service National Organic Program An Overview

USDA Agricultural Marketing Service National Organic Program An Overview Интернет-магазин одежды

Интернет-магазин одежды Tutorial to advertise Money Leads apps on Adwords

Tutorial to advertise Money Leads apps on Adwords Группа компаний Упаковкин. Упаковочные пленки и емкости из полимеров, одноразовая посуда и расходные материалы

Группа компаний Упаковкин. Упаковочные пленки и емкости из полимеров, одноразовая посуда и расходные материалы Нестандартные упаковочные решения ООО Зеленая территория

Нестандартные упаковочные решения ООО Зеленая территория Риэлтор в социальных сетях

Риэлтор в социальных сетях Омега-3. Онлайн мастер-класс

Омега-3. Онлайн мастер-класс Анализ рыночной ситуации

Анализ рыночной ситуации Гайды для креативов

Гайды для креативов Рекламное агентство Соль

Рекламное агентство Соль Пиар-технологии во внешней политике государства

Пиар-технологии во внешней политике государства Индивидуальный проект. СПА салон

Индивидуальный проект. СПА салон