Содержание

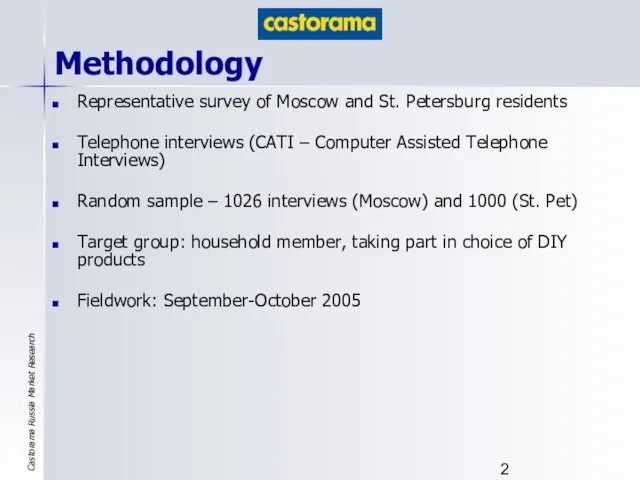

- 2. Methodology Representative survey of Moscow and St. Petersburg residents Telephone interviews (CATI – Computer Assisted Telephone

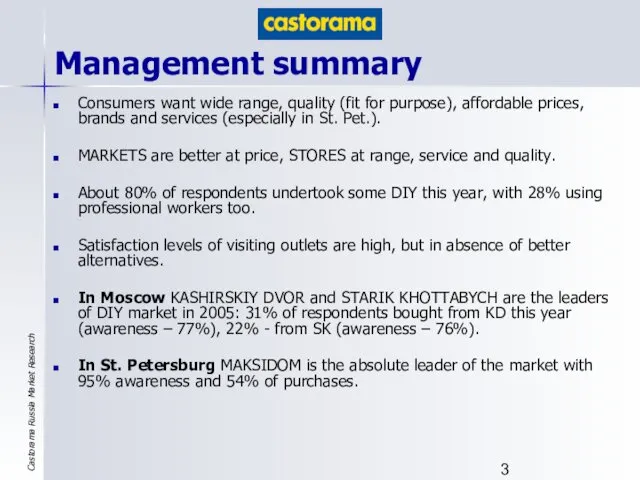

- 3. Management summary Consumers want wide range, quality (fit for purpose), affordable prices, brands and services (especially

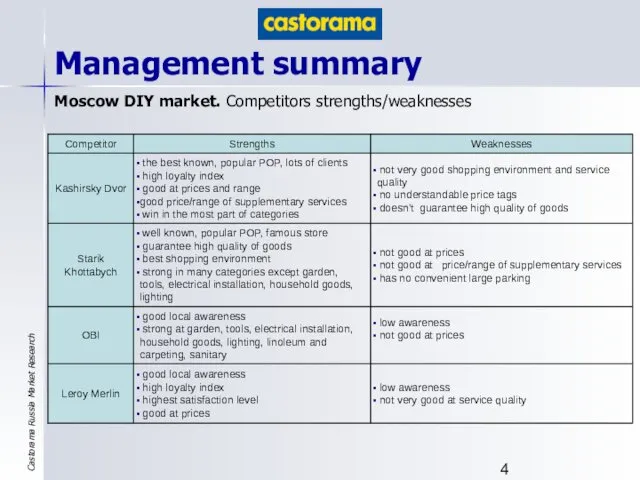

- 4. Moscow DIY market. Competitors strengths/weaknesses Management summary

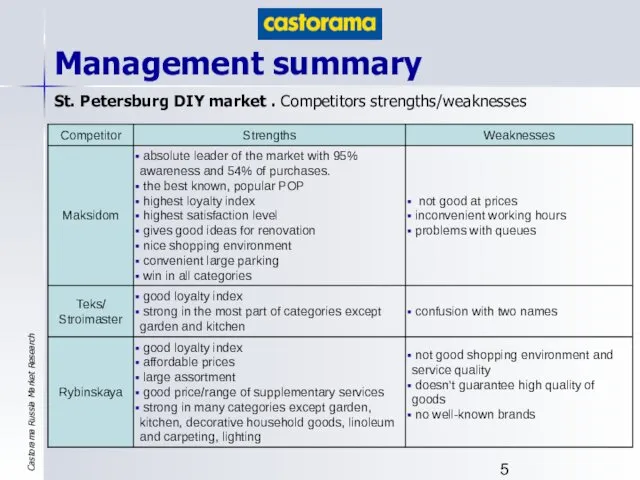

- 5. St. Petersburg DIY market . Competitors strengths/weaknesses Management summary

- 6. Content Moscow & St. Petersburg DIY market Awareness Purchases Loyalty Satisfaction with POP Assessment of POP

- 7. Moscow DIY market

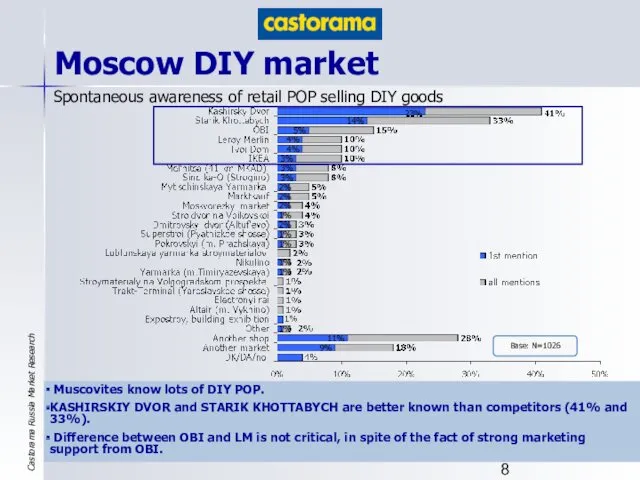

- 8. Base: N=1026 Spontaneous awareness of retail POP selling DIY goods Moscow DIY market Muscovites know lots

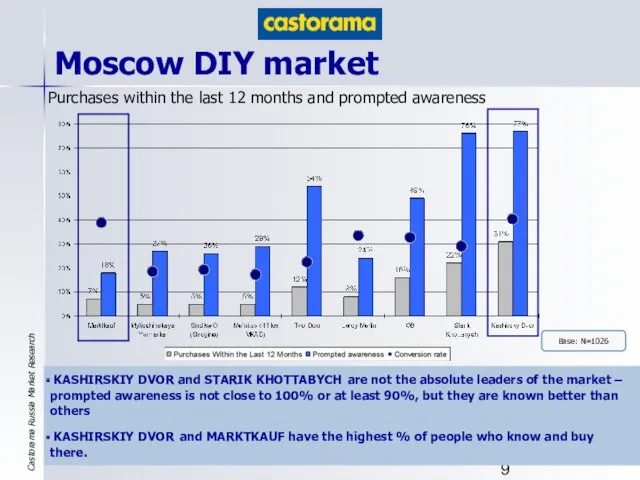

- 9. Moscow DIY market KASHIRSKIY DVOR and STARIK KHOTTABYCH are not the absolute leaders of the market

- 10. Moscow DIY market KASHIRSKIY DVOR and STARIK KHOTTABYCH are the leaders in the most part of

- 11. Moscow DIY market KASHIRSKIY DVOR and STARIK KHOTTABYCH are the best known POP amongst professionals/trade. But

- 12. Moscow DIY market Willingness to Recommend POP LEROY MERLIN and KASHIRSKIY DVOR have the highest loyalty

- 13. Moscow DIY market В5. How satisfied are you in general with the outlet ______? Please, use

- 14. Moscow DIY market Consumer Assessment of POP Top 2 boxes (4, 5) for 5-point scale +

- 15. Moscow DIY market Evaluation of Stores vs. Markets Stores Markets Markets win on price, stores on

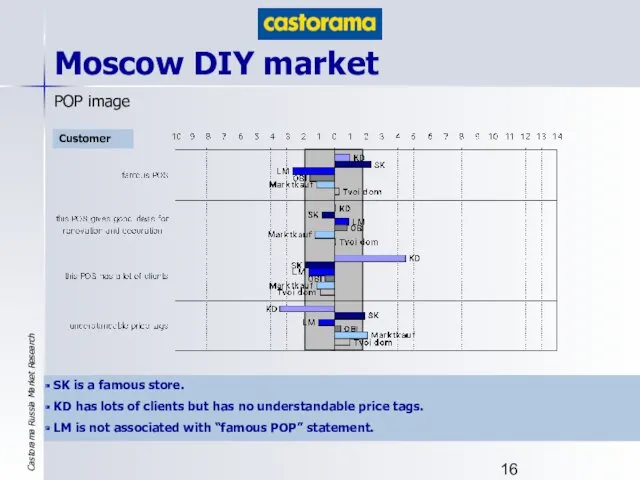

- 16. Moscow DIY market POP image Customer SK is a famous store. KD has lots of clients

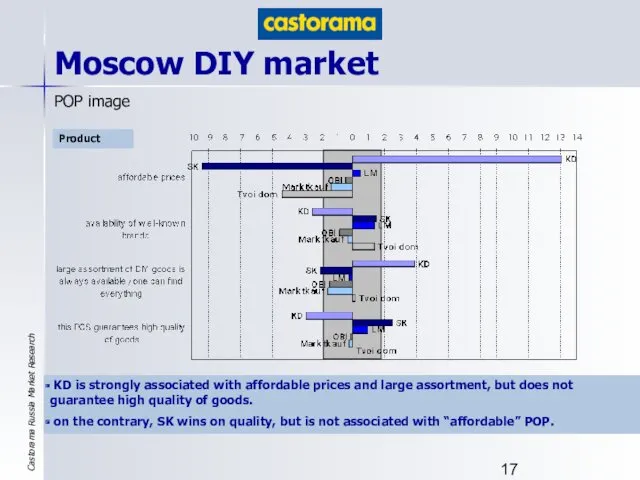

- 17. Moscow DIY market POP image Product KD is strongly associated with affordable prices and large assortment,

- 18. Moscow DIY market POP image Services/Staff KD is strongly associated with good availability and prices of

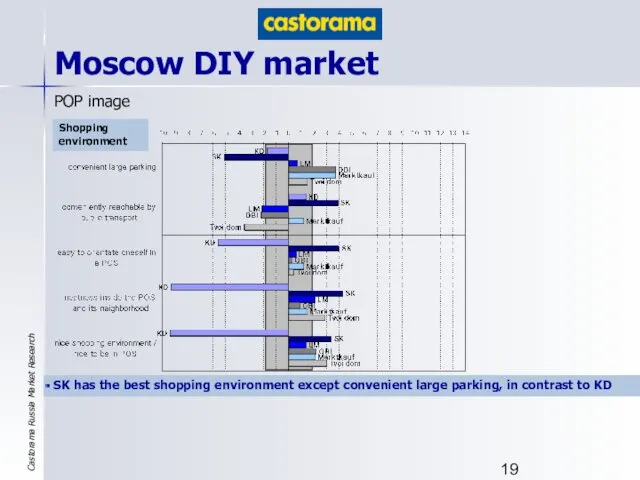

- 19. Moscow DIY market POP image Shopping environment SK has the best shopping environment except convenient large

- 20. Where people buy the key product categories Moscow DIY market

- 21. St. Petersburg DIY market

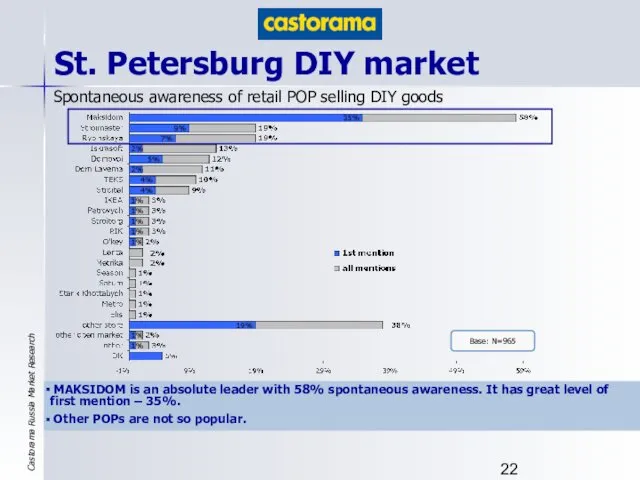

- 22. St. Petersburg DIY market Spontaneous awareness of retail POP selling DIY goods MAKSIDOM is an absolute

- 23. St. Petersburg DIY market MAKSIDOM is the absolute leader of the market – prompted awareness is

- 24. St. Petersburg DIY market MAKSIDOM and RYBINSKAYA are the best known POS amongst professionals/trade. But in

- 25. St. Petersburg DIY market Willingness to Recommend POP MAKSIDOM has the highest loyalty index. People are

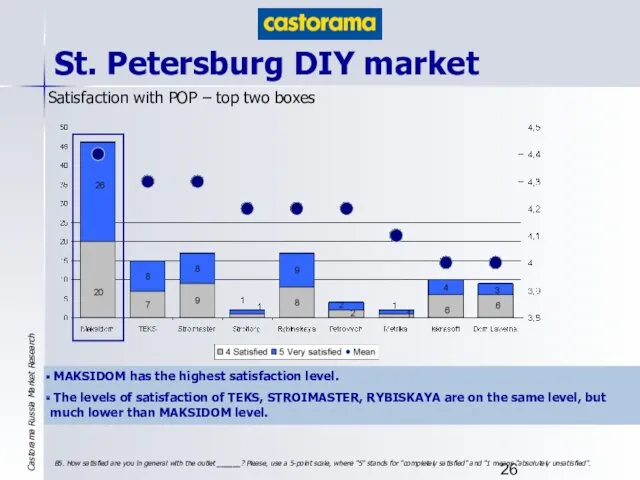

- 26. St. Petersburg DIY market В5. How satisfied are you in general with the outlet ______? Please,

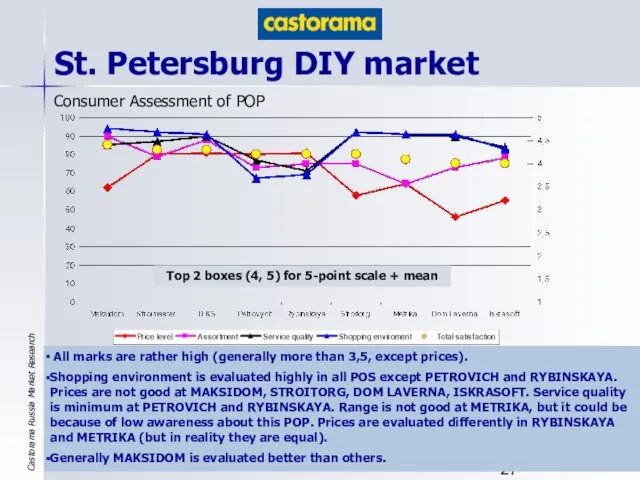

- 27. St. Petersburg DIY market Consumer Assessment of POP Top 2 boxes (4, 5) for 5-point scale

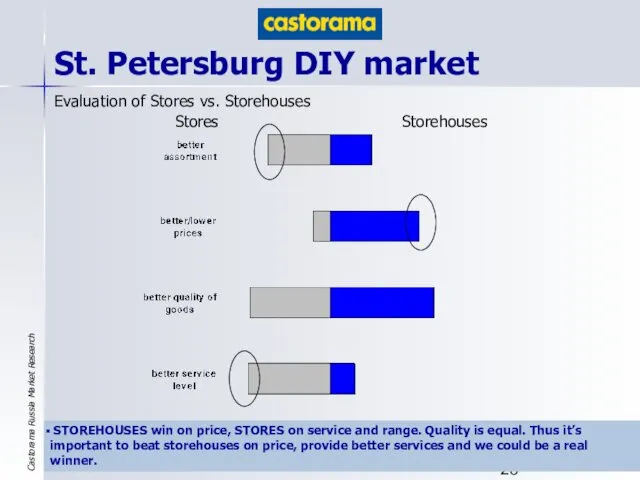

- 28. St. Petersburg DIY market Evaluation of Stores vs. Storehouses Stores Storehouses STOREHOUSES win on price, STORES

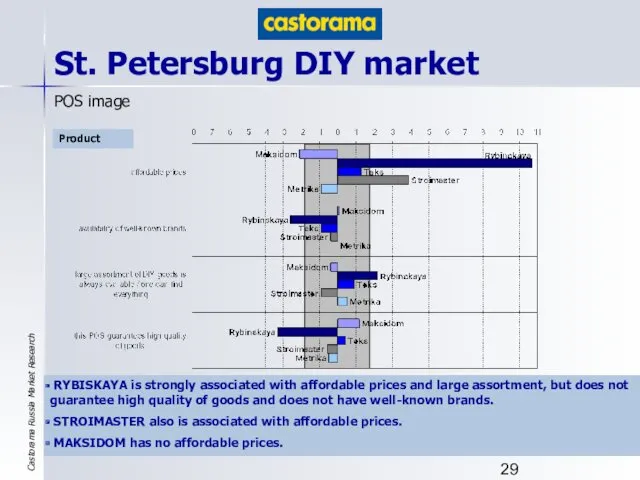

- 29. St. Petersburg DIY market POS image Product RYBISKAYA is strongly associated with affordable prices and large

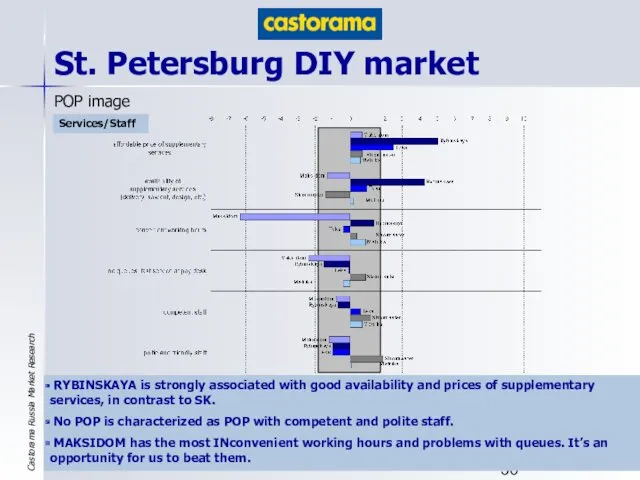

- 30. St. Petersburg DIY market POP image Services/Staff RYBINSKAYA is strongly associated with good availability and prices

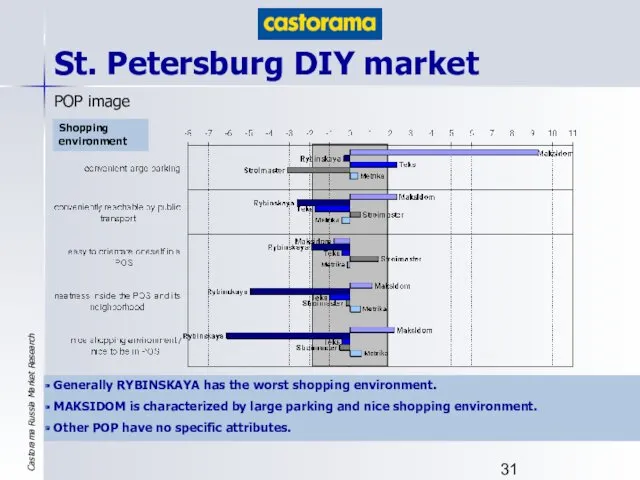

- 31. St. Petersburg DIY market POP image Shopping environment Generally RYBINSKAYA has the worst shopping environment. MAKSIDOM

- 32. Where people buy the key product categories St. Petersburg DIY market

- 33. Moscow vs. St. Pet DIY market Consumer behavior

- 34. Moscow vs. St. Pet DIY market ! ! ! The most important choice criteria in both

- 35. Moscow vs. St. Pet DIY market Renovation within 12 months About 80% of respondents made renovation

- 36. Moscow vs. St. Pet DIY market Renovation works at dacha (last 12 months) There are more

- 37. Moscow vs. St. Pet DIY market Usage of supplementary services offered by POP DELIVERY is the

- 38. Moscow vs. St. Pet DIY market Car ownership and Car usage for DIY purchases Most of

- 39. Moscow vs. St. Pet DIY market Leaflets delivered to mail box and attitude towards leaflets About

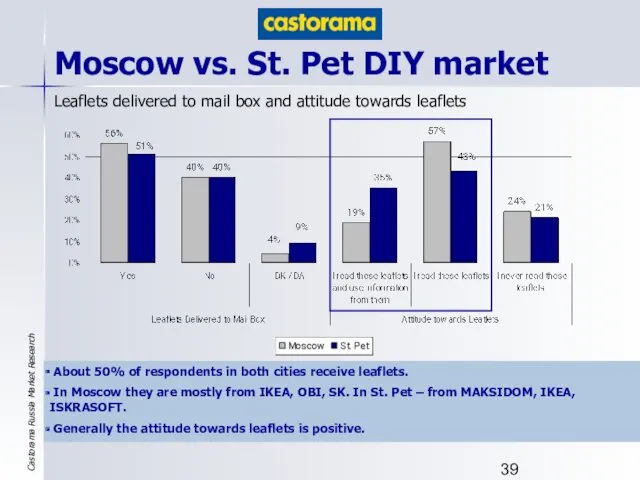

- 40. Moscow vs. St. Pet DIY market Spending for DIY goods Average spending is about 19 800

- 41. Moscow vs. St. Pet DIY market Category purchases within the last 12 months The most popular

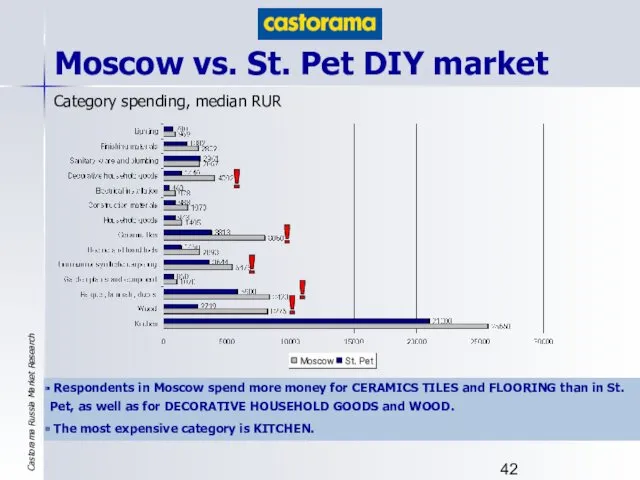

- 42. Moscow vs. St. Pet DIY market Respondents in Moscow spend more money for CERAMICS TILES and

- 43. Moscow vs. St. Pet DIY market Category share of spending In spite of the fact that

- 44. Appendix

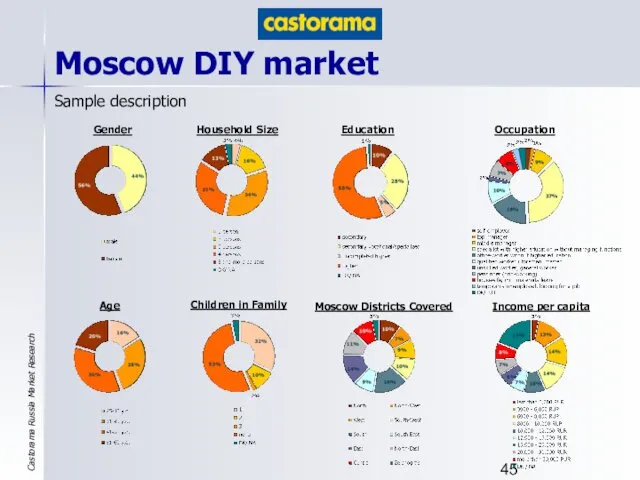

- 45. Moscow DIY market Sample description Gender Age Household Size Children in Family Education Occupation Income per

- 47. Скачать презентацию

Доклад Интерактивные технологии

Доклад Интерактивные технологии Презентация - Рыночные отношения

Презентация - Рыночные отношения Новости недели. Политинформация 1

Новости недели. Политинформация 1 Социальное проектирование

Социальное проектирование Социальные изменения. Мировая система и процессы глобализации. (Лекция 11)

Социальные изменения. Мировая система и процессы глобализации. (Лекция 11) Основы социального проектирования

Основы социального проектирования Социологические подходы к изучению общества

Социологические подходы к изучению общества Урок Право, семья, ребенок 9 класс

Урок Право, семья, ребенок 9 класс Традиционные и новые формы отклоняющегося поведения

Традиционные и новые формы отклоняющегося поведения Будемо небайдужі до чужого горя. Міжнародний день інваліда

Будемо небайдужі до чужого горя. Міжнародний день інваліда Социальный проект Социальная гостиница

Социальный проект Социальная гостиница Гражданский брак. За или Против

Гражданский брак. За или Против Ученический совет МБОУ СОШ № 42 г. Челябинска. Заседание № 5

Ученический совет МБОУ СОШ № 42 г. Челябинска. Заседание № 5 Social Cognition

Social Cognition Обществознание. 6 класс

Обществознание. 6 класс Индивидуальные и семейные развлечения, хобби. Обществознание. 5 класс

Индивидуальные и семейные развлечения, хобби. Обществознание. 5 класс Презентация к уроку Источники права 10 класс

Презентация к уроку Источники права 10 класс Создание сети центров общения, досуга и творчества

Создание сети центров общения, досуга и творчества Семья и семейные отношения. Обществознание. 5 класс

Семья и семейные отношения. Обществознание. 5 класс Молодая семья: особенности, брачно-семейная адаптация, распределения семейных ролей

Молодая семья: особенности, брачно-семейная адаптация, распределения семейных ролей Общественные отношения в постиндустриальном обществе

Общественные отношения в постиндустриальном обществе Презентация к уроку Межличностные отношения. 6 класс.

Презентация к уроку Межличностные отношения. 6 класс. Дружба между мужчиной и женщиной

Дружба между мужчиной и женщиной Социальная структура общества

Социальная структура общества Общие представления о коммуникации. Виды социальных коммуникаций

Общие представления о коммуникации. Виды социальных коммуникаций Путівник Волонтера iGov. Впровадження державних послуг залежить від кожного з нас

Путівник Волонтера iGov. Впровадження державних послуг залежить від кожного з нас Многодетные матери Мезенского края

Многодетные матери Мезенского края Социальные институты и социальные организации

Социальные институты и социальные организации