Содержание

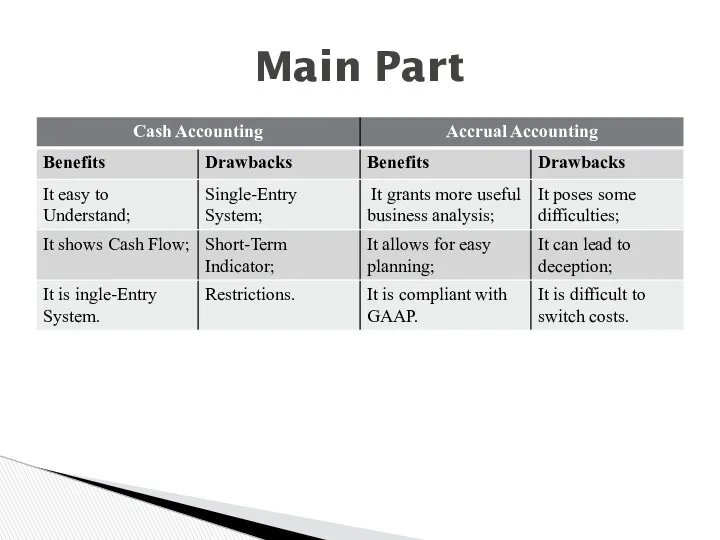

- 2. Introduction Main body -Basis of Accounting: Concepts and Principles; -Differences between them (theoretical part, example); -Benefits

- 3. Companies generally use one of two accounting methods for financial reporting. The choice of accounting method

- 4. Basis of Accounting: Concepts and Principles Cash Accounting; Accrual Accounting; Main Part

- 5. Differences between them (theoretical part, example) - Revenue recognition. A company sells $1000 of tables and

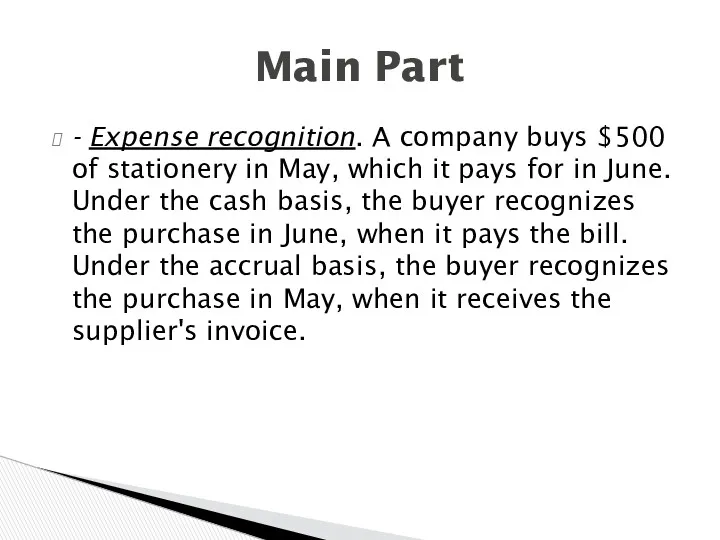

- 6. - Expense recognition. A company buys $500 of stationery in May, which it pays for in

- 7. Main Part

- 9. Скачать презентацию

История создания министерства внутренних дел

История создания министерства внутренних дел Основы фотографии

Основы фотографии Живопись маньеризма

Живопись маньеризма Презентация С днем Матери

Презентация С днем Матери Узнать лжеца по выражению лица

Узнать лжеца по выражению лица Работа студентов с научной литературой

Работа студентов с научной литературой Организация видов работ при эксплуатации и реконструкции строительных объектов

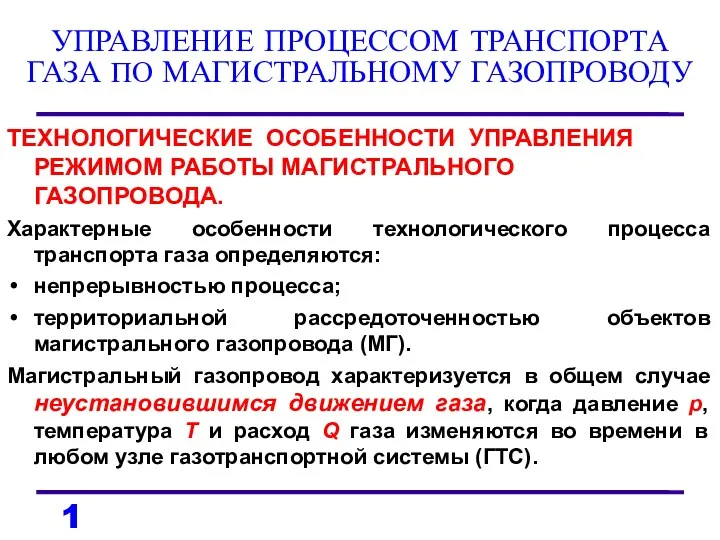

Организация видов работ при эксплуатации и реконструкции строительных объектов Управление процессом транспорта газа по магистральному газопроводу

Управление процессом транспорта газа по магистральному газопроводу Профессия программист

Профессия программист Решение задач с монетами

Решение задач с монетами Андрей Рублёв и Феофан Грек. Русская иконопись периода XIV-XV веков

Андрей Рублёв и Феофан Грек. Русская иконопись периода XIV-XV веков Емдік тамақтандыру. Анемия. Қызба. Оттегі терапия

Емдік тамақтандыру. Анемия. Қызба. Оттегі терапия Презентация и конспект к уроку по химии Кислоты

Презентация и конспект к уроку по химии Кислоты Презентация. Слова категории состояния

Презентация. Слова категории состояния Презентация Круг семейного чтения

Презентация Круг семейного чтения Анализ прочности детали Вал раздаточной коробки и разработка технологического процесса ее изготовления

Анализ прочности детали Вал раздаточной коробки и разработка технологического процесса ее изготовления Металлография

Металлография Әртүрлі жастағы дені сау балалардың асқорыту жүйесін функциональды және құралсаймандармен зерттеу әдістері

Әртүрлі жастағы дені сау балалардың асқорыту жүйесін функциональды және құралсаймандармен зерттеу әдістері Политическая раздробленность Руси в XII – XIII вв.: причины, важнейшие княжества и земли (Владимиро-Суздальское княжество)

Политическая раздробленность Руси в XII – XIII вв.: причины, важнейшие княжества и земли (Владимиро-Суздальское княжество) Содержание работы воспитателей в группах по УМК: организация игровых диалогов, контроль за усвоением лексического материала

Содержание работы воспитателей в группах по УМК: организация игровых диалогов, контроль за усвоением лексического материала 172262685746923205.1.1

172262685746923205.1.1 Преемственность ДОУ и школы

Преемственность ДОУ и школы Игры по развитию речевого анализа и синтеза

Игры по развитию речевого анализа и синтеза Основные сведения о насосах

Основные сведения о насосах Les sports

Les sports Математика 1 класс. УМК Перспектива. Урок №2. Тема Разговор о величине

Математика 1 класс. УМК Перспектива. Урок №2. Тема Разговор о величине Презентация Осень Диск

Презентация Осень Диск презентация к занятию о весне Диск

презентация к занятию о весне Диск