Содержание

- 2. AGENDA | |

- 3. WISE YTD 5 ROUD ACCIDENT IN TEAM 2 INSIDENT ON ROAD AND 3 ON THE PARKING

- 4. average age – 24 y.o. average work experience – 2,6 y. TAEM OF EAST

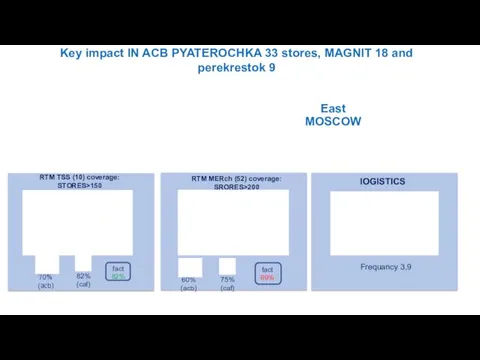

- 5. RTM RTM MERch (52) coverage: SRORES>200 lOGISTICS 70% (acb) 82% (caf) 60% (acb) 75% (caf) Key

- 6. Top 5 key account

- 7. cfr (85%) influenced the negative indicator of may 5”ka” grew First month in june with negative

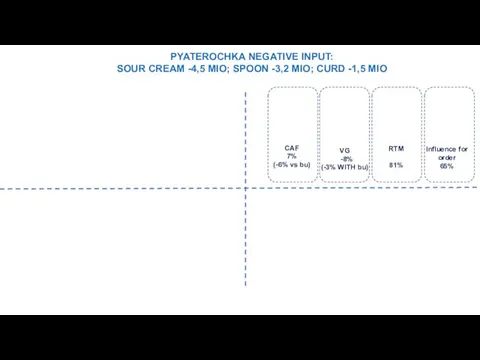

- 8. PYATEROCHKA NEGATIVE INPUT: SOUR CREAM -4,5 MIO; SPOON -3,2 MIO; CURD -1,5 MIO CAF 7% (-6%

- 9. EXECUTION 30 % OF ACB FREE - / PAY –52 65% OF ACB In shops 114

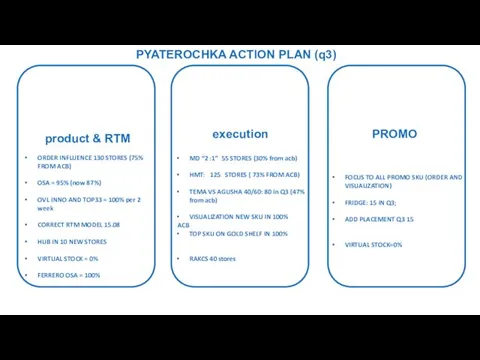

- 10. product & RTM execution PROMO PYATEROCHKA ACTION PLAN (q3) ORDER INFLUENCE 130 STORES (75% FROM ACB)

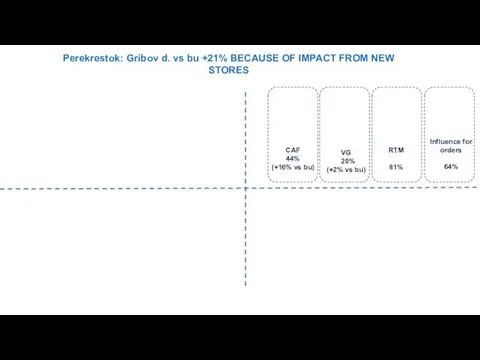

- 11. CAF 44% (+16% vs bu) VG 20% (+2% vs bu) Perekrestok: Gribov d. vs bu +21%

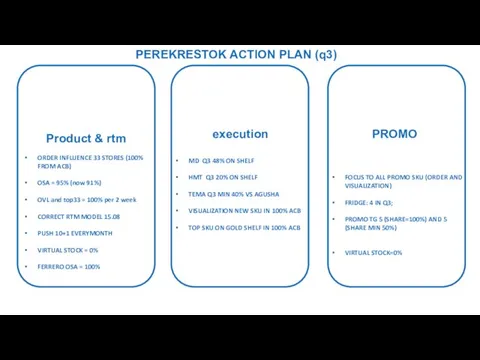

- 12. Product & rtm execution PROMO PEREKRESTOK ACTION PLAN (q3) ORDER INFLUENCE 33 STORES (100% FROM ACB)

- 13. Sell 0UT 2017 ASM gribov: caf ytd +19%, vg +13% KEY IMPACT FOR POSSITIVE DELTA IN

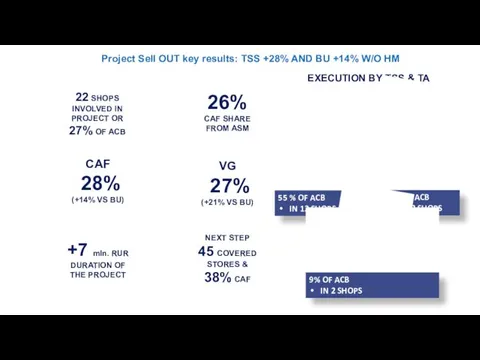

- 14. Project Sell OUT key results: TSS +28% AND BU +14% W/O HM EXECUTION BY TSS &

- 15. FORECAST SELL IN Fy +6% SELL out Fy +22%

- 17. Скачать презентацию

Мы помним! Мы гордимся

Мы помним! Мы гордимся презентация Талисманы Олимпийских игр

презентация Талисманы Олимпийских игр Использование матрицы БКГ для FMСG компании на примере компании PepsiCo

Использование матрицы БКГ для FMСG компании на примере компании PepsiCo Загрязнение природных вод

Загрязнение природных вод Бу күшті қондырғының негізгі циклы (Ренкин циклы)

Бу күшті қондырғының негізгі циклы (Ренкин циклы) Разборка ноутбука Asus K50IJ

Разборка ноутбука Asus K50IJ Asus repair. Audio. (Lesson 3)

Asus repair. Audio. (Lesson 3) Классификация металлообрабатывающих станков

Классификация металлообрабатывающих станков Классы и объекты

Классы и объекты Разработка технологического маршрута изготовления рамной конструкции

Разработка технологического маршрута изготовления рамной конструкции урок географии в 6 классе по теме Атмосферное давление + презентация

урок географии в 6 классе по теме Атмосферное давление + презентация Стандартные настройки Windows

Стандартные настройки Windows Микрофлора водоемов. Отдел золотистые водоросли

Микрофлора водоемов. Отдел золотистые водоросли Исследовательская подводная лодка

Исследовательская подводная лодка Проектирование беспроводной сети малого офиса

Проектирование беспроводной сети малого офиса Чёрная металлургия

Чёрная металлургия Технический анализ финансовых рынков

Технический анализ финансовых рынков Астафьев Виктор Петрович

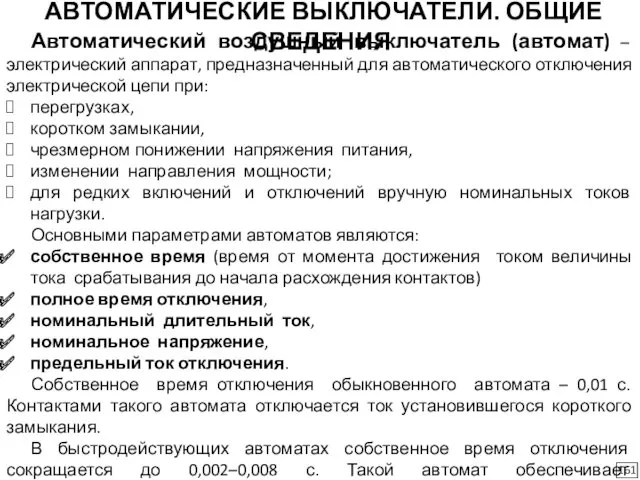

Астафьев Виктор Петрович Автоматические выключатели. Общие сведения

Автоматические выключатели. Общие сведения Кадровая политика и кадровая безопасность России

Кадровая политика и кадровая безопасность России Система учебников Начальная школа XXI века

Система учебников Начальная школа XXI века Тепло родного очага

Тепло родного очага Проектная деятельность учащихся

Проектная деятельность учащихся Чтоб здоровым всегда быть, нужно постараться

Чтоб здоровым всегда быть, нужно постараться Цилиндр, конус, шар

Цилиндр, конус, шар Работа с одарёнными детьми

Работа с одарёнными детьми Правила поведения на воде и на льду в осенне-зимнее время

Правила поведения на воде и на льду в осенне-зимнее время Флаги, переходы, макрокоманды условий, циклы, битовые операции, стек, подпрограммы, сдвиги в MASM

Флаги, переходы, макрокоманды условий, циклы, битовые операции, стек, подпрограммы, сдвиги в MASM