10

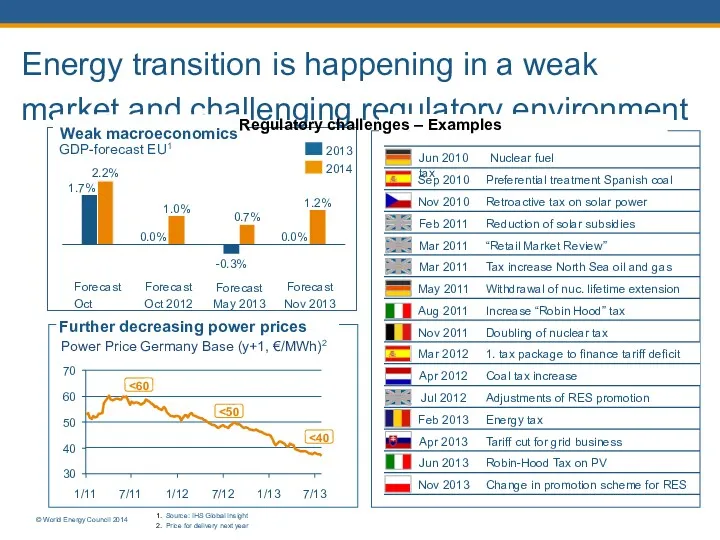

Energy transition is happening in a weak market and challenging regulatory environment

GDP-forecast

EU1

2.2%

Forecast Nov 2013

1.2%

0.0%

-0.3%

Forecast May 2013

0.7%

Forecast Oct 2012

1.0%

0.0%

Forecast Oct 2011

1.7%

2013

2014

Weak macroeconomics Regulatory challenges – Examples

30

40

50

60

70

7/11

1/11

7/13

1/13

7/12

1/12

Power Price Germany Base (y+1, €/MWh)2

<60

<50

<40

Further decreasing power prices

Jun 2010 Nuclear fuel tax

Sep 2010

Preferential treatment Spanish coal

Nov 2010

Retroactive tax on solar power

Feb 2011

Reduction of solar subsidies

Mar 2011

“Retail Market Review”

Mar 2011

Tax increase North Sea oil and gas

May 2011

Withdrawal of nuc. lifetime extension

Aug 2011

Increase “Robin Hood” tax

Nov 2011

Doubling of nuclear tax

Mar 2012

1. tax package to finance tariff deficit

Apr 2012

Coal tax increase

Jul 2012

Adjustments of RES promotion

Feb 2013

Energy tax

Apr 2013

Tariff cut for grid business

Jun 2013

Robin-Hood Tax on PV

Nov 2013

Change in promotion scheme for RES

1. Source: IHS Global Insight

2. Price for delivery next year

© World Energy Council 2014

Презентация Сюжетно-ролевая игра в развитии старших дошкольников

Презентация Сюжетно-ролевая игра в развитии старших дошкольников Теория строение органических соединений

Теория строение органических соединений Приложение 1 к уроку по теме Озёра. Презентация. часть1

Приложение 1 к уроку по теме Озёра. Презентация. часть1 Древние образы в народном искусстве. 5 класс

Древние образы в народном искусстве. 5 класс Сталинградская битва.

Сталинградская битва. Материки и океаны

Материки и океаны Черная металлургия. Производство чугуна и стали. 9 класс

Черная металлургия. Производство чугуна и стали. 9 класс Қатты отындарды газдендіру

Қатты отындарды газдендіру Выявлекние и устранение типовых неисправностей блоков питания

Выявлекние и устранение типовых неисправностей блоков питания Теория к заданию № 16 (ЕГЭ по русскому языку. Версия 2019 года)

Теория к заданию № 16 (ЕГЭ по русскому языку. Версия 2019 года) Самостоятельная двигательная активность детей на прогулке, руководство ею

Самостоятельная двигательная активность детей на прогулке, руководство ею Презентация выступления на педсовете по теме Выявление трудных детей

Презентация выступления на педсовете по теме Выявление трудных детей Родительское собрание Роль книги в развитии интеллектуальных умений ребёнка (Конспект с презентацией)

Родительское собрание Роль книги в развитии интеллектуальных умений ребёнка (Конспект с презентацией) Классный час Я и другие люди. Вежливость.

Классный час Я и другие люди. Вежливость. класс

класс Развертка пирамиды

Развертка пирамиды Общие пути катаболизма. Энергетический обмен

Общие пути катаболизма. Энергетический обмен Презентация к уроку библиотечно-информационной грамотности по теме Структура книги

Презентация к уроку библиотечно-информационной грамотности по теме Структура книги Внеурочная деятельность (кружки)

Внеурочная деятельность (кружки) Деловая игра, как способ развития социальной компетентности у учащихся на уроках географии

Деловая игра, как способ развития социальной компетентности у учащихся на уроках географии Артикуляционная гимнастика для малышей

Артикуляционная гимнастика для малышей Раннее Новое время: от средневекового общества к обществу индустриальному

Раннее Новое время: от средневекового общества к обществу индустриальному Получение негативного изображения

Получение негативного изображения Пеларгония зональная красная

Пеларгония зональная красная Здоровьесберегающие технологии в начальной школе.

Здоровьесберегающие технологии в начальной школе. Презентация Природные зоны Северной Америки

Презентация Природные зоны Северной Америки Органы цветковых растений. Корень

Органы цветковых растений. Корень Система ЦТ SECAM

Система ЦТ SECAM