Содержание

- 2. International Organizations

- 3. Lecture Plan Part 1: Global IOs supporting development: International Financial Institutions: IMF, BIS, World Bank Group;

- 4. GLOBAL INTERNATIONAL ORGANIZATIONS SUPPORTING DEVELOPMENT Part 1

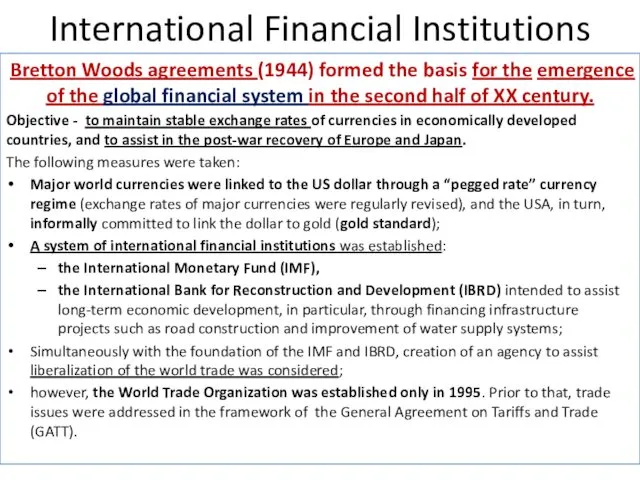

- 5. International Financial Institutions Bretton Woods agreements (1944) formed the basis for the emergence of the global

- 6. “Money is the Lifeblood of the Economy”

- 7. International Financial Institutions: mandate and status International financial institutions (IFIs) have a common goal: promote cooperation

- 8. International Monetary Fund (IMF) Initial Functions: Assist countries in maintaining the fixed exchange rate through providing

- 9. Council for Mutual Economic Assistance (CMEA), byname “Comecon” Совет Экономической Взаимопомощи (СЭВ) International intergovernmental organization established

- 10. Present-Day IMF The IMF current membership is 187 countries (except Cuba, North Korea, Andorra, Monaco, Nauru

- 11. Bank for International Settlements (BIS) The Bank for International Settlements (BIS) is based in Basel, Switzerland

- 12. World Bank Group

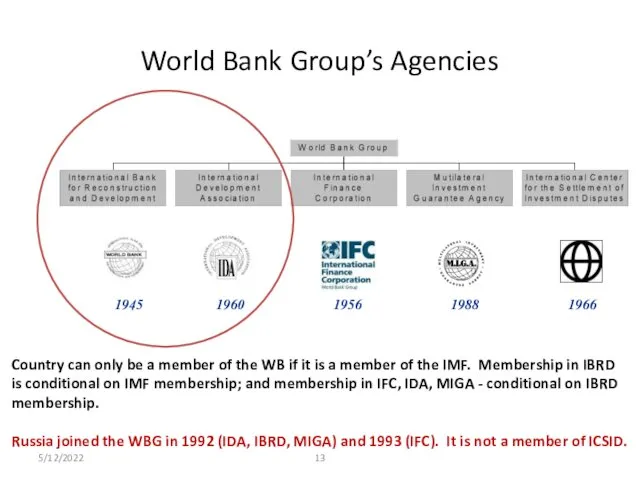

- 13. 5/12/2022 World Bank Group’s Agencies 1945 1988 1956 1960 1966 Country can only be a member

- 14. 5/12/2022 How did it begin… International Bank for Reconstruction and Development established July 1944, Bretton Woods

- 15. 5/12/2022 Early Borrowers France first to borrow $250 million to finance post-war reconstruction in 1947, and

- 16. 5/12/2022 1950s (Europe Reconstruction) Physical 1960s (Rural) Natural 1970s (Human Development) Human 1980s (Economic Reform) Financial

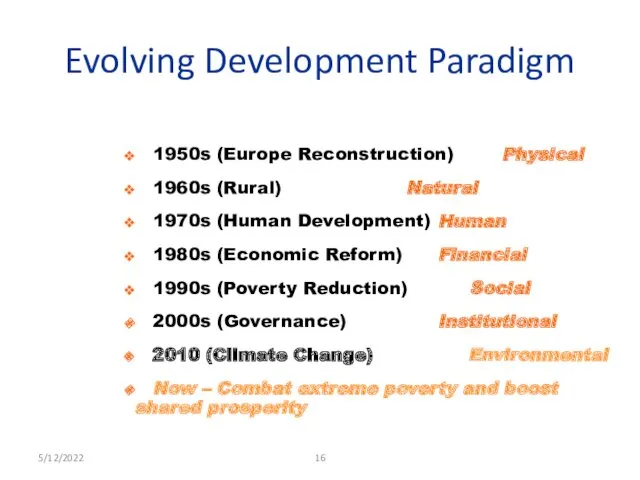

- 17. Current Mandate: Two Ambitious Twin Goals The overall framework for these goals are the sustainable development

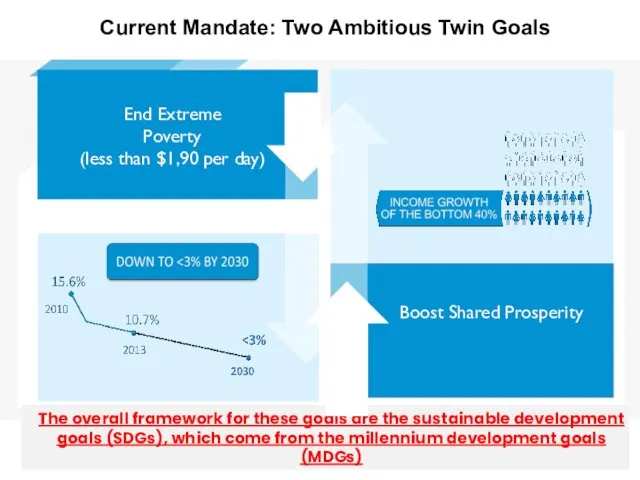

- 18. Who owns the World Bank Group? U.S. 16.44% Japan 7.09% China 4.58% Germany 4.15% France 3.89%

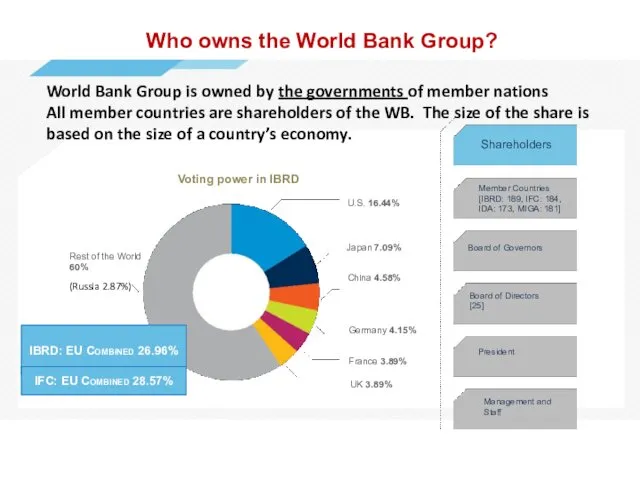

- 19. 5/12/2022 World Bank Staff 130 offices 16,000 staff 15,000 Consultants 130 offices 174 nationalities Who they

- 20. How is the World Bank organized?

- 21. Global Practices and Cross Cutting Solution Areas

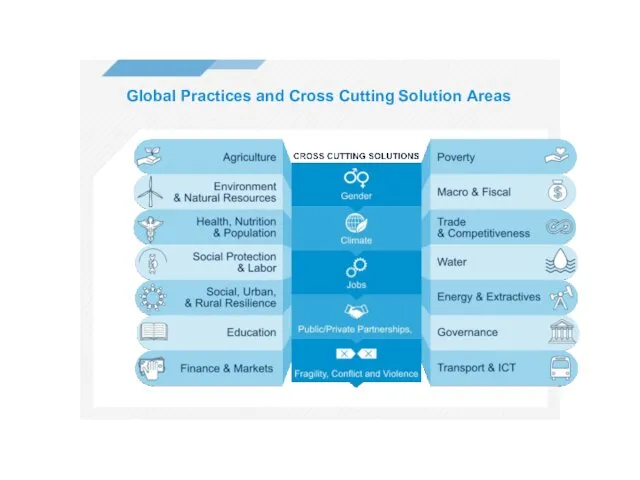

- 22. WBG GLOBAL COMMITMENTS in fiscal 2020

- 23. IBRD – What do We Support Today IBRD Global Lending by Sector (GP) and Region FY16

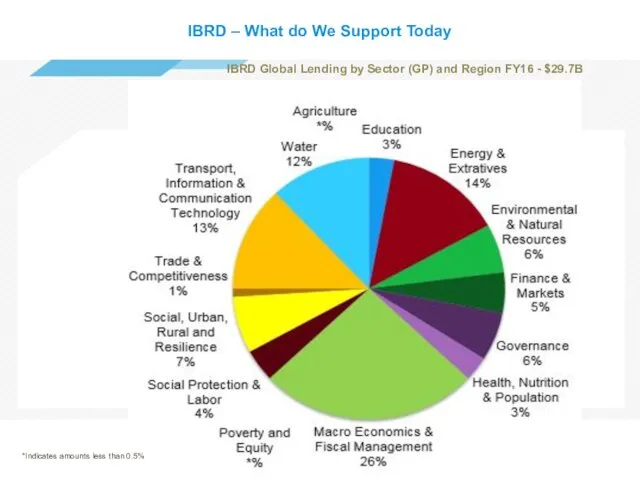

- 24. 5/12/2022 Where does the money come from? IBRD: Raises funds on capital markets at rates lower

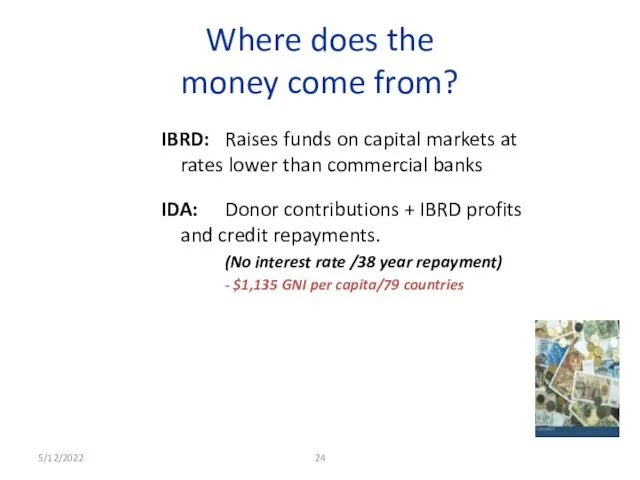

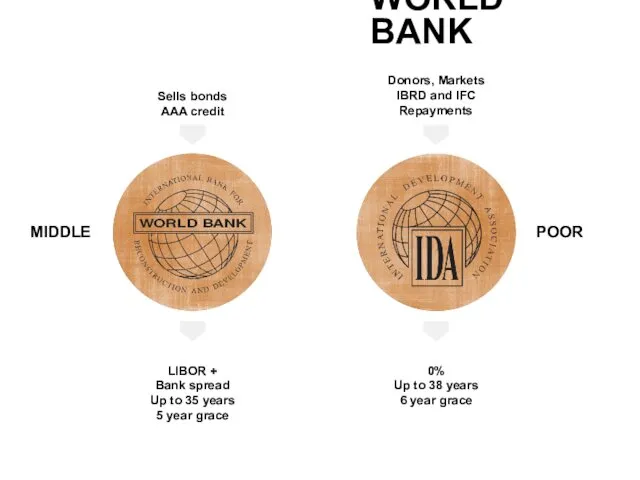

- 25. LIBOR + Bank spread Up to 35 years 5 year grace 0% Up to 38 years

- 26. WB Classification of Countries Each year on July 1, the World Bank updates its classification of

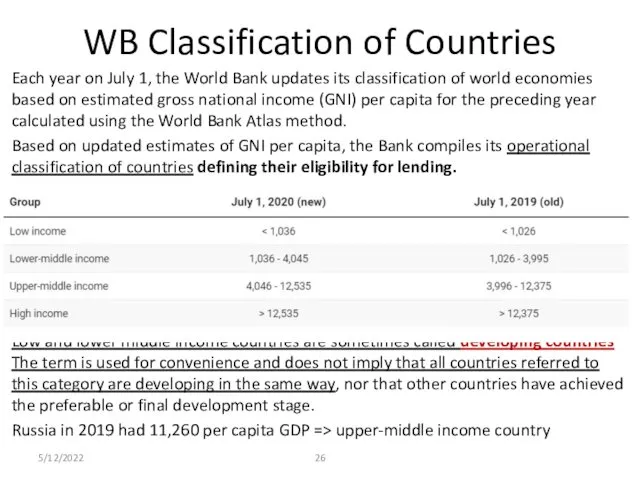

- 27. Financing instruments Investment Project Financing provides IBRD loan, IDA credit/grant and guarantee financing to governments for

- 28. Top Borrowers in Fiscal Year 2015 (mln. $)

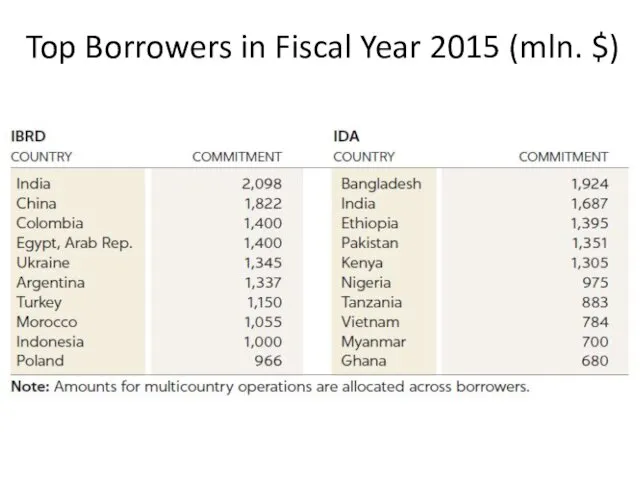

- 29. IBRD and IDA top country borrowers FY20

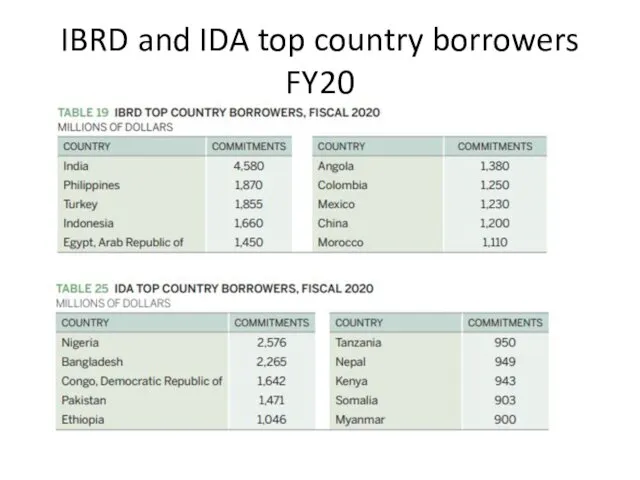

- 30. Advisory Services and Analytics (ASA) Economic and Sector Work: diagnostic and analytical work aiming to influence

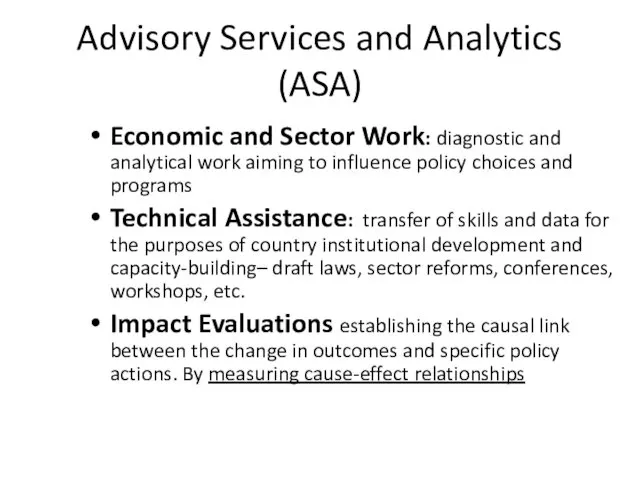

- 31. Country Assistance Strategy – Country Partnership Strategy – Country Partnership Framework A 4-6 year framework document

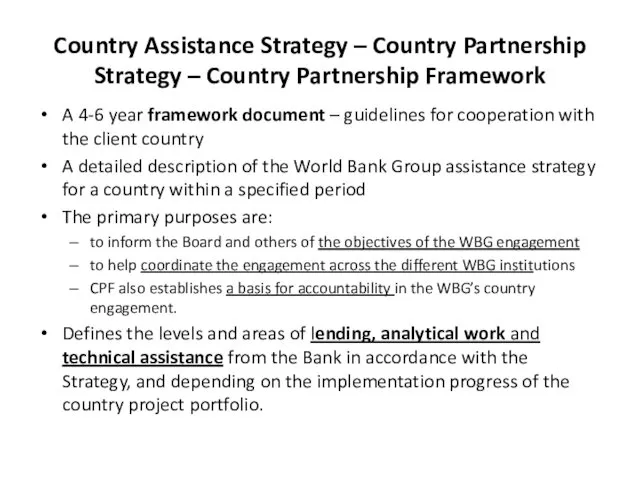

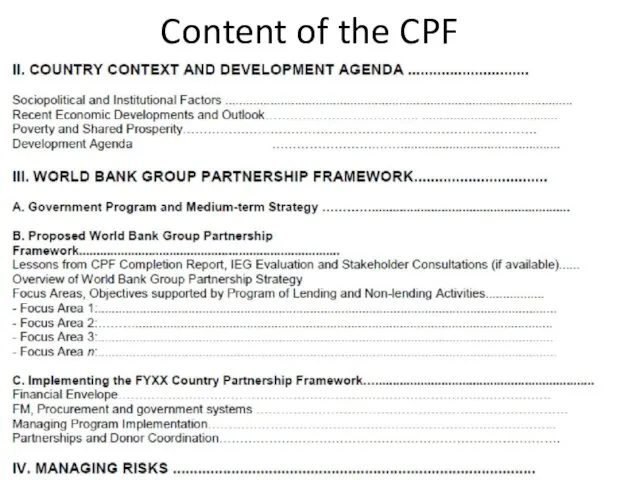

- 32. Content of the CPF

- 33. World Bank as Knowledge Bank WB Analytical and Research Work

- 34. https://openknowledge.worldbank.org/ 5/12/2022

- 35. http://data.worldbank.org/ 5/12/2022

- 36. 5/12/2022 Documents and Reports, and Operations Operations: country aggregate reports, strategies, policies and procedures, procurement, list

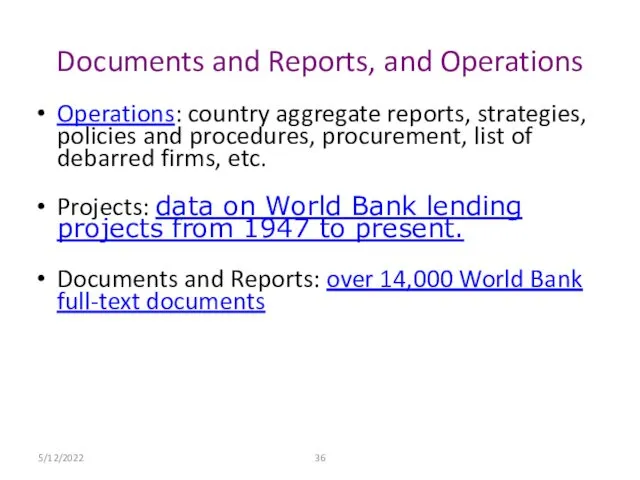

- 37. Major WB Publications WB Annual Report World Development Report (WDR) World Development Indicators Global Economic Prospects

- 38. Joining the World Bank Group Young Professionals Program Junior Professional Associate Analyst (GE-level) Extended Term Consultant/Temporary

- 39. Books to Read “The Bottom Billion: Why the poorest countries are failing and what can be

- 41. Скачать презентацию

Безопасность движения поездов. Действие локомотивной бригады в аварийной ситуации

Безопасность движения поездов. Действие локомотивной бригады в аварийной ситуации Мальчики или девочки: кто умнее?

Мальчики или девочки: кто умнее? Дидактические игры своими руками для детей первой младшей группы

Дидактические игры своими руками для детей первой младшей группы Американская общественно-политическая мысль

Американская общественно-политическая мысль Неделя игры и игрушки в подготовительной группе №8

Неделя игры и игрушки в подготовительной группе №8 Андрій Чебикін

Андрій Чебикін Основы построения средств и комплексов РЭБ. Беспоисковые и поисковые способы пеленгации РЭС

Основы построения средств и комплексов РЭБ. Беспоисковые и поисковые способы пеленгации РЭС Нормативно-правовые и психолого-педагогические основы инклюзивного образования

Нормативно-правовые и психолого-педагогические основы инклюзивного образования Профилактика пролежней

Профилактика пролежней Город Севастополь

Город Севастополь Презентация по экономике 10 класс

Презентация по экономике 10 класс Photo description

Photo description Нервная ткань

Нервная ткань Природные зоны Австралии. Своеобразие органического мира

Природные зоны Австралии. Своеобразие органического мира Эволюция управленческой мысли

Эволюция управленческой мысли Александр Сергеевич Пушкин

Александр Сергеевич Пушкин Биоенергетика. Общие пути катаболизма

Биоенергетика. Общие пути катаболизма Особенности работы с семьей в психологической диагностике. Методы семейной диагностики

Особенности работы с семьей в психологической диагностике. Методы семейной диагностики Конкурс Кукурузная фантазия

Конкурс Кукурузная фантазия Беседы о профессиях. Музыкант

Беседы о профессиях. Музыкант Международные отношения, мировая политика, внешняя политика и дипломатия в контексте новой научной парадигмы

Международные отношения, мировая политика, внешняя политика и дипломатия в контексте новой научной парадигмы Многопараметрические защиты при замыканиях на землю

Многопараметрические защиты при замыканиях на землю Применение новых CRM-технологий в сфере туризма

Применение новых CRM-технологий в сфере туризма как питаются паразиты

как питаются паразиты Возможные варианты применения основных типов конструктивных систем

Возможные варианты применения основных типов конструктивных систем Название темы кейса

Название темы кейса 15 мая – международный день семьи

15 мая – международный день семьи Древние образы богов

Древние образы богов