Содержание

- 2. Dear Epamer Please send back to HR below documents: 1. One copy employment contract 2. One

- 3. OBLIGATORY DOCUMENTS

- 4. EMPLOYMENT CONTRACT, ADDITIONAL INFORMATION TO THE CONTRACT, CONFIDENTIALITY AND NON-COMPETITION CLAUSE Please note HR sends two

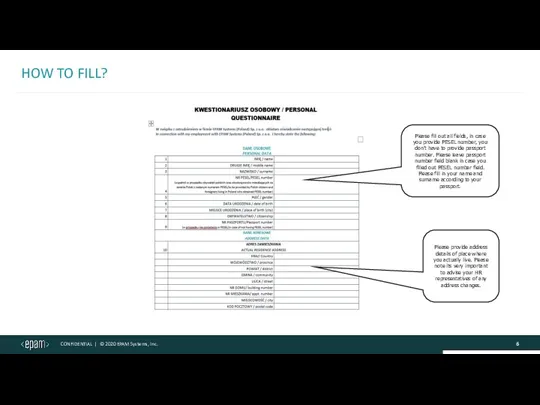

- 5. PERSONAL QUESTIONNAIRE This document enables us to register you as employee in our company system, register

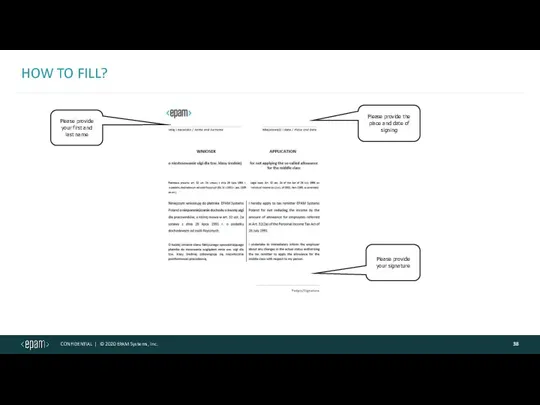

- 6. HOW TO FILL? Please fill out all fields, in case you provide PESEL number, you don’t

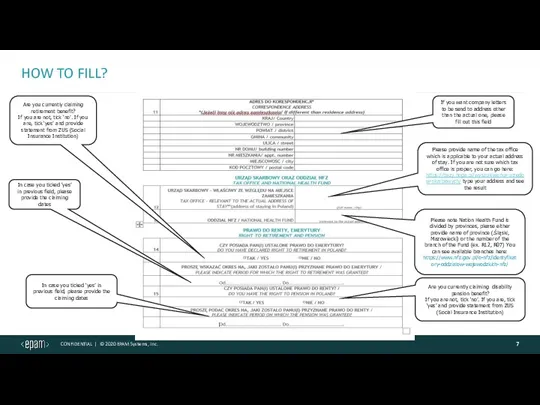

- 7. HOW TO FILL? Please provide address details of place where you actually live. Please note its

- 8. HOW TO FILL? Please provide address details of place where you actually live. Please note its

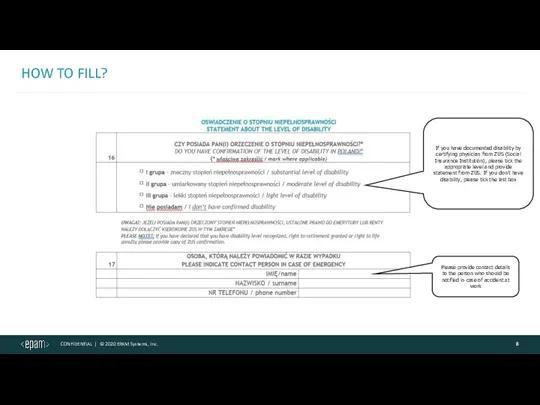

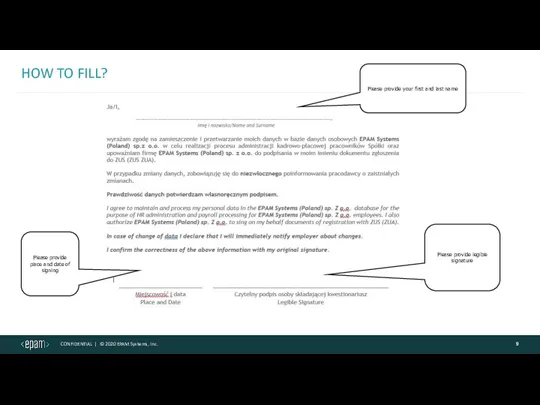

- 9. HOW TO FILL? Please provide address details of place where you actually live. Please note its

- 10. BANK AUTHORIZATION FORM EPAM employees receive salary by means of bank transfer to their bank accounts.

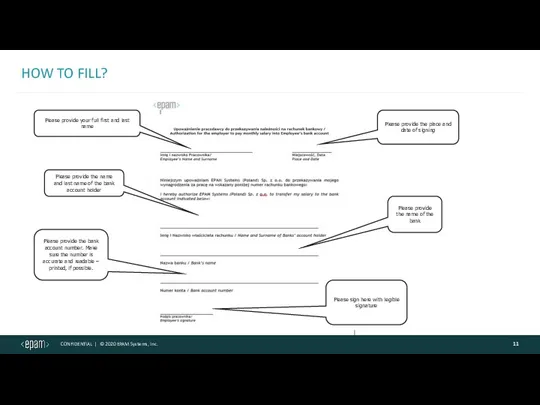

- 11. HOW TO FILL? Please provide address details of place where you actually live. Please note its

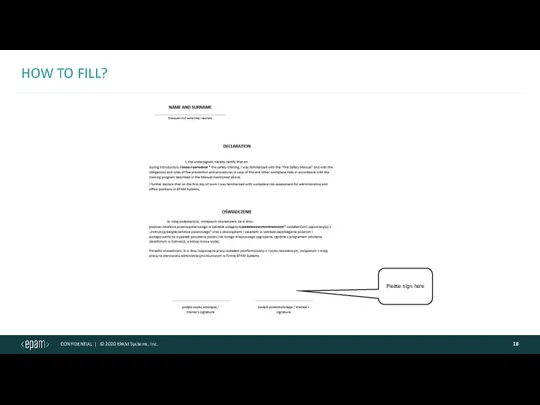

- 12. STATEMENT On your first day we will familiarize yourself with our work regulations, renumeration regulations and

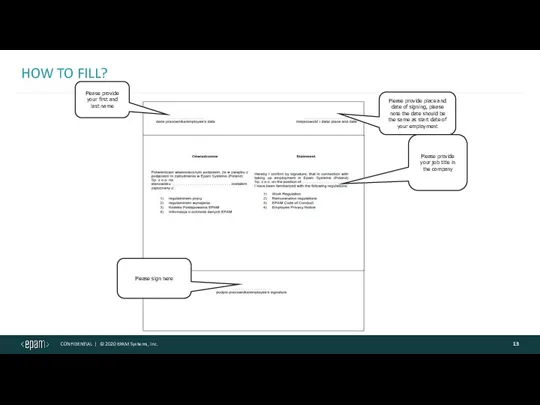

- 13. HOW TO FILL? Please provide address details of place where you actually live. Please note its

- 14. TAX RESIDENCE DECLARATION This document specifies the country in which you want to settle your taxes.

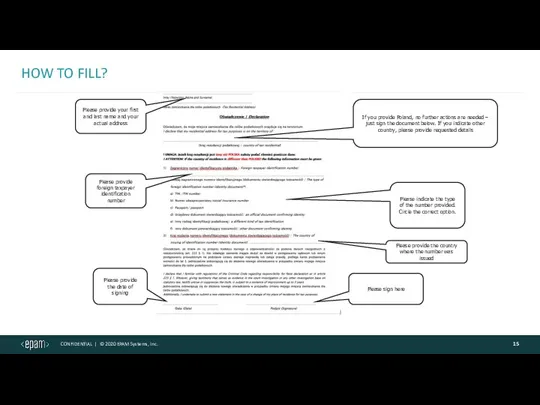

- 15. HOW TO FILL? Please provide address details of place where you actually live. Please note its

- 16. FIRE PROTECTION & OCCUPATIONAL HEALTH AND SAFETY TRAINING CARDS These cards confirm that you underwent Fire

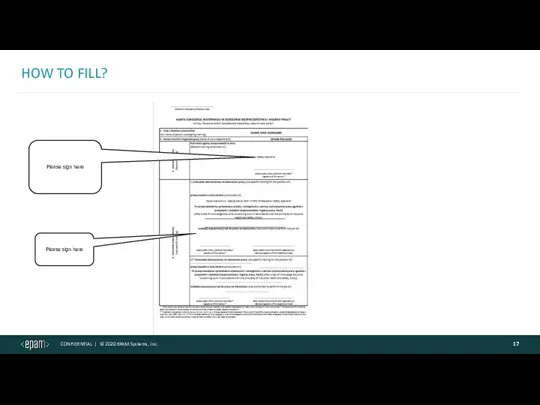

- 17. HOW TO FILL? Please provide address details of place where you actually live. Please note its

- 18. HOW TO FILL? Please provide address details of place where you actually live. Please note its

- 19. MEDICAL CERTIFICATE OF FITNESS TO WORK Please note in Poland it is mandatory to obtain medical

- 20. Please provide address details of place where you actually live. Please note its very important to

- 21. EMPLOYEE PROVACY NOTICE Please note to sign this document with signature at right bottom of each

- 22. ADDITIONAL DOCUMENTS

- 23. PIT-2 FORM This document allows us to reduce the amount of advance personal income tax payment

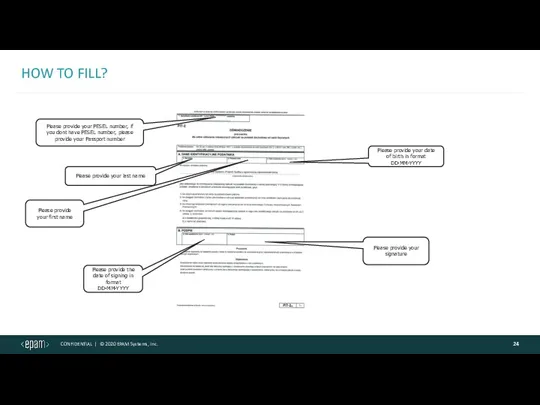

- 24. HOW TO FILL? Please provide your PESEL number, if you dont have PESEL number, please provide

- 25. INCREASED DEDUCTIBLE DEPRICIATION You fill out this form if you live in a city different than

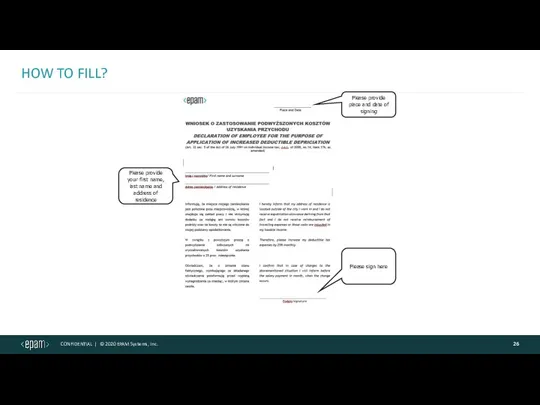

- 26. HOW TO FILL? Please provide address details of place where you actually live. Please note its

- 27. APPLICATION TO COVER FAMILY MEMBER WITH HEALTH INSURANCE People who are working under contract of employment

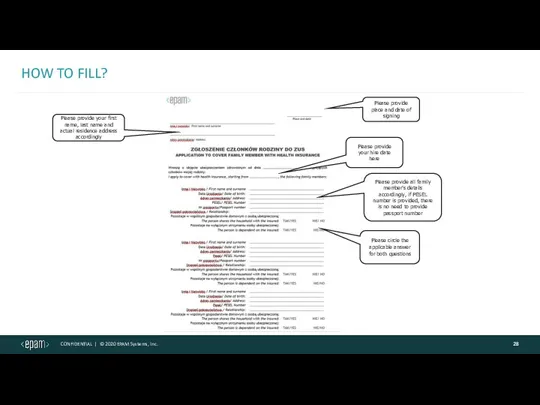

- 28. HOW TO FILL? Please provide address details of place where you actually live. Please note its

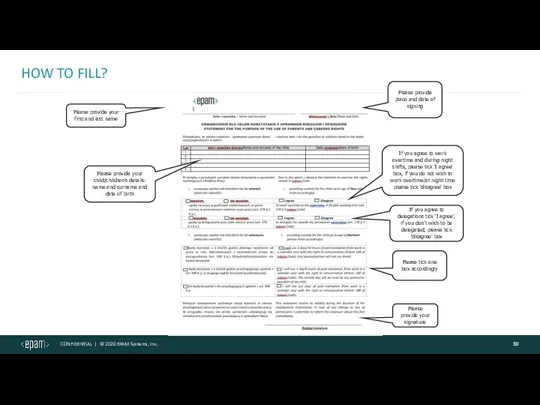

- 29. STATEMENT FOR THE PURPOSE OF THE USE OF PARENTS AND CAREERS RIGHTS Parents have special employment

- 30. HOW TO FILL? Please provide address details of place where you actually live. Please note its

- 31. JOINT TAXATION Polish tax residents are subject to Personal Income Tax which is deducted from their

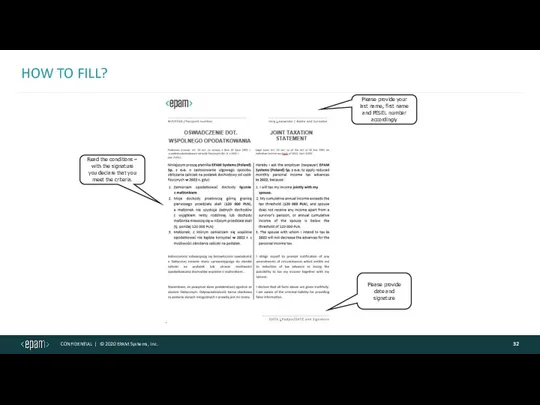

- 32. HOW TO FILL? Please provide your last name, first name and PESEL number accordingly Please provide

- 33. CONTRIBUTION DECLARATION In Poland your gross salary is reduced by tax and contributions. If the amount

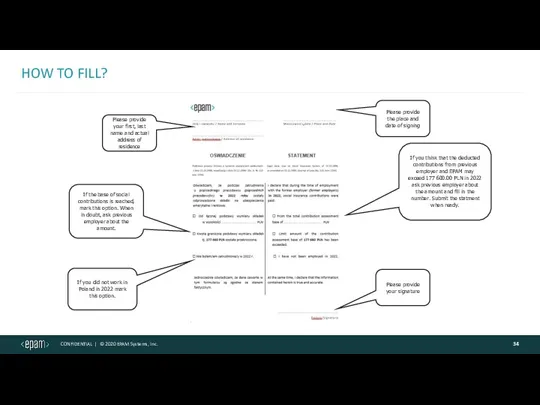

- 34. HOW TO FILL? Please provide your first, last name and actual address of residence Please provide

- 35. DECLARATION CONCERNING APPLYING HIGHER TAX RATE FOR PERSONAL INCOME TAX Please provide this form if you

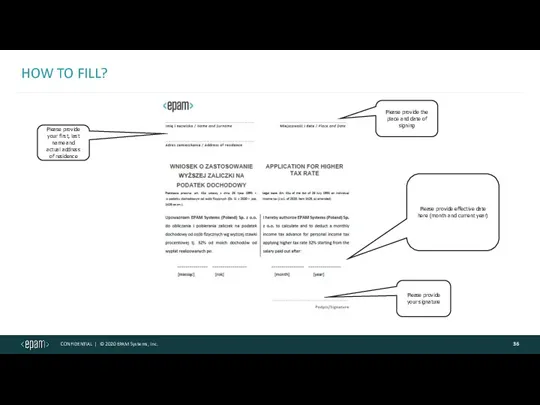

- 36. HOW TO FILL? Please provide your first, last name and actual address of residence Please provide

- 37. RESIGNATION FROM THE SO-CALLED ALLOWANCE FOR MIDDLE CLASS From 2022, the employer is entitled to apply

- 38. HOW TO FILL? Please provide the place and date of signing Please provide your signature Please

- 39. PLEASE SEND US PICTURES OR SCANS OF SIGNED DOCUMENTS AS SOON AS YOU FILL THEM TO

- 41. Скачать презентацию

Глава муниципального образования

Глава муниципального образования Гражданин Российской Федерации. Принципы гражданства Российской Федерации

Гражданин Российской Федерации. Принципы гражданства Российской Федерации Новостройки. Что, как, зачем и кому

Новостройки. Что, как, зачем и кому Нотариустың рәсімдеу жазбасы. Нотариалдық іс жүргізу тәртібі

Нотариустың рәсімдеу жазбасы. Нотариалдық іс жүргізу тәртібі Нормативно-правовое регулирование фармацевтической деятельности. Классификация и структура аптечных организаций

Нормативно-правовое регулирование фармацевтической деятельности. Классификация и структура аптечных организаций Экономические методы регулирования туристской деятельности

Экономические методы регулирования туристской деятельности Методика экспертизы холодного оружия

Методика экспертизы холодного оружия Величайшее поощрение преступления - безнаказанность

Величайшее поощрение преступления - безнаказанность Контакт та прикриття

Контакт та прикриття Договор. Виды договора

Договор. Виды договора Управление земельными ресурсами и объектами недвижимости

Управление земельными ресурсами и объектами недвижимости Система права и система законодательства

Система права и система законодательства Структура таможенных органов Федеральной таможенной службы России

Структура таможенных органов Федеральной таможенной службы России Медичне право і його місце в системі права і законодавства України

Медичне право і його місце в системі права і законодавства України Основы государственного управления транспортной деятельностью в России

Основы государственного управления транспортной деятельностью в России Государственная служба России

Государственная служба России Осуществление правосудия в судебной системе Германии

Осуществление правосудия в судебной системе Германии Салалық стандарттарды және нормативтік-құқықтық құжаттарды даярлап жасауда қолданылатын терминдер

Салалық стандарттарды және нормативтік-құқықтық құжаттарды даярлап жасауда қолданылатын терминдер Понятие и содержание договора

Понятие и содержание договора Система государственного управления РФ

Система государственного управления РФ Ответственность за нарушения в области ГО и ЧС

Ответственность за нарушения в области ГО и ЧС Права, смежные с авторскими

Права, смежные с авторскими Семейное право России

Семейное право России Student Self-Government

Student Self-Government Развитие карьерной стратегии молодежи. Государственная молодежная политика в России

Развитие карьерной стратегии молодежи. Государственная молодежная политика в России Права и свободы человека и гражданина

Права и свободы человека и гражданина Служебные преступления

Служебные преступления Общая часть налогового права

Общая часть налогового права