Содержание

- 2. FIN 591: Financial Fundamentals/Valuation M&M: The Starting Point A number of restrictive assumptions apply Use the

- 3. FIN 591: Financial Fundamentals/Valuation The M&M Assumptions Homogeneous expectations Homogeneous business risk (σEBIT) classes Perpetual no-growth

- 4. FIN 591: Financial Fundamentals/Valuation Business Risk Business risk: Risk surrounding expected operating cash flows Factors causing

- 5. FIN 591: Financial Fundamentals/Valuation Principle of Additivity Allows you to value the cash flows in any

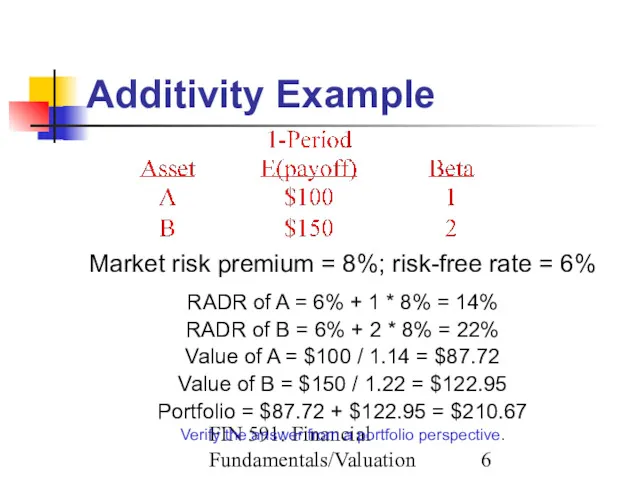

- 6. FIN 591: Financial Fundamentals/Valuation Additivity Example Market risk premium = 8%; risk-free rate = 6% RADR

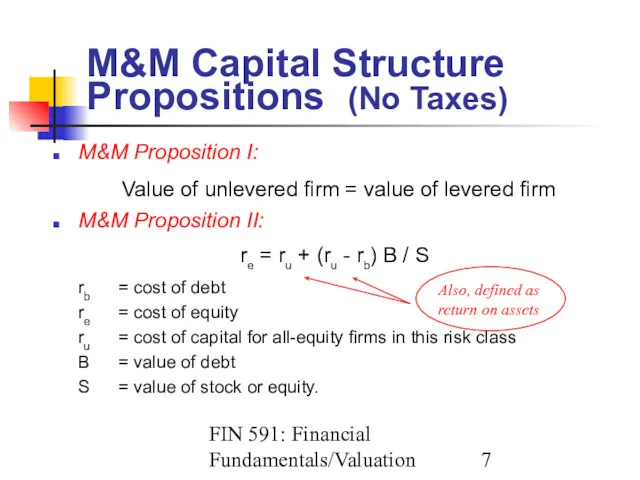

- 7. FIN 591: Financial Fundamentals/Valuation M&M Capital Structure Propositions (No Taxes) M&M Proposition I: Value of unlevered

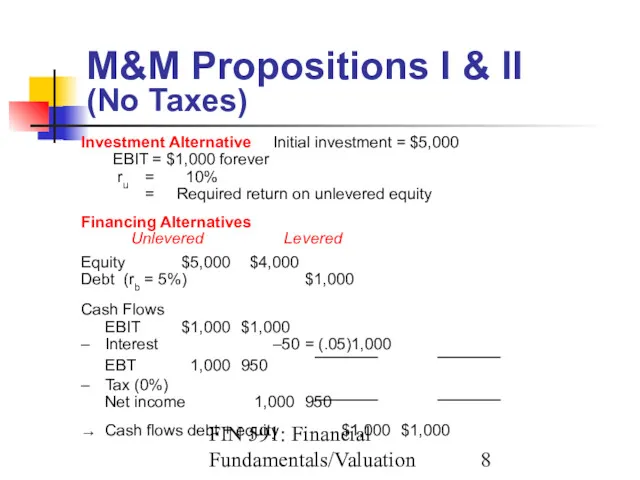

- 8. FIN 591: Financial Fundamentals/Valuation M&M Propositions I & II (No Taxes) Investment Alternative Initial investment =

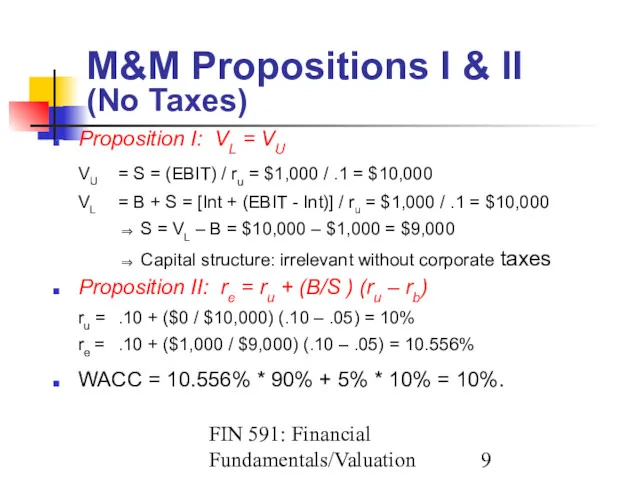

- 9. FIN 591: Financial Fundamentals/Valuation M&M Propositions I & II (No Taxes) Proposition I: VL = VU

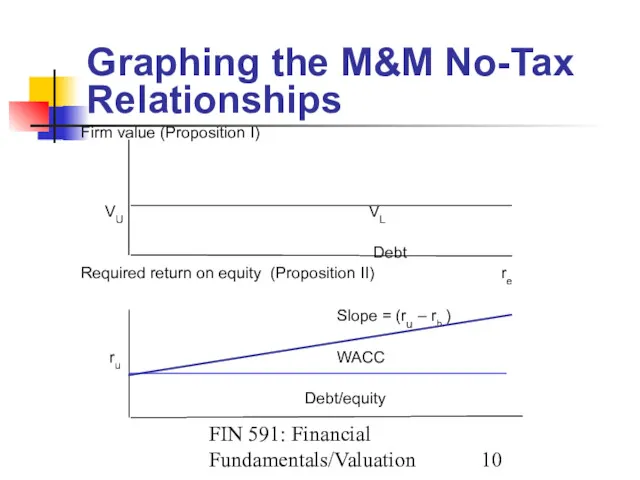

- 10. FIN 591: Financial Fundamentals/Valuation Graphing the M&M No-Tax Relationships Firm value (Proposition I) VU VL Debt

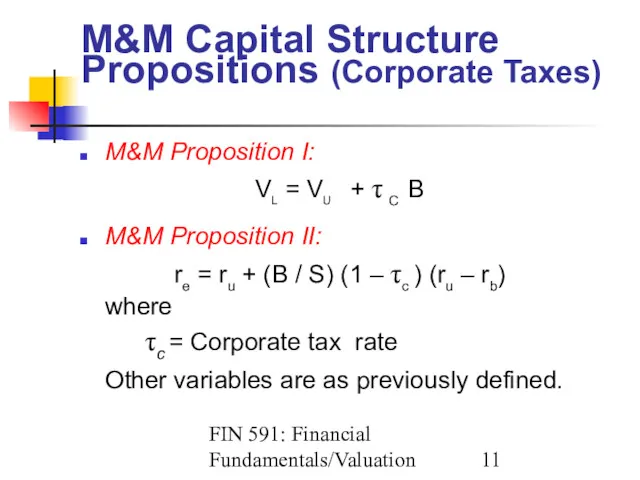

- 11. FIN 591: Financial Fundamentals/Valuation M&M Capital Structure Propositions (Corporate Taxes) M&M Proposition I: VL = VU

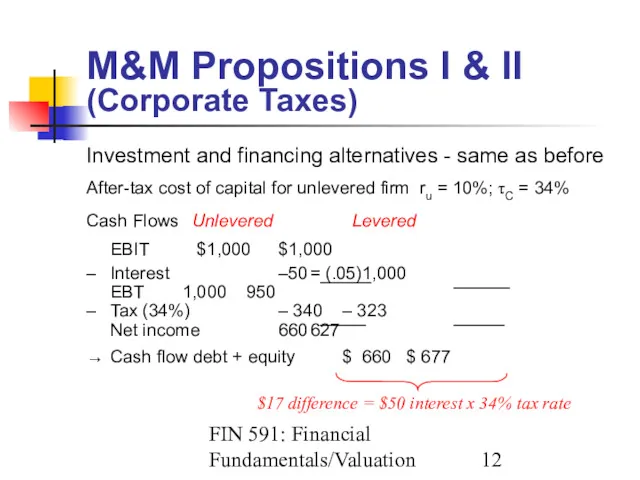

- 12. FIN 591: Financial Fundamentals/Valuation M&M Propositions I & II (Corporate Taxes) Investment and financing alternatives -

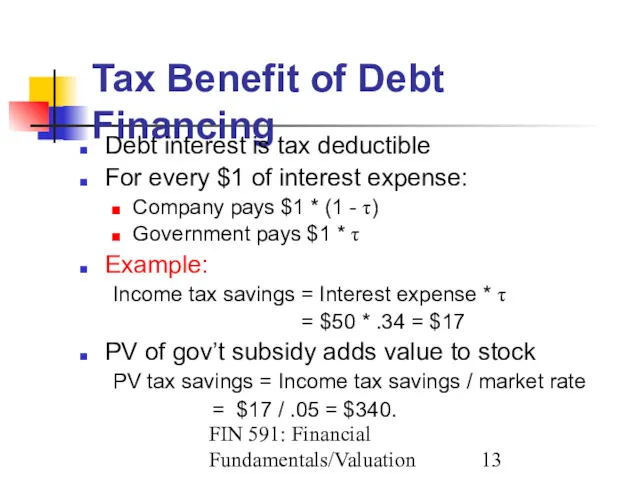

- 13. FIN 591: Financial Fundamentals/Valuation Tax Benefit of Debt Financing Debt interest is tax deductible For every

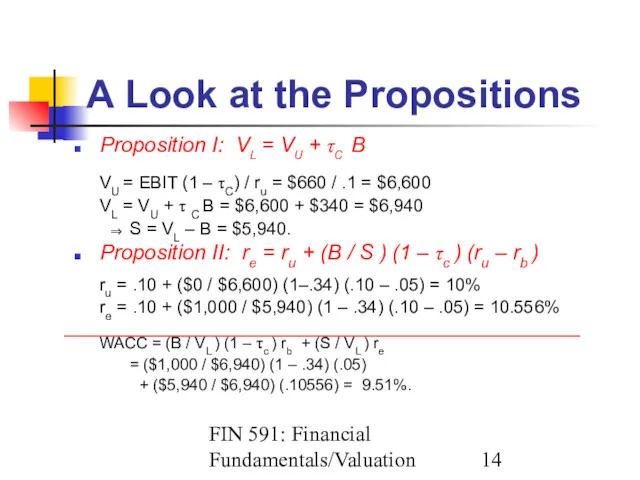

- 14. FIN 591: Financial Fundamentals/Valuation A Look at the Propositions Proposition I: VL = VU + τC

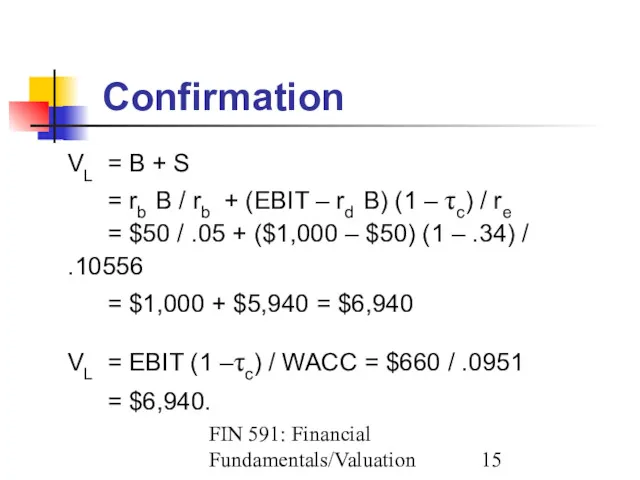

- 15. FIN 591: Financial Fundamentals/Valuation Confirmation VL = B + S = rb B / rb +

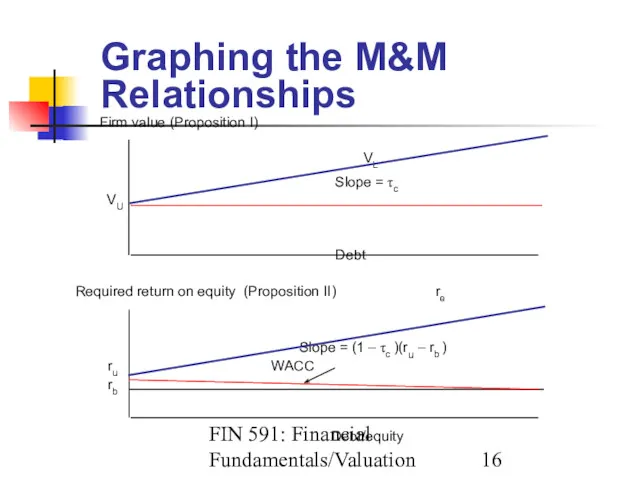

- 16. FIN 591: Financial Fundamentals/Valuation Graphing the M&M Relationships Firm value (Proposition I) VL Slope = τc

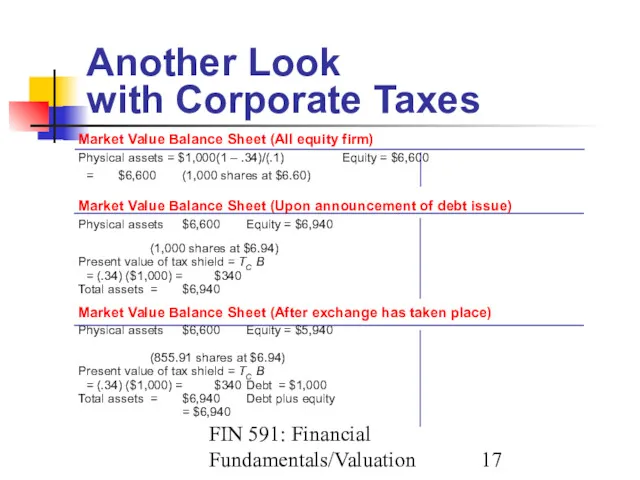

- 17. FIN 591: Financial Fundamentals/Valuation Another Look with Corporate Taxes Market Value Balance Sheet (All equity firm)

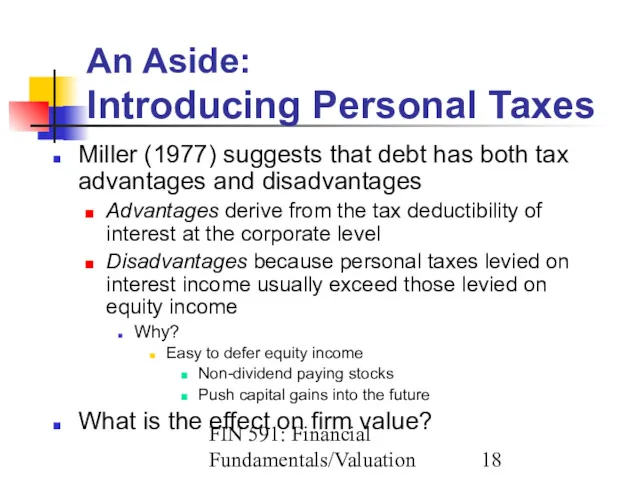

- 18. FIN 591: Financial Fundamentals/Valuation An Aside: Introducing Personal Taxes Miller (1977) suggests that debt has both

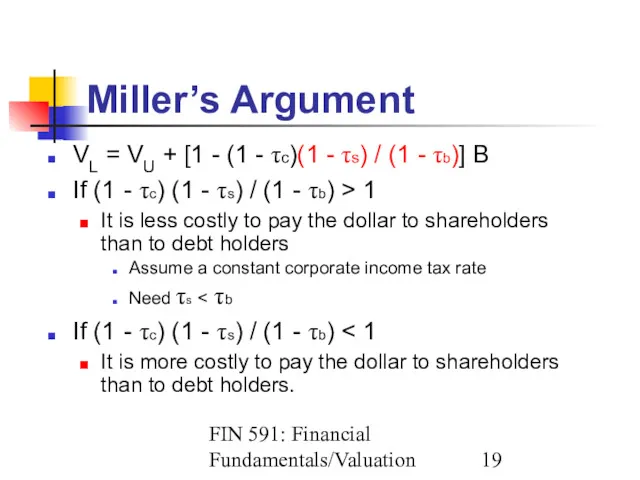

- 19. FIN 591: Financial Fundamentals/Valuation Miller’s Argument VL = VU + [1 - (1 - τc)(1 -

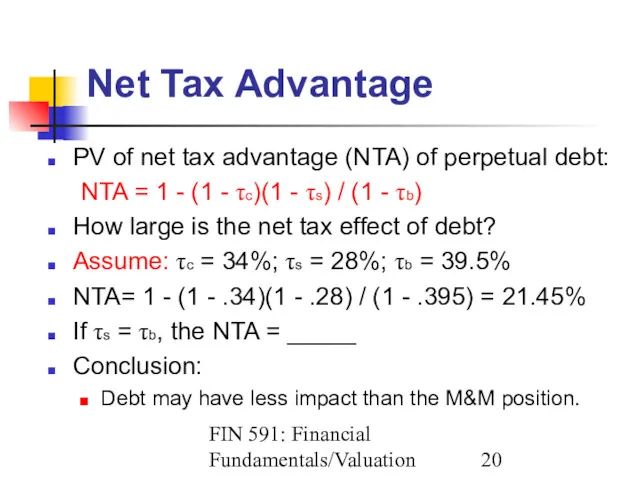

- 20. FIN 591: Financial Fundamentals/Valuation Net Tax Advantage PV of net tax advantage (NTA) of perpetual debt:

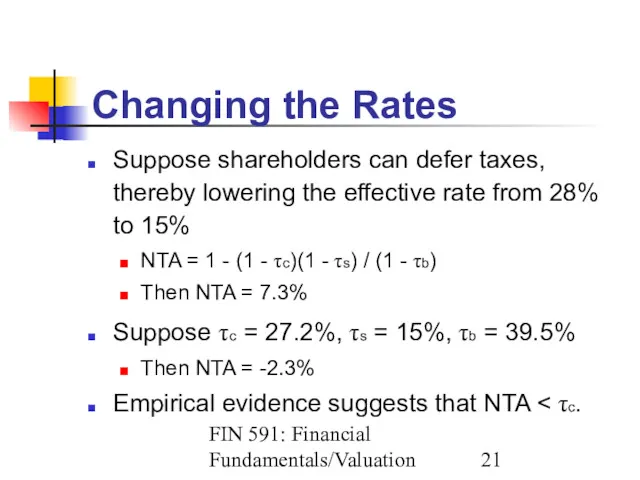

- 21. FIN 591: Financial Fundamentals/Valuation Changing the Rates Suppose shareholders can defer taxes, thereby lowering the effective

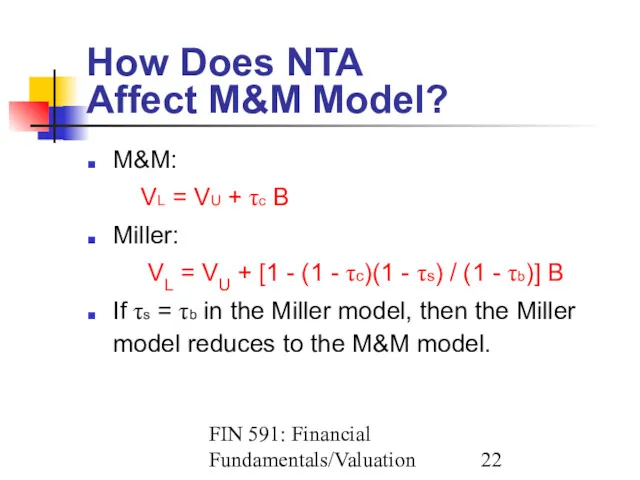

- 22. FIN 591: Financial Fundamentals/Valuation How Does NTA Affect M&M Model? M&M: VL = VU + τc

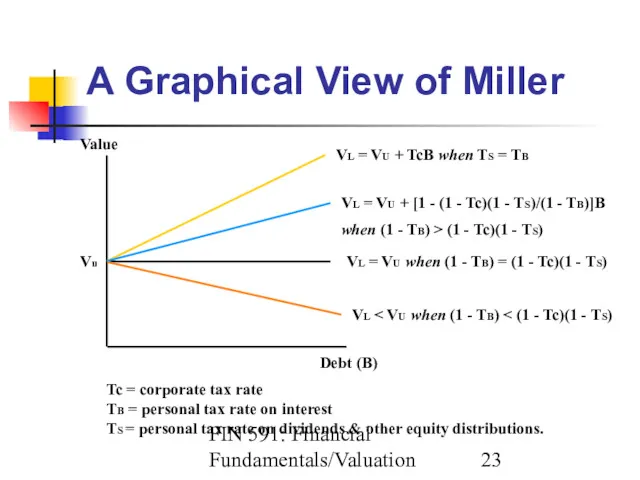

- 23. FIN 591: Financial Fundamentals/Valuation A Graphical View of Miller Value Vu Debt (B) VL = VU

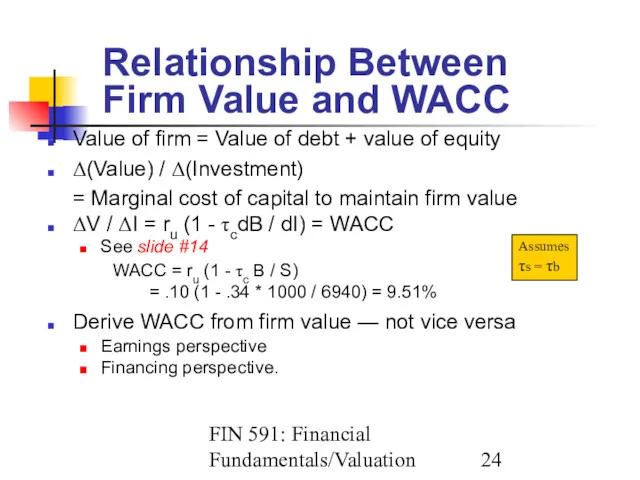

- 24. FIN 591: Financial Fundamentals/Valuation Relationship Between Firm Value and WACC Value of firm = Value of

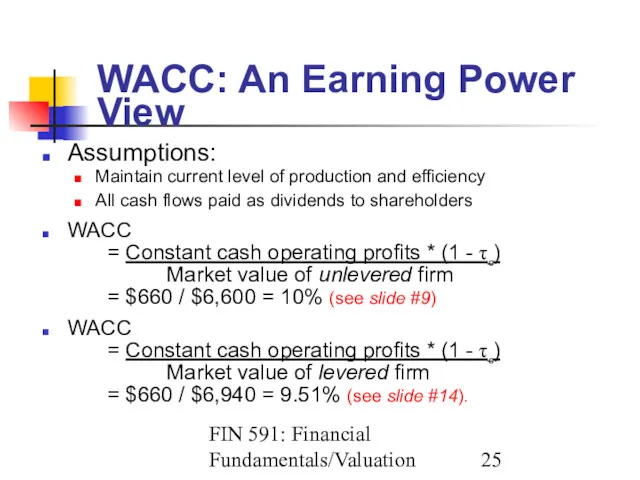

- 25. FIN 591: Financial Fundamentals/Valuation WACC: An Earning Power View Assumptions: Maintain current level of production and

- 26. FIN 591: Financial Fundamentals/Valuation WACC: A Financing View Calculate the cost of: Debt Preferred stock Common

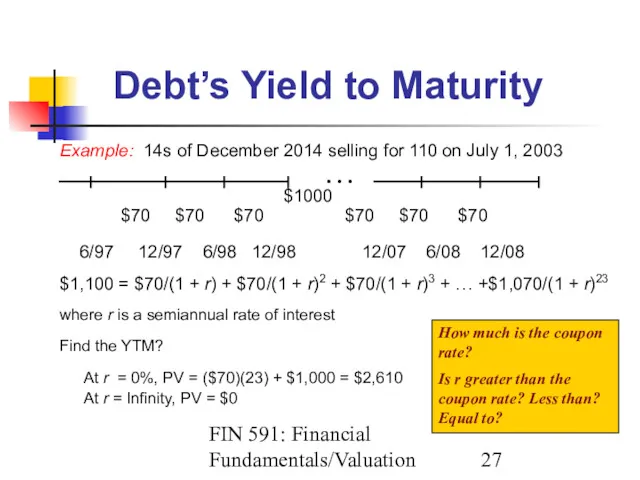

- 27. FIN 591: Financial Fundamentals/Valuation Debt’s Yield to Maturity Example: 14s of December 2014 selling for 110

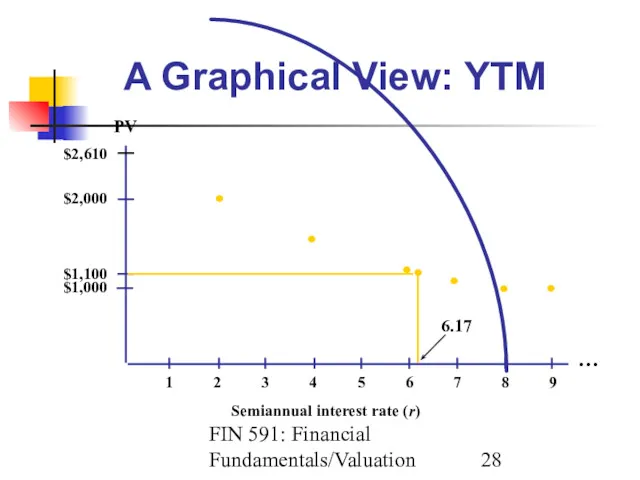

- 28. FIN 591: Financial Fundamentals/Valuation A Graphical View: YTM Semiannual interest rate (r) $2,610 $2,000 $1,100 $1,000

- 29. FIN 591: Financial Fundamentals/Valuation Cost of Debt Cost of debt to the firm is the YTM

- 30. FIN 591: Financial Fundamentals/Valuation Cost of Debt = YTM * (1 - τc) Represents a good

- 31. FIN 591: Financial Fundamentals/Valuation Cost of Preferred Stock Preferred stock dividend is not tax deductible Cost

- 32. FIN 591: Financial Fundamentals/Valuation Cost of Equity Cost of equity is more difficult to calculate than

- 33. FIN 591: Financial Fundamentals/Valuation Using Historic Returns Estimating cost of capital using past returns is justified

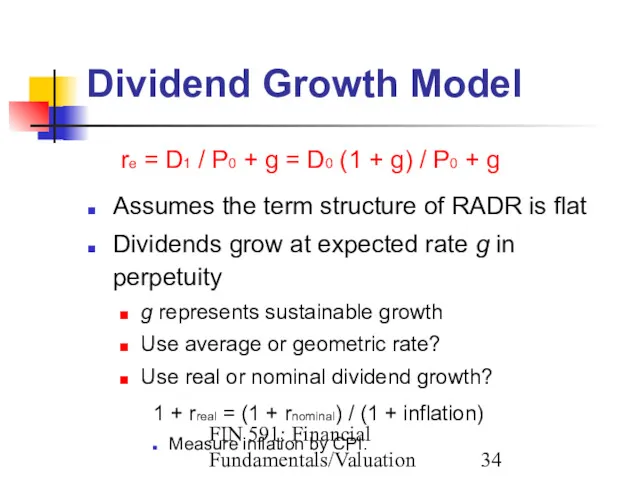

- 34. FIN 591: Financial Fundamentals/Valuation Dividend Growth Model re = D1 / P0 + g = D0

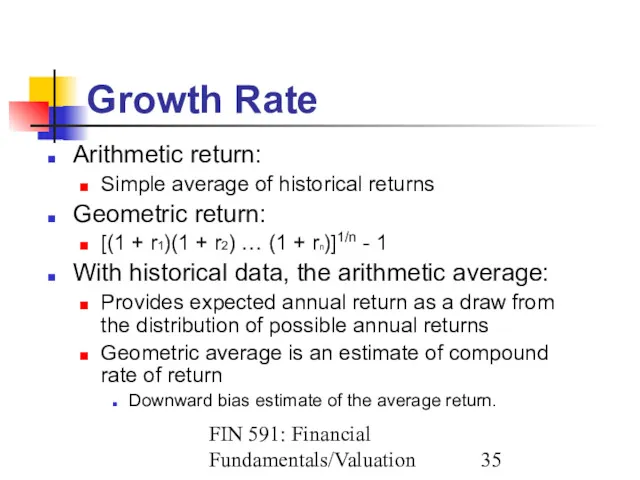

- 35. FIN 591: Financial Fundamentals/Valuation Growth Rate Arithmetic return: Simple average of historical returns Geometric return: [(1

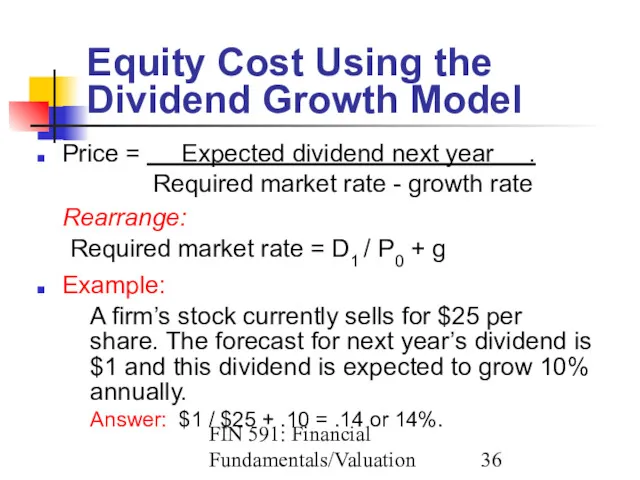

- 36. FIN 591: Financial Fundamentals/Valuation Equity Cost Using the Dividend Growth Model Price = Expected dividend next

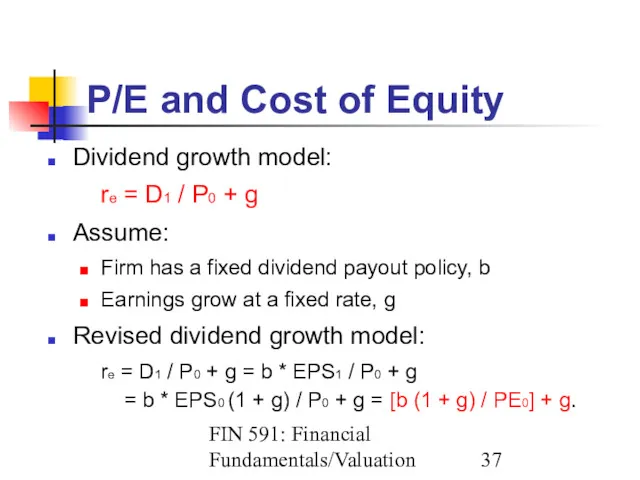

- 37. FIN 591: Financial Fundamentals/Valuation P/E and Cost of Equity Dividend growth model: re = D1 /

- 38. FIN 591: Financial Fundamentals/Valuation Problem with Dividend Model Says nothing about risk! Returns should be based

- 40. Скачать презентацию

Новые правила грамматики английского языка

Новые правила грамматики английского языка London attractions

London attractions Infinitive. The negative infinitive. The present infinitive

Infinitive. The negative infinitive. The present infinitive Интерактивные методы обучения как способ формирования коммуникативной компетенции учащихся при изучении английского языка

Интерактивные методы обучения как способ формирования коммуникативной компетенции учащихся при изучении английского языка The Beatles music

The Beatles music Future Tenses

Future Tenses Косвенная речь

Косвенная речь All about volcanoes

All about volcanoes Present Continuous mine

Present Continuous mine Неопределенный артикль, 5 класс

Неопределенный артикль, 5 класс Language and culture

Language and culture We are having a great time!

We are having a great time! Body parts

Body parts Everyday products

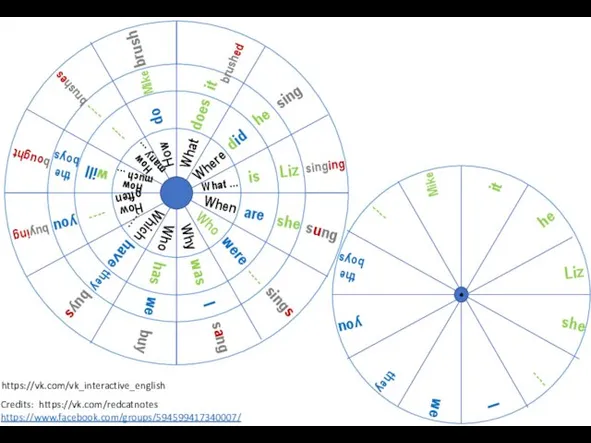

Everyday products Wh-questions vk interactive english

Wh-questions vk interactive english Using games in a foreign language classroom

Using games in a foreign language classroom The impact of discrimination on culture

The impact of discrimination on culture The Verb

The Verb Present Simple

Present Simple Leisure and entertainment

Leisure and entertainment Big Ben

Big Ben Hello, kids! Hello September

Hello, kids! Hello September Игра-викторина по английскому языку

Игра-викторина по английскому языку Rotordynamics

Rotordynamics Leisure Activities. Vocabulary

Leisure Activities. Vocabulary Причастие – неличная форма глагола, сочетающая свойства глагола, прилагательного и наречия

Причастие – неличная форма глагола, сочетающая свойства глагола, прилагательного и наречия Трудности перевода терминов

Трудности перевода терминов Distinctive features of the functional styles. Lecture 10

Distinctive features of the functional styles. Lecture 10