Содержание

- 2. Defining M& A One plus one makes three: this equation is the special alchemy of a

- 4. Distinction between Mergers and Acquisition Although they are often uttered in the same breath and used

- 5. In practice, however, actual mergers of equals don't happen very often. Usually, one company will buy

- 6. Synergy may be in Staff reductions - Mergers tend to mean job losses. Money is saved

- 18. Скачать презентацию

Reported speech. Косвенная речь. Тест

Reported speech. Косвенная речь. Тест The definite article

The definite article St. Paul's Cathedral in London

St. Paul's Cathedral in London Animals at the zoo

Animals at the zoo Викторина по английскому языку для младших школьников

Викторина по английскому языку для младших школьников Theories of Second Language Acquisition (SLA)

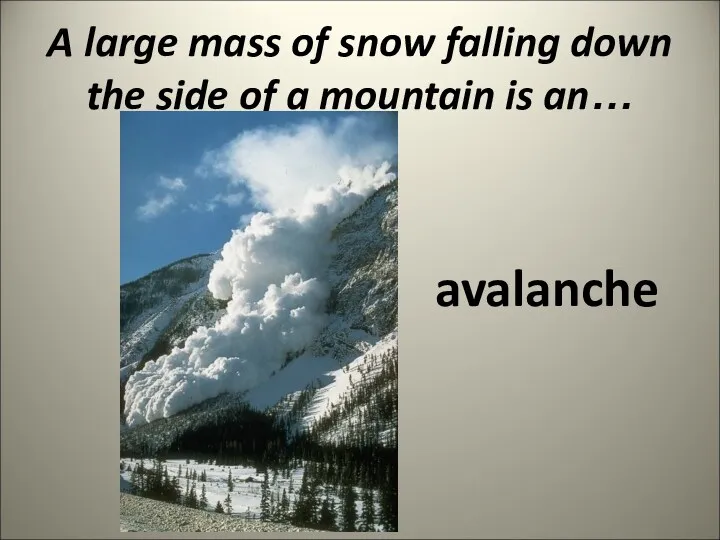

Theories of Second Language Acquisition (SLA) disasters

disasters The history of the invention of the car

The history of the invention of the car Present perfect continuous progressive tense

Present perfect continuous progressive tense Opinion essay

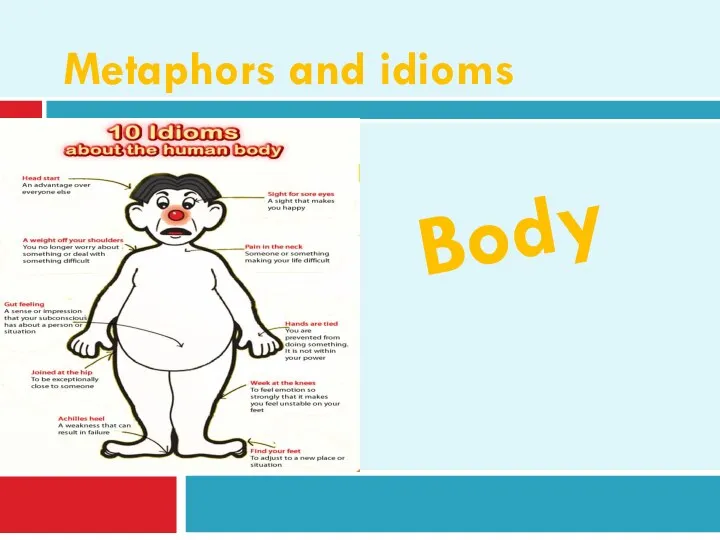

Opinion essay Metaphors and idioms

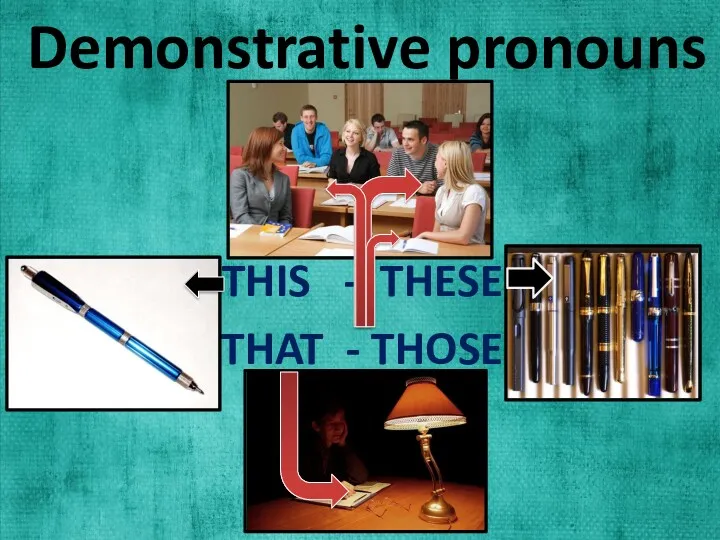

Metaphors and idioms Demonstrative pronouns

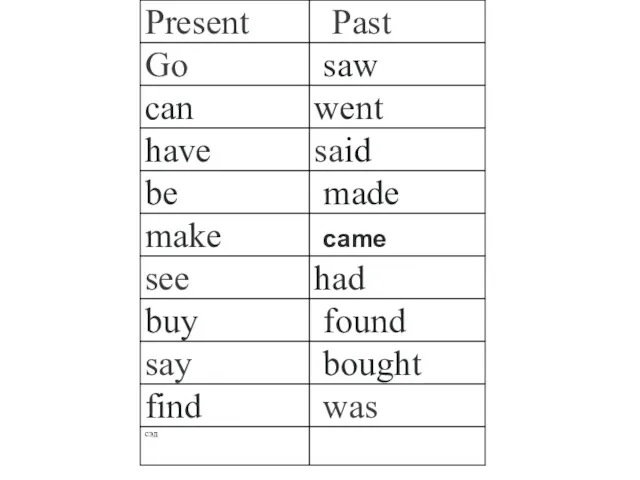

Demonstrative pronouns Present. Past

Present. Past Alphabet revision

Alphabet revision Food products

Food products Формирование коммуникативной компетенции у учащихся на уроках английского языка

Формирование коммуникативной компетенции у учащихся на уроках английского языка Lecture 6. Word-building (part 2 )

Lecture 6. Word-building (part 2 ) Местоимения much, many, a few, a little

Местоимения much, many, a few, a little Idioms. A game

Idioms. A game Русские и английские пословицы и поговорки. Сходства и различия

Русские и английские пословицы и поговорки. Сходства и различия Обзор пособий по методике Jolly Phonics. Работа с каталогом

Обзор пособий по методике Jolly Phonics. Работа с каталогом Australia is a fascinating

Australia is a fascinating The Present Continuous Tense. What are the Smurfs doing?

The Present Continuous Tense. What are the Smurfs doing? What do you think of this present? Bubble wrap costume

What do you think of this present? Bubble wrap costume Present Simple

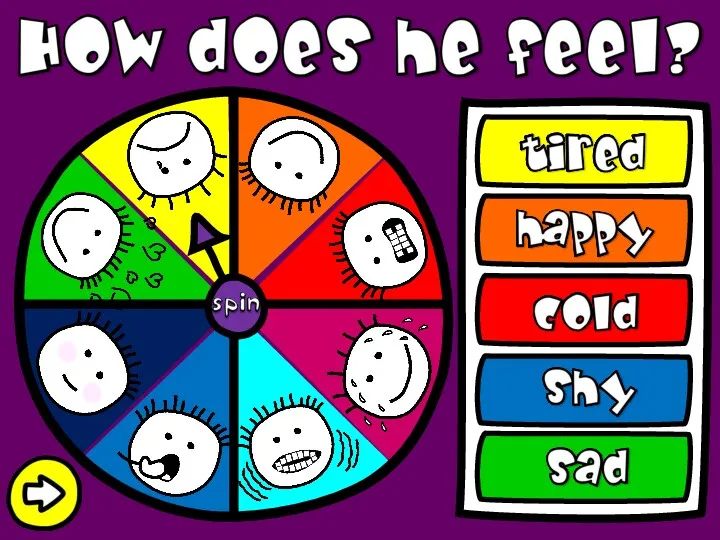

Present Simple How does he feel?

How does he feel? Quiz. English language grade 6

Quiz. English language grade 6 Готовимся к ЕГЭ: last-minute tips 2019

Готовимся к ЕГЭ: last-minute tips 2019