Слайд 2

OVERVIEW

The investment bank – a division of a bank or financial

institution – provides capital raising and M&A (mergers and acquisitions) advisory services. Labuan investment banking mainly serves governments, corporations, institutions and high-net-worth individuals as part of their wealth management business. Investment banking business operates as a medium between investors and corporations. Labuan international bank financial center has successfully attracted many international investment bankers to set up in Labuan jurisdictions,owing to its strong regulatory framework, flexible tax regimes and low cost set up and operation.

Слайд 3

Слайд 4

What are the permitted activities of the investment bank business?

Labuan investment

bank is permitted to conduct all business activities of commercial banks, except receiving individual/corporate account deposits. Here are some authorized activities of the investment banking business in Labuan.

Transaction banking

Corporate finance

Securities trading

Asset & wealth management

Слайд 5

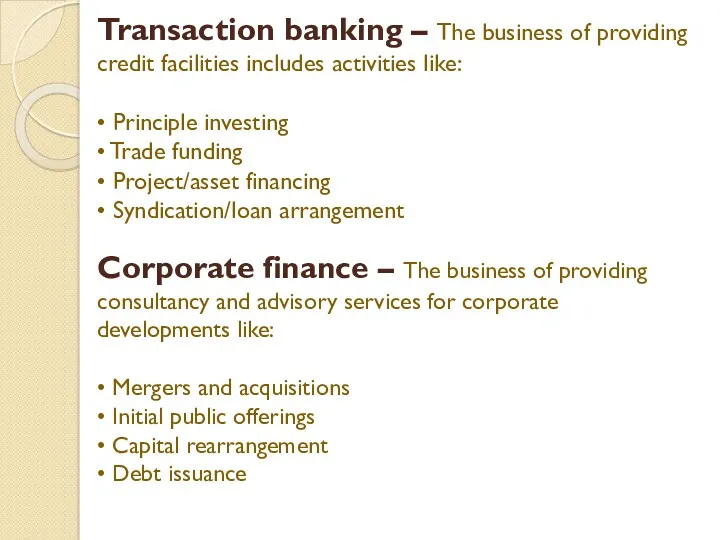

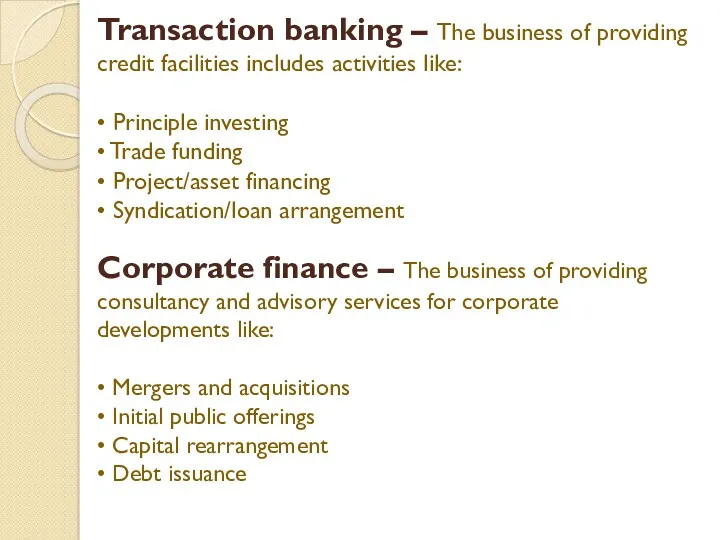

Transaction banking – The business of providing

credit facilities includes activities like:

•

Principle investing

• Trade funding

• Project/asset financing

• Syndication/loan arrangement

Corporate finance – The business of providing

consultancy and advisory services for corporate

developments like:

• Mergers and acquisitions

• Initial public offerings

• Capital rearrangement

• Debt issuance

Слайд 6

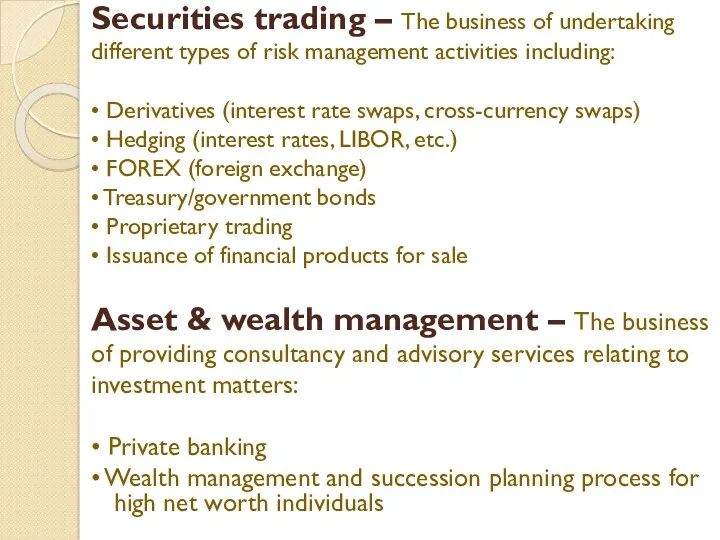

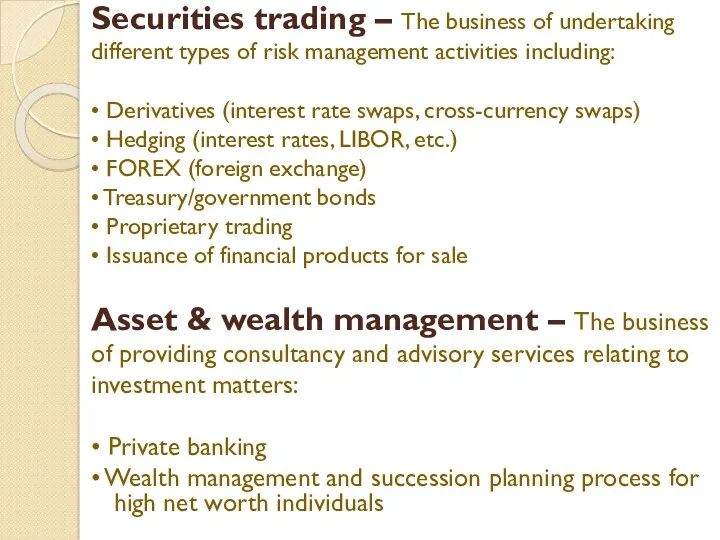

Securities trading – The business of undertaking

different types of risk management

activities including:

• Derivatives (interest rate swaps, cross-currency swaps)

• Hedging (interest rates, LIBOR, etc.)

• FOREX (foreign exchange)

• Treasury/government bonds

• Proprietary trading

• Issuance of financial products for sale

Asset & wealth management – The business

of providing consultancy and advisory services relating to

investment matters:

• Private banking

• Wealth management and succession planning process for high net worth individuals

Слайд 7

Why should you choose Labuan for investment business?

Labuan brings various financial

benefits together with

improved working conditions including privacy

legislation toprotect to company assets and details. For

maximum profit, saved money can be invested back into your

firm or elsewhere. Let’s take a look at a few key reasons for

choosing Labuan for the investment banking business.

No tax for non-trading companies

A tax rate of 3 % for trading companies

No capital gains tax

A highly developed legal infrastructure

Strategic location and optimal time zone

A strong economy and low operating costs

Flexibility for Labuan Banks to conduct business in designated areas of Malaysia

Слайд 8

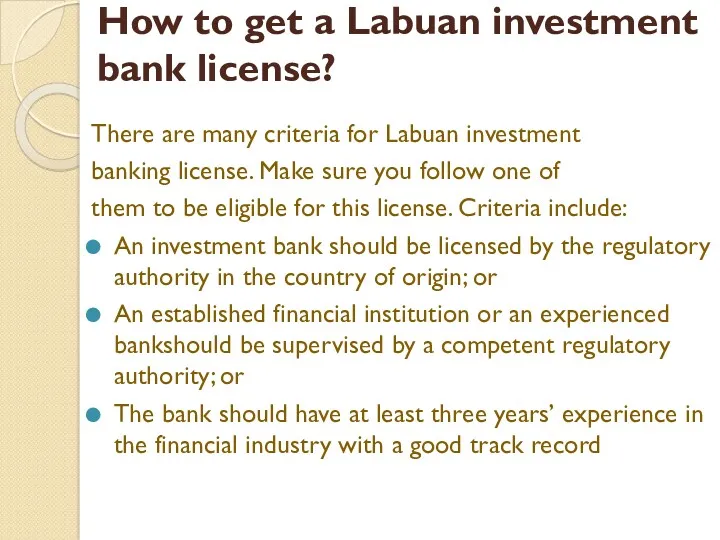

How to get a Labuan investment bank license?

There are many criteria

for Labuan investment

banking license. Make sure you follow one of

them to be eligible for this license. Criteria include:

An investment bank should be licensed by the regulatory authority in the country of origin; or

An established financial institution or an experienced bankshould be supervised by a competent regulatory authority; or

The bank should have at least three years’ experience in the financial industry with a good track record

Слайд 9

For More Information Contact here

CONTACT US :- +60 3 9212 6940

VISIT

HERE: https://offshore-labuan.com

ADDRESS:- Unit No. 3A-16, Level 3A

Labuan Times Square

87000 F.T. Labuan, Malaysia

Понятие и источники предпринимательского права. (Тема 1)

Понятие и источники предпринимательского права. (Тема 1) Гастрономический тур в Хорватию

Гастрономический тур в Хорватию Американская модель корпоративной социальной ответственности

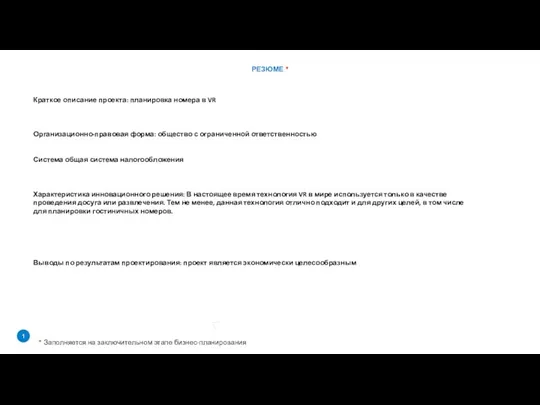

Американская модель корпоративной социальной ответственности Шаблон бизнес - модели

Шаблон бизнес - модели Для чего обучаться коучингу в кризис

Для чего обучаться коучингу в кризис Магазин чая и сопутствующих товаров

Магазин чая и сопутствующих товаров Restaurants alliance White Rabbit Family

Restaurants alliance White Rabbit Family Ресторан Діамант

Ресторан Діамант Формирование кадровой политики для малых отелей (на примере ООО Отель Виноградово)

Формирование кадровой политики для малых отелей (на примере ООО Отель Виноградово) Бизнес-план ресторана

Бизнес-план ресторана Количественный анализ бизнес-процессов

Количественный анализ бизнес-процессов Бизнес-моделирование. Инновация

Бизнес-моделирование. Инновация Разработка бизнес - плана открытия клиники UfaDent

Разработка бизнес - плана открытия клиники UfaDent Школа социального предпринимательства

Школа социального предпринимательства Социально ответственный бизнес

Социально ответственный бизнес Молочні бари

Молочні бари Ferroni company. Production entrance doors

Ferroni company. Production entrance doors Бизнес-проект: Магазин чая и кофе

Бизнес-проект: Магазин чая и кофе Презентация Гостиница Волга - Тверь (Майоров).html

Презентация Гостиница Волга - Тверь (Майоров).html Doing business in Europe

Doing business in Europe Риски в малом бизнесе

Риски в малом бизнесе Современное состояние и тенденции правовой среды бизнеса

Современное состояние и тенденции правовой среды бизнеса Global case challenge de Mexico. Develop a product strategy for the international entry

Global case challenge de Mexico. Develop a product strategy for the international entry Spółka jawna

Spółka jawna Виды и формы бизнеса

Виды и формы бизнеса ООО Ависта Сервис

ООО Ависта Сервис Переваги ведення бізнесу по франчайзингу

Переваги ведення бізнесу по франчайзингу Бизнес-планирование

Бизнес-планирование