Содержание

- 2. Key highlights: Overall market In Jan-Jul 2020, Russian pharmaceutical market grew by + 14% in value

- 3. Ключевые выводы Рынок в целом С начала 2020 года российский фармацевтический рынок вырос на 14% в

- 4. Source: IQVIA highlights report July’20

- 5. Source: IQVIA highlights report Jul’20

- 6. Ipsen place on the market In MAT Jul’20 Ipsen overperformed Rompharm, Geropharm and gained 54th place

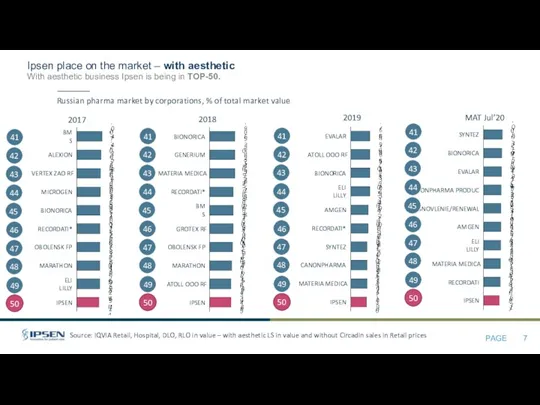

- 7. Ipsen place on the market – with aesthetic With aesthetic business Ipsen is being in TOP-50.

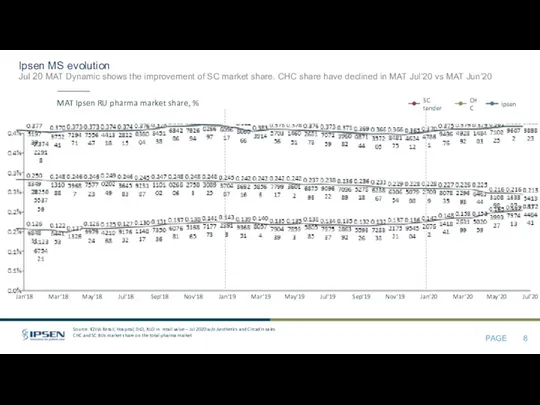

- 8. Ipsen MS evolution Jul 20 MAT Dynamic shows the improvement of SC market share. CHC share

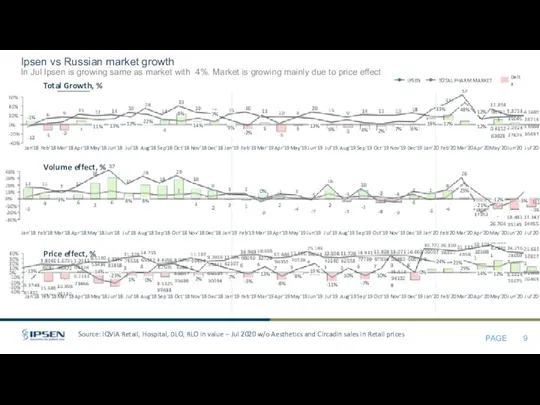

- 9. Ipsen vs Russian market growth In Jul Ipsen is growing same as market with 4%. Market

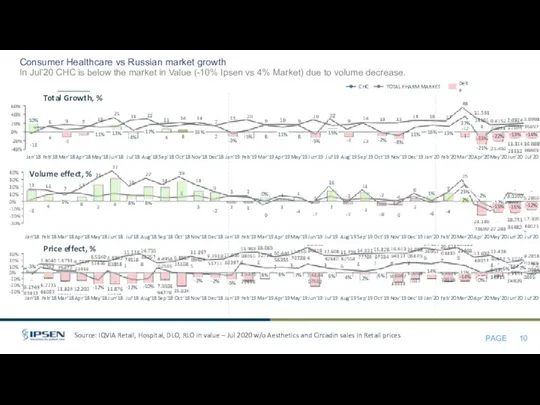

- 10. Consumer Healthcare vs Russian market growth In Jul’20 CHC is below the market in Value (-10%

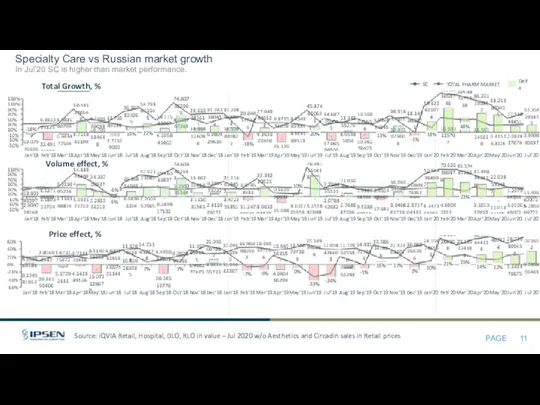

- 11. Specialty Care vs Russian market growth In Jul’20 SC is higher than market performance. Aug’18 19%

- 12. Distribution Index dynamic Purchase index have recovered after drop in April. Distribution of Eziclen decreased from

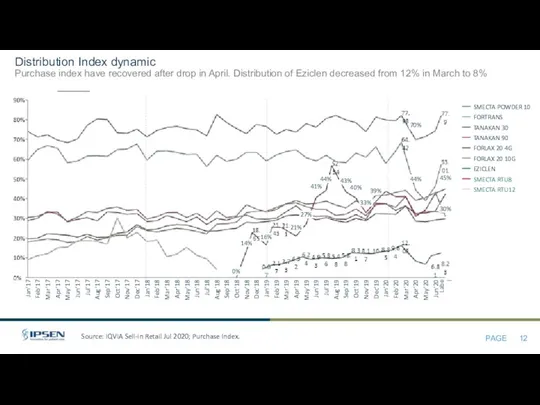

- 13. Ipsen Brand Market Share % YTD’ Jul MQ’ Jul MQ*’Jul vs LY CHC Performance July’20 Sell

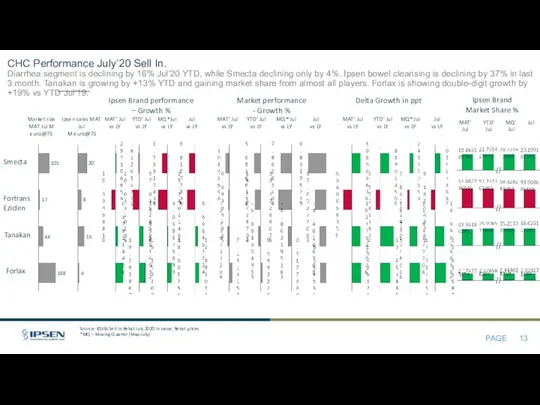

- 14. Smecta retail performance Smecta gained +2.1 pts MS in MAT’Jul 20 vs LY but decreased in

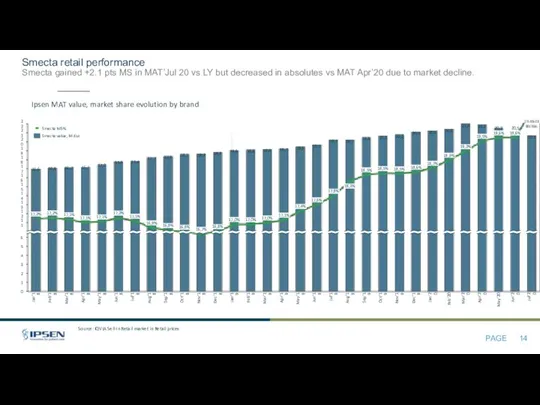

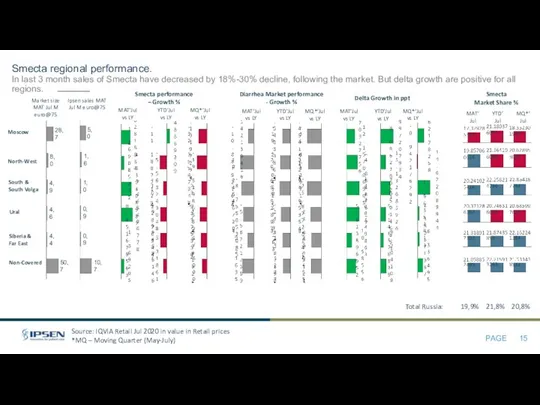

- 15. Smecta regional performance. In last 3 month sales of Smecta have decreased by 18%-30% decline, following

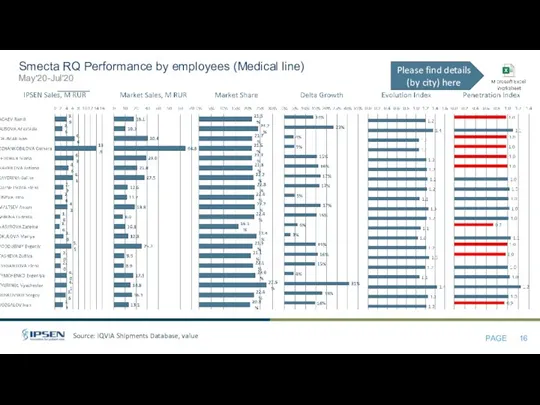

- 16. Source: IQVIA Shipments Database, value Smecta RQ Performance by employees (Medical line) May'20-Jul'20 Please find details

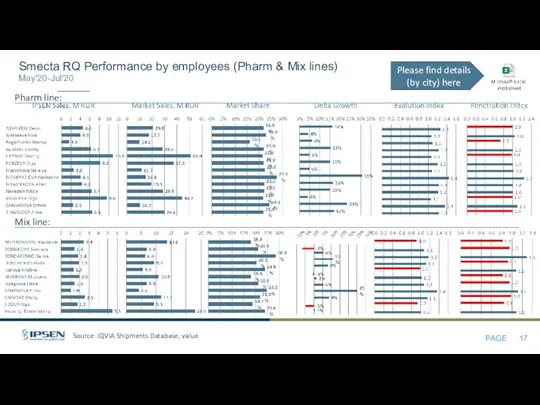

- 17. Source: IQVIA Shipments Database, value Smecta RQ Performance by employees (Pharm & Mix lines) May'20-Jul'20 Mix

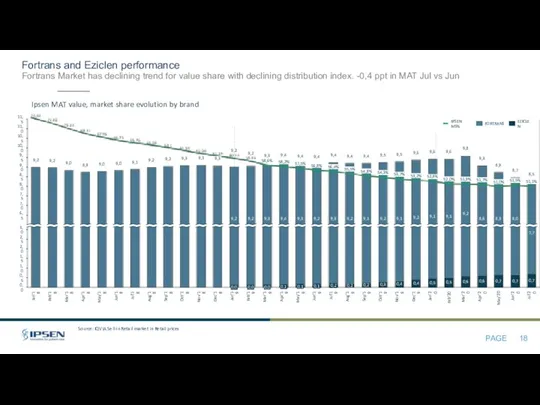

- 18. Fortrans and Eziclen performance Fortrans Market has declining trend for value share with declining distribution index.

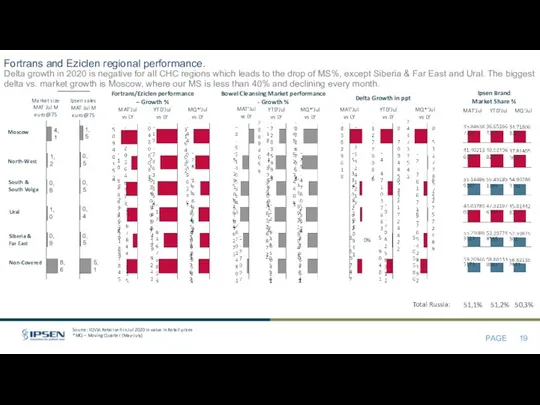

- 19. Fortrans and Eziclen regional performance. Delta growth in 2020 is negative for all CHC regions which

- 20. Source: IQVIA Shipments Database, value Fortrans and Eziclen RQ Performance by employees (Medical line) May'20-Jul'20 Please

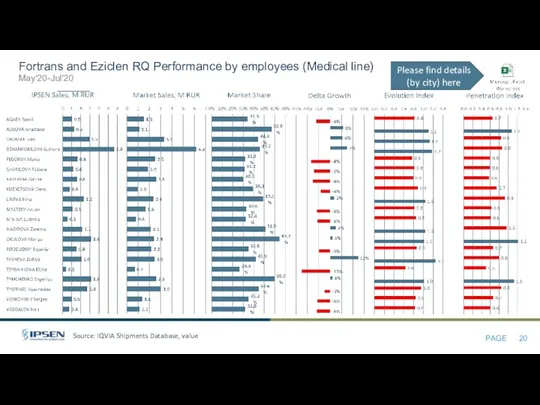

- 21. Source: IQVIA Shipments Database, value Fortrans and Eziclen YTD Performance by employees (Pharm & Mix lines)

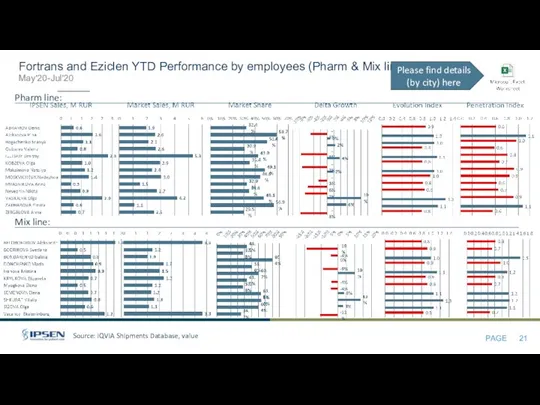

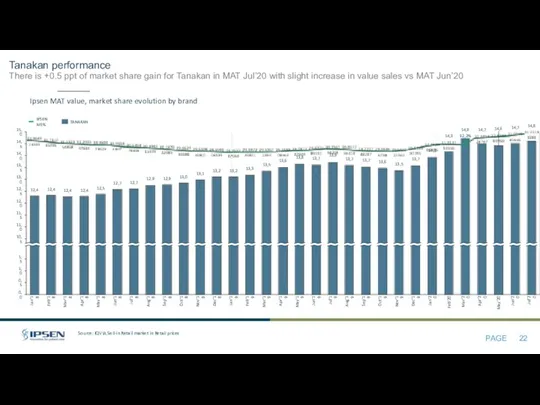

- 22. Tanakan performance There is +0.5 ppt of market share gain for Tanakan in MAT Jul’20 with

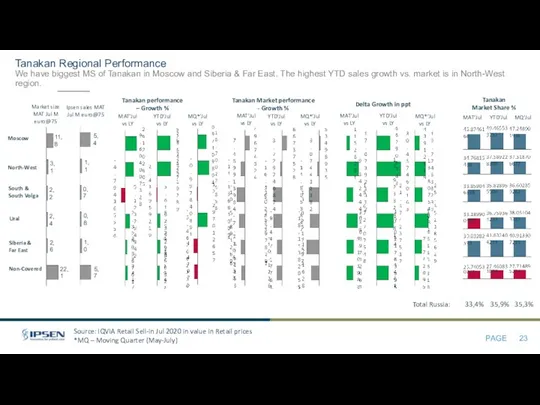

- 23. Tanakan Regional Performance We have biggest MS of Tanakan in Moscow and Siberia & Far East.

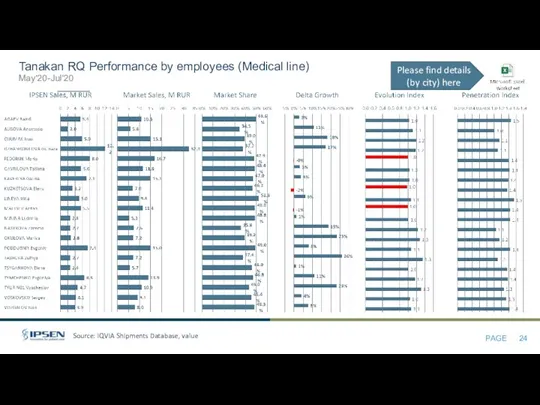

- 24. Source: IQVIA Shipments Database, value Tanakan RQ Performance by employees (Medical line) May'20-Jul'20 Please find details

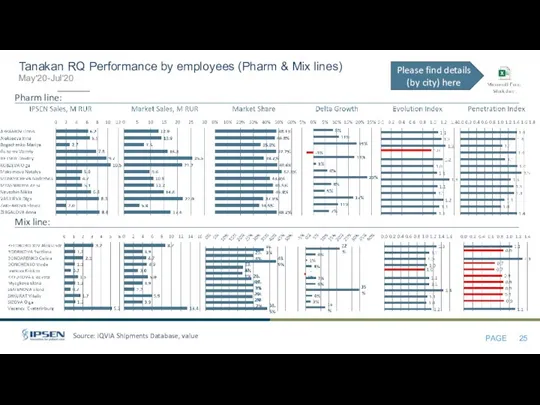

- 25. Source: IQVIA Shipments Database, value Tanakan RQ Performance by employees (Pharm & Mix lines) May'20-Jul'20 Mix

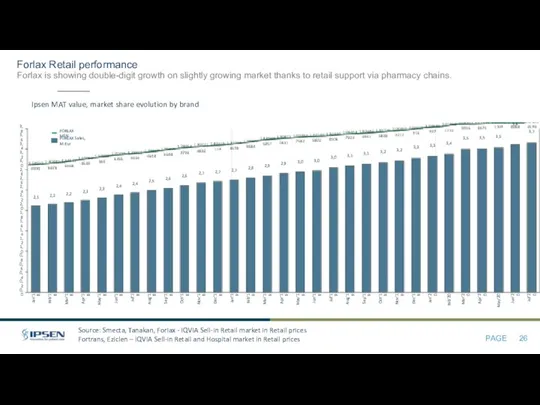

- 26. Forlax Retail performance Forlax is showing double-digit growth on slightly growing market thanks to retail support

- 27. Forlax Regional Performance Forlax is growing much faster than market and showing the double-digit growth in

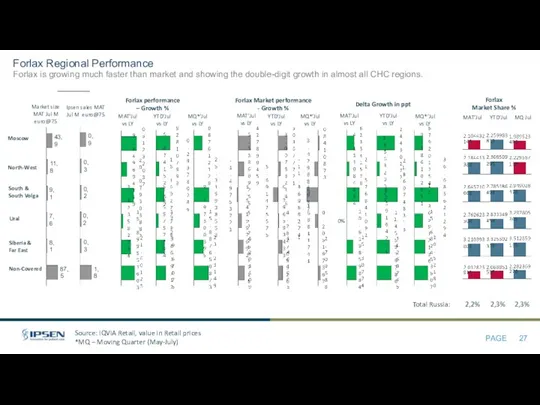

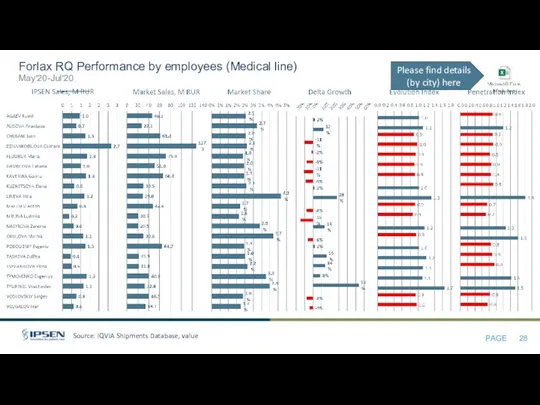

- 28. Source: IQVIA Shipments Database, value Forlax RQ Performance by employees (Medical line) May'20-Jul'20 Please find details

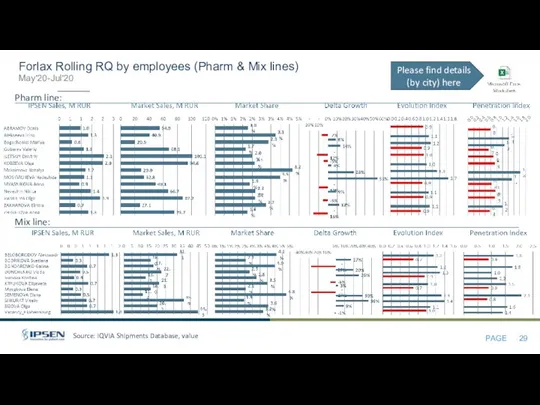

- 29. Source: IQVIA Shipments Database, value Forlax Rolling RQ by employees (Pharm & Mix lines) May'20-Jul'20 Mix

- 30. SC Performance Jul’20 All brands are demonstrating growth above the market in YTD vs LY. Cabometyx

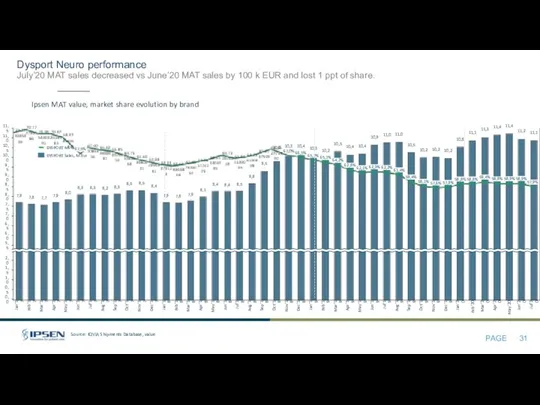

- 31. Dysport Neuro performance July’20 MAT sales decreased vs June’20 MAT sales by 100 k EUR and

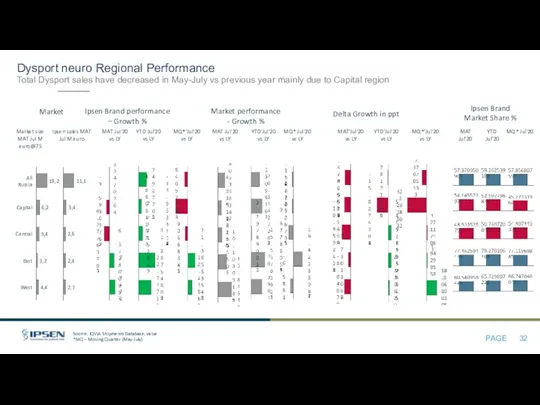

- 32. MQ*’Jul'20 vs LY Ipsen Brand performance – Growth % Market performance - Growth % Delta Growth

- 33. Dysport market performance Other players are growing much faster and gaining market share from Dysport. Botox

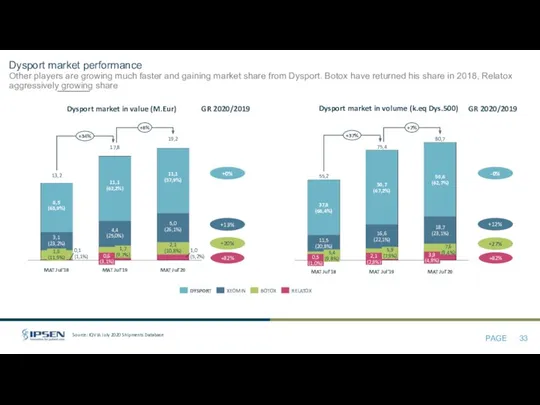

- 34. Source: IQVIA Shipments Database, value Dysport Rolling Half-Year Performance by employees Feb’20 – Jul'20 Please find

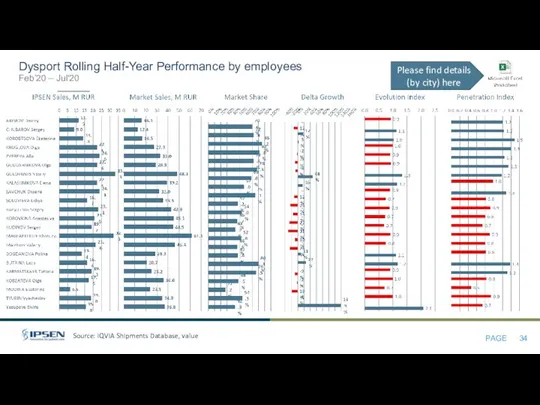

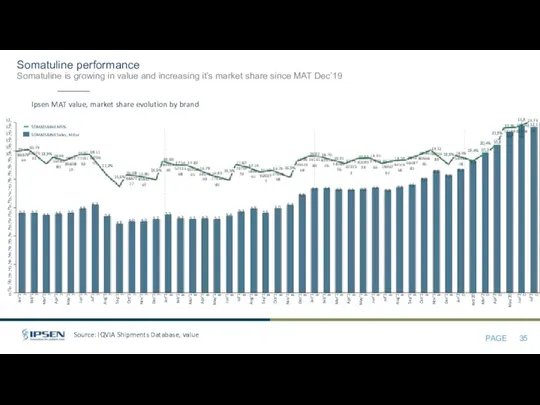

- 35. Somatuline performance Somatuline is growing in value and increasing it’s market share since MAT Dec’19 Source:

- 36. MQ*’Jul'20 vs LY Ipsen Brand performance – Growth % Market performance - Growth % Delta Growth

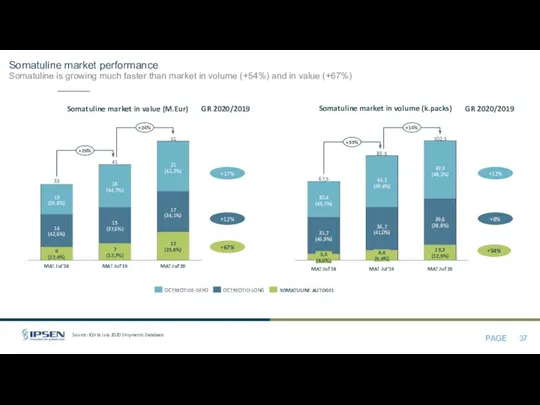

- 37. Somatuline market performance Somatuline is growing much faster than market in volume (+54%) and in value

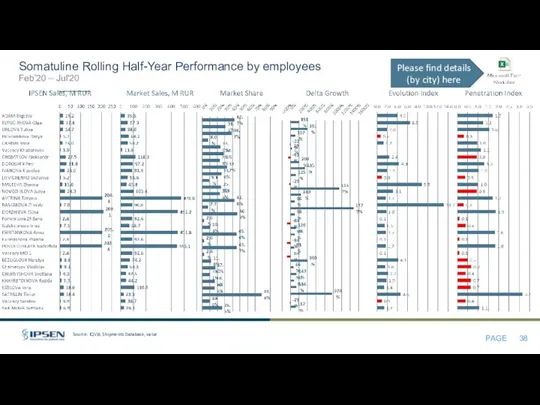

- 38. Source: IQVIA Shipments Database, value Somatuline Rolling Half-Year Performance by employees Feb’20 – Jul'20 Please find

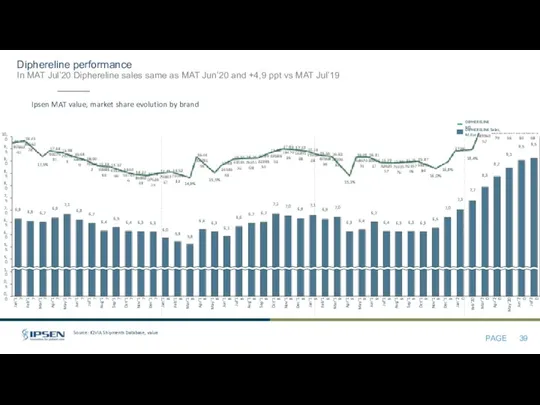

- 39. Diphereline performance In MAT Jul’20 Diphereline sales same as MAT Jun’20 and +4,9 ppt vs MAT

- 40. MQ*’Jul'20 vs LY Ipsen Brand performance – Growth % Market performance - Growth % Delta Growth

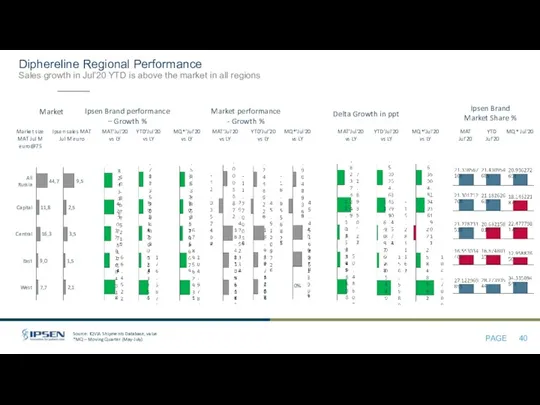

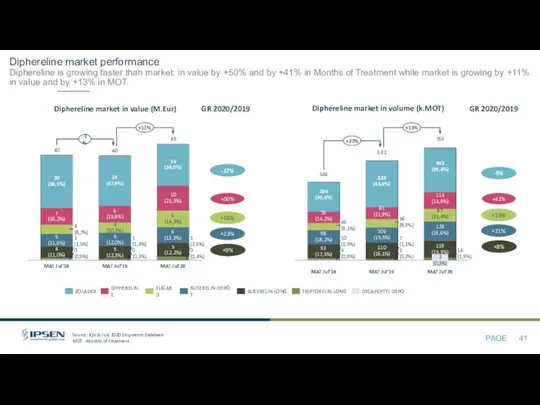

- 41. Diphereline market performance Diphereline is growing faster than market: in value by +50% and by +41%

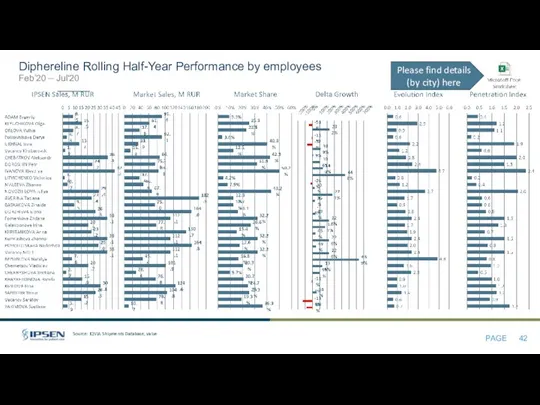

- 42. Source: IQVIA Shipments Database, value Diphereline Rolling Half-Year Performance by employees Feb’20 – Jul'20 Please find

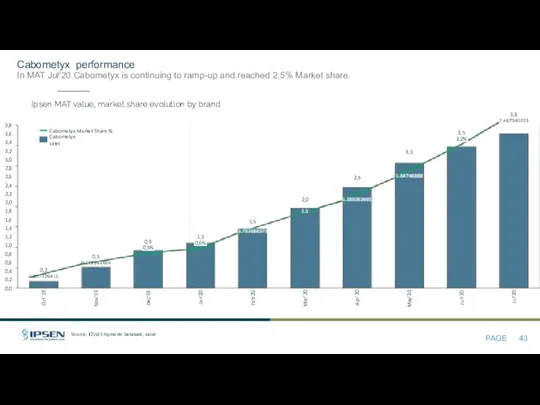

- 43. Cabometyx performance In MAT Jul’20 Cabometyx is continuing to ramp-up and reached 2,5% Market share. Ipsen

- 44. 19,6 (12,8%) 6,2 10,1 41,6 (32,2%) 30,4 (23,6%) 10,4 8,6 18,6 (14,4%) 5,8 3,7 3,7 0,0

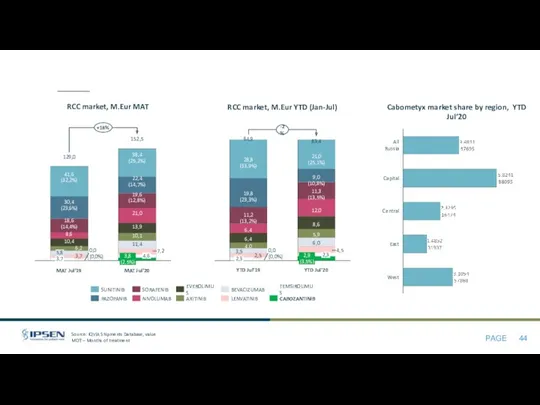

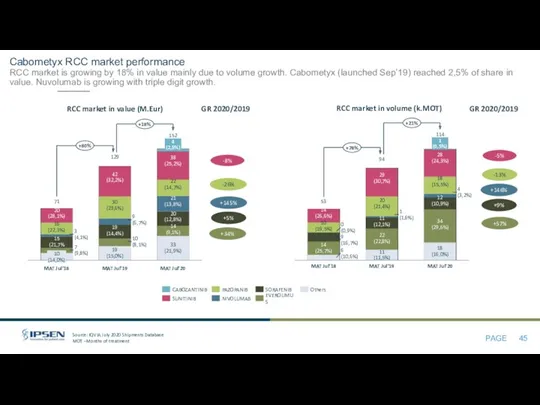

- 45. Cabometyx RCC market performance RCC market is growing by 18% in value mainly due to volume

- 46. Cabometyx TKIs 2nd line market performance The TKIs 2nd line market is growing by 20% in

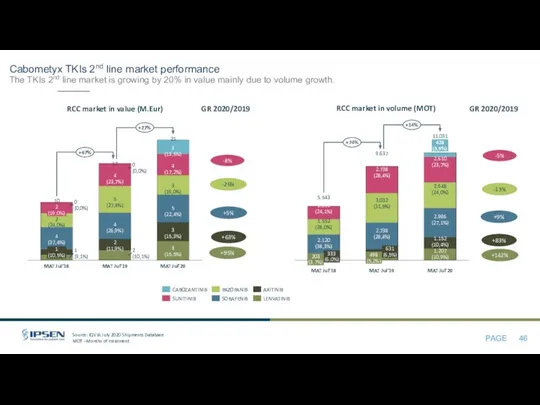

- 47. 24,5 1,0 25,0 23,0 19,5 24,0 20,5 0,5 20,0 0,0 1,5 3,0 3,5 23,5 21,5 4,0

- 48. 2,2 0,8 3,0 0,2 1,2 0,0 3,2 0,6 0,4 1,0 2,4 1,4 2,8 2,6 1,6 1,8

- 49. CIS Countries

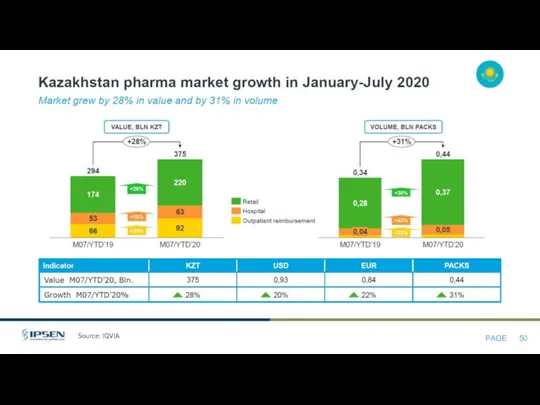

- 50. Source: IQVIA

- 51. Source: IQVIA

- 52. Source: IQVIA

- 53. Appendix

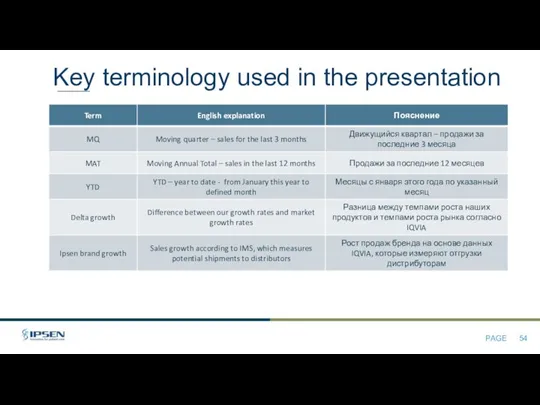

- 54. Key terminology used in the presentation

- 56. Скачать презентацию

Key highlights:

Overall market

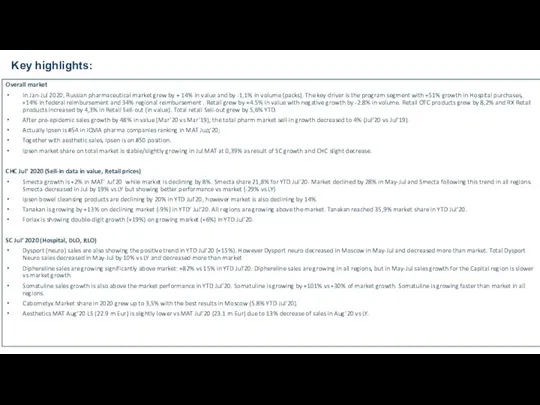

In Jan-Jul 2020, Russian pharmaceutical market grew by + 14% in

Key highlights:

Overall market

In Jan-Jul 2020, Russian pharmaceutical market grew by + 14% in

After pre-epidemic sales growth by 48% in value (Mar’20 vs Mar’19), the total pharm market sell-in growth decreased to 4% (Jul’20 vs Jul’19).

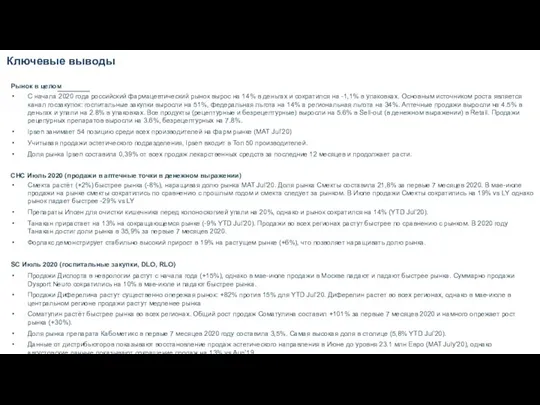

Actually Ipsen is #54 in IQVIA pharma companies ranking in MAT Juд’20;

Together with aesthetic sales, Ipsen is on #50 position.

Ipsen market share on total market is stable/slightly growing in Jul MAT at 0,39% as result of SC growth and CHC slight decrease.

CHC Jul’ 2020 (Sell-in data in value, Retail prices)

Smecta growth is +2% in MAT’ Jul’20 while market is declining by 8%. Smecta share 21,8% for YTD Jul'20. Market declined by 28% in May-Jul and Smecta following this trend in all regions. Smecta decreased in Jul by 19% vs LY but showing better performance vs market (-29% vs LY)

Ipsen bowel cleansing products are declining by 20% in YTD Jul’20, however market is also declining by 14%.

Tanakan is growing by +13% on declining market (-9%) in YTD’ Jul’20. All regions are growing above the market. Tanakan reached 35,9% market share in YTD Jul’20.

Forlax is showing double-digit growth (+19%) on growing market (+6%) in YTD Jul’20.

SC Jul’ 2020 (Hospital, DLO, RLO)

Dysport (neuro) sales are also showing the positive trend in YTD Jul’20 (+15%). However Dysport neuro decreased in Moscow in May-Jul and decreased more than market. Total Dysport Neuro sales decreased in May-Jul by 10% vs LY and decreased more than market

Diphereline sales are growing significantly above market: +82% vs 15% in YTD Jul’20. Diphereline sales are growing in all regions, but in May-Jul sales growth for the Capital region is slower vs market growth

Somatuline sales growth is also above the market performance in YTD Jul’20. Somatuline is growing by +101% vs +30% of market growth. Somatuline is growing faster than market in all regions.

Cabometyx Market share in 2020 grew up to 3,5% with the best results in Moscow (5.8% YTD Jul’20).

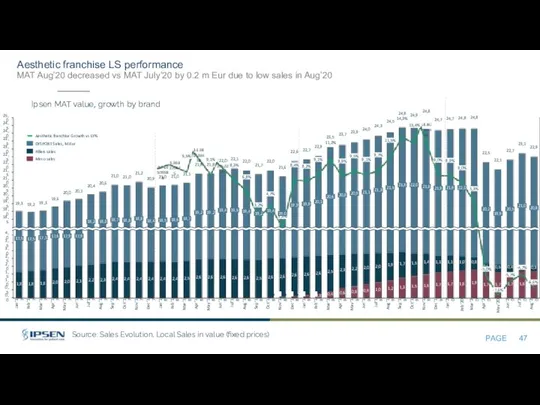

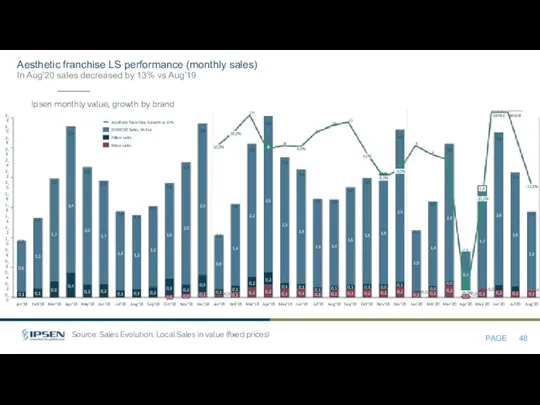

Aesthetics MAT Aug’20 LS (22.9 m Eur) is slightly lower vs MAT Jul’20 (23.1 m Eur) due to 13% decrease of sales in Aug’20 vs LY.

Ключевые выводы

Рынок в целом

С начала 2020 года российский фармацевтический рынок вырос на 14%

Ключевые выводы

Рынок в целом

С начала 2020 года российский фармацевтический рынок вырос на 14%

Ipsen занимает 54 позицию среди всех производителей на фарм рынке (МAT Jul’20)

Учитывая продажи эстетического подразделения, Ipsen входит в Топ 50 производителей.

Доля рынка Ipsen составила 0,39% от всех продаж лекарственных средств за последние 12 месяцев и продолжает расти.

CHC Июль 2020 (продажи в аптечные точки в денежном выражении)

Смекта растёт (+2%) быстрее рынка (-8%), наращивая долю рынка MAT Jul’20. Доля рынка Смекты составила 21,8% за первые 7 месяцев 2020. В мае-июле продажи на рынке смекты сократились по сравнению с прошлым годом и смекта следует за рынком. В Июле продажи Смекты сократились на 19% vs LY однако рынок падает быстрее -29% vs LY

Препараты Ипсен для очистки кишечника перед колоноскопией упали на 20%, однако и рынок сократился на 14% (YTD Jul’20).

Танакан прирастает на 13% на сокращающемся рынке (-9% YTD Jul’20). Продажи во всех регионах растут быстрее по сравнению с рынком. В 2020 году Танакан достиг доли рынка в 35,9% за первые 7 месяцев 2020.

Форлакс демонстрирует стабильно высокий прирост в 19% на растущем рынке (+6%), что позволяет наращивать долю рынка.

SC Июль 2020 (госпитальные закупки, DLO, RLO)

Продажи Диспорта в неврологии растут с начала года (+15%), однако в мае-июле продажи в Москве падают и падают быстрее рынка. Суммарно продажи Dysport Neuro сократились на 10% в мае-июле и падают быстрее рынка.

Продажи Диферелина растут существенно опережая рынок: +82% против 15% для YTD Jul’20. Диферелин растет во всех регионах, однако в мае-июле в центральном регионе продажи растут медленее рынка

Соматулин растёт быстрее рынка во всех регионах. Общий рост продаж Соматулина составил +101% за первые 7 месяцев 2020 и намного опрежает рост рынка (+30%).

Доля рынка препарата Кабометикс в первые 7 месяцев 2020 году составила 3,5%. Самая высокая доля в столице (5,8% YTD Jul’20).

Данные от дистрибьюторов показывают восстановление продаж эстетического направления в Июне до уровня 23.1 млн Евро (MAT July’20), однако августовские данные показывают сокращение продаж на 13% vs Aug’19

Source: IQVIA highlights report July’20

Source: IQVIA highlights report July’20

Source: IQVIA highlights report Jul’20

Source: IQVIA highlights report Jul’20

Ipsen place on the market

In MAT Jul’20 Ipsen overperformed Rompharm, Geropharm and gained

Ipsen place on the market In MAT Jul’20 Ipsen overperformed Rompharm, Geropharm and gained

2017

Russian pharma market by corporations, % of total market value

53

54

55

56

57

58

59

60

61

62

SOPHARMA*

FARMASOFT

CANONPHARMA

ATOLL OOO RF

NIARMEDIK PLUS

GROTEX RF

INFAMED RF

BOSNALIJEK

OZON OOO

IPSEN

2018

2019

53

54

55

56

57

FARMASOFT

OBNOVLENIE

UNIDENTIFIED

IPSEN

NIARMEDIK PLUS

INFAMED RF

UNIPHARM U.S.A

SOPHARMA*

GEROPHARM

ROMPHARM

58

59

60

61

62

53

54

55

56

57

58

59

60

61

62

FARMASOFT

SUN PHARMA

SEVERNAYA ZVEZDA

ROMPHARM

GEROPHARM

INFAMED RF

IPSEN

ALEXION PHARMA

NIARMEDIK PLUS

OZON OOO

Source: IQVIA Retail, Hospital, DLO, RLO in value - Jul 2020 w/o Aesthetics and Circadin sales in Retail prices

MAT Jul’20

SUN PHARMA

SOPHARMA

GEROPHARM

IPSEN

FARMASOFT

ROMPHARM

POLYSAN

OZON OOO

GLENMARK

PRO.MED.PRAHA

53

54

55

56

57

58

59

60

61

62

Ipsen place on the market – with aesthetic

With aesthetic business Ipsen is being

Ipsen place on the market – with aesthetic With aesthetic business Ipsen is being

2017

Russian pharma market by corporations, % of total market value

OBOLENSK FP

ELI LILLY

MICROGEN

BMS

IPSEN

ALEXION

MARATHON

VERTEX ZAO RF

BIONORICA

RECORDATI*

2018

2019

GENERIUM

BIONORICA

MATERIA MEDICA

RECORDATI*

MARATHON

BMS

GROTEX RF

OBOLENSK FP

ATOLL OOO RF

IPSEN

RECORDATI*

AMGEN

CANONPHARMA

BIONORICA

EVALAR

ATOLL OOO RF

SYNTEZ

ELI LILLY

MATERIA MEDICA

IPSEN

Source: IQVIA Retail, Hospital, DLO, RLO in value – with aesthetic LS in value and without Circadin sales in Retail prices

41

42

43

44

45

46

47

48

49

50

41

42

43

44

45

46

47

48

49

50

41

42

43

44

45

46

47

48

49

50

MAT Jul’20

EVALAR

SYNTEZ

BIONORICA

ELI LILLY

CANONPHARMA PRODUC

MATERIA MEDICA

OBNOVLENIE/RENEWAL

AMGEN

RECORDATI

IPSEN

41

42

43

44

45

46

47

48

49

50

Ipsen MS evolution

Jul 20 MAT Dynamic shows the improvement of SC market share.

Ipsen MS evolution Jul 20 MAT Dynamic shows the improvement of SC market share.

Jan’18

Sep’18

Mar’18

Jul’18

May’18

Nov’19

Nov’18

May’19

Jan’19

Mar’19

Jul’19

Sep’19

May’20

Jan’20

Mar’20

Jul’20

MAT Ipsen RU pharma market share, %

Source: IQVIA Retail, Hospital, DLO, RLO in retail value – Jul 2020 w/o Aesthetics and Circadin sales

CHC and SC BUs market share on the total pharma market

SC tender

CHC

Ipsen

Ipsen vs Russian market growth

In Jul Ipsen is growing same as market with

Ipsen vs Russian market growth In Jul Ipsen is growing same as market with

Apr’18

13%

18%

9%

Jan’18

Jun’20

13%

-1%

Jan’20

7%

Feb’18

2%

11%

Mar’18

Dec’19

May’18

Jun’18

17%

12%

Jul’18

22%

Aug’18

Sep’18

8%

Oct’18

14%

Apr’19

Nov’18

7%

48%

Dec’18

-2%

Feb’19

Mar’19

May’19

Jun’19

5%

17%

Jul’19

Oct’19

Jan’19

Sep’19

4%

Nov’19

Apr’20

6%

Aug’19

Feb’20

Jul’20

12%

Mar’20

May’20

33%

IPSEN

Delta

TOTAL PHARM MARKET

Total Growth, %

May’18

Nov’18

Mar’18

Feb’18

Jan’18

Sep’19

Aug’19

9%

8%

Apr’18

Jun’18

Jan’19

Jul’18

-12%

8%

0%

Aug’18

Sep’18

Oct’18

Dec’18

Feb’19

Mar’19

Apr’19

May’19

Jul’19

Jun’19

Oct’19

23%

Feb’20

Nov’19

Dec’19

Jan’20

Mar’20

-21%

Apr’20

May’20

-3%

Jun’20

Jul’20

May’18

Feb’18

Jan’18

Mar’18

0%

-23%

Apr’18

-14%

Jun’18

1%

Jul’18

Aug’18

May’20

Jan’19

Sep’18

Oct’18

2%

Sep’19

Apr’19

Nov’18

Dec’18

Aug’19

7%

Nov’19

-3%

Feb’19

13%

Mar’19

Jul’20

-8%

25%

8%

May’19

19%

Oct’19

Jun’19

-11%

Jul’19

10%

Dec’19

-13%

12%

10%

0%

24%

Jan’20

-7%

Feb’20

Mar’20

14%

Apr’20

Jun’20

21%

Volume effect, %

Price effect, %

Source: IQVIA Retail, Hospital, DLO, RLO in value – Jul 2020 w/o Aesthetics and Circadin sales in Retail prices

Consumer Healthcare vs Russian market growth

In Jul’20 CHC is below the market in

Consumer Healthcare vs Russian market growth In Jul’20 CHC is below the market in

Jan’19

Mar’18

-13%

Jul’19

Feb’18

-22%

Jan’18

11%

13%

Nov’19

-8%

May’18

Jun’18

4%

Feb’20

Sep’19

Jul’18

17%

Aug’18

Sep’18

-2%

Oct’18

Mar’20

16%

Nov’18

Dec’18

-3%

Jul’20

5%

Feb’19

Mar’19

Oct’19

-5%

11%

Apr’19

Apr’20

May’19

Jun’19

-21%

15%

Apr’18

11%

16%

Dec’19

Jan’20

10%

Aug’19

37%

-33%

May’20

Jun’20

-14%

13%

CHC

Delta

TOTAL PHARM MARKET

Total Growth, %

Feb’20

Mar’18

Aug’19

May’18

Jan’18

Feb’18

Jun’18

9%

8%

Apr’18

Jul’18

8%

Aug’18

Jan’19

Sep’18

May’20

Oct’18

Nov’18

Dec’18

Jan’20

Feb’19

Jun’19

0%

Mar’19

-2%

Apr’19

May’19

Jul’19

Sep’19

Oct’19

Mar’20

Nov’19

Dec’19

1%

23%

2%

Apr’20

-12%

Jun’20

-15%

-16%

Jul’20

-12%

Aug’19

7%

Sep’18

Nov’19

Mar’18

-3%

2%

-10%

Feb’18

11%

Apr’18

-12%

May’20

May’18

Jun’18

Dec’18

-2%

-12%

Jul’18

8%

Aug’18

Sep’19

Oct’18

Nov’18

-2%

-14%

May’19

-5%

Jan’19

Jul’20

6%

Feb’19

8%

-14%

Mar’19

Jan’18

Apr’19

Jun’19

Jul’19

4%

6%

Oct’19

Dec’19

Jun’20

14%

Jan’20

Feb’20

Mar’20

0%

Apr’20

6%

7%

Volume effect, %

Price effect, %

Source: IQVIA Retail, Hospital, DLO, RLO in value – Jul 2020 w/o Aesthetics and Circadin sales in Retail prices

Specialty Care vs Russian market growth

In Jul’20 SC is higher than market performance.

Aug’18

19%

Mar’20

Dec’18

18%

Mar’18

-18%

Oct’18

Jan’18

May’18

Feb’18

Apr’18

Jul’20

Jun’18

-18%

Jul’18

22%

Jan’19

Sep’18

Jun’19

Nov’18

Feb’19

13%

Mar’19

Apr’19

May’19

Feb’20

20%

Jan’20

Jul’19

Aug’19

Sep’19

Oct’19

Nov’19

-1%

Dec’19

48%

Apr’20

May’20

Jun’20

SC

TOTAL

Specialty Care vs Russian market growth

In Jul’20 SC is higher than market performance.

Aug’18

19%

Mar’20

Dec’18

18%

Mar’18

-18%

Oct’18

Jan’18

May’18

Feb’18

Apr’18

Jul’20

Jun’18

-18%

Jul’18

22%

Jan’19

Sep’18

Jun’19

Nov’18

Feb’19

13%

Mar’19

Apr’19

May’19

Feb’20

20%

Jan’20

Jul’19

Aug’19

Sep’19

Oct’19

Nov’19

-1%

Dec’19

48%

Apr’20

May’20

Jun’20

SC

TOTAL

Delta

Total Growth, %

Jan’18

Oct’18

Feb’18

23%

May’18

Aug’19

Apr’18

Mar’19

Mar’18

10%

6%

-6%

Jul’18

Jan’19

Sep’18

Aug’18

Nov’18

Jun’18

Feb’19

Jun’20

Apr’19

May’19

Jun’19

Jul’19

Sep’19

Oct’19

Apr’20

Nov’19

Dec’19

Jan’20

Feb’20

Mar’20

May’20

Jul’20

Dec’18

Jan’19

Jun’18

Apr’18

12%

Jan’18

May’19

Feb’18

7%

7%

Mar’18

25%

-1%

Jul’18

2%

May’18

0%

Aug’18

Sep’18

Jul’19

Oct’18

Nov’18

Dec’18

Nov’19

-7%

-5%

May’20

Feb’20

-33%

Mar’19

Apr’19

Jun’19

14%

-24%

Aug’19

Feb’19

16%

Oct’19

17%

Dec’19

10%

Sep’19

Jan’20

21%

Mar’20

Apr’20

Jun’20

Jul’20

Volume effect, %

Price effect, %

Source: IQVIA Retail, Hospital, DLO, RLO in value – Jul 2020 w/o Aesthetics and Circadin sales in Retail prices

Distribution Index dynamic

Purchase index have recovered after drop in April. Distribution of Eziclen

Distribution Index dynamic Purchase index have recovered after drop in April. Distribution of Eziclen

21%

Jun’17

44%

Feb’20

Mar’17

Jun’19

Apr’18

Aug’17

27%

Jul’18

Jan’17

30%

Apr’17

Feb’17

14%

May’17

Jul’17

Mar’20

Sep’17

Oct’18

Sep’18

Oct’17

Nov’17

16%

May’18

Dec’17

Jan’18

40%

Feb’19

Feb’18

May’20

43%

Mar’18

Jul’19

Jun’18

Aug’18

33%

0%

Jun’20

Nov’18

Dec’18

Jan’19

Mar’19

Apr’19

May’19

41%

Nov’19

44%

Aug’19

Sep’19

Oct’19

39%

Dec’19

Jan’20

70%

Apr’20

Label

45%

Source: IQVIA Sell-in Retail Jul 2020; Purchase Index.

FORLAX 20 4G

SMECTA POWDER 10

TANAKAN 30

TANAKAN 90

FORTRANS

FORLAX 20 10G

EZICLEN

SMECTA RTU8

SMECTA RTU12

Ipsen Brand

Market Share %

YTD’

Jul

MQ’

Jul

MQ*’Jul

vs LY

CHC Performance July’20 Sell In.

Diarrhea segment

Ipsen Brand

Market Share %

YTD’

Jul

MQ’

Jul

MQ*’Jul

vs LY

CHC Performance July’20 Sell In. Diarrhea segment

Ipsen Brand performance

– Growth %

Market performance

- Growth %

Delta Growth in ppt

MAT’ Jul

vs LY

YTD’ Jul

vs LY

MQ*Jul

vs LY

MAT’ Jul

vs LY

YTD’ Jul

vs LY

MQ*’Jul

vs LY

MAT’ Jul

vs LY

YTD’ Jul

vs LY

Smecta

Fortrans

Eziclen

Tanakan

Forlax

MAT’

Jul

Source: IQVIA Sell-in Retail July 2020 in value, Retail prices

*MQ – Moving Quarter (May-July)

Market size MAT Jul M euro@75

Ipsen sales MAT Jul

M euro@75

15

8

20

4

101

17

44

168

Jul

vs LY

Jul

vs LY

Jul

vs LY

Jul

Smecta retail performance

Smecta gained +2.1 pts MS in MAT’Jul 20 vs LY but

Smecta retail performance Smecta gained +2.1 pts MS in MAT’Jul 20 vs LY but

Source: IQVIA Sell-in Retail market in Retail prices

Ipsen MAT value, market share evolution by brand

17

18

19

20

3

21

2

22

4

6

12

15

13

14

16

5

11

0

1

17,1%

17,8%

Mar’18

17,2%

Oct’19

May’19

Jan’20

19,9

17,1%

20,8

17,9

21,3

17,0%

18,5%

Apr’20

18,6%

Jun’20

17,4

Jan’18

17,2%

Feb’18

17,1%

Apr’18

19,6%

Sep’19

May’18

17,7

Jun’19

Feb’19

Jul’19

18,3%

Aug’19

17,0%

18,5%

18,5%

17,0%

Nov’19

Dec’18

Dec’19

18,7%

18,9%

Jan’19

19,2%

Mar’20

19,5%

17,3

16,8%

May’20

Nov’18

16,6

16,7

16,7

17,0

16,7%

18,1

Oct’18

18,2

16,8%

18,3

Feb’20

18,6

Sep’18

18,6

Apr’19

18,6

18,7

16,8%

18,9

Aug’18

19,1

20,1

19,7

20,2

16,9%

19,7

20,5

Jul’18

20,6

21,4

20,9

17,1%

20,5

16,6

Jul’20

20,1

17,1%

Jun’18

17,4%

17,6%

17,2%

19,6%

Mar’19

Smecta MS%

Smecta value, M.Eur

Smecta regional performance.

In last 3 month sales of Smecta have decreased by 18%-30%

Smecta regional performance. In last 3 month sales of Smecta have decreased by 18%-30%

Smecta performance

– Growth %

Diarrhea Market performance

- Growth %

Delta Growth in ppt

Smecta

Market Share %

MAT’Jul

vs LY

YTD’Jul

vs LY

MQ*’Jul

vs LY

MAT’Jul

vs LY

YTD’Jul

vs LY

MQ*’Jul

vs LY

MAT’Jul

vs LY

YTD’Jul

vs LY

MQ*’Jul

vs LY

19,9%

21,8%

20,8%

Total Russia:

MAT’

Jul

YTD’

Jul

MQ*’

Jul

Moscow

North-West

Siberia & Far East

Non-Covered

South & South Volga

Ipsen sales MAT Jul M euro@75

Market size MAT Jul M euro@75

4,4

4,6

4,9

8,0

28,7

50,7

0,9

5,0

1,6

1,0

10,7

0,9

Source: IQVIA Retail Jul 2020 in value in Retail prices

*MQ – Moving Quarter (May-July)

Ural

Source: IQVIA Shipments Database, value

Smecta RQ Performance by employees (Medical line)

May'20-Jul'20

Please find details

Source: IQVIA Shipments Database, value

Smecta RQ Performance by employees (Medical line)

May'20-Jul'20

Please find details

Source: IQVIA Shipments Database, value

Smecta RQ Performance by employees (Pharm & Mix lines)

May'20-Jul'20

Mix

Source: IQVIA Shipments Database, value

Smecta RQ Performance by employees (Pharm & Mix lines)

May'20-Jul'20

Mix

Pharm line:

Please find details (by city) here

Fortrans and Eziclen performance

Fortrans Market has declining trend for value share with

Fortrans and Eziclen performance Fortrans Market has declining trend for value share with

Source: IQVIA Sell-in Retail market in Retail prices

Ipsen MAT value, market share evolution by brand

6,5

9,5

10,0

11,0

0,5

10,5

3,0

1,0

1,5

2,0

2,5

11,5

7,5

8,5

8,0

9,0

7,0

0,0

8,0

51,0%

9,3

9,1

0,0

0,6

0,2

Sep’18

9,1

9,2

9,2

May’19

Jul’18

0,0

9,2

53,7%

58,6%

Jan’19

Jan’18

Feb’18

Mar’18

Apr’18

May’18

Jun’18

Aug’18

Oct’18

Nov’18

Dec’18

9,2

9,2

Feb’19

9,3

0,0

Mar’19

58,2%

9,4

0,1

Apr’19

57,5%

9,3

9,6

9,6

8,9

Jul’20

8,5

0,7

51,1%

7,7

9,1

Nov’19

53,2%

9,2

Oct’19

0,4

Dec’19

52,8%

9,4

0,5

9,4

9,2

Jan’20

52,0%

9,1

0,5

54,3%

Feb’20

51,9%

0,2

9,2

9,2

51,7%

Mar’20

8,6

9,1

0,6

54,8%

Apr’20

Aug’19

8,3

9,8

55,5%

0,7

May’20

Jul’19

51,5%

0,7

0,4

8,7

Jun’20

9,2

9,0

0,2

8,9

9,3

9,0

9,0

9,2

9,3

9,3

56,4%

9,2

9,3

Jun’19

9,4

9,4

9,4

Sep’19

9,4

0,1

9,5

0,3

9,3

9,2

9,5

9,6

56,8%

0,1

IPSEN MS%

FORTRANS

EZICLEN

Fortrans and Eziclen regional performance.

Delta growth in 2020 is negative for all CHC

Fortrans and Eziclen regional performance. Delta growth in 2020 is negative for all CHC

Fortrans/Eziclen performance

– Growth %

Bowel Cleansing Market performance

- Growth %

Delta Growth in ppt

Ipsen Brand

Market Share %

MAT’Jul

vs LY

YTD’Jul

vs LY

MQ*’Jul

vs LY

YTD’Jul

vs LY

MQ*’Jul

vs LY

YTD’Jul

vs LY

MQ*’Jul

vs LY

51,1%

51,2%

50,3%

Total Russia:

Ipsen sales MAT Jul M euro@75

Market size MAT Jul M euro@75

Source: IQVIA Retail sell-in Jul 2020 in value in Retail prices

*MQ – Moving Quarter (May-July)

0%

MAT’Jul

vs LY

MAT’Jul

vs LY

MAT’Jul

Moscow

North-West

Siberia & Far East

Non-Covered

South & South Volga

1,0

4,1

8,6

1,2

0,8

0,9

5,1

0,5

0,5

1,5

0,5

0,4

Ural

YTD’Jul

MQ’Jul

Source: IQVIA Shipments Database, value

Fortrans and Eziclen RQ Performance by employees (Medical line)

May'20-Jul'20

Please

Source: IQVIA Shipments Database, value

Fortrans and Eziclen RQ Performance by employees (Medical line)

May'20-Jul'20

Please

Source: IQVIA Shipments Database, value

Fortrans and Eziclen YTD Performance by employees (Pharm &

Source: IQVIA Shipments Database, value

Fortrans and Eziclen YTD Performance by employees (Pharm &

Mix line:

Pharm line:

Please find details (by city) here

Tanakan performance

There is +0.5 ppt of market share gain for Tanakan in MAT

Tanakan performance There is +0.5 ppt of market share gain for Tanakan in MAT

Source: IQVIA Sell-in Retail market in Retail prices

Ipsen MAT value, market share evolution by brand

11,5

12,0

15,0

14,0

13,0

13,5

12,5

14,5

0,0

11,0

0,5

1,0

1,5

10,5

Feb’20

12,7

Dec’19

13,5

Jul’18

12,9

12,4

Jun’18

Jan’19

Aug’19

Nov’18

May’18

14,1

Jan’18

Oct’19

13,2

Sep’19

13,2

Jul’19

13,3

13,5

Jun’19

13,6

May’19

13,8

Apr’19

13,7

13,9

May’20

Mar’19

13,7

13,6

13,7

14,3

14,9

14,7

13,7

14,6

14,7

Apr’20

Jul’20

14,8

Feb’19

32,2%

Mar’20

Jun’20

12,4

Dec’18

Jan’20

12,4

Oct’18

12,4

Nov’19

12,5

Sep’18

12,7

12,9

Aug’18

13,0

Apr’18

13,1

Mar’18

Feb’18

IPSEN MS%

TANAKAN

Tanakan Regional Performance

We have biggest MS of Tanakan in Moscow and Siberia &

Tanakan Regional Performance We have biggest MS of Tanakan in Moscow and Siberia &

Source: IQVIA Retail Sell-in Jul 2020 in value in Retail prices

*MQ – Moving Quarter (May-July)

Tanakan performance

– Growth %

Tanakan Market performance

- Growth %

Delta Growth in ppt

Tanakan

Market Share %

MAT’Jul

vs LY

YTD’Jul

vs LY

MQ*’Jul

vs LY

YTD’Jul

vs LY

MQ*’Jul

vs LY

YTD’Jul

vs LY

MQ*’Jul

vs LY

Ipsen sales MAT Jul M euro@75

Market size MAT Jul M euro@75

MAT’Jul

vs LY

MAT’Jul

vs LY

MAT’Jul

Moscow

North-West

Siberia & Far East

Non-Covered

South & South Volga

11,8

3,1

2,2

2,6

2,4

22,1

5,4

5,7

1,1

0,7

0,8

1,0

Ural

YTD’Jul

33,4%

35,9%

35,3%

Total Russia:

MQ’Jul

Source: IQVIA Shipments Database, value

Tanakan RQ Performance by employees (Medical line)

May'20-Jul'20

Please find details

Source: IQVIA Shipments Database, value

Tanakan RQ Performance by employees (Medical line)

May'20-Jul'20

Please find details

Source: IQVIA Shipments Database, value

Tanakan RQ Performance by employees (Pharm & Mix lines)

May'20-Jul'20

Mix

Source: IQVIA Shipments Database, value

Tanakan RQ Performance by employees (Pharm & Mix lines)

May'20-Jul'20

Mix

Pharm line:

Please find details (by city) here

Forlax Retail performance

Forlax is showing double-digit growth on slightly growing market thanks to

Forlax Retail performance Forlax is showing double-digit growth on slightly growing market thanks to

Source: Smecta, Tanakan, Forlax - IQVIA Sell-in Retail market in Retail prices

Fortrans, Eziclen – IQVIA Sell-in Retail and Hospital market in Retail prices

Ipsen MAT value, market share evolution by brand

0,8

3,8

2,8

0,4

0,0

1,4

0,2

0,6

3,0

1,2

1,0

2,2

3,2

1,6

1,8

3,4

2,0

2,4

3,6

2,6

2,2

3,0

Nov’18

Jun’19

Sep’18

Feb’19

Apr’19

Dec’18

2,7

Jan’18

Apr’18

Feb’18

2,3

3,1

May’18

Mar’18

2,4

2,2

Jun’18

2,7

Jul’18

Aug’18

May’19

Oct’18

Feb’20

Jan’19

Dec’19

Mar’19

Jul’19

Nov’19

Aug’19

Sep’19

Oct’19

2,4

Jan’20

Mar’20

2,8

Apr’20

May’20

Jun’20

2,1

2,3

2,5

2,6

2,7

2,9

2,9

3,0

Jul’20

3,0

3,1

2,6

3,2

3,3

3,3

3,4

3,5

3,5

3,5

3,6

3,7

3,2

FORLAX MS%

FORLAX Sales, M.Eur

Forlax Regional Performance

Forlax is growing much faster than market and showing the double-digit

Forlax Regional Performance Forlax is growing much faster than market and showing the double-digit

Source: IQVIA Retail, value in Retail prices

*MQ – Moving Quarter (May-July)

Forlax performance

– Growth %

Forlax Market performance

- Growth %

Delta Growth in ppt

Forlax

Market Share %

MAT’Jul

vs LY

YTD’Jul

vs LY

MQ*’Jul

vs LY

YTD’Jul

vs LY

MQ*’Jul

vs LY

YTD’Jul

vs LY

MQ*’Jul

vs LY

Ipsen sales MAT Jul M euro@75

Market size MAT Jul M euro@75

0%

MAT’Jul

vs LY

MAT’Jul

vs LY

MAT’Jul

Moscow

North-West

Siberia & Far East

Non-Covered

South & South Volga

9,1

43,9

87,5

7,6

11,8

8,1

0,2

0,9

0,3

0,3

0,2

1,8

Ural

YTD’Jul

2,2%

2,3%

2,3%

Total Russia:

MQ Jul

Source: IQVIA Shipments Database, value

Forlax RQ Performance by employees (Medical line)

May'20-Jul'20

Please find details

Source: IQVIA Shipments Database, value

Forlax RQ Performance by employees (Medical line)

May'20-Jul'20

Please find details

Source: IQVIA Shipments Database, value

Forlax Rolling RQ by employees (Pharm & Mix lines)

May'20-Jul'20

Mix

Source: IQVIA Shipments Database, value

Forlax Rolling RQ by employees (Pharm & Mix lines)

May'20-Jul'20

Mix

Pharm line:

Please find details (by city) here

SC Performance Jul’20

All brands are demonstrating growth above the market in YTD vs

SC Performance Jul’20 All brands are demonstrating growth above the market in YTD vs

0%

Source: IQVIA Shipments Database, value

*MQ – Moving Quarter (May-July)

MAT Jul'20

vs LY

YTD Jul'20

vs LY

MQ*’Jul'20

vs LY

MAT Jul’20

vs LY

YTD Jul'20

vs LY

MQ* Jul'20

vs LY

MAT Jul'20

vs LY

YTD Jul'20

vs LY

MQ* Jul'20

vs LY

Ipsen Brand performance

– Growth %

Market performance

- Growth %

Delta Growth in ppt

Ipsen Brand

Market Share %

Market size MAT Jul M euro@75

Ipsen sales MAT Jul M euro

Market

Dysport

neuro

50,9

Cabometyx

Somatuline

Diphereline

19,2

44,7

152,5

3,8

11,1

12,1

9,5

MAT’

Jul'20

YTD’

Jul'20

MQ*

Jul'20

Dysport Neuro performance

July’20 MAT sales decreased vs June’20 MAT sales by 100 k

Dysport Neuro performance July’20 MAT sales decreased vs June’20 MAT sales by 100 k

Ipsen MAT value, market share evolution by brand

0,5

7,5

2,0

1,5

10,0

9,0

9,5

5,5

8,0

6,0

6,5

11,0

1,0

0,0

10,5

7,0

8,5

11,5

8,3

Oct’17

Apr’19

8,3

67,0%

58,9%

62,8%

Jul’18

Nov’17

May’17

May’20

7,8

Feb’17

Jan’17

10,9

Nov’18

Mar’17

Apr’17

7,9

67,5%

Jun’17

10,2

Aug’18

Jul’17

Aug’17

Feb’18

Sep’17

Dec’17

Jan’18

Mar’18

May’18

Jun’18

7,9

Sep’18

Oct’18

Dec’18

65,7%

Jan’19

65,1%

Feb’19

64,2%

Mar’19

62,1%

May’19

62,3%

Jun’19

62,2%

Jul’19

61,4%

Aug’19

59,4%

Sep’19

58,1%

Oct’19

57,6%

Nov’19

57,8%

Dec’19

58,8%

Jan’20

58,8%

Feb’20

59,4%

Mar’20

58,8%

Apr’20

58,9%

10,4

Jun’20

7,9

7,8

7,7

8,0

8,3

8,2

8,5

8,5

8,4

7,9

8,1

8,4

8,4

8,5

8,8

9,5

10,0

10,3

10,3

10,2

10,5

10,4

10,4

11,0

11,0

10,5

10,2

10,2

10,8

11,1

11,3

11,4

11,4

11,2

Jul’20

11,1

66,5%

Apr’18

57,9%

DYSPORT MS%

DYSPORT Sales, M.Eur

Source: IQVIA Shipments Database, value

MQ*’Jul'20

vs LY

Ipsen Brand performance

– Growth %

Market performance

- Growth %

Delta Growth

MQ*’Jul'20

vs LY

Ipsen Brand performance

– Growth %

Market performance

- Growth %

Delta Growth

Ipsen Brand

Market Share %

Source: IQVIA Shipments Database, value

*MQ – Moving Quarter (May-July)

Dysport neuro Regional Performance

Total Dysport sales have decreased in May-July vs previous year mainly due to Capital region

MAT Jul'20

vs LY

YTD Jul'20

vs LY

MQ*’Jul'20

vs LY

MAT Jul'20

vs LY

YTD’Jul'20

vs LY

MQ* Jul'20

vs LY

MAT’Jul'20

vs LY

YTD’Jul'20

vs LY

East

Central

All Russia

6,2

Capital

5,4

West

19,2

3,2

4,4

Market size MAT Jul M euro@75

Ipsen sales MAT Jul M euro

11,1

3,4

2,7

2,4

2,6

Market

MAT

Jul’20

YTD

Jul’20

MQ* Jul'20

Dysport market performance

Other players are growing much faster and gaining market share from

Dysport market performance Other players are growing much faster and gaining market share from

Dysport market in value (M.Eur)

4,4

(25,0%)

17,8

0,1

(1,1%)

3,1

(23,2%)

19,2

8,5

(63,9%)

1,6

(11,9%)

2,1

(10,8%)

11,1

(62,2%)

MAT Jul’18

1,7

(9,7%)

0,6

(3,1%)

MAT Jul’19

11,1

(57,9%)

5,0

(26,1%)

1,0

(5,2%)

MAT Jul’20

13,2

+34%

+8%

Dysport market in volume (k.eq Dys.500)

GR 2020/2019

DYSPORT

BOTOX

RELATOX

XEOMIN

GR 2020/2019

+13%

+0%

+20%

5,9

(7,9%)

MAT Jul’18

11,5

(20,8%)

0,5

(1,0%)

37,8

(68,4%)

5,4

(9,8%)

16,6

(22,1%)

50,7

(67,2%)

2,1

(2,8%)

MAT Jul’19

50,6

(62,7%)

18,7

(23,1%)

7,6

(9,4%)

3,9

(4,8%)

MAT Jul’20

55,2

75,4

80,7

+37%

+7%

+12%

-0%

+27%

+82%

+82%

Source: IQVIA July 2020 Shipments Database

Source: IQVIA Shipments Database, value

Dysport Rolling Half-Year Performance by employees

Feb’20 – Jul'20

Please find

Source: IQVIA Shipments Database, value

Dysport Rolling Half-Year Performance by employees

Feb’20 – Jul'20

Please find

Somatuline performance

Somatuline is growing in value and increasing it’s market share since MAT

Somatuline performance Somatuline is growing in value and increasing it’s market share since MAT

Source: IQVIA Shipments Database, value

Ipsen MAT value, market share evolution by brand

7,5

1,0

0,0

6,0

6,5

2,5

0,5

3,5

10,0

12,0

7,0

1,5

2,0

11,0

3,0

8,0

4,0

10,5

4,5

5,0

8,5

5,5

9,5

11,5

9,0

12,5

Mar’17

11,8

May’17

9,3

10,8

Dec’17

5,5

Aug’19

Jun’17

Feb’17

Nov’18

Oct’17

Sep’19

16,5%

5,9

Dec’18

8,7

Jul’19

Jan’17

May’20

18,9%

Jul’18

Apr’17

Jul’17

17,2%

Aug’17

Jun’19

Jan’18

15,6%

5,2

Sep’17

Apr’18

Nov’17

16,6%

Feb’18

Mar’18

8,0

Jun’18

Sep’18

Oct’18

16,9%

Jan’19

Feb’19

Mar’19

Apr’19

May’19

6,9

Oct’19

Nov’19

18,8%

Dec’19

Jan’20

19,4%

Feb’20

5,4

20,4%

Mar’20

21,8%

Apr’20

Jun’20

5,7

5,7

5,5

5,6

5,6

Aug’18

6,2

5,4

4,9

May’18

5,0

5,0

5,2

5,2

5,2

5,2

5,7

5,6

6,0

6,2

5,9

7,3

7,3

7,3

7,4

7,2

7,5

7,6

8,6

8,3

10,2

11,3

Jul’20

12,1

7,4

7,4

SOMATULINE MS%

SOMATULINE Sales, M.Eur

MQ*’Jul'20

vs LY

Ipsen Brand performance

– Growth %

Market performance

- Growth %

Delta Growth

MQ*’Jul'20

vs LY

Ipsen Brand performance

– Growth %

Market performance

- Growth %

Delta Growth

Ipsen Brand

Market Share %

Source: IQVIA Shipments Database, value

*MQ – Moving Quarter (May-July)

Somatuline Regional Performance

Significant growth in Central, West and East regions.

MAT’Jul'20

vs LY

YTD’Jul'20

vs LY

MQ*’Jul'20

vs LY

MAT’Jul'20

vs LY

YTD’Jul'20

vs LY

MQ*’Jul'20

vs LY

MAT’Jul'20

vs LY

YTD’Jul'20

vs LY

0%

MAT

Jul’20

YTD

Jul’20

MQ* Jul'20

11,3

All Russia

50,9

West

Capital

Central

East

23,5

7,1

9,0

Market size MAT Jul M euro@75

Ipsen sales MAT Jul M euro

1,6

7,1

12,1

1,8

1,7

Market

Somatuline market performance

Somatuline is growing much faster than market in volume (+54%) and

Somatuline market performance Somatuline is growing much faster than market in volume (+54%) and

Somatuline market in value (M.Eur)

18

(44,7%)

13

(39,8%)

15

(37,6%)

MAT Jul’18

6

(17,6%)

14

(42,6%)

7

(17,7%)

MAT Jul’19

21

(42,2%)

MAT Jul’20

17

(34,1%)

12

(23,8%)

33

41

51

+26%

+24%

Somatuline market in volume (k.packs)

GR 2020/2019

OCTREOTIDE-DEPO

SOMATULINE AUTOGEL

OCTREOTID-LONG

GR 2020/2019

+12%

+17%

+67%

30,4

(45,1%)

MAT Jul’18

31,7

(46,9%)

5,4

(8,0%)

8,6

(9,6%)

MAT Jul’19

44,2

(49,4%)

36,7

(41,0%)

49,3

(48,3%)

39,6

(38,8%)

13,2

(12,9%)

MAT Jul’20

67,5

89,5

102,1

+33%

+14%

+8%

+12%

+54%

Source: IQVIA July 2020 Shipments Database

Source: IQVIA Shipments Database, value

Somatuline Rolling Half-Year Performance by employees

Feb’20 – Jul'20

Please find

Source: IQVIA Shipments Database, value

Somatuline Rolling Half-Year Performance by employees

Feb’20 – Jul'20

Please find

Diphereline performance

In MAT Jul’20 Diphereline sales same as MAT Jun’20 and +4,9 ppt

Diphereline performance In MAT Jul’20 Diphereline sales same as MAT Jun’20 and +4,9 ppt

Ipsen MAT value, market share evolution by brand

0,5

0,0

7,0

8,0

5,0

8,5

9,5

5,5

7,5

9,0

6,0

6,5

1,0

10,0

Dec’18

6,4

Jul’17

17,5%

Apr’17

Sep’18

6,0

Mar’17

7,0

Jan’19

6,7

6,3

Oct’17

Feb’19

Jun’17

6,9

Jun’19

Jan’17

Oct’18

Feb’17

14,9%

May’17

Aug’17

6,4

6,3

Sep’17

Jun’18

Nov’17

Mar’18

Feb’18

May’19

15,1%

Apr’18

15,5%

May’18

Jul’18

Apr’19

Jul’19

Aug’19

Sep’19

Oct’19

Nov’19

16,8%

Dec’19

Jan’20

18,4%

Feb’20

Apr’20

May’20

Jun’20

6,9

6,8

7,1

6,8

6,7

6,4

6,5

6,4

5,9

5,8

6,3

6,1

Dec’17

6,7

6,7

7,1

7,0

6,9

7,1

6,9

6,3

6,7

6,4

6,3

6,3

6,3

6,5

6,6

7,3

7,7

8,3

16,0%

8,7

9,1

9,5

Jul’20

9,5

Jan’18

Mar’19

Mar’20

Nov’18

Aug’18

7,0

DIPHERELINE MS

DIPHERELINE Sales, M.Eur

Source: IQVIA Shipments Database, value

MQ*’Jul'20

vs LY

Ipsen Brand performance

– Growth %

Market performance

- Growth %

Delta Growth

MQ*’Jul'20

vs LY

Ipsen Brand performance

– Growth %

Market performance

- Growth %

Delta Growth

Ipsen Brand

Market Share %

Source: IQVIA Shipments Database, value

*MQ – Moving Quarter (May-July)

Diphereline Regional Performance

Sales growth in Jul’20 YTD is above the market in all regions

MAT’Jul'20

vs LY

YTD’Jul'20

vs LY

MQ*’Jul’20

vs LY

MAT’Jul'20

vs LY

YTD’Jul’20

vs LY

MQ*’Jul'20

vs LY

MAT’Jul'20

vs LY

YTD’Jul'20

vs LY

0%

11,8

Central

All Russia

Capital

44,7

East

West

16,3

9,0

7,7

Market size MAT Jul M euro@75

Ipsen sales MAT Jul M euro

9,5

2,5

1,5

3,5

2,1

Market

MAT

Jul’20

YTD

Jul’20

MQ* Jul'20

Diphereline market performance

Diphereline is growing faster than market: in value by +50% and

Diphereline market performance Diphereline is growing faster than market: in value by +50% and

Diphereline market in value (M.Eur)

0

(0,4%)

5

(12,2%)

0

(0,9%)

1

(2,6%)

MAT Jul’18

MAT Jul’19

5

(12,0%)

19

(47,9%)

1

(1,5%)

6

(15,8%)

4

(10,2%)

5

(11,6%)

5

(12,3%)

1

(1,4%)

4

(11,0%)

0

(0,3%)

16

(36,0%)

10

(21,3%)

4

(8,7%)

6

(14,3%)

6

(13,3%)

20

(50,1%)

45

40

MAT Jul’20

7

(16,2%)

40

-1%

+11%

Diphereline market in volume (k.MOT)

GR 2020/2019

ZOLADEX

BUSERELIN-DEPOT

DIPHERELINE

ELIGARD

BUSERELIN-LONG

TRIPTORELIN-LONG

DECAPEPTYL DEPO

GR 2020/2019

+23%

-17%

+55%

+50%

+9%

49

(9,1%)

206

(38,4%)

119

(15,5%)

76

(14,2%)

4

(0,8%)

1

(0,2%)

10

(1,9%)

536

106

(15,5%)

110

(16,1%)

14

(1,9%)

MAT Jul’19

7

(1,1%)

303

(39,4%)

114

(14,9%)

87

(11,4%)

128

(16,6%)

81

(11,9%)

2

(0,3%)

MAT Jul’20

320

(46,9%)

98

(18,2%)

MAT Jul’18

93

(17,3%)

682

769

56

(8,3%)

+27%

+13%

+21%

-5%

+55%

+41%

+8%

Source: IQVIA July 2020 Shipments Database

MOT –Months of treatment

Source: IQVIA Shipments Database, value

Diphereline Rolling Half-Year Performance by employees

Feb’20 – Jul'20

Please find

Source: IQVIA Shipments Database, value

Diphereline Rolling Half-Year Performance by employees

Feb’20 – Jul'20

Please find

Cabometyx performance

In MAT Jul’20 Cabometyx is continuing to ramp-up and reached 2,5% Market

Cabometyx performance In MAT Jul’20 Cabometyx is continuing to ramp-up and reached 2,5% Market

Ipsen MAT value, market share evolution by brand

1,0

3,8

2,8

0,0

2,0

3,0

1,8

0,2

0,4

2,2

0,6

2,4

0,8

3,4

2,6

1,4

1,2

1,6

3,2

3,6

0,9

2,0

Jul’20

Feb’20

Oct’19

3,8

Nov’19

0,5%

3,5

Dec’19

Jan’20

Mar’20

1,5

Apr’20

May’20

1,1

2,5

Jun’20

3,1

0,2

0,5

0,6%

2,2%

Cabometyx Market Share %

Cabometyx sales

Source: IQVIA Shipments Database, value

19,6

(12,8%)

6,2

10,1

41,6

(32,2%)

30,4

(23,6%)

10,4

8,6

18,6

(14,4%)

5,8

3,7

3,7

0,0

(0,0%)

MAT Jul’19

38,4

(25,2%)

3,8

(2,5%)

22,4

(14,7%)

21,0

13,9

11,4

7,2

4,6

MAT Jul’20

129,0

152,5

+18%

RCC market, M.Eur MAT

East

Central

Capital

All Russia

West

Cabometyx market share by region, YTD Jul’20

Source:

19,6

(12,8%)

6,2

10,1

41,6

(32,2%)

30,4

(23,6%)

10,4

8,6

18,6

(14,4%)

5,8

3,7

3,7

0,0

(0,0%)

MAT Jul’19

38,4

(25,2%)

3,8

(2,5%)

22,4

(14,7%)

21,0

13,9

11,4

7,2

4,6

MAT Jul’20

129,0

152,5

+18%

RCC market, M.Eur MAT

East

Central

Capital

All Russia

West

Cabometyx market share by region, YTD Jul’20

Source:

MOT – Months of treatment

PAZOPANIB

SUNITINIB

SORAFENIB

NIVOLUMAB

EVEROLIMUS

TEMSIROLIMUS

AXITINIB

BEVACIZUMAB

LENVATINIB

CABOZANTINIB

RCC market, M.Eur YTD (Jan-Jul)

2,5

84,9

4,0

28,8

(33,9%)

3,5

19,8

(23,3%)

6,4

2,9

(3,5%)

11,2

(13,2%)

6,4

YTD Jul’20

2,3

0,0

(0,0%)

YTD Jul’19

21,0

(25,1%)

9,0

(10,8%)

11,3

(13,5%)

12,0

8,6

5,9

6,0

4,5

83,4

2,3

-2%

Cabometyx RCC market performance

RCC market is growing by 18% in value mainly due

Cabometyx RCC market performance RCC market is growing by 18% in value mainly due

RCC market in value (M.Eur)

7

(9,8%)

MAT Jul’18

20

(12,8%)

30

(23,6%)

33

(21,9%)

9

(6,7%)

19

(14,4%)

21

(13,8%)

3

(4,1%)

10

(8,1%)

129

19

(15,0%)

15

(21,7%

4

(2,5%)

38

(25,2%)

22

(14,7%)

14

(9,1%)

MAT Jul’20

20

(28,1%)

16

(22,3%)

10

(14,0%)

42

(32,2%)

71

152

MAT Jul’19

+80%

+18%

RCC market in volume (k.MOT)

GR 2020/2019

PAZOPANIB

CABOZANTINIB

SORAFENIB

SUNITINIB

NIVOLUMAB

EVEROLIMUS

Others

GR 2020/2019

+145%

-26%

-8%

+5%

28

(24,3%)

9

(16,7%)

14

(25,7%)

0

(0,9%)

94

6

(10,6%)

MAT Jul’18

29

(30,7%)

20

(21,4%)

14

(26,6%)

11

(11,5%)

18

(16,0%)

MAT Jul’19

1

(0,5%)

18

(15,5%)

11

(12,1%)

4

(3,2%)

12

(10,9%)

MAT Jul’20

22

(22,8%)

114

34

(29,6%)

10

(19,5%)

53

1

(1,6%)

+78%

+21%

+146%

-13%

-5%

+9%

Source: IQVIA July 2020 Shipments Database

MOT –Months of treatment

+34%

+57%

Cabometyx TKIs 2nd line market performance

The TKIs 2nd line market is growing by

Cabometyx TKIs 2nd line market performance The TKIs 2nd line market is growing by

RCC market in value (M.Eur)

3

(13,5%)

17

MAT Jul’18

0

(0,0%)

4

(23,7%)

5

(27,4%)

4

(26,9%)

1

(9,1%)

2

(11,9%)

1

(10,5%)

2

(10,1%)

MAT Jul’19

4

(17,2%)

3

(16,0%)

5

(22,4%)

10

3

(15,3%)

3

(15,5%)

0

(0,0%)

2

(19,0%)

4

(37,4%)

2

(24,0%)

21

MAT Jul’20

+67%

+27%

RCC market in volume (MOT)

GR 2020/2019

AXITINIB

CABOZANTINIB

SUNITINIB

PAZOPANIB

SORAFENIB

LENVATINIB

GR 2020/2019

+5%

-26%

-8%

+63%

11.031

333

(6,0%)

2.610

(23,7%)

MAT Jul’18

1.335

(24,1%)

203

(3,7%)

1.552

(28,0%)

2.738

(28,4%)

2.120

(38,3%)

3.032

(31,5%)

2.738

(28,4%)

631

(6,5%)

498

(5,2%)

MAT Jul’19

428

(3,9%)

2.648

(24,0%)

2.986

(27,1%)

1.152

(10,4%)

1.207

(10,9%)

MAT Jul’20

5.543

9.637

+74%

+14%

+9%

-13%

-5%

+83%

Source: IQVIA July 2020 Shipments Database

MOT –Months of treatment

+95%

+142%

24,5

1,0

25,0

23,0

19,5

24,0

20,5

0,5

20,0

0,0

1,5

3,0

3,5

23,5

21,5

4,0

2,0

22,0

21,0

18,5

2,5

22,5

19,0

0,5

17,5

2,6

0,8

17,9

2,3

9,1%

23,1

21,3

Oct’19

Sep’18

May’18

22,7

20,8

0,6

2,0

1,5

Jan’17

9,5%

21,0

Feb’17

0,8

2,6

17,6

17,5

17,5

1,8

Mar’17

19,2

Apr’17

2,0

2,6

2,6

May’17

17,9

2,1

1,7

Jun’17

18,2

0,6

2,2

Jul’17

-7,6%

18,7

18,3

19,3

Aug’17

2,4

Sep’17

1,3

18,6

0,2

2,4

Oct’17

18,8

2,4

Nov’17

Feb’20

18,4

2,4

Dec’17

18,5

2,4

Jan’18

21,8

18,6

9,7%

May’19

2,4

Feb’18

Aug’20

18,7

2,5

Mar’18

19,2

0,4

Apr’18

9,1%

24,8

2,6

19,4

13,4%

2,6

Jun’18

8,3%

22,5

19,5

1,7

2,6

Jul’18

6,8%

22,0

19,2

19,4

0,4

2,6

0,4

Aug’18

19,2

2,5

19,4

1,0

2,6

0,0

Oct’18

1,8%

19,0

1,8

0,1

Nov’18

21,0

21,8

19,9

2,6

1,5

0,1

Dec’18

19,9

20,2

Jan’19

9,1%

Mar’19

20,1

9,5%

0,3

Feb’19

2,5

20,8

2,3

Apr’19

20,9

2,2

21,8

21,1

21,0

22,1

2,0

0,9

Jun’19

2,0

1,0

0,3

Jul’19

21,5

1,9

1,2

Aug’19

14,3%

22,1

21,8

1,7

Sep’19

22,0

21,8

1,4

1,8

Nov’19

9,0%

1,1

1,7

Dec’19

8,9%

21,9

1,1

Jan’20

8,0%

1,8

5,3%

1,9

24,7

Mar’20

-5,0%

Apr’20

19,9

1,7

21,2

May’20

21,0

20,5

1,7

Jun’20

1,8

Jul’20

19,3

19,6

20,0

20,1

20,4

20,6

20,9

1,6

21,1

22,0

22,1

21,7

22,0

21,6

22,6

22,7

22,9

23,5

23,7

23,9

24,0

24,3

24,5

24,8

24,9

24,8

24,7

24,8

-6,6%

22,9

1,8

20,6

22,0

3,2%

4,7%

8,4%

8,2%

11,2%

8,9%

11,5%

-5,7%

-4,7%

21,0

Aesthetic franchise LS performance

MAT Aug’20 decreased vs MAT July’20 by 0.2 m Eur

24,5

1,0

25,0

23,0

19,5

24,0

20,5

0,5

20,0

0,0

1,5

3,0

3,5

23,5

21,5

4,0

2,0

22,0

21,0

18,5

2,5

22,5

19,0

0,5

17,5

2,6

0,8

17,9

2,3

9,1%

23,1

21,3

Oct’19

Sep’18

May’18

22,7

20,8

0,6

2,0

1,5

Jan’17

9,5%

21,0

Feb’17

0,8

2,6

17,6

17,5

17,5

1,8

Mar’17

19,2

Apr’17

2,0

2,6

2,6

May’17

17,9

2,1

1,7

Jun’17

18,2

0,6

2,2

Jul’17

-7,6%

18,7

18,3

19,3

Aug’17

2,4

Sep’17

1,3

18,6

0,2

2,4

Oct’17

18,8

2,4

Nov’17

Feb’20

18,4

2,4

Dec’17

18,5

2,4

Jan’18

21,8

18,6

9,7%

May’19

2,4

Feb’18

Aug’20

18,7

2,5

Mar’18

19,2

0,4

Apr’18

9,1%

24,8

2,6

19,4

13,4%

2,6

Jun’18

8,3%

22,5

19,5

1,7

2,6

Jul’18

6,8%

22,0

19,2

19,4

0,4

2,6

0,4

Aug’18

19,2

2,5

19,4

1,0

2,6

0,0

Oct’18

1,8%

19,0

1,8

0,1

Nov’18

21,0

21,8

19,9

2,6

1,5

0,1

Dec’18

19,9

20,2

Jan’19

9,1%

Mar’19

20,1

9,5%

0,3

Feb’19

2,5

20,8

2,3

Apr’19

20,9

2,2

21,8

21,1

21,0

22,1

2,0

0,9

Jun’19

2,0

1,0

0,3

Jul’19

21,5

1,9

1,2

Aug’19

14,3%

22,1

21,8

1,7

Sep’19

22,0

21,8

1,4

1,8

Nov’19

9,0%

1,1

1,7

Dec’19

8,9%

21,9

1,1

Jan’20

8,0%

1,8

5,3%

1,9

24,7

Mar’20

-5,0%

Apr’20

19,9

1,7

21,2

May’20

21,0

20,5

1,7

Jun’20

1,8

Jul’20

19,3

19,6

20,0

20,1

20,4

20,6

20,9

1,6

21,1

22,0

22,1

21,7

22,0

21,6

22,6

22,7

22,9

23,5

23,7

23,9

24,0

24,3

24,5

24,8

24,9

24,8

24,7

24,8

-6,6%

22,9

1,8

20,6

22,0

3,2%

4,7%

8,4%

8,2%

11,2%

8,9%

11,5%

-5,7%

-4,7%

21,0

Aesthetic franchise LS performance MAT Aug’20 decreased vs MAT July’20 by 0.2 m Eur

Ipsen MAT value, growth by brand

Aesthetic franchise Growth vs LY%

Meso sales

Fillers sales

DYSPORT Sales, M.Eur

Source: Sales Evolution, Local Sales in value (fixed prices)

2,2

0,8

3,0

0,2

1,2

0,0

3,2

0,6

0,4

1,0

2,4

1,4

2,8

2,6

1,6

1,8

2,0

2,9

1,4

2,5

2,1

Dec’18

0,1

9,0%

1,3

-12,8%

1,6

0,2

Feb’18

0,1

2,0

Jun’18

1,6

0,1

1,7

0,8

Jan’18

Sep’18

1,2

0,1

0,3

1,7

Mar’18

2,4

Oct’18

0,2

0,4

Jan’19

Apr’18

2,0

May’18

0,2

0,1

Jul’18

0,3

Nov’18

Dec’19

1,2

10,0%

Aug’18

0,0

0,2

0,2

0,2

0,3

0,0

0,1

0,0

18,0%

1,4

0,1

0,1

Feb’19

2,2

Nov’19

Sep’19

0,2

Mar’19

2,6

0,2

Apr’19

0,1

0,1

May’19

1,9

0,1

0,1

Jun’19

1,5

0,1

0,1

Jul’19

1,6

2,5

1,4

0,2

0,1

0,1

Aug’19

1,6

0,1

1,3

5,0%

1,8

0,1

0,2

Oct’19

0,0

-8,0%

1,9

0,0

0,2

1,3

-4,0%

0,1

0,2

1,0

0,0

0,1

Jan’20

1,4

0,0

0,1

Feb’20

2,8

2,3

0,2

Jun’20

Mar’20

-75,0%

0,7

0,2

0,9

0,0

0,0

Apr’20

-20,0%

1,7

0,0

0,1

May’20

2,6

0,0

0,9

1,9

0,0

0,2

Jul’20

2,0

2,9

2,2

2,0

1,4

1,4

1,0

1,9

2,3

2,6

3,0

2,3

2,1

1,6

1,6

1,8

2,0

2,1

2,8

1,1

2,6

0,8

1,9

2,1

Aug’20

0,0

0,1

1,3

1,5

Aesthetic franchise LS performance (monthly sales)

In Aug’20 sales decreased by 13% vs Aug’19

Ipsen

2,2

0,8

3,0

0,2

1,2

0,0

3,2

0,6

0,4

1,0

2,4

1,4

2,8

2,6

1,6

1,8

2,0

2,9

1,4

2,5

2,1

Dec’18

0,1

9,0%

1,3

-12,8%

1,6

0,2

Feb’18

0,1

2,0

Jun’18

1,6

0,1

1,7

0,8

Jan’18

Sep’18

1,2

0,1

0,3

1,7

Mar’18

2,4

Oct’18

0,2

0,4

Jan’19

Apr’18

2,0

May’18

0,2

0,1

Jul’18

0,3

Nov’18

Dec’19

1,2

10,0%

Aug’18

0,0

0,2

0,2

0,2

0,3

0,0

0,1

0,0

18,0%

1,4

0,1

0,1

Feb’19

2,2

Nov’19

Sep’19

0,2

Mar’19

2,6

0,2

Apr’19

0,1

0,1

May’19

1,9

0,1

0,1

Jun’19

1,5

0,1

0,1

Jul’19

1,6

2,5

1,4

0,2

0,1

0,1

Aug’19

1,6

0,1

1,3

5,0%

1,8

0,1

0,2

Oct’19

0,0

-8,0%

1,9

0,0

0,2

1,3

-4,0%

0,1

0,2

1,0

0,0

0,1

Jan’20

1,4

0,0

0,1

Feb’20

2,8

2,3

0,2

Jun’20

Mar’20

-75,0%

0,7

0,2

0,9

0,0

0,0

Apr’20

-20,0%

1,7

0,0

0,1

May’20

2,6

0,0

0,9

1,9

0,0

0,2

Jul’20

2,0

2,9

2,2

2,0

1,4

1,4

1,0

1,9

2,3

2,6

3,0

2,3

2,1

1,6

1,6

1,8

2,0

2,1

2,8

1,1

2,6

0,8

1,9

2,1

Aug’20

0,0

0,1

1,3

1,5

Aesthetic franchise LS performance (monthly sales)

In Aug’20 sales decreased by 13% vs Aug’19

Ipsen

Source: Sales Evolution, Local Sales in value (fixed prices)

Aesthetic franchise Growth vs LY%

DYSPORT Sales, M.Eur

Meso sales

Fillers sales

CIS Countries

CIS Countries

Source: IQVIA

Source: IQVIA

Source: IQVIA

Source: IQVIA

Source: IQVIA

Source: IQVIA

Appendix

Appendix

Key terminology used in the presentation

Key terminology used in the presentation

Бизнес-план инвестиционного проекта

Бизнес-план инвестиционного проекта Деятельность индивидуальных предпринимателей в Беларуси

Деятельность индивидуальных предпринимателей в Беларуси Как работает бизнес?

Как работает бизнес? Бизнес-план. Ритуальное агентство Лакримоза

Бизнес-план. Ритуальное агентство Лакримоза Шиномонтаж Aura. Бизнес - план

Шиномонтаж Aura. Бизнес - план Организация процесса разработки бизнес-плана. Шаблон бизнес модели

Организация процесса разработки бизнес-плана. Шаблон бизнес модели Бизнес-идея фреш-бара Аскерöм юан

Бизнес-идея фреш-бара Аскерöм юан Бизнес-планирование в социокультурной сфере

Бизнес-планирование в социокультурной сфере Новая стартовая программа. Модель бизнеса для тебя!

Новая стартовая программа. Модель бизнеса для тебя! Частный детский сад Росточек

Частный детский сад Росточек Цветочный магазин. Бизнес-план

Цветочный магазин. Бизнес-план Проектирование от А до Я. Как создать свой социальный бизнес или творческий проект и получить поддержку

Проектирование от А до Я. Как создать свой социальный бизнес или творческий проект и получить поддержку Бизнес-план судоходной компании Cutty Ore Star Llc

Бизнес-план судоходной компании Cutty Ore Star Llc Основные этапы бизнес -планирования предприятия

Основные этапы бизнес -планирования предприятия Создание индивидуальных бюджетных протезов для людей, лишившихся конечности рук

Создание индивидуальных бюджетных протезов для людей, лишившихся конечности рук Бизнес-модель гостиницы

Бизнес-модель гостиницы Товарищество с ограниченной ответственностью

Товарищество с ограниченной ответственностью Business project: Art School in the District Nagatino-Sadovniki, Moscow

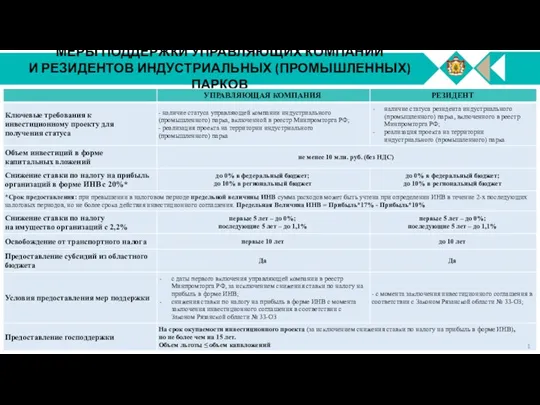

Business project: Art School in the District Nagatino-Sadovniki, Moscow Меры поддержки управляющих компаний и резидентов индустриальных (промышленных) парков управляющая компания

Меры поддержки управляющих компаний и резидентов индустриальных (промышленных) парков управляющая компания Планирование каталожного периода. Практические рекомендации

Планирование каталожного периода. Практические рекомендации Телепроект Білімді ұрпақ – Бақытты отбасы

Телепроект Білімді ұрпақ – Бақытты отбасы Речевой этикет в деловом общении

Речевой этикет в деловом общении Моя бизнес-идея Автомастерская в центре города

Моя бизнес-идея Автомастерская в центре города Региональный сетевой акселератор

Региональный сетевой акселератор Бизнес-план по теме Мобильная кофейня

Бизнес-план по теме Мобильная кофейня Рыбное хозяйство ИП Зварич И.И

Рыбное хозяйство ИП Зварич И.И Пансионаты в Евпатории

Пансионаты в Евпатории ООО Black House • Специфика – тату салон

ООО Black House • Специфика – тату салон