Strengthening a company’s competitive position. Strategic moves, timing, and scope of operations. (Chapter 6) презентация

Содержание

- 2. THIS CHAPTER WILL HELP YOU UNDERSTAND: LO 1 Whether and when to pursue offensive or defensive

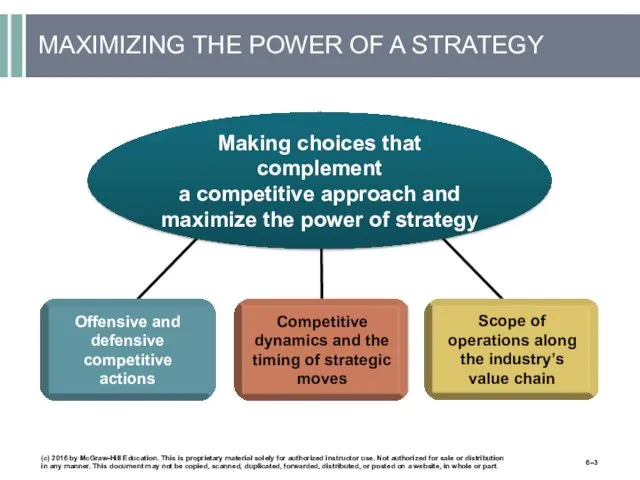

- 3. MAXIMIZING THE POWER OF A STRATEGY (c) 2016 by McGraw-Hill Education. This is proprietary material solely

- 4. CONSIDERING STRATEGY-ENHANCING MEASURES Whether and when to go on the offensive strategically. Whether and when to

- 5. LAUNCHING STRATEGIC OFFENSIVES TO IMPROVE A COMPANY’S MARKET POSITION Strategic Offensive Principles: Focusing relentlessly on building

- 6. Sometimes a company’s best strategic option is to seize the initiative, go on the attack, and

- 7. CHOOSING THE BASIS FOR COMPETITIVE ATTACK Avoid directly challenging a targeted competitor where it is strongest.

- 8. The best offensives use a company’s most powerful resources and capabilities to attack rivals in the

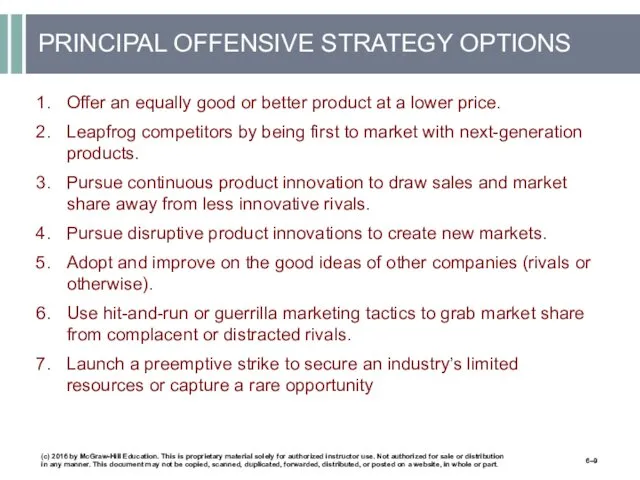

- 9. PRINCIPAL OFFENSIVE STRATEGY OPTIONS Offer an equally good or better product at a lower price. Leapfrog

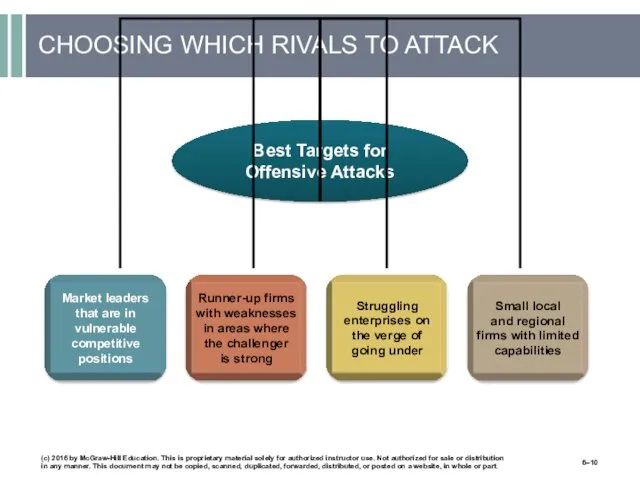

- 10. CHOOSING WHICH RIVALS TO ATTACK (c) 2016 by McGraw-Hill Education. This is proprietary material solely for

- 11. BLUE-OCEAN STRATEGY— A SPECIAL KIND OF OFFENSIVE The business universe is divided into: An existing market

- 12. (c) 2016 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized

- 13. A blue-ocean strategy offers growth in revenues and profits by discovering or inventing new industry segments

- 14. Good defensive strategies can help protect a competitive advantage but rarely are the basis for creating

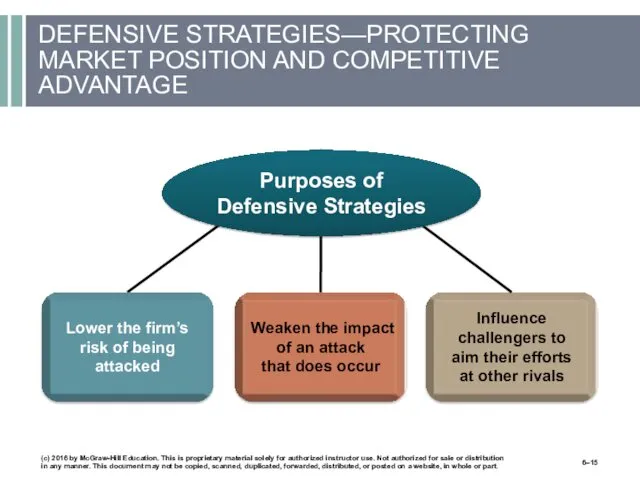

- 15. DEFENSIVE STRATEGIES—PROTECTING MARKET POSITION AND COMPETITIVE ADVANTAGE (c) 2016 by McGraw-Hill Education. This is proprietary material

- 16. There are many ways to throw obstacles in the path of would-be challengers. (c) 2016 by

- 17. BLOCKING THE AVENUES OPEN TO CHALLENGERS Adopt alternative technologies as a hedge against rivals attacking with

- 18. SIGNALING CHALLENGERS THAT RETALIATION IS LIKELY Signaling is an effective defensive strategy when the firm follows

- 19. To be an effective defensive strategy, signaling needs to be accompanied by a credible commitment to

- 20. Because of first-mover advantages and disadvantages, competitive advantage can spring from when a move is made

- 21. TIMING A FIRM’S OFFENSIVE AND DEFENSIVE STRATEGIC MOVES Timing’s Importance: Knowing when to make a strategic

- 22. CONDITIONS THAT LEAD TO FIRST-MOVER ADVANTAGES When pioneering helps build a firm’s reputation and creates strong

- 23. (c) 2016 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized

- 24. THE POTENTIAL FOR LATE-MOVER ADVANTAGES OR FIRST-MOVER DISADVANTAGES When pioneering is more costly than imitating and

- 25. TO BE A FIRST MOVER OR NOT Does market takeoff depend on complementary products or services

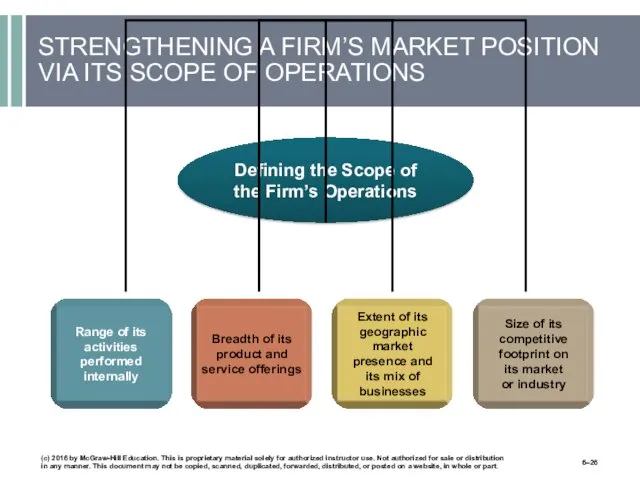

- 26. STRENGTHENING A FIRM’S MARKET POSITION VIA ITS SCOPE OF OPERATIONS (c) 2016 by McGraw-Hill Education. This

- 27. The scope of the firm refers to the range of activities that the firm performs internally,

- 28. Horizontal scope is the range of product and service segments that a firm serves within its

- 29. HORIZONTAL MERGER AND ACQUISITION STRATEGIES Merger Is the combining of two or more firms into a

- 30. STRATEGIC OJECTIVES FOR HORIZONTAL MERGERS AND ACQUISITIONS Creating a more cost-efficient operation out of the combined

- 31. BENEFITS OF INCREASING HORIZONTAL SCOPE Increasing a firm’s horizontal scope strengthens its business and increases its

- 32. (c) 2016 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized

- 33. WHY MERGERS AND ACQUISITIONS SOMETIMES FAIL TO PRODUCE ANTICIPATED RESULTS Strategic Issues: Cost savings may prove

- 34. A vertically integrated firm is one that performs value chain activities along more than one stage

- 35. VERTICAL INTEGRATION STRATEGIES Vertically Integrated Firm Is one that participates in multiple segments or stages of

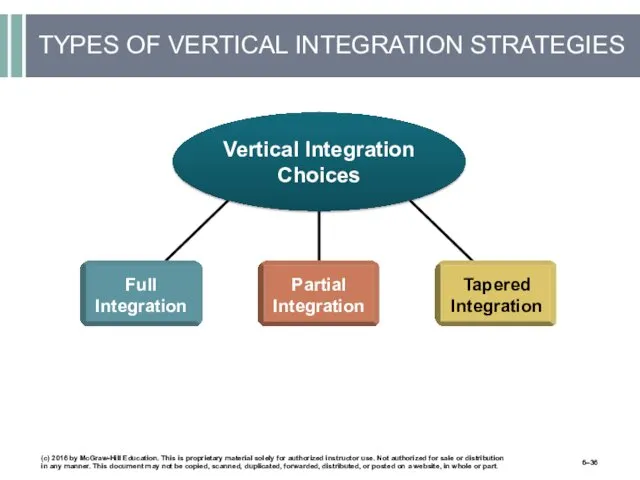

- 36. TYPES OF VERTICAL INTEGRATION STRATEGIES (c) 2016 by McGraw-Hill Education. This is proprietary material solely for

- 37. TYPES OF VERTICAL INTEGRATION STRATEGIES Full Integration A firm participates in all stages of the vertical

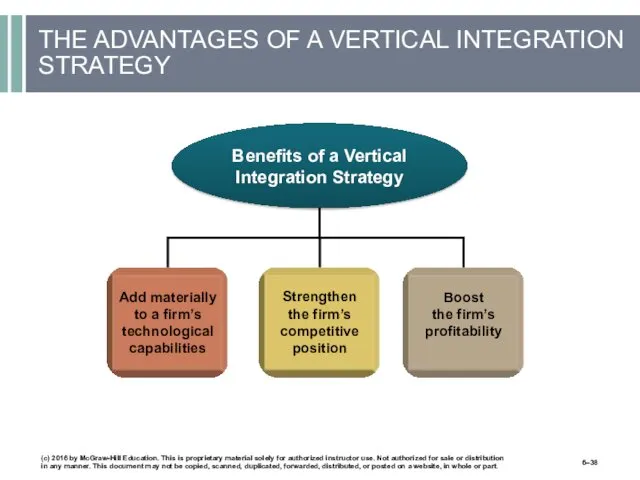

- 38. THE ADVANTAGES OF A VERTICAL INTEGRATION STRATEGY Add materially to a firm’s technological capabilities Strengthen the

- 39. Backward integration involves entry into activities previously performed by suppliers or other enterprises positioned along earlier

- 40. INTEGRATING BACKWARD TO ACHIEVE GREATER COMPETITIVENESS Integrating Backwards By: Achieving same scale economies as outside suppliers—

- 41. INTEGRATING FORWARD TO ENHANCE COMPETITIVENESS Reasons for Integrating Forward: To lower overall costs by increasing channel

- 42. DISADVANTAGES OF A VERTICAL INTEGRATION STRATEGY Increased business risk due to large capital investment. Slow acceptance

- 43. WEIGHING THE PROS AND CONS OF VERTICAL INTEGRATION Can vertical integration enhance the performance of strategy-critical

- 44. (c) 2016 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized

- 45. Outsourcing involves contracting out certain value chain activities that are normally performed in-house to outside vendors.

- 46. OUTSOURCING STRATEGIES: NARROWING THE SCOPE OF OPERATIONS Outsource an activity if it: Can be performed better

- 47. THE BIG RISKS OF OUTSOURCING VALUE CHAIN ACTIVITIES Hollowing out resources and capabilities that the firm

- 48. A company must guard against outsourcing activities that hollow out the resources and capabilities that it

- 49. A strategic alliance is a formal agreement between two or more separate companies in which they

- 50. FACTORS THAT MAKE AN ALLIANCE “STRATEGIC” An strategic alliance: Facilitates achievement of an important business objective.

- 51. BENEFITS OF STRATEGIC ALLIANCES AND PARTNERSHIPS Minimize the problems associated with vertical integration, outsourcing, and mergers

- 52. Companies that have formed a host of alliances need to manage their alliances like a portfolio.

- 53. WHY AND HOW STRATEGIC ALLIANCES ARE ADVANTAGEOUS Strategic Alliances: Expedite development of promising new technologies or

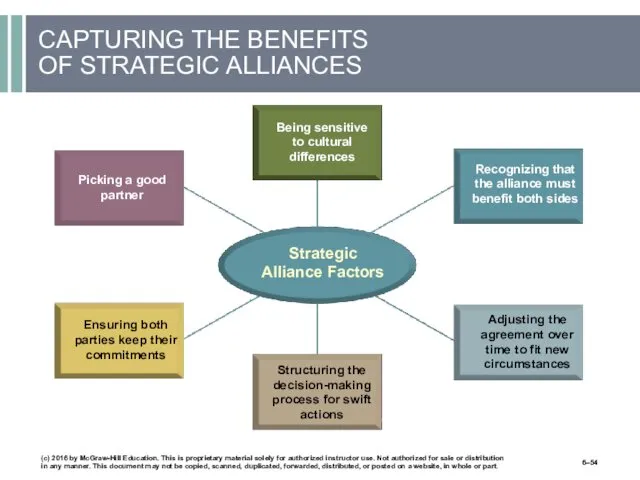

- 54. CAPTURING THE BENEFITS OF STRATEGIC ALLIANCES (c) 2016 by McGraw-Hill Education. This is proprietary material solely

- 55. The best alliances are highly selective, focusing on particular value chain activities and on obtaining a

- 56. REASONS FOR ENTERING INTO STRATEGIC ALLIANCES When seeking global market leadership: Enter into critical country markets

- 57. PRINCIPLE ADVANTAGES OF STRATEGIC ALLIANCES They lower investment costs and risks for each partner by facilitating

- 58. STRATEGIC ALLIANCES VERSUS OUTSOURCING Key Advantages of Strategic Alliances: The increased ability to exercise control over

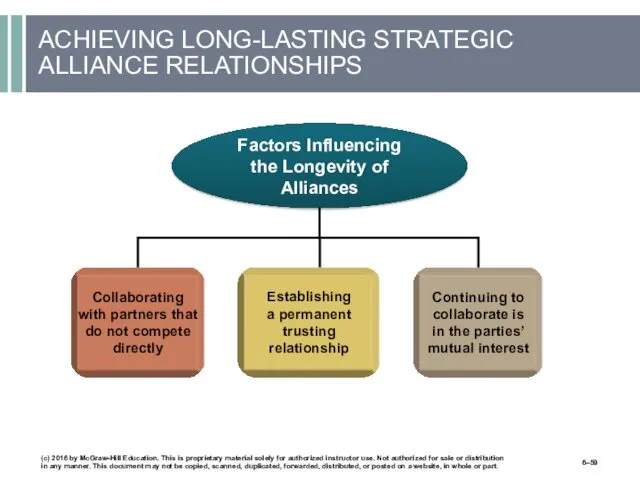

- 59. ACHIEVING LONG-LASTING STRATEGIC ALLIANCE RELATIONSHIPS Collaborating with partners that do not compete directly Establishing a permanent

- 60. THE DRAWBACKS OF STRATEGIC ALLIANCES AND PARTNERSHIPS Culture clash and integration problems due to different management

- 62. Скачать презентацию

Customer Development: работа с гипотезами

Customer Development: работа с гипотезами Мне нужен аниматор

Мне нужен аниматор Знакомство с командой (запуски)

Знакомство с командой (запуски) Планування прибутку на лісогосподарських підприємствах

Планування прибутку на лісогосподарських підприємствах Содержание внешнеторгового контракта купли-продажи

Содержание внешнеторгового контракта купли-продажи Развитие туризма в Москве

Развитие туризма в Москве Проект: создание в г. Караганде гостиницы категории 3

Проект: создание в г. Караганде гостиницы категории 3 Бизнес-план. Проект: Много специй

Бизнес-план. Проект: Много специй Tea Masters Cup. Чайный чемпионат

Tea Masters Cup. Чайный чемпионат Мотивы для изменений

Мотивы для изменений Создание международного центра по разработке и внедрению новых материалов и имплантантов на рынок ортопедических услуг

Создание международного центра по разработке и внедрению новых материалов и имплантантов на рынок ортопедических услуг Ефективна комунікація. Діалоги в офіційному спілкуванні

Ефективна комунікація. Діалоги в офіційному спілкуванні Виды работ, которые помогут приумножить ваших потенциальных клиентов

Виды работ, которые помогут приумножить ваших потенциальных клиентов Шаблон бизнес-модели по Остервальдеру

Шаблон бизнес-модели по Остервальдеру Франшиза центров выдачи интернет-заказов

Франшиза центров выдачи интернет-заказов LifeHacker Coffee. Кофейные автоматы

LifeHacker Coffee. Кофейные автоматы Зоогостиница Каникулы

Зоогостиница Каникулы Пошаговая скоростная система для рекрутинга

Пошаговая скоростная система для рекрутинга Счастье первого заказа. Ускоряемся

Счастье первого заказа. Ускоряемся Региональный сетевой акселератор

Региональный сетевой акселератор Бизнес-план, как проект нового предприятия

Бизнес-план, как проект нового предприятия Тамақтану технологиясы индустриясы

Тамақтану технологиясы индустриясы Liqui Moly - лучший бренд в Германии

Liqui Moly - лучший бренд в Германии Рыбное хозяйство ИП Зварич И.И

Рыбное хозяйство ИП Зварич И.И Жеке бизнес құрудың принциптері мен шарттары

Жеке бизнес құрудың принциптері мен шарттары Инвестиционный проект Зоомагазин

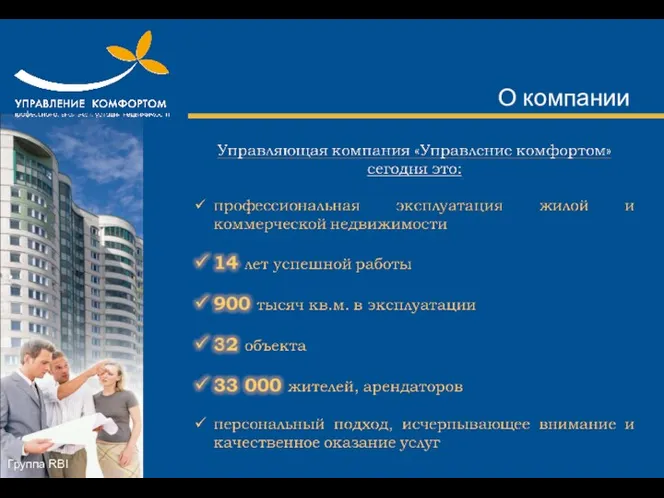

Инвестиционный проект Зоомагазин Управляющая компания Управление комфортом

Управляющая компания Управление комфортом Малое и среднее предпринимательство как модели ведения бизнеса

Малое и среднее предпринимательство как модели ведения бизнеса