Содержание

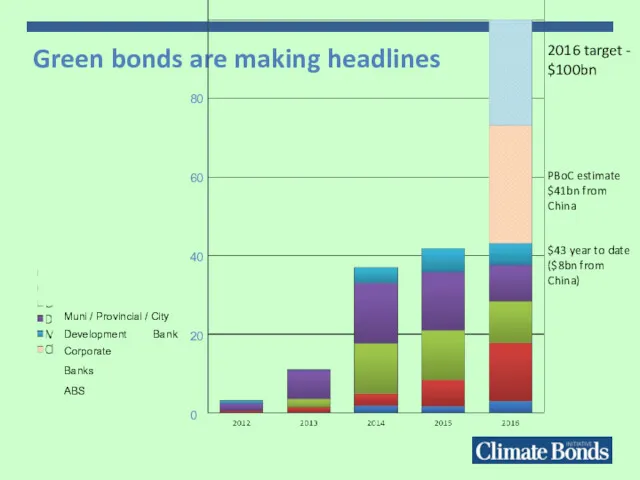

- 2. Green bonds are making headlines 80 60 40 20 0 2016 target - $100bn PBoC estimate

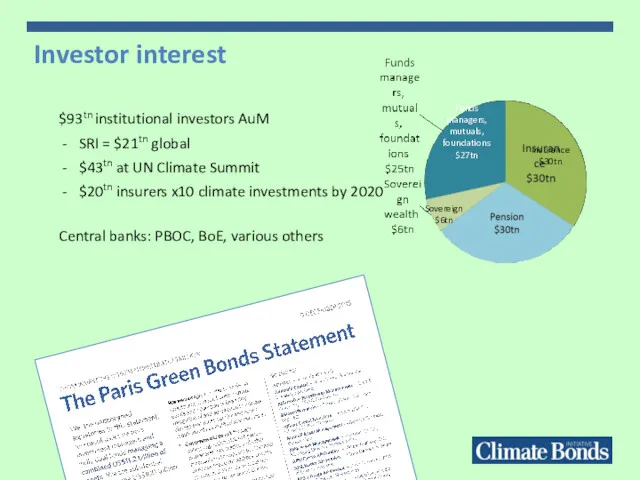

- 3. $93tn institutional investors AuM SRI = $21tn global $43tn at UN Climate Summit $20tn insurers x10

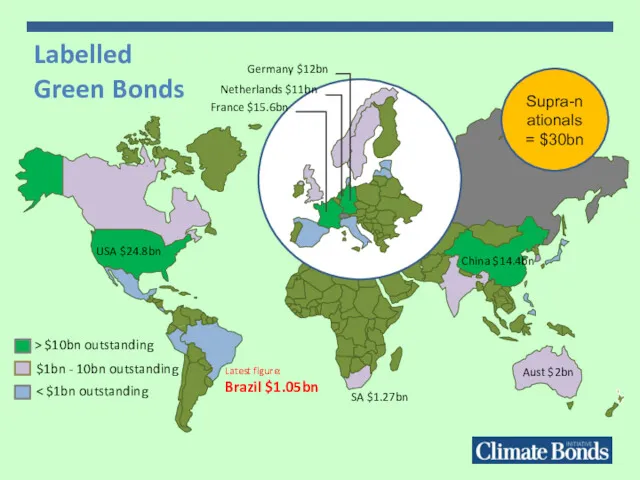

- 4. USA $24.8bn China $14.4bn Supra-nationals = $30bn Labelled Green Bonds Latest figure: Brazil $1.05bn

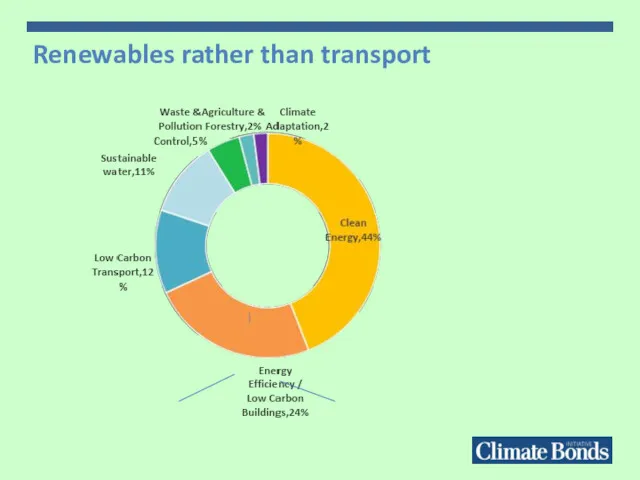

- 5. Renewables rather than transport

- 6. Green Bond Principles – ICMA Proceeds must go to green / Explain process for project selection;

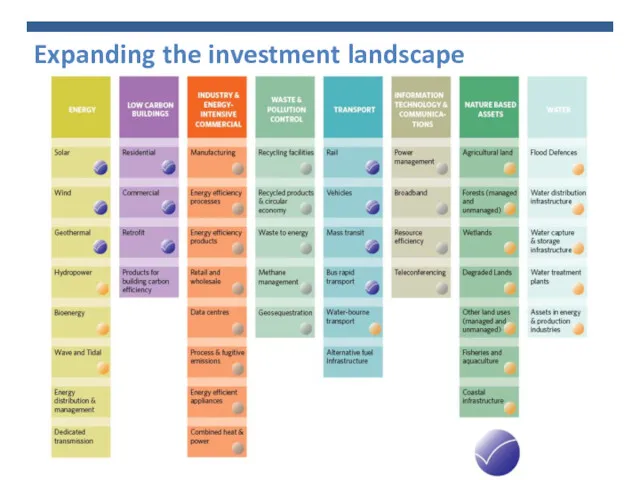

- 7. Expanding the investment landscape

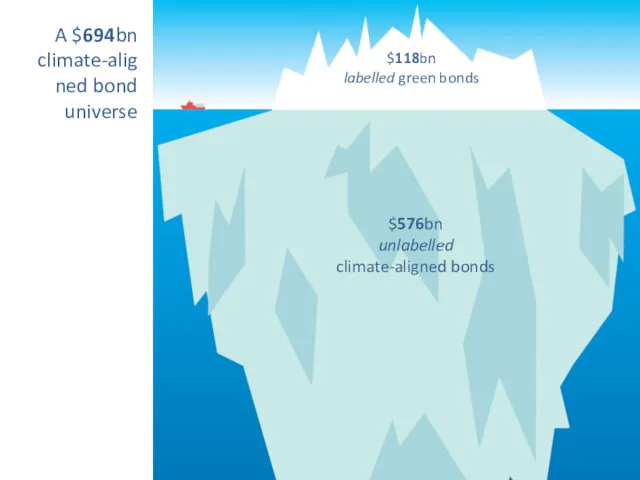

- 8. $118bn labelled green bonds A $694bn climate-aligned bond universe $576bn unlabelled climate-aligned bonds

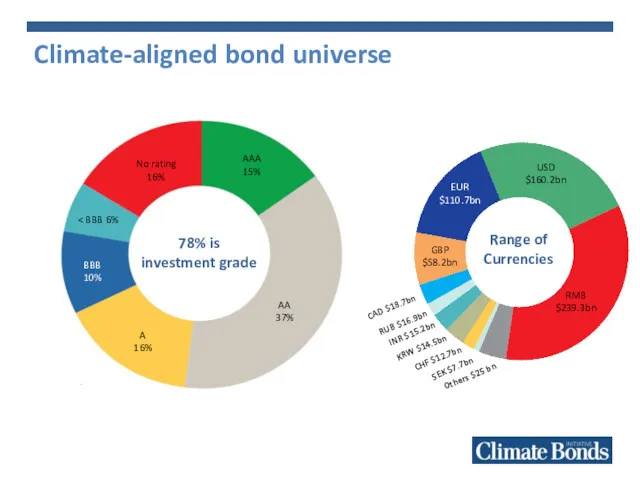

- 9. Climate-aligned bond universe AAA 15% AA 37% A 16% No rating 16% BBB 10% 78% is

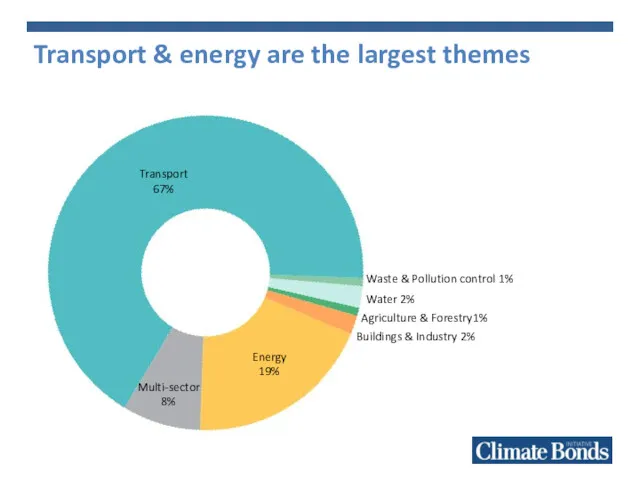

- 10. Transport & energy are the largest themes Transport 67% Energy 19% Multi-sector 8% Water 2% Buildings

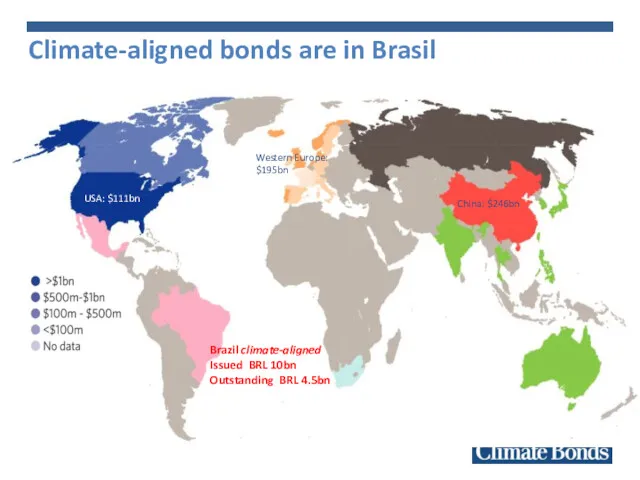

- 11. Climate-aligned bonds are in Brasil Western Europe: $195bn USA: $111bn China: $246bn Brazil climate-aligned Issued BRL

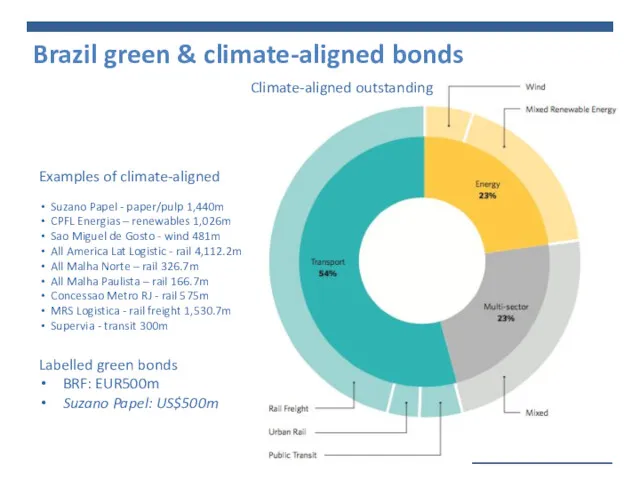

- 12. Brazil green & climate-aligned bonds Examples of climate-aligned Suzano Papel - paper/pulp 1,440m CPFL Energias –

- 13. Opportunities in Brazil Agribusiness Forestry & paper Renewable energy

- 14. Roadmap Blue-chip issuance Market education Fiscally efficient support & incentives Aggregation vehicles Grow green projects pipeline

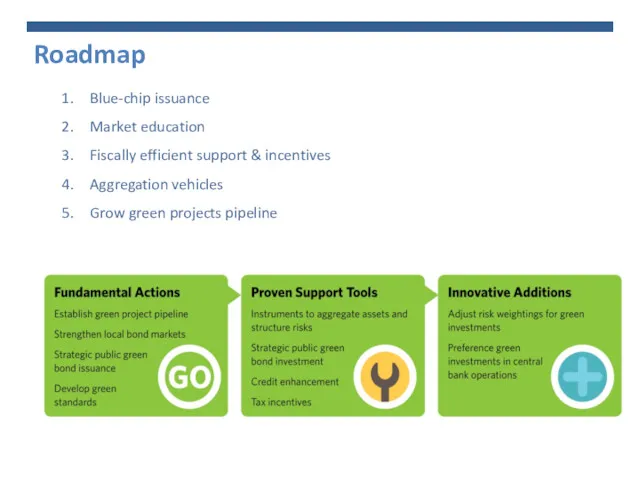

- 15. Green Infra Investment & INDCs Investor-country dialogue India Brazil China

- 17. Скачать презентацию

Аварии на АЭС

Аварии на АЭС Охрана окружающей среды в России

Охрана окружающей среды в России За чистую планету

За чистую планету Особо охраняемые природные территории

Особо охраняемые природные территории Совещание по правоприменительной практике Управления Росприроднадзора по ХМАО-Югре

Совещание по правоприменительной практике Управления Росприроднадзора по ХМАО-Югре гигиена и экология человека

гигиена и экология человека Озеленение Санкт-Петербурга и борьба с замусориванием улиц

Озеленение Санкт-Петербурга и борьба с замусориванием улиц Нормирование качества воды поверхностных водоемов

Нормирование качества воды поверхностных водоемов Конкурс на лучший стенд (уголок) Эколята - молодые защитники Природы

Конкурс на лучший стенд (уголок) Эколята - молодые защитники Природы Классный час Профилактика лесных пожаров

Классный час Профилактика лесных пожаров Методы очистки

Методы очистки Екологія Оболонь

Екологія Оболонь Экологические проблемы использования тепловых двигателей

Экологические проблемы использования тепловых двигателей Wetlands International - міжнародна неурядова організація, яка існує задля збереження і відновлення водно-болотних угідь

Wetlands International - міжнародна неурядова організація, яка існує задля збереження і відновлення водно-болотних угідь Аллея России. Всероссийская патриотическая акция

Аллея России. Всероссийская патриотическая акция Забруднення навколишнього середовища твердими побутовими відходами

Забруднення навколишнього середовища твердими побутовими відходами Охрана окружающей среды

Охрана окружающей среды Приспособление организмов к среде обитания

Приспособление организмов к среде обитания Влияние промышленных предприятий на окружающую среду

Влияние промышленных предприятий на окружающую среду Проект добрые крышечки

Проект добрые крышечки Урок по экологии Качество жизни

Урок по экологии Качество жизни Агробиоценоз как экологическая система

Агробиоценоз как экологическая система Ecosisteme naturale terestre

Ecosisteme naturale terestre Глобальное потепление и его последствия

Глобальное потепление и его последствия Опыт работы ФГБУ Заповедное Приамурье в области охраны окружающей среды 2015-2018гг

Опыт работы ФГБУ Заповедное Приамурье в области охраны окружающей среды 2015-2018гг Способы обезвреживания отходов

Способы обезвреживания отходов Министерство природных ресурсов и экологии РФ

Министерство природных ресурсов и экологии РФ Устюртский государственный природный заповедник

Устюртский государственный природный заповедник