Содержание

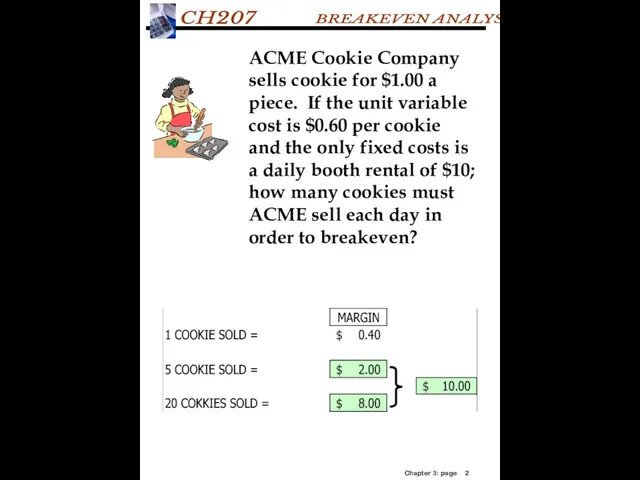

- 2. ACME Cookie Company sells cookie for $1.00 a piece. If the unit variable cost is $0.60

- 3. ASSUMPTIONS: Costs can be easily classified as fixed or variable. Variable Costs vary directly with volume

- 4. VARIABLE RATE (VR): Variable rate is the variable cost expressed as a percentage of sales. We

- 5. CONTRIBUTION MARGIN (CM) CM is the amount of sales dollar left after subtracting VC from total

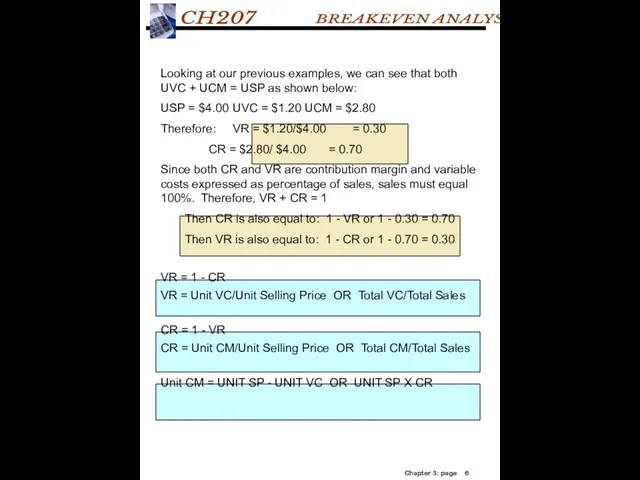

- 6. Looking at our previous examples, we can see that both UVC + UCM = USP as

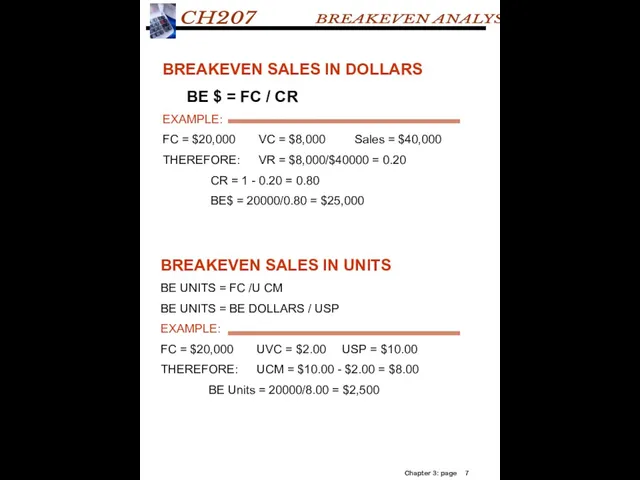

- 7. BREAKEVEN SALES IN DOLLARS BE $ = FC / CR EXAMPLE: FC = $20,000 VC =

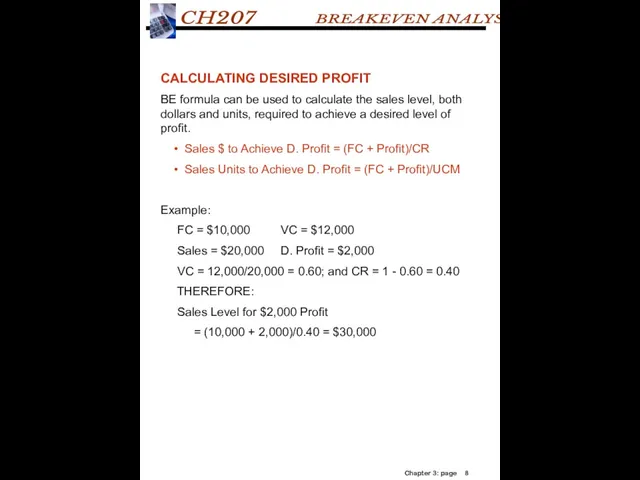

- 8. CALCULATING DESIRED PROFIT BE formula can be used to calculate the sales level, both dollars and

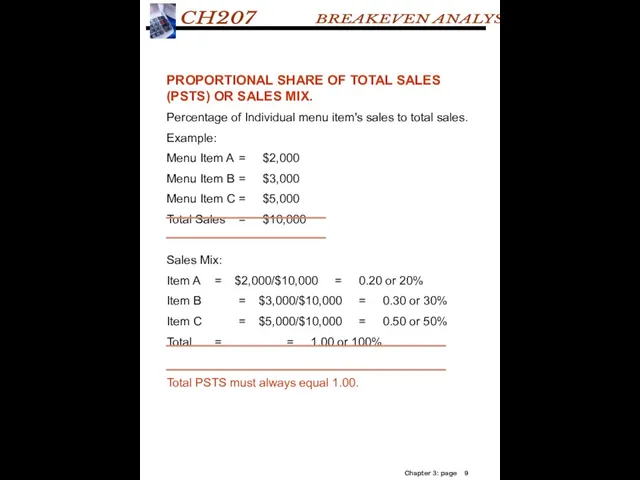

- 9. PROPORTIONAL SHARE OF TOTAL SALES (PSTS) OR SALES MIX. Percentage of Individual menu item's sales to

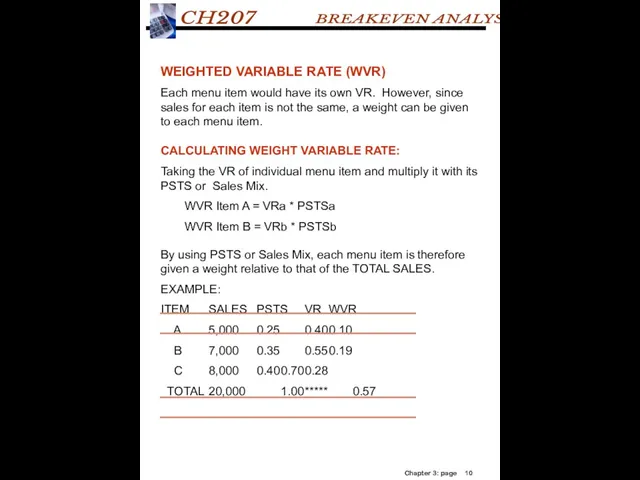

- 10. WEIGHTED VARIABLE RATE (WVR) Each menu item would have its own VR. However, since sales for

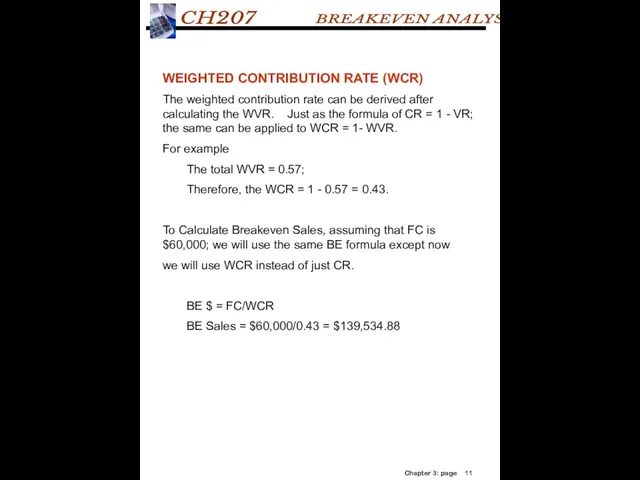

- 11. WEIGHTED CONTRIBUTION RATE (WCR) The weighted contribution rate can be derived after calculating the WVR. Just

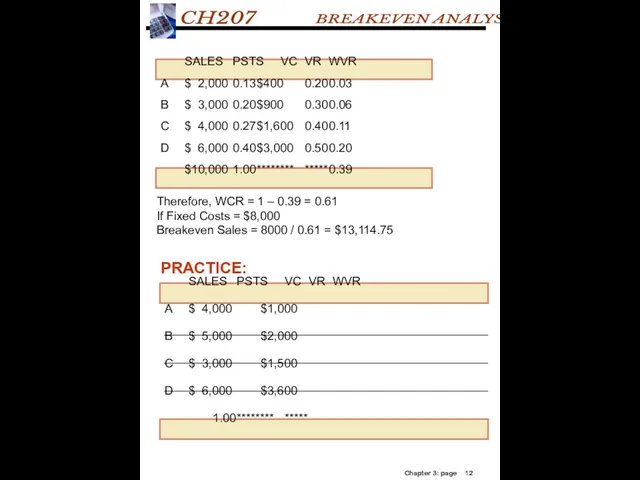

- 12. SALES PSTS VC VR WVR A $ 2,000 0.13 $400 0.20 0.03 B $ 3,000 0.20

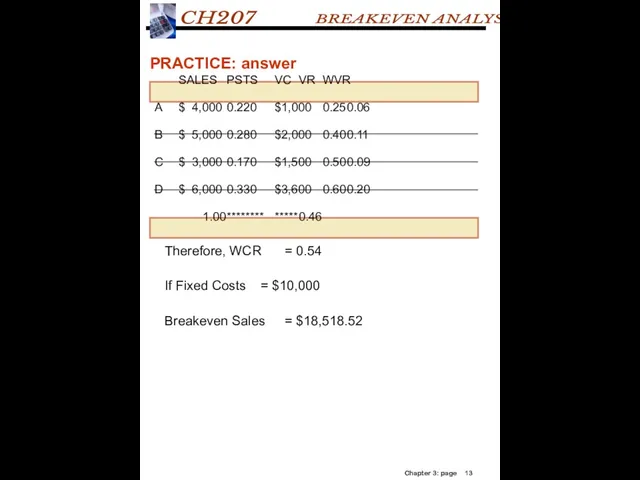

- 13. SALES PSTS VC VR WVR A $ 4,000 0.220 $1,000 0.25 0.06 B $ 5,000 0.280

- 14. 3.1 Given the following information, find variable rate: a) Selling price per unit $7.65; variable cost

- 15. 3.4 If sales price per unit is $4.00 and there were 12,000 units sold. What is

- 16. 3.8 If total sales are $45,670; profit is $7,800 and variable rate is .45, what are

- 18. Скачать презентацию

Рынок труда

Рынок труда Факторы, условия и резервы роста производительности труда

Факторы, условия и резервы роста производительности труда Планирование и прогнозирование в экономике

Планирование и прогнозирование в экономике Оценка конкурентоспособности продукции и пути ее повышения

Оценка конкурентоспособности продукции и пути ее повышения Ресурсы мировой экономики

Ресурсы мировой экономики Экономика экологической безопасности

Экономика экологической безопасности Monopolistic competition. (Lecture 17)

Monopolistic competition. (Lecture 17) Метод экспертных оценок

Метод экспертных оценок Особенности управления городским хозяйством

Особенности управления городским хозяйством Уровень цены

Уровень цены Мировая экономика и международные экономические отношения

Мировая экономика и международные экономические отношения Поведение фирмы в условиях совершенной конкуренции, чистой монополии, монополистической конкуренции и олигополии

Поведение фирмы в условиях совершенной конкуренции, чистой монополии, монополистической конкуренции и олигополии Стратегическое планирование на муниципальном уровне, как механизм долгосрочного развития территорий

Стратегическое планирование на муниципальном уровне, как механизм долгосрочного развития территорий Экономическая характеристика деятельности предприятия

Экономическая характеристика деятельности предприятия Собственность и экономические системы. (Тема 3)

Собственность и экономические системы. (Тема 3) Экономика и ее роль в жизни общества

Экономика и ее роль в жизни общества Транснационализация и глобализация мировой экономики и их последствия

Транснационализация и глобализация мировой экономики и их последствия Типы экономических систем

Типы экономических систем Особенности формирования и механизм функционирования рынка труда

Особенности формирования и механизм функционирования рынка труда Правовое регулирование инвестиционно-строительной деятельности

Правовое регулирование инвестиционно-строительной деятельности Естественные монополии: понятие, признаки, виды

Естественные монополии: понятие, признаки, виды Рынок труда

Рынок труда Трансформация международных транспортных коридоров

Трансформация международных транспортных коридоров Классическая политическая экономия

Классическая политическая экономия Концепция функционирования розничных рынков электрической энергии в 2012 г. и далее

Концепция функционирования розничных рынков электрической энергии в 2012 г. и далее Производственная структура организации

Производственная структура организации Факторы размещения производства

Факторы размещения производства Рынок труда. Обществознание 11 класс

Рынок труда. Обществознание 11 класс