Содержание

- 2. 5 Billion Unscored People Worldwide

- 3. Credit Scoring Algorithm 1

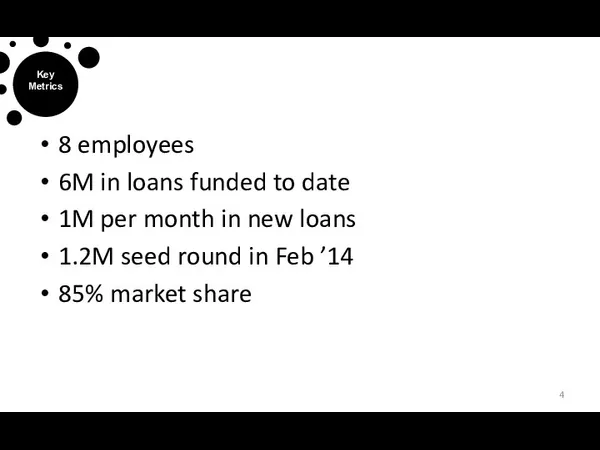

- 4. 8 employees 6M in loans funded to date 1M per month in new loans 1.2M seed

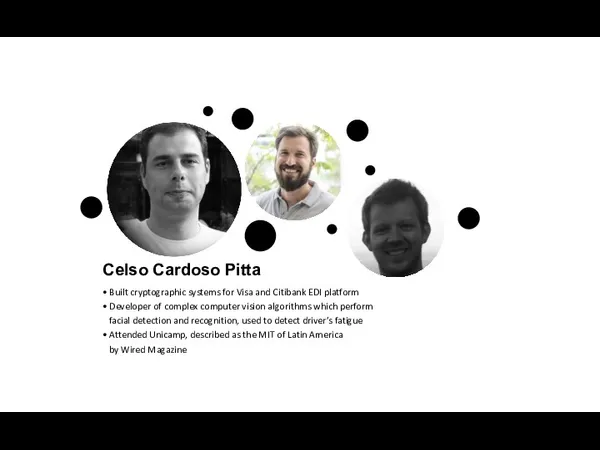

- 5. • Built cryptographic systems for Visa and Citibank EDI platform • Developer of complex computer vision

- 6. Co-Founder @ HelpSaude (merged with NetCom) Co-founder @ Bondfaro (merged with Buscapé, sold for US$400M) BA

- 7. Team: high tech capability and knowledge in B.I. and financial systems Cofounder/CMO of DeinDeal.ch (acquired by

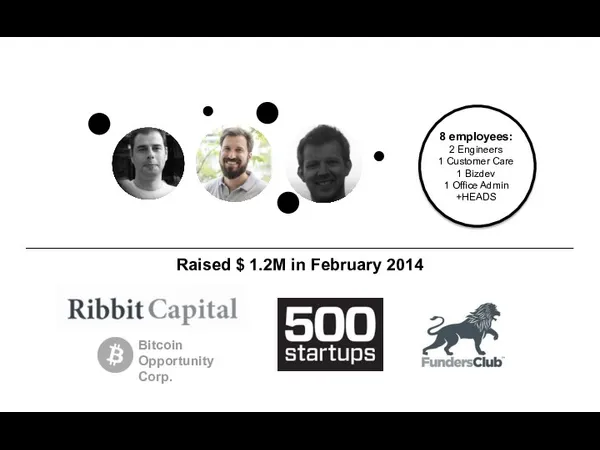

- 8. Team: high tech capability and knowledge in B.I. and financial systems Raised $ 1.2M in February

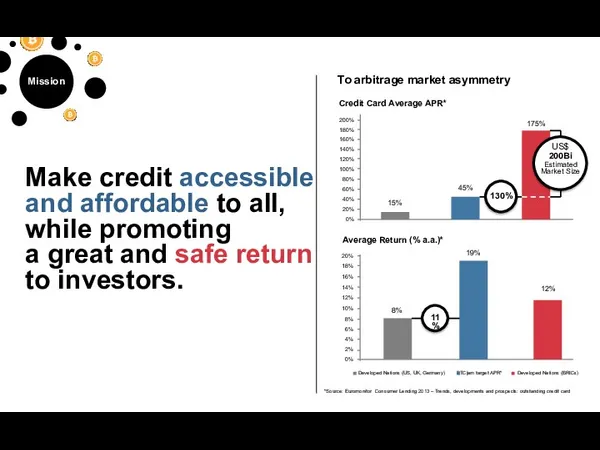

- 9. Make credit accessible and affordable to all, while promoting a great and safe return to investors.

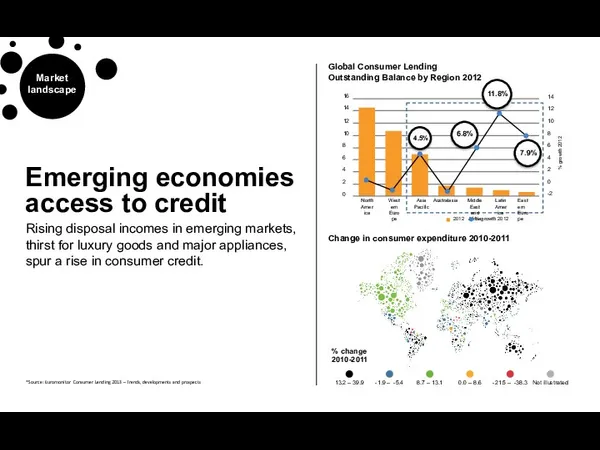

- 10. *Source: Euromonitor Consumer Lending 2013 – Trends, developments and prospects Rising disposal incomes in emerging markets,

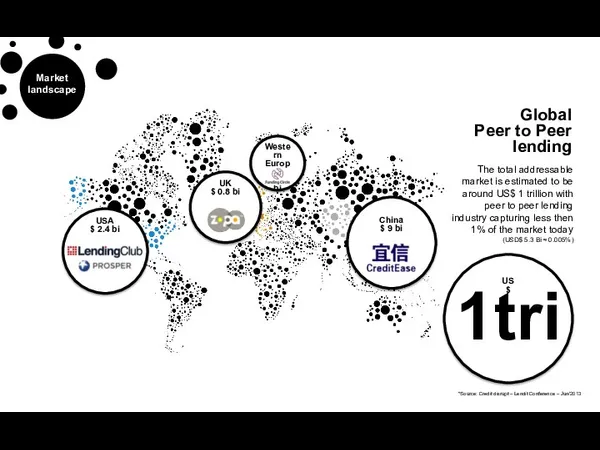

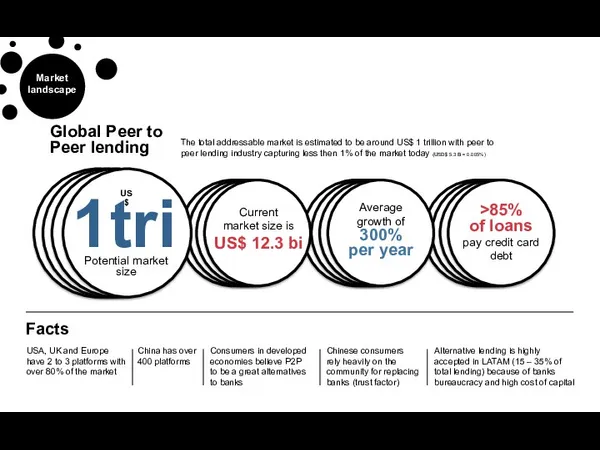

- 11. The total addressable market is estimated to be around US$ 1 trillion with peer to peer

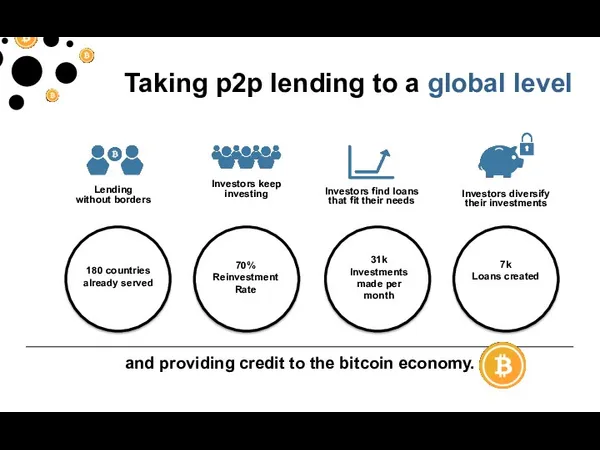

- 12. Taking p2p lending to a global level and providing credit to the bitcoin economy.

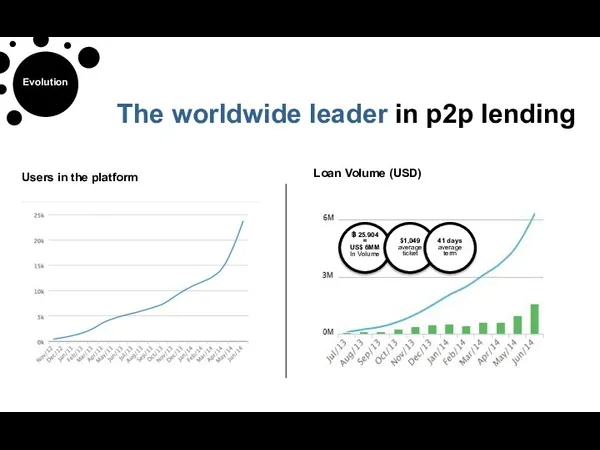

- 13. Loan Volume (USD) The worldwide leader in p2p lending Users in the platform

- 14. Loan Volume and Overall Repayment Rate Default Rate by Credit Score The worldwide Credit Bureau

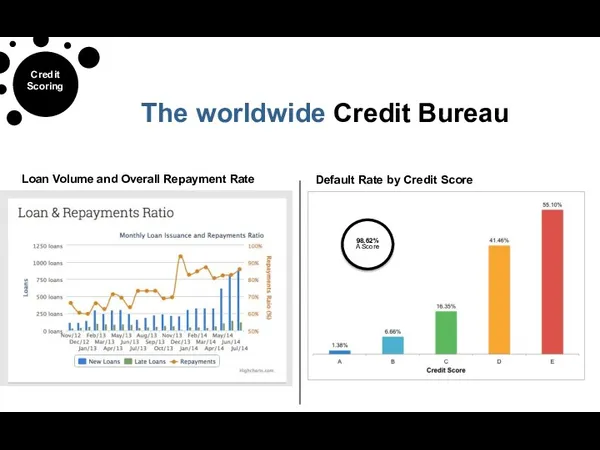

- 15. New Borrowers per week up 300% since start of marketing

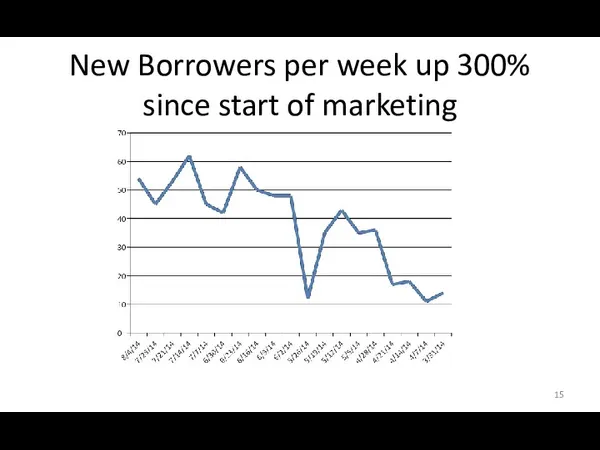

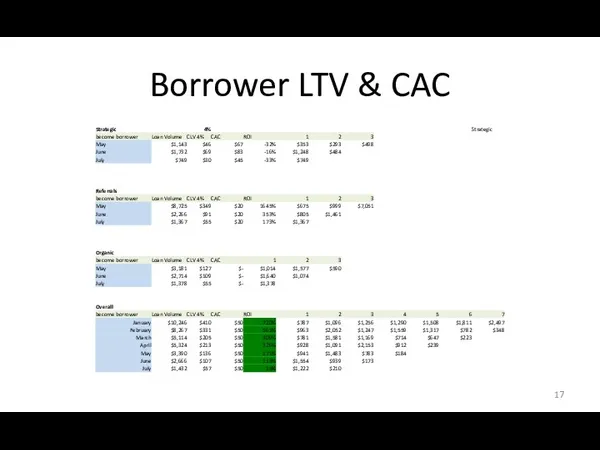

- 16. Growing while lowering costs per borrower

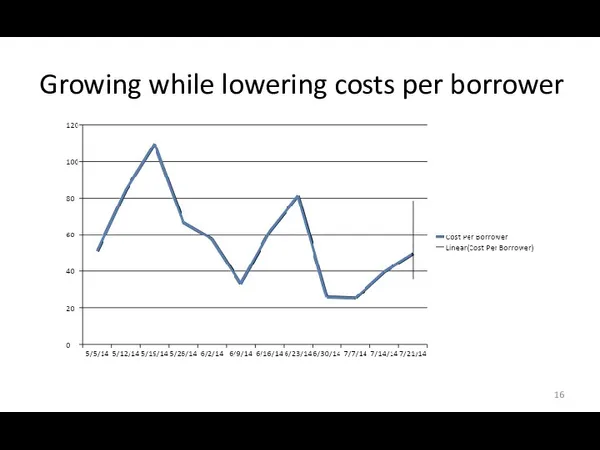

- 17. Borrower LTV & CAC

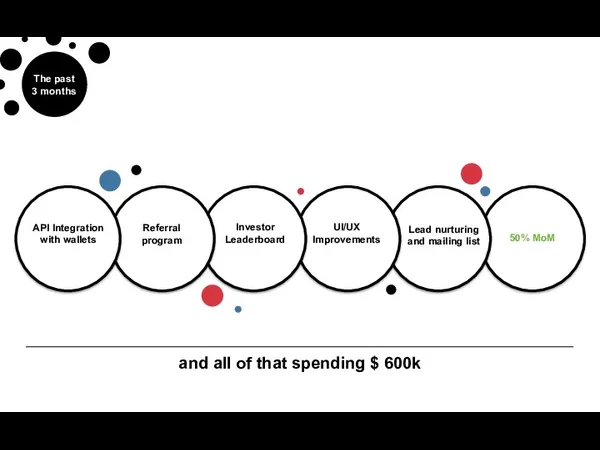

- 18. and all of that spending $ 600k

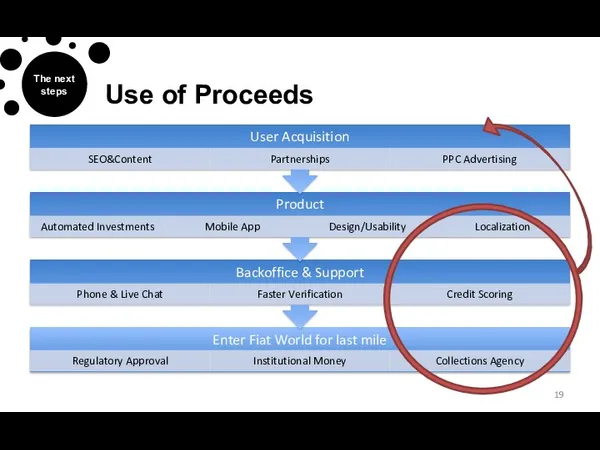

- 19. Use of Proceeds

- 20. Recap Killer team with 3 exits 1 Trillion dollar market size 5 Billion unscored people Growing

- 21. celso@btcjam.com

- 22. Appendix

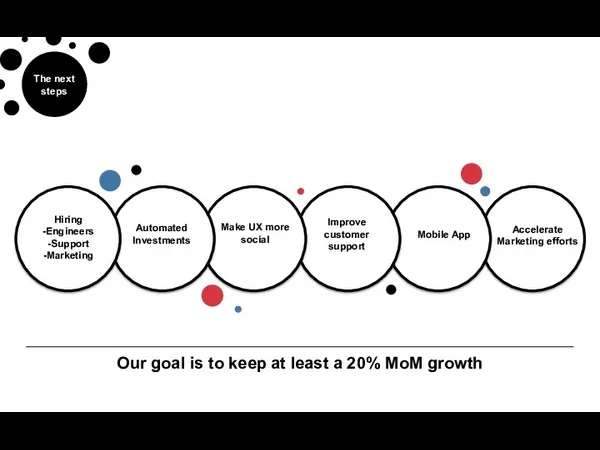

- 23. Our goal is to keep at least a 20% MoM growth

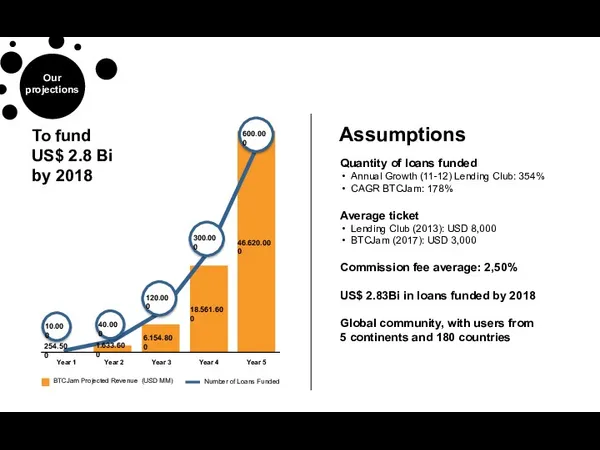

- 24. To fund US$ 2.8 Bi by 2018 Quantity of loans funded Annual Growth (11-12) Lending Club:

- 25. The total addressable market is estimated to be around US$ 1 trillion with peer to peer

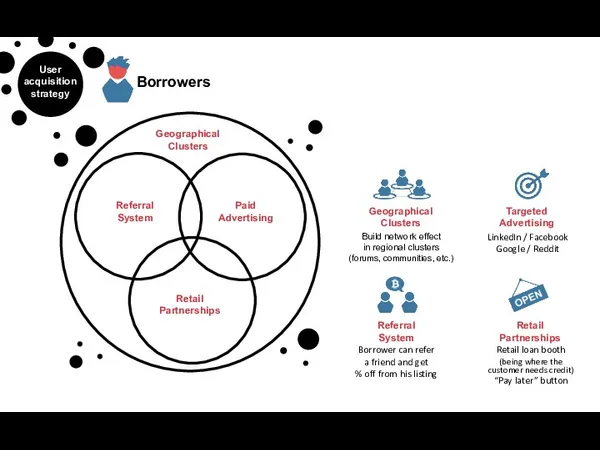

- 26. Borrowers

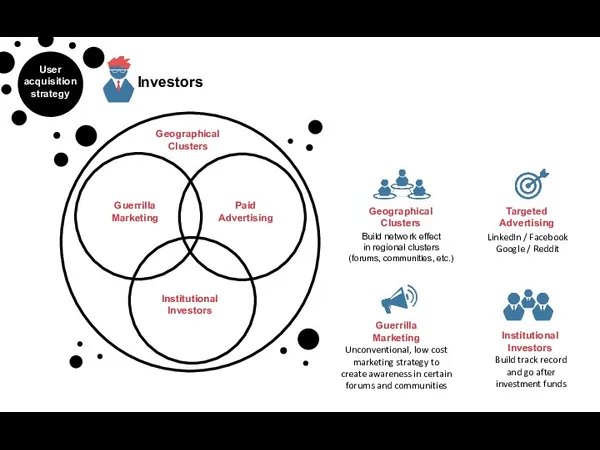

- 27. Investors

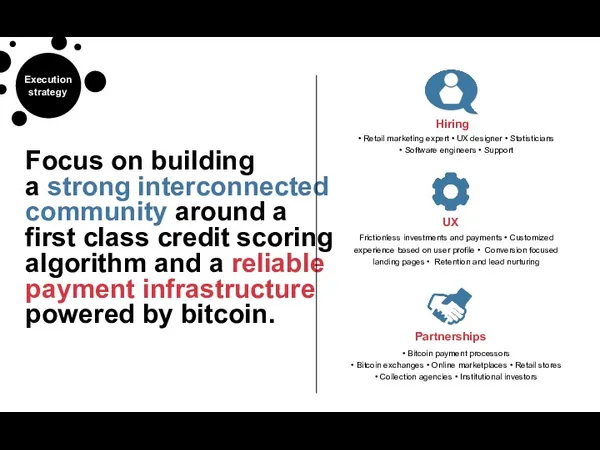

- 28. Focus on building a strong interconnected community around a first class credit scoring algorithm and a

- 30. Скачать презентацию

Зміна стилю життя літніх жителів України у період економічної кризи

Зміна стилю життя літніх жителів України у період економічної кризи Система национального счетоводства

Система национального счетоводства Экономика. Искусство ведения хозяйства

Экономика. Искусство ведения хозяйства Экономическая система Дании

Экономическая система Дании Совершенствование программно-целевого планирования социально-экономического развития муниципальных образований

Совершенствование программно-целевого планирования социально-экономического развития муниципальных образований Конкуренция. Типы рыночных структур

Конкуренция. Типы рыночных структур Сетевые организации

Сетевые организации Мероприятия по совершенствованию системы организации наставничества в рамках деятельности Университета талантов

Мероприятия по совершенствованию системы организации наставничества в рамках деятельности Университета талантов Отчёт главы сельского поселения Яснэг о результатах своей деятельности и администрации сельского поселения Яснэг

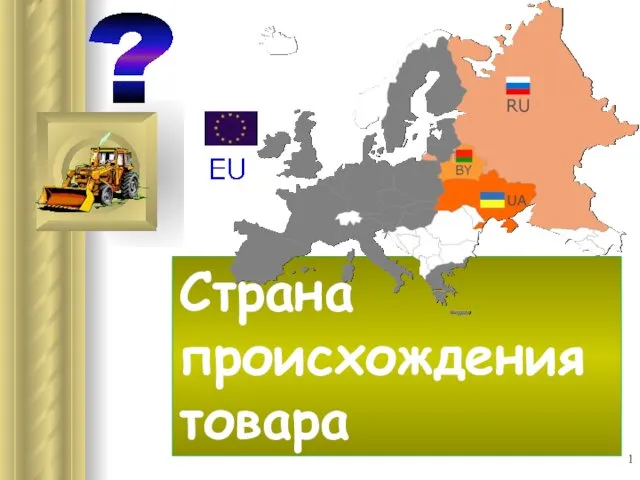

Отчёт главы сельского поселения Яснэг о результатах своей деятельности и администрации сельского поселения Яснэг Страна происхождения товара

Страна происхождения товара Статистика пәні, әдістері мен міндеттері

Статистика пәні, әдістері мен міндеттері Экономика отрасли

Экономика отрасли Монополии. Понятие монополии

Монополии. Понятие монополии Ресурсосбережение объектов коммунального хозяйства

Ресурсосбережение объектов коммунального хозяйства Историческое развитие экономической ситуации в США и Англии

Историческое развитие экономической ситуации в США и Англии Новая программа ипотечного кредитования в РФ

Новая программа ипотечного кредитования в РФ Обмен, торговля, реклама

Обмен, торговля, реклама Презентация ЭКОНОМИКА

Презентация ЭКОНОМИКА Экономика библиотечного дела. Тема 1

Экономика библиотечного дела. Тема 1 Кадры организации и производительность труда. Трудовые ресурсы

Кадры организации и производительность труда. Трудовые ресурсы Консультационная деятельность МБУ ИКЦ Янаул Информ муниципального района Янаульский район РБ

Консультационная деятельность МБУ ИКЦ Янаул Информ муниципального района Янаульский район РБ Проектная работа. Социально – экономическая статистика

Проектная работа. Социально – экономическая статистика Экономическая информация и ее место в производственных и социально-экономических системах

Экономическая информация и ее место в производственных и социально-экономических системах Особенности экономики и управления энергетикой промышленных предприятий

Особенности экономики и управления энергетикой промышленных предприятий Статистика уровня жизни

Статистика уровня жизни Introduction to Economics – Principles of Economics. Introductory lecture. Olzhas Kuzhakhmetov

Introduction to Economics – Principles of Economics. Introductory lecture. Olzhas Kuzhakhmetov Экономика Турции

Экономика Турции Business statistics

Business statistics