Содержание

- 2. I. Cost structure of the Electricity Business. II. Capital Cost Analysis. III. Economic and Financial Analysis.

- 3. III. ECONOMIC & FINANCIAL ANALYSIS. RATIOS

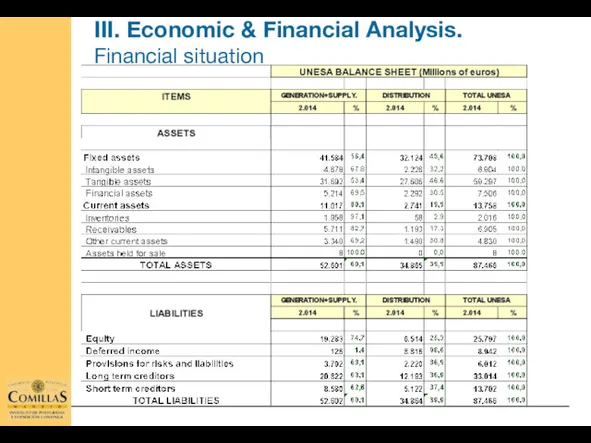

- 4. III. Economic & Financial Analysis. Financial situation

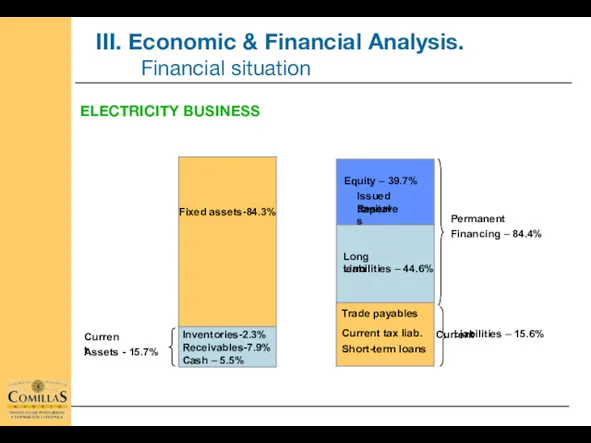

- 5. ELECTRICITY BUSINESS Permanent Financing – 84.4% Current Liabilities – 15.6% Assets - 15.7% Equity – 39.7%

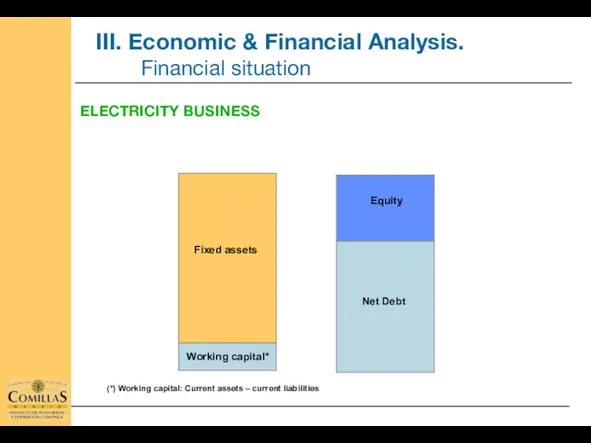

- 6. ELECTRICITY BUSINESS Equity Working capital* Fixed assets Net Debt III. Economic & Financial Analysis. Financial situation

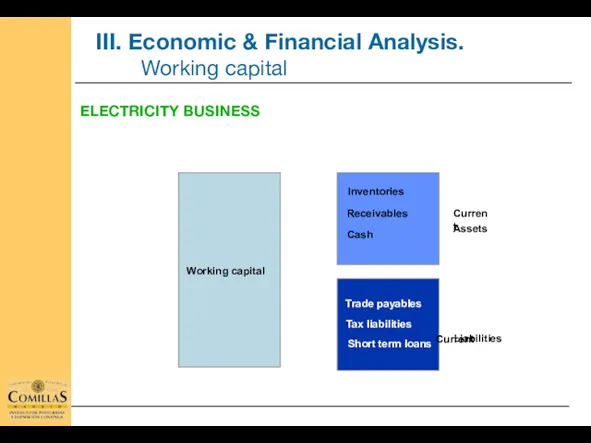

- 7. ELECTRICITY BUSINESS Inventories Working capital III. Economic & Financial Analysis. Working capital Trade payables Tax liabilities

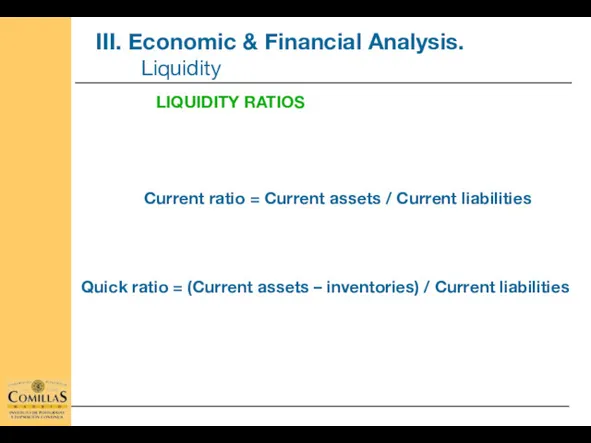

- 8. Current ratio = Current assets / Current liabilities LIQUIDITY RATIOS Quick ratio = (Current assets –

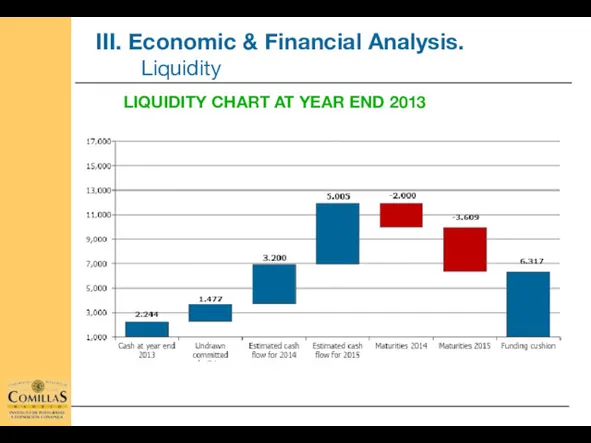

- 9. LIQUIDITY CHART AT YEAR END 2013

- 10. The business return is the main performance indicator and the most frequently used by stake holders.

- 11. FINANCIAL RETURN Relationship between earnings after taxes (net income) and equity. Return indicator to be used

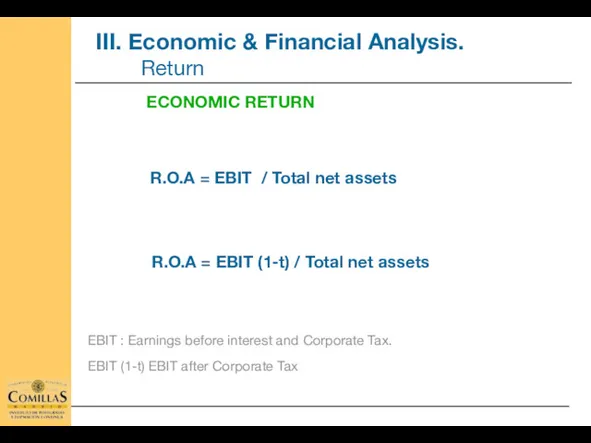

- 12. R.O.A = EBIT (1-t) / Total net assets EBIT : Earnings before interest and Corporate Tax.

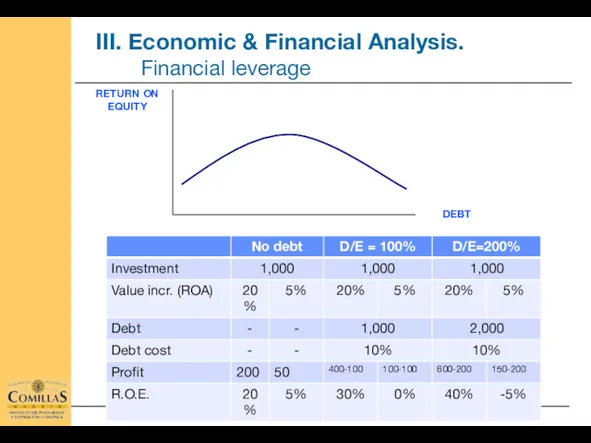

- 13. RETURN ON EQUITY DEBT

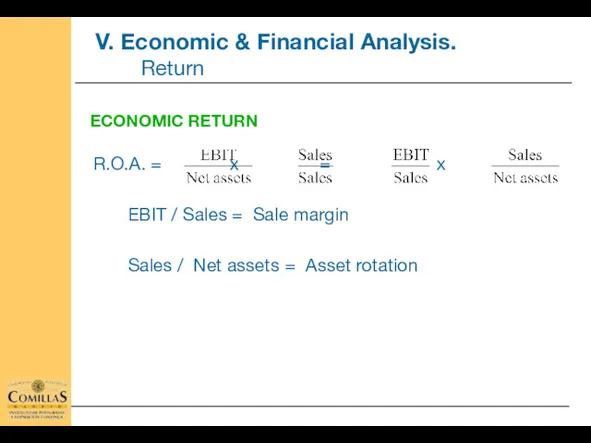

- 14. ECONOMIC RETURN R.O.A. = x = x EBIT / Sales = Sale margin Sales / Net

- 15. FINANCIAL RETURN AND FINANCIAL LEVERAGE (1) R.O.E. = R.O.E. = x x x x R.O.E. =

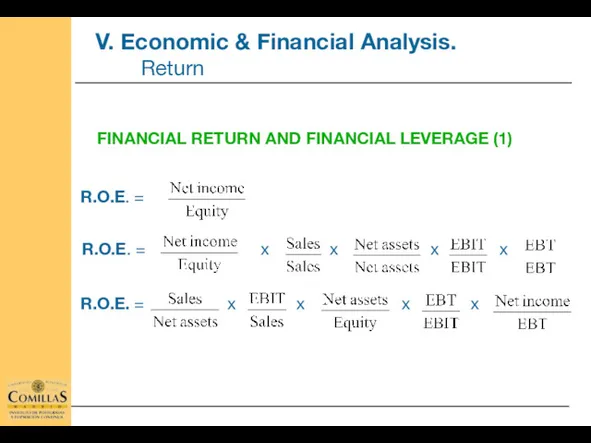

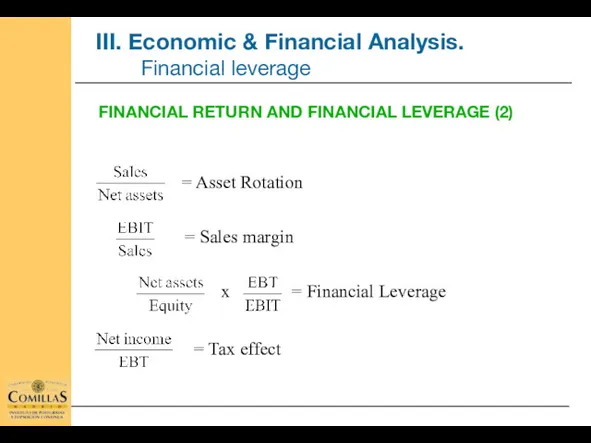

- 16. FINANCIAL RETURN AND FINANCIAL LEVERAGE (2) = Asset Rotation = Sales margin = Financial Leverage =

- 17. FINANCIAL RETURN AND FINANCIAL LEVERAGE (3) Financial Return (i.e. Equity Return) can be also analysed as

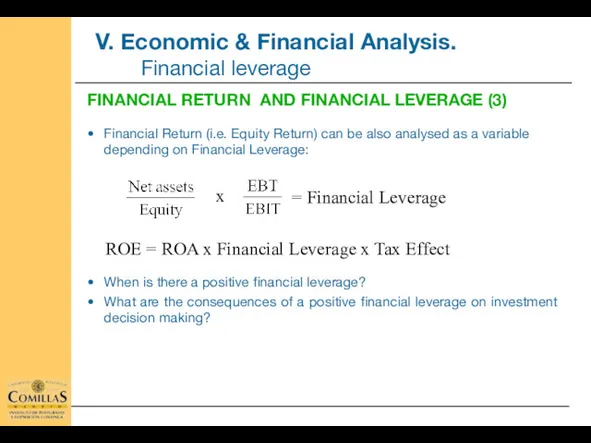

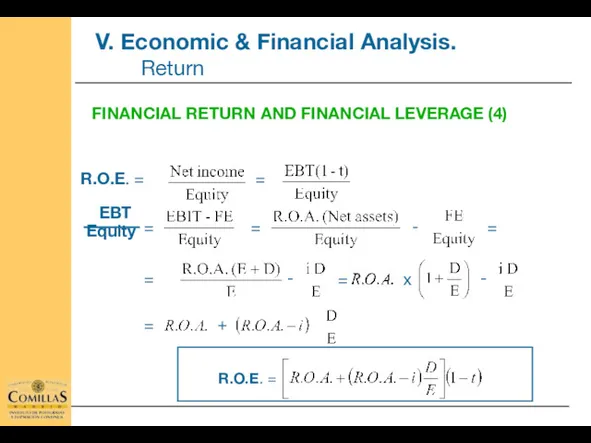

- 18. FINANCIAL RETURN AND FINANCIAL LEVERAGE (4) R.O.E. = = EBT Equity = = - = =

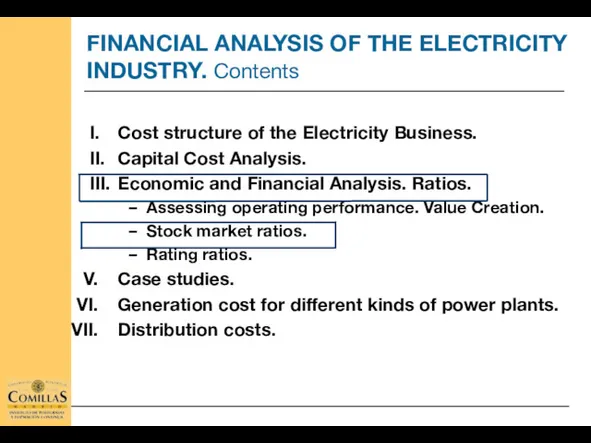

- 19. I. Cost structure of the Electricity Business. II. Capital Cost Analysis. III. Economic and Financial Analysis.

- 20. III. ECONOMIC & FINANCIAL ANALYSIS. STOCK MARKET RATIOS

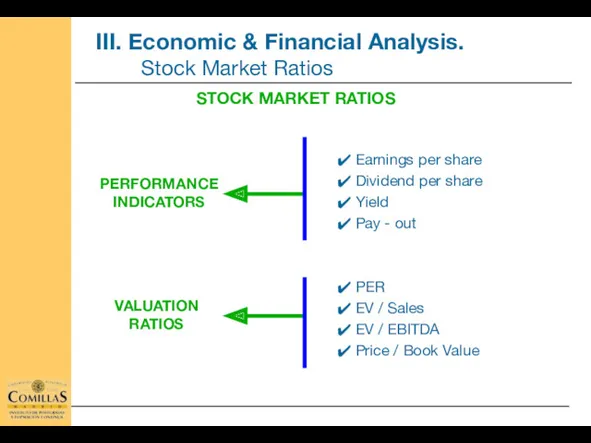

- 21. Earnings per share Dividend per share Yield Pay - out PER EV / Sales EV /

- 22. STOCK MARKET RATIOS: Earnings per share Earnings = Net income Net income ENEL(1) = 3,032 €m.

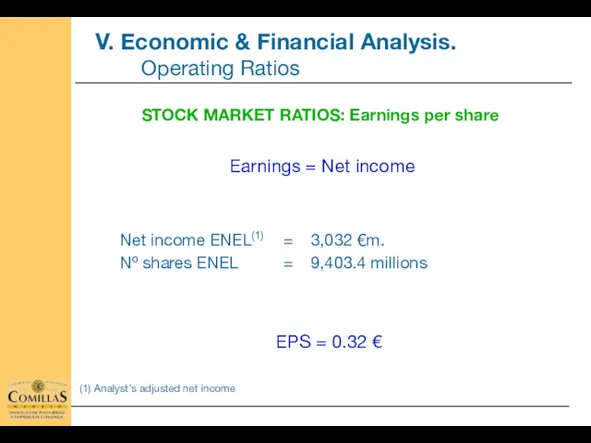

- 23. STOCK EXCHANGE RATIOS : Dividend per share Dividend = Distributed income Dividends ENEL = 1,506 €m

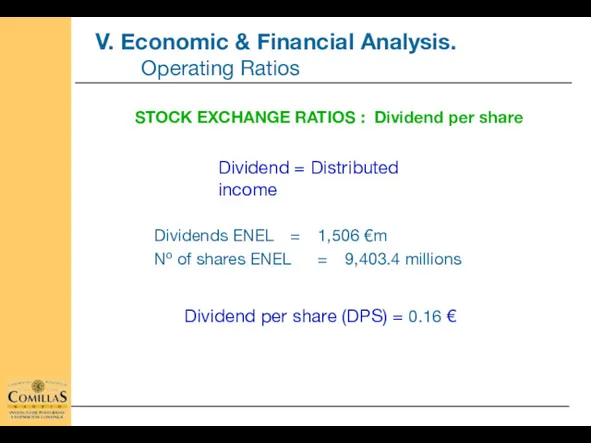

- 24. STOCK EXCHANGE RATIOS: Pay - out Pay - out = Distributed income / Net income Distributed

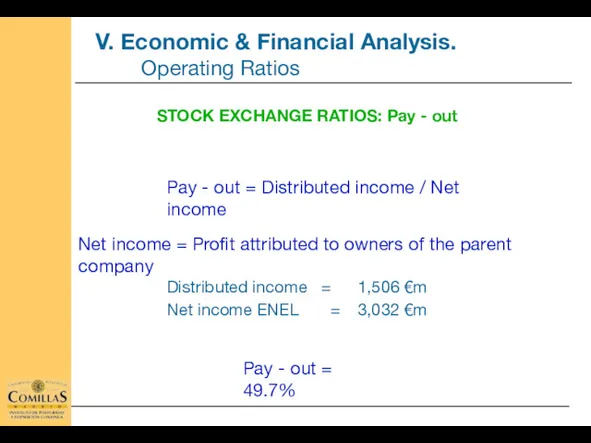

- 25. STOCK EXCHANGE RATIOS: Price Earning Ratio (PER) Net income Market Capitalisation ENEL = 39,739 €m Net

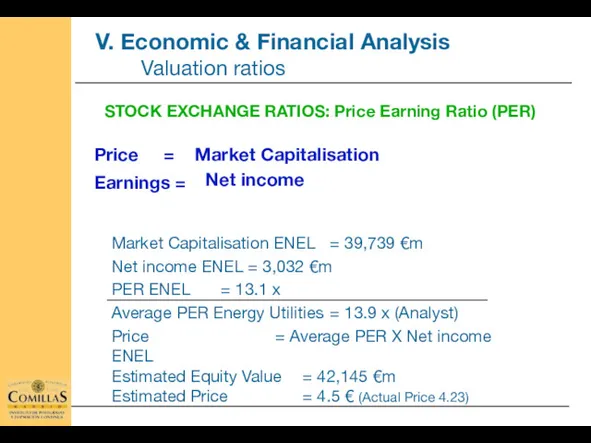

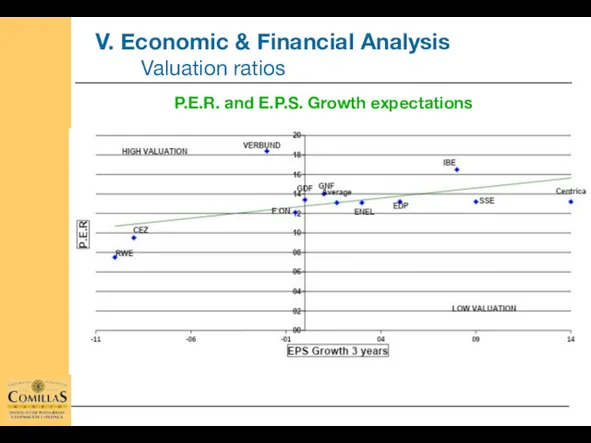

- 26. P.E.R. and E.P.S. Growth expectations

- 27. STOCK EXCHANGE RATIOS: EV / EBITDA Enterprise Value = Average Ratio x EBITDA IBE EV /

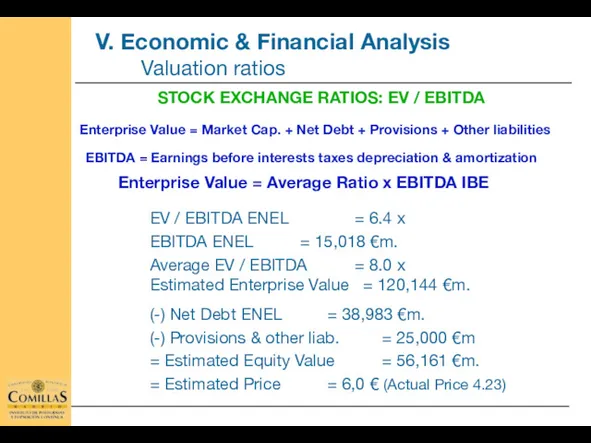

- 28. EV / Ebitda and Ebitda Growth expectations

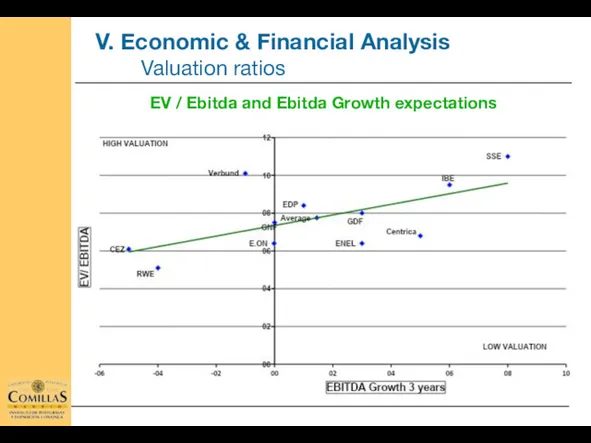

- 29. I. Cost structure of the Electricity Business. II. Capital Cost Analysis. III. Economic and Financial Analysis.

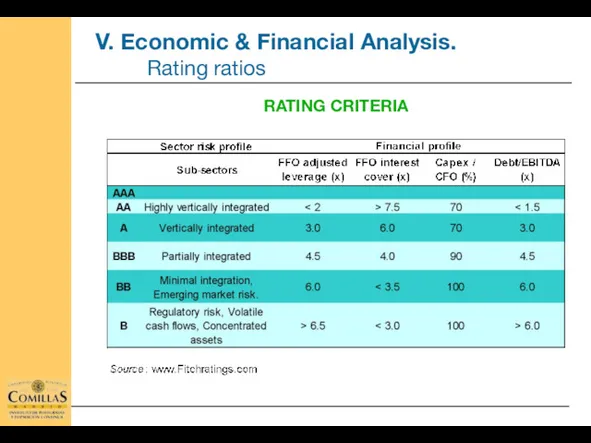

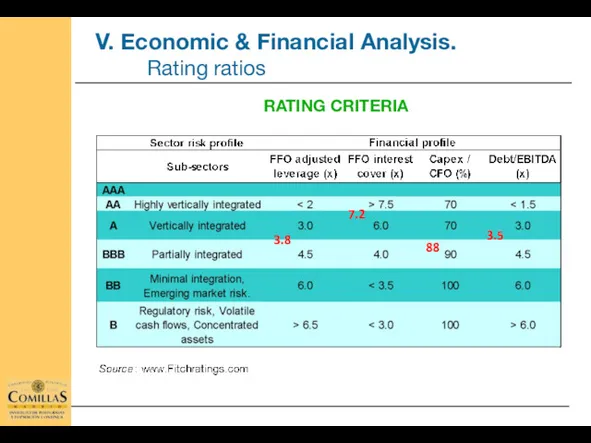

- 30. RATING CRITERIA

- 31. FFO adjusted leverage (x) FFO interest cover (x) Capex / FFO (%) Debt / Ebitda (x)

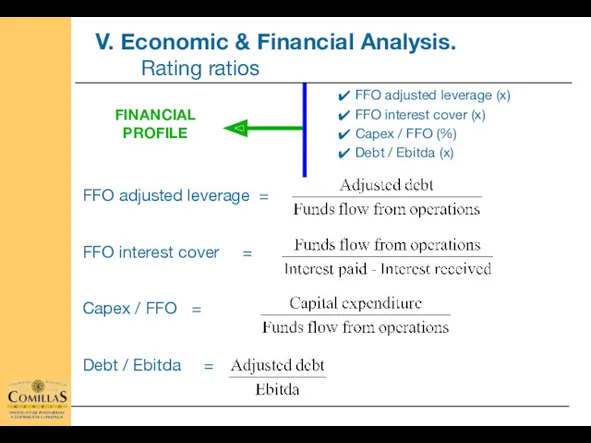

- 32. V. Capital cost analysis. Financial needs estimation

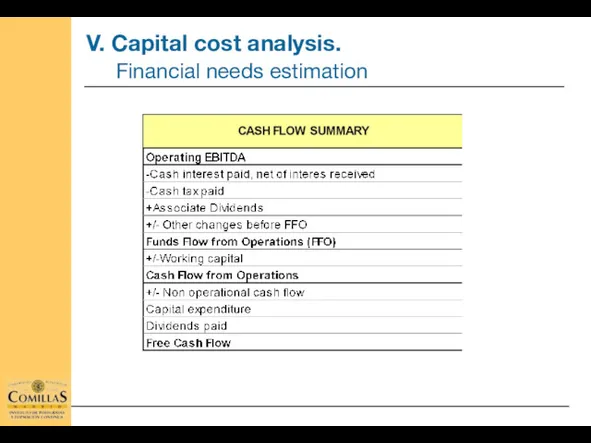

- 33. FFO adjusted leverage = = 3.8 FFO interest cover = = 7.2 Capex / FFO =

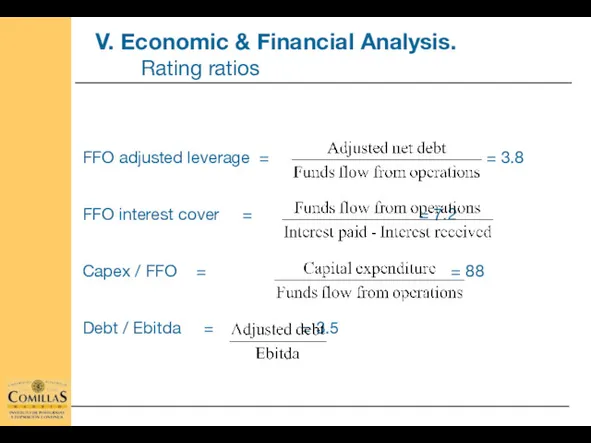

- 34. RATING CRITERIA 3.5 88 7.2 3.8

- 36. Скачать презентацию

Экономические циклы

Экономические циклы Глобальний економічний цикл. (Лекція 3)

Глобальний економічний цикл. (Лекція 3) Особая экономическая зона промышленно-производственного типа Липецк

Особая экономическая зона промышленно-производственного типа Липецк Инфляция и безработица

Инфляция и безработица Рынок труда в сфере юриспруденции

Рынок труда в сфере юриспруденции Отличия городского хозяйства от национального хозяйства

Отличия городского хозяйства от национального хозяйства Общественные блага. (Тема 13)

Общественные блага. (Тема 13) Энергоэффективные общественные здания. Архитектурные-планировочные и конструктивные особенности

Энергоэффективные общественные здания. Архитектурные-планировочные и конструктивные особенности Державне регулювання економіки та зовнішньоекономічна діяльність

Державне регулювання економіки та зовнішньоекономічна діяльність Инфляция

Инфляция Энергия будущего

Энергия будущего Segmentace trhu

Segmentace trhu Характеристика логистической инфраструктуры Алжира

Характеристика логистической инфраструктуры Алжира Достоинства и недостатки фирмы (экономика)

Достоинства и недостатки фирмы (экономика) Международная торговля

Международная торговля Оценка конкурентоспособности коммерческого предприятия и пути её повышения

Оценка конкурентоспособности коммерческого предприятия и пути её повышения Теория отраслевых рынков. Вертикальные отношения

Теория отраслевых рынков. Вертикальные отношения Основы теории фирмы (предприятия, организации)

Основы теории фирмы (предприятия, организации) Приоритетные направления в практике разработки стратегии

Приоритетные направления в практике разработки стратегии Презентация по экономики для 9 класса на тему Безработица

Презентация по экономики для 9 класса на тему Безработица Муниципальное образование город Обнинск

Муниципальное образование город Обнинск Кейнсианская революция и эволюция кейнсианства. Неоконсервативная революция. Монетаризм. Теория рациональных ожиданий

Кейнсианская революция и эволюция кейнсианства. Неоконсервативная революция. Монетаризм. Теория рациональных ожиданий Своя игра. Обществознание

Своя игра. Обществознание Экономическая сущность, формы и виды инвестиций

Экономическая сущность, формы и виды инвестиций Урок-обобщение по теме Бюджет и бюджетные отношения

Урок-обобщение по теме Бюджет и бюджетные отношения Экономика и технологические уклады. Сущность экономической деятельности

Экономика и технологические уклады. Сущность экономической деятельности Европейские страны Большой семерки

Европейские страны Большой семерки Разработка водного тура

Разработка водного тура