©Ella Khromova

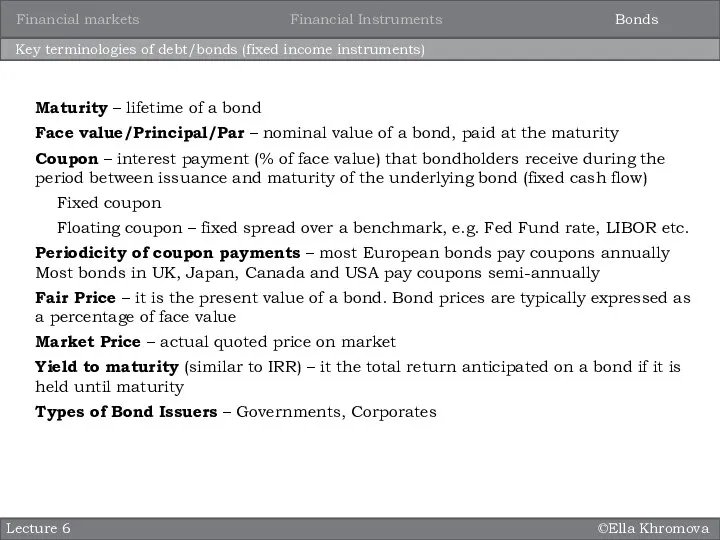

Key terminologies of debt/bonds (fixed income instruments)

Lecture 6

Maturity – lifetime

of a bond

Face value/Principal/Par – nominal value of a bond, paid at the maturity

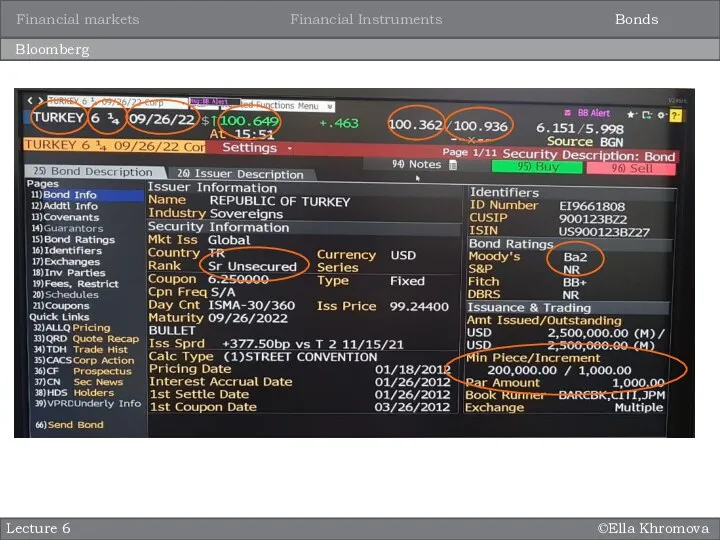

Coupon – interest payment (% of face value) that bondholders receive during the period between issuance and maturity of the underlying bond (fixed cash flow)

Fixed coupon

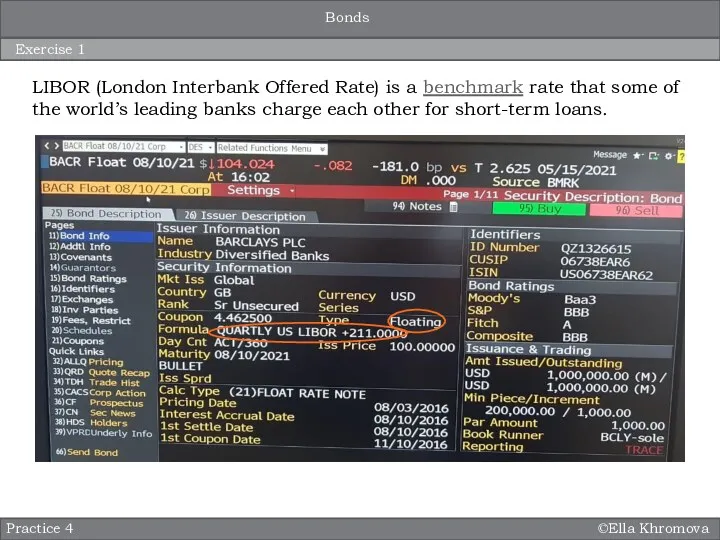

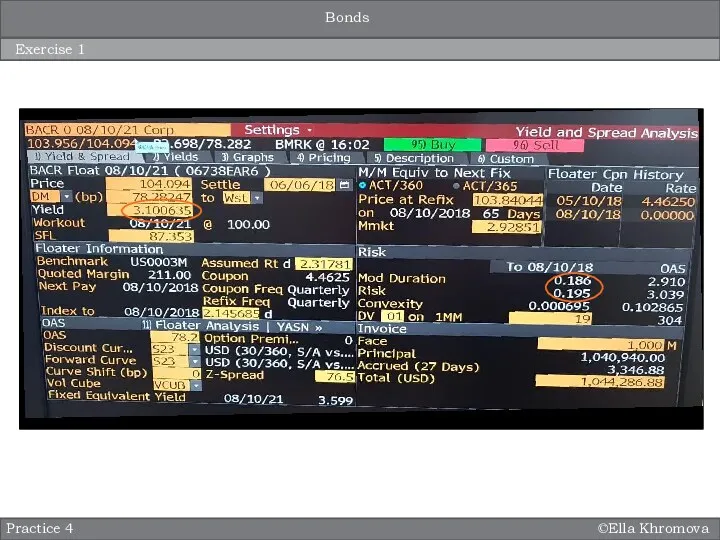

Floating coupon – fixed spread over a benchmark, e.g. Fed Fund rate, LIBOR etc.

Periodicity of coupon payments – most European bonds pay coupons annually Most bonds in UK, Japan, Canada and USA pay coupons semi-annually

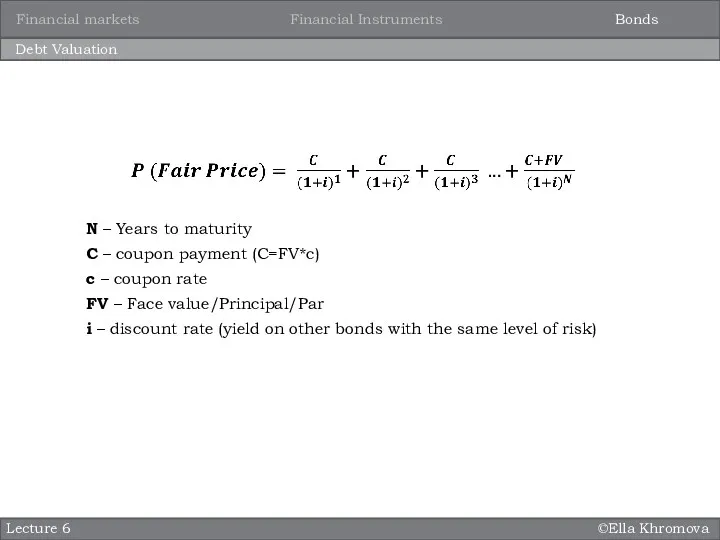

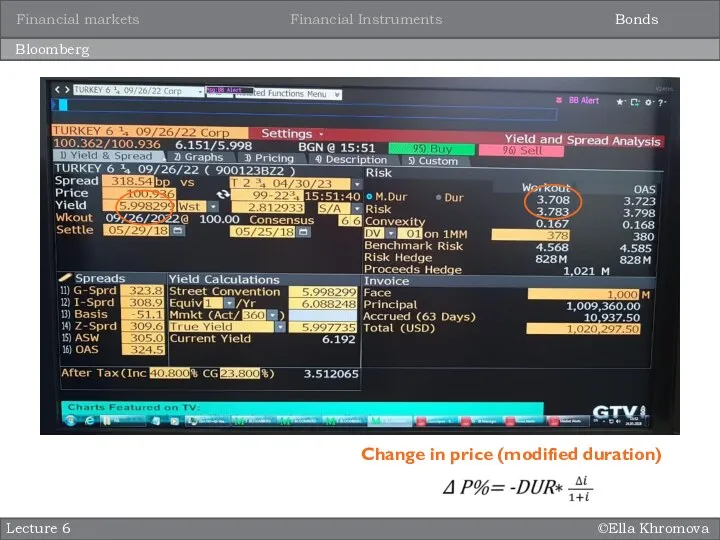

Fair Price – it is the present value of a bond. Bond prices are typically expressed as a percentage of face value

Market Price – actual quoted price on market

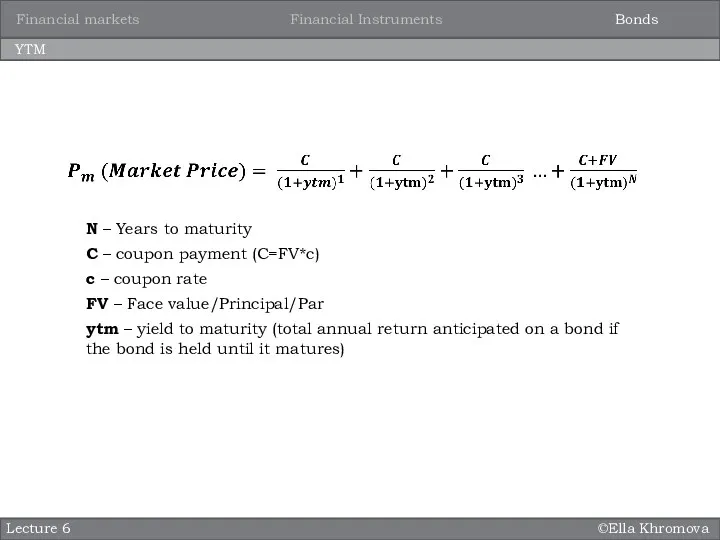

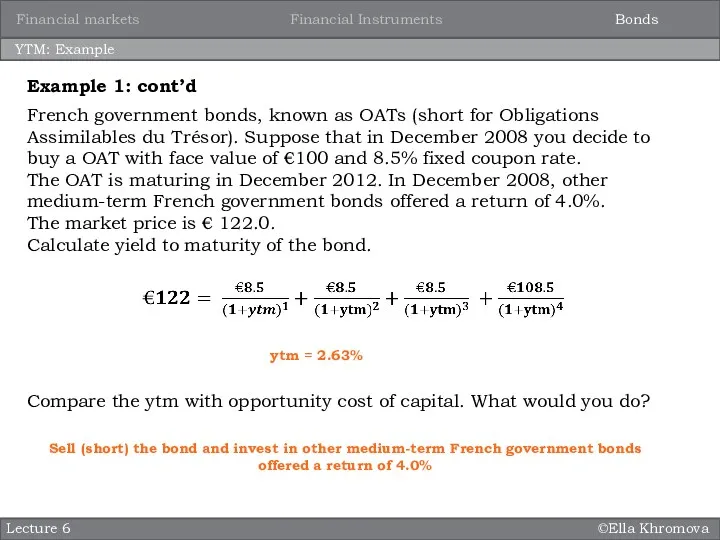

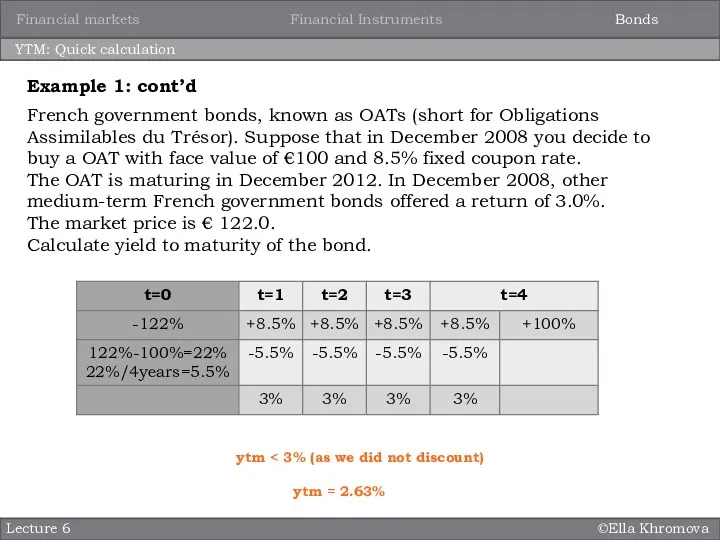

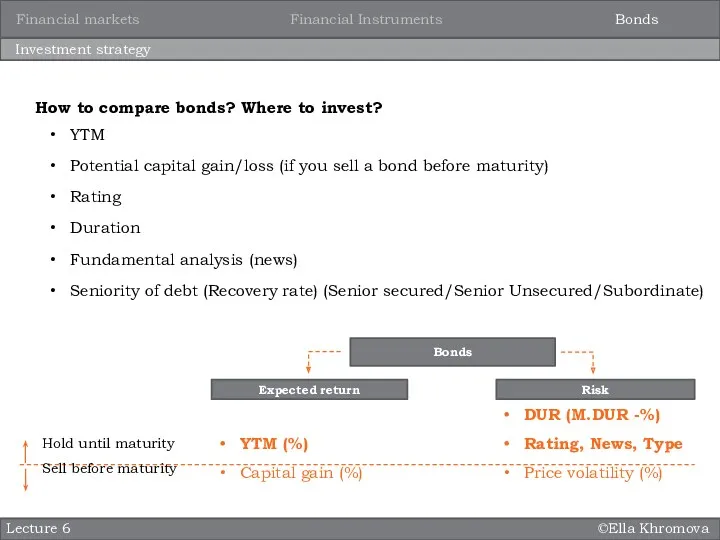

Yield to maturity (similar to IRR) – it the total return anticipated on a bond if it is held until maturity

Types of Bond Issuers – Governments, Corporates

Bonds

Financial Instruments

Financial markets

Социальная сфера в системе национальной экономики

Социальная сфера в системе национальной экономики Совершенная конкуренция, как тип рынка

Совершенная конкуренция, как тип рынка Роль государства в обеспечении устойчивости и конкурентоспособности предприятий горнодобывающей отрасли Арктической зоны РФ

Роль государства в обеспечении устойчивости и конкурентоспособности предприятий горнодобывающей отрасли Арктической зоны РФ Общество как сложная динамическая система

Общество как сложная динамическая система Инфрақұрылым түсінігі

Инфрақұрылым түсінігі Энергосбережение и повышение энергетической эффективности

Энергосбережение и повышение энергетической эффективности Информационные ресурсы и технологии в экономике

Информационные ресурсы и технологии в экономике Дальневосточный федеральный округ

Дальневосточный федеральный округ Статус территории опережающего социально-экономического развития

Статус территории опережающего социально-экономического развития Teorie regionálního rozvoje

Teorie regionálního rozvoje Социология богатых и бедных

Социология богатых и бедных Инфляция и семейная экономика

Инфляция и семейная экономика Инвестиции в основной капитал

Инвестиции в основной капитал Саладағы экономика

Саладағы экономика Защита экономических интересов государства при осуществлении внешней торговли

Защита экономических интересов государства при осуществлении внешней торговли Содружество независимых государств (СНГ)

Содружество независимых государств (СНГ) Рынок как объект управления. Рынок. Структура рынка

Рынок как объект управления. Рынок. Структура рынка Современные тренды развития мирового туризма

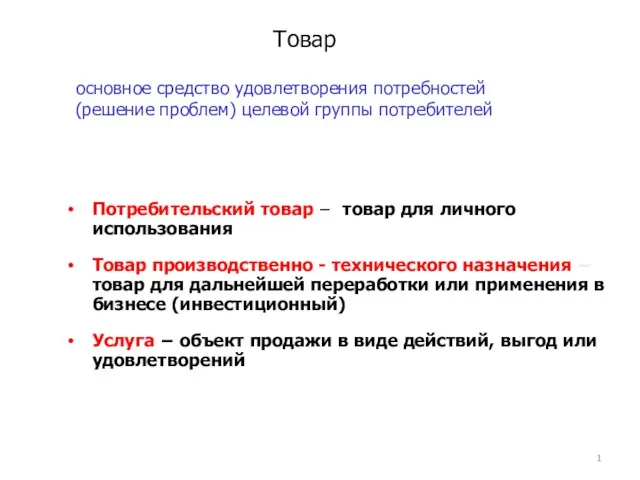

Современные тренды развития мирового туризма Товар. Классификация товаров

Товар. Классификация товаров Economia de piață. (Curs 2)

Economia de piață. (Curs 2) Результаты Уругвайского раунда переговоров ГАТТ

Результаты Уругвайского раунда переговоров ГАТТ Интеграционные процессы в АТР (азиатско-тихоокеанский регион) и их особенности

Интеграционные процессы в АТР (азиатско-тихоокеанский регион) и их особенности Модернизация экономики севера

Модернизация экономики севера Международные компании и инновационное развитие мировой экономики

Международные компании и инновационное развитие мировой экономики Институционализм. Сущность, этапы развития и методология

Институционализм. Сущность, этапы развития и методология Экономические циклы

Экономические циклы Разделение и кооперация труда

Разделение и кооперация труда Жилищная экономика и жилищная политика. (Тема 8)

Жилищная экономика и жилищная политика. (Тема 8)