Содержание

- 2. CONTENT: 1. General definitions and terms of GE. 2. Theories of the world trade (WT). 3.

- 3. Part 1. General definitions and terms of GE.

- 4. The difference between similar terms: economic/economical Economic pertains to the economy. Economical means not wasteful. economy/economics

- 5. The world economy or global economy is the economy of the world, considered as the international

- 6. A subject matter of GE is WER. WER: trade of goods and services; capital flow; labour

- 7. BACKGROUND AND FORMATION PERIOD OF GE: 1. Definition of GE and global market. 2. International division

- 8. IDL - the allocation of various parts of the production process to different places in the

- 9. GENERAL MEANING OF THE TERM «GE»: a system of world economic relations, national economies` cooperation; A

- 10. Stages of GE’s formation: Age of Discovery Before the 1st World War Between 2 World Wars

- 12. GE – a system of Goods, Services and Capital exchange between Buyers (Customers) and Sellers. Attributes/

- 13. World Trade theories: Mercantilism Absolute advantages Comparative advantages Heckscher-Ohlin theorem Technological gap by Posner and Product

- 14. Part 2. Theories of WT.

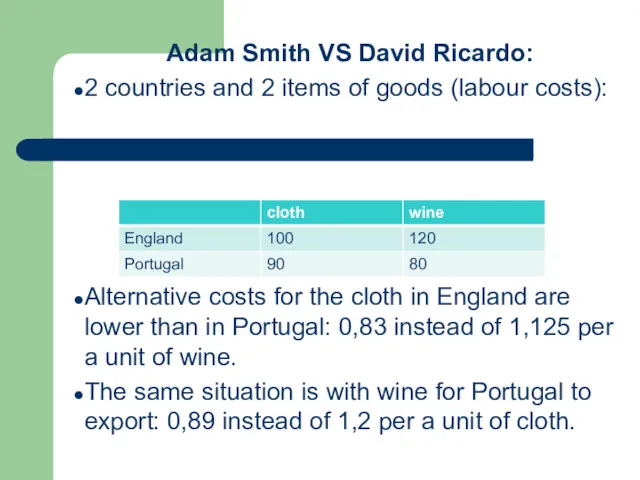

- 15. Adam Smith VS David Ricardo: 2 countries and 2 items of goods (labour costs): Alternative costs

- 16. Basics of Heckscher Ohlin theory: 2 countries 2 items of goods – cloth and food 2

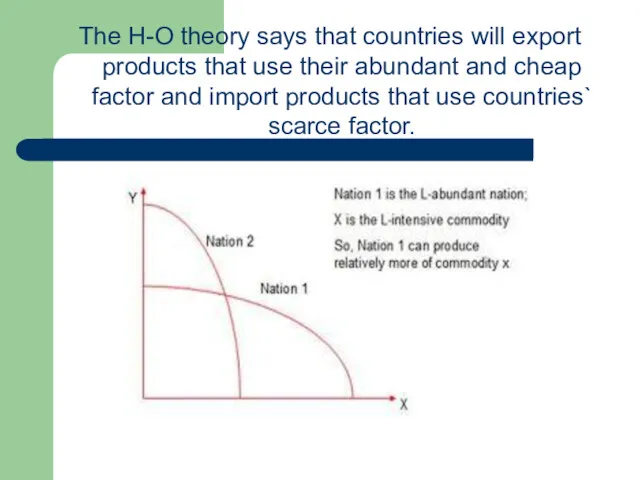

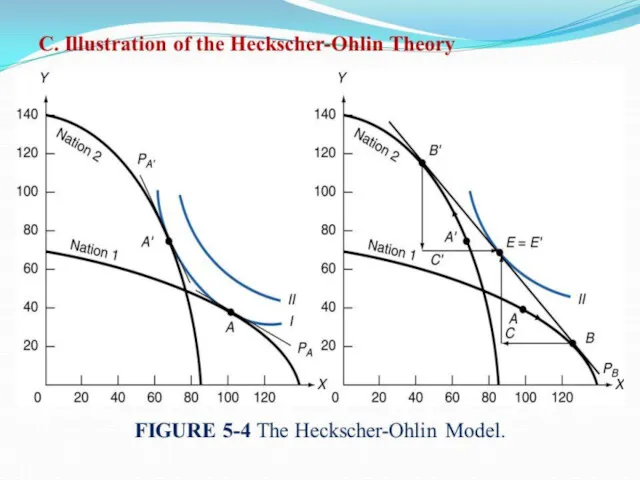

- 17. The H-O theory says that countries will export products that use their abundant and cheap factor

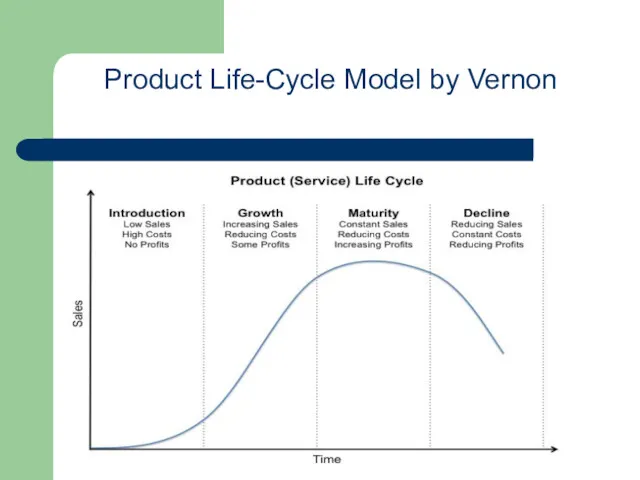

- 19. Product Life-Cycle Model by Vernon

- 20. Part 3. WT regulation. Free trading and protectionism. INCOTERMS 2010.

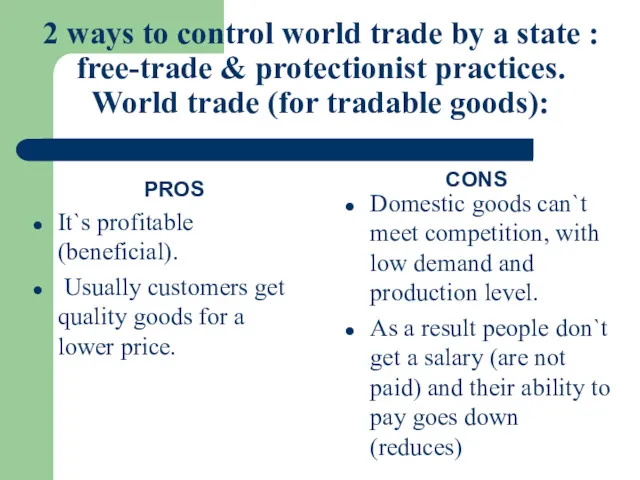

- 21. 2 ways to control world trade by a state : free-trade & protectionist practices. World trade

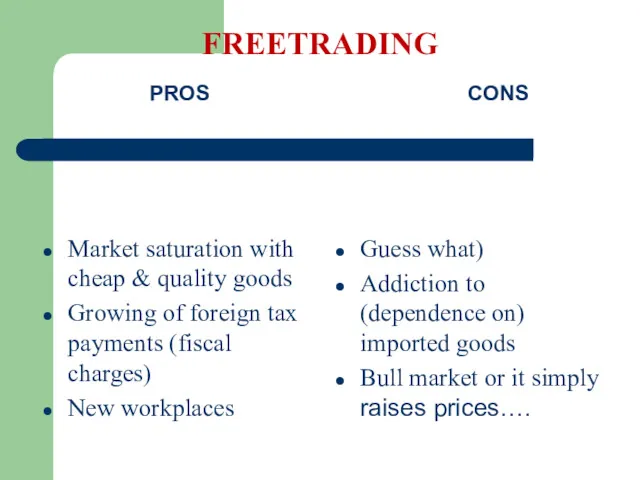

- 22. FREETRADING PROS Market saturation with cheap & quality goods Growing of foreign tax payments (fiscal charges)

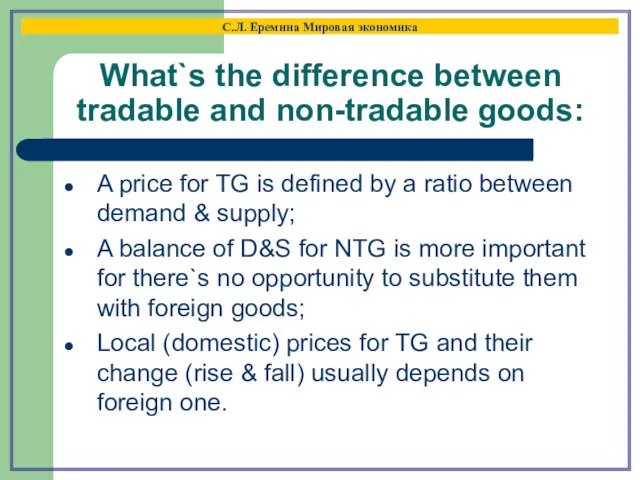

- 23. What`s the difference between tradable and non-tradable goods: С.Л. Еремина Мировая экономика A price for TG

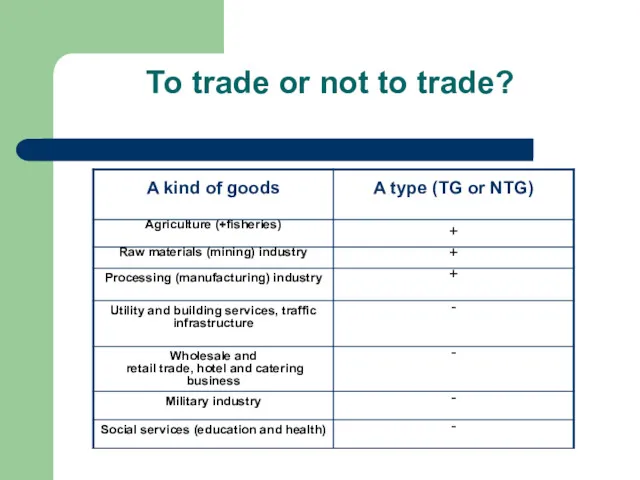

- 24. To trade or not to trade?

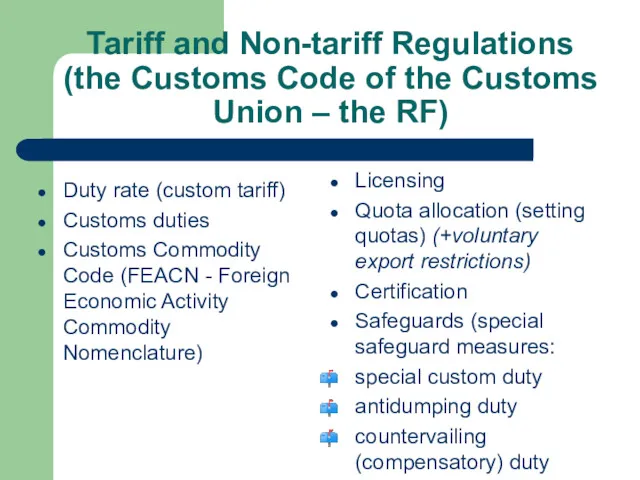

- 25. Tariff and Non-tariff Regulations (the Customs Code of the Customs Union – the RF) Duty rate

- 26. Eurasian Economic Union is an economic unionis an economic union of states located primarily in northern

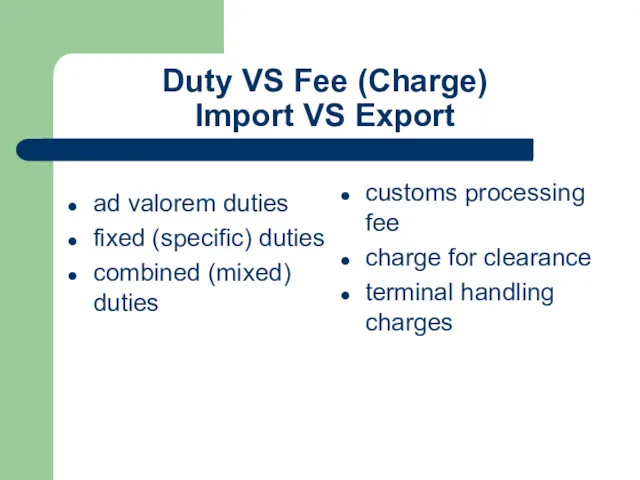

- 27. Duty VS Fee (Charge) Import VS Export ad valorem duties fixed (specific) duties combined (mixed) duties

- 28. Russia VS other countries General rate of duties Most favoured nation treatment Preferential duties

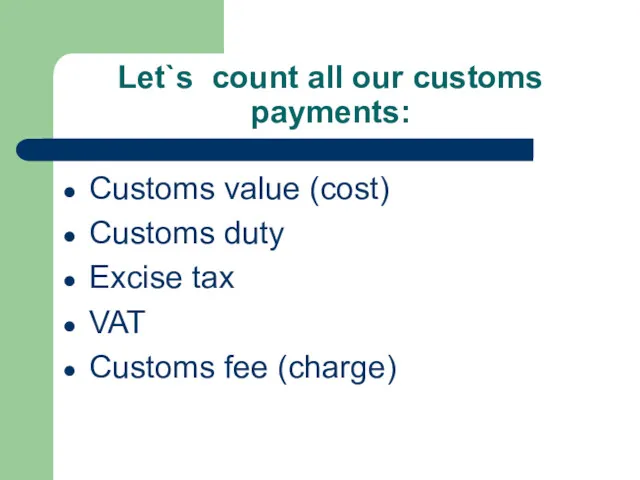

- 29. Let`s count all our customs payments: Customs value (cost) Customs duty Excise tax VAT Customs fee

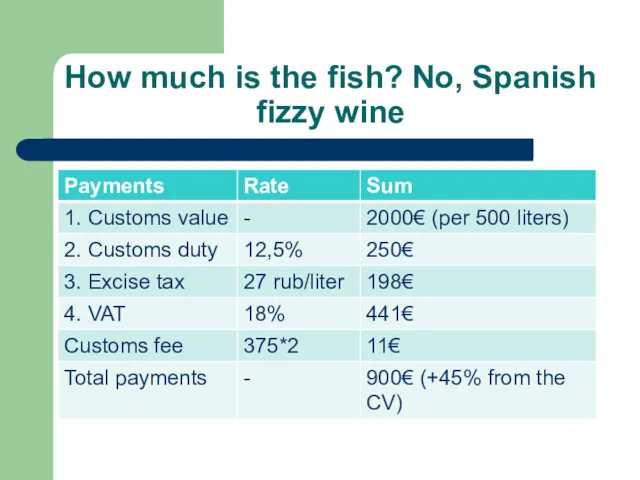

- 30. How much is the fish? No, Spanish fizzy wine

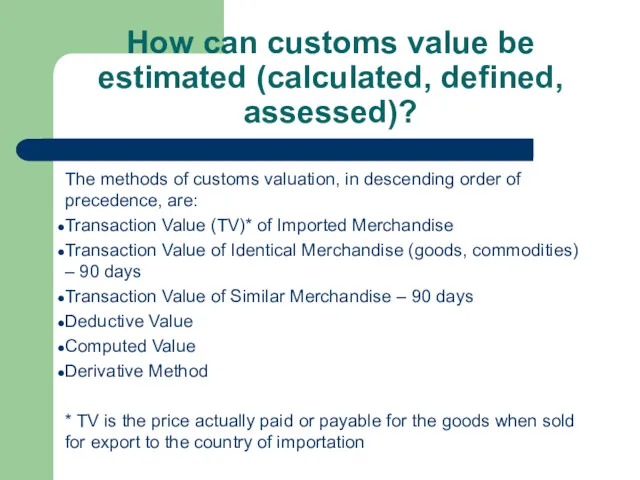

- 31. How сan customs value be estimated (calculated, defined, assessed)? The methods of customs valuation, in descending

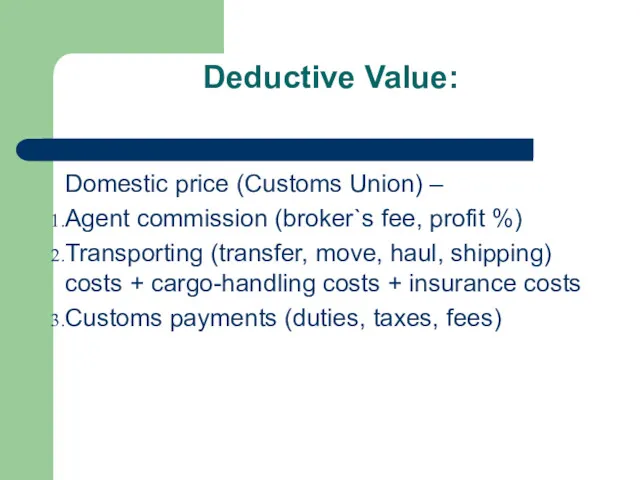

- 32. Deductive Value: Domestic price (Customs Union) – Agent commission (broker`s fee, profit %) Transporting (transfer, move,

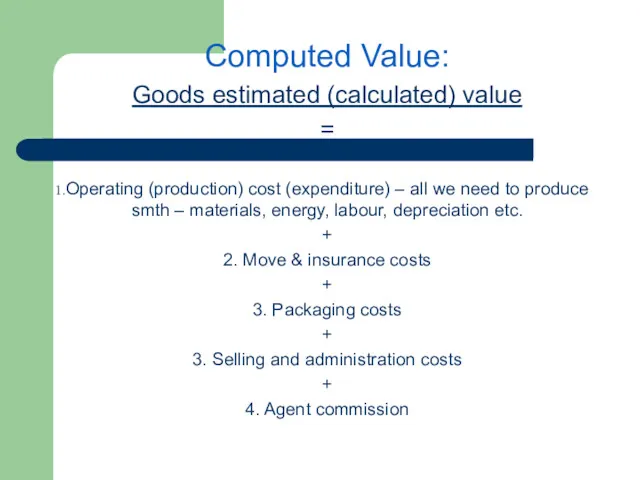

- 33. Computed Value: Goods estimated (calculated) value = Operating (production) cost (expenditure) – all we need to

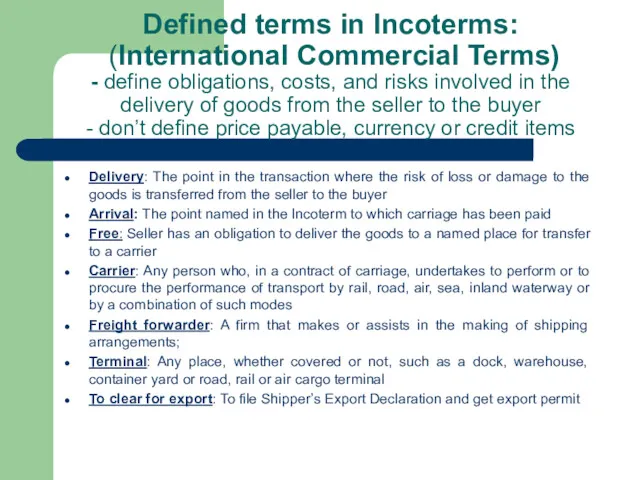

- 34. Defined terms in Incoterms: (International Commercial Terms) - define obligations, costs, and risks involved in the

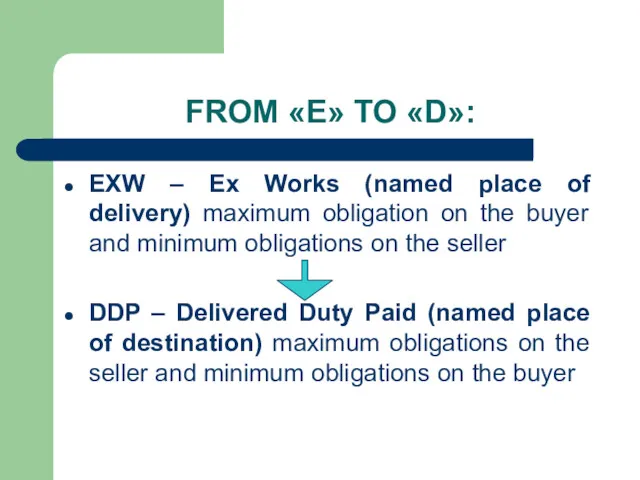

- 35. FROM «E» TO «D»: EXW – Ex Works (named place of delivery) maximum obligation on the

- 36. The Economic Integration between two countries is a measure of how much two or more countries

- 37. Part 4. Economic integration.

- 38. Economic integration: is the unification of economic policies between different states; the partial or full abolition

- 39. What is the basis of economic integration? Comparative advantageComparative advantage refers to the ability of a

- 40. Degrees of economic integration: Preferential trading area Free trade area (North American Free Trade Agreement) Customs

- 41. Additional info about degrees: A "free trade area" (FTA) is formed when at least two states

- 42. Pros and Cons of Economic Integration: Trade benefits: a reduction in the trade cost; an improved

- 43. Measuring Economic Integration The methodology for measuring economic integration typically involves the combination of multiple economic

- 44. Part 5. Currency. International monetary system.

- 45. Currency refers to a particular authorized monetary system, monetized in specific units (euros, dollars, pesos, etc.)

- 46. Each currency typically has a main currency unit (the dollar(the dollar, for example, or the euro)

- 47. Convertibility of a currency determines the ability of an individual, corporate or government to convert its

- 48. Partially convertible Central banks control international investments flowing in and out of the country, while most

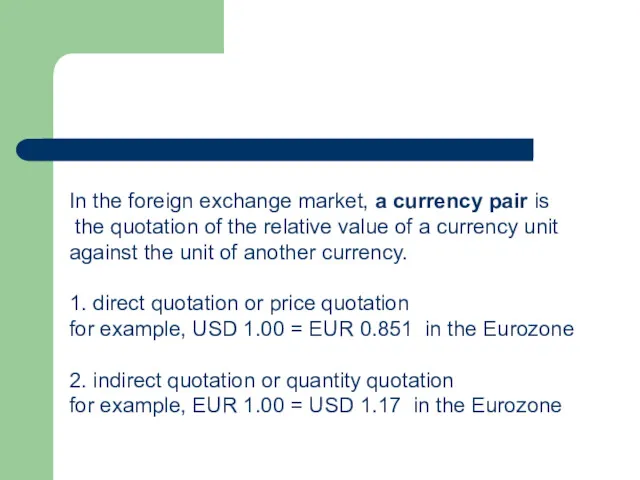

- 49. In the foreign exchange market, a currency pair is the quotation of the relative value of

- 50. Example: Russian ruble is the national currency. Direct quotation is 57,03 USD/RUB which means you can

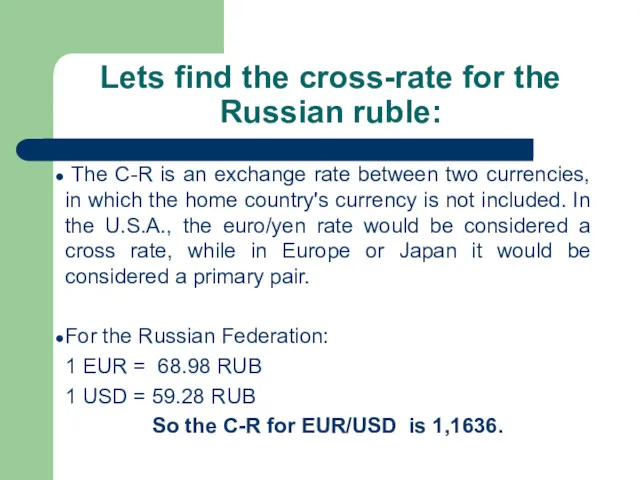

- 51. Lets find the cross-rate for the Russian ruble: The C-R is an exchange rate between two

- 52. An exchange-rate regime (ERR) is the way an authority manages its currency is the way an

- 53. Floating rates are the most common exchange rate regime today. For example, the dollar, euro, yenthe

- 54. Pegged floating currencies are pegged to some band or value, either fixed or periodically adjusted. During

- 55. Fixed rates are those that have direct convertibility towards another currency. In case of a separate

- 58. International monetary systems (IMS) International monetary systems are sets of internationally agreed rules and supporting institutions,

- 59. What do IMS provide? Confidence Sufficient liquidity for fluctuating levels of trade Means by which global

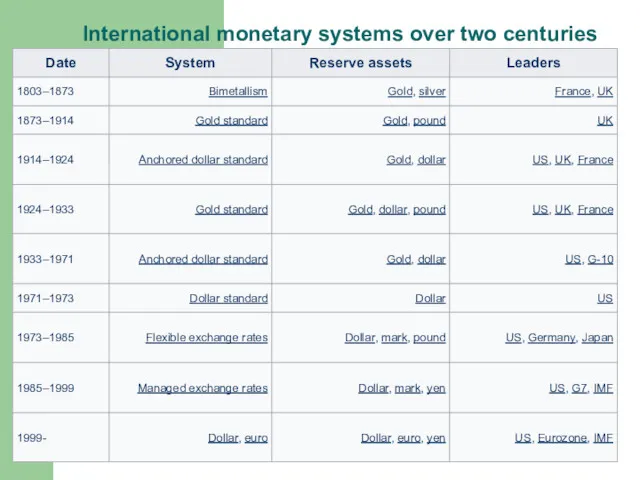

- 60. International monetary systems over two centuries

- 61. Competing ideas for the next international monetary system

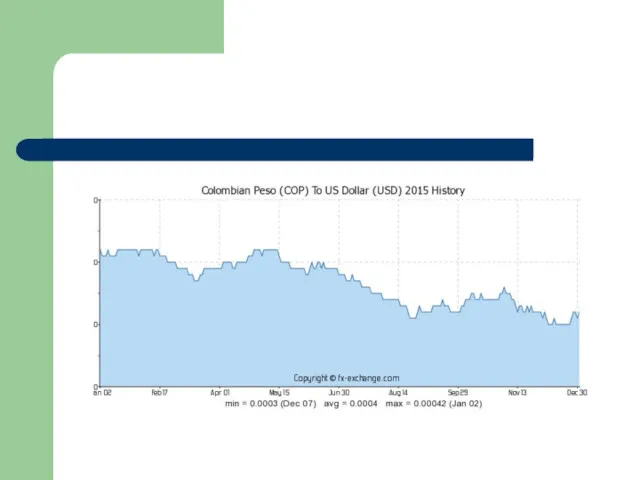

- 62. By the way, what`s about the Russian ruble? As for the ruble, in spite of high

- 63. Part 6. Transnational corporations.

- 64. Transnational Corporations

- 65. The United Nations has justly described TNC as “the productive core of the globalizing world economy.”

- 66. Sustainable Development Goals (SDGs) and TNCs The globalization of economic activity in general, and the growing

- 67. The Sustainable Development Goals (SDGs). Goal 1: No Poverty Goal 2: Zero Hunger Goal 3: Good

- 68. What are the functions of TNC? Importing and exporting goods and services Making significant investments in

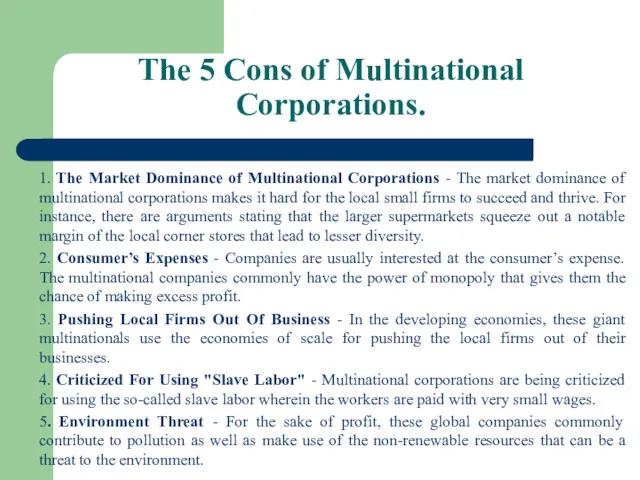

- 69. The 5 Cons of Multinational Corporations. 1. The Market Dominance of Multinational Corporations - The market

- 71. Скачать презентацию

Структурные формы конкуренции. Совершенная конкуренция. Модели несовершенной конкуренции

Структурные формы конкуренции. Совершенная конкуренция. Модели несовершенной конкуренции Институциональная теория фирмы. (Тема 9)

Институциональная теория фирмы. (Тема 9) Внешнеторговая политика и роль государства в ее регулировании

Внешнеторговая политика и роль государства в ее регулировании Анализ производства и реализации продукции

Анализ производства и реализации продукции Формирование объемов деятельности предприятия

Формирование объемов деятельности предприятия Субъект международного права : Республика Индия

Субъект международного права : Республика Индия Зарождение и развитие маржинализма

Зарождение и развитие маржинализма Теоретические основы экономики труда

Теоретические основы экономики труда Государственное регулирование ВЭД

Государственное регулирование ВЭД Производство - основа экономики

Производство - основа экономики Табиғи ресурстарды бағалау

Табиғи ресурстарды бағалау Инфляция и ее измерение

Инфляция и ее измерение Макроэкономика после Дж.М. Кейнса

Макроэкономика после Дж.М. Кейнса Макроэкономические показатели и система национального счетоводства

Макроэкономические показатели и система национального счетоводства Капитализм в современной России

Капитализм в современной России Demand and supply. The purchasing power of money

Demand and supply. The purchasing power of money Факторы процесса ресурсосбережения

Факторы процесса ресурсосбережения Международная экономическая интеграция (часть 1)

Международная экономическая интеграция (часть 1) Демографическая ситуация в современной России

Демографическая ситуация в современной России Распад плановой экономики 90-ых годов и переход на рыночние рельсы в России

Распад плановой экономики 90-ых годов и переход на рыночние рельсы в России Brexit: reasons and possible implications

Brexit: reasons and possible implications Всемирная организация здравоохранения

Всемирная организация здравоохранения Модель соціальної політики Японії

Модель соціальної політики Японії Проектная работа на тему: Челябинская агломерация

Проектная работа на тему: Челябинская агломерация Муда (потери). Виды потерь

Муда (потери). Виды потерь Оценка экономической эффективности вложений в проект по производству виноматериала

Оценка экономической эффективности вложений в проект по производству виноматериала Планирование экономических показателей работы автомобилей на шиноремонтном участке

Планирование экономических показателей работы автомобилей на шиноремонтном участке Measuring a nation’s income

Measuring a nation’s income