Содержание

- 2. 1. The discontents of globalization - Pressing issues - Underlying general concerns - Conditionality - Global

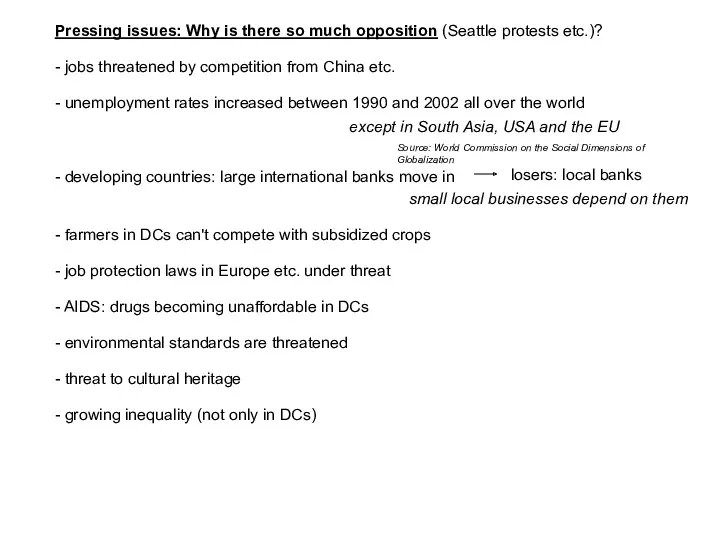

- 3. Pressing issues: Why is there so much opposition (Seattle protests etc.)? - jobs threatened by competition

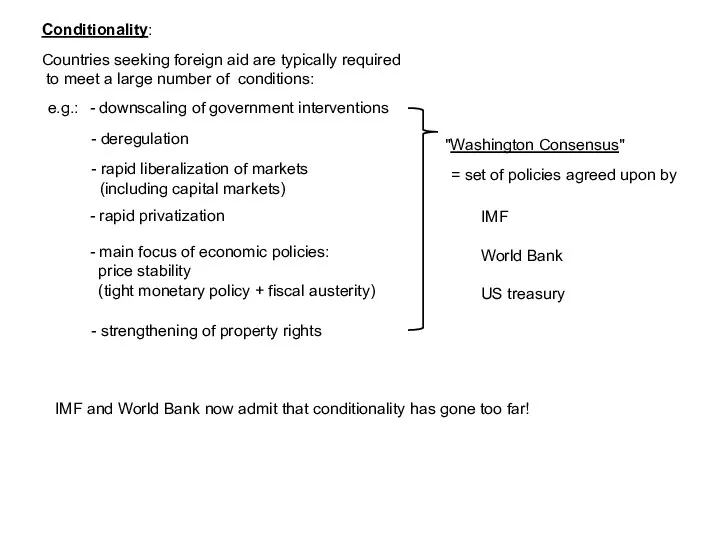

- 5. Conditionality: Countries seeking foreign aid are typically required to meet a large number of conditions: e.g.:

- 6. Global governance Still far away: single legitimate global government! Problems:

- 7. Development "There is no magic solution!" Problems: - uneven distribution of new wealth - education -

- 8. Consequence: Policies must change! The government must play a more active role! must promote development and

- 9. Washington Consensus ? based on a market theory of perfect competition but: Markets are always more

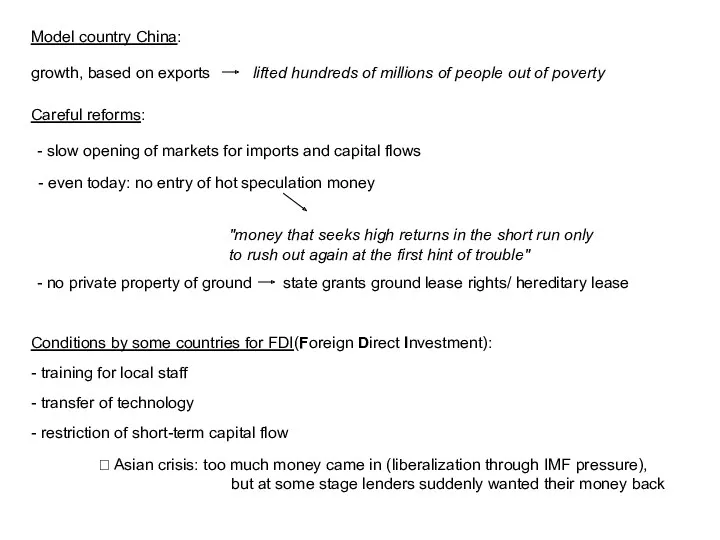

- 10. Model country China: growth, based on exports lifted hundreds of millions of people out of poverty

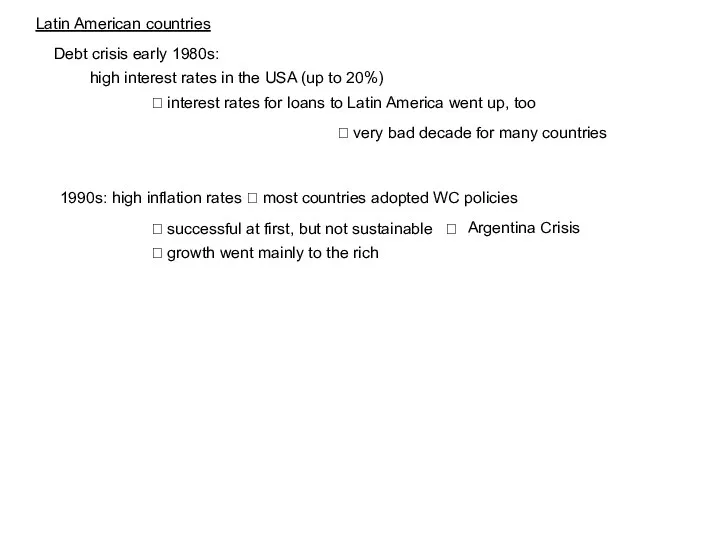

- 11. Latin American countries Debt crisis early 1980s: high interest rates in the USA (up to 20%)

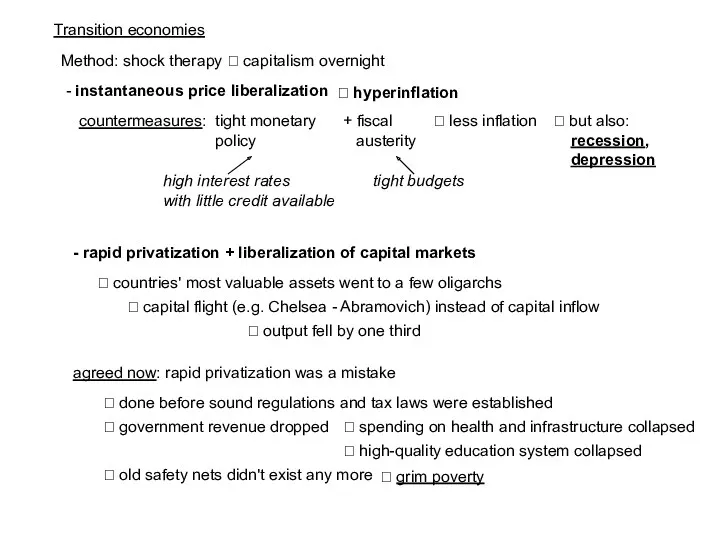

- 12. Transition economies Method: shock therapy ? capitalism overnight - instantaneous price liberalization ? hyperinflation tight monetary

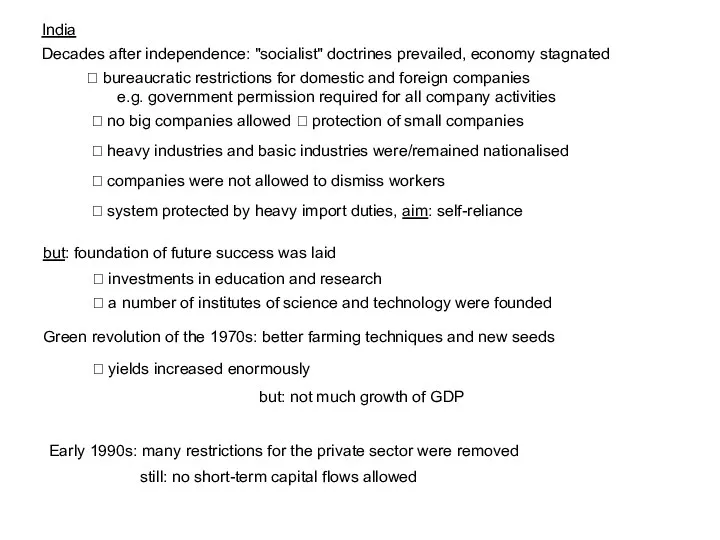

- 13. India Decades after independence: "socialist" doctrines prevailed, economy stagnated but: foundation of future success was laid

- 14. A vision of development Goal: sustainable, equitable and democratic development Focus: increase of living standards Measurement:

- 15. Free Trade Theory: free trade benefits everybody Problems: ? there is no free trade (in many

- 16. Consequence: Developing countries should be treated differently ? widely accepted view now developed countries can deviate

- 17. Subsidy problem: 2/3 of farm income in Norway and Switzerland come from subsidies Japan: 1/2 EU:

- 18. Trade barriers are still around - safeguards e.g. through WTO sanctions: ? in case of a

- 19. Patents TRIPS: ? WTO agreement that forces countries to recognize patents and copyrights Trade-Related Aspects of

- 20. Proposal: - medicines at cost to DCs - compulsory licenses to allow DCs to produce drugs

- 21. "The resource curse" Paradox: many resource-rich countries have high poverty rates e.g. Nigeria (oil-rich country): -

- 22. Alternatives: - state-owned companies can keep the wealth in the country ? successful cases: - Malaysia

- 23. - "Extractive Industries Transparency Initiative": ? no tax deduction for payments to foreign governments without disclosure

- 24. Saving the Planet The Tragedy of the Commons: Middle Ages: more and mor sheep on common

- 25. Kyoto Protocol: - DCs are not obliged to anything, but: by 2025 their emissions will exceed

- 26. ? common tax on greenhouse gases (same rate for all countries) - social costs must be

- 27. Multinational corporations ? they are rich: richer than most countries in the developing world ? powerful

- 28. bribery and corruption: ? "it's much cheaper to pay a government official a large bribe than

- 29. Proposals: - Limiting the power of corporations: reqires a global competition law and a global competition

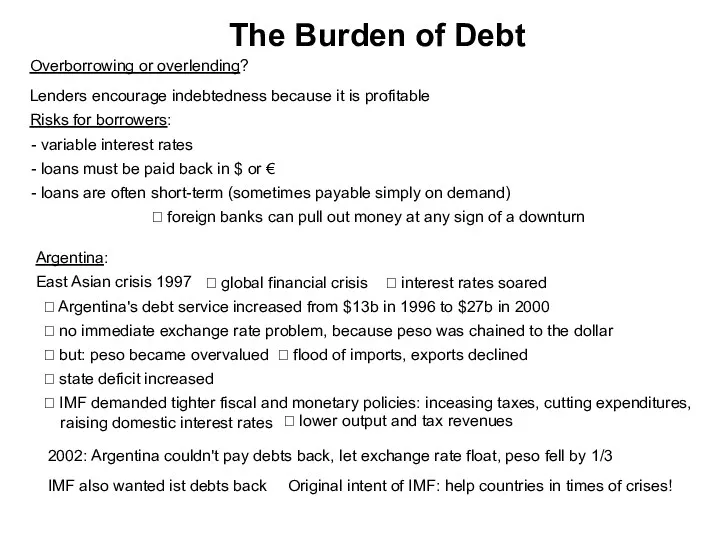

- 30. The Burden of Debt Overborrowing or overlending? Lenders encourage indebtedness because it is profitable Risks for

- 32. Скачать презентацию

Внешние эффекты (экстерналии)

Внешние эффекты (экстерналии) Обоснование ресурсов. Производственные мощности. Капитальные затраты. Затраты на сырье и материалы

Обоснование ресурсов. Производственные мощности. Капитальные затраты. Затраты на сырье и материалы Экономика және оның қоғам өміріндегі орны

Экономика және оның қоғам өміріндегі орны Демография – наука о народонаселении

Демография – наука о народонаселении Правовое и организационное обеспечение экономической безопасности

Правовое и организационное обеспечение экономической безопасности Экономический рост и развитие

Экономический рост и развитие Презентация Упражнения по теме спрос и предложение

Презентация Упражнения по теме спрос и предложение Статистические показатели, используемые в государственном регулировании

Статистические показатели, используемые в государственном регулировании Типи країн та показники їх економічного рівня

Типи країн та показники їх економічного рівня Предмет и метод экономической теории. (Тема 1)

Предмет и метод экономической теории. (Тема 1) Государственные и муниципальные унитарные предприятия. Производственные кооперативы. Объединения предприятий. Малый бизнес

Государственные и муниципальные унитарные предприятия. Производственные кооперативы. Объединения предприятий. Малый бизнес Историческое развитие человечества. Формационный подход

Историческое развитие человечества. Формационный подход Тема 9_Открытая экономика при несовершенной мобильности капитала

Тема 9_Открытая экономика при несовершенной мобильности капитала Понятие, источники, элементы и показатели предпринимательского дохода

Понятие, источники, элементы и показатели предпринимательского дохода Главная цель экономического развития региона Ленинградской области

Главная цель экономического развития региона Ленинградской области Занятие 29. Экономический рост

Занятие 29. Экономический рост Международные валютно-кредитные и финансовые организации и их регулирующая роль в мировом хозяйстве

Международные валютно-кредитные и финансовые организации и их регулирующая роль в мировом хозяйстве Занятие по Экономическому практикуму

Занятие по Экономическому практикуму Рынок инноваций

Рынок инноваций Развитие промышленности в Краснодарском крае

Развитие промышленности в Краснодарском крае Преступления в сфере экономической деятельности. Тема 21

Преступления в сфере экономической деятельности. Тема 21 Сукупний попит та сукупна пропозиція: макроекономічна рівновага. (Тема 5)

Сукупний попит та сукупна пропозиція: макроекономічна рівновага. (Тема 5) Технологічна політика ТНК

Технологічна політика ТНК Анализ технологических укладов

Анализ технологических укладов Территория опережающего социально-экономического развития

Территория опережающего социально-экономического развития Риск и неопределенность

Риск и неопределенность Экономика семьи

Экономика семьи Экономика: наука и хозяйство

Экономика: наука и хозяйство