Содержание

- 2. ECONOMIC GROWTH I: CAPITAL ACCUMULATION & POPULATION GROWTH 8

- 3. 8-1 The Accumulation of Capital 8-2 The Golden Rule Level of Capital 8-3 Population Growth

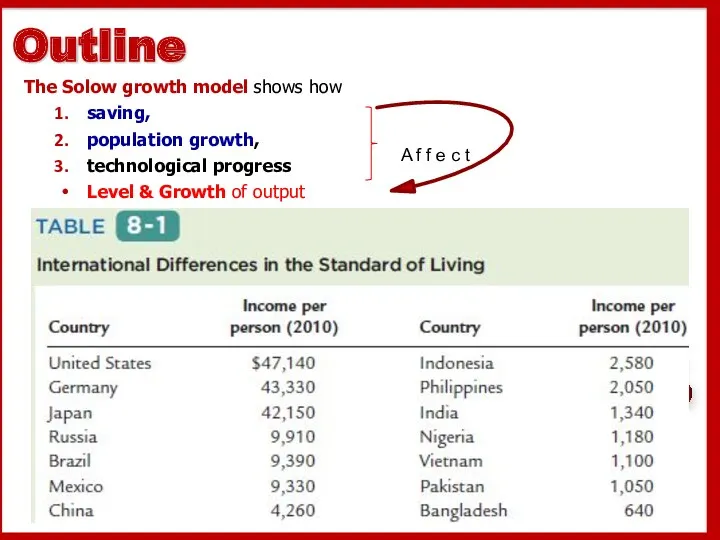

- 4. The Solow growth model shows how saving, population growth, technological progress Level & Growth of output

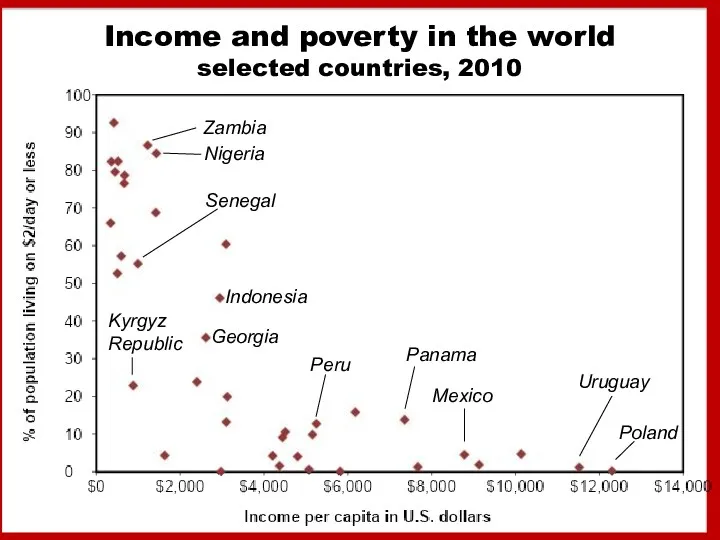

- 5. Income and poverty in the world selected countries, 2010 Indonesia Uruguay Poland Senegal Kyrgyz Republic Nigeria

- 6. 8-1 The Accumulation of Capital The Supply and Demand for Goods Growth in the Capital Stock

- 7. y = Y/L is output per worker k = K/L is capital per worker f(k) =

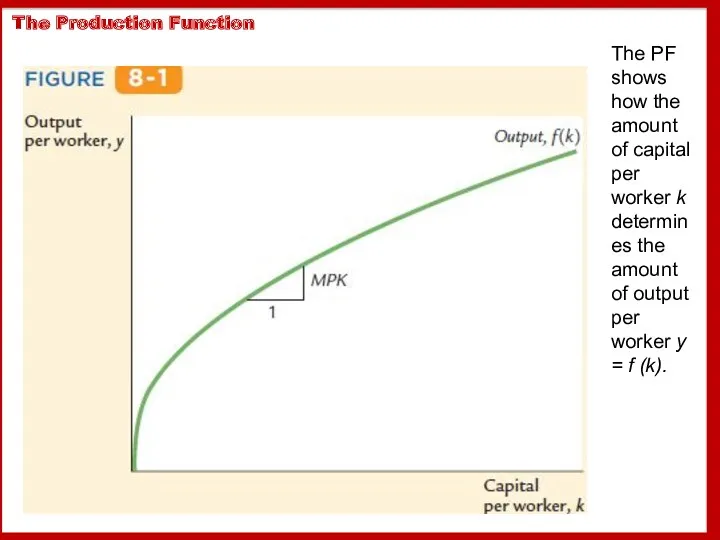

- 8. The Production Function The PF shows how the amount of capital per worker k determines the

- 9. 8-1 The Accumulation of Capital The Supply and Demand for Goods Growth in the Capital Stock

- 10. 8-1 The Accumulation of Capital The Supply and Demand for Goods Growth in the Capital Stock

- 11. 8-1 The Accumulation of Capital The Supply and Demand for Goods Growth in the Capital Stock

- 12. 8-1 The Accumulation of Capital The Supply and Demand for Goods Growth in the Capital Stock

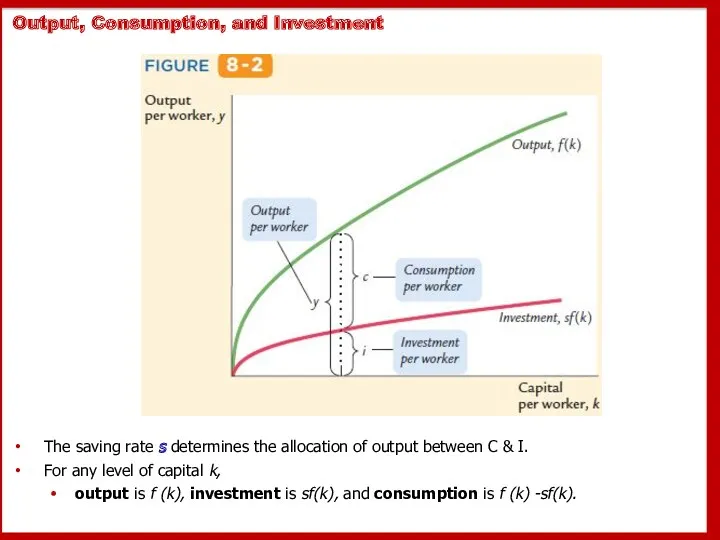

- 13. Output, Consumption, and Investment The saving rate s determines the allocation of output between C &

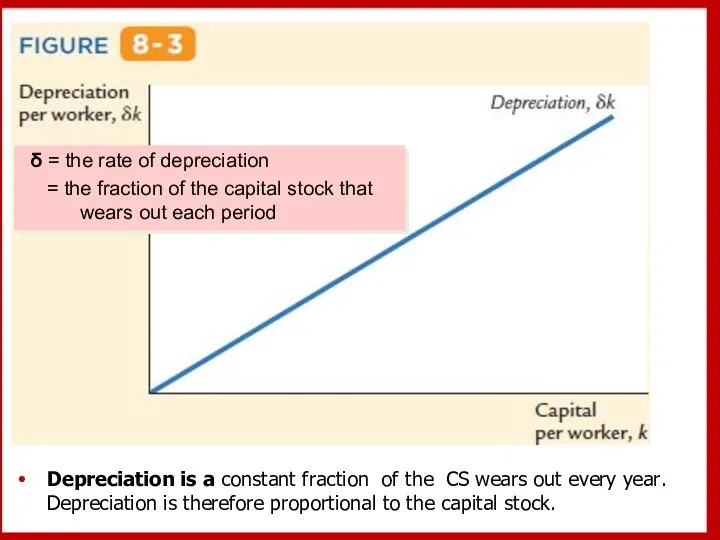

- 14. Depreciation is a constant fraction of the CS wears out every year. Depreciation is therefore proportional

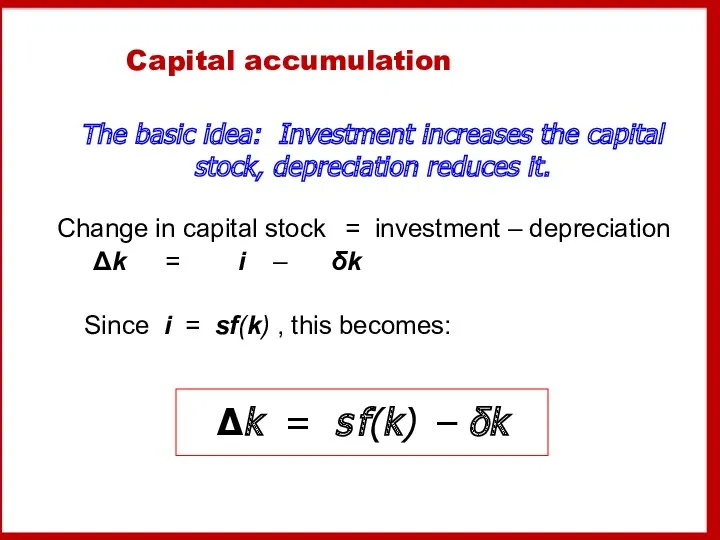

- 15. Capital accumulation Change in capital stock = investment – depreciation Δk = i – δk Since

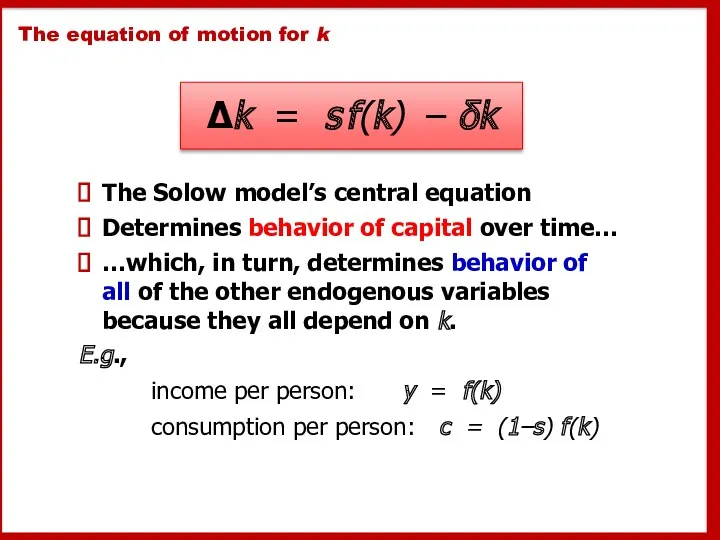

- 16. The equation of motion for k The Solow model’s central equation Determines behavior of capital over

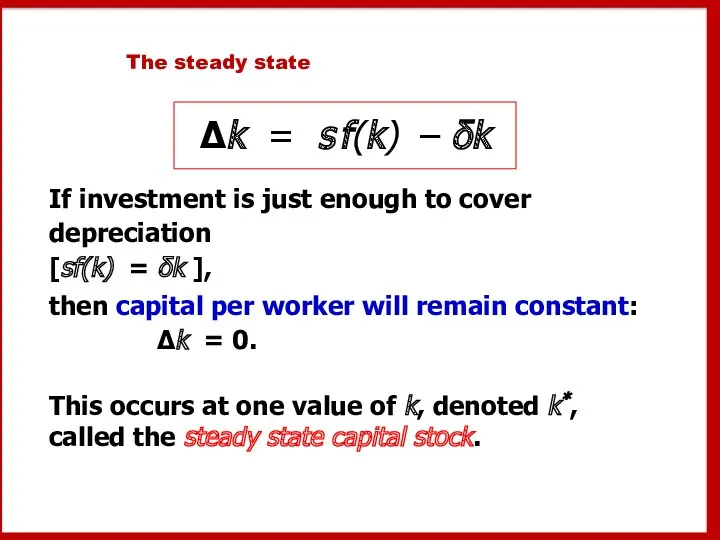

- 17. The steady state If investment is just enough to cover depreciation [sf(k) = δk ], then

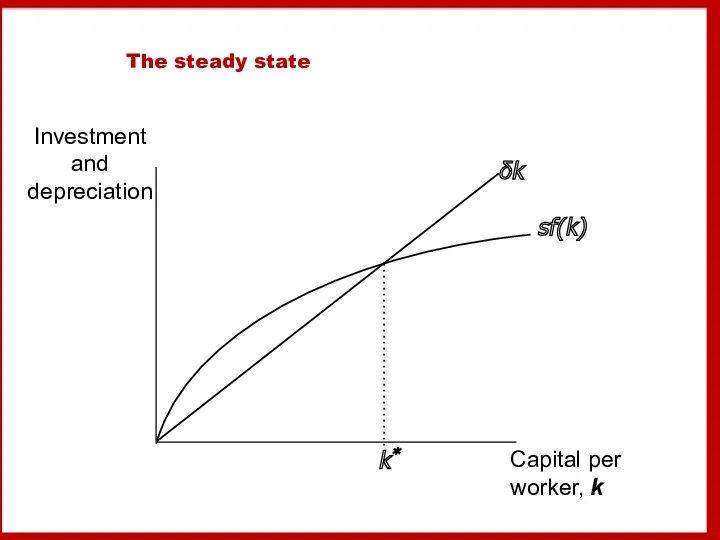

- 18. The steady state

- 19. Moving toward the steady state Δk = sf(k) − δk

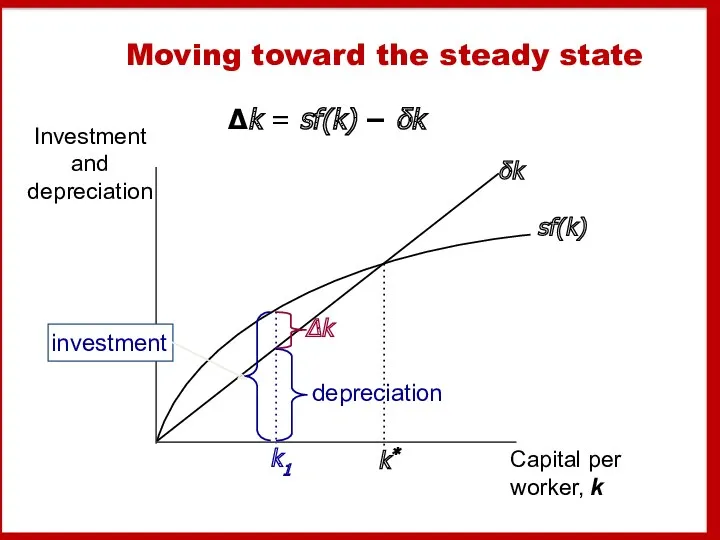

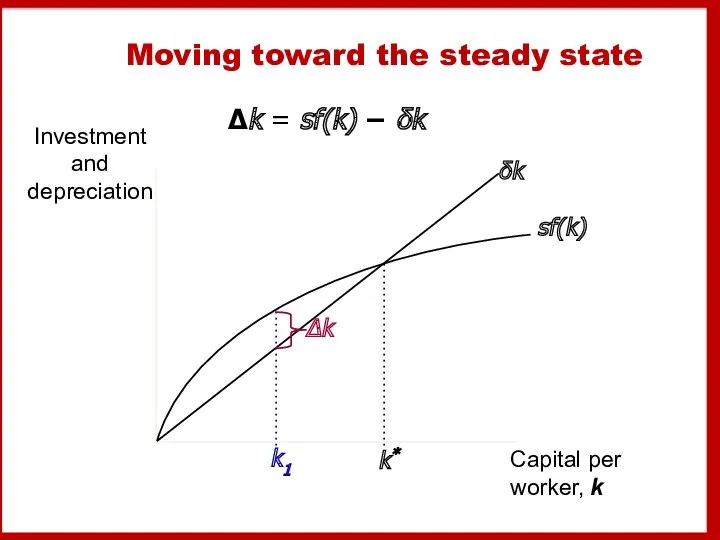

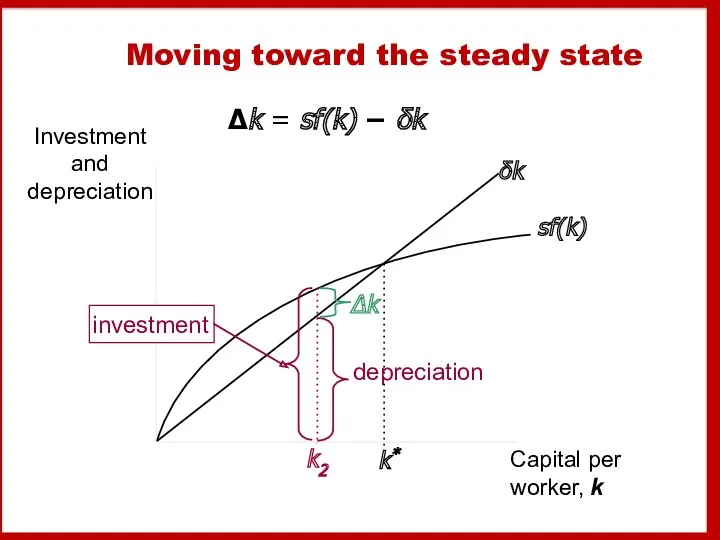

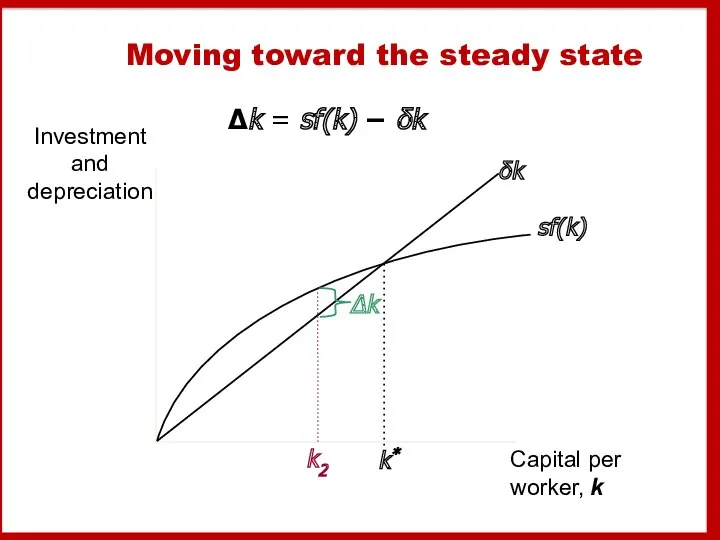

- 20. Moving toward the steady state Δk = sf(k) − δk

- 21. Moving toward the steady state Δk = sf(k) − δk k2

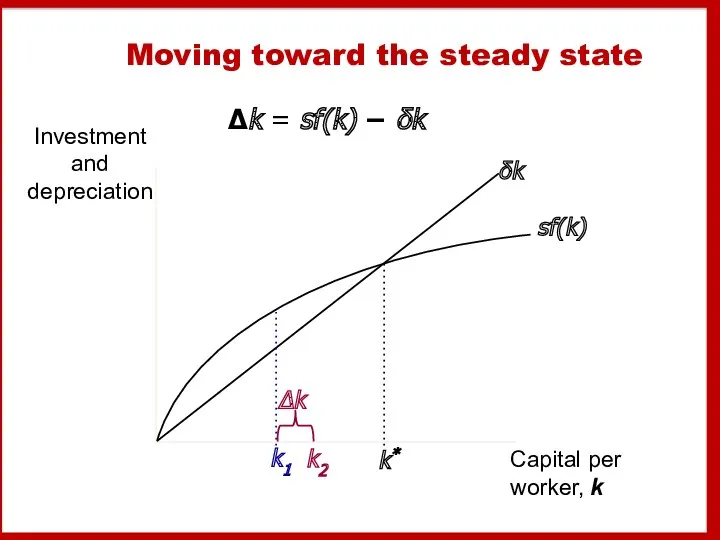

- 22. Moving toward the steady state Δk = sf(k) − δk k2

- 23. Moving toward the steady state Δk = sf(k) − δk

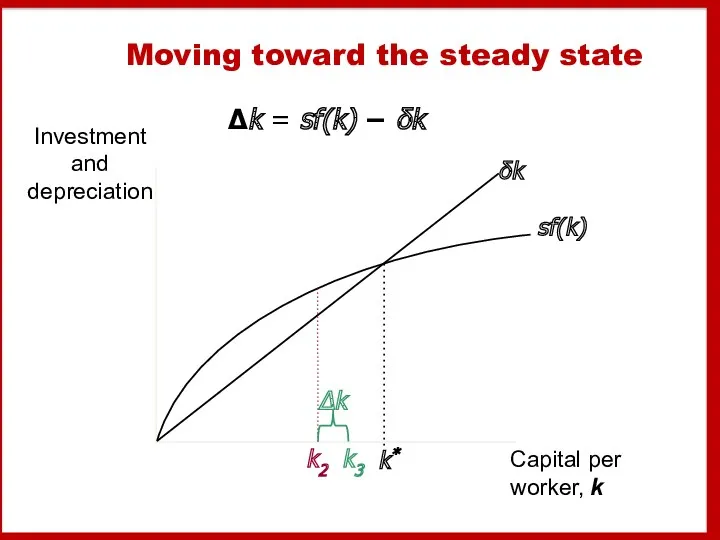

- 24. Moving toward the steady state Δk = sf(k) − δk k2 k3

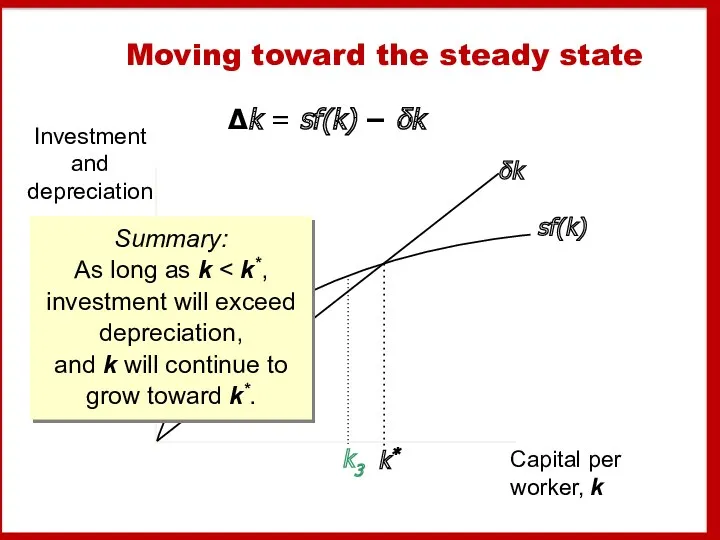

- 25. Moving toward the steady state Δk = sf(k) − δk k3 Summary: As long as k

- 26. Now you try: Draw the Solow model diagram, labeling the steady state k*. On the horizontal

- 27. A numerical example Production function (aggregate): To derive the per-worker production function, divide through by L:

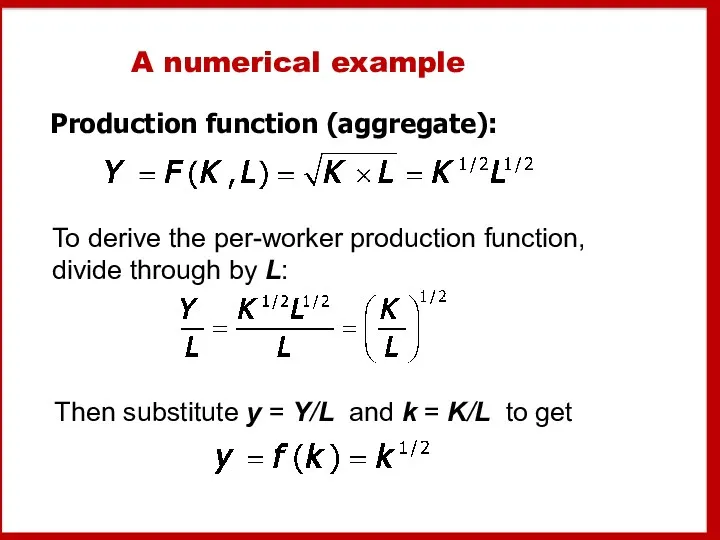

- 28. A numerical example, cont. Assume: s = 0.3 δ= 0.1 initial value of k = 4.0

- 29. Approaching the steady state: A numerical example Year k y c i k k 1 4.000

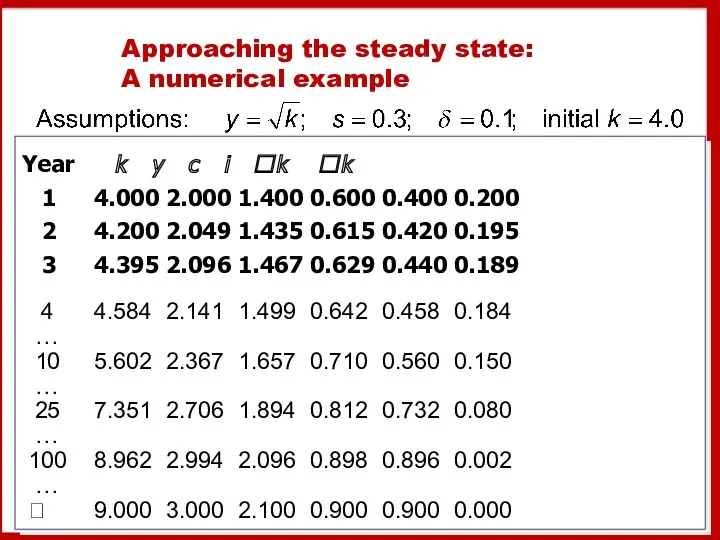

- 30. Exercise: Solve for the steady state Continue to assume s = 0.3, δ = 0.1, and

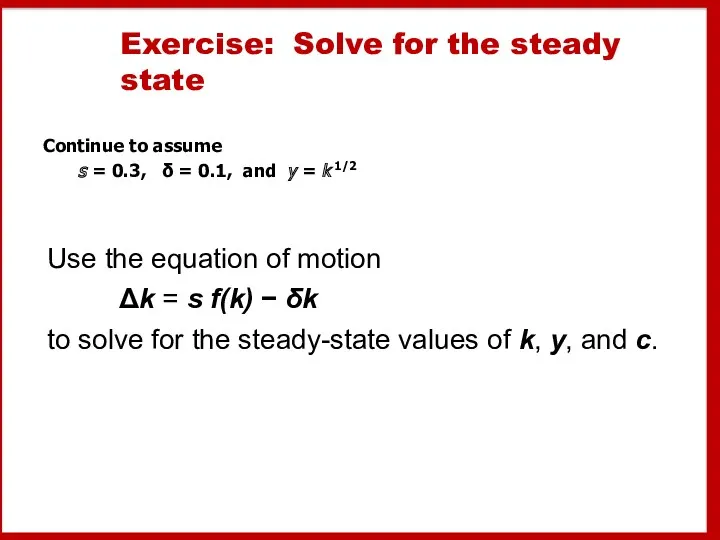

- 31. Solution to exercise:

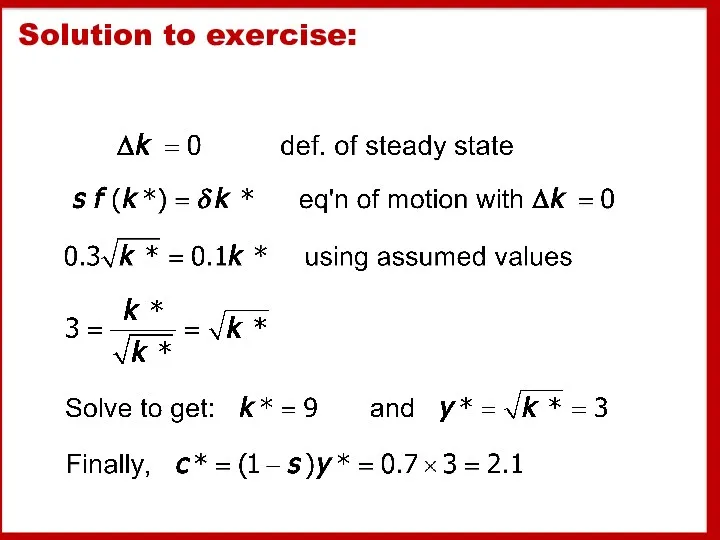

- 32. An increase in the saving rate An increase in the saving rate raises investment… …causing k

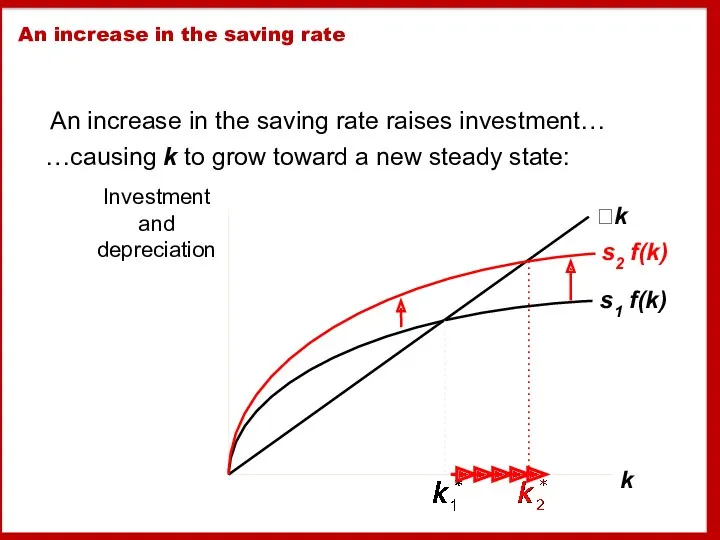

- 33. Prediction: Higher s ⇒ higher k*. And since y = f(k) , higher k* ⇒ higher

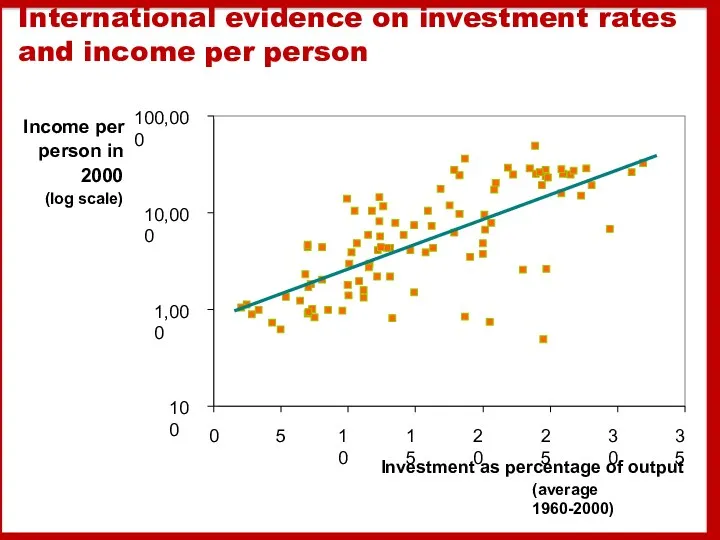

- 34. International evidence on investment rates and income per person 100 1,000 10,000 100,000 0 5 10

- 35. The Golden Rule: Introduction Different values of s lead to different steady states. How do we

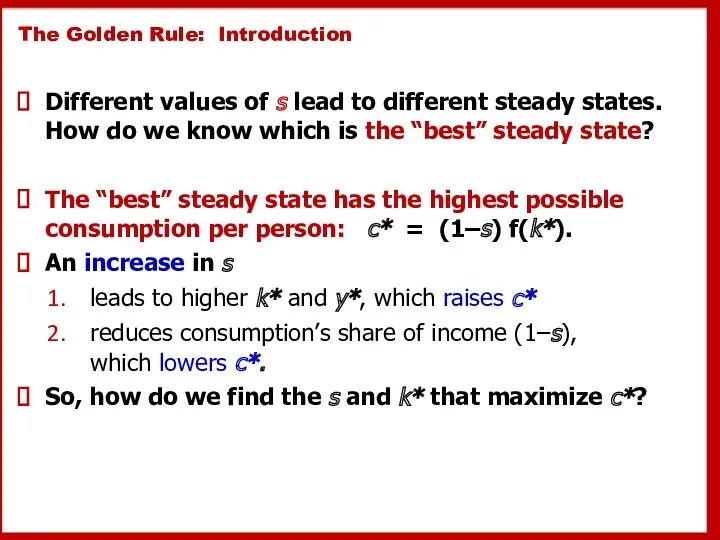

- 36. The Golden Rule capital stock the Golden Rule level of capital, the steady state value of

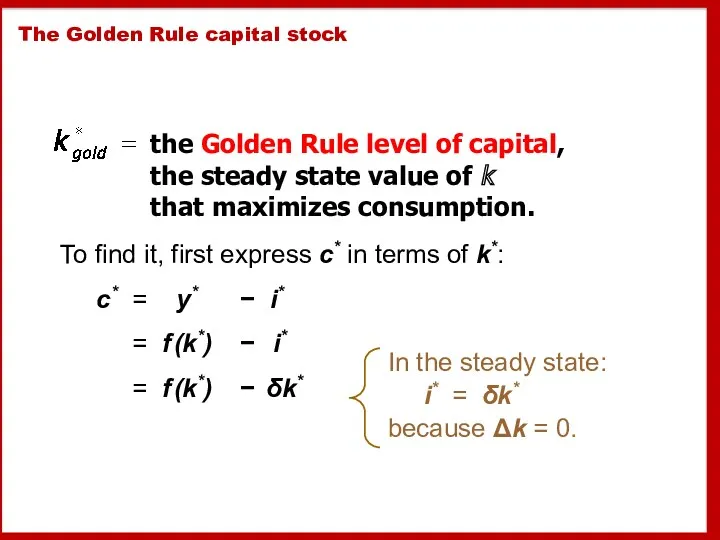

- 37. Then, graph f(k*) and δk*, look for the point where the gap between them is biggest.

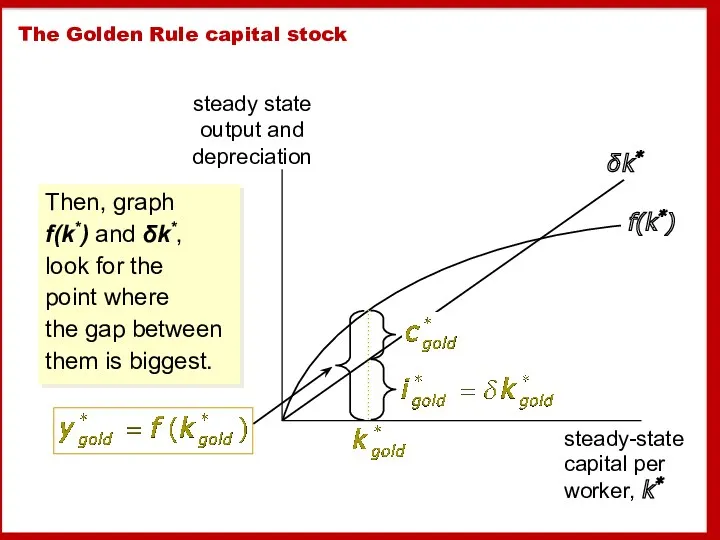

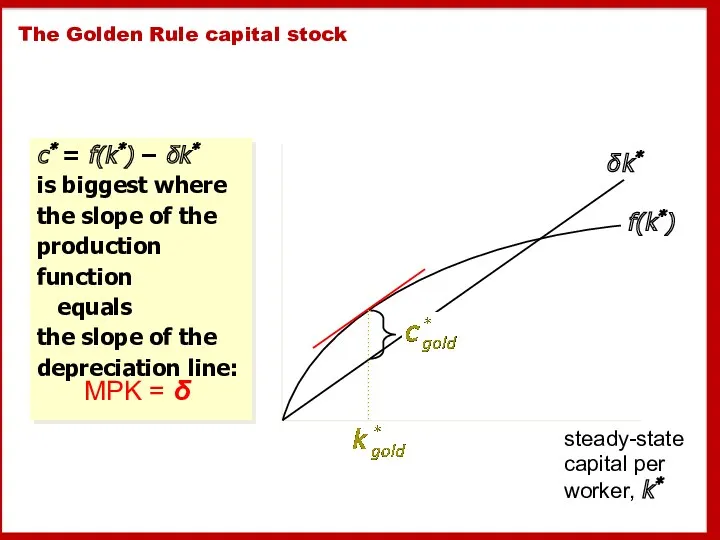

- 38. The Golden Rule capital stock c* = f(k*) − δk* is biggest where the slope of

- 39. The transition to the Golden Rule steady state The economy does NOT have a tendency to

- 40. Starting with too much capital then increasing c* requires a fall in s. In the transition

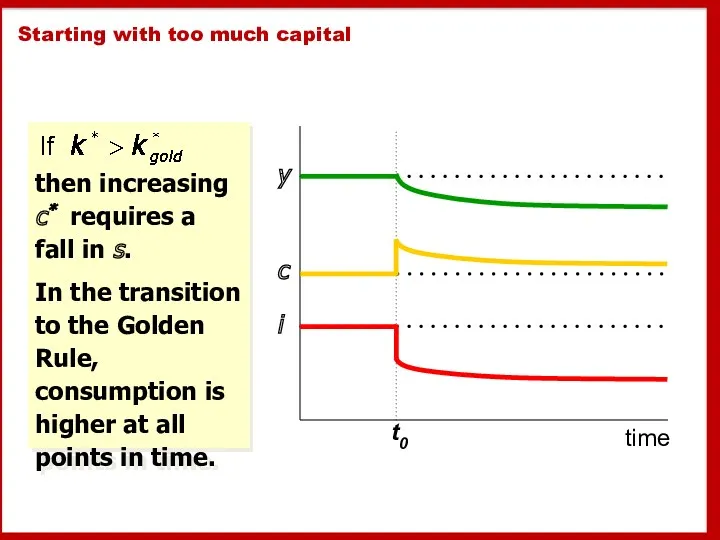

- 41. Starting with too little capital then increasing c* requires an increase in s. Future generations enjoy

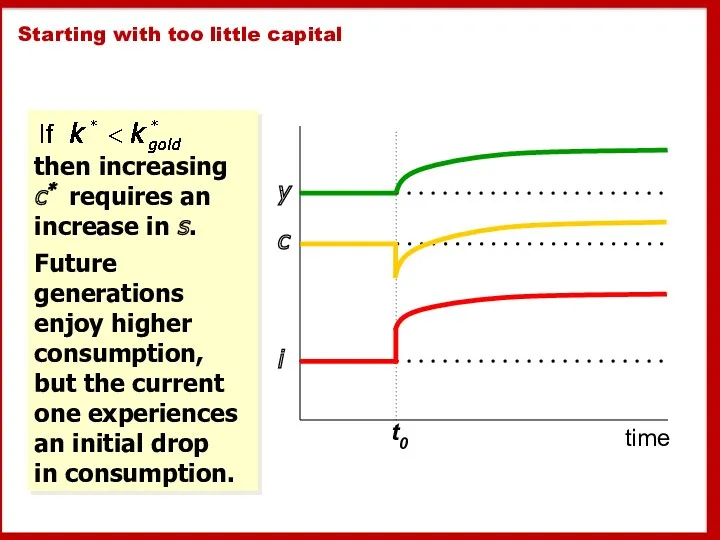

- 42. Population growth Assume that the population (and labor force) grow at rate n. (n is exogenous.)

- 43. Break-even investment (δ + n)k = break-even investment, the amount of investment necessary to keep k

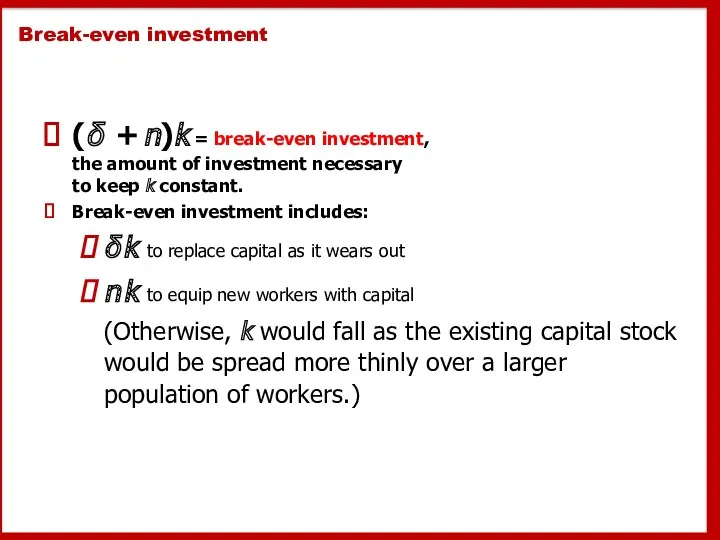

- 44. The equation of motion for k With population growth, the equation of motion for k is

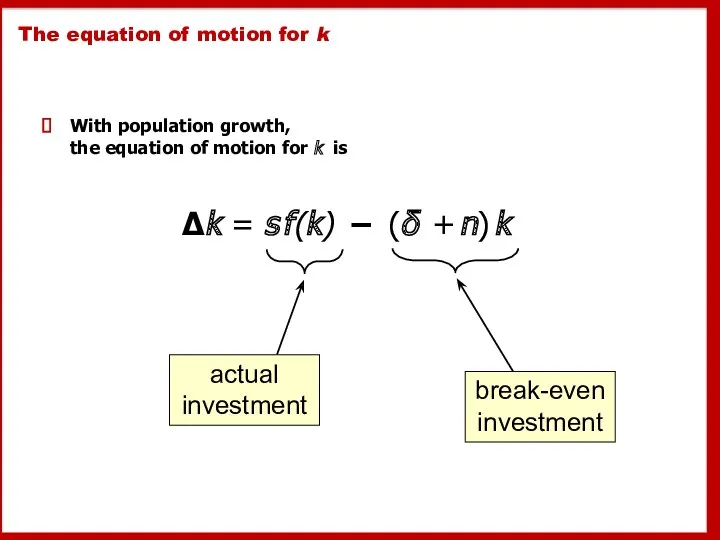

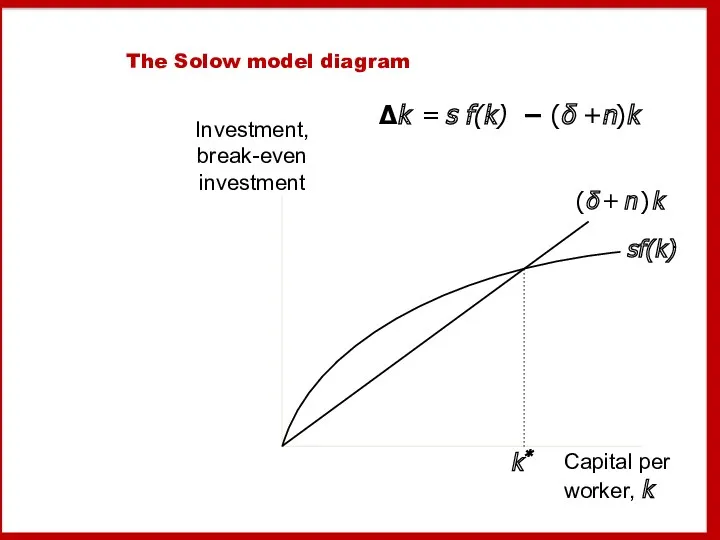

- 45. The Solow model diagram Δk = s f(k) − (δ +n)k

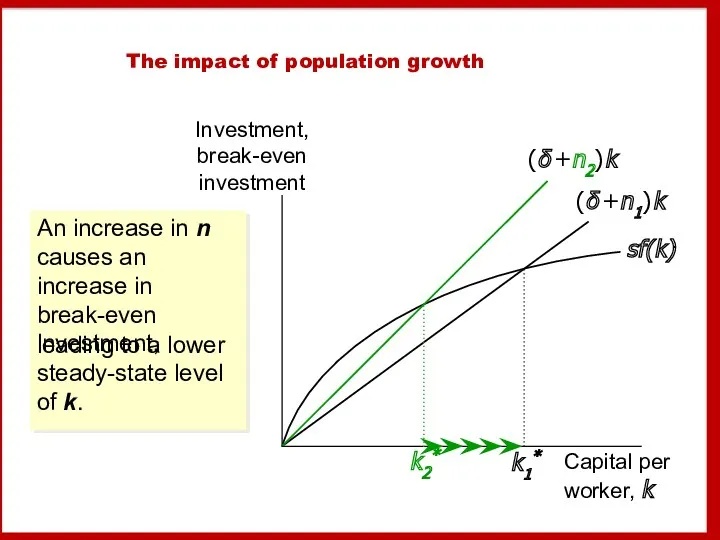

- 46. The impact of population growth Investment, break-even investment Capital per worker, k (δ +n1) k k1*

- 47. Prediction: Higher n ⇒ lower k*. And since y = f(k) , lower k* ⇒ lower

- 48. International evidence on population growth and income per person 100 1,000 10,000 100,000 0 1 2

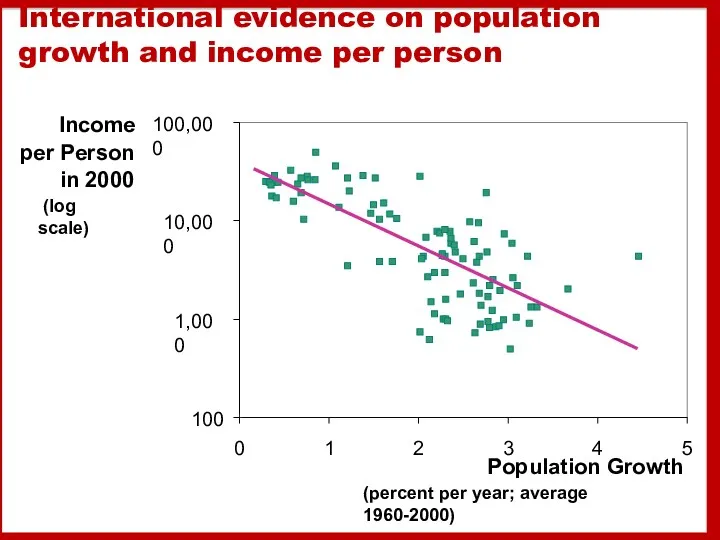

- 49. The Golden Rule with population growth To find the Golden Rule capital stock, express c* in

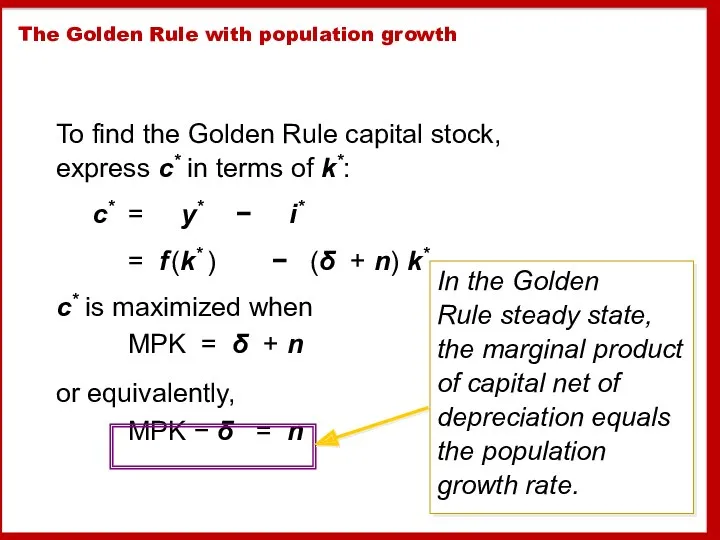

- 50. Alternative perspectives on population growth The Malthusian Model (1798) Predicts population growth will outstrip the Earth’s

- 51. Alternative perspectives on population growth The Kremerian Model (1993) Posits that population growth contributes to economic

- 52. Chapter Summary 1. The Solow growth model shows that, in the long run, a country’s standard

- 54. Скачать презентацию

Внешние эффекты (экстерналии)

Внешние эффекты (экстерналии) Обоснование ресурсов. Производственные мощности. Капитальные затраты. Затраты на сырье и материалы

Обоснование ресурсов. Производственные мощности. Капитальные затраты. Затраты на сырье и материалы Экономика және оның қоғам өміріндегі орны

Экономика және оның қоғам өміріндегі орны Демография – наука о народонаселении

Демография – наука о народонаселении Правовое и организационное обеспечение экономической безопасности

Правовое и организационное обеспечение экономической безопасности Экономический рост и развитие

Экономический рост и развитие Презентация Упражнения по теме спрос и предложение

Презентация Упражнения по теме спрос и предложение Статистические показатели, используемые в государственном регулировании

Статистические показатели, используемые в государственном регулировании Типи країн та показники їх економічного рівня

Типи країн та показники їх економічного рівня Предмет и метод экономической теории. (Тема 1)

Предмет и метод экономической теории. (Тема 1) Государственные и муниципальные унитарные предприятия. Производственные кооперативы. Объединения предприятий. Малый бизнес

Государственные и муниципальные унитарные предприятия. Производственные кооперативы. Объединения предприятий. Малый бизнес Историческое развитие человечества. Формационный подход

Историческое развитие человечества. Формационный подход Тема 9_Открытая экономика при несовершенной мобильности капитала

Тема 9_Открытая экономика при несовершенной мобильности капитала Понятие, источники, элементы и показатели предпринимательского дохода

Понятие, источники, элементы и показатели предпринимательского дохода Главная цель экономического развития региона Ленинградской области

Главная цель экономического развития региона Ленинградской области Занятие 29. Экономический рост

Занятие 29. Экономический рост Международные валютно-кредитные и финансовые организации и их регулирующая роль в мировом хозяйстве

Международные валютно-кредитные и финансовые организации и их регулирующая роль в мировом хозяйстве Занятие по Экономическому практикуму

Занятие по Экономическому практикуму Рынок инноваций

Рынок инноваций Развитие промышленности в Краснодарском крае

Развитие промышленности в Краснодарском крае Преступления в сфере экономической деятельности. Тема 21

Преступления в сфере экономической деятельности. Тема 21 Сукупний попит та сукупна пропозиція: макроекономічна рівновага. (Тема 5)

Сукупний попит та сукупна пропозиція: макроекономічна рівновага. (Тема 5) Технологічна політика ТНК

Технологічна політика ТНК Анализ технологических укладов

Анализ технологических укладов Территория опережающего социально-экономического развития

Территория опережающего социально-экономического развития Риск и неопределенность

Риск и неопределенность Экономика семьи

Экономика семьи Экономика: наука и хозяйство

Экономика: наука и хозяйство