Содержание

- 2. Macroeconomic Indicators Production: GDP, GNP, NI Business Cycles Inflation Unemployment Interest Rates

- 3. Quantity Aggregates To understand the macroeconomy, we need to measure it. Chief measure of economy is

- 4. Gross Domestic Product (GDP) GDP is the sum of the value of new, final goods produced

- 5. Three Methods for Calculating GDP Expenditure Method - The sum of the domestic spending on final

- 6. Expenditure Method

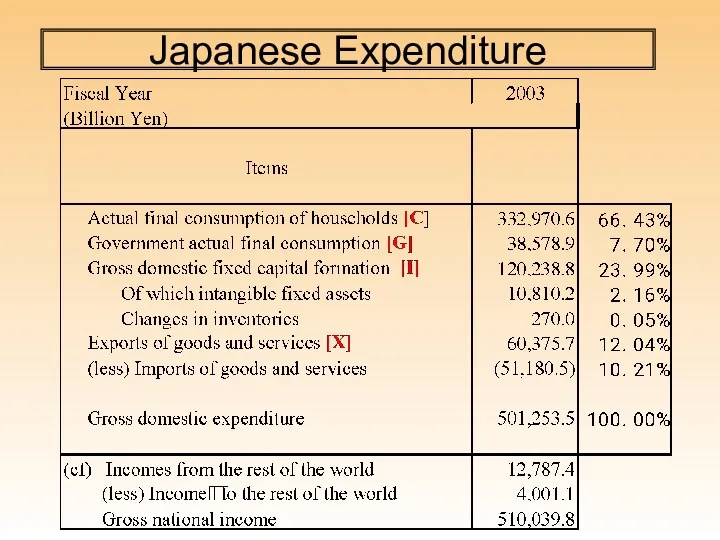

- 7. Japanese Expenditure

- 8. GNP vs. GDP Net Factor Income [NFI] is income earned on overseas work or investments minus

- 9. Compare Macau and the Philippines GDP or GNP Macau produces a lot of profits paid to

- 10. Comparing GDP levels across time GDP measures the value of the goods produced by an economy

- 11. Real GDP: Yt GDP or Nominal GDP or Current Dollar GDP is the weighted sum of

- 12. Solved Problem Real GDP: 2021 (2020 Base Year)

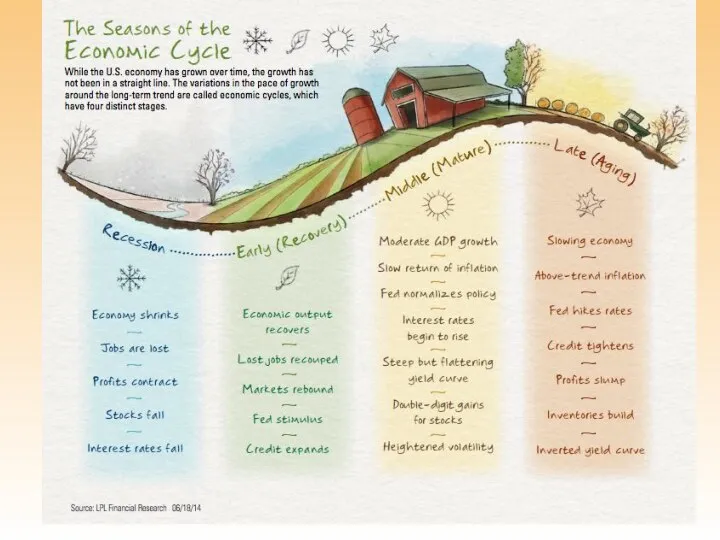

- 13. Recessions and Expansions Business cycle positions are sometimes characterized as booms and recessions. These names have

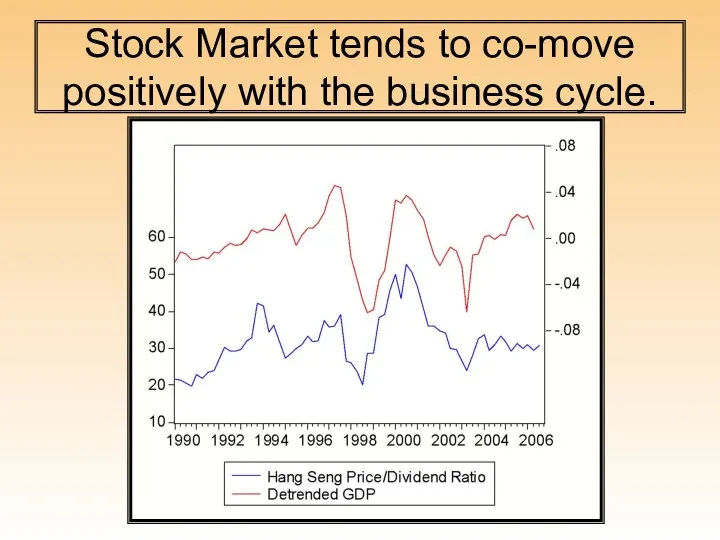

- 14. Stock Market tends to co-move positively with the business cycle.

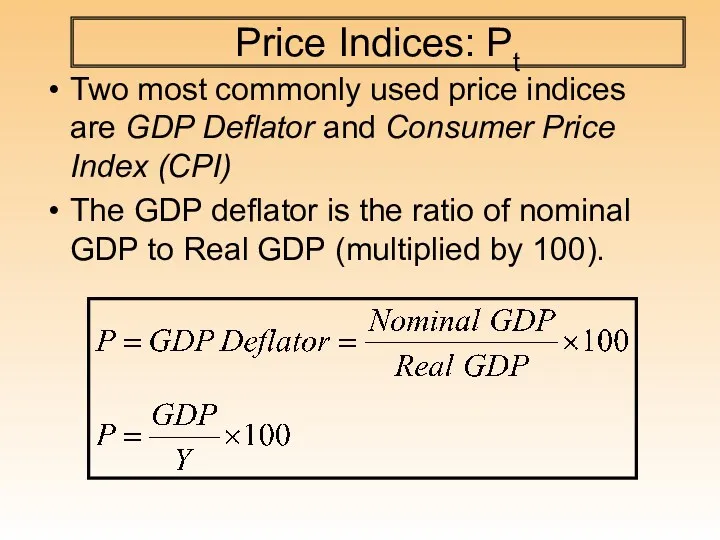

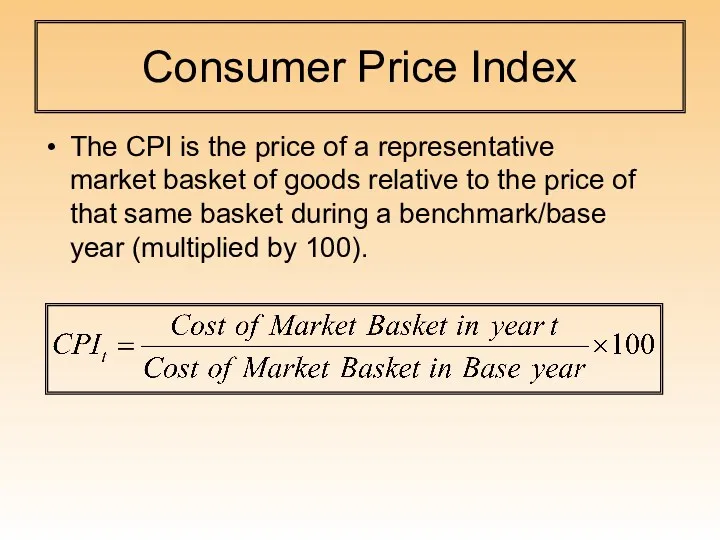

- 16. Price Indices: Pt Two most commonly used price indices are GDP Deflator and Consumer Price Index

- 17. Consumer Price Index The CPI is the price of a representative market basket of goods relative

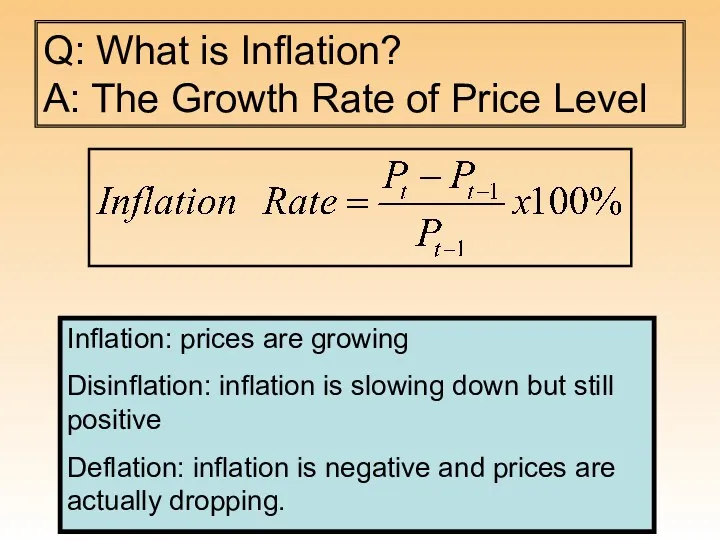

- 18. Q: What is Inflation? A: The Growth Rate of Price Level Inflation: prices are growing Disinflation:

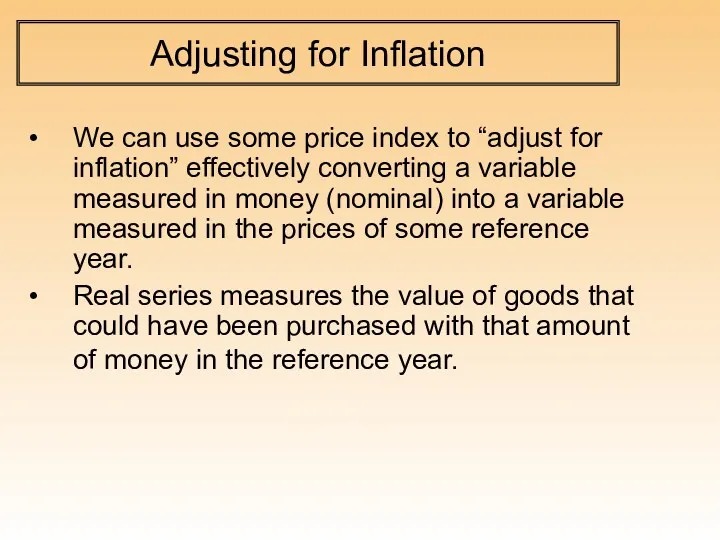

- 19. Adjusting for Inflation We can use some price index to “adjust for inflation” effectively converting a

- 20. Converting Current Price Series into Constant Price Series Series to be adjusted for inflation: Nt Contemporaneous

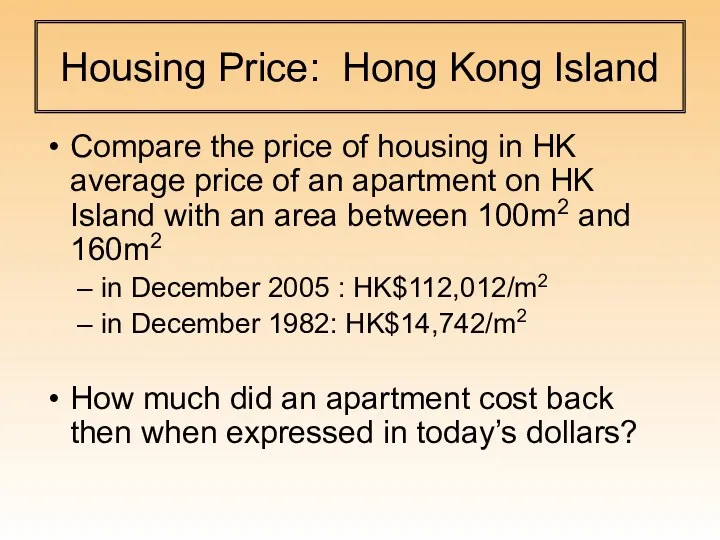

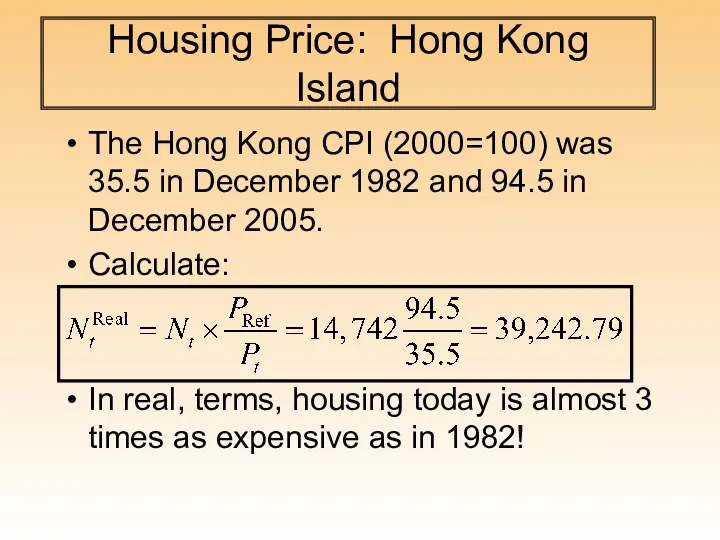

- 21. Housing Price: Hong Kong Island Compare the price of housing in HK average price of an

- 22. Housing Price: Hong Kong Island The Hong Kong CPI (2000=100) was 35.5 in December 1982 and

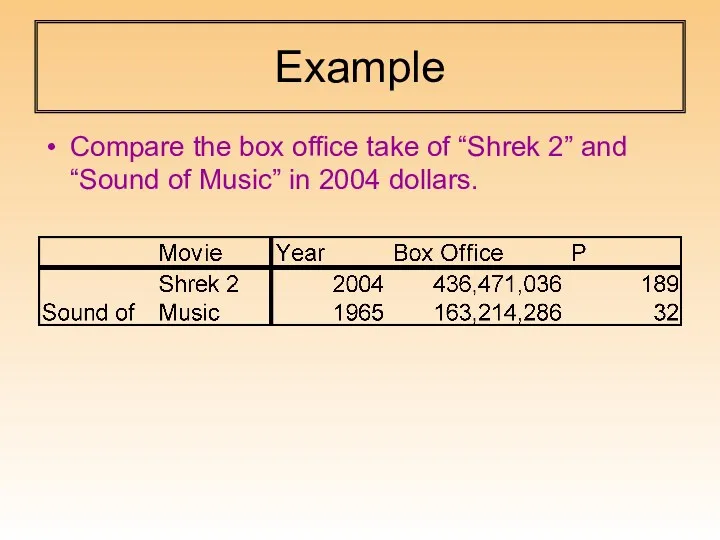

- 23. Example Compare the box office take of “Shrek 2” and “Sound of Music” in 2004 dollars.

- 24. Interest Rates

- 25. What are some major interest rates in financial markets? Be as specific as possible.

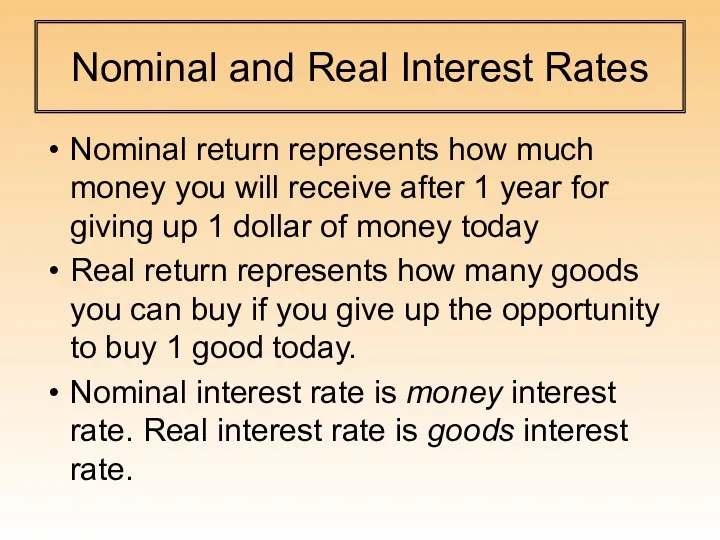

- 26. Nominal and Real Interest Rates Nominal return represents how much money you will receive after 1

- 27. Imagine a 1 year loan [T =1]: The lender gives up some goods to make a

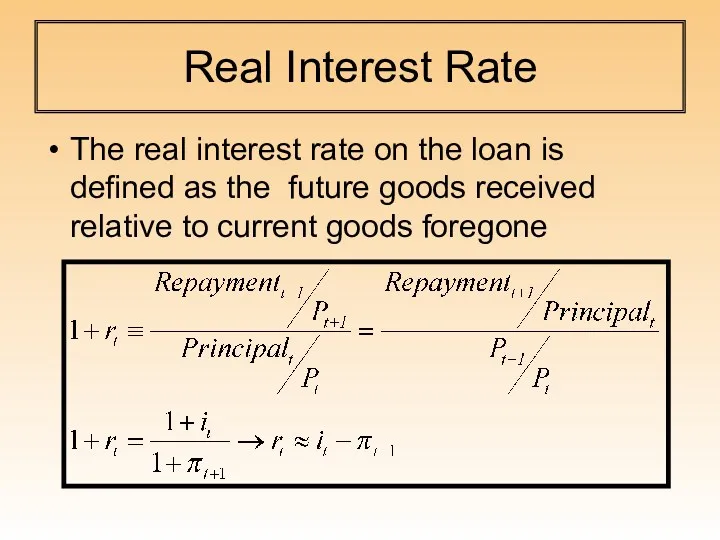

- 28. Real Interest Rate The real interest rate on the loan is defined as the future goods

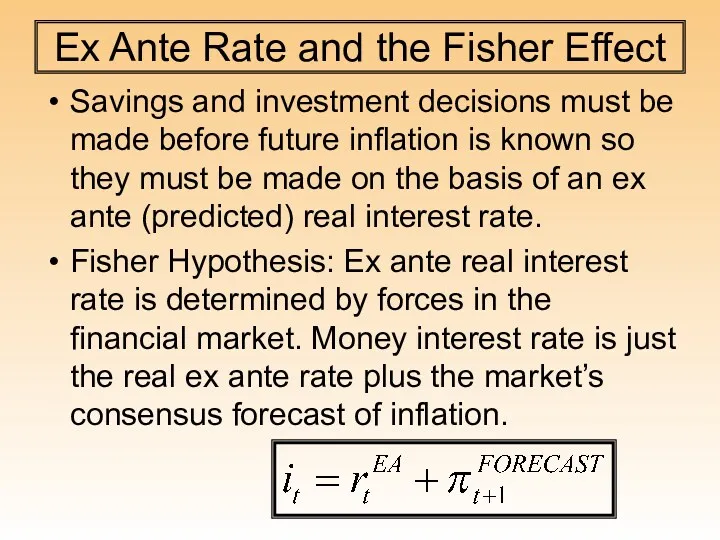

- 29. Ex Ante Rate and the Fisher Effect Savings and investment decisions must be made before future

- 31. Скачать презентацию

![GNP vs. GDP Net Factor Income [NFI] is income earned](/_ipx/f_webp&q_80&fit_contain&s_1440x1080/imagesDir/jpg/607634/slide-7.jpg)

![Imagine a 1 year loan [T =1]: The lender gives](/_ipx/f_webp&q_80&fit_contain&s_1440x1080/imagesDir/jpg/607634/slide-26.jpg)

Impact of globalization on local culture

Impact of globalization on local culture Спрос и предложение на рынке труда

Спрос и предложение на рынке труда Развитие экспортного потенциала культурных и креативных индустрий в Европейском союзе

Развитие экспортного потенциала культурных и креативных индустрий в Европейском союзе Индикаторы устойчивого развития-2

Индикаторы устойчивого развития-2 Человек в мире экономических отношений

Человек в мире экономических отношений Международные валютные отношения и валютный рынок. (Темы 1-2) Валюта как ключевая категория международных валютных отношений

Международные валютные отношения и валютный рынок. (Темы 1-2) Валюта как ключевая категория международных валютных отношений Теории эластичности спроса и предложения

Теории эластичности спроса и предложения Макроэкономическая нестабильность. Безработица и занятость (макроэкономические показатели)

Макроэкономическая нестабильность. Безработица и занятость (макроэкономические показатели) Організація та технологія надання пасажирських послуг

Організація та технологія надання пасажирських послуг Өндіріс факторларының нарығы

Өндіріс факторларының нарығы Альтерглобалізм та його форми

Альтерглобалізм та його форми Экономика и государство

Экономика и государство Кейнсианство. Джон Мейнард Кейнс

Кейнсианство. Джон Мейнард Кейнс Производственная программа и производственные мощности. Экономика организации. (Лекция 7)

Производственная программа и производственные мощности. Экономика организации. (Лекция 7) Цели, организация и методы антимонопольного регулирования

Цели, организация и методы антимонопольного регулирования Анализ возможностей выхода ПАО Газпром на Азиатско-тихоокеанские рынки

Анализ возможностей выхода ПАО Газпром на Азиатско-тихоокеанские рынки Спрос. Закон спроса. Эластичность спроса

Спрос. Закон спроса. Эластичность спроса Підприємницька ідея: механізм генерування та впровадження

Підприємницька ідея: механізм генерування та впровадження Место Китая в мировом хозяйстве

Место Китая в мировом хозяйстве Экономика организации. Трудовые ресурсы организации. Основы организации труда и его оплаты

Экономика организации. Трудовые ресурсы организации. Основы организации труда и его оплаты Анализ рынка СЭД в РФ

Анализ рынка СЭД в РФ Әлеуметтік – экономикалық дамудағы дағдарыс түсінігі және оның пайда болу себептері

Әлеуметтік – экономикалық дамудағы дағдарыс түсінігі және оның пайда болу себептері Рыночная экономика. Тема 14. Обществознание. 8 класс

Рыночная экономика. Тема 14. Обществознание. 8 класс Фінансові ресурси торговельного підприємства. (Лекція 11)

Фінансові ресурси торговельного підприємства. (Лекція 11) Тема 10. Экономическая роль государства

Тема 10. Экономическая роль государства Рынки факторов производства

Рынки факторов производства Риск в экономике

Риск в экономике История создания ГАТТ/ВТО. Организационная структура ВТО

История создания ГАТТ/ВТО. Организационная структура ВТО