Содержание

- 2. Macroeconomic Indicators Production: GDP, GNP, NI Business Cycles Inflation Unemployment Interest Rates

- 3. Quantity Aggregates To understand the macroeconomy, we need to measure it. Chief measure of economy is

- 4. Gross Domestic Product (GDP) GDP is the sum of the value of new, final goods produced

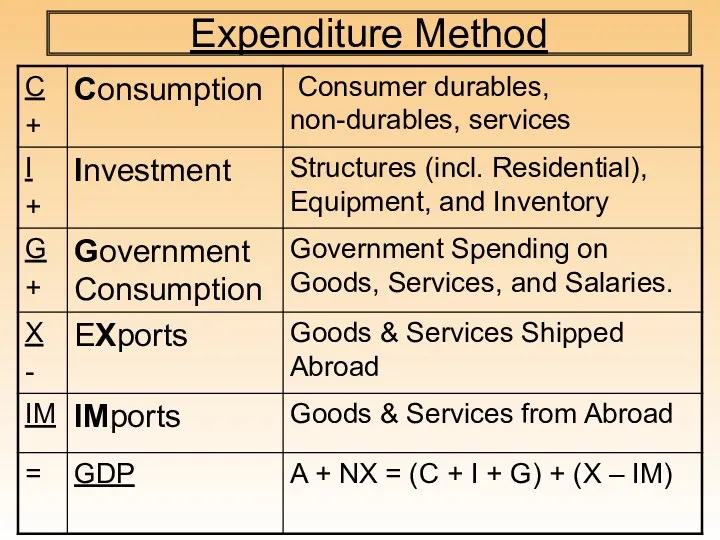

- 5. Three Methods for Calculating GDP Expenditure Method - The sum of the domestic spending on final

- 6. Expenditure Method

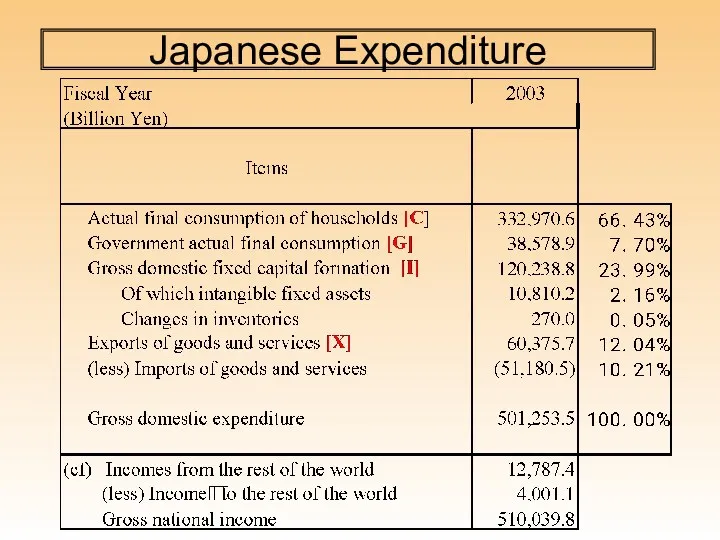

- 7. Japanese Expenditure

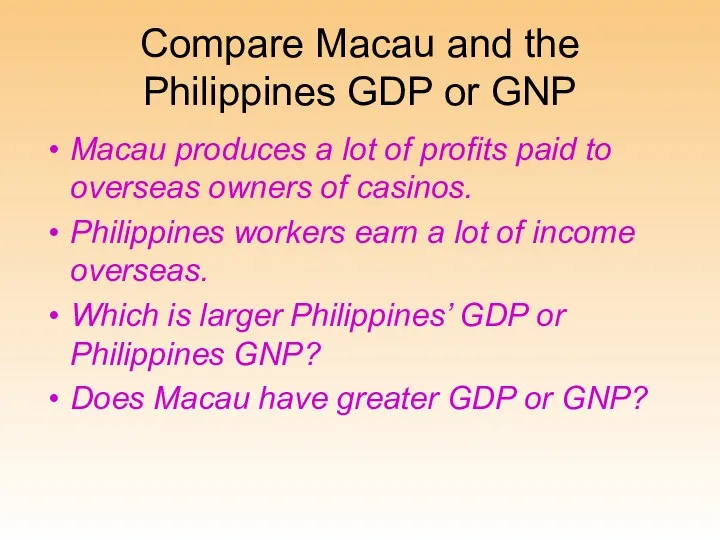

- 8. GNP vs. GDP Net Factor Income [NFI] is income earned on overseas work or investments minus

- 9. Compare Macau and the Philippines GDP or GNP Macau produces a lot of profits paid to

- 10. The main macroeconomic issues: Inflation. Employment and unemployment. Stagflation and deflation. Business cycles. Economic growth. The

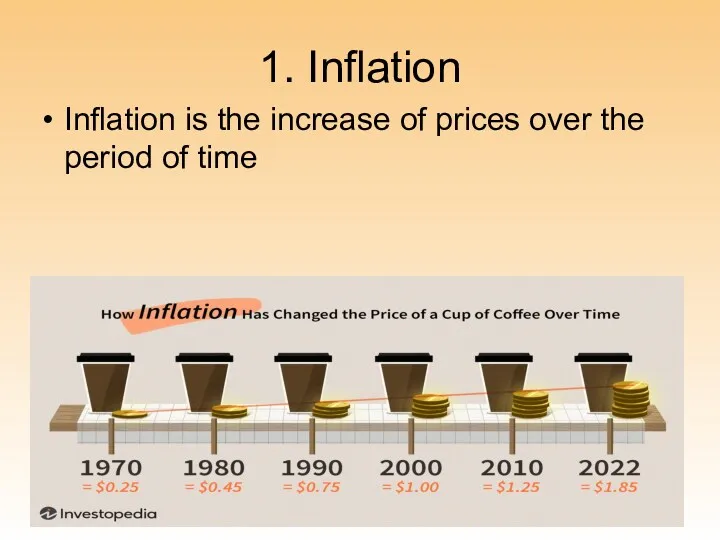

- 11. 1. Inflation Inflation is the increase of prices over the period of time

- 12. Why prices increase? Demand-pull inflation – this occurs when aggregate demand (AD) will be increasing faster

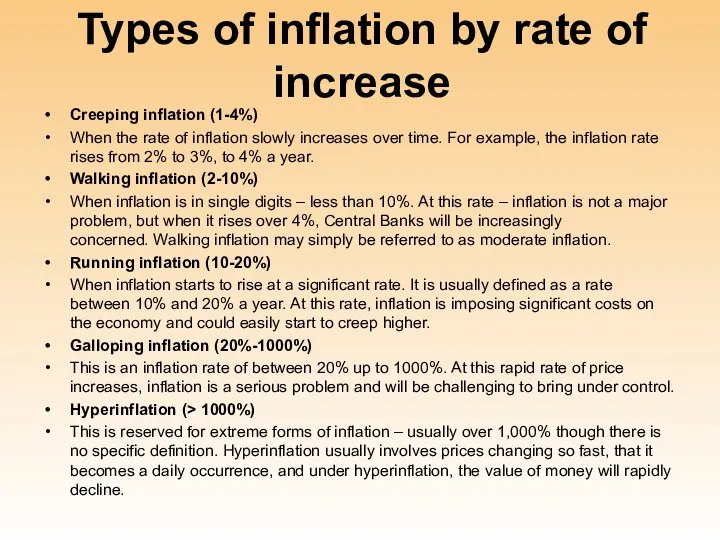

- 13. Types of inflation by rate of increase Creeping inflation (1-4%) When the rate of inflation slowly

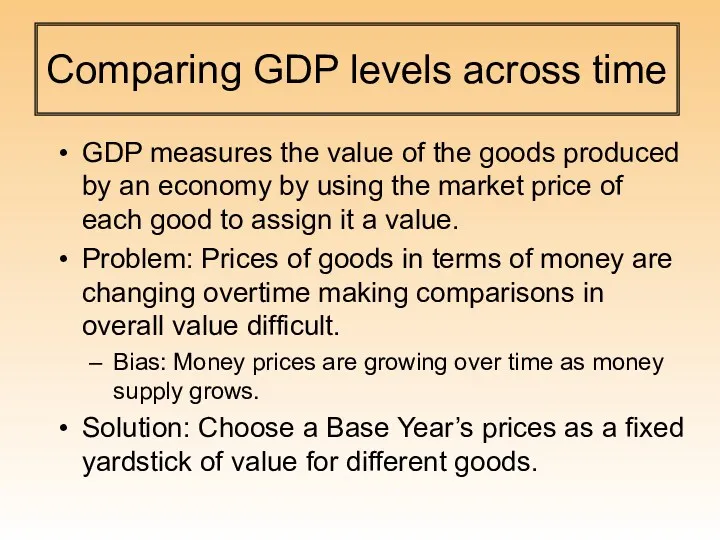

- 15. Comparing GDP levels across time GDP measures the value of the goods produced by an economy

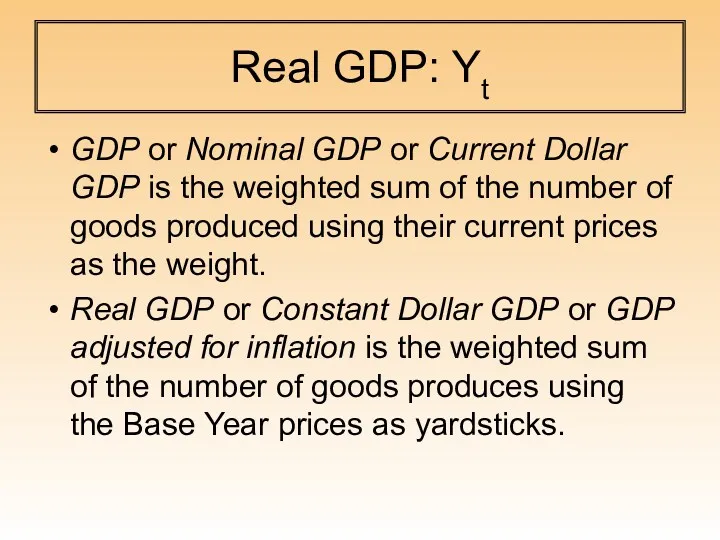

- 16. Real GDP: Yt GDP or Nominal GDP or Current Dollar GDP is the weighted sum of

- 17. Solved Problem Real GDP: 2021 (2020 Base Year)

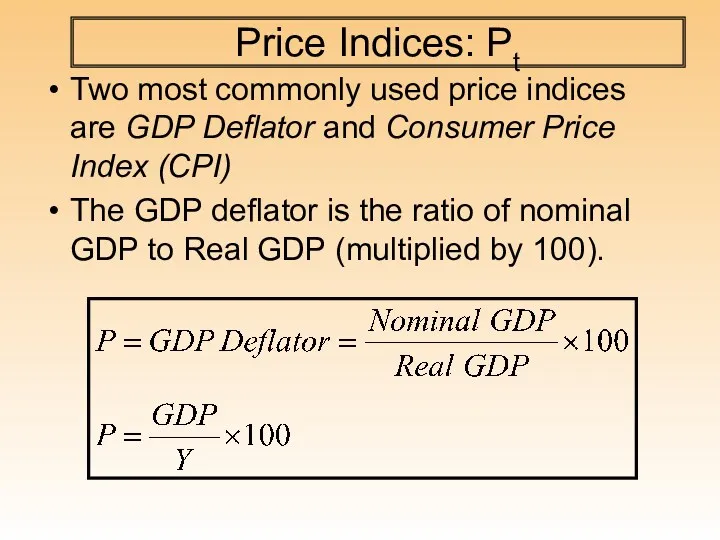

- 19. Price Indices: Pt Two most commonly used price indices are GDP Deflator and Consumer Price Index

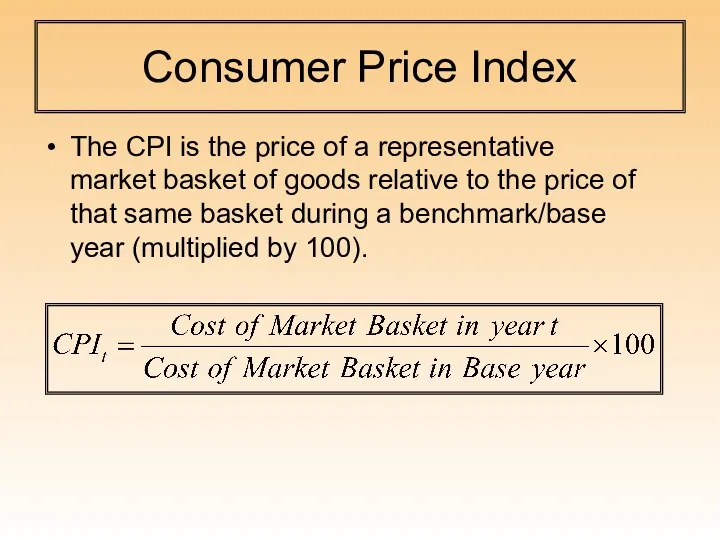

- 20. Consumer Price Index The CPI is the price of a representative market basket of goods relative

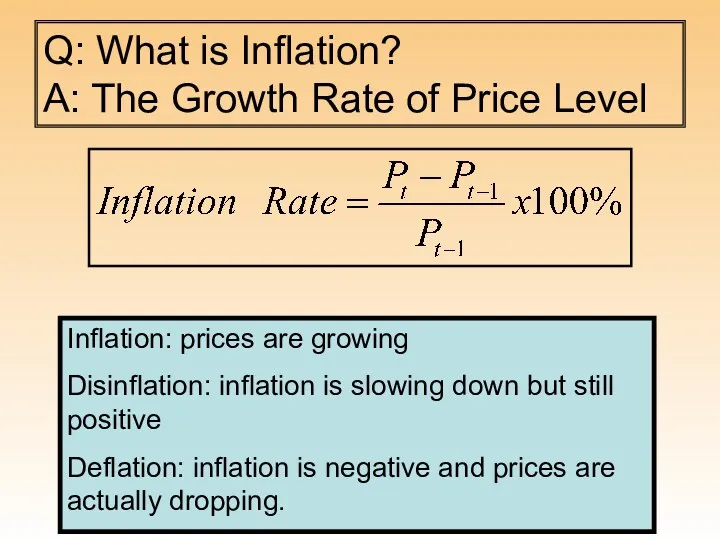

- 21. Q: What is Inflation? A: The Growth Rate of Price Level Inflation: prices are growing Disinflation:

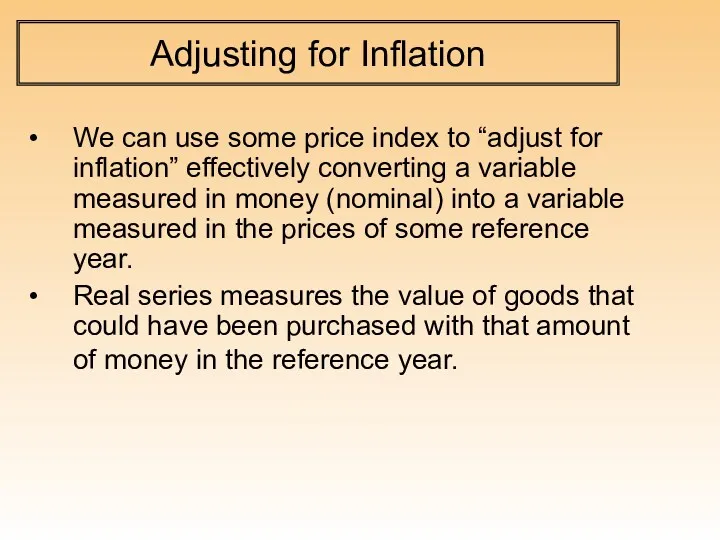

- 22. Adjusting for Inflation We can use some price index to “adjust for inflation” effectively converting a

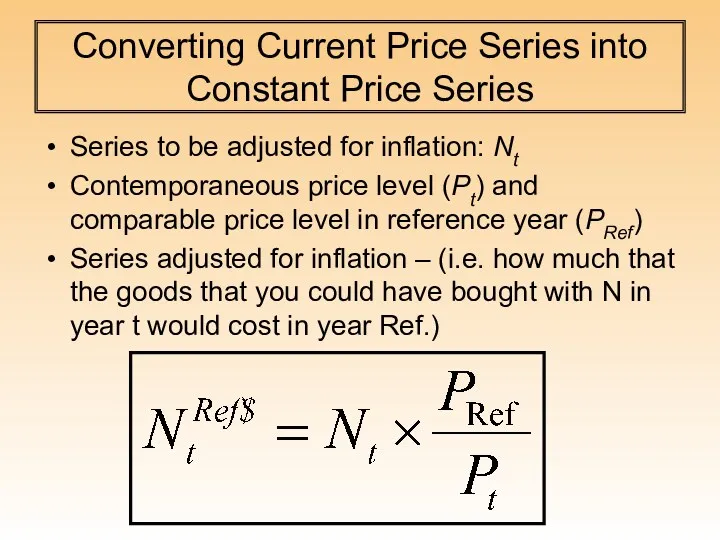

- 23. Converting Current Price Series into Constant Price Series Series to be adjusted for inflation: Nt Contemporaneous

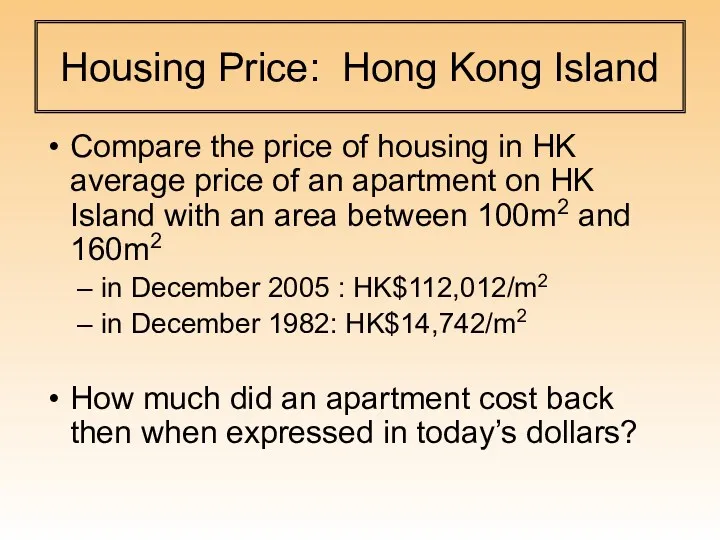

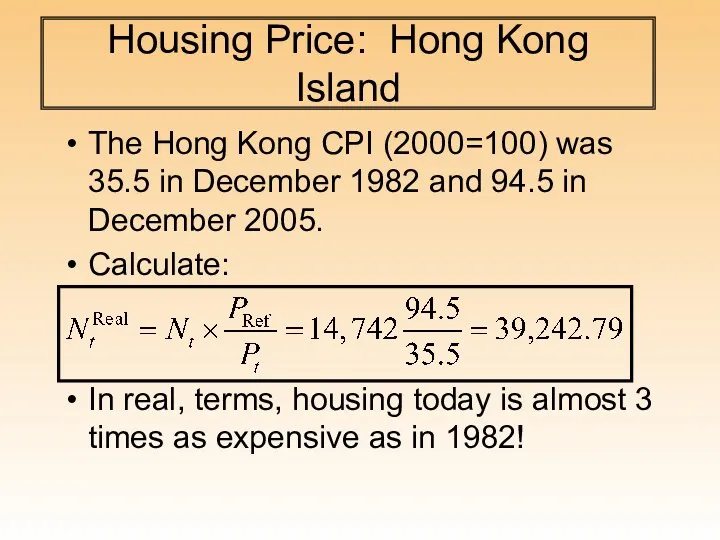

- 24. Housing Price: Hong Kong Island Compare the price of housing in HK average price of an

- 25. Housing Price: Hong Kong Island The Hong Kong CPI (2000=100) was 35.5 in December 1982 and

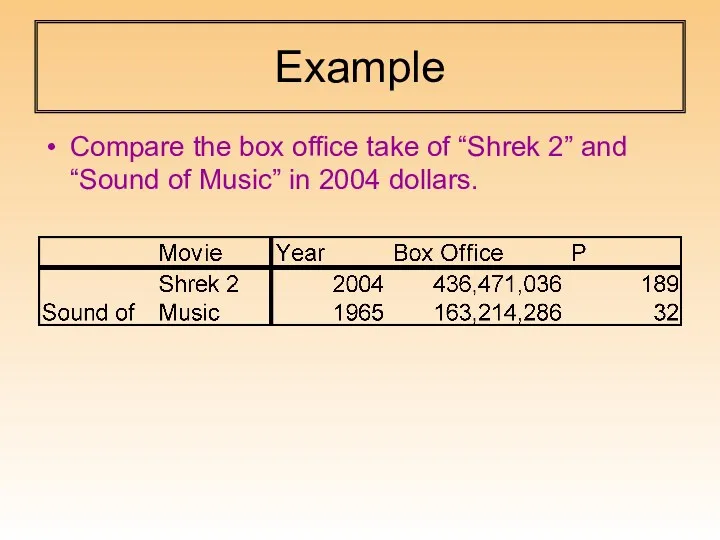

- 26. Example Compare the box office take of “Shrek 2” and “Sound of Music” in 2004 dollars.

- 27. Interest Rates

- 28. What are some major interest rates in financial markets? Be as specific as possible.

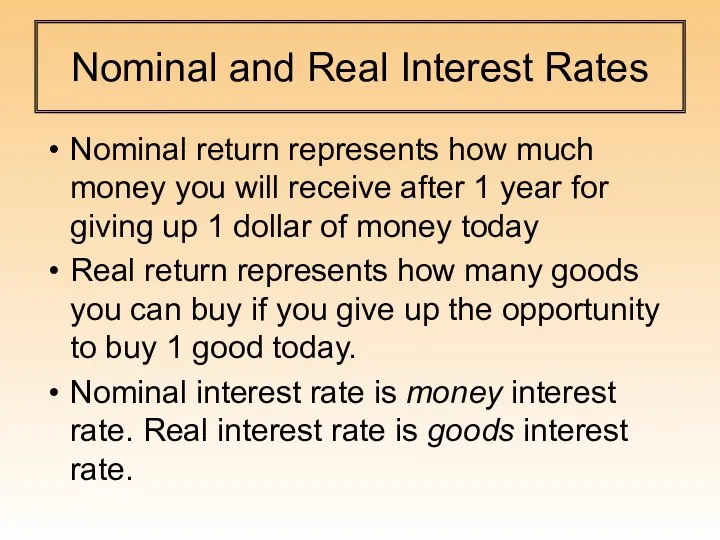

- 29. Nominal and Real Interest Rates Nominal return represents how much money you will receive after 1

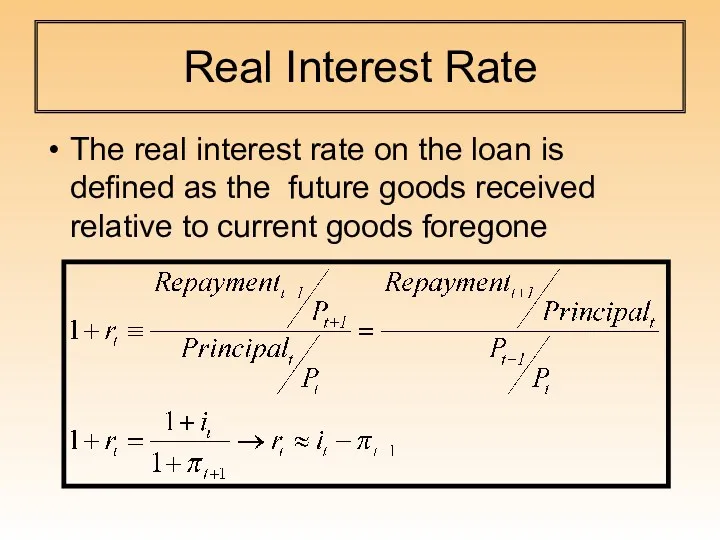

- 30. Imagine a 1 year loan [T =1]: The lender gives up some goods to make a

- 31. Real Interest Rate The real interest rate on the loan is defined as the future goods

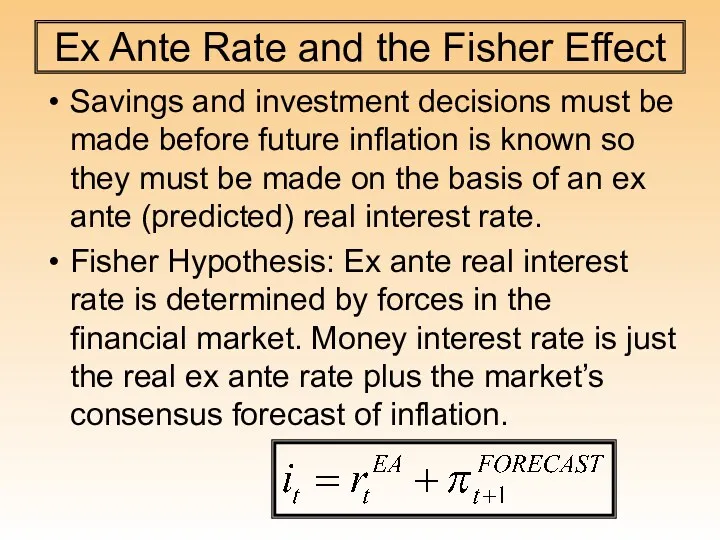

- 32. Ex Ante Rate and the Fisher Effect Savings and investment decisions must be made before future

- 33. Economic growth

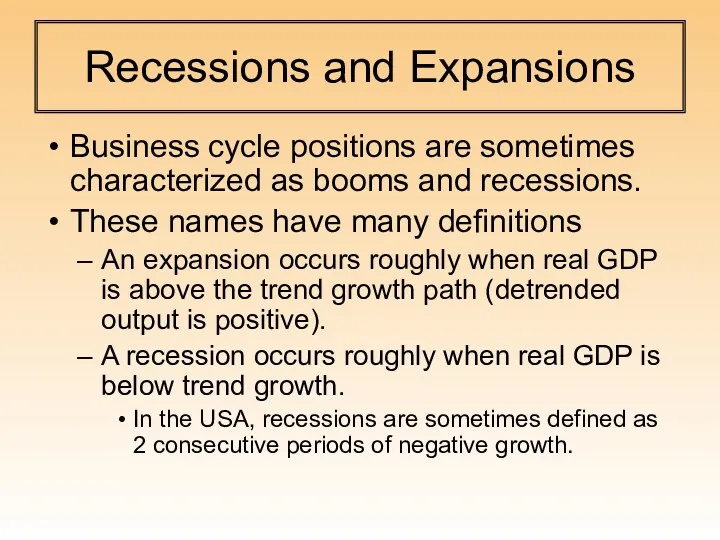

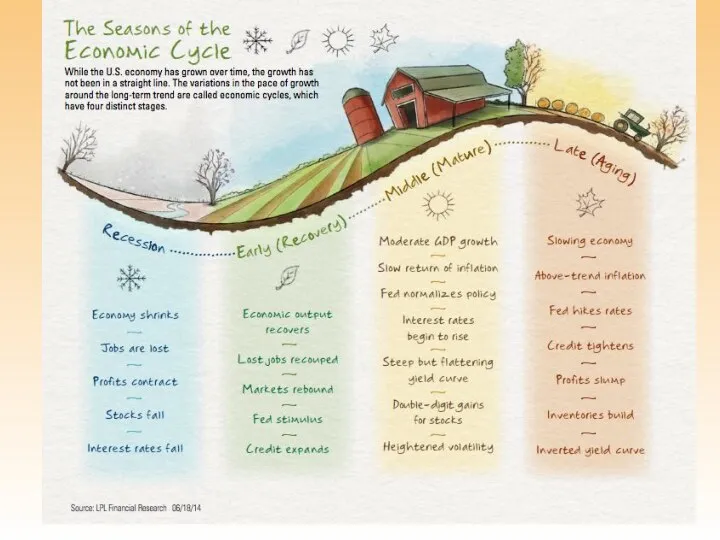

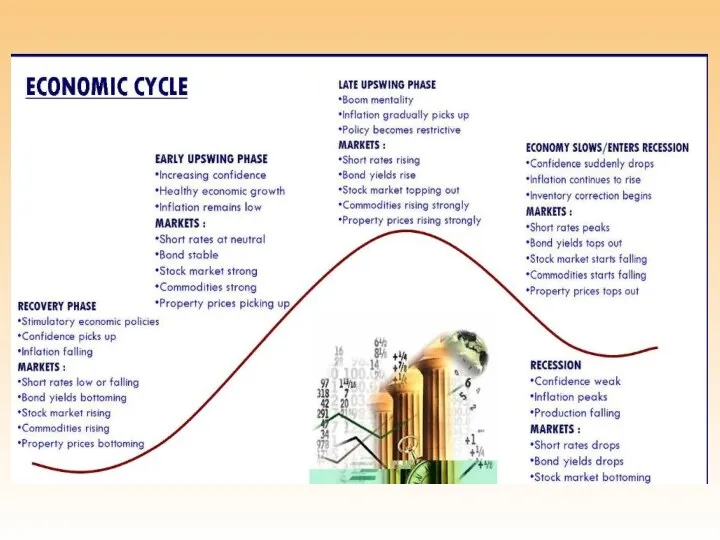

- 34. Recessions and Expansions Business cycle positions are sometimes characterized as booms and recessions. These names have

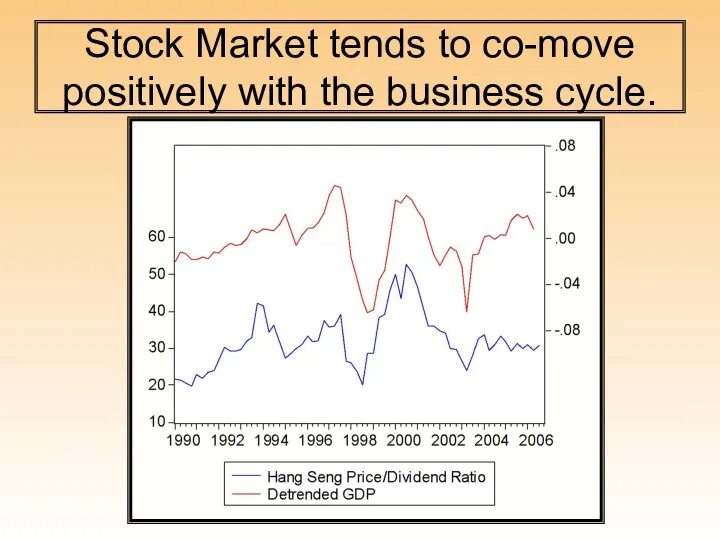

- 37. Stock Market tends to co-move positively with the business cycle.

- 40. Скачать презентацию

![GNP vs. GDP Net Factor Income [NFI] is income earned](/_ipx/f_webp&q_80&fit_contain&s_1440x1080/imagesDir/jpg/612511/slide-7.jpg)

![Imagine a 1 year loan [T =1]: The lender gives](/_ipx/f_webp&q_80&fit_contain&s_1440x1080/imagesDir/jpg/612511/slide-29.jpg)

Рынок недвижимости в стране Япония

Рынок недвижимости в стране Япония Заработная плата, как экономическая категория

Заработная плата, как экономическая категория Система оценки качества продукции в производстве

Система оценки качества продукции в производстве Лесное хозяйство. Охота

Лесное хозяйство. Охота Что такое заработная плата и от чего она зависит

Что такое заработная плата и от чего она зависит Вход, выход и формирование рынков. Концепции современной теории отраслевых рынков

Вход, выход и формирование рынков. Концепции современной теории отраслевых рынков Экономическая география, как наука

Экономическая география, как наука Цели устойчивого развития в Беларуси

Цели устойчивого развития в Беларуси Управление затратами и ценообразование в инновационной сфере

Управление затратами и ценообразование в инновационной сфере Экономическая социология

Экономическая социология Организационная структура ПАО Иркутскэнерго и ООО Иркутскэнергосбыт

Организационная структура ПАО Иркутскэнерго и ООО Иркутскэнергосбыт Економічна характеристика Південної Кореї

Економічна характеристика Південної Кореї Автоматизированные системы контроля и учета электроэнергии

Автоматизированные системы контроля и учета электроэнергии Макроэкономикалық көрсеткіш

Макроэкономикалық көрсеткіш Национальная экономика. Основные результаты и их измерение

Национальная экономика. Основные результаты и их измерение Многообразие рынков. Признаки и функции рынка

Многообразие рынков. Признаки и функции рынка Метод функционально-стоимостного анализа (ФСА)

Метод функционально-стоимостного анализа (ФСА) Планирование деятельности компаний-участников международного бизнеса. (Тема 6)

Планирование деятельности компаний-участников международного бизнеса. (Тема 6) Финансовые рынки

Финансовые рынки Основы моделирования социально-экономических процессов

Основы моделирования социально-экономических процессов Развитие экологического туризма в Республике Казахстан

Развитие экологического туризма в Республике Казахстан Максимизация прибыли и ценовая дискриминация

Максимизация прибыли и ценовая дискриминация Семейный бюджет

Семейный бюджет Конкуренция и монополия

Конкуренция и монополия Целостность и противоречивость современного мира

Целостность и противоречивость современного мира Инфляция и ее измерение

Инфляция и ее измерение Економічна система суспільства

Економічна система суспільства Государственное регулирование ВЭД

Государственное регулирование ВЭД